- home

- Reference

- About the Pension Fund

Conducting a business or any other significant economic activity requires, among other things, close interaction with regulatory authorities and structures. One of them is the state pension fund.

Those organizations and individual entrepreneurs that have employees are required to provide periodic reporting to the Pension Fund of the Russian Federation related to personalized accounting and calculation of insurance premiums. The features of its presentation will be discussed further in the article.

- 2.1 By post

Who reports electronically?

The unified report form was approved by Resolution of the Pension Fund Board of February 1, 2016 No. 83p. The information is necessary to record the insured persons. Budgetary organizations are required to provide this type of reporting for hired employees. This should be done monthly, no later than the 15th day of the month following the reporting period. That is, for September, the company must report no later than October 15. If the deadline for submitting a report falls on a weekend or holiday, the date is moved to the next business day.

An organization with an average headcount of 25 or more people is required to report electronically or fill out the SZV-M on the PFR website online. Otherwise, representatives of the territorial branch of the Pension Fund of the Russian Federation will issue a fine of 1,000 rubles.

Organizations with 24 or fewer employees have the right to both send electronic forms and send reports on paper.

Filling out PFR information in the service

To fill out a report in Kontur.Extern, do the following:

1. On the main page, click “PFR” → “Create new”.

2. Select the desired report.

3. If necessary, indicate the type of information (original, adjusting report) and reporting period. If not, go to step 4.

4. Click Create Report. The report form opens.

- If a report for the selected period has already been created, a message about this will appear. Click Edit Report.

5. Fill out the report and proceed to send it using the “Check and send” button

More details about sending are described in the instructions “Transferring ready information to the Pension Fund”.

How to fill out SZV-M correctly

Making mistakes in a report is expensive. For distortion of information, there is a fine of 500 rubles for each insured person in whose information inaccuracies were identified. The organization faces a similar amount of fines if the report is submitted later than the deadline or is not sent at all.

A step-by-step algorithm for filling out a report is discussed in the article “SZV-M reporting: step-by-step instructions for filling out.” The requirements for filling out the fields are the same and do not depend on how the report is submitted: online or on paper. The only difference is that you will need a document in Excel format (XML file).

Transfer of ready information to the Pension Fund of Russia

1. Select the menu item “PFR” > “Load from file”. If there are no ready-made files, read about filling out the information in the service.

2. In the next window, click on the “Add files” button.

3. In the window that opens, select the prepared reporting files. If necessary, select attachments to the report. Click "Open".

You can upload multiple files at the same time if:

- The organization in the files matches the organization selected in the system.

- The reporting period and registration number of the Pension Fund coincide in all packs.

- Files can be sent to the Pension Fund in one package. Detailed information on the procedure for transferring bundles to the Pension Fund of the Russian Federation is published in the following instructions. If it is necessary to send corrective information for previous periods according to the old rules for receiving packages, then the package should be generated in accordance with the recommendations.

4. Files are added to the system. The page displays a list of added files.

- If you encounter any errors while adding files, correct them and re-upload.

5. Click “Check and Proceed to Submit.”

6. Review the test results.

- If errors are found, click on the test log link and see what errors are found. Correct them here in Kontur.Extern (the “Edit” button) or in the program in which the report files were prepared.

- If warnings are found in the report, click on the test log link and read the warnings. They are advisory in nature and are acceptable in submitted reporting documents. Reports that only contain warnings can be sent to the FIU.

- If there are no errors or warnings, the document is ready to be sent.

If the report was edited in Kontur.Extern and was not sent, it will remain in the service (item “PFR” → “Reports in progress”).

7. To send the report, click “Send to the Pension Fund”.

8. The report will be sent in 10 minutes.

How to submit electronically

All budgetary organizations are interested in reducing reporting costs. The Internet offers a large selection of programs and online services that will generate and send any reports for free. Accounting programs are equipped with the function of automatically sending reporting forms to regulatory authorities.

How to submit a free report:

- Install a free program from the list of recommended financial institutions.

- Fill out the SZV-M online for free on the Pension Fund website.

- Take advantage of promotional access to paid online services.

In any case, it will not be possible to organize electronic document management completely free of charge. You will have to order an electronic signature (ES) of the manager at a special certification center. Electronic signature is necessary to certify information and information contained in electronic documents. Otherwise, the reporting will not be accepted and a fine will be issued.

Submission methods

The completed report must be submitted to the authority in one of the following possible ways - on paper or in electronic format.

However, the business entity itself cannot choose a more convenient option for it - it depends on the number of employees:

- If a business entity has contracts with more than 25 employees, the report must be submitted only in electronic format. In this case, the file must be prepared in a special computer program or service and signed with an electronic signature. If a business entity sends a paper report, although according to the law it must be submitted only electronically, a fine will be issued.

- If up to 24 employees are registered, the report can be submitted on paper, or, if desired, in electronic format.

Free Pension Fund programs

Using specialized software is quite simple. To do this, download one of the programs presented for generating and sending reports on the official website of the Russian Pension Fund, in the “Free programs, forms and protocols” section.

The following applications are suitable for preparing the SZV-M form:

- “PU 6 Documents”;

- "Spu_orb";

- "PD SPU";

- "PsvRSV".

To determine which application is best suited specifically for your budget organization, consult with a Pension Fund specialist.

Should I submit zero reporting?

Very often, responsible persons have a question: is it necessary to submit a zero form. In fact, the answer to this lies in the very concept of form. It is submitted if the company or entrepreneur has concluded employment agreements.

In this case, the key word is “concluded”, because even if an individual entrepreneur or company does not operate and does not pay wages to employees, but they themselves have employees with valid contracts, they do not cease to be insured persons.

On the other hand, if an entrepreneur has no hired employees at all, and the company has no concluded contracts, including with the director, then they are generally exempt from filing a report.

Attention! Thus, SZV-M cannot be zero at all - either contracts have been concluded and the report is filled out, regardless of payment/non-payment of wages, or there are no contracts and the subject is exempt from completing the report.

Online reporting via the website of the Pension Fund of the Russian Federation

Instructions on how to submit SZV-M to the pension fund for free via the Internet:

- Conclude an agreement on electronic document management.

- Specialists of the Pension Fund of the Russian Federation will carry out the difficult procedure of connection and registration.

- Conduct special testing of the electronic document management channel.

- Fill out the SZV-M form.

- Sign the report with an electronic signature and send it through your personal account on the Pension Fund website.

IMPORTANT!

To register in your personal account on the website of the Pension Fund of the Russian Federation, you need an electronic signature and a registration card, which is issued by specialists from the territorial branch of the fund.

Four information blocks to fill out

The structure and composition of SZV-M data is quite simple. If the employer does not have many insured persons, the entire report can fit on 1 page.

There are a total of 4 sections in the report:

- Employer information.

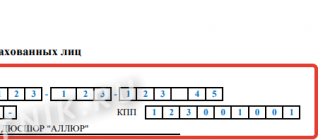

Registration number in the Pension Fund is a 12-digit digital code assigned to each employer upon registration with the Pension Fund. To make sure that the data about this number available to the report compiler is reliable, you can check it on the Federal Tax Service website by opening an extract from the Unified State Register of Legal Entities/Unified State Register of Individual Entrepreneurs. In the statement, the registration number is indicated in the section “Information about the policyholder in the Pension Fund”.

The remaining information about the employer entered into the form must be completely identical to the data from the constituent documents (regarding the name of the company), as well as the Certificate of registration with the tax authority (data on TIN and KPP).

- Reporting period.

In this section you need to enter only 2 digits: the calendar year and the reporting month number in the established format:

- Form type.

This section specifies one of three proposed form types: “out”, “add” or “cancel”. The explanation of each type is given in the form itself:

Based on the information from this section, Pension Fund specialists will understand whether you are submitting the SZV-M report with the initial data for the reporting period or correcting an already submitted form if missing or erroneous data is identified in it.

- Information about the insured persons.

To fill out this section, you need correct information about the full name, SNILS and TIN of the insured persons:

In this case, in the column “Last name, first name, patronymic” the patronymic is filled in if available. The same rule applies to the “TIN” column - if an individual does not have one, this column is not filled in. But without data on SNILS, it will not be possible to submit a report.

The preparation of the report is completed by the standard procedure - signing by the responsible person, indicating his position and decoding his full name. The report is certified with a seal only if the employer has one.

This is what the SZV-M sample for 2021 looks like.

Download our checklist for filling out the SZV-M and avoid making mistakes.

How to check whether the report is filled out correctly

Before sending the document, you must check the SZV-M online for free. To monitor and eliminate errors, use free checking programs. Download them from the Pension Fund website. Please note that the generated file format - XML only or reporting will not be accepted.

The most popular ones are CheckXML and CheckPFR. To work, install the application on your work computer and follow the software prompts. The procedure is simple:

- In the verification section, specify the path to the XML file with the report.

- The program will analyze it and indicate what to fix.

After sending

After sending the report, you must wait to receive a receipt and control protocol from the Pension Fund.

Receipt (confirmation of receipt) – a document confirming the fact of delivery of sent documents to the Pension Fund. The regulated period for receiving a receipt is 2 business days.

Control protocol is a document containing the result of checking the report on the side of the regulatory body. If no errors are found, the protocol has the status “positive” and indicates the successful submission of the report to the Pension Fund. A “negative” protocol indicates the presence of errors, in which case the report must be resent. The regulated period for receiving the protocol is 2 business days from the date of receipt of the delivery receipt.

To view or save a submitted report, receipt or processing protocol, select this report in the list of sent documents.

All sent reports are located in the section “PFR” → “Sent reports”.

How to simplify reporting

We invite you to familiarize yourself with little tricks that will save time on the formation and delivery of SZV-M:

- When submitting a report on paper, take with you an electronic version of the report on a flash drive, in XML format. Many representatives of the Pension Fund began to demand an electronic form of the document. Of course, this is not necessary, but it will avoid unnecessary conflicts.

- The employer is obliged to report monthly in the SZV-M form not only to the Pension Fund, but also to employees. That is, monthly print out and issue statements to employees indicating that they are included in the list of insured persons. There is no penalty for violating this condition yet. It is most convenient to register the issuance of statements for each employee in a random journal, where you indicate the reporting period, the employee’s surname and initials, the date of issue, and the employee signs for the received form.

- There is no information for reporting in the reporting period? In such a situation, for insurance, send a blank SZV-M form. Does the company expect long-term absence of employees? Then send a written request to representatives of the Pension Fund of the Russian Federation, with a detailed description of the circumstances. Without written confirmation from the Pension Fund, stopping reporting is risky.

Where to submit reports

Companies and individual entrepreneurs must send a report to the Pension Fund of Russia at the place where they are registered as an employer. This means that firms report according to their location, and entrepreneurs according to their registration.

In addition, the law establishes that individual divisions and branches must submit reports separately from their parent companies. In this situation, they indicate the TIN code of the head unit on the form, and the checkpoint code - their own.

You might be interested in:

Information on the average number of employees: sample filling, form