Documentation

Which form of the SZV-TD form must be filled out in 2021? Has the new one been approved? Have you changed

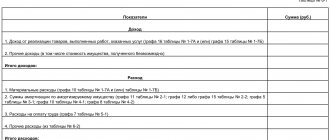

All individual entrepreneurs are required to keep a Book of Income and Expenses, abbreviated as KUDiR, with a few exceptions.

Form P24001 (application according to form P24001) is intended for making changes to the Unified State Register of Individual Entrepreneurs (in types

Legal topics are very complex, but in this article we will try to answer the question “Issuance

The Tax and Duty Service administers the timeliness and correctness of the calculation of tax obligations to the budget

To correctly close cost accounts, we will analyze the basic recommendations for accounting in the 1C-Rarus program:

From January 1, 2021, 48 international standards will come into force in the Russian Federation

The VAT deduction operation reduces the amount of tax payable. There are situations when a deduction was made, but

Payment of one-time assistance to an employee in difficult or joyful life situations that require additional expenses –

non-current assets: intangible assets; research and development results; Intangible search assets; tangible prospecting assets;