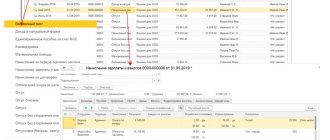

The fiscal data operator, OFD, transmits to the tax office the documents generated by the online cash register. These documents include reports:

- about registering a cash register - it is generated by the cash register after connecting to the operator;

- on the opening and closing of a shift - the shift should not exceed 24 hours, if the report on the closure of the shift did not arrive at the bank on time - this is a violation of the law on cash register systems;

- about the closure of the financial fund is formed when it is necessary to change the fiscal drive. The service life of the FN is 13, 15 or 36 months;

- about re-registration of a cash register - needed after replacing the drive, or if the data that was specified during registration of the cash register has changed;

- shows transmitted and untransmitted data about the current state of calculations. If the data from the cash register does not reach the operator for more than 30 days, the drive is blocked and sales stop. The report can be generated at the checkout and not have to close the shift;

- cash receipt - confirms payment for a product or service;

- correction check - created when the cash register made an error or made a purchase without a receipt.

The online cash register transmits the data to the operator. The tax office receives sales data upon request when it wants to check the company. This is how the Federal Tax Service monitors the company’s revenue and checks whether the entrepreneur pays taxes correctly.

Fiscal document - what is it?

Fiscal documents are documents that are generated by a cash register. In accordance with Law 54-FZ, which regulates the use of cash register equipment, all fiscal documents are now transferred to the Tax Service . The scheme is as follows: the document is sent by the online cash register to the fiscal data operator - in response, confirmation of its successful transmission is received - the OFD sends the document to the Federal Tax Service. The exchange of fiscal documents takes just a few minutes and occurs automatically.

Next, let's look at what fiscal documents exist.

How to connect to OFD

To work according to the law, you need an online cash register from the tax register and an agreement with the OFD. At Modulbank we ourselves prepare the online cash register for operation: we issue an electronic digital signature, enter into an agreement with the fiscal data operator, register the cash register with the tax office, and set up a cash register. The online cash register, fiscal storage and service packages can be purchased in installments for 6 months without a down payment, fines and commissions.

We are constantly improving the checkout to make it faster and more convenient. Therefore, the price and number of models may vary. Current information is on our website.

how the online cash register transfers data to the OFD transfer of the OFD to the tax office what data is transferred to the tax office how to send fiscal data to the OFD OFD fiscal data of the OFD what data is transferred send documents to the OFD data of the OFD for the CCP OFD what data is transferred to the tax office what the OFD transfers to the tax office will it be cash registers are required for individual entrepreneurs in 2021 fine for the lack of a cash register at an LLC in 2021 online cash registers for individual entrepreneurs on the UTII in 2021 law deferment from online cash registers for individual entrepreneurs on the USN latest news is a cash register required for individual entrepreneurs on the USN when providing services? cash registers for individual entrepreneurs on the USN in 2021 cash registers for individual entrepreneurs in 2021 on the UTII law cash registers from 2021 for individual entrepreneurs on the UTII why cash registers for individual entrepreneurs on the UTII from 2021 who should enter into an agreement with the fiscal data operator OFD how to enter into an agreement with the operator fiscal data how to find out OFD operator of fiscal data operator of fiscal data list of the Federal Tax Service agreement with the operator of fiscal data operators of fiscal data in Russia list of the Federal Tax Service register of operators of fiscal data Federal Tax Service of Russia operator of fiscal data list of organizations in St. Petersburg concluding an agreement with the operator of fiscal data how to find out the operator of fiscal data how to choose fiscal data operator fiscal data operator personal account fiscal data operator list of organizations register of fiscal data operators Federal Tax Service connection to the fiscal data operator activation code of the fiscal data operator comparison of fiscal data operators OFD OFD fiscal data operators list selection of a fiscal data operator fiscal data operator list of fiscal data operators in Russia list of operators for the transfer of fiscal data fiscal data operators in Russia comparison of fiscal data operators rating of fiscal data operators the best fiscal data operators list of fiscal data operators register of fiscal data operators operation of cash register equipment, enter into an agreement with the office of department for connecting and registering the cash register, operation of the cash register, TB and technical maintenance of the cash register registration of the cash register in the Federal Tax Service and the Office of the Federal Tax Service cost service life of the fiscal drive in the cash register service contract for the connection of the cash register to the office of the financial tax service contract for the maintenance and repair of the cash register computer maintenance of the cash register according to 54 Federal Tax Laws checking the labeling of goods made from natural fur Federal Tax Service marking system for products made from natural fur registering a cash register in the Federal Tax Service and the Office of the Astral Office of Change of the official office operator without replacing the fn fn for the cash register the price of the fn for the cash register buy buy a cash register with fn for 36 months cash registers transfer of data to the tax price cash register with data transfer to the tax office prices cash registers with data transfer to the tax office cash register with data transfer function buy setting up data transfer to OFD enter into an agreement with OFD for data transfer terminals with manual data entry cards pos terminal manual card data entry how to set up data transfer to OFD data transfer to fair sign set up data transfer to OFD KKM data transfer buy buy fiscal drive for the cash register sales receipt form for individual entrepreneurs without a cash register cash registers with a fiscal drive for individual entrepreneurs stand-alone cash registers with a fiscal drive connecting the cash register to an online store how much does it cost to service a cash register rental of a cash register with egais sales receipt for a sole proprietor without a cash register sample sales receipt for USN without cash register connection terminal for paying with bank cards connecting a pos terminal to the crm system connecting a pos terminal to 1c connecting a pos terminal to a computer connecting a pos terminal to a cash register connecting to the honest sign system 1s housing and communal services connecting a cash register connecting to an honest sign connecting an acquiring terminal connecting a pos terminal connecting a pos terminal ltd repair and maintenance of cash register equipment, operation of cash register equipment and settlements with customers regarding the use of cash register equipment in homeowners' associations, types of cash register equipment used in the store, concept and types of cash register equipment, commissioning of cash register equipment, preparation and operation of cash register equipment, operation of various cash register equipment types of operating procedures for cash register equipment requirements for cash register equipment buy a drive for a cash register buy a cash register for individual entrepreneurs with a fiscal drive where to buy a cash register with a fiscal drive cash register with a fiscal drive buy a pos terminal with a fiscal registrar pos terminal with a fiscal drive cash register without a fiscal drive contract number with an honest sign operator barcode scanner for an honest sign bar code honest sign cash register equipment for cafes with egais pos terminal egais honest sign egais edo honest sign shoe labeling edo what to do after registering with an honest sign when clothing stores will start operating after quarantine what will happen to the stores clothes after quarantine how prices for clothes will change after quarantine electronic signature for labeling shoes unified national digital labeling system honest sign of the TRCU in terms of labeling food products what equipment is needed for labeling medicines numbers for labeling furniture in kindergarten for labeling car tires a unified system is used honest sign failed to create a signature honest sign does not see the electronic signature electronic signature for an honest sign honest sign what kind of signature is needed honest sign electronic signature who benefits from the pandemic how much does servicing a cash register cost per month servicing a cash register under the new law sale and maintenance of cash registers

CCP registration report

The very first fiscal document that will need to be generated is a cash register registration report. It is compiled once during the initial registration of the cash register with the Federal Tax Service .

The registration report reflects information about the taxpayer, the selected cash register model, the location of its installation, operating mode and fiscal data operator. In addition, the report contains the information necessary to indicate in your personal account on the Federal Tax Service website:

- fiscal sign of the document;

- Document Number;

- date and time of receipt of the fiscal sign.

Important! You can use the cash register only after the Federal Tax Service has generated a cash register card. This information is available in your personal account on the website www.nalog.ru.

Online cash registers and cash documents according to new rules

6. OBTAINING A FISCAL REPORT

A sample fiscal report and the sequence of actions to obtain it must be indicated in the ED for a specific cash register model.

6.1. The cash register must ensure receipt of a fiscal report, both full and abbreviated, specifying the period with both dates and shift closing numbers, while the beginning and end of the period must be specified in the same way.

(paragraph introduced by the Minutes of the GMEC meeting dated 07/02/1998 N 5/43-1998)

To receive a fiscal report:

(as amended by the Minutes of the GMEC meeting dated August 29, 1996 N 5/30-96)

(see text in previous

— enter the previously set access password to the FP;

— enter the start date (or the start shift closing number) of the period for which the fiscal report is obtained;

— enter the end date (or end shift closing number) of the period for which the fiscal report is being obtained;

— enter the type of fiscal report (full or abbreviated).

In the general case, a period that is obviously longer than that actually registered in the FP can be specified.

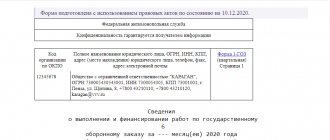

6.2. The fiscal report must contain the following details:

— name of the enterprise in accordance with the technical specifications for a specific cash register group;

— a sign of a fiscal report;

— end-to-end serial number of the document;

— date of receipt of the report;

— time of receipt of the report in accordance with technical specifications for a specific cash register group;

— the period for which the report is generated;

— serial number of the KKM;

— details (except for the password) for fiscalization of the cash register;

— details (except for the password) of all re-registrations of the cash register;

— details of all activations of EKLZ as part of the cash register;

(paragraph introduced by the Minutes of the GMEC meeting dated November 27, 2001 N 6/65-2001)

* - all results of shift sales for the period, indicating the date of registration of a specific result and the closing number of the shift;

* - all results of shift purchases for the period, indicating the date of registration of a specific result and the closing number of the shift;

** — total sales for the period;

**—total total of purchases for the period;

* - all results of shift sales returns for the period, indicating the date of registration of a specific result and the shift closing number;

(the details were introduced by the Minutes of the GMEC meeting dated 08.08.2000 N 3/57-2000)

* - all results of shift purchase returns for the period, indicating the date of registration of the specific result and the shift closing number;

(the details were introduced by the Minutes of the GMEC meeting dated 08.08.2000 N 3/57-2000)

** — total total of sales returns for the period;

(the details were introduced by the Minutes of the GMEC meeting dated 08.08.2000 N 3/57-2000)

**—the total total of purchase returns for the period.

(the details were introduced by the Minutes of the GMEC meeting dated 08.08.2000 N 3/57-2000)

Notes.

1) * - details are displayed only when a full fiscal report is received.

2) ** - if during the period for which the fiscal report is being prepared, the position of the decimal point has changed, the details must be recalculated and printed in the format established in the cash register, containing the maximum number of digits after the decimal point.

Shift opening report

So, the cash register is registered - you can start working. First of all, you need to open a shift . This is a daily operation, and it is accompanied by the generation of a report on the opening of the shift. Only after this will it be possible to accept payment at the checkout. The report reflects:

- shift number;

- Full name of the cashier who opened it;

- opening date and time.

Example of a shift opening report

In addition to the report, information about the start of the shift is reflected in the user’s personal section on the website of his OFD . There you can also find a lot of other information - the amounts received from customers and returned to them, the size of the average check, and more. This information will allow you to more effectively monitor the store and generate various reports.

What is a fiscal report

Most likely, law enforcement practice will be formed in the mode of receiving requests and the appearance of details when implementing the requirements of the Federal Tax Service letter No. ED-4-20 / [email protected] dated June 19, 2017.

It should be taken into account that, due to the situation as of June 2021, from 30 to 60% of enterprises in the country did not have time to switch to the new mode of working with cash register systems. This means a huge volume of cash register equipment that will have to be deregistered, which will place a huge burden on both the central service center and the Federal Tax Service employees. In this situation, we recommend that enterprises document their actions as much as possible, which can help confirm your conscientiousness in complying with the requirements of 290-FZ and 54-FZ.

You can find out about the availability of online cash registers in our warehouse or place a purchase order on our website by sending a request by email or calling.

27.06.2017

Cash receipt and its analogue - BSO

A cash receipt is a well-known fiscal document, the creation of which accompanies every cash and bank card payment in a store. Receipts are generated not only when goods are sold, but also when they are returned, and in some other cases.

In accordance with the current version of Law 54-FZ, a cash receipt must have many different details, which are listed in paragraph 1 of Article 4.7 of this law.

, a strict reporting form (SSR) can replace a cash receipt . The form must contain the same mandatory details as a cash receipt. Organizations and entrepreneurs that provide services to the public are allowed to use BSO instead of a cash register check.

It is impossible to create BSO on a computer - they are created using special automated systems . You can purchase them at printing houses or create them online for a small fee, and then print them on a regular printer.

From July 1, 2021, it will be possible to form a BSO exclusively using special systems - BSO-KKT .

Fiscal check: what is it?

The concept of “fiscal check” has not yet been enshrined in federal legislation and is not used there. It is noteworthy that not so long ago it could have appeared there: in one of the first editions, bill No. 551847-7 (introducing a number of changes to the Tax Code of the Russian Federation and other federal laws) contained language that determined sanctions for failure to provide a fiscal receipt to the Federal Tax Service by individuals with professional income tax payer status. The bill was adopted in November 2021, but in the final version the wording containing the term “fiscal check” was replaced by those containing the concept of “information on settlements made.”

Thus, the term in question can be interpreted freely, but taking into account the established practice of its use. Of course, including taking into account the fact that it was replaced in the said bill with the term noted above. Moreover, we have the right to define a fiscal check based on the meaning of the final wording of the relevant bill.

That is, a fiscal check is, first of all, a document that reflects “information about the calculations made.” In the case of the subject of regulation of the law that was adopted following the consideration of the bill (we are talking about the Law of November 27, 2018 No. 425-FZ - LINK), this is information about the calculations of an individual who pays (as part of a well-known experiment) tax on professional income, with customers (clients). In a broader sense, a fiscal receipt may thus contain information about any settlements of a particular entity with other participants in economic relations.

It is right to wonder why the legislator decided to abandon the use of the term “fiscal check”. It is likely that this is due to the fact that “information about the calculations made” does not necessarily have to be presented in the form of a document corresponding to the characteristics of a “check”. That is, a certain form on which the calculated data is recorded. Logically, this information does not necessarily have to be “fiscal” - that is, related to the performance by an authorized government body (in this case, the Federal Tax Service) of functions related to ensuring the representation of the interests of the treasury.

To understand the validity of our assumptions, let’s turn to the sources of law that regulate (in accordance with Law No. 425-FZ) the exchange of “information on settlements made.” We will talk, first of all, about Article 14 of the Law of November 27, 2018 No. 422-FZ (LINK), which states that:

- An individual paying tax on professional income, when receiving payment for goods or services, undertakes - using the “My Tax” mobile application (or acting through an authorized operator of an electronic platform or a bank):

- transfer information about settlements to the Federal Tax Service;

- generate a check and give it to the buyer (unless otherwise provided by law).

- The composition of information about calculations is determined by the procedure for using the “My Tax” application.

Thus, we immediately note that the legislator shares:

- information - subject to transfer to the Federal Tax Service;

- check - subject to transfer to the buyer (client).

It turns out that changing the content of the law in different readings is quite justified: the check is created, indeed, for non-fiscal purposes (since its recipient obviously does not perform fiscal functions), and the “information” is transferred to the Federal Tax Service (the entity, in turn, performing fiscal functions ) in the prescribed format, regardless of the receipt. And there is really no need to summarize them into some kind of “fiscal check”. Two different procedures are formed - “fiscalization” (outside the procedure for working with a check) and transferring the check to the buyer (outside the fiscalization mechanism).

At the same time, there is still a lot in common between the “information” and the check: in accordance with the rules for using the “My Tax” application (LINK), the composition of the “information” must be identical to the list of details of a cash receipt in accordance with paragraph 6 of Article 14 of Law No. 422-FZ. So, in a sense, “fiscal” information is still a kind of “check” (since in the case under consideration it repeats its details).

In turn, attention is also drawn to the fact that the mandatory details of the check include an identification number assigned by the Federal Tax Service (subclause 12 of clause 6 of Article 14 of Law No. 422-FZ). Therefore, it would not be entirely correct to talk about the complete “non-fiscal” nature of the check. Yes, it can only be transferred to the buyer - but the Federal Tax Service is “aware” of its existence (since it issues an identifier).

Thus, at the level of federal legislation, the concept of “fiscal check” has not yet been enshrined, but the basic principles of its application can be identified. This, one way or another, will be a document that:

- Contains information about settlements (between the supplier of goods and services and their buyer).

- Contains information that is subject to transfer to the Federal Tax Service in accordance with the established procedure.

- Represented by a document that may include details similar to those typical for a check.

At the same time, the document acquires the “fiscal” property precisely for the reason that it is subject to transfer to the regulatory authority. If such a transfer does not occur, then the check can be legitimately considered as “non-fiscal” - even if it meets the other two criteria.

The most common “fiscal” check is a cash receipt. But it is not the only one that can be classified in this category of documents. Let us consider which documents, in principle, based on the above definition, can be legally classified as “fiscal” and “non-fiscal” checks, in more detail.

Shift closing report

A cash register shift cannot last more than 24 hours . At the very end, it is necessary to generate a report on the closure of the shift. It contains information about the shift number, the date and time it was closed, as well as how many checks were issued.

If for some reason during the shift not all fiscal documents were transferred to the OFD , the closing report contains their number, as well as the date and time of generation of the first of them. If the cash register stops transferring receipts to the OFD, it means something went wrong - the Internet was lost, some problems occurred in the machine itself, and so on. From the moment the fact of non-transfer of the first fiscal document is recorded, the 30-day reporting period . During this time, “stuck” documents must be sent to the Federal Tax Service. If this does not happen, the fiscal drive (memory module of the online cash register) will be blocked and will not be able to conduct sales.

When it’s time to replace the fiscal drive, the cash register will notify you about it. This information is also reflected in the shift closing report. Such messages will begin to appear when there are 30 days left until the expiration date of the fiscal storage device or if the cash register memory is filled to 99%.

In addition, the shift close report may contain some sales data , such as total revenue, including cash and electronic funds. This information is not a required part of the report, so it may not appear. If necessary, they can be obtained from your personal account on the OFD website.

Examples

To get an idea of what a report on closing a fiscal accumulator looks like, pay attention to the required details:

- TIN and name of the organization;

- serial and registration number of the cash register;

- FN number;

- date and time of receipt generation;

- Cashier's full name.

For subsequent re-registration of the cash register, you will need the report number on the closure of the fiscal drive, which is the FD number:

Correction check

A variation of a cash receipt is a correction check. It breaks through when the CCT was not applied in a timely manner . For example, during the payment process the cash register broke down or the electricity went out. Another example: the cashier made a payment at the acquiring terminal, but did not issue a receipt.

A correction check allows you to avoid liability under Article 14.5 of the Code of Administrative Offenses of the Russian Federation for failure to use cash register equipment, therefore the tax authorities pay special attention to this fiscal document. You should also be prepared for the fact that inspectors may ask for clarification regarding the generation of such a check.

The adjustment procedure is as follows:

- Drawing up a foundation document - an act or memo. It should indicate the number and date of compilation, note the time at which the cash register was not applied, and state the reason for this.

- Formation of a correction check . It records the amount that was not punched out at the cash register in a timely manner, and indicates the date, number and name of the document from paragraph 1.

- Tax notice. A free-form application is drawn up in which the taxpayer reports the fact that the cash register has not been used and that it has been corrected using a correction check.

We recommend reading detailed material on adjusting revenue unaccounted for on cash registers with examples and sample documents.

Note! If the wrong amount , then there is no need to draw up a correction check. In this case, it is enough to carry out the reverse operation and then punch the correct check. For example, if the cashier incorrectly indicated the purchase amount on the sales receipt, he should generate a check with the attribute “return of receipt” for the incorrect amount, and then issue a receipt “receipt”, in which he should indicate the correct cost of the purchase.

Example of a correction check

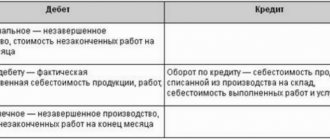

Posting expenses to a cash register in accounting

As mentioned above, you can post a cash register in the accounting department as fixed assets or inventories. The postings when accounting for cash registers will be different.

| Operation name | Debit (Dt) | Credit (Kt) | ||

| MPZ | OS | MPZ | OS | |

| The cost of purchasing cash register equipment and the associated costs of setting it up, including installing software. | 10 | 08 | 60 | |

| Value added tax (20% of the price of purchased equipment) | 19 | 60 | ||

| Transfer of overpaid VAT to the next tax period (VAT offset) | 68 | 60 | ||

| Total costs of not putting the cash register into operation | 44 | 01 | 10 | 08 |

| The cost of purchasing cash register equipment and the associated costs of setting it up, including installing software. | 60 | 51 | ||

Everything said above applies only to organizations under any tax regime, since individual entrepreneurs are exempt by law from mandatory accounting.

We'll tell you which cash register from our catalog is suitable for your business.

Leave a request and receive a consultation within 5 minutes.

What is the initial cost of KKM formed from?

The initial cost of purchasing equipment includes not only the price of the equipment itself. This also includes associated costs:

- online checkout delivery cost;

- consultation costs when purchasing a cash register;

- payment for distributor services (if there is an intermediary agreement);

- costs incurred by the company in bringing the cash register machine into a usable condition.

In the case of online technology, the last point includes the purchase of software and payment for services for its installation and configuration.

Registration settings change report

When registering a cash register with the Federal Tax Service, the owner provides various information about himself, the cash register, and the fiscal drive. Sometimes there is a change in this data. For example, the cash register was moved from one office to another, it was time to replace the fiscal drive, or the store began to sell cigarettes, alcohol or other excisable goods.

In all these and many other cases, it is necessary to change the settings on the cash register itself and re-register it . During this process, you will need to generate a report on changes in the CCP registration parameters. It indicates the reason for re-registration of the cash register and all registration parameters. Data that is subject to change is indicated in an updated form.

Note! Re-registration of the cash register will be completed after the user provides the data from this report in his personal account on the Tax Service website.

Accounting for cash registers as part of inventories

In addition to including equipment as part of fixed assets, many companies capitalize equipment to account 10 as part of the inventory and immediately write off the cost of commissioning to the corresponding cost accounts. In this case, information about the fiscal accumulator and cash register can be taken into account in an off-balance sheet account or checked during detailed analytical accounting of the account. 10.

Case Study 2

Limited Liability Company "Kaktus" as part of modernization acquired the fiscal registrar "ATOL" worth 32 thousand rubles (including VAT 18% 4881.36 rubles). The costs of concluding an agreement with the OFD and calling technical specialists amounted to 15 thousand rubles, including VAT 18% 2288.14 rubles. The company is a small trading enterprise.

The accounting department of Cactus LLC compiled the following transactions:

- Dt 10 Kt 60 – 27118.64 rub. – receipt of goods from the supplier.

- Dt 19 Kt 60 – 4881.36 rub. – VAT included.

- Dt 44 Kt 60 – 12,711.86 rub. – costs for calling specialists are included in sales costs.

- Dt 19 Kt 60 – 2288.14 rub. – tax accounting.

- Dt 68 Kt 19 – 7169.50 rub. – VAT is accepted for deduction.

- Dt 44 Kt 10 – 27,118.64 rub. – the cash register is put into operation.

Financial Fund closing report

Throughout the article, we repeatedly mentioned the fiscal drive - this is the memory of the online cash register. It encrypts, stores and transmits fiscal documents over the Internet. The FN has a validity period, after which it must be replaced. There are also other reasons for replacing it, for example, the cash register is deregistered or the storage capacity of the drive runs out.

Before generating a report on closing a financial fund, you should make sure that there are no untransferred documents left in it. This information can be obtained from the shift closing report.

If everything is in order, you can generate a report on closing the financial fund. It will contain the parameters necessary to re-register the cash register in connection with replacing the drive or to deregister it. This is a fiscal sign, the date and time of its receipt and the number of the fiscal document. The same information will be reflected in the OFD personal account.

A short video about correction checks:

Instructions on how to form at different cash desks

ATOL

ATOL cash register equipment is used by many entrepreneurs. Before making a report on the closure of the ATOL 30F fiscal accumulator, make sure that all data has been transferred to the Federal Tax Service. Then follow these steps:

Step 1. Connect the cash register to your computer via a USB port. The CCP registration application will open automatically, after which you should select “Close FN archive” in the menu.

Step 2. Synchronize the cash register and PC. Check that the date and time on the cash register and computer match.

Step 3. Select “Close FN” and wait until data archiving is complete.

The next question is how to get a report on the closure of an ATOL 90F fiscal drive or any other cash register of this brand? The receipt will be printed automatically while sending encrypted information to the tax data operator.

Shtrikh-M

To generate a report on the closure of the Shtrikh-M fiscal storage device, follow these steps:

- Connect the cash register to your PC and run the Driver Test program.

- In the menu on the left, select “FN” and make sure that all data has been transferred to the operator (the number of untransmitted messages is 0).

- In the top tab “Fiscalization of FN”, click on the button “Request for results of fiscalization”, then check the data specified for the old FN (TIN, tax regime, etc.).

- Go to the “Fiscal State” tab and select “Close Fiscal. mode".