Home — Articles

It happens that a VAT evader receives money from a buyer, but this tax is highlighted in the payment slip by mistake . At the same time, the buyer did not change the amount due from him, but simply determined the VAT by calculation and indicated its amount in the “Purpose of payment” field, or simply wrote: “ Including VAT 18% .” Is this situation familiar to you? Then our article is for you. You are not obliged to pay such VAT, since an invoice with the allocated amount of VAT was not issued to the buyer (Clause 5 of Article 173 of the Tax Code of the Russian Federation; Letter of the Federal Tax Service of Russia for Moscow dated March 31, 2009 N 20-14/2/ [email protected] ) . However, you should not calm down and expect that you will easily explain everything to the tax authorities when they come to you with an on-site audit. The thing is that the inspectorate will most likely see the VAT payment much earlier. And it’s good if the inspector starts by asking you for clarification. But, as practice shows, he can act differently, causing you a lot of trouble. So, what could a buyer’s mistake result in and what needs to be done to prevent negative consequences?

Causes and common types of errors

Payment orders are usually drawn up by an employee of the accounting or financial department.

When filling out a document manually, errors are inevitable. Most often, employees make mistakes in the contract number or its date, incorrectly indicate the name of the paid goods or services, and when transferring tax, they make mistakes in the BCC and payment period. In 2021, due to the change in the VAT rate from 18% to 20%, cases of errors in indicating the tax rate and amount have become more frequent. We will tell you how and in what cases to write a sample letter about an error in the purpose of payment. Some details must be corrected, but in some cases this is not necessary. A clarifying letter must be drawn up if the translation cannot be clearly identified, that is, it cannot be determined for what and on what basis the payment was made. If the error is not critical, a clarification notice need not be drawn up.

Errors in payments

The professional activities of accountants are always associated with cash flow. We use different programs to make payments. But they all require careful attention from a specialist. What to do if a mistake is made?

Shipping methods

Every accountant can tell a story where he or a colleague made a mistake in filling out a payment document. It would seem that it would be difficult to issue a payment order, especially since the form of the document has remained unchanged since 2003. But mistakes still happen.

It’s good if you can calculate the error before the bank executes the order. Then there is still the opportunity to withdraw the payment or clarify it.

But in all other cases, errors lead to an increase in document flow, the emergence of arrears in payments to the budget, and, as a result, the accrual of penalties.

The emergence of client banks has significantly simplified the work of transferring finances and eliminated errors associated with signatures and seals.

Today, there are such concepts as “client-bank” and “Internet bank”.

The difference between them is that “client-bank” is a special program installed on a computer, through which data is exchanged.

And work with Internet Banking takes place through an Internet browser in the current time. Often accounting specialists do not share these concepts. The main thing is that payments reach recipients on time and in full.

Error error discord

The most common errors in payment orders are incorrect payment purposes and VAT calculations.

In the first case, the funds will arrive to the recipient as planned, but will add work. You will have to draw up a letter clarifying the payment to the address of the recipient and the bank (Appendix 1).

The mark of a credit organization can become a decisive argument in a dispute with controllers accusing them of understating VAT, which is confirmed by arbitration practice (resolution of the Federal Arbitration Court of the North Caucasus District dated August 16, 2011 No. A61-1787/2010).

Although experts believe that the purpose of payment does not concern the bank, but is intended only for the collaboration of suppliers and buyers. It’s a pity that professional opinion is not an argument for fiscal authorities.

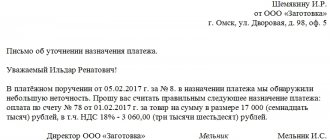

Annex 1

| Limited Liability Company "Best Employer" Ref. No.____from "____"__________2011 To the JSCB "Stolichny" to the General Director of LLC "Passive" From LLC "Best Employer" INN/KPP 7723618957/772301001 Address of the organization's location: 109382, Moscow, Krasnodonskaya street, building No. 139 Due to the discovery of an error when When filling out the “Payment purpose” field of payment order No. 313 dated June 10, 2011 in the amount of 10,000 (Ten thousand) rubles 00 kopecks, please consider the following purpose as correct: “Payment by account. No. 672 of June 9, 2011 for stationery, including VAT 18%.” General Director __________________ / V.V. Detochkin/Isp. A.B. Cracker(495)744-08-32 |

The problem with VAT is based on paragraph 4 of Article 168: “In settlement documents, including in registers of checks and registers for receiving funds from a letter of credit, primary accounting documents and invoices, the corresponding amount of tax is highlighted as a separate line.” And if the fee is not highlighted as a separate line, then the Federal Tax Service employees say that the use of the deduction is illegal. Or, on the contrary, about non-payment of tax, if VAT is highlighted in the payment slip, and the organization is not its payer (applies special regimes).

More than needed

If the counterparty is paid more than necessary, the management will not be happy. And much will depend on the existing contractual relations between the companies. Perhaps the overpayment will become an advance payment towards future deliveries or work.

If all contacts with the payee are terminated, then a bona fide counterparty will most likely return the overpayment, indicating “erroneously transferred funds” in the payment purpose.

When a company does not want to return overpaid money, it is worth checking whether there is an instruction from management to transfer exactly these funds, and write a letter to the counterparty.

The claim should indicate that interest is paid on the amount of unexpected monetary enrichment at the refinancing rate from the moment when the acquirer became aware of the groundlessness of what was received (clause 2 of Article 1107 of the Civil Code). If the warning does not have an effect on the partner, then all that remains is to go to court.

Another case is if the payment was made using incorrect details. Amounts paid with an incorrect current account, TIN, or recipient's name will not reach the addressee, but will be returned to the sender's current account in approximately 5 days.

Here you can rely on paragraph 6 of Appendix 28 to the Regulations of the Central Bank of the Russian Federation dated October 3, 2002.

No. 2-P, which states that “the credit institution (branch) of the recipient takes prompt measures to obtain supporting documents and ensure that funds are credited as intended by sending a request through the Bank of Russia to the payer’s credit institution with a request to confirm the correctness of the details.” But practice shows that not all banks adhere to these rules. And it is better to send a letter to the credit institution servicing company yourself, specifying the recipient of the payment.

Budget payments

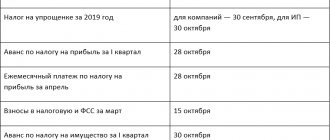

Budget payments have many more lines to fill out and, therefore, more chances for errors. When posting received payments, fiscal authorities are guided by Order of the Ministry of Finance of the Russian Federation No. 106n dated November 24, 2004.

Fortunately, there are fields that the feds do not pay attention to when entering payments.

Errors in such lines as “tax period”, “document number and date”, “taxpayer status”, “basis of payment” and “payment type” usually go unnoticed, and the funds are transferred to the correct BCC. Many novice accountants worry about incorrectly indicating the “payment order”.

This detail, if the company operates without any particular financial difficulties, is not the main one. But as soon as problems arise in the form of restrictions on spending transactions or insufficient money in the bank account, this field is checked first.

The significance of the error in OKATO will be determined based on the professional opinion of a specialist. Most often, when replenishing federal and regional budgets, this detail is not carefully studied.

But repayment of debt on local taxes will most likely be delayed. Errors in other fields will lead to the fiscal authorities classifying the payment as “unexplained”.

But there is a way out of this situation.

Much can be improved

The right to correct an error in an order to transfer tax is enshrined in paragraph 7 of Article 45 of the Tax Code. For example, by submitting an application to the fiscal authorities to clarify the type and nature of the payment (we published a sample in No. 8, 2011), you can correct the incorrectly specified BCC. Clarification is possible provided that the payment is “stuck” on “unexplained payments”.

But, if the money is sent to the KBK of another tax, then you need to act differently. There are two possible scenarios.

When taxes go to one budget, it is possible to transfer them according to the correct BCC. And it is better to do this by submitting an application for offset of amounts of overpaid tax (clause 5 of Article 78 of the Tax Code).

The legislation stipulates that the tax authority “is obliged to inform the taxpayer about each fact of excessive payment of tax and the amount of overpaid tax that has become known to the tax authority within 10 days from the date of discovery of such a fact,” but, unfortunately, in the life of organizations they rarely receive this information from fiscal authorities otherwise than by receiving a message about the suspension of expenditure transactions on current accounts. After all, overpayment of one tax often leads to non-payment of another.

The second option is more unpleasant. The money went into the budget of another level.

In this situation, the tax authorities will refuse to offset, citing paragraph 1 of Article 78 of the Tax Code “the offset of amounts of overpaid federal taxes and fees, regional and local taxes is carried out for the relevant types of taxes and fees, as well as for penalties accrued on the corresponding taxes and fees” .

In this case, we can only advise you to pay the tax again, indicating the correct BCC and submit an application to offset the overpayment against future payments. Of course, Article 78 also provides for the return of funds paid in excess, but practice shows that the application of this norm is very labor-intensive and is almost never put into practice.

Another negative aspect of an error in a payment order, especially in the BCC, is that the fiscal authorities will most likely charge penalties and fines. In particular, this is directly stated in paragraph 4 of part 6 of article 18 of the Federal Law of July 24, 2009 No. 212-FZ. This means that penalties will be charged on the amount of the debt until the company clarifies the details, and a fine provided for in Article 47 of Law No. 212-F3.

Errors when processing payment orders happen all the time. However, the accountant does not need to worry, because there is always a way to competently deal with the issue that has arisen. When making payments to partners, you can agree on a refund. And if a mistake is made when transferring taxes, it may be possible to offset the money in different budgets.

26 January 2012, 16:00

Source: https://www.raschet.ru/articles/1/5190/text/

Who and in what cases draws up a notification to clarify the details of the payment order?

A letter of clarification is drawn up and sent by the person who transferred the funds. After all, only the payer has the right to dispose of his funds.

If the recipient of the money believes that there is an error in the payment order, he needs to contact the payer and request a correction. The recipient of the money cannot independently take into account the funds at his own discretion without the permission of the payer.

| Error | Do I need to fix it? | Why |

| Wrong contract | Yes | The supplier may consider the payment as an advance under an erroneous contract and not pay the actual debt for goods and services. In this case:

|

| Incorrect name of product or service | Not necessary | If there are frequent errors or a large transfer amount, the discrepancy between the specified product or service and the recipient’s activity may raise questions from the bank, including blocking the account. It is better to indicate the correct name of the product or service, but in case of widespread errors, they still need to be clarified. |

| VAT rate | No | There are no legal or tax risks. Here, problems may arise for the payer when offsetting VAT from the supplier's advance payment by the Federal Tax Service if the inaccuracy flows into the advance invoice. |

What could happen next?

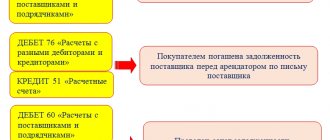

Having discovered a payment with VAT , the inspectors will decide that you issued an invoice to the buyer with an allocated tax, which means you had to pay its amount to the budget (Clause 5 of Article 173 of the Tax Code of the Russian Federation). In addition, tax authorities believe that if a VAT evader has issued a VAT invoice, then he is obliged to file a declaration for this tax (Clause 3 of the Procedure for filling out a tax return for value added tax, approved by Order of the Ministry of Finance of Russia dated October 15, 2009 N 104n; Letter of the Ministry of Finance of Russia dated October 23, 2007 N 03-07-11/512). True, the courts refuse to fine for failure to submit a declaration even those special regime officers who actually issued tax invoices (Resolutions of the Presidium of the Supreme Arbitration Court of the Russian Federation dated October 30, 2007 N 4544/07; FAS ZSO dated April 26, 2007 N F04-2469/2007 (33681-A70 -6)). To find out why VAT is indicated on the payment slip, the inspector must request written explanations from you (Clause 3 of Article 88 of the Tax Code of the Russian Federation) or call you to give explanations (Subclause 4 of Clause 1 of Article 31 of the Tax Code of the Russian Federation) as part of that desk audit, when which I requested a bank statement from. But often tax authorities do it much simpler: - block your current account for failure to submit a VAT return (Clause 3 of Article 76 of the Tax Code of the Russian Federation); — write off the VAT indicated on the payment invoice for collection. A softer, but still unpleasant option is also possible, in which the tax authorities: - demand to pay the amount of VAT, penalties (Article 75 of the Tax Code of the Russian Federation) and a fine (Article 75 of the Tax Code of the Russian Federation), and in case of non-payment they threaten with undisputed write-off and blocking of the account; - they are required to submit a VAT return and are fined for late submission. All this is illegal. It is impossible to charge additional taxes, and also to conclude that a particular person has an obligation to submit a declaration and pay tax, based only on a bank statement, without studying the primary documents and establishing the substance of business transactions as part of an audit carried out by law (FAS Resolutions ZSO dated 03/28/2011 in case No. A45-12006/2010; FAS North Kazakhstan region dated 07/12/2006 N F08-3078/2006-1320A). Indeed, in this case, the conclusion that you have issued an invoice will have only a speculative nature, not supported by evidence collected in accordance with the Tax Code of the Russian Federation (Clause 4 of Article 101 of the Tax Code of the Russian Federation; Resolution of the Federal Antimonopoly Service of the Northern Territory of October 17, 2008 in case No. A21-13/2008 ). Actually, such evidence could only be the invoice itself (Resolutions of the FAS VSO dated January 31, 2006 N A19-17585/05-40-F02-3/06-S1; FAS UO dated August 24, 2006 N F09-7242/06- C2), but you did not exhibit it, and the inspection cannot have it. So the inspector’s actions can be challenged. However, it is better not to give her any reason for such actions, having ruled out in advance the possibility of suspecting you of charging VAT to the buyer. Let's see how to do this.

We draw up a correction letter about the purpose of payment in the payment order to the supplier

When it is necessary to change the purpose of payment in a payment order, the letter is drawn up in any form. There is no approved form at the legislative level.

The document must indicate:

- document number and date;

- sender and recipient data;

- details of the payment document in which the error was made;

- correct name of erroneous details;

- signature of the responsible persons (the same ones who signed the payment).

You can send a notification in any convenient way. It is not necessary to receive notification from the counterparty about the receipt of the letter. But it’s better to get it to make sure that the recipient of the money has made accounting corrections.

Sample letter about the correct purpose of payment

What to do if the bank or buyer refuses to correct the error

Most often, banks agree to correct the purpose of a payment that has already been made - many of them even have this service highlighted in their price list. But it happens that the bank refuses this or ignores such a request. Then all that remains is a letter from the buyer to your address, confirming that he highlighted the VAT in the payment slip incorrectly and the purpose of the payment should read “Without VAT”. Attach this letter to the declaration along with your own explanation that you did not issue an invoice. And finally, if the buyer himself does not intend to do anything to correct the mistake he has made, all that remains is to remember in whose hands the salvation of the drowning people lies. Draw up and attach to the declaration your explanatory note stating that the buyer erroneously allocated VAT in the payment invoice. Please also attach copies of the contract with the buyer, the invoice issued to him and the primary documents for the transaction (certificate of completed work or services, invoice), in which the price is indicated without VAT.

* * *

As you can see, one small mistake made by others can cause a lot of trouble. Of course, if you did not issue an invoice, then the problem will most likely be resolved during a visit to the inspectorate - the tax authorities are unlikely to bring the conflict to court. And to reduce such cases, highlight in capital letters the warning “No VAT!” on all documents presented to customers.

VAT, UTII, simplified tax system

Incorrectly transferred funds will be refunded if the correct procedure in such cases is followed. To begin with, a letter is drawn up explaining the event of the erroneously transferred funds, at the end of which you can write the details for returning the amount.

How to correct a tax payment

There are rules for clarifying tax payments:

- No more than three years have passed since the date of transfer.

- Clarification will not lead to arrears.

- The payment went to the budget.

It is impossible to clarify the payment if the payer made a mistake in the Federal Treasury account number or bank details. It is considered not to have been received by the budget, and can only be returned.

To correct an error in a payment order, you must compose a letter in any form and also attach a copy of the incorrect payment order to it.

What are the dangers of erroneous VAT in a payment invoice for those who use the special regime?

However, you should not calm down and expect that you will easily explain everything to the tax authorities when they come to you with an on-site audit. The thing is that the inspectorate will most likely see the VAT payment much earlier. And it’s good if the inspector starts by asking you for clarification. But, as practice shows, he can act differently, causing you a lot of trouble. So, what could a buyer’s mistake result in and what needs to be done to prevent negative consequences?

Sample letter about incorrect purpose of payment to the Federal Tax Service

When composing a notice, it must indicate:

- sender's details (name, address, TIN, OGRN);

- tax office details;

- data of the payment document in which there was an inaccuracy;

- details that need to be corrected with their correct values.

Sample letter about the correct purpose of payment to the tax office

You can send a notification:

- in writing in person to the Federal Tax Service or by mail;

- in electronic form through an EDF operator.

Is it possible to challenge a payment change?

Sometimes the recipient of the money does not agree with the changes made by the payer. Unfortunately, it is quite difficult to challenge a letter of clarification. This must be done in court. It is advisable to resolve the problem through negotiations.

When making changes to the purpose of payment, you must remember that such transactions are carefully reviewed by regulatory authorities. If the Federal Tax Service sees signs of tax evasion in such letters, then claims may be made: additional taxes and penalties will be assessed. The most common issue that arises is prepayment under a supply agreement, which is later reclassified as a transfer under a loan agreement. This clearly shows a way to avoid paying VAT on the buyer's advance payment, and questions from the tax inspectorate are inevitable.

Letter to counterparty

What are the dangers of erroneously allocating VAT to a special regime person on a payment slip?

It happens that a VAT evader receives money from a buyer, but this tax is highlighted in the payment slip by mistake . At the same time, the buyer did not change the amount due from him, but simply determined the VAT by calculation and indicated its amount in the “Purpose of payment” field, or simply wrote: “ Including VAT 18% .” Is this situation familiar to you? Then our article is for you. You are not obliged to pay such VAT, since an invoice with the allocated amount of VAT was not issued to the buyer (Clause 5 of Article 173 of the Tax Code of the Russian Federation; Letter of the Federal Tax Service of Russia for Moscow dated March 31, 2009 N 20-14/2/ [email protected] ) .