When purchasing a computer program, you can acquire exclusive or non-exclusive rights to it - the accounting and tax accounting scheme used directly depends on this. In this article we will look at the features of accounting for rights to software products in 1C.

You will learn:

- on the legislative procedure for accounting for costs of non-exclusive rights;

- how to determine the useful life of a software product;

- which document and on which accounts in 1C the costs of purchasing software are reflected?

Rights to use software

In relation to the purchase of a computer program, accounting entries reflect the protected results of intellectual activity (Clause 1 of Article 1225 of the Civil Code of the Russian Federation). This may include accounting programs. The rights to use such programs are transferred by concluding a license agreement (Article 1235 of the Civil Code of the Russian Federation).

A license agreement may provide for the transfer of both exclusive and non-exclusive rights (clause 1 of Article 1236 of the Civil Code of the Russian Federation).

In the latter case, we are talking about a simple (non-exclusive) license. It does not transfer the ownership of the result of intellectual activity, but only the right to use such a result.

How to reflect the cost of the program in tax accounting

Companies that apply the general taxation system can take into account the costs of the program when taxing profits (subclause 26, clause 1, article 264 of the Tax Code of the Russian Federation). But the question remains controversial as to how costs should be formed using the accrual method: at a time when purchasing software, or gradually over the period of useful use.

Officials believe that if the license agreement sets a period, then the costs of purchasing software should be taken into account evenly over this period (see letter of the Ministry of Finance of Russia dated 06/07/11 No. 03-03-06/1/331).

However, there is also an opposite point of view. According to it, costs can in any case be written off at a time, since the Tax Code does not contain any prohibitions in this regard. There are many examples in arbitration practice when judges supported this particular position (see, for example, decisions of the FAS Volga District dated 02.16.09 No. A55-9496/2008 and FAS Moscow District dated 09.07.09 No. KA-A40/6263-09) .

In our opinion, it is permissible to immediately include the full cost of the license in expenses. An organization that classifies such costs as indirect has an additional argument. Indeed, in accordance with paragraph 2 of Article 318 of the Tax Code of the Russian Federation, indirect costs are reflected in the period in which they arose.

Companies using the cash method can write off program costs as a lump sum without hesitation. The same applies to the “simplified” ones (they take into account these costs on the basis of subparagraph 19 of paragraph 1 of Article 346.16 of the Tax Code of the Russian Federation).

Maintain accounting and tax records for free in the web service

Accounting Software: Postings

Reflection of the right to use a computer program by postings in accounting depends on the type of rights that are transferred.

Situation 1

If the exclusive rights to a software product are transferred to an organization under a licensing agreement, then if it meets the criteria of an intangible asset (IMA) (clause 3 of PBU 14/2007), it is reflected in account 04 “Intangible assets” (Order of the Ministry of Finance dated October 31, 2000 No. 94n) :

| Operation | Account debit | Account credit |

| Purchasing software | 08 “Investments in non-current assets”, sub-account “Acquisition of intangible assets” | 60 “Settlements with suppliers and contractors” |

| The software product was accepted for accounting as part of intangible assets | 04 | 08, subaccount “Purchase of intangible assets” |

If it is possible to determine the useful life of intangible assets, such an asset is depreciated in one of 3 ways provided for in clause 28 of PBU 14/2007:

Debit of accounts 26 “General business expenses”/44 “Sales expenses”, etc. – Credit of account 05 “Amortization of intangible assets”.

Also see “Rules for the valuation of intangible assets in accounting.”

Situation 2

In accounting, the entry when purchasing a program with non-exclusive rights depends on the procedure for payment for it (clause 39 of PBU 14/2007):

| Periodic payments | Current expense accounts are used: Dt 26, 44, etc. – Kt 60 |

| Fixed one-time payment transferred | The amount of the one-time payment is preliminarily taken into account in deferred expenses: Dt 97 “Future expenses” - Kt 60 |

Then, during the term of the agreement, the amount reflected in account 97 is written off as expenses for the reporting periods:

Dt 26, 44, etc. – Kt 97

If the term is not specified in the contract, the organization sets it itself.

How to determine useful life

To properly take into account the program, you need to know the period of its use. Most often it is equal to the license validity period. This period is specified in the license agreement, the text of which is presented in the form of a separate document or posted on the packaging.

Another option is possible: the period of use of the program is equal to the validity period of the contract itself.

If the agreement and contract do not mention the term, then it is considered equal to five years. This is stated in paragraph 4 of Article 1235 of the Civil Code.

Buying a computer with software

When purchasing the computer itself, depending on the cost, it is taken into account as part of the OS or MPZ.

If programs are included as a separate line in the computer delivery documents, they must be taken into account in the order for accounting programs (see above). But nuances are possible.

For example, if without the specified software the computer cannot be used for its intended purpose, and the program itself cannot be reinstalled on another computer, it can be taken into account in the cost of the computer.

If the cost of the software is not indicated at all, it is not taken into account separately, but is included in the initial cost of the purchased computer and reflected in the cost of the operating system or inventory on account 01 “Fixed Assets” or account 10 “Materials,” respectively.

Read also

12.08.2019

If the program was purchased online

Often the right to use the program is purchased on the Internet. The buyer transfers money and in return receives an activation code, with which he downloads the software to his computer. Before installation, the client reads the text of the license agreement, presented in electronic form, and, using a special option, confirms his agreement with its terms. At the same time, the buyer does not have a “paper” agreement, act or other documents.

In such a situation, will it be possible to write off the cost of the license as an expense? We believe that it will not succeed, since there is no documentary evidence, and the conditions for recognizing expenses set out in Article 252 of the Tax Code of the Russian Federation are not met. The only way out is to ask the developer to send a “paper” version of the license agreement. In addition, it is better to pay for the license not from a mobile phone or from an electronic wallet, but from a regular bank account. Then, during the inspection, you can present the inspector with a payment order that is familiar to him, which, most likely, will allow him to avoid claims. Officials also come to similar conclusions (see, for example, letter of the Ministry of Finance of Russia dated September 28, 2011 No. 03-03-06/1/596).

*New edition of clause 65 of the Regulations on accounting and financial reporting in the Russian Federation, approved by order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n.

What can be transferred to account 012

If an accountant decides to introduce an off-balance sheet account. 012, then he must record the innovation in the company’s working chart of accounts. We remind you that the working chart of accounts is a mandatory appendix to the accounting policy of the organization (clause 4 of PBU 1/08).

In the working chart of accounts, the accountant must indicate:

- name of the new off-balance sheet account;

- what values or obligations will be taken into account.

You will find an example of a working chart of accounts in the article “Working chart of accounts for accounting - sample 2015”.

According to the purpose of off-balance sheet accounts on the account. 012 you can transfer values or liabilities that require separate accounting from balance sheet assets. Or values with a special accounting procedure.

The most common example is low-value property. This includes something whose useful life is more than 12 months, and its cost is below 40,000 rubles. In accounting, property within the limit fixed in the accounting policy (but not more than 40,000 rubles) can be taken into account as part of the inventory and attributed to expenses at the time of commencement of use.

However, due to the fact that such valuables are used for a long time, it is necessary to organize control over their safety (paragraph 4, paragraph 5 of PBU 6/01, approved by order of the Ministry of Finance of the Russian Federation dated March 30, 2001 No. 26n). The legislation does not establish methods of such control. A common method is to create an off-balance sheet account. 012 “Low-valued property” and reflect on it the assets transferred for operation in a conditional valuation - for example, the cost of 1 object is equal to 1 ruble.

What is an off-balance sheet account

The Chart of Accounts has 8 sections with balance sheet accounts and a separate section “Off-balance sheet accounts”. Information on off-balance sheet accounts does not enter the company’s balance sheet, and accounting is carried out using a simple entry - information is recorded either as a debit or as a credit to the off-balance sheet account.

What exactly is taken into account behind the balance sheet - read the material “Rules for maintaining accounting on off-balance sheet accounts”.

In total, the Chart of Accounts provides for 11 off-balance sheet accounts. However, the accountant has the right to open new off-balance sheet accounts for his own needs, as well as to ensure the principles of reliable accounting/reporting and property separation (clause 5 of PBU 1/08, approved by order of the Ministry of Finance of the Russian Federation dated October 6, 2008 No. 106n).

Ways to reflect costs

The option for reflecting the costs of purchasing a computer program depends on the form in which it was sold. The program could be immediately installed on a computer or sold on a separate electronic medium. Also, the procedure for accounting for the costs of purchasing a program depends on how it affects the functioning of the computer as an object of fixed assets.

For example, without an installed operating system, a computer cannot work and becomes useless. This means that the costs associated with its installation should be attributed to the increase in the initial cost of the computer. But it is quite possible that some other shell is already installed on the computer, which allows it to work, and the new program is purchased under a separate contract separately from it. In this case, the costs of purchasing additional software are not included in the increase in the cost of the fixed asset, but are taken into account as other expenses.

Write-off of deferred expenses

To automatically account for software costs on a monthly basis, you need to run the Month Closing routine operation Write-off of deferred expenses in the Operations - Period Closing - Month Closing section.

Postings according to the document

Accounting for software costs for July

The document generates the posting:

- Dt Kt 97.21 - accounting for software costs as part of general business expenses for July.

Accounting for software costs for August

The document generates the posting:

- Dt Kt 97.21 - accounting for software costs as part of general business expenses for August.

Similarly, software costs are recorded for the following months before the expiration of the non-exclusive right.

Control

Let us check the correctness of the calculation of the amount of software costs by the program:

Documenting

The organization must approve the forms of primary documents, including a document for calculating the monthly amount of software costs, for example, an Accounting Certificate.

In 1C, you can print a form for calculating the monthly amount of software costs using the report Help-calculation of write-off of deferred expenses (in accounting PDF, NU PDF) in the section Operations - Closing the period - Closing the month - button Help-calculations - Write-off of deferred expenses.

Test yourself! Take a test on this topic using the link >>

See also:

- What costs can be taken into account as part of the BPR?

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Step-by-step instruction

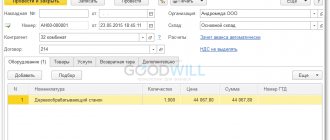

On July 24, the Organization, in accordance with the license agreement, received, under an acceptance certificate from FIRST BIT LLC, non-exclusive rights to use the 1C:ERP Enterprise Management 2 program worth 360,000 rubles. The period of use of the program specified in the contract is 2 years.

Let's look at step-by-step instructions for creating an example. PDF

| date | Debit | Credit | Accounting amount | Amount NU | the name of the operation | Documents (reports) in 1C | |

| Dt | CT | ||||||

| Reflection in accounting of costs for the acquisition of software | |||||||

| July 24 | 97.21 | 60.01 | 360 000 | 360 000 | 360 000 | Accounting for deferred expenses | Receipt (act, invoice) - Services (act) |

| 012 | 360 000 | Accounting for non-exclusive rights off-balance sheet | Manual entry - Operation | ||||

| Write-off of deferred expenses for July | |||||||

| July 31 | 97.21 | 3 870,97 | 3 870,97 | 3 870,97 | Write-off of deferred expenses | Closing the month - Write-off of deferred expenses | |

| Write-off of deferred expenses for August | |||||||

| August 31 | 97.21 | 15 000 | 15 000 | 15 000 | Write-off of deferred expenses | Closing the month - Write-off of deferred expenses | |