Payroll (Unified form No. T-51)

Excerpt from Resolution of the State Statistics Committee of the Russian Federation dated January 5, 2004 No. 1 “On approval of unified forms of primary accounting documentation for recording labor and its payment”:

When using a payroll slip in Form N T-49, other settlement and payment documents in Forms N T-51 and T-53 are not drawn up.

For employees receiving wages using payment cards, only a payslip is drawn up, and payroll and payslips are not drawn up.

The statements are compiled in one copy in the accounting department.

Payroll (forms N T-49 and N T-51) is made on the basis of data from primary documents recording production, hours actually worked and other documents.

In the “Accrued” columns, amounts are entered by type of payment from the payroll fund, as well as other income in the form of various social and material benefits provided to the employee, paid for from the organization’s profits and subject to inclusion in the tax base. At the same time, all deductions from the salary amount are calculated and the amount to be paid to the employee is determined.

On the title page of the payroll slip (Form N T-49) and the payroll slip (Form N T-53) the total amount to be paid is indicated. The permission to pay wages is signed by the head of the organization or a person authorized by him to do so. At the end of the statement, the amounts of paid and deposited wages are indicated.

In the payroll (form N T-49) and payroll (form N T-53), upon expiration of the payment period, an o is made against the names of employees who did not receive wages, respectively in columns 23 and 5. If necessary, the number of the presented document is indicated in the “Note” column of Form N T-53.

At the end of the payroll, after the last entry, a final line is drawn to indicate the total amount of the payroll. For the amount of wages issued, an expense cash order is drawn up (Form N KO-2), the number and date of which are indicated on the last page of the payroll.

In pay slips compiled on computer storage media, the composition of the details and their location are determined depending on the adopted information processing technology. In this case, the document form must contain all the details of the unified form.

Filling algorithm

For full functionality, the paper can be issued in a single copy. At the top of the document fill out:

- Basic details. The OKPO code is already entered in the form - 0301010. OKUD is filled out.

- The full name of the company, if any, the structural division of the company within which the form is being filled out.

- The name of the statement, its number, the date of signatures.

- The period for which the calculations were made.

The date for drawing up the document can be chosen arbitrarily, but on the condition that this day will not be earlier than the last day in the current month and no later than the actual day the funds are written off from the organization's cash desk.

In addition, on the second page of the statement there is a table, each column of which must be filled in (otherwise a dash is placed in the table cell).

In total, the document contains 18 columns with the following names:

- serial number of the employee to whom the payment is intended;

- personnel number of the same employee;

- last name, first name and patronymic (the latter are abbreviated to initials);

- position held, profession or specialization in which the employee is engaged;

- salary or tariff rate;

- how many days or hours were worked during the specified period (weekends and weekdays are indicated separately);

- the amount accrued by the organization to this employee for the month (the column is divided into different types of fees, including a “general” column that summarizes the data);

- what amount was withheld and credited earlier (advance payment, income tax, etc.);

- the employee’s debts to the organization or, conversely, the exact amount;

- how much money is supposed to be paid to the employee according to this statement.

Contents of the statement

The statement form has a title page and a table on the back . in a large organization, the form consists of several sheets. The title page of the statement must indicate:

- Name of the organization

- date

- Organization code

- Amount to be paid

- Billing period, in organizations. As a rule, this is one month for which wages are calculated

According to current legislation, payroll records must be kept for five years . For verification, a turnover sheet can be drawn up, which serves to summarize the data entered in the primary document in order to check the opening balance, turnover for the billing period, and the ending balance.

Features of filling and sample

Just the T-51 form is not enough; you need to be able to fill it out correctly. Remember that the document is filled out in rubles and kopecks. The register itself contains a title page and a reverse side, the number of pages of which depends on the staff of the organization.

The title page indicates the full name of the institution, division (if any), OKUD form code, as well as OKPO. The following is the name of the register itself, its details and the billing period - month.

Then the tabular part is filled in, reflecting information on employee accruals.

The following columns must be filled in in the table:

- serial number;

- personnel number for each employee;

- surname, name and patronymic of employees;

- job title;

- salary or tariff rate;

- actually worked time in accordance with the time sheet;

- holidays and weekends worked (actual time is indicated in hours);

- accruals for time payments;

- accruals for piecework payments;

- other accrued amounts;

- social, material benefits;

- total accrued income;

- withheld personal income tax;

- other deductions - union dues, payments under writs of execution;

- amount after deductions;

- the organization's debt to employees for previous billing periods;

- debt of the employee to the organization;

- total amount to be paid.

It is forbidden to leave empty fields in the register. If any cell does not contain current data, the specialist must put a dash.

>Ready sample T-51

What is a payroll summary?

Such a statement is used in agricultural enterprises in order to control the flow of funds for wages and reporting . Such a statement is drawn up for a billing period of one year; every month, for all categories of employees, data on earnings, bonuses, compensation, and any other payments that are included in the wage fund are entered. A separate line indicates the amounts that were paid in kind for wages, as well as payments that are not part of the wage fund.

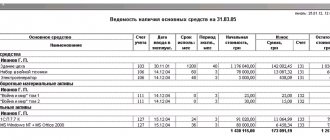

Methods for accounting salaries in 1C

Salaries and personnel/ Directories and settings/ Methods of salary accounting

This guide is intended for setting up salary accounting methods in 1C. Each method contains an accounting account and a cost item for assigning salaries. One method has already been created in the information base, which is called “Reflection of accruals by default”, indicating account 26 and the article “Wages”. The accountant can, if necessary, change this method or create new ones.

Get 267 video lessons on 1C for free:

Salary reports when checking the Social Insurance Fund

Hello dear forum users. Help is needed. From the Social Insurance Fund, the auditors requested salary records

for the year, broken down by month, to verify the correctness of the calculated NSiPZ. We have 1C Accounting 7.7. As far as I know, in ZiK it is possible to form some kind of vaults, but in 1C Bukh. Looks like this isn't possible? Maybe someone has a processing for 1C, or at least tell me what they look like, these vaults!

So print out “payroll statements for __ month” for them, which are generated monthly, in 1C they are called “Accrued taxes from payroll”. What do you doubt?

Reports=Specialized=accrued taxes from payroll

For example, in 1C I have this

Yes indeed, I have one too. Why didn't I see him before? Thanks a lot. For now, I decided to take them the table made in Ixelles, in which the lines indicate the total amounts for wages, compensation, sick leave at the expense of the employee and for the account. Wed in FSS, vacation pay, and in the month columns. Those. the same SALT according to the count. 70, but all months are on one sheet. And then we’ll see if it suits them or not.

Thank you all for your answers, they helped a lot.

they have now come to check my colleague according to the new rules, the pension is jointly with the Social Insurance Fund, and they also requested a set of statements. We work in Parus, and we don’t make records, only statements, as I understand it, they ask for the same as it is derived from 1C. And they ask for a code broken down into payments, in order to probably exclude payments that are not taxed. Tell me, based on what documents, they generally work and conduct these checks, which they have the right to demand. There is no set of wages in the Instructions for Budget Accounting (and as far as I remember, in commercial accounting too), this is not a mandatory form, but an analytical piece of paper “for yourself.” And the payroll sheet does not suit the inspectors, you have to calculate everything yourself

I speak for a long time and unconvincingly, as if I were talking about the friendship of peoples.

Everything I said is IMHO, if there are no references to legislation

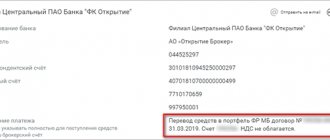

Zup 8-set of accruals, advance.

Standardly, the report displays summary information on accrued and paid wages for a specified period. But we will try to reconfigure the cat report to obtain information about accrued and withheld wages in an arbitrary period of time. First, let's go to "Settings" and delete everything that is configured there as standard.

Let's add a new table to the report structure. Let's add the "Section" grouping and the subordinate grouping "Calculation Type" to the rows, and to the "Accrual Month" columns. Now we'll select the topmost element of the report hierarchy and in the selection setting we'll indicate the employee for whom we want to receive data, by the way, I think, the balance in the report will be superfluous, and we will exclude it using the comparison type “Does not contain” “Balance”. Great, now we can select a custom period to view employee salary information.

Basic moments

According to Art. 136 of the Labor Code of the Russian Federation, the employer is obliged to adhere to a certain procedure and deadlines for issuing wages, preparing and filling out the relevant papers.

The procedure for issuing money must be documented. The enterprise creates special statements. Their forms are approved by law.

They come in three types:

- settlement;

- payment;

- settlement and payment.

The use of one form or another depends on some nuances.

Authorized employees issuing wages, first of all, must study in detail the following issues:

- definitions;

- purpose of the document;

- existing standards.

To more easily study the legislative framework regarding filling out cash registers and other documents, you need to know the relevant terminology.

Pay slip in 1C ZUP 3.0

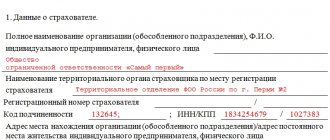

In 1C ZUP 3.0 a very convenient form of payslips is created, as compact as possible for printing. Details of displaying information on payslips can be configured using the “Settings” button:

Using the checkboxes, you can configure the content of information to be printed:

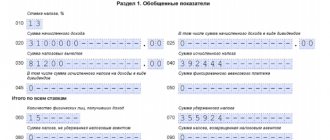

The payslip indicates the accrued amount of income, how much was withheld, actually paid, and the amount paid in salary is indicated as the amount payable:

If you enter everything correctly in 1C ZUP 3.0 and pay wages on time, then there will be no balance. If the statement is filled out automatically, then the 1C ZUP 3.0 program offers to pay everything that has been accrued.

Pay slip in 1C ZUP 3.0

In 1C ZUP 3.0 a very convenient form of payslips is created, as compact as possible for printing. Details of displaying information on payslips can be configured using the “Settings” button:

Using the checkboxes, you can configure the content of information to be printed:

The payslip indicates the accrued amount of income, how much was withheld, actually paid, and the amount paid in salary is indicated as the amount payable:

If you enter everything correctly in 1C ZUP 3.0 and pay wages on time, then there will be no balance. If the statement is filled out automatically, then the 1C ZUP 3.0 program offers to pay everything that has been accrued.