Average number of employees: general procedure and calculation formula

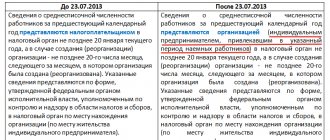

When calculating the average headcount, you should be guided by the procedure that Rosstat prescribes to use for filling out the statistical form P-4.

This procedure for 2021 was approved by Rosstat order No. 711 dated November 27, 2019. Important! From 01/01/2021, order No. 711 is applied as amended by Rosstat order No. 706 dated 11/17/2020. You can find out what changes in this regard in the calculation of the SSC from the Review from ConsultantPlus. Trial access to the system can be obtained for free.

The general formula for calculating the average number of employees per year can be presented as follows (clauses 79.6, 79.7 of Rosstat instructions No. 711):

Average year = (Average 1 + Average 2 + … + Average 12) / 12,

Where:

Average number of years is the average headcount for the year;

Average number 1, 2, etc. - the average number for the corresponding months of the year (January, February, ..., December).

In turn, to calculate the average number of employees per month, you need to sum up the number of employees for each calendar day of the month, including holidays and weekends, and divide this amount by the number of calendar days of this month.

Example. Calculation of the average headcount for the month from ConsultantPlus As of 08/01/2020, the organization has 24 full-time employees. On August 10, one of the workers went on maternity leave. The number of employees... You can view the full example in K+. Trial access is free.

For information about who submits information on the average number of employees and within what time frame, read the material “Submitting information on the average number of employees”

Average number of employees under civil law contracts

Workers registered under civil contracts (contracts, services, copyrights) are counted for each calendar day as whole units throughout the entire term of the contract. Moreover, the time of payment of remuneration is not taken into account.

When calculating the average number of employees for a weekend or holiday, take the number of employees for the previous working day.

Please note: an employee who is on the payroll of a company and has entered into a civil contract with it is not included in the average number of employees who performed work under civil contracts.

The same applies to individual entrepreneurs (PBOYUL), who entered into civil contracts with the company and received remuneration under them, as well as to employees who were not included in the payroll and with whom such contracts were not concluded.

Average headcount of a newly created organization: an important feature

When calculating, newly created organizations sum up the average number of employees for all months worked in the corresponding year and divide the resulting amount by 12, and not by the number of months of work, as one might assume (clause 79.10 of Rosstat instructions No. 711).

For example, an organization was created in September. The average number of employees in September was 60 people, in October - 64 people, in November - 62 people, in December - 59 people. The average number of employees for the year will be 20 people:

(60 + 64 + 62 + 59) / 12.

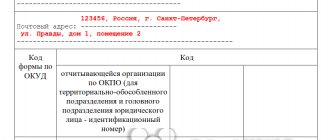

Filling out the KND form 1110018

consists of one page and contains information about the company and the total value of the SCN, calculated in accordance with the Guidelines. In the fields you need to indicate:

- name of the organization or full name of the individual entrepreneur,

- TIN,

- checkpoint,

- name and code of the tax authority where the report is submitted,

- indicators about the SSC,

- the date for which the indicator is calculated,

- Signature stamp.

If information is submitted for the past calendar year, the date indicated is January 1 of the current year.

The number of employees: what is it and how to calculate it

The headcount is the number of personnel in an organization on a specific calendar day of the month. It includes all employees with whom employment contracts have been concluded, including temporary and seasonal ones. And not only those who actually worked that day, but also those who were absent from work, for example, on a business trip, on sick leave, on vacation (including at their own expense) and even skipped work (see the full list). in paragraph 77 of Rosstat instructions No. 711).

Categories of workers not taken into account in the payroll are given in paragraph 78 of Rosstat instructions No. 711. In particular, these are:

- external part-time workers;

- working under GPC agreements;

- owners who do not receive a salary from the organization, etc.

Employees on maternity leave or “children’s” leave are generally included in the payroll, but are not taken into account in the average payroll. But if they work part-time or at home while maintaining benefits, they are taken into account in the SSC (clause 79.1 of Rosstat instructions No. 711). From 2021, an employee fired on Friday does not need to be included in the payroll for Saturday and Sunday (clause 76 of Rosstat instructions No. 711).

Determination of average number

According to paragraph 77 of the Instructions, the average number of employees includes: – average number of employees; – average number of external part-time workers; – the average number of employees performing work under civil contracts.

Hence, the Ministry of Finance of Russia concluded that PSN has the right to apply an individual entrepreneur whose average number of employees, together with external part-time workers and those working under civil contracts, is up to 15 people (inclusive).

As for the individual entrepreneur himself, he is not taken into account when calculating employees. Example 1

Individual entrepreneur O.P. Lapshin provides excursion services. In 2013, he switched to PSN. The patent validity period is from January 1 to December 31, 2013. To check the availability in April of the right to use PSN O.P. Lapshin decided to calculate the average number of his employees from January 1 to March 31. During this period, he was assisted in providing excursion services by employees who: – worked for him under an employment contract; – performed labor duties under civil contracts; - were invited from other organizations to work part-time. At the same time, O.P. Lapshin, the average number of employees was 4 people, the average number of external part-time workers was 6 people, the average number of employees performing work under civil contracts was 5 people. Thus, the average number of employees at O.P. Lapshin consisted of 15 people (4 + 6 + 5), which did not exceed the established limit.

This means that in April he has the right to apply the PSN, of course, if he has not violated the conditions regarding the amount of income from sales and timely payment of tax (payment of the patent).

In the published letter, the Russian Ministry of Finance also noted that an individual entrepreneur who does not involve hired workers when conducting “patent” activities also has the right to use PSN.

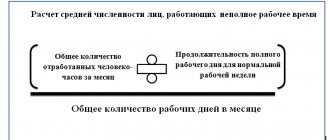

How to count part-time workers

It all depends on the basis on which part-time employment is applied.

If part-time work is an initiative of the employer or a legal requirement, such workers are considered a full-time employee. And if part-time work is established by an employment contract, staffing schedule or with the written consent of the employee, then in proportion to the time worked in the following order (clause 79.3 of Rosstat instructions No. 711):

- Calculate the total number of man-days worked. To do this, divide the man-hours worked by the length of the working day, based on the length of the working week:

- with a 40-hour work week - by 8 hours (with a 5-day work week) or by 6.67 hours (with a 6-day work week);

- at 36-hour - by 7.2 hours (with a 5-day work week) or by 6 hours (with a 6-day work week);

- at 24-hour - by 4.8 hours (with a 5-day work week) or by 4 hours (with a 6-day work week).

An example of calculating the “man-days” indicator to determine the average number of part-time workers from ConsultantPlus There are two employees at Alfa LLC - Sidorov A.D. and Samokhin N.I. work on a part-time basis. One - 6 hours a day, the other - 5 hours a day. Both employees have part-time working hours by agreement of the parties. In July 2020, Sidorov A.D. worked 23 days, Samokhin N.I. - 22 days. The organization operates on a five-day workweek schedule, so the working day is 8 hours (40/5). You can view the entire example in K+ by getting free trial access.

- The average number of part-time workers for the reporting month is determined in terms of full employment. To do this, divide the person-days worked by the number of working days according to the calendar in the reporting month. At the same time, for days of illness, vacation, absences, the hours of the previous working day are conditionally included in the number of man-hours worked.

Let's explain with an example (for a regular 40-hour 5-day work week).

The organization had 7 employees working part-time in October:

- four worked 23 days for 4 hours, we count them as 0.5 people (4.0: 8 hours);

- three - 3.2 hours a day for 23, 15 and 10 working days, respectively - this is 0.4 people (3.2: 8 hours).

Then the average number will be 2.8 people:

(0.5 × 23 × 4 + 0.4 × 23 + 0.4 × 15 + 0.4 × 10) / 22 working days in October.

For information on how long working hours can be, read the material “Normal working hours cannot exceed?” .

Reflection in the application for a patent

An individual entrepreneur who decides to use PSN must indicate the average number of employees in the application for a patent.

In the published letter, the Russian Ministry of Finance reminds that the recommended form of this document was approved by order of the Federal Tax Service of Russia dated December 14, 2012 No. ММВ-7-3/957.

In it, the taxpayer should indicate:

- information that he carries out entrepreneurial activities either with the involvement of hired workers (including under civil contracts) or without their involvement;

- the average number of hired workers involved or zero if they are not involved.

It must be borne in mind that the constituent entities of the Russian Federation have the right to establish the amount of annual income that an individual entrepreneur can potentially receive, including depending on the average number of employees.

In the commented document, specialists from the Finance Ministry believe that an individual entrepreneur who does not employ hired workers when carrying out business activities on the territory of a constituent entity of the Russian Federation, to which the PSN is applied, is included in the group “average number of hired workers up to 5 people inclusive.”

Commented document: Letter of the Ministry of Finance of the Russian Federation No. 03-11-12/38 dated March 28, 2013 “Patent taxation system: calculation of the average number of employees”

Tax consultant P.R. Sidorov

Work with personnel at the enterprise

Correctly drawn up documents will protect you from penalties from inspectors and will get you out of a conflict situation with employees. With the e-book “Working with Personnel in an Enterprise,” you will have all your documentation in perfect order. Find out more >>