Which legal acts regulate the filling out of the account balance sheet

Historically, the term “ turnover balance sheet ” was not fixed in the regulatory legal acts of the Russian Federation - in fact, it is used unofficially.

However, the corresponding document is widely used in practice. The use of balance sheets is indirectly predetermined by the provisions of Art. 10 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ. This regulation provides that:

- information reflected in primary documents must be registered and accumulated in accounting registers (Clause 1, Article 10 of Law No. 402-FZ);

- the structure of the accounting register must contain a grouping of accounting objects, as well as the monetary value of the corresponding objects;

- the forms of the corresponding registers for private economic entities are approved by management, for state ones - by budgetary legal acts.

The fact that the balance sheet is used as an accounting register can be associated, first of all, with the legal tradition that was formed in the Soviet Union.

Thus, in the letter of the Ministry of Finance of the USSR and the Central Statistical Office of the USSR dated February 20, 1981 No. 35, it is recommended to use just the same turnover statements as accounting registers - for main, synthetic accounts, as well as sub-accounts.

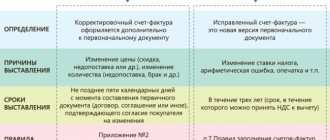

Another significant factor predetermining the use of turnover by modern enterprises is the publication by the Ministry of Finance of Russia of Order No. 119n dated December 28, 2001, by which the department approved methodological guidelines regarding the accounting of inventories of Russian enterprises. The provisions of this legal regulation use 2 concepts:

- turnover sheet - a source that records the amounts of income and expenses that correlate with the movement of goods or materials in the warehouse, balances at the beginning and end of the reporting month, as well as the corresponding amounts in synthetic accounts and sub-accounts;

- balance sheet - a document that generally corresponds to the turnover sheet, but it does not record the receipt and consumption of goods or materials.

Due to the availability of these legal regulations, as well as in the course of document management practices in the business and accounting community of the Russian Federation, more or less generally accepted formats of balance sheets gradually became widespread, the structure of which we will consider further.

There is another significant factor for the compilation of turnover by Russian enterprises. The Federal Tax Service quite often requests them during inspections - both during traditional interaction with taxpayers, and as part of innovative methods of communication with companies, such as tax monitoring.

In particular, clause 8 of the order of the Federal Tax Service of Russia dated 05/07/2015 No. ММВ-7-15/184 states that the regulations for information interaction between the taxpayer and the Federal Tax Service should fix the obligation of the former to submit balance sheets to the Federal Tax Service as part of tax monitoring .

Is the fine for failure to submit SALT to the tax authorities legal? The answer to this question, supported by arguments from law enforcement practice, can be found in ConsultantPlus:

If you do not yet have access to the legal system, a trial of full access to the system is available for free.

Off-balance sheet accounts in 1C: Accounting ed. 3.0

Published 08/26/2020 09:11 Author: Administrator We constantly talk about balance sheet transactions and somehow needlessly neglect off-balance sheet accounts. But, unfortunately, many accountants heard about them for the last time only at the university bench. Properly executed off-balance sheet accounts are designed to account for objects that do not belong to the organization, but are temporarily at its disposal. It is this information that makes it possible to conduct a more accurate analysis of the company’s creditworthiness and determine its financial stability. We will talk about what off-balance sheet accounts are and the procedure for using them in this article.

What are off-balance sheet accounts?

Off-balance sheet accounts are not included in the balance sheet. Hence their name - off-balance sheet. Having prescribed it in the accounting policy, the company can open its own off-balance sheet accounts.

In the 1C: Enterprise Accounting program there are 11 off-balance sheet accounts. Let’s make sure of this by going to the “Main” - “Chart of Accounts” section. They are located at the end of the list of main accounting accounts.

Off-balance sheet accounts can be divided into groups:

• For property accounting (001, 002, etc.);

• To account for liabilities (007, 008, 009);

• To account for other property (003)

Open any off-balance sheet account to view. It has a checkbox selected - “off-balance sheet” and subcontos are defined that the user fills in when entering a transaction.

By opening the chart of accounts from the “Main” - “Chart of Accounts” section, the user can see the sub-accounts established for a specific off-balance sheet account.

Let's look at some accounts.

Account 001 – records of leased operating systems are kept on it. For example, renting a warehouse, store, car, property. It is recommended to keep separate records of leased fixed assets on the territory of the Russian Federation and abroad, allocating separate subaccounts for this - 001.1 and 001.2. This account also takes into account one of the VAT transactions of tax agents.

Account 002 – is intended to account for inventory items accepted for critical injuries. This could be an injury under a contract, storage of sold material assets that the buyer did not pick up, and other situations, for example, the return of substandard goods to the supplier.

Account 003 – this account records customer-supplied raw materials and materials accepted for processing.

Account 004 – it records goods accepted for commission, broken down by counterparties and item.

Account 005 is intended for accounting by the contractor of the equipment transferred to him for installation.

Account 006 – BSO – strict reporting forms. These can be various gift certificates, store bonus cards, voucher forms, tickets, coupons, diplomas, subscriptions, etc.

Account 007 is intended for maintaining records of the amounts of written off receivables. If within 5 years the counterparty-debtor has not paid off its obligations, then such debt is written off as the company’s losses with a parallel display on the off-balance sheet account.

Account 008 – it takes into account the amounts of security for obligations, for example: • letters of guarantee from a debtor who has not paid within a certain period of time; • deposit; • pledge; • guarantee; • bank guarantee.

But do not confuse a deposit with an advance! In accounting, the deposit is reflected on the balance sheet.

Account 009 – this account records obligations (letters of guarantee, sureties, etc.) issued by our company to ensure repayment of the debt.

Account 010 - for accounting for depreciation of fixed assets, listed housing assets or other improvement objects.

Account 011 is intended for accounting for fixed assets leased. Accounting is carried out in the context of the counterparty-tenant and fixed assets.

You can learn more about information about accounts by highlighting the account and clicking the “Account Description” button in the “Chart of Accounts” directory.

Off-balance sheet accounting

In the 1C: Enterprise Accounting program, movements in off-balance sheet accounts can be reflected in two ways:

Method 1 – using the document “Operation entered manually”.

Method 2 – using the documents provided by the program.

For example, let’s display the transaction of receipt to off-balance sheet account 002 “Inventory and materials accepted for safekeeping.”

From the counterparty, the Planet of Talents Foundation, we accepted for storage “Trading tent Mitek Domik 2.5x2.0m” - 1 piece, worth 16,230 rubles.

1 way.

Step 1. Go to the “Operations” - “Operations entered manually” section.

Step 2. Click “Create” and create a posting – Account Dt 002.

Step 3. Fill in the subconto details - name of inventory items, counterparty. Please indicate quantity and amount.

Step 4: Save the document. The transaction is reflected in the accounting.

To write off inventory items, the operation is reflected in the same document, but on the credit of account 002 “Inventory items accepted for safekeeping.”

Method 2.

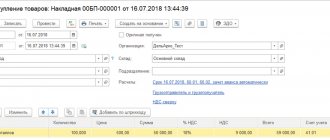

Step 1. Create the document “Receipt” - “Goods (invoice)” in the “Purchases” - “Receipts (acts, invoices)” section.

Step 2. Fill out the document header and the tabular part - the “Add” button. Select the item number, indicate the quantity and amount.

Please note that the accounting account was set automatically - 002.

The defining point is that when creating an item it is indicated - “Type of item” - “Goods in safekeeping”.

Step 3. Generate a document movement report – button at the top of the document. The document generated a posting - debit of account 002, similar to the one we reflected in the document “Operation entered manually”.

Thus, we reflected the receipt of inventory items to off-balance sheet account 002 “Inventory items, in custody” using a document.

If there is no document that can be used to record the movement on off-balance sheet accounts, you can always use the first option - register using the document “Operation entered manually.”

Entering balances on off-balance sheet accounts if accounting was previously carried out in another program

A special document is intended for this. Here we must take into account that the principle of double entry does not apply to off-balance sheet accounts. Those. a transaction on such an account is recorded only as a debit or credit.

Let's look at this with an example.

Step 1. To enter balances at the beginning of the current year, go to the “Main” - “Balance Entry Assistant” section.

Step 2. Set the date for entering balances - the last day of the month preceding the beginning of the current year. So, to enter balances as of January 1, 2021, we will set the date to December 31, 2021.

Step 3. Go to the “Off-balance sheet accounts” tab, select the account for which balances are being deposited and click the “Add account balances” button.

Step 4. In the document that opens, click “Add” and specify the off-balance sheet account.

Step 5. Specify the name of the inventory items by selecting “Nomenclature” from the directory.

For example, let’s add the balance to account 002 – “Goods in safekeeping.” When selecting an item, we will create an object indicating the type of item “Goods in safekeeping.”

The correctness of specifying the accounting account in transactions when selecting this element depends on the correct filling of the “Types of items” field!

Step 6. Specify the counterparty, quantity and cost.

Once again, we draw your attention to the fact that if the account balance is in debit, then only the debit of the account is indicated. The credit is not filled in and remains empty!

Step 7. Save the document – “Post and close”.

In this way, balances on other off-balance sheet accounts are also entered. All entered data is displayed in the table. Here the user can open them and edit them if necessary.

By double-clicking on the selected account, a document log for entering balances will open. Off-balance sheet accounts belong to the section – “Other accounting accounts”.

After reflecting account balances, the question will obviously arise: “How can I view the entered data in the reports?” Let's look at this next.

Reports on off-balance sheet accounts

Information about these off-balance sheet accounts can be viewed:

1. In the report “Turnover balance sheet”. It reflects general account data.

2. In the report “Account balance sheet”, indicating the off-balance sheet account of interest.

Let's generate these reports.

Step 1. Open the “Reports” section - “Turnover balance sheet”.

Step 2. Go to the “Selection” tab and check the “Display off-balance sheet accounts” checkbox.

Step 3. Generate a report – the “Generate” button. At the end of the report, data on off-balance sheet accounts will be displayed.

More detailed information on off-balance sheet accounts can be obtained by generating the “Account balance sheet” by selecting a specific off-balance sheet account.

Step 4. Go to “Reports” - Account balance sheet.” Enter the account, for example, 002 (inventory accepted for safekeeping) and click “Generate”.

A report on off-balance sheet account 002 has been generated.

Author of the article: Olga Kruglova

Did you like the article? Subscribe to the newsletter for new materials

Add a comment

Comments

0 Irina Plotnikova 10/07/2020 00:45 I quote Viktor Sofronov:

Olga, good afternoon! How can you reflect on the off-balance sheet 1C 8.3, old equipment that has been depreciated and written off but can still be used, as well as old power lines, old OS objects.

Victor, hello.

There is no need to transfer the OS for balance; this mechanism is not even implemented in the program. Fully depreciated fixed assets continue to be listed in the program, on account 01 at their original cost, they are not reflected in the balance sheet. On the balance sheet we reflect only inventories worth up to 40 thousand rubles. Fixed assets can only be disposed of due to sale, transfer, gratuitous donation, complete disposal, etc. Quote 0 Victor Sofronov 10/06/2020 18:01 Olga, good afternoon! How can you reflect on the off-balance sheet 1C 8.3, old equipment that has been depreciated and written off but can still be used, as well as old power lines, old OS objects.

Quote

Update list of comments

JComments

What does a balance sheet look like (structure example)

The Soviet legacy and modern business practices have led to the emergence of 3 main types of balance sheets:

- compiled from a set of values in synthetic accounts;

- compiled according to analytical accounts;

- combined, combining the previous types of whorls.

Statements on a set of synthetic accounts compiled by different enterprises will generally be very similar to each other, since the list of relevant accounts is approved by law.

In turn, filling out SALT for analytical accounts in each organization may differ in very specific nuances. Let's consider what a typical structure of a balance sheet for analytical accounts might look like.

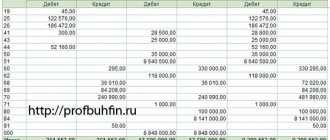

A typical balance sheet for an active or passive account consists of 7 columns:

- name of a specific account (sub-account);

- debit and credit balance at the beginning of the reporting period;

- turnover within the reporting period by debit and credit;

- debit and credit balance at the end of the reporting period.

Depending on which account the balance sheet reflects - active or passive, an increase in assets is recorded in the “Debit” columns and a decrease in them in the “Credit” columns (for active accounts) or, conversely, a decrease in liabilities in the “Debit” and an increase in those in the “Credit” columns (for passive accounts).

You can check whether you are preparing your accounting registers correctly using the Typical Situation from ConsultantPlus. Study the material by getting trial access to the K+ system for free.

Account 08: subaccounts

The chart of accounts provides for a number of subaccounts:

- 08.01 opened to systematize information about investments in land plots.

- 08.02 specializes in environmental management facilities.

- 08.03 is suitable for accounting for newly created fixed assets.

- account 08.04 – fixed assets assets acquired by the enterprise.

- 08.05 – intangible assets purchased from suppliers.

- 08.06 – young animals to be transferred to the main herd.

- Account 08 of the sub-account for adult animals that are accepted for registration as part of the main herd - 08.07.

- Account 08.08 was created to reflect the results of scientific work.

Where are the SALT fills?

You can download a sample of filling out the balance sheet on our website using the link below. Our experts have prepared for you an example of filling out a statement in Word format, reflecting transactions on account 60 (“Settlements with suppliers and contractors”).

This turnover sheet reflects the following sequence of business transactions:

1. The company transferred to its counterparty an advance payment for goods under a contract in the amount of 100,000 rubles. and reflected this operation as an increase in assets in the debit of active subaccount 60.1. Posting: Dt 60.1 Kt 51 for 100,000 rubles.

2. The counterparty delivered goods to the company under a contract in the amount of 150,000 rubles, and this operation is reflected as an increase in liability in the credit of passive subaccount 60.2. Wiring: Dt 41 Kt 60.2 for RUB 150,000.

3. The company partially pays the counterparty for the goods, and we reflect this transaction as a decrease in liabilities by 100,000 rubles. in the debit of the passive subaccount 60.2 and as a decrease in assets in the credit of subaccount 60.1. Posting: Dt 60.2 Kt 60.1 for 100,000 rubles.

4. As a result, the company owes the counterparty 50,000 rubles, and we record this in the credit of the passive subaccount 60.2, in the credit of the active-passive account 60 as a whole, and also in the final line - as of the end of the reporting period.

Similar statements can be compiled for any accounting account.

Where is account 08 reflected in the balance sheet?

Filling out a balance sheet with existing open balances on investments in non-current assets requires their reflection in the appropriate lines, broken down by the purpose of the objects. Account 08 in the balance sheet can be represented by five lines:

- Intangible search assets.

- Material prospecting assets.

- NMA.

- OS.

- The results of research and development.

As a result, which line is account 08 reflected in the balance sheet? For enterprises involved in the development of natural resources, the first two options are relevant. Feature - if there is accrued depreciation on assets, they should be included in the balance sheet at their residual value.

Account 08 in the balance sheet for fixed assets is reflected in one line with the balance of account 07. If expenses on intangible assets and scientific developments turned out to be insignificant in the current period, they can be added to the fixed assets item.

Which line of the balance sheet is account 08 reflected when filling out the abbreviated report form? The amounts are distributed between tangible and intangible (including financial and other) non-current assets.

Where can I download a blank balance sheet form for free?

The balance sheet form is also available to you on our website. You can download it in Excel format, which allows you to make calculations and apply mathematical formulas.

You can get acquainted with the features of compiling turnover for some common accounts in the articles:

- “Features of the balance sheet for account 60”;

- “Features of the balance sheet for account 01.”

Results

The balance sheet is an accounting register, which is an element of the system for collecting and processing information. As a rule, the form is filled out automatically in accounting systems. Using the statement for tax calculation purposes is possible only in special cases. When carrying out transactions that entail different accounting procedures, there is a need to adjust or prepare a new register for tax purposes.

Sources:

Order of the Ministry of Finance of Russia dated December 28, 2001 N 119n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.