In the latest issue of accounting educational program, Alexey Ivanov explains why a balance sheet is needed, what can be seen in it, and why being able to read a balance sheet is important not only for an accountant. At the end of the article there is an example of constructing a balance sheet that will be understandable even to a reader who is very far from accounting.

Hi all! Alexey Ivanov is with you, the knowledge director of the online accounting “My Business” and the author of the telegram channel “Accounting Translator”. Every Friday on our blog on Klerke.ru I talk about accounting. I started with the basics, then I will move on to more complex matters. For those who are just preparing to become an accountant, this will help them get to know the profession better. Seasoned chief accountants should look at familiar categories from a different angle.

Why do you need a balance sheet?

For three months in a row I talked about certain types of assets and liabilities that accounting deals with. It's time to collect them into a useful tool for the director, business owner, financier, economist and anyone who wants to assess the financial position of the company. This tool is called a balance sheet. It contains information about what assets the company has and where they came from.

The balance sheet and income statement are the two main forms of financial statements that banks, investors, creditors and counterparties study to determine whether they are worth doing business with. The form of the Russian balance sheet is approved by Order of the Ministry of Finance of Russia dated July 2, 2010 N 66n, but its essence is the same in Russia, the USA, Zimbabwe and any other country.

The balance sheet is based on the statement on which all accounting has been built for more than five hundred years. The amount of assets must be equal to the amount of liabilities. Violation of this equality would mean that you have an asset from nowhere or a source of nothing - failure to comply with the law of conservation of matter in a single company. The conservation law for accounting is described by the capital equation:

Assets = Capital Liabilities.

Such an entry means that any asset is financed either by its own or borrowed liabilities. There is nowhere else for assets to come from. If you bought an asset, there will be accounts payable that will need to be paid. If received from the founders, the amount of the authorized capital will increase. Even if the asset was received as a gift, its value will be recorded as profit in the liability.

Analysis of the balance sheet allows you to understand the structure and liquidity of the company’s assets, the provision of own and borrowed funds, solvency, financial stability and other important characteristics of the business. I’ll tell you how to do this in the next issues of educational program.

Asset Analysis

For reporting, in any case, a balance sheet asset is a grouping of property by service life or turnover time. Property with a service life of more than 12 months is classified as non-current, and property with a service life of less than 12 months is classified as current.

Actually, a balance sheet asset is a grouping of economic resources according to the degree of their liquidity. Liquid assets include: money in cash or in bank accounts, financial investments for up to 12 months, property assets that can be quickly sold, bills of exchange for which payment has come due, accounts receivable with a short maturity. Illiquid ones, that is, those whose implementation will take a long time, include: fixed assets, intangible assets, long-term financial investments, etc. Grouping assets according to this principle provides visual information about whether the property is quickly sold or not. The excess of the ratio of current assets over non-current assets indicates the high liquidity of the enterprise, the ability to quickly sell its property and receive money for it, for example, to pay off obligations.

An example of constructing a balance sheet

LLC "Horns and Hooves" as of January 1, 2021, has the following assets and liabilities:

- intangible assets - 100 thousand rubles;

- fixed assets - 200 thousand rubles;

- stocks of materials and goods - 300 thousand rubles;

- accounts receivable from customers - 250 thousand rubles;

- money in current accounts and at the cash desk - 150 thousand rubles;

- authorized capital - 400 thousand rubles;

- retained earnings - 50 thousand rubles;

- long-term loan debt - 200 thousand rubles;

- accounts payable - 350 thousand rubles.

The balance sheet of Horns and Hooves LLC looks like this.

By the way, in the online accounting “My Business” the balance sheet is generated automatically based on the balances of the accounting accounts. At the same time, the system checks control ratios and compliance of data for previous years with submitted reports. If something doesn’t add up, she will alert the accountant about it. Try it - it's convenient and saves a lot of time!

Liability Analysis

Liabilities reflect the sources of funds through which the enterprise’s property was acquired: equity capital, reserves, long-term borrowed funds and accounts payable. As can be seen from the table, sources are divided into own and borrowed. It is by the ratio of these liability indicators that one can understand with what funds, own or borrowed, the property was acquired. To do this, several coefficients are calculated:

- autonomy coefficient as the ratio of equity capital to the total amount of sources of funds of the enterprise, Ka;

- debt-to-equity ratio as the ratio of long-term and short-term debt to equity capital, Kz/s.

So, if, when calculating the indicators, we received Ka ≥ 0.5 and Kz/s ≤ 1, this means that the enterprise’s obligations can be covered with its own funds.

So, the ratio of sections and articles of reporting can give a complete picture of the economic indicators of the enterprise in numbers. In order to correctly understand the obtained figures and make management conclusions and decisions based on them, it is enough for a manager to have basic financial literacy.

Sustainable Liabilities

Stable liabilities include funds that do not belong to the enterprise, which are constantly at its disposal until the debt is repaid. One of the main sources of formation of sustainable liabilities is the enterprise’s long-term accounts payable.

Stable liabilities also include the following types of funds:

- minimum carryover debt for wages to employees of the enterprise;

- reserve for future payments;

- minimum carryover debt to the budget and extra-budgetary funds;

- minimum debt to customers on deposits for returnable packaging;

- creditor funds received in the form of prepayment for products (goods, services);

- carryover balances of the consumption fund, etc.

Accruals for these payments are made by the enterprise on a daily basis (as current business operations are carried out), and the repayment of these obligations is made within the established time limits in the range of up to one month. They are a free source of borrowed funds for the enterprise.

Total liabilities

See what “Total liabilities” are in other dictionaries:

- Samsung Group - Type Industrial concern Listing on the KSE ... Wikipedia

- SAMSUNG — Coordinates: 37°19′55″ N. w. 122°01′47″ W d. / 37.331944° s. w. 122.029722° W d. ... Wikipedia

- Samsung - Group 삼성그룹 Type Industry ... Wikipedia

- Samsung group - Coordinates: 37°19′55″ N. w. 122°01′47″ W d. / 37.331944° s. w. 122.029722° W d. ... Wikipedia

- Samsung — Coordinates: 37°19′55″ N. w. 122°01′47″ W d. / 37.331944° s. w. 122.029722° W d. ... Wikipedia

- Balance sheet currency - (total assets) the total amount of the asset and the total amount of the liability of the balance sheet (necessarily equal to each other). See Total assets, Total liabilities... Economic and mathematical dictionary

- C - Balance Foreign trade balance State budget balance Trade balance see Foreign trade balance ... Economic and mathematical dictionary

- balance sheet currency - Sum (total) for all component accounts of the balance sheet. This amount should be the same for the assets and liabilities of the balance sheet. balance sheet currency Total asset amount and total liability amount... ... Technical Translator's Guide

- Liquidity - (Liquidity) Liquidity is the mobility of assets, ensuring the possibility of uninterrupted payment of obligations. Economic characteristics and liquidity ratio of an enterprise, bank, market, assets and investments as an important economic... ... Investor's Encyclopedia

- Fractional reserve banking - Finance Public finance: International finance State budget Local budget Private finance: Corporate finance Household finance Financial markets: Money market Foreign exchange market Stock market Derivatives market Financial instruments ... Wikipedia

The essence and meaning of the balance sheet

Accounting is a science that has its own methods and techniques. The main method of accounting is the balance sheet. Everything is connected to it and all accounting is focused on drawing up a balance sheet. The balance sheet is an integral part of the financial statements

The balance sheet is a generalized, cost reflection of the enterprise’s funds at the end of the reporting period by composition and sources of formation.

The balance sheet is a two-sided table: - The left side is the asset ; - Right - passive .

The assets of the balance sheet reflect funds by composition, and the liabilities show the same funds but by sources of education, i.e. assets and liabilities reflect the same funds of the enterprise at the end of the reporting period, which is why assets and liabilities must be equal, hence the name - balance sheet.

The balance sheet is drawn up at the end of each reporting period - month, quarter and year on the first day of the next month (for example, the balance sheet for the first quarter will be drawn up on March 1 of the current year).

The balance sheet is compiled on the basis of current accounting records, i.e. accounting accounts. Balances from these accounts are transferred to the balance sheet.

The balance sheet is of great importance: - Reflects the availability of funds, their composition and movement during the reporting period; — Reflects the order of formation of funds, i.e. their sources. This is important because this information about own and borrowed funds characterizes financial independence, solvency and financial results; — Has great control value because if in the end it is not equal, then errors were made in the current accounting.

Composition and content of the balance sheet.

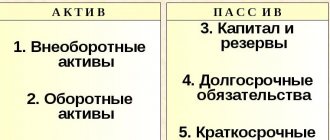

The balance sheet consists of 5 sections, the left side of the asset has 2 sections:

I. Current assets. Cash, short-term investments, inventories (TMZ), and short-term receivables are reflected here. These funds are called current assets or working capital of the enterprise. They move quickly, transferring value from one type of funds to another;

II. Long-term assets. This includes fixed assets, intangible assets, long-term investments and long-term receivables. Long-term assets are those funds that are used by the enterprise for more than one year.

The sheet liability contains 3 sections:

III. Short-term liabilities. Short-term loans and current accounts payable.

IV. Long term duties. Long-term loans and borrowings (for a period of more than a year).

V. Own capital. Authorized capital, share premium, profit reserves.

Now let's solve the problem with you and look at it all clearly.

Task

The first thing we will do is group the funds below by composition and sources of formation, thereby understanding the subject of accounting even more deeply.

Let's take for example some kind of cooking that has the following means:

| Name | Sum | Name | Sum |

| Cabbage | 1 920 | Money in a current bank account | 178 000 |

| Yeast dough | 4 585 | Gas stove | 31 000 |

| Money in the cash register | 20 560 | Premium flour | 9 290 |

| Building | 130 000 | Authorized capital | 320 000 |

| Debt for catering for pies | 4 950 | Pies with potatoes | 5 000 |

| Sunflower oil | 3 800 | Money was given to driver Ivanov for an oil change | 945 |

| Closet | 16 000 | Debt to Zerno LLP for flour | 8 225 |

| Get in front of the bank for a short-term loan | 35 000 | Potato | 4 650 |

| Pan | 2 300 | Debt to employees for May | 200 000 |

| Profit | 74 000 | Minibus | 224 225 |

Grouping of products by composition:

| Fixed assets | Sum | Goods | Sum |

| Building | 130 000 | - Finished products | |

| Gas stove | 31 000 | Pies with potatoes | 5 000 |

| Minibus | 224 225 | Total | 5 000 |

| Pan | 2 300 | ||

| Closet | 16 000 | Cash | Sum |

| Total | 221 525 | Money in the cash register | 20 560 |

| Raw materials | Sum | Money in a current bank account | 178 000 |

| Potato | 4 650 | Total | 198 560 |

| Cabbage | 1 920 | Funds in settlements | Sum |

| Premium flour | 9 290 | — Settlements with customers | |

| Sunflower oil | 3 800 | Debt for catering for pies | 4 950 |

| Total | 19 660 | - Calculations with accountable persons | |

| Unfinished production | Sum | Money was given to driver Ivanov for an oil change | 945 |

| Yeast dough | 4 585 | Total | 5 895 |

Grouping of funds by sources of education:

| Authorized capital | Sum | Current accounts payable | Sum |

| Authorized capital | 320 000 | — Settlements with suppliers | |

| Total | 320 000 | Debt to Zerno LLP for flour | 8 225 |

| Profit | 74 000 | Total | 8 225 |

| Total | 74 000 | — Payroll calculations | |

| Short-term bank loans | Sum | Debt to kitchen workers for May | 200 000 |

| Get in front of the bank for a short-term loan | 35 000 | Total | 18 000 |

| Total | 35 000 |

That's it, we've grouped the funds, now let's draw up a balance based on this.

Balance sheet

| Assets | Sum | Passive | Sum |

| I. Current assets Cash in hand Cash in the current account Settlements with customers Settlements with accountable persons Raw materials Finished products Work in progress Total Section I II. Long-term assets Fixed assets Total Section II Total | 20 560 178 000 4 950 945 19 660 5 000 4 585 233 700 403 525 403 525 637 225 | III. Short-term liabilities Short-term loans Settlements with suppliers Payments for wages Total Section III IV. Long-term assets V. Own capital Authorized capital Profit Total Section V Total | 35 000 8 225 200 000 243 225 — 320 000 74 00 394 000 637 225 |

Well, that's all, the funds are grouped, the balance is drawn up. I hope everything is clear.

Current liabilities in the balance sheet are line 1500 of the balance sheet

Often, accountants, when filling out tables characterizing the financial condition of an organization, encounter difficulties when it is necessary to indicate current liabilities, because this concept is absent in regulatory documents on accounting and taxation.

To determine where current liabilities are reflected on the balance sheet, let us turn to the meaning of this term. The Financial Dictionary defines current liabilities as accounts payable due within the next 12 months. In other words, current liabilities are synonymous with current liabilities. Short-term liabilities are reflected in section V of the liability side of the balance sheet. Thus, current liabilities in the balance sheet are line 1500 “Total for Section V”, which is defined as the sum of lines 1510, 1520, 1540, 1550, 1530 of the balance sheet liabilities.

How to fill out the lines of the Liability table?

Authorized capital. The amount of the authorized capital, which is recorded in the constituent documents, is recorded.

Reserve capital. This article indicates the amount that remains from the original capital.

Reserves to cover upcoming expenses and payments. The article summarizes the values of unused reserves during the year and reserves carried over to the next year (indicated in the annual balance sheet)

Revenue of the future periods. The amount of cash that was received in the reporting period, but according to the plan belongs to subsequent periods.

Profit. The profit received as a result of the main economic activity of the organization for the reporting period is taken into account, minus the amount already spent from this profit in the reporting period.

Accounts payable. The amount of existing debts to the organization’s creditors is taken into account.

Passive as an expression of an asset

“To understand accounting,” Scher argues, “it is extremely important to see this contrast not just as an obvious analytical equation, but to understand its deeper meaning; it is precisely this that represents the opposition, on the one hand, of exchange values, real, existing in tactile form, differentiated into economic and legal categories of the constituent parts of all property of the economy (the left side of the equation) and, on the other hand, the resulting abstract value, the capital of the owner of a given farms."

The assets of the balance sheet reflect information on:

- Non-current assets - this section contains information on fixed assets that are regularly used in the company’s activities over a long period of time. This includes buildings, equipment, structures, vehicles, and other fixed assets. Additionally, information is provided on intangible assets, various long-term investments, and other non-current assets.

- Current assets - this block collects data on consumable inventories, VAT balances, cash, receivables, existing short-term investments, and other current assets.

Attention! Under any conditions, assets in the balance sheet, line 1600, are equal in amount to liabilities, line 1700.

Balance sheet assets

Assets are means and resources used to increase the profit of an enterprise. These include income, profits, receipts, investments. Let's look at the decoding of the active part along with the procedure for calculating the amounts.

- 1110 – NMA. As part of the reflection, accounts 04, 05 are used.

- 1130. Investments in assets not involved in commodity circulation. Account 08 (debit) and 05 (credit) are used.

- 1140. Search resources of a material nature. It is directly related to account 08, 02, which are used in the process of processing accounting transactions.

- 1150. We are talking about fixed assets that are used in postings with accounts 01, 02.

- 1160. Numerous investments reflected in accounts 03, 02.

- 1170. Financial contributions, the line corresponds to 58, 55 (3), 59, 73 (1).

- 1180. We are talking about deferred tax assets. In particular, their detailed reflection is carried out on account 09 (debit direction).

- 1190. Other assets outside current operations. Accounts used in postings are 07, 08, 97.

- 1210. Reserves - various material, food, resource reserves. In the process of processing transactions, accounts 10, 11, 14-16, 20, 21, 23, 28, 29, 41-45, 97 are used.

- 1220. Value added taxes. This direction implies the use of account 19 in postings.

- 1230. Debt from debtors. As part of the preparation of documents, the following accounts are used: 62, 63, 68, 69, 70, 71, 73, 75, 76.

- 1240. Financial investments. The exception in this situation is cash equivalents. Accounts used in recording transactions are 58, 55, 59, 73.

- 1250. Various financial resources and their basic equivalents. A large number of accounts appear within the line. The main ones are 50, 51, 52, 55, 57.

- 1260. Other assets involved in current transactions. The score is 50-3, 94.

In general, there are usually fewer active areas than passive ones, but their goal is to increase the capital and profit of the organization.

Classification of balances

Buh. balances are classified according to various criteria:

- Based on time:

- Opening balance – formed when registering a new company.

- Initial balance - its formation is carried out annually to determine the financial position of the company after a whole year of activity.

- Interim balance - it is formed every quarter, at the end of the year it is allowed to be adjusted.

- Closing balance sheet – it is formed upon liquidation of the company.

- Based on the completeness of the information provided:

- General balance sheet - includes data on the property and liabilities of the company as a whole.

- Private balance sheet - includes information about the property assets and liabilities of a separate part of the company.

What is included in liabilities

As mentioned in the definition above, liabilities are the sources that form assets. Examples of elements included in liabilities:

- the authorized capital of an enterprise - the contributions of its founders, from which the start-up capital is made up, providing the basis for financial resources;

- short- and long-term loans and credits taken by the enterprise (debts to the bank and other creditors), since this is the money with which raw materials, means of production, and other things necessary for the life of the enterprise are purchased;

- additional capital - finance generated in the course of the company’s activities, for example, during the revaluation of fixed assets;

- retained earnings - net annual profit that can be used for various expense items in the future;

- tax obligations;

- future income;

- enterprise reserves;

- the company's own shares;

- depreciation of fixed assets.

Below is a summary table of liabilities in the balance sheet. As you can see, they are grouped into three sections.