A lot of material has been written about how the depreciation of fixed assets is correctly reflected in the balance sheet, and it is not surprising, because the correctness of the organization’s reporting largely depends on this. Correct preparation of documentation allows analysts to form an accurate picture of the financial situation in the company, which, in turn, serves as the basis for making the right management decisions.

We don't miss anything!

Correctly reflected depreciation of fixed assets in the balance sheet allows you to accurately understand how large the organization’s profit is and how large amounts need to be included in the report. This determines what results the financial analysis will show, on the basis of which it will be possible to draw conclusions about the profitability of the enterprise. In addition, it is the depreciation of fixed assets in the balance sheet that is a significant factor. The financial leverage of the organization depends quite heavily on this.

Why is it so important how accurately depreciation is reflected on the balance sheet? The relationship is as follows: balance sheet information allows one to draw conclusions about how solvent the organization is. And it will be correct only if the depreciation in the balance sheet that accompanies the recapitalization of part of the company is correctly entered into the reporting.

General provisions

Issues of correct calculation and reflection of depreciation in the balance sheet were discussed in materials published by IFRS. From these publications it follows that depreciation is an accounting process. Its main task is to identify the useful life of the OS and distribute the price of the OS over this period. The concept of a depreciable object in these fundamental materials, which explain where depreciation is on the balance sheet, is based on assets, an assessment of their importance. From the point of view of experts, assets are what is a method for a company to make a profit in a given time period.

Analysts have suggested breaking down the objects to be studied into components to more accurately estimate depreciation. This made it possible to achieve higher calculation accuracy. In this case, a separate component must be depreciated separately if its price relative to the total cost is quite significant. In some cases, such an approach cannot be used, but if its use is realistic, then it becomes mandatory. However, this does not mean that the company’s assets should be divided, at least in a situation where there is no particular significance for the indicators reflected in the reports.

Calculation of depreciation amount

To calculate your monthly depreciation amount, you first need to determine your annual depreciation rate. To do this, use the formula:

| Annual wear rate | = | 1 | : | Useful life of a fixed asset, years | × | 100% |

Then calculate the annual depreciation amount. To do this, use the formula:

| Annual depreciation amount | = | Annual wear rate | × | Initial (replacement) cost of fixed assets |

Every month in accounting you need to reflect accrued depreciation in the amount of 1/12 of the annual amount.

This procedure is provided for in paragraph 19 of PBU 6/01.

An example of reflecting depreciation on a fixed asset of a non-profit organization in accounting

The non-profit organization "Alpha" purchased a car for use in its statutory (non-commercial) activities. Its initial cost, formed in accounting, is 200,000 rubles. When commissioned, the vehicle had a useful life of 4 years.

The annual depreciation rate for a car is: (1: 4 years) × 100% = 25%.

The annual depreciation amount is: RUB 200,000. × 25% = 50,000 rub.

The monthly depreciation amount is: RUB 50,000. : 12 months = 4167 rub.

Starting from the month following the commissioning of the vehicle, the Alpha accountant reflects the accrual of depreciation on a monthly basis by posting:

Debit 010 – 4167 rub. – depreciation has been accrued for the vehicle for the current month.

Where do we start?

As follows from the mentioned IFRS document, first of all, the company decides in favor of choosing a specific amount - the initial price of the fixed asset. The choice is made by taking into account the significant components, of which each will have accrued depreciation in the balance sheet.

Example: If you want to look at an airplane, it can be divided into seats and body, ventilation system and engines. For each individual component, its own service life is determined. Depreciation is calculated for this period. In the balance sheet, the line reflects the indicators not for this component, but for the entire object as a whole, that is, for the aircraft. It is recommended to use this procedure both in the case when all components and the object as a whole are the property of the company, and when drawing up a lease agreement in which the object is listed on the balance sheet of the real owner, and not the tenant.

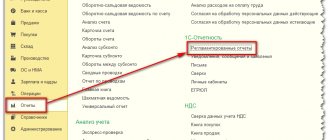

Reflection in 1C

Admission

In the 1C accounting program, the calculation of depreciation amounts is directly related to fixed assets or intangible assets, and therefore they should first be entered into accounting records. For this purpose, special documents “Receipt of fixed assets” or “Receipt of intangible assets” are used. The following basic details are filled in:

- number and date of the generated document;

- the name of the supplier of the object, as well as the number and date of the contract on the basis of which the acquisition was made;

- number and date of documents related to the receipt of the object;

- the warehouse where the object will be listed;

- name of the fixed asset or intangible asset;

- number of received objects, price per unit, total cost of receipt without VAT, amount of VAT, total cost of receipt with VAT.

Invoice received

After creating this document, it is necessary to generate the “Invoice received” document, which displays the number and date of the incoming primary document, the name of the supplier, the number and date of the contract, the amount of receipt, including the amount of VAT. Based on the entered invoice, accounts payable are formed, that is, the organization must pay the supplier for its purchase if it has not done so earlier. You must click the “Create based on” button and select the “Payment order” item, in which the fields associated with the recipient of funds (name of the supplier), his details, contract number and the direct purpose of the payment are filled in.

Count 02 is described in detail in this video:

Acceptance for registration

After the documents are generated, that is, the direct receipt of fixed assets or intangible assets to the enterprise is reflected, it is necessary to accept them for accounting, that is, put them into operation or direct use. A document “Acceptance for accounting of fixed assets” is created, which is drawn up for both fixed assets and intangible assets.

If several identical units of objects were purchased, this document should be created for each of them so that each of them can be assigned its own individual inventory number.

The most important details in this document will be the specific location of the object in the enterprise and the financially responsible person who will be in charge of the object being taken into account. In this case, the inventory number is assigned to the object automatically, but if necessary, it can be changed, although this is undesirable so that the numbering of the objects is not violated in the future.

When adding an object to this document, a new form will be opened to be filled out, which should contain information about the depreciation charge. Here it is necessary to note which depreciation group the object belongs to, depending on its useful life. The document is closed and saved, and then in the document “Acceptance for accounting of fixed assets” the tab regarding accounting is filled in. It must reflect the following parameters:

- the account in which depreciation charges will be reflected;

- the method that will be used to calculate depreciation;

- method of reflecting depreciation expenses;

- useful life of the object in the number of months.

The same items must be filled out in the tab regarding tax accounting, since, as you know, depreciation is calculated both in accounting and tax accounting.

Regular operation

All of these documents were generated and filled out in order to prepare for the calculation of depreciation, and the calculation procedure itself is formed at the close of each month with the “Routine operation” document. When selected, a new document for calculating depreciation will appear, in which you must fill in the month of accrual, and then post and save. It is on the basis of this document that entries are generated for accounts 02 and 05 related to the calculation of depreciation on objects.

After completing this document, you can view the register of depreciation charges, which is called “Certificate-calculation of depreciation.” When selecting a period for displaying data, the register will list all objects for which depreciation was accrued for the specified period, reflecting their inventory numbers, date of commissioning, initial and residual value, initial and remaining useful life in months and the direct amount of accrued depreciation for the period .

How Depreciation is calculated in 1C 7.7, see this video:

Fresh materials

- Clarification on 4 FSS When it is necessary to adjust 4-FSS The calculation presented in the FSS in form 4-FSS does not need adjustments if...

- Social tax 2021 Tax accrualIn accounting, the amounts of advance tax payments are reflected in the credit of account 69 (68)…

- Tax planning Tax planning in an organization Tax planning can significantly affect the formation of the financial results of an organization,…

- Why do they buy gold? Selling gold competently is a process that will require you to spend some free time. It will be necessary to find out...

A separate story

A situation is possible when there is a certain fixed asset, divided into several components, and the analysis for each of them shows the same time intervals for reflecting depreciation in the balance sheet, and the theory also recommends using the same calculation methods. If there is such a coincidence, grouping of similar objects is allowed. The period of operation of the facility depends on:

- from the time interval planned by the company for using the facility;

- from the number of production units, similar, planned to be received during the operation of the facility.

Together? Separately?

In the case where it was decided to reflect depreciation for the components of an OS object (balance sheet item: OS = D 01 - K 02) separately, then a similar approach should be practiced for other parts of the object, which include elements that do not actually exist.

What scheme should be used to amortize such residuals? To do this, first analyze the consumer mode, estimate the approximate service life of all components of the OS object. The company has the right to separately deal with the depreciation of components whose original price relative to the cost as a whole represents an insignificant amount. At the same time, you need to remember: in fact, it is impossible to find where depreciation is reflected on the balance sheet, since according to accounting rules, in the 120th line you need to enter the cost, from which depreciation figures have already been subtracted.

Accounts, depreciation, rules: how does it work?

Another important point is related to which line of the balance sheet shows depreciation and where it should not be mentioned. Any organization adopts accounting policies. The chief accountant of the enterprise is usually responsible for its formation. The accounting policy must specify the method by which depreciation is calculated. This document consolidates the approach to the issue and regulates the accumulation of depreciation in the balance sheet line reflecting account 02 credit.

In general, a correctly completed balance sheet, as already stated above, does not directly reflect the amounts accrued as depreciation. The balance sheet instead records assets only as balances after depreciation amounts have been deducted. Account 01 is responsible for the original price of the objects, and credit 02 shows what will remain after wear and tear. The balance also contains an indicator of the difference between accrued depreciation and the initial price. This value is entered into the balance of account 02. Line No. 1150 is intended for this. The described principle was not introduced by chance. Typically, the people for whom financial statements are intended are interested in seeing how large the assets actually are at any given time.

Types of activities of non-profit organizations

A non-profit organization can have several types of activities:

- statutory (non-profit), for which the organization was created and which is aimed at solving social, cultural and other socially significant problems;

- entrepreneurial (commercial), which is of an auxiliary nature and the results of which (profit) should be aimed at achieving statutory (non-commercial) goals. As part of this activity, a non-profit organization has the right to engage in production, trade, participate in the authorized capital of other organizations, as well as conduct other operations not prohibited by law.

This follows from the provisions of paragraph 2 of Article 2 and paragraph 2 of Article 24 of the Law of January 12, 1996 No. 7-FZ.

A non-profit organization must take into account income and expenses related to business activities separately (clause 3 of Article 24 of the Law of January 12, 1996 No. 7-FZ).

Accounting and reporting

Where is depreciation shown on the balance sheet? In fact, it is taken into account in account 02, but is not reflected directly. The parameters of this account are such that it is considered regulating. This means that the account has no independent meaning. This status imposes certain restrictions: the use of material is allowed only if there is data from account 01, that is, the main one. It is on it that you can find what the cost of the object was at the beginning, which was later reduced by the amount of depreciation.

A separate group of assets - intangible - cannot be reflected in account 01; account 04 is intended for it. In general, the logic for calculating and reflecting changes here is similar, and depreciation in the balance sheet is shown by account 05, on which you can see how much depreciation accrued on the funds was. At the same time, it is not possible to directly see depreciation on the balance sheet. The data obtained during accounting calculations is not recorded on its own, since it is necessary to reflect assets on the balance sheet; depreciation is not such, but is important in the formation of costs and determination of costs associated with the production process.

Calculation of the value of intangible assets in the balance sheet of an enterprise (formulas)

Important! In general, the value of line 1110 as of December 31 of the previous and previous periods is transferred from the balance sheet for the previous year.

The formula for calculating the value on line 1110 “Intangible assets” (residual value of intangible assets) is as follows:

In the event that depreciation is calculated without using account 05, there is no need to deduct the Credit Balance on this account, and the formula takes a simplified form:

Important! If the company also takes into account in account 04 the costs of completed R&D, the results of which are not subject to legal protection, the amount of such costs must be deducted from the balance of the said account.

Expenses and depreciation

The price of a product produced by a company directly depends not only on the input materials, but also on the wear and tear of the company’s property, which is included in the final cost. Based on this, in order to formulate costs correctly, you need to evaluate distribution costs, as well as the movement of funds through accounts linked to the main production processes. These are accounts numbered 20, 26, 44. All of them are accounting entries and allow you to estimate and reflect depreciation on the balance sheet, albeit indirectly. Information is placed on expense accounts DT 20, 26, 44, as well as KT 02.

Costs: fixed, variable, indirect, direct

What wear will be depends very little on production volumes and their changes. This allows you to classify depreciation charges as permanent expenses. The company decides in favor of a specific method for calculating funds and takes into account the same amount every month. This means that when producing hundreds of units of a product, deductions for depreciation are the same as when producing a thousand units.

According to the laws currently in force in our country, entrepreneurs are not limited in where and how to allocate costs. If you wish, you can qualify a specific article as indirect, and call another direct; you can do the opposite. Chapter 25 of the Tax Code is devoted to this, but there are no specific explanations or working rules in it yet. The taxpayer can independently make a decision and set up accounting in a way that is beneficial to him. In practice, depreciation charges are almost always classified as indirect costs.

How to make friends with the tax office?

But when tax officials come to an enterprise to conduct an audit, many of them like to make claims specifically under this article. An entrepreneur should think in advance about the motivation for the gradation he has introduced, and such that it satisfies the officials. Typically, tax auditors justify their interest by the fact that in any enterprise the costs on which the price of the final product depends are extremely significant, therefore classifying them as indirect is incorrect.

However, the most reliable method of freeing yourself from too much attention is to work out the organization’s accounting policies. You can add paragraphs to it to describe the mechanics of dividing direct and indirect costs. Additionally, it would not be superfluous to economically justify the decision. This will help resolve once and for all any disputes and doubts about the correctness of the company’s work. It will also help avoid disagreements within the organization. So, if depreciation of fixed assets is shown as an indirect expense on the balance sheet, it should be indicated as such.

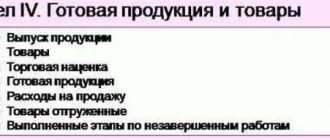

Reporting and depreciation

As has been said more than once above, when forming a balance sheet, it does not directly indicate the depreciation of an asset. Nevertheless, a thoughtful manager is usually interested in seeing the amounts allocated by the accounting department - if only for the sake of checking the correctness of the accountants' work. To get acquainted with the calculated indicators, you need to request reports on the financial performance of the enterprise.

In this document it will be possible to find the amounts of depreciation in various lines; this is determined by the characteristics of the activities of a particular organization. Let's say there are enterprises that use fixed assets in the production process for the main type of work, and they are not used anywhere else. Then line 2120, dedicated to sales and cost, will tell about depreciation. But if the enterprise has assets operated in trade, then the information can be found in line 2210, dedicated to expenses caused by commercial activities.

Accounting

Non-profit organizations can conduct accounting in a simplified way. But, if the receipt of funds and property for the previous reporting year exceeds 3,000,000 rubles, accounting should be kept in full.

This procedure is established by paragraph 1 of Article 32 of the Law of January 12, 1996 No. 7-FZ, paragraph 1 of Part 1 of Article 2 and paragraph 2 of Part 4 of Article 6 of the Law of December 6, 2011 No. 402-FZ.

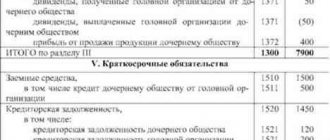

See additional reporting forms for non-profit organizations

Consequently, non-profit organizations must comply with the procedure for accounting for fixed assets established by PBU 6/01.

Unlike depreciation, depreciation of fixed assets is not included in expenses. Depreciation amounts are reflected on the balance sheet in account 010 “Depreciation of fixed assets.” When accruing depreciation, the following is posted monthly:

Debit 010

– depreciation has been accrued on the fixed assets of a non-profit organization.

Such rules are established by paragraph 17 of PBU 6/01.

Special cases

In some organizations, operating systems are used in industries of an additional nature. As a rule, these are not common species. Some companies transfer fixed assets under a lease agreement, and it is believed that making a profit from rent is not the main source of income for the organization. Then depreciation will need to be taken into account in line 2350 of the balance sheet, that is, among other expenses.

Fixed assets can also be used for general business purposes. This is permitted if such permission was included in the enterprise's accounting policy. Depreciation amounts for such a company will be reflected in the balance sheet in line 2220.

Warranty service.

Sometimes companies offer warranties on the products they sell. If the product fails to meet the warranty requirements, the company will bear the cost of repairing or replacing the product.

At the time of sale, the company does not know the amount of future expenses it will incur in a warranty claim.

One possible approach is for a company to wait until actual warranty costs are incurred and record the expense at that time. However, this will not result in matching these expenses with the corresponding revenue.

The matching principle requires a company to estimate the amount of future costs arising from its warranty obligations, recognize estimated warranty costs at the time of sale, and update (re-estimate) those costs over the warranty period based on warranty experience.

Theoretical aspects: what are fixed assets?

Of course, the issue of reflecting depreciation of fixed assets on the balance sheet of an enterprise and in the reporting generated by accountants is clear. But what, in principle, should be classified as fixed assets, and what cannot be classified in this category?

OS are those values and property of the company that can be used as assets in production. They are needed to produce a product or provide a service, to perform work. In addition, it is customary to classify as OS such property that is necessary for the organization to be effectively managed.

OS is:

- equipment;

- equipment, including computing and measuring;

- building;

- Earth;

- equipment used in farming;

- livestock;

- planting perennial plants;

- roads.

OS is a capital investment in land, including various works that improve the quality of the territory from an agricultural point of view. This includes environmental management facilities and capital investments made in property received under a lease agreement.

The listed operating systems are not a complete list of all those that exist in all the diversity of companies in our world. In some organizations you can find quite specific operating systems. In general, the decision to include a particular item in the operating system is made by assessing how important the property is for production and management processes within the company.

List of enterprise costs for the purchase of an intangible asset

Let us determine what costs of an organization are considered to be expenses incurred due to the need to acquire an object of intangible assets. These include:

- costs of paying financial specialists and lawyers for information services and legal consultations, respectively (in terms of consultations directly related to the purchase of intangible assets);

- payment to the copyright holder under agreements on the alienation of the exclusive right to a means of individualization or to the results of intellectual activity;

- remuneration for intermediation to participants in a transaction for the purchase of intangible assets;

- customs duties and duties;

- various types of duties (patent, government...), non-refundable tax payments that were made on the occasion of the purchase of an intangible asset;

- other costs that occurred due to the direct purchase of an intangible asset or due to the need to ensure conditions for using the acquired intangible asset for the intended purposes.

And why is depreciation needed?

When a decision has been made to classify a certain object as a fixed asset, its value is determined. From quarter to quarter it becomes less by an amount defined as depreciation. Initially, a decision is made for the object on how long the operational period is. Throughout this period, reporting for each new quarter will contain updated indicators of the value of property included in the fixed assets.

Depreciation is calculated regardless of how large the organization's profit or loss is. Key concepts are the duration of the reporting period and the established depreciation rates for a specific fixed asset. But how deductions for depreciation are reflected in the financial statements depends on the method chosen in the accounting policy. Some companies use a linear method of reflecting data, while others have established a write-off of value, depending on the timing, proportional to the volume of goods produced by the company. You can also reduce balances.

Rules and exceptions

Only those for which the operational period exceeds 12 months and the initial price is more than 40 thousand rubles can be classified as OS. In addition to fixed assets, intangible assets can be amortized. Property subject to depreciation represents capital investments aimed at generating profit. Some of them are additionally associated with lease agreements, and transfer for free use is also allowed.

But there are some exceptions to this rule (as well as to almost any rule). For example, if we are talking about a unitary enterprise, then depreciation will have to be charged on any property transferred by the owner for management or under operational management rights.

If there is a company that has found an investor for itself, then the property transferred by this person to the organization must be depreciated from the investor. This process is regulated by the investment agreement concluded at the beginning of cooperation. The investor accrues depreciation only during the period while the concluded agreement is in effect.

Natural resources, land, goods are objects that are not subject to depreciation. There is no need to calculate it for securities, as well as capital construction projects, work on which has not yet been completed.

Finally, there are fixed assets that are not recognized as depreciable. For example, if municipalities and government bodies do not participate in the transaction, then fixed assets transferred for free use cannot be called depreciable.

Answers to frequently asked questions about intangible assets in the balance sheet of an enterprise

Question: What documents can confirm an organization’s rights to own an intangible asset and operate it?

Answer: These can be patents, certificates, agreements on the alienation of the exclusive right to the result of intellectual activity or to a means of individualization.

Question: How to test for impairment of intangible assets?

Answer: You should follow the instructions given in International Financial Reporting Standards (IAS 38, IAS 36). This is stated in paragraph 22 of PBU 14/2007.