Home — News

- Rules for submitting tax reports for personal income tax

- Calculation of personal income tax: the moment of determining the income received by an employee for calculating tax How to determine income and pay personal income tax on it starting in 2021

- How will the dates for receiving certain types of income change in 2016?

This spring, the President of the Russian Federation signed Federal Law No. 113-FZ dated May 2, 2015 (hereinafter referred to as Law No. 113-FZ), which introduces changes to the procedure for calculating and paying personal income tax, as well as submitting reports on it. The changes will take effect next year. Thus, one of the most important and global innovations in personal income tax is the introduction of quarterly reporting. It provides that from 2016, in addition to annual 2-NDFL certificates, employers will have to submit quarterly calculations to the tax office.

In addition, legislators clarified some dates of receipt of income for the purpose of calculating personal income tax, which were previously not clearly defined. They also introduced a single deadline for the transfer of this tax, which does not depend on how the income is paid - to the employee’s card, from the cash register or in another way.

First of all, it is necessary to say about the introduction of a new procedure for calculating personal income tax by a tax agent

All tax agents, starting from 2021, will be required to submit a quarterly calculation to the tax authority at their place of registration

amounts of personal income tax calculated and withheld by the tax agent. This obligation is to submit to the tax authorities the calculation of personal income tax amounts specified in clause 1. Art. 80 of the Tax Code of the Russian Federation, established in paragraph 2. Art. 230 of the Tax Code of the Russian Federation, which by Federal Law of May 2, 2015. No. 113-FZ is stated in a new edition.

The calculation form was approved by order of the Federal Tax Service of Russia dated October 14, 2015. No. ММВ-7-11/ [email protected] “On approval of the form for calculating the amounts of personal income tax calculated and withheld by the agent ( Form 6-NDFL

), the procedure for filling it out and submitting it, as well as the format for presenting the calculation of the amounts of personal income tax calculated and withheld by the tax agent in electronic form.” This calculation reflects information in general for all individuals, that is, the calculation is not personalized, and is provided by tax agents to the tax authority no later than April 30, July 31 and October 31, and for the year - no later than April 1 of the next year in accordance with clause. 2 tbsp. 230 Tax Code of the Russian Federation.

At the same time, the obligation of tax agents to submit a document containing information on the income of individuals for each individual is retained annually no later than April 1 of the year following the expired tax period in form 2-NDFL, approved by the Order of the Federal Tax Service of Russia dated October 30, 2015. No. ММВ-7-11/ [email protected] “On approval of the form of information on the income of an individual, the procedure for filling it out and the format for its presentation in electronic form.”

Regarding the method of submitting information on the income of individuals in form 2-NDFL and the quarterly calculation of tax amounts in form 6-NDFL, in the general case they are submitted by tax agents in electronic form via telecommunication channels. A tax agent can submit paper reports only if the number of individuals who received income during the tax period is up to 25 people.

Decoding the abbreviation personal income tax

Here is a breakdown of personal income tax - the combination of these letters means “tax on personal income”. This tax can also be called income tax, as it is withheld from taxpayers’ income.

Taxpayers are residents who receive income both in the Russian Federation and outside the country, as well as non-residents whose source of income is in Russia. More details about who is recognized as residents when calculating personal income tax are stated in clauses 2 and 3 of Art. 207 of the Tax Code of the Russian Federation.

We draw attention to the increased responsibility of tax agents

From January 1, 2021:

- in accordance with clause 1.2 of the article. 126 of the Tax Code of the Russian Federation, failure by a tax agent to submit within the established period of time the calculation of personal income tax amounts calculated and withheld by the tax agent to the tax authority at the place of registration entails the collection of a fine in the amount of 1000 rubles for each full or partial month from the date established for submission

- Submission by a tax agent to the tax authority of documents containing false information entails a fine of 500 rubles for each false document. However, the tax agent is exempt from liability if he independently identifies errors and submits updated documents before the tax inspectorate discovers that the information contained in the documents is unreliable (according to the new Article 126.1 of the Tax Code of the Russian Federation)

- in the event of a tax agent’s failure to submit a quarterly calculation of personal income tax amounts within 10 days after the expiration of the established period, the tax authority may decide to suspend the tax agent’s operations on his bank accounts and transfers of his electronic funds (clause 3.2 of Article 76 of the Tax Code of the Russian Federation)

What is the priority of personal income tax payments in 2016–2017?

When preparing payment orders for personal income tax in 2016-2017, you should be guided by the current rules for filling out such documents. The rules for indicating the necessary information about the payer and recipients of funds when paying personal income tax in 2016-2017 are contained in Order of the Ministry of Finance dated November 12, 2013 No. 107n, which should be applied in the current version.

When making an income tax payment in 2016–2017 , in the “Payment order” column of the payment order, enter the value “5” if we are talking about planned deductions. Explanations on this issue are given in the letter of the Ministry of Finance dated January 20, 2014 No. 02-03-11/1603, which provides a reference to the changes that have occurred in civil legislation. In accordance with these changes, now personal income tax made by banks on tax payment orders have a priority of “3”. And personal income tax carried out as planned by tax agents (taxpayers themselves) have a priority of “5”.

Providing standard deductions for children

Federal Law of November 23, 2015 No. 317-FZ introduced changes to the Tax Code of the Russian Federation regarding the provision of standard tax deductions for children. According to paragraphs. 4 clause 1 of Article 218 of the Tax Code of the Russian Federation, the main changes will affect:

- parents and adoptive parents

of a disabled child under 18 years of age or a full-time student, graduate student, resident, intern, student under the age of 24, if he is a disabled person of groups I and II, then the deduction is set at

12,000.00 rubles. - for guardians, trustees and adoptive parents

of a disabled child, accordingly, the deduction is set by law at a smaller amount of

6,000.00 rubles

.

We also note that Law No. 317-FZ increased the limit on income subject to personal income tax at a rate of 13% to 350,000.00 rubles, upon reaching which standard deductions for children are not provided (recall that before January 1, 2021, this limit was 280,000. 00 rub.).

An example of filling out sections 1 and 2 of the annual calculation

Now we will give an example of filling out the 6-NDFL calculation for 2021, so that the general principle of filling out the sections is clear. Let's assume that in 2021, 27 people received income from the organization. In total, for the period from January to December, the summarized indicators for section 1 are as follows:

- the total amount of accrued income is 8,430,250 rubles (line 020);

- the amount of tax deductions is 126,000 rubles (line 030);

- the amount of calculated personal income tax is 1,079,552 rubles (line 070);

- the amount of tax not withheld by the organization is 116,773 rubles (line 080).

As for the fourth quarter of 2021 itself, income, deductions and personal income tax were distributed as follows:

| Income date | Type of income | Amount of income | Amount of deductions | Personal income tax amount | Personal income tax rate | Personal income tax was withheld | Paid personal income tax |

| 30.09.2016 | Salary for September 2021 | 562 000 | 3000 | 72 670 | 13 | 05.10.2016 | 06.10.2016 |

| 30.10.2016 | Salary for October 2021 | 588 000 | 3000 | 76 050 | 13 | 03.11.2016 | 07.11.2016 |

| 28.11.2016 | Sick leave | 14 200 | — | 1846 | 13 | 28.11.2016 | 30.11.2016 |

| 30.11.2016 | Salary for November 2021 | 588 000 | 3000 | 76 050 | 13 | 05.12.2016 | 06.12.2016 |

| 30.12.2016 | Salary for December 2021 | 654 000 | 3000 | 84 630 | 13 | 31.12.2016 | 09.01.2017 |

| 30.12.2016 | Annual bonus | 250 000 | 3000 | 32 103 | 13 | 30.12.2016 | 09.01.2017 |

Under such conditions, in section 1 you need to show generalized information from the beginning of 2021 on an accrual basis, and in section 2 you need to distribute accruals and payments relating to the 4th quarter of 2021. It will look like this:

Please note that our example conditions include the salary for December and the annual bonus for 2021, which were paid to employees on December 30, 2021. However, we did not reflect these payments in the annual report 6-NDFL. It does not matter when you actually paid your December salary and annual bonus: in 2016 or 2021. They need to be reflected in section 2 of the 6-NDFL calculation for the first quarter of 2021, since these operations will be completed in 2017. According to the latest clarifications from tax authorities, “completion of the operation” should be determined by the latest date when personal income tax should be transferred to the budget. We will consider in more detail the issue of reflecting “carryover” payments in 6-NDFL below.

Providing social deductions

From 2021, amendments introduced by the Federal Law of 04/06/2015. No. 85-FZ in paragraph 2 of clause 2 of Article 219 of the Tax Code of the Russian Federation, expands the list of social tax deductions that allow the taxpayer to receive a social tax deduction from the employer - tax agent.

To social tax deductions provided for in paragraphs. 4 (in the amount of pension contributions under the agreement (agreements) of non-state pension provision), and paragraphs. 5 (in the amount of additional insurance contributions for a funded pension) clause 1 of Article 219 of the Tax Code of the Russian Federation, deductions established by clauses have been added. 2 and 3 of this paragraph, namely for training and treatment.

According to the new edition of paragraph 2 of Article 219 of the Tax Code of the Russian Federation, the above-mentioned social tax deductions for treatment and training can be provided to the taxpayer before the end of the tax period when he submits a written application to the employer - tax agent.

In this case, a mandatory condition is established: - the taxpayer must confirm his right to receive social tax deductions. To do this, he submits the corresponding confirmation issued by the tax authority in the form of a notification approved by the Order of the Federal Tax Service of Russia dated October 27, 2015. No. ММВ-7-11/ [email protected]

The right to receive these social tax deductions must be confirmed by the tax authority within a period not exceeding 30 calendar days from the date of submission of a written application and documents confirming the right to receive these deductions.

The maximum amount of social tax deductions provided for in subparagraphs 2 - 5 of paragraph 1 of Art. 219 of the Tax Code of the Russian Federation (with the exception of expenses for the education of the taxpayer’s children and expenses for expensive treatment - this deduction is limited to the amount of 50,000.00 rubles), in total no more than 120,000 rubles for the tax period. Accordingly, the amount that the tax office will return to you in this case will not exceed 15,600 rubles. (RUB 120,000 x 13%).

Personal income tax in 2016-2017

Personal income tax in 2021 has undergone a number of regular changes, the most significant of which are:

- appearance of quarterly reports on tax amounts accrued and paid for the reporting period;

- changing the conditions for exemption from taxation of income from the sale of real estate acquired after 01/01/2016;

- providing deductions for treatment and on-the-job training;

- an increase (up to 350 thousand rubles) in the amount of income up to which the employee has the right to receive a child deduction;

- increase in the amount of deductions for disabled children;

- introduction of a single deadline for paying personal income tax on income (no later than the working day following the day of payment) with the exclusion of sick leave and vacation pay;

- clarification of dates for receipt of certain types of income (travel allowances, offset of counterclaims, debt write-off, financial benefits);

- change in the direction of increasing by 1 month the period for submitting to the Federal Tax Service information about the impossibility of withholding personal income tax from paid income;

- establishing a new deadline (December 1 of the following year) for an individual to pay tax not withheld from him by a tax agent.

For information on the rules for issuing a certificate of unwithheld income from an individual, read the material “Reporting about unwithheld personal income tax - sample certificate 2-NDFL.”

The 2017 innovations regarding personal income tax , which came into force from the beginning of the year, did not differ in such variety:

- a fee for an independent assessment of his qualifications, paid by the employer, has been added to the employee’s non-taxable income;

- the list of deductions available to an individual is supplemented by a fee for an independent assessment of qualifications, which the person paid independently.

Providing property deductions

Federal Law of November 29, 2014 No. 382-FZ introduced a new article 217.1 of the Tax Code of the Russian Federation “Features of exemption from taxation of income from the sale of real estate”.

According to clause 3 of Article 217.1, the minimum maximum period of ownership of real estate is 3 years

for the following real estate objects, in respect of which at least one of the following conditions is met:

- ownership was obtained by inheritance or under a gift agreement from an individual recognized as a family member and (or) his close relative in accordance with the Family Code of the Russian Federation

- ownership obtained as a result of privatization

- the right of ownership was obtained by the rent payer as a result of the transfer of property under a lifelong maintenance agreement with dependents

In all other cases, the minimum period of ownership of real estate for exemption from personal income tax is 5 years.

The article also provides for a situation where the taxpayer’s income from the sale of a real estate property is less than the cadastral value of this property as of January 1 of the year in which state registration of the transfer of ownership of the real estate property being sold was carried out, multiplied by a reduction factor of 0.7 .

In this case, for tax purposes, the taxpayer’s income is taken to be equal to the cadastral value multiplied by a factor of 0.7. However, the constituent entities of the Russian Federation, on the basis of clause 6 of Art. 217.1 of the Tax Code of the Russian Federation will be able to legally reduce:

- the minimum maximum period of ownership of a real estate property specified in paragraph 4 of this article

- the size of the reduction factor established in clause 5 of Art. 217.1 of the Tax Code of the Russian Federation (0.7) down to zero for all or certain categories of taxpayers and (or) real estate objects

Attention!

The provisions of Article 217.1 of the Tax Code of the Russian Federation (as amended by Law No. 382-FZ dated November 29, 2014) apply to real estate acquired after January 1, 2021.

Property deductions in relation to shares in the authorized capital.

In addition, from January 1, 2021 The list of grounds for providing a property tax deduction is expanded in accordance with paragraphs. 1 clause 1 art. 220 of the Tax Code of the Russian Federation (clause 2 of article 1, part 2 of article 2 of the Federal Law of June 8, 2015 No. 146-FZ).

In addition to cases of sale of property, share(s) in it, share(s) in the authorized capital and assignment of rights under agreements related to shared construction, it is also granted in the following situations:

- upon leaving the company's membership

- when transferring funds (property) to a participant in a liquidated company

- when the nominal value of a share in the authorized capital of the company decreases

New edition of paragraphs. 2 p. 2 art. 220 of the Tax Code of the Russian Federation has been supplemented with provisions that establish the specifics of providing such a property deduction, in particular by indicating a list of expenses associated with the acquisition of a share in the authorized capital:

- expenses in the amount of cash and (or) the cost of other property made as a contribution to the authorized capital when establishing a company or when increasing its authorized capital

- expenses for the acquisition or increase of a share in the authorized capital of the company

In the absence of documented expenses for the acquisition of a share in the authorized capital of the company, a property tax deduction is provided in an amount not exceeding a total of 250,000 rubles for the tax period.

When a company participant receives income in the form of payments in cash or in kind in connection with a decrease in the authorized capital of the company, such expenses are taken into account in proportion to the decrease in the authorized capital (paragraph 8, paragraph 2, paragraph 2, article 220 of the Tax Code of the Russian Federation).

In a situation where the nominal value of a share in the authorized capital of a company is reduced after a previously increased authorized capital due to the revaluation of assets, the costs of acquiring a share in the authorized capital are taken into account in the amount of payment to the participant exceeding the amount of the increase in the nominal value of his share as a result of such revaluation (paragraph 9 Subclause 2, Clause 2, Article 220 of the Tax Code of the Russian Federation).

According to paragraph 7 of Art. 220 of the Tax Code of the Russian Federation, these property deductions are provided when the taxpayer submits a declaration to the Federal Tax Service at the end of the tax period.

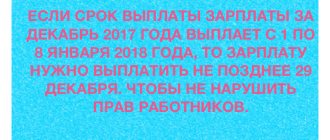

Salaries for December were paid in January

Many employers paid salaries for December in January 2017. If so, then show the December salary issued in January 2017 in the 6-NDFL reporting for 2021 only in section 1. After all, you recognized income in the form of wages in December and calculated personal income tax on it in the same month. Therefore, when calculating 6-personal income tax for 2016, distribute payments as follows:

- on line 020 – accrued income in the form of December salary;

- on line 040 – calculated personal income tax.

Line 070 of the 6-NDFL calculation for 2021, intended for withheld tax, is not increased in this case, since the withholding took place already in 2021 (letter of the Federal Tax Service of Russia dated December 5, 2016 No. BS-4-11/23138). In section 2 of the annual calculation, do not show the December salary paid in January (letter of the Federal Tax Service of Russia dated November 29, 2021 No. BS-4-11/22677)

Salaries for December were issued after the New Year

On January 9, 2021, the organization issued employees salaries for December 2021 - 250,000 rubles. Personal income tax was withheld from the payment on the same day - 32,500 rubles. (RUB 200,000 × 13%). Add this amount to line 070 of the 6-NDFL calculation for the first quarter of 2021. In section 2 of the same calculation, distribute the dates along lines 100–140:

- line 100 – December 31, 2016 (date of receipt of income);

- line 110 – 01/09/2017 (date of personal income tax withholding);

- line 120 – 01/10/2017 (date of transfer of personal income tax to the budget).

Dates of receipt of income and personal income tax calculations for some cases have been clarified

Federal Law of May 2, 2015 No. 113-FZ amended Art. 223 and 226 of the Tax Code of the Russian Federation.

This eliminates the uncertainty regarding establishing the date of receipt of income in the form of material benefits obtained from savings on interest when using borrowed funds. According to the law No. 113-FZ, paragraph 7. clause 1. Art. Article 223, the date of receipt of income from savings on interest is considered to be the last day of each month

during the period for which the borrowed (credit) funds were provided.

Until January 1, 2021, in accordance with the position of the Ministry of Finance set out in the letter dated July 15, 2014. No. 03-04-06/34520, when determining the tax base for income in the form of material benefits for using an interest-free loan, the dates of receipt of income in the form of material benefits were the dates of the actual repayment of borrowed funds.

In addition to this subparagraph, for some cases, starting from 2021, the date of actual receipt of income is defined as the day:

- acquisition of goods (work, services), acquisition of securities - upon receipt of income in the form of material benefits. An exception to this rule is if payment for purchased securities is made after the transfer of ownership of these securities to the taxpayer, the date of actual receipt of income is determined as the day the corresponding payment is made to pay for the cost of the purchased securities (clause 3)

- offset of counter homogeneous claims (clause 4)

- writing off bad debt from the organization’s balance sheet in accordance with the established procedure (clause 5)

- the last day of the month in which the advance report is approved after the employee returns from a business trip (clause 6)

Also, Federal Law No. 113-FZ amended Art. 226 Tax Code of the Russian Federation. In the new edition of paragraph 6 of Art. 226 of the Tax Code of the Russian Federation, the tax agent’s obligation to transfer personal income tax amounts from 2021 is carried out no later than the day the income is paid to the individual

.

An exception would be payments of benefits for temporary disability (including benefits for caring for a sick child), and in the form of payment for vacations; in this case, tax agents are required to transfer the amounts of calculated and withheld tax no later than the last day of the month

in which such payments were made.

According to the new edition of paragraph 5 of Art. 226 of the Tax Code of the Russian Federation, if a tax agent cannot withhold personal income tax, he must inform both the taxpayer and the inspectorate about this. From 2021, the period during which this must be done has been increased - no later than March 1 of the year following the expired tax period. Before this deadline, you must submit a certificate to the tax office in form 2-NDFL with attribute “2” - “Authorized representative”.

Personal income tax formula

Personal income tax is calculated using the following formula:

Tax base × Tax rate.

In this case, the tax base refers to all income (in cash and in kind, as well as in the form of material benefits) of individuals from whom personal income tax is withheld. When determining the tax base, the amounts of deductions (property, professional, social, investment, standard) to which the taxpayer has the right are excluded.

The tax rate for resident taxpayers is 13%, for non-resident individuals - in most cases - 30% (salaries - 13%, dividends from Russian companies - 15%).

The following are subject to a rate of 35%:

- lottery winnings, prizes (except sports), gifts, including from employers, over 4,000 rubles;

- bank interest exceeding the Central Bank refinancing rate, increased by 5 points - on ruble deposits, on deposits in foreign currency - at a rate above 9% per annum;

- savings on interest on loans from consumer cooperatives if their size is less than 2/3 of the Central Bank refinancing rate in rubles (9% in foreign currency).

A reduced tax rate (9%) applies to interest on bonds issued before 01/01/2007. Income from securities is subject to personal income tax at the rate of 30%.

Read more about the current income tax rates in the article “What are the tax rates for personal income tax in 2016–2017?”

Personal income tax accounting in a separate division

From 2021, the amount of personal income tax payable to the budget at the location of the separate division is determined based on the amount of income accrued and paid to individuals under contracts concluded with these separate divisions

(clause 7 of article 226 of the Tax Code of the Russian Federation).

Previously, this paragraph dealt only with employees of this

separate division.

Thus, according to the new rules, at the location of a separate division, the amounts of income paid not only under labor contracts, but also under civil law contracts must be taken into account.

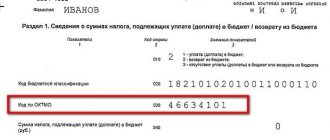

Taking into account paragraphs 4 and 5 of paragraph 2 of Article 230 of the Code (as amended on January 1, 2021), tax agents - Russian organizations with separate divisions, submit calculations in form 6-NDFL in relation to employees of these separate divisions to the tax authority at the place of registration of such separate divisions.

In accordance with paragraph 5 of paragraph 2 of Article 230 of the Tax Code of the Russian Federation, organizations classified as the largest taxpayers have the right to choose to submit a calculation of personal income tax amounts calculated and withheld by the tax agent, either to the tax authority at the place of registration as the largest taxpayer or to the tax authority at the place accounting of such a taxpayer for the corresponding separate division (separately for each separate division). These clarifications are set out in a letter from the Ministry of Finance of the Russian Federation dated September 2, 2015. No. 03-04-06/50652.

At the same time, tax agents - Russian organizations with separate divisions are required to transfer calculated and withheld tax amounts to the budget both at their location and at the location of each of their separate divisions (explanations are given in the Letter of the Federal Tax Service of the Russian Federation dated December 28, 2015 No. BS -4-11/ [email protected] “On filling out and submitting calculations in form 6-NDFL by a tax agent with separate divisions”).

Until 2021, the situation was controversial when an individual entrepreneur (IP) using UTII was simultaneously registered both at the place of residence (based on clause 3 of Article 83 of the Tax Code of the Russian Federation) and with one or more tax authorities at the place of implementation “stationary” UTII activity (based on clause 2 of Article 346.28 of the Tax Code of the Russian Federation):

Law No. 113-FZ, effective January 1, 2021, eliminates this uncertainty (new edition of clause 7 of article 226 of the Tax Code of the Russian Federation).

Tax agents - individual entrepreneurs who are registered with the tax authority at the place of their activity in connection with the application of UTII and (or) the patent tax system, are required to transfer personal income tax amounts from the income of employees to the budget at the place of their registration in connection with the implementation of such activities; information in form 2-NDFL, messages about the impossibility of withholding personal income tax, calculations of personal income tax amounts in relation to their employees must also be submitted to the tax authority at the place of their registration in connection with the implementation of such activities (new edition of paragraph 5 of article 226, paragraph 2 Article 230 of the Tax Code of the Russian Federation).

What taxes levied on the profits of individuals reduce personal income tax?

In accordance with paragraph 5 of Art. 225 of the Tax Code of the Russian Federation, the amount of trade tax paid by the taxpayer in the current tax period reduces the amount of personal income tax for the same period. In order to exercise this right, an entrepreneur must notify the Federal Tax Service about his registration as a payer of the trade tax in relation to the object of his business activity.

personal income tax by a foreigner employed in Russia reduces the amount of income tax withheld from him. Such an employee submits information about payment for the patent to his source of payments, and the tax agent adjusts the amount of personal income tax from the taxpayer’s income by this amount.

Income from operations on an individual investment account and investment tax deduction

Law of November 28, 2015 No. 327-FZ introduced Article 214.9 into the Tax Code of the Russian Federation, which talks about the specifics of determining the tax base, accounting for losses, calculating and paying tax on transactions accounted for on an individual investment account (IIA).

Let us remind you that in accordance with Art. 10.2-1 of the Federal Law of April 22, 1996 No. 39-FZ “On the Securities Market”, an individual investment account is opened and maintained by a broker or manager on the basis of a separate agreement for brokerage services or a securities trust management agreement, which provide for the opening and maintenance of an individual investment account.

Clause 1 of Art. 214.9 of the Tax Code of the Russian Federation provides that the tax base for transactions with securities accounted for in an individual investment account is recognized as income determined from the totality of the corresponding transactions on an accrual basis for the period from the beginning of the agreement for maintaining IIS, and the financial result is determined by summing up the financial results determined for relevant transactions at the end of each tax period of the agreement on maintaining IIS, and the financial result as of the date of termination of the said agreement.

This financial result is determined separately from the financial result for other transactions and is not reduced by the amount of the negative result for transactions not accounted for in this account (clause 2 of Article 214.9 of the Tax Code of the Russian Federation).

According to paragraphs 3 and 4 of Art. 214.9 of the Tax Code of the Russian Federation, the calculation of the amount of tax in relation to income from transactions accounted for in an individual investment account is carried out by a tax agent in two cases:

- on the date of payment of income to the taxpayer (including in kind) not to the individual investment account of the taxpayer

- on the date of termination of the agreement on maintaining an individual investment account

We also note that in accordance with paragraphs. 2 and 3 paragraph 1 of Article 219.1 of the Tax Code of the Russian Federation, the taxpayer has the right to receive investment tax deductions, respectively, in the amount of funds contributed by the taxpayer in the tax period to an individual investment account, or in the amount of income received from transactions accounted for on an individual investment account. The specifics of providing these deductions are defined in paragraphs 3, 4 of Art. 219.1 Tax Code of the Russian Federation.

Income tax in the Russian Federation on advance payment

When paying an advance payment to an employee on salary, the employer - tax agent does not withhold personal income tax , since withholding personal income tax is possible only at the end of the month when wages are calculated (clause 2 of Article 223 of the Tax Code of the Russian Federation).

For more information about why personal income tax is not withheld from an advance, read the article “Do I need to pay personal income tax on an advance and when?” .

As for the bonus paid in advance, this rule does not work here, since the bonus is income recognized according to other rules (subclause 1, clause 1, article 223 of the Tax Code of the Russian Federation): on the date of actual payment. This means that, having made a partial payment of the premium in advance earlier than the agreed period, the tax agent must withhold and transfer personal income tax to the budget.

If the advance payment is provided for in a civil contract with an individual, then with such payment the tax agent must also withhold personal income tax .

Exemption from personal income tax

In accordance with Federal laws of 06/08/2015. No. 150-FZ, dated November 23, 2015. No. 320-FZ and dated December 29, 2015. No. 396-FZ, Article 217 of the Tax Code of the Russian Federation “Income not subject to taxation (exempt from taxation)” was supplemented with the following paragraphs 60-65:

60) income (except for cash) in the form of the value of the received property (property rights), received during the liquidation of a foreign organization - by a shareholder entitled to receive such income, while simultaneously complying with the conditions specified in this article

61) income in the form of reimbursement to the taxpayer on the basis of a court decision of legal expenses incurred during the consideration of the case in court

62) income in the form of the amount of debt to creditors, from the fulfillment of requirements for the payment of which the taxpayer is exempted as part of the bankruptcy procedures of a citizen, in the manner established by the legislation on insolvency (bankruptcy)

63) income from the sale of property subject to sale in the event that the taxpayer is declared bankrupt and a procedure for the sale of his property is introduced in accordance with the legislation on insolvency (bankruptcy)

64) income in the form of compensation payments paid to depositors in connection with the acquisition of rights (claims) from them on deposits in banks and separate structural divisions of banks registered and (or) operating in the territory of the Republic of Crimea and the federal city of Sevastopol"

65) income in the form of the amount of debt on a housing mortgage loan (loan) and material benefits in cases provided for by the provisions of this article

It should be noted that the provisions of paragraphs 64 and 65 of Article 217 (as amended by Federal Law No. 396-FZ dated December 29, 2015) apply to legal relations that arose from January 1, 2014.

Income tax in Russia

Personal income tax is withheld by tax agents (or paid by individuals themselves) on the following income:

- interest (which is higher than the Central Bank refinancing rate + 5 points, except for interest on government bonds) and dividends received from Russian legal entities and individual entrepreneurs, as well as from foreign companies;

- insurance payments upon the occurrence of an insured event, received by an individual insured from Russian and foreign companies;

- income of authors and owners of related rights, including when using these rights abroad;

- rent (payment for temporary paid use) for property located in Russia and abroad;

- from the sale of real estate, securities and shares in the authorized capital of legal entities, debt receipts of companies and other property; the location of these objects can be both Russia and foreign countries;

- payment for work, services, performance of duties under labor and civil law contracts in the Russian Federation and outside the country;

- scholarships, pensions (except for those paid by the Pension Fund), benefits (except for state ones) received in accordance with Russian and foreign legislation;

- income received during transportation to/from the Russian Federation (as well as at any unloading/unloading points) by vehicles; this also includes the income of the Russian controlling person from the activities of the carrier organization controlled by him;

- rent from the use of power lines, fiber-optic data lines, pipelines and computer networks;

- pension payments received by legal successors for deceased insured individuals;

- other income received by taxpayers in Russia and abroad, with the exception of those listed in Art. 217 Tax Code of the Russian Federation.

For more information about income exempt from income tax, read the material “Income not subject to personal income tax (2015–2016) ” .

The Federal Tax Service configures the program to fill out the TIN in the 2-NDFL form

The Federal Tax Service sets up a program that checks 2-NDFL certificates from employers.

It will be improved so that the machine does not miss certificates without these details or with incorrect numbers. This was reported in letter No. 11-2-06 dated November 23, 2015 / [email protected] If you do not have information about the TIN of one of the employees, it is safer to find out it or double-check it on the Federal Tax Service website through the “Find out TIN” service .

The Order contains a clause on the optionality of the TIN

The approved electronic format adopted for submitting information on the income of individuals (Order of the Federal Tax Service of Russia dated October 30, 2015 No. ММВ-7-11/485) contains a field for the TIN in 2-NDFL of individuals, however this detail is not mandatory. In order to fill out form 2-NDFL (Section IY, Appendix 2 to the Order) it is stated that if the taxpayer does not have an INN, the field is not filled in. In another part of the same order, which deals with the electronic format of the certificate, it is directly stated that the TIN element is optional:

| Item name | Abbreviated name (code) of the element | Element type attribute | Element Format | Mandatory element indicator | Additional Information |

| TIN in the Russian Federation | INNFL | A | T(=12) | N | Type element <INNFLType> |

The legislation does not oblige a citizen to provide his TIN when applying for a job, although the TIN is mentioned in Art. 57 of the Labor Code of the Russian Federation is among the information that is included in the employment contract. Moreover, the TIN does not have to be indicated even in declarations, applications and other documents submitted to the tax office if the citizen is not an individual entrepreneur (Order of the Ministry of Finance of Russia, Federal Tax Service of Russia dated June 29, 2012 No. ММВ-7-6/435).

READ ON THE TOPIC:

In which areas of activity will prices rise due to a tax increase in 2021

Until recently, the TIN in 2-NDFL was affixed if the accountant had the necessary information.

Now the inspectorate insists on the mandatory indication of details, based on the assumption that all Russian citizens have been assigned a TIN. If the employee does not know it or has not informed the employer, this is a problem for the organization, which is obliged to report on personal income tax. From January 1, a new art. 126.1 of the Tax Code of the Russian Federation, which provides for a fine of 500 rubles for each document submitted to the inspection with false information. (remember, 2-NDFL is filled out for each employee). Let’s assume that during the inspection the inspection does not find in its database for a specific individual the full name, date of birth, passport, or TIN. Does this provide grounds for applying liability under Art. 126.1 Tax Code of the Russian Federation? Logic dictates that it will not come to a fine. The fact is that the presence and structure of the indicator are checked at the first stage, and the certificate simply will not pass format and logical control. Unreliability of information is revealed already at the third stage of verification, when full name, date of birth, passport details, etc. are verified.

Responsibility under Art. 126 Tax Code of the Russian Federation: 200 rubles. for each document not submitted. This sanction may be applied if the certificate does not pass control and the report is thereby not submitted on time.

The accountant’s task is to collect TIN from all his employees. The situation is complicated by the fact that some of them do not know their TIN, some do not, and some have already quit and simply do not have access to them. Tax officials suggest looking for your own and someone else’s INN on the nalog.ru portal through the “Find out your/other people’s INN” service (service.nalog.ru/inn.do). To do this, you will need the citizen’s passport data.

Practice has shown that not everyone can find a TIN. The tax authorities have not yet explained what to do if the TIN is not found or is completely absent from the employee. However, you can always address your questions to the Department of Taxation of Property and Income of Individuals of the Federal Tax Service of Russia.

It makes sense for the accountant to inform the company’s management, internal communications department or human resources department about the current situation. With their help, post an appeal on the internal portal or send a letter to employees with a request to urgently make inquiries about their TIN or obtain it from the inspectorate. The manager, in turn, can issue an internal document with appropriate instructions and assign responsibility, for example, to heads of departments.

Salaries for September were paid in October

The deadline for paying personal income tax on salaries for September is October 2021. Therefore, when calculating for nine months, the accountant showed this payment only in section 1. Now these amounts need to be transferred to the reporting for 2021. See “6-NDFL for 9 months of 2021: example of filling out”.

In section 2 of the 6-NDFL calculation for 2021, you need to show the salary for September paid in October. Let's assume that the September salary was paid on October 10. The accountant will fill out section 2 of the annual calculation of 6-NDFL as shown in the example. The validity of this approach is confirmed, for example, by the Letter of the Federal Tax Service of Russia dated 01.08. No. BS-4-11/13984.

Payments under a civil contract: payment in January

Let's consider another situation when an act for work performed (services rendered) under a civil contract with an individual was approved in December 2021, and payment for it took place in January 2017. In this case, the remuneration under the contract and personal income tax from it should be shown in sections 1 and 2 of the calculation for the first quarter of 2021. Do not show the operation in the 2021 calculations. This follows from the letter of the Federal Tax Service of Russia dated December 5, 2016 No. BS-4-11/23138.

If in December an advance was issued under a civil contract, then it should fall into section 2 of the annual calculation.

Advance under a contract

The organization paid an advance to an individual under a contract on December 19, 2021 in the amount of 20,000 rubles. The tax withheld from this amount amounted to 2600 rubles. (20,000 x 13%). The balance is planned to be issued in January 2021 - after completion and delivery of all work.

In such a situation, reflect the advance to the contractor in the payment period (in December). The date of receipt of income in this case is the day when the company transferred or issued the money to the person. It does not matter whether the company issues money before the end of the month for which the service is provided, or after.

In section 2 of the 6-NDFL calculation for 2021, show the advance by line:

- 100 “Date of actual receipt of income” – 12/19/2016;

- 110 “Tax withholding date” – 12/19/2016;

- 120 “Tax payment deadline” – 12/20/2016;