Documentation

How to fill out the 6-NDFL calculation for the 4th quarter of 2021? Has the new payment form been approved?

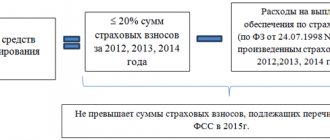

Sick leave under the FSS pilot project in the regions participating in the experiment is paid according to a different scheme. Transition order

The calculation consists of: title page; section 1 “Generalized indicators”; section 2 “Dates and amounts

Salaries must be paid twice a month - in advance and in the main payment. But every

April 1, 2021 – this is the deadline set for tax agents to submit reports for

New deduction codes In 2-NDFL certificates submitted in 2021, section 3 is reflected

Employer reporting Olga Yakushina Tax expert-journalist Current as of September 19, 2019 For important holidays

Since conducting a special assessment of working conditions relates to preventive measures to reduce occupational injuries

Companies and individual entrepreneurs acting as tax agents for withholding and transferring personal income tax from their own income

On a quarterly basis, tax agents paying remuneration to individuals must report to the Federal Tax Service in Form 6-NDFL.