The list of documents that must be submitted by the policyholder to reimburse the costs of paying insurance coverage (benefits) for compulsory social insurance in case of temporary disability and in connection with maternity, when the employer applies to the Social Insurance Fund, is determined by the Order of the Ministry of Health and Social Development of the Russian Federation dated December 4 2009 No. 951n. Order of the Ministry of Labor of Russia dated October 28, 2016 No. 585n “On introducing changes to the list of documents that must be submitted by the policyholder for the territorial body of the Social Insurance Fund of the Russian Federation to make a decision on the allocation of the necessary funds for the payment of insurance coverage, approved by order of the Ministry of Health and Social Development of the Russian Federation dated December 4, 2009 No. 951n" established that from January 1, 2021 it is necessary to submit a calculation certificate, which must include all indicators, according to paragraph.

Standard forms of documents

N 457 Application for the return of amounts of excessively collected insurance premiums, penalties, fines 24-FSS Appendix No. 4 to the order of the FSS of the Russian Federation dated November 17, 2021 N 457 Application for reimbursement of expenses for the payment of temporary disability benefits Order of the FSS of the Russian Federation dated September 17, 2012 N 335 Application for reimbursement of expenses for the payment of social benefits for funerals Order of the Federal Social Insurance Fund of the Russian Federation dated September 17, 2012 N 335 Application for reimbursement of expenses for paying four additional days off to one of the parents (guardian, trustee) for the care of disabled children Order of the Social Insurance Fund of the Russian Federation dated September 17. 2012 N 335 Application for reimbursement of the cost of a guaranteed list of funeral services Order of the FSS of the Russian Federation dated September 17, 2012 N 335 Application for payment (recalculation) of benefits (vacation pay) Appendix No. 1 to the order of the FSS of the Russian Federation dated November 24, 2017

FSS approved new application forms for payment of benefits

Accounting. Taxes. Audit Login Registration Subscribe to news May 01: Green card (club card Bukhchas-online) for Russian specialists

- Your Fin. Analyst

- IFRS reporting

- accounting policy

- NEWS

- CURRENCY

- Assistant accountant

- LEGISLATION

- ARTICLES

- education

- Online accounting

- CLUB (SOCIAL NETWORK)

- Forms

- Report forms to the Social Insurance Fund

Report forms to the Social Insurance Fund. Report forms to the Social Insurance Fund of the Russian Federation.

Name Code/No. of the form Form approved Calculation of accrued and paid insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity and for compulsory social insurance against accidents at work 4-FSS Order of the Social Insurance Fund of the Russian Federation dated September 26, 2021 . N 381 (ed.

Form 23-fss. application for refund of overpaid insurance premiums

- application for reimbursement of expenses for temporary disability benefits;

- notification of the provision of missing documents or information;

- decision to refuse to assign and pay temporary disability benefits;

- application for reimbursement of expenses for payment of social benefits for funeral;

- an application for reimbursement of expenses for additional paid days off for one of the parents (guardian, trustee) to care for disabled children;

- application for reimbursement of the cost of a guaranteed list of funeral services;

- decision to refuse to consider documents (information);

- certificate of calculation of the amount of vacation pay.

Among the innovations, we can note the emergence of the opportunity to receive benefits not only by postal or bank transfer, as now, but also by contacting other organizations.

The Social Insurance Fund will change the forms of documents for paying benefits to employees

The FSS has developed new forms of documents that will be used for the payment of sick leave, children's and other social benefits.

The draft corresponding order was published on the Unified portal for posting draft legal acts.

Let us remind you that from January 1, 2021, the mechanism of “direct payments” of sick leave and other social benefits has been extended to all regions. It involves the payment of benefits to all employees directly from the Social Insurance Fund, and not from the employer’s cash register using the offset principle.

In this regard, the FSS has prepared a draft order, which contains the forms:

- inventory of submitted documents (information);

- notifications of termination of the insured person's right to receive monthly child care benefits;

- applications for reimbursement of expenses for temporary disability benefits;

- notifications about the submission of missing documents (information);

- notices of amendments to the certificate of incapacity for work;

- decisions to refuse to assign and pay temporary disability benefits;

- applications for reimbursement of expenses for payment of social benefits for funeral;

- applications for reimbursement of expenses for additional paid days off for one of the parents (guardian, trustee) to care for disabled children;

- applications for reimbursement of the cost of funeral services;

- decisions to refuse to consider documents (information);

- certificates of calculation of the amount of vacation pay.

The previously listed forms of documents were approved by FSS Order No. 578 dated November 24, 2017 and were used in pilot regions, that is, where until 2021 there was a transition to paying benefits to employees directly from the FSS. Now, since such forms of documents will be used in all regions, they will be approved by a new order of the FSS.

As the Fund explains, in addition to the forms already in use, the draft order includes new forms:

- information about the insured person;

- applications for recalculation of previously assigned benefits;

- applications for reimbursement of expenses incurred for preventive measures to reduce occupational injuries and occupational diseases of workers and sanatorium and resort treatment for workers engaged in work with harmful and (or) dangerous production factors.

The updated form “Information about the insured person” is structured by categories of insured persons and information on them. The new form also provides a record of the will of the insured person to pay benefits.

Also, the draft order of the Fund provides for the approval of new forms of registers of information necessary for the appointment and payment of the corresponding type of benefit and the procedures for filling them out. In particular, the draft order contains the forms:

- a register of information necessary for the appointment and payment of benefits for temporary disability, pregnancy and childbirth, one-time benefits for women registered with medical organizations in the early stages of pregnancy;

- a register of information necessary for the appointment and payment of a one-time benefit at the birth of a child;

- register of information necessary for the appointment and payment of monthly child care benefits.

Employers must send these registers to the Social Insurance Fund for the appointment and payment of various social benefits to employees. The currently existing register forms for pilot regions, approved by Order No. 579 dated November 24, 2017, will be abolished.

In accounting solutions “1C:Enterprise 8”, updated forms of documents for the payment of benefits to employees will be implemented after the approval of the relevant order by the Social Insurance Fund and its publication in the prescribed manner with the release of subsequent versions. For deadlines, see “Legislation Monitoring.”

Application for FSS sick leave (form and sample)

Compensation for unused vacation: ten and a half months count for a year When dismissing an employee who has worked in the organization for 11 months, compensation for unused vacation must be paid to him as for a full working year (clause 28 of the Rules, approved by the People's Commissariat of Labor of the USSR on April 30, 1930 No. 169) . But sometimes these 11 months are not so spent.

Attention

Submitting SZV-M for the founding director: the Pension Fund has made its decision The Pension Fund has finally put an end to the debate about the need to submit the SZV-M form in relation to the director-sole founder. So, for such persons you need to take both SZV-M and SZV-STAZH! When paying for “children’s” sick leave, you will have to be more careful. A certificate of incapacity for caring for a sick child under 7 years of age will be issued for the entire period of illness without any time limits. But be careful: the procedure for paying for “children’s” sick leave remains the same!

An important clarification: if the fact of overpaid contributions was revealed during reconciliation, then the period for their return is counted from the date of signing the reconciliation act. Rules for filling out form 23-FSS of the Russian Federation When filling out the form, several important points should be taken into account.

- Firstly, any errors when specifying the organization’s details can lead to very unpleasant consequences, so you need to pay especially close attention to them. If everything is more or less clear with the TIN, KPP and other parameters, then many people have difficulty with the line called “OKATO code” (stands for All-Russian Classifier of Objects of Administrative-Territorial Division). Today, it is necessary to put the OKTMO code in this line (in other words, the All-Russian Classifier of Municipal Territories), which can be found, for example, on the tax service website.

FSS application new sample

To do this, an employee who wants to receive payment for sick time must fill out an application form for sick leave from the Social Insurance Fund and hand it to his employer. It is important to remember that each enterprise is obliged to submit an application and sick leave to the territorial body of the Social Insurance Fund no later than five days after receiving the employee’s request. Ignoring this instruction will lead to a violation of the rights of citizens to timely payment of sick leave. Filling out the application The official application form for sick leave from the FSS is approved by Order of the Social Insurance Fund of the Russian Federation dated September 17, 2012 N 335. It can be downloaded from the link below, on the official website of the FSS or using the “Consultant+” reference and legal system.

Application to the Social Insurance Fund for direct payments

The application form to the FSS for direct payments was approved by Order of the FSS of the Russian Federation dated November 24, 2017 No. 578. All persons working under employment contracts can submit it. On the official website of the Social Insurance Fund, applications for direct payments and other application forms are freely available.

Application procedure:

- The employee fills out the application form and, together with additional documents entitling him to receive benefits, submits it to the employer.

- The employing organization submits the application to the Social Insurance Fund in electronic or paper form.

- Fund employees check the received documents, then calculate the benefit and transfer it to the employee’s personal account.

The application form for direct payments to the Social Insurance Fund is very convenient to submit electronically. The employer must prepare a register of benefit recipients in an approved form. It contains all the information necessary for the calculation and payment of benefits. The compiled registers must be signed electronically. If the organization employs more than 25 people, application registers must be submitted only in electronic format; if less than 25, submission on paper is allowed.

A sample of filling out an application for direct payments to the Social Insurance Fund is given below.

FSS application form 23-fss RF

Important

Check employee salaries with the new minimum wage. From 05/01/2018, the federal minimum wage will be 11,163 rubles, which is 1,674 rubles more than now. This means that employers who pay their employees at the minimum wage must raise their wages from May 1.

It is impossible to give a resigning employee a copy of SZV-M. According to the law on personal accounting, when dismissing an employee, the employer is obliged to give him copies of personalized reports (in particular, SZV-M and SZV-STAZH). However, these reporting forms are list-based, i.e. contain information about all employees.

This means transferring a copy of such a report to one employee means disclosing the personal data of other employees.

FSS application form 574n dated 10/25/2013

- Themes:

- HR records and documents

- Benefits

- Labor legislation

The FSS of Russia adopted a departmental act that put into effect new forms of documents submitted and received by insured persons and policyholders under OSS in case of temporary disability and in connection with maternity, as well as from industrial accidents and occupational diseases. The FSS of Russia adopted a departmental act that put into effect new forms of documents submitted and received by insured persons and policyholders under OSS in case of temporary disability and in connection with maternity, as well as from industrial accidents and occupational diseases, to the territorial body of the FSS of Russia ( or from it) to receive social benefits (order of the Federal Social Insurance Fund of the Russian Federation dated November 24, 2021

The essence of the FSS pilot project “Direct Payments”

The main goal of the project is to ensure that working citizens receive benefits, even if the employing organization is currently experiencing financial difficulties. We are talking about all types of benefits in connection with temporary disability and maternity. Benefits will be paid to employees to their personal bank account or by mail directly, bypassing the employer. To receive money, citizens need to fill out an application for direct payments from the Social Insurance Fund and submit it at their place of work. The principle for calculating the amount of benefits remained unchanged.

FSS application form

- Secondly, when demanding the return of money, it is necessary to indicate its purpose (i.e., put the amount exactly in the cell to which it belongs).

- And the third important point: if an application to the fund is submitted not by the applicant personally, but by his representative, detailed information about him must be entered in a special section of the application.

The application is drawn up in two copies, one of which is transferred to the specialist of the extra-budgetary fund, and the second, as potential evidence, remains in the hands of the payer.

In this case, the employee of the institution is obliged to stamp both documents. Below is an example of filling out Form 23-FSS of the Russian Federation - Application for the return of amounts of overpaid insurance contributions, penalties and fines to the Social Insurance Fund of the Russian Federation.

A new procedure has been approved for registration and deregistration in the Federal Social Insurance Fund of Russia of separate divisions of legal entities (in case such legal entities must be registered with the Social Insurance Fund) and individuals who have entered into an employment or civil law contract with employees*. Among other things, the new Procedure directly states that deregistration of the policyholder is carried out regardless of whether he has arrears in contributions. The corresponding changes will come into force on June 11. The current procedure, approved by order of the Ministry of Health and Social Development of the Russian Federation, will be canceled from this date.

Debt in contributions is not a reason for refusing to deregister

As before, the territorial body of the Federal Social Insurance Fund of the Russian Federation is obliged to remove the policyholder from registration within fourteen days from the date of submission of the relevant application. At the same time, the procedure now directly states that deregistration is carried out regardless of the presence of arrears in insurance premiums. However, deregistration of the policyholder does not relieve him of the obligation to repay the debt (clause 22 of the Procedure).

* The title of the document is “On the procedure for registration and deregistration in the territorial bodies of the Social Insurance Fund of policyholders and persons equated to policyholders.”

In what case should separate units and individuals register with the Social Insurance Fund?

The following are subject to mandatory registration as insurers:

1.

Organizations at the location of a separate division if such a division has a separate balance sheet and current account; itself calculates payments in favor of individuals. A separate division is registered as an insurer in the Social Insurance Fund for two types of compulsory social insurance: - in case of temporary disability and in connection with maternity; - from industrial accidents and occupational diseases.

The application for registration is submitted in the form given in Appendix No. 2 to the Administrative Regulations of the FSS (approved by order of the Ministry of Labor). As before, the application is submitted no later than 30 calendar days from the date of creation of the separate unit.

2.

Individuals who have entered into an employment contract with an employee. They are also registered as an insurer with the Social Insurance Fund for two types of compulsory social insurance:

- in case of temporary disability and in connection with maternity;

- from accidents at work and occupational diseases.

The application form for registration is provided for in Appendix No. 2 to the Administrative Regulations of the FSS (approved by order of the Ministry of Labor).

According to the new rules, an application must be submitted no later than 30 calendar days from the date of conclusion of the contract with the first hired employee (the current procedure allows only 10 days for this).

3.

Individuals obligated to pay insurance premiums in connection with the conclusion of a civil contract, the subject of which is the performance of work or provision of services, an author's order agreement. They are registered with the Social Insurance Fund as insurers only for compulsory social insurance against industrial accidents and occupational diseases. The application form for registration is provided for in Appendix No. 2 to the Administrative Regulations of the FSS (approved by order of the Ministry of Labor).

Deadlines for submitting an application for direct payments to the Social Insurance Fund

An application from an employee for direct payments must be submitted to the employer within 6 months from the end of the insured event. The responsible official enters information into the application on behalf of the employer and sends it, along with the attached documents, to the territorial body of the Social Insurance Fund. Documents must be submitted to the department no later than 5 calendar days from the date they were submitted by the employee.

If the set of documents submitted to the FSS is incomplete, the agency is obliged to notify the employer about this within 5 working days. The employer is also given 5 days to provide the missing documents. The FSS is obliged to make a decision on the appointment of payment of benefits and transfer it within 10 days from the date of receipt of the full package of documents.

Registration procedure

The policyholder registration period has been reduced from 5 to 3 working days. During registration, the FSS body determines the class of professional risk for the policyholder to establish the size of the insurance tariff for insurance against industrial accidents and occupational diseases (clause 14 of the Procedure). In case of extension of the validity period of employment or civil law contracts before the expiration of their validity period or the conclusion of a new agreement (agreements), the policyholder is not re-registered, and the term of his registration is extended until the termination of the contracts (clause 23 of the Procedure).

The procedure for registration and deregistration when the location (residence) of policyholders changes (Section V of the Procedure) is separately prescribed.

Application for registration as an insurer of an individual (filling sample)

Appendix No. 2 to the Administrative Regulations of the Social Insurance Fund of the Russian Federation for the provision of public services for registration and deregistration of policyholders - individuals who have entered into an employment contract with an employee, approved by the Order of the Ministry of Labor and Social Protection

Russian Federation dated October 25, 2013 N 574n

Form

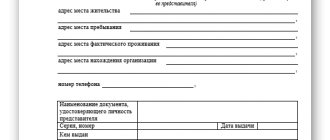

June 6, 2014 ——————————— (Date, month (in words), year) Branch No. 35 of the Moscow Regional Branch of the FSS of the Russian Federation B —————————————— ——————————- (Name of the territorial body of the Social Insurance Fund of the Russian Federation) APPLICATION for registration as an insurer of an individual Information about the applicant 1 Ivanov Ivan Ivanovich 1. —————- —————— ——————————— (Last name) (First name) (Patronymic) 2. Address

123456 City of Moscow (Postal code) (Constituent of the Russian Federation)

— Yasny Proezd 10 — 20 (City, region, other locality) (Street/alley/prospect) (House) (Building) (Apartment)

(495)1234567 Telephone (indicating the code) ———————————————— Email address ___________________________________________________ 3. Identity document: passport of a citizen of the Russian Federation name of the document ———————— —————————- 45 04 123456 series ——————— number —————————————— Department of Internal Affairs of the Yuzhnoye Medvedkovo district of Moscow 07/22/2002 by and when issued ——————————————————— 07.18.1982, Moscow date and place of birth —————————————————— 4. Information on state registration: 4.1. Name of the body that carried out the state registration Interdistrict Inspectorate of the Federal Tax Service of Russia for Moscow N 46 —————————————————————————— 102774612345678 4.2. Registration number ———————————————— 02/01/2011 4.3. Date of state registration ————————————- (Day, month, year) 5. Information on issued licenses (other documents giving the right to an individual to engage in private practice in accordance with the legislation of the Russian Federation): - 5.1 . Name of the document —————————————————— 5.2. Name of the authority that issued the document —————————— ___________________________________________________________________________ — 5.3. Document number ———————————————————— 5.4. Date of issue of the document ———————————————— (Day, month, year) — 5.5. Expiration date of the document —————————— (Day, month, year or “indefinitely”) 1 2 June 14 6. Number and date of conclusion of the employment contract N —- from — ——— 20— (day and month) 06/02/2014 09/30/2014 7. Validity period of the employment contract 2: from ————— to ————- (Date, (Day, month, year) month, year) — ———— ————- (indefinite period) Repair of household products and personal items 8. Main activity ———————————————— 52.7 OKVED code ————————— ———————————— (Indicate a digital code of at least three characters) 9. Address of the place of business

123456 City of Moscow (Postal code) (Constituent of the Russian Federation)

— Yasny Proezd 10 — 20 (City, region, other locality) (Street/alley/prospect) (House) (Building) (Apartment, office)

(495) 9876543 Phone (with code) ———————————————— 526000 10. OKDP code —————————————————— —— 11. Registered for tax purposes with the Federal Tax Service of Russia for Moscow No. 15 —————————————————————————— (Name of the tax authority that registered the legal entity for registration at the location) 771512345768 TIN ———————————————————————— (Taxpayer Identification Number) 40802810100000000123 12. Account with a credit institution —————— ———————— JSCB “Bank of Moscow” (OJSC), Moscow in ————————————————————————— (Name of bank) 044525219 BIC ———————————————————————— 5 13. Date of receipt of funds for wages ——— each month.

(date) I ask you to register as an insured with the territorial body of the Social Insurance Fund of the Russian Federation and ¦ ¦ hand over/¦X¦ — — send the 3 first copy of the notice of registration as an insured of an individual in the territorial body of the Social Insurance Fund of the Russian Federation. Ivanov Signature of the applicant —————————- 1 The applicant is responsible in accordance with the legislation of the Russian Federation for the accuracy of the information contained in this application.

2 The corresponding line is filled in depending on the type of employment contract.

3 Please note what needs to be noted.

Where to get an individual entrepreneur application form to the FSS

Naturally, an entrepreneur can download an application to the Social Insurance Fund on the official website of this service. I’ll say right away that it turned out to be quite difficult to find an up-to-date form for registering an individual entrepreneur as an insurer in the Social Insurance Fund.

More precisely, I downloaded several completely different options and simply went to the FSS service to clarify which one was correct (the Internet is truly a dump of low-quality sites).

AND ATTENTION!!! None of the bottoms were correct (honestly I was shocked). Fortunately, the FSS service specialist turned out to be very kind and not only gave me the correct sample, but also explained how to fill it out correctly (for which special thanks to her).

To simplify the task of finding a current application, I will post it on my Yandex disk from which you can download it without leaving this article: download the application for registration with the FSS.

Filling out an individual entrepreneur’s application to the Social Insurance Fund 2015

I will say right away that an entrepreneur becomes an employer in the Social Insurance Fund only once; subsequently, he will be listed as an employer until he decides to either close the individual entrepreneur or simply fire all employees and work on his own, then the individual entrepreneur will no longer need to be listed as an employer and you will need to deregister as an employer.

I will not fill it out on my fingers and, as always, I will record a video in which I will explain how to correctly fill out this rather important document and will definitely post it at the end of this article.

Individual entrepreneur application for registration with the Social Insurance Fund, first page

Individual entrepreneur application for registration with the Social Insurance Fund, second page

Let me remind you that in order to register with the FSS (social insurance fund), according to the law, you have 10 days.

I strongly recommend not to delay this issue, in general, train yourself from the very beginning - everything that concerns public services and deadlines - do everything on time, why bother with unnecessary troubles, fines, etc. (you still have to do it)!

Currently, many entrepreneurs use this Internet accounting to calculate taxes, contributions and submit reports online, try it for free. The service helped me save on accountant services and saved me from going to the tax office.

The procedure for state registration of an individual entrepreneur or LLC has now become even simpler. If you have not yet registered your business, prepare documents for registration completely free of charge without leaving your home through the online service I have tested: Registration of an individual entrepreneur or LLC for free in 15 minutes. All documents comply with the current legislation of the Russian Federation.

If you have any questions, you can ask them in the comments or in my group on the social network VKONTAKTE “