Modern business conditions are characterized by the desire of many companies to overcome crisis phenomena and develop successful prospects for the development of debt policy, since borrowing funds is part of the business activities of any company, allowing it to maintain the capital structure, financial condition and creditworthiness. A necessary element of such a policy is to provide an information base for determining the need to attract borrowed sources with the need to maintain the financial flexibility of the company and diversify sources of financing.

The implementation of such tasks is possible only if the enterprise is provided with an accounting and analytical base that allows recording the company’s economic activities related to debt obligations, reflecting the costs of attracting debt sources.

The essence of the concept

Debt capital represents various debt obligations of the company, which are formed through external sources of financing.

Attracting borrowed capital within reasonable limits is profitable, since the cost of its servicing (interest paid) is written off as expenses, that is, it reduces taxable income.

An increase in the share of borrowed capital in the structure of financing sources entails an increase in the financial risk personified by this company, a decrease in reserve borrowed capital and an increase in the weighted average cost of capital of the company.

Channels

Channels of borrowed capital include funds that were raised:

- under leasing agreements;

- under loan agreements with financial institutions;

- directly from individuals or legal entities in the form of a loan;

- in the form of debt obligations.

Long-term channels often include non-banking instruments, including shares provided from the municipal or federal budget. Additionally, this may include long-term loans from other legal entities.

Classification

The main features for identifying types of debt capital are reflected in the table below.

| Sign | Typology |

| Period (term) |

|

| Goals |

|

| Sources of attraction |

|

| Form of attraction |

|

| Attraction methods |

|

| Security form |

|

How is it reflected in the balance sheet?

Borrowed capital is reflected in the balance sheet using sections 4 and 5 of the balance sheet. Section 4 is intended to display long-term liabilities, and 5 – for short-term liabilities.

A separate line that reveals the value of material assets attracted from outside to make a profit is not provided in the form of a balance sheet. However, based on the report data, you can calculate the total amount of borrowed capital.

Since borrowed capital is the total expression of the 4th and 5th sections of the balance sheet, the formula for its calculation can be presented as follows. Borrowed capital and balance sheet formula looks like this:

ZK = page 1400 + page 1500

Where:

- ZK – borrowed capital, t.r.;

- p. 1400 – long-term liabilities, t.r.;

- line 1500- short-term liabilities, t.r..

Thus, borrowed capital is understood as the monetary form of debt obligations, which can be calculated as the sum of sections 4 and 5 of the balance sheet. This indicator is reflected in the balance sheet by items by funding source.

The amount of borrowed capital in the balance sheet in lines 1400 and 1500 represents the amount of financial liabilities that can be formed in the following form:

- loan agreements;

- loan agreements;

- commodity loan agreements.

This type of capital is a powerful resource that a company may need in any situation.

Borrowed capital in the balance sheet is divided into categories and lines:

- line 1410 reflects outstanding long-term loans;

- line 1420 reflects deferred debt obligations for VAT;

- page 1430 keeps records of estimated liabilities;

- line 1450 takes into account other long-term liabilities;

- line 1510 takes into account short-term borrowed funds, which reflect the loan body and interest;

- line 1520 keeps records of short-term accounts payable;

- page 1530 keeps records of debts under obligations to the participants of the company;

- line 1540 keeps records of estimated liabilities for less than 12 months;

- line 1550 reflects short-term payable debt obligations that were not previously taken into account in lines 1510-1540.

Traditional method of calculating equity from the balance sheet (formula)

It is very simple to calculate the value of the SC using the traditional method. For this purpose, it is enough to decide what figure is indicated in the balance line 1300.

Sk = page 1300.

However, if we talk about interpreting the essence of equity capital as net assets, then calculating equity capital on the balance sheet is a more complicated task. Let's consider the features of its solution.

If we take into account that net assets are essentially equivalent to equity capital on the balance sheet, this will allow us to determine their essence based on the criteria given in Russian legal regulations. There are quite a lot of relevant documents. Among those that are most widely used is Order No. 84n of the Ministry of Finance of Russia dated August 28, 2014.

Read more about the provisions of Order No. 84n of the Ministry of Finance here.

In accordance with the method of the Ministry of Finance, the structure of assets accepted for calculating equity capital must contain absolutely all assets, with the exception of those that reflect the debt of the founders and shareholders for contributions to the authorized capital of the company.

In turn, obligations must also be taken into account, except for some future income, namely those associated with receiving assistance from the state, as well as the gratuitous receipt of this or that property.

In the balance sheet form, there are 2 sections for displaying the liabilities of the enterprise, which are regarded as amounts of borrowed capital - in the balance sheet these are sections 4 and 5. Section 4 is intended to display long-term liabilities, 5 - for short-term ones.

The balance sheet form does not provide for a separate line that would reveal the cost of material assets attracted from outside to make a profit. However, based on the report data, you can calculate the total amount of borrowed capital.

Amount of borrowed capital = line 1400 line 1500.

Read about the structure of the balance sheet in the article “Balance Sheet (Assets and Liabilities, Sections, Types).”

Analytical indicators

Among the informative indicators taken into account when assessing debt capital on the balance sheet are:

- debt ratio. The calculation of this value corresponds to the formula:

Kdn = D/EBTIDA,

Where:

- D – amount of debt obligations, t.r.;

- EBTIDA is an analytical indicator defined as the difference between the company’s profit before interest, taxes and depreciation, etc.

The standard for this coefficient is defined within the range of 2-2.5. Debt can be considered long-term loans and borrowings (in international practice), short-term loans and borrowings (in Russian practice).

- indicator of financial leverage (debt capital ratio on the balance sheet), which is determined by the formula:

FR = (DO + KO) / SK,

Where:

- DO – long-term liabilities, t.r.;

- KO – short-term liabilities, t.r.;

- SK – equity capital, t.r.

The recommended standard is 0.25 – 1. With a value of 0.25, we can conclude that the debt load is favorable for the company, which indicates a positive assessment of its creditworthiness. With a value close to 1, the load is considered maximum. If the value of the debt capital ratio according to the formula on the balance sheet goes beyond 1, then creditworthiness is assessed negatively.

- share of financing of fixed assets through long-term loans:

D = DO / VA,

where VA – non-current assets, i.e.

Attracting loans to finance fixed assets is justified, since these amounts are repaid further due to the cash flows created by these fixed assets.

- the ratio of working capital and short-term loans is determined by the formula:

SOB = OA / KO,

where OA is the company’s working capital, i.e.

The standard for this indicator varies from 1.5 to 2.

As a result of analyzing these indicators regarding the use of debt obligations of the company, it is possible to draw a conclusion about its creditworthiness. The information base obtained on the basis of calculating the presented indicators also allows management to develop a number of measures aimed at increasing the creditworthiness of the company.

Results

Borrowed capital is a monetary value of debt obligations, which is calculated as the sum of the 4th and 5th sections of the balance sheet. This indicator has many classification characteristics and is displayed in the balance sheet by items depending on the source of financing.

If you have any unresolved questions, you can find answers to them in ConsultantPlus. Full and free access to the system for 2 days.

An idea of the amount of equity in the balance sheet is given by the value indicated in its line 1300. However, in its essence, equity corresponds to the concept of “net assets”. To calculate net assets, there is a formula approved by the Russian Ministry of Finance, based on balance sheet data, but taking them into account taking into account some nuances.

Interaction of equity and debt capital

The relationship between these two structural elements represents the role of financial leverage, which is present in companies that do not have the required amount of finance to conduct business or to expand it. In such a situation, borrowed funds meet the needs of the company in the current period and bring profit. But the size of the ratio between equity and debt capital on the balance sheet plays a big role and affects the financial stability of the company.

If the amount of borrowed funds significantly exceeds equity, bankruptcy is possible. At the same time, the risky policy of using borrowed capital is the most profitable.

The following options for using levers are possible:

- positive application: in this case, the income from borrowed funds exceeds the fee for their use, the company makes a profit;

- neutral application: income from borrowed funds is equal to the cost of their maintenance;

- negative application: here the company incurs losses, the use of the loan does not pay off.

Financial dependency analysis

How much the company needs borrowed funds is up to management to decide. On the one hand, borrowed capital is a powerful resource needed in many situations. For example, if you need to expand economic activity and buy expensive equipment that can quickly pay for itself and make a profit. On the other hand, it is very easy to become financially dependent and begin to attract other people’s money at the slightest crisis, which will inevitably entail a high rate of increase in debt.

Therefore, it is necessary to analyze this balance sheet item. The simplest way to analyze the situation is to calculate the financial dependence ratio. It shows the ratio of equity to debt. Formula for calculating dependency:

To Federal Law = Equity capital / borrowed capital.

Own capital refers to the information contained in section III of the balance sheet Capital and reserves:

- authorized capital;

- retained earnings from previous years;

- retained earnings of the reporting period.

To calculate loans and credits, you need to add the company's accounts payable. If, based on the calculation results, the coefficient is greater than 1, then this means that own funds constitute the bulk of the company’s capital, that is, sufficient financial stability.

Accordingly, an indicator less than 1 will indicate an excess of borrowed funds over equity. This means that the company's financial vulnerability will increase, since it is dependent on third-party sources and, in fact, works on debt.

You can see how borrowed capital works in the video at the link:

It is necessary to carefully monitor the growth of the share of borrowed capital in the balance sheet structure, since other people's funds will have to be returned. Meanwhile, the terms of contracts may change, interest rates may increase, and the company will begin to fall behind the payment repayment schedule, which can lead to ruin and bankruptcy.

The organization's balance sheet presents many important financial indicators that characterize the company's business, including the cost of equity capital. At the moment, there are various ways to calculate such an indicator as equity capital - we will consider this below.

One of the main methods for calculating equity capital is based on the balance sheet data and is indicated in line 1300 “Total for section 3”. It consists of authorized capital, additional capital (also arising during the revaluation of fixed assets), reserve fund, as well as retained earnings.

In Russian legislation, the concept of equity capital often refers to net assets, which are formed from the balance sheet data by subtracting from the company’s assets (line 1600) all liabilities (lines 1400 and 1500), debts of participants and adding future income. This method helps participants and investors assess the value of a business.

There is also a method for determining equity for tax purposes when it comes to calculating income tax and there is controlled debt, that is, debt under a loan or credit when the person who issued the loan or security is a foreign company owning more than 20% of the borrower's share capital (directly or indirectly).

We must not forget that debt must exceed more than three times the amount of equity capital. For such borrowings, interest is not taken into account in expenses in full, but within certain limits (the “thin capitalization” rule). When we calculate equity capital for this case, then equity in the balance sheet is line 1300 “Total according to section. Ш" plus the borrower's tax debt.

I note that when it comes to tax arrears, this does not include arrears of contributions to funds (Pension Fund, Social Insurance Fund, Mandatory Health Insurance Fund).

Directions for optimizing debt capital

In order to increase the creditworthiness of a company using an information base on debt obligations, it is proposed to improve methodological approaches to reflecting and evaluating the activities of a company with borrowed funds. In order to manage debt obligations and ensure the creditworthiness of a company, it is necessary to generate data of different degrees of generalization: consolidated and more detailed.

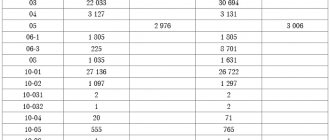

To increase the information content of the data, it is recommended to revise the organization of analytical accounting of the company’s debt obligations by changing the second-order accounts and separating the third-order (and even fourth-order) accounts.

Estimated values

The ZK indicator is used in the analysis and assessment of the efficiency of conducting economic activities of an enterprise. For example, having determined the ratio of equity to borrowed funds, we obtain the debt coverage ratio: how much the company is able to pay with its own funds. By calculating the inverse ratio of loans to equity assets, we find out the solvency ratio and financial stability of the company.

Return on borrowed capital (formula on the balance sheet) reflects the profitability of the circulation of borrowed finance in activities. The indicator is calculated in relation to one ruble of borrowed funds.

The coefficient of concentration of borrowed capital (balance sheet formula) determines the ratio of borrowed finance to the volume of total capital of an economic entity. In fact, this is the degree of debt load, encumbrance of the enterprise.

The indicators of financial statements for one calendar year are analyzed.

Suggestions for optimizing accounting

The proposed structure for constructing accounts for accounting for a company’s debt funds in order to increase its creditworthiness is as follows:

- first-order accounts, which combine all possible data on the state of the company's borrowed funds (both long-term and short-term);

- second-order accounts, which are capable of reflecting accounting information on generalized types of debt obligations, such as: loans and borrowings;

- third-order accounts are capable of detailing information on a more specific type of obligation, for example, a commercial loan, a loan agreement, etc.;

- fourth-order accounts, which are capable of recording information on various types of payments, for example, debt, interest, fines, etc.

Such a grouping of accounts for a company will allow a more in-depth study of analytical accounting for all types of debt obligations of the company. It can also improve control in this area, increase the efficiency of debt management of the company, and strengthen creditworthiness. It is recommended to improve the control system by introducing internal reports in the company, as well as the dynamics and structure of borrowed funds. Such reports can be prepared every month and submitted to management by the 25th. They will allow management to monitor timely negative trends in the structure of borrowed funds and capital of the company, eliminate them in a timely manner, thereby increasing the efficiency of debt management and the company’s creditworthiness indicators.

Improving management efficiency

To increase the efficiency of debt management, it is possible to introduce a document flow schedule and introduce the position of an accountant for debt obligations. The duties of such an accountant may include:

- control of the correct processing of primary documents on the company’s debts;

- checking the correctness of interest calculations;

- checking the correctness of recording of transactions accounting for the company's debts.

The introduction of these procedures helps reduce the percentage of errors and inaccuracies in accounting.