Statistical customs declaration is the conventional name of a document issued during mutual trade between economic entities of member countries of the Economic Union between the Russian Federation, the Republic of Belarus, the Republic of Kazakhstan, the Kyrgyz Republic and the Republic of Armenia.

The customs legislation of the Eurasian Economic Union establishes that during trade turnover between member countries, control of goods transported across their borders is not carried out. But in order to collect statistical data on mutual trade, the Federal Customs Service of the Russian Federation, by Decree of the Government of the Russian Federation dated December 7, 2015 No. 1329 “On the organization of maintaining statistics of mutual trade of the Russian Federation with member states of the Eurasian Economic Union,” is responsible for collecting and maintaining such statistics. Filling out and submitting this statistical form is not a procedure for customs clearance of export or import. The idea that this report is a customs statistical form is due to the fact that it is submitted to the Federal Customs Service, and not to any other government agency. Customs does not control and does not have the right to detain the corresponding cargo and shipments in case of failure to submit the statistical form or errors in filling it out.

Features of filling out individual columns of the statistical form and the order of filling them out

Decree of the Government of the Russian Federation dated June 19, 2020 No. 891 “On the procedure for maintaining statistics of mutual trade in goods of the Russian Federation with member states of the Eurasian Economic Union and invalidating Decree of the Government of the Russian Federation of December 7, 2015 No. 1329” approved the Rules for maintaining statistics of mutual trade in goods of the Russian Federation. Federations with EAEU member states. In accordance with Appendix No. 2, the procedure for filling out the columns of the statistical form is determined.

In particular, the following is established in relation to individual columns:

in columns 1 “Seller”, 2 “Buyer”, 3 “Person responsible for financial settlement” there are more clear requirements for indicating the address (you must fill in information about the country, subject of the Russian Federation (for a Russian person), postal code, locality, street , number of the house (building, building), apartment (room, office);

Column 10 “Documents” additionally indicates accounting documents (if available), declarations on transactions with timber during the export of timber (if available);

the description of the goods in column 12 “Description of goods” has been expanded: information about the manufacturer of the goods, in addition to the name, includes its details (TIN, OGRN, KPP, OKATO); for goods subject to traceability, the quantity of goods is indicated in an additional unit of measurement used for traceability of goods; for goods subject to mandatory labeling, identification codes are indicated (identification codes for group or transport packaging);

in column 19 “Additional information”, the list of transaction codes for goods has doubled: codes from 05 to 08 have been added (processing for domestic consumption in the Russian Federation; goods, the period of temporary import (export) of which has been extended and amounted to more than 1 year; goods exported within the framework of online trade addressed to individuals; goods subject to traceability);

in column 20 “Declaration of goods (application for the release of goods before filing a declaration for goods)” it is now possible to indicate the number of the application for the release of goods before filing a declaration for goods;

in the “Applicant” column, information only about the persons specified in paragraph 5 of the Rules is indicated. Previously allowed by Resolution No. 1329, the indication in this column of information about a person duly authorized to submit a statistical form on behalf of the applicant is not regulated by Resolution 891.

Processing concept

Processing allows:

- automatically generate a statistical form

in the context of counterparties and contracts based on already entered documents

Sales

(acts, invoices) - generate upload files for sending to regulatory authorities, which you can easily send through 1C-Reporting

or other special operators - all this without changes

to the configuration code.

Completed report forms are saved in the familiar form of Regulated reports

in a programme.

Frequently Asked Questions When Submitting Statistical Forms

Answers to frequently asked questions when submitting statistical forms to the customs authority are posted on the official website of the Federal Customs Service of Russia https://edata.customs.ru/FtsPersonalCabinetHelp/Home/FAQContent/?fName=Stat.html

- Organizational issues In what cases filled out ?

- In what cases NOT filled out ?

- Who fills out the statistical form?

- What are the deadlines for submitting the statistical form?

- I need to confirm my organization details, but I don't have an electronic signature. What to do?

- Where can I see the list of previously provided statistical forms for our organization?

- I can't load an XML file generated in another software

- System number

- Section Statistical Forms

New terms

Resolution No. 891 gives participants of foreign trade activities two relaxations in terms of deadlines.

Plus two working days to submit the report . Statistical forms are submitted to customs monthly. Previously, this was set at 8 working days after the month in which the goods were shipped or received. Now - 10 working days.

Plus 10 days to correct errors . Previously, if a Federal Customs Service inspector discovered errors in the statistical form, this would in any case result in a fine for the company. Now the company has 10 days to provide correct information in place of incorrect information. The period is counted from the day the inspector sends a message to your personal account about the identified error. If the company sends the correct information on time, it will not be held liable.

Responsibility for violation of the procedure for submitting a statistical form to the customs authority

On January 29, 2017, the Federal Law of December 28, 2016 No. 510-FZ “On Amendments to Articles 12 and 104 of the Federal Law “On Customs Regulation in the Russian Federation” and the Code of the Russian Federation on Administrative Offenses” came into force, according to which The Code of Administrative Offenses of the Russian Federation has been supplemented with Article 19.7.13 “Failure to submit or untimely submission to the customs authority of a statistical form for recording the movement of goods.”

In accordance with Part 1 of Art. 19.7.13 of the Code of Administrative Offenses of the Russian Federation, failure to submit or untimely submission to the customs authority of a statistical form for recording the movement of goods or submission of a statistical form for recording the movement of goods containing false information shall entail the imposition of an administrative fine on officials in the amount of ten thousand to fifteen thousand rubles; for legal entities - from twenty thousand to fifty thousand rubles.

In accordance with Part 2 of Art. 19.7.13 Code of Administrative Offenses of the Russian Federation repeated commission of an administrative offense under Part 1 of Art. 19.7.13 of the Code of Administrative Offenses of the Russian Federation, entails the imposition of an administrative fine on officials in the amount of twenty thousand to thirty thousand rubles; for legal entities - from fifty thousand to one hundred thousand rubles.

It should be noted that the Applicant is considered to have fulfilled his obligation:

- Upon timely submission of the statistical form, if it is submitted through your personal account within the established time frame (subparagraph “a” of paragraph 15 of the Rules for maintaining statistics on mutual trade in goods of the Russian Federation with the EAEU member states, approved by Decree of the Government of the Russian Federation dated June 19, 2020 No. 891 (hereinafter referred to as Rules)).

- Upon submission of a statistical form containing reliable information, in the following cases (clause 14, subclause “b” of clause 15 of the Rules):

2.1 if, having received a notification that an official of the customs authority has discovered false information, no later than 10 working days from the date of its receipt, he submitted to the customs authority through his personal account a new statistical form with reliable information, along with an application for cancellation of the previous statistical form.

The notification (in electronic form) is considered received by the applicant on the day following the day it was sent by the customs authority (Part 3 of Article 282 of Law No. 289-FZ);

2.2 if he independently discovered the fact of submitting false information before it was discovered by a customs official and submitted to the customs authority through his personal account a new statistical form with reliable information and an application for cancellation of the previous statistical form.

Under such circumstances, the actions of the person (applicant) will not constitute an administrative offense under Article 19.7.13 of the Code of Administrative Offenses of the Russian Federation. If there is already an initiated case regarding an administrative offence, it is subject to termination taking into account the provisions of Part 2 of Article 1.7 of the Code of Administrative Offenses of the Russian Federation and on the basis of paragraph 2 of Part 1 of Article 24.5 of the Code of Administrative Offenses of the Russian Federation.

Help from a specialist in generating a report

Due to numerous requests, we have added a new item to the price list - purchasing a report with installation by a specialist and generation of one report.

This option is suitable for those who do not want to deal with the instructions. Our specialist will set everything up and tell you how to generate a report.

The cost of this option: 8,000 rubles (for 1C: Accounting) and 12,000 rubles (1C: Integrated Automation 2 and ERP)

For 1C:Accounting

| Cost: 6 000 ₽ | Cost: 8,000 ₽ (with installation ) | |

| Available in 1C:FRESH | Order extension | Order extension |

Connecting the extension to the base

Menu Administration - Printed forms, reports and processing - Extensions click Added from file , the Security Warning window opens, then click Continue.

Next, select the extension file and after that be sure to restart the program

To open processing you need to enter the Sales - Service menu

Ready! Processing is connected!

How to draw up an MP-sp form

The four-page form consists of three sections. On the title page the company enters its details, including:

- full and abbreviated name (short name is indicated in brackets);

- postal address of the enterprise;

- TIN;

- OKPO organization.

Next, fill in the indicators for the company's activities.

Section 1 indicates the initial data:

- whether entrepreneurial activity was carried out in 2021 (put o in the required field);

- the actual number of months of activity is entered;

- postal address of the place of business;

- applied taxation system.

Section 2 reflects quantitative and cost indicators:

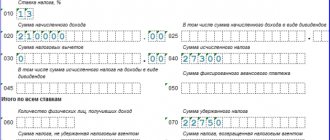

- by number of personnel (in p. 09 of Table 2.1 the average payroll number of the organization is entered, including contractors and external part-time workers, on p. 10 - only the payroll) and the wage fund (accrued wages, bonuses and vacation pay, regardless of the day of their payment, with In this case, the payroll does not include severance pay, and amounts of payments from extra-budgetary state funds, including for temporary disability, insurance contributions);

- by revenue, incl. by type of activity (information broken down by each OKVED code, the OKVED code must contain at least 4 digits);

- at the cost of construction work for major and current repairs performed on its own;

- construction and scientific and technical work performed by subcontractors.

Below for information (sign “X”) it is indicated whether the organization provided paid services to the population and whether it mastered new production (whether it was engaged in the production of new goods, works, services).

The average headcount does not include women on maternity leave or persons who have taken parental leave and students in an educational institution who have taken leave at their own expense. A detailed procedure for calculating the average number and reflecting the payroll is given in the Instructions for filling out the form.

Cost indicators are indicated with one decimal place.

If the company did not conduct business in 2020, it does not fill out section 2.

Section 3 is intended for indicators on the company's fixed assets and investments. For PF, the initial (book) and residual values are indicated. Investments in new fixed assets are indicated regardless of the order of their further use. All indicators are expressed in thousand rubles, minus VAT.

This section also separately shows the number of trucks actually used by the organization during the year. Special equipment and cars, leased vehicles do not need to be included in the total quantity.

Here is a sample of filling out the MP-SP for 2021 using the example of a report compiled by TiS LLC:

Stat form correction

If you realize that you made a mistake, did not completely provide information, or duplicated a statistical form previously registered with customs, you can cancel it in one of the following ways:

- By submitting a new statistical form instead of the canceled one. This is done, for example, when you want to correct detected inaccuracies or errors in a registered form.

- Without submitting a new statistical form. This method can be used when duplication has been detected, i.e. two identical SFs have been sent and registered, and one of them needs to be deleted.

Thus, inaccuracies in the statistical declaration can only be corrected by registering a new form. The old registered application will be canceled and a new one will be registered in its place.

You have the right to simply cancel the statistical form without submitting a new one. But this is only possible under the following circumstances:

- the shipment (receipt) of the goods specified in the registered form did not take place;

- multiple forms were registered for one shipment;

- goods subject to customs declaration were registered in accordance with the customs legislation of the EAEU and regulatory legal acts of the Russian Federation;

- products that are not subject to mandatory registration were registered;

- registered products were previously transferred to a non-resident under a foreign trade agreement on the territory of the Russian Federation, but in fact they were not exported outside the territory of the Russian Federation if this fact is documented;

- other reasons.