What is account 69 in accounting

69 accounting account is a tool used to accumulate information on accruals and payments for all types of personnel insurance. It is located in Section VI “Calculations” of the Chart of Accounts for accounting of the financial and economic activities of the organization.

Extra-budgetary funds of the Russian Federation

In 2021, contributions to state funds are set in the following amounts (without benefits):

- FFOMS - 5.1%;

- PFR - 10% (above the maximum base of 1.1 5 million rubles) and 22% (up to the maximum base of 1.15 million rubles);

- FSS - 0% (above the maximum base of 865 thousand rubles) and 2.9% (below the maximum base of 865 thousand rubles).

Regulatory framework and analytical analysis

For each type of deduction, reconciliation of mutual settlements takes place under the strict control of authorized bodies. The procedure is carried out in accordance with the current account of which VNF the deductions will be made and the type of payment made. The data indicated on the account must completely coincide with the information from the certificate issued by the Federal Tax Service.

The rules for using account 69 to record information on settlements between an enterprise, the tax authority and extra-budgetary funds are regulated by the Chart of Accounts, Order of the Ministry of Finance of the Russian Federation No. 94 of October 31, 2000, Federal Law No. 243 and other legislative acts.

Characteristics of account 69

On the account 69 reflects information not only on the accrual and payment of monthly payments to state funds, but also penalties and penalties imposed for late and non-payment.

Debit 69 of the account shows the amounts of paid contributions to compulsory medical insurance, the Pension Fund of the Russian Federation and the Social Insurance Fund, funds that are reimbursed to employees of the enterprise upon the occurrence of an insured event, as well as overpaid amounts that were returned by state funds. For loan 69, you can control the accrual of installments that are payable, as well as penalties and fines for late payments.

You can determine whether account 69 is active or passive after analyzing its balance at the beginning and end of the reporting period. Such a balance can show both an overpayment and arrears of payments, therefore it can be a credit or debit, respectively, defining account 69 as active-passive.

Scheme 69

The debit balance reflects the debt incurred by government agencies to the organization. It arises as a result of overpaid insurance premiums and is subject to refund. The emergence of a credit balance occurs as a result of the formation of amounts of accrued but not yet paid contributions. Due to the fact that balances are displayed in the context of subaccounts, you can immediately determine which payments have not been made.

The accounting department of the enterprise has the right to include all accrued contributions as indirect, direct or other costs, depending on the type of settlement with personnel on the basis of which the contributions were paid. Thus, the accrued amounts of payments reduce the taxable profit of the enterprise.

The amounts of insurance payments are accrued monthly when making settlements with personnel, and payment of accruals made is carried out until the 15th of the next month.

Active or passive

Account 69 is used to record accrued and paid contributions to extra-budgetary funds.

Sub-accounts can be opened for it, which are divided according to the purpose of payment. This account can be used for transactions:

- on the calculation of contributions - penalties, penalties;

- when paying accrued penalties, fines, etc.;

- recording in the reporting documentation the amount of expenses for paying contributions to extra-budgetary funds.

From 01/01/2017, in accordance with the adopted changes in the legislation of the Russian Federation, all payments between the organization and the VNF will be carried out with the help of the branches of the Federal Tax Service. The exception is calculations in the event of an employee being injured at work.

Main type subaccounts:

- Sbsch. 69.1 - is responsible for recording information on transactions between the company, the Federal Tax Service and the Social Insurance Fund.

- Sbsch. 69.02 – displays settlements with the Pension Fund.

- Sbsch.69.03 – contributions to the Federal Tax Service on account of medical insurance companies.

Count 69 is active-passive. For debit, information on completed payments is displayed, and for credit, charges (their generalized amount) are displayed.

Existing subaccounts 69

Account 69, the sub-accounts of which reflect data in the context of state funds receiving payments, shows the accrued and paid amounts of contributions:

- 69-01 - an account for reflecting social insurance payments that are paid to the Social Insurance Fund.

- 69-02 - accounting for pension accruals in favor of the Russian Pension Fund. Depending on the activity of the enterprise, additional sections may be opened on this sub-account to reflect information on contributions for additional payments to certain categories of employees, for example, aviation workers, coal industry organizations, and those employed in work with harmful or difficult working conditions.

- 69-03 - accounting for payments for compulsory health insurance for employees. The subaccount is divided into payments to the Federal Compulsory Medical Insurance Fund and the territorial one.

- 69-07 - contributions to the funded part of the pension, made on the basis of the employee’s application.

- 69-08 - employer contributions for employees to private medical centers.

- 69-11 - an account for accrual (expense) of amounts for insurance against occupational diseases or industrial accidents in favor of the Social Insurance Fund.

Attention! If an enterprise has relationships with other extra-budgetary funds, then accounting provides for the possibility of opening other sub-accounts to simplify the accounting of transactions.

Subaccounts 69

Interest rates

The amount of taxes to be transferred is calculated for each fund separately. The calculation is made on the basis of the tariff rate established by the Tax Code of the Russian Federation. For 2021, the percentage of the amount of payments from the employee’s income is:

- Pension fund – 22%.

- Social Insurance Fund – 2.8%.

- Federal Compulsory Medical Insurance Fund – 5.1%.

In total, the total contribution rate will be 30%. Some types of business are taxed at a preferential rate:

- organizations operating under a special regime are taxed at a rate of 20%;

- Skolkovo participants have the right to contribute only 14% to the Pension Fund;

- companies engaged in intellectual activities contribute a total of 14% to all social insurance funds;

- employers of ship crew are taxed at a zero rate;

- a reduced tariff of 7.6% is available in Crimea.

It is also necessary to take into account that exceeding the limit of the base used for calculating insurance payments entails an additional charge of 10% in the Pension Fund and 5.1% in the Federal Compulsory Medical Insurance Fund of the excess amount. For 2021, the maximum amounts have been set for the Social Insurance Fund - 723 thousand rubles, and the Pension Fund - 800 thousand rubles. The rule does not apply to reduced rate users.

Correspondence of account 69 with other accounts

Account 69 in most cases corresponds with the accounts on which the calculation of wages is reflected (in relation to deductions made from the enterprise’s funds). However, correspondence is also possible with accounts that record profits and losses, expenses and income of the enterprise. This is the count. 99, and correspondence with him reflects the accrual of fines issued and penalties incurred for late payments and non-payments.

Correspondence under debit 69 occurs with the following accounts:

- Section V “Cash” - 50, 51, 52, 55. In this case, the entries reflect transactions carried out with the company’s money in any form: cash and non-cash located on the company’s current, foreign currency or special accounts.

- Section VI “Calculations” - 70. This is the main corresponding account reflecting calculations for personnel wages.

Correspondence for loan 69 occurs with the following accounts:

- Section I “Non-current assets” - 08.

- Section III “Production Costs” - 20, 23, 25, 26, 28, 29. The accounts correspond to the calculation and payment of insurance premiums for workers of various types of production, depending on the specialization of the enterprise.

- Section IV “Finished products and goods” - 44 (for trade workers).

- Section V “Cash” - 51, 52. In this case, transactions carried out with non-cash funds in the current and foreign currency accounts of the enterprise are reflected.

- Section VI “Calculations” - 70, 73. These are the main corresponding accounts, reflecting calculations for wages and other transactions with personnel.

- Section VIII “Financial results” - 91, 96, 97, 99.

Main correspondence

Typical wiring

Account 69 can correspond with the following accounts.

From the debit of account 69 to the credit of accounts:

- Account 50 - used in certain cases when social benefits are issued from the cash register. Moreover, such an entry can only be made in situations where the benefit is not combined with salary payments and is calculated bypassing account 70. In addition, they should not be subject to taxes and other deductions.

- Account 51 - when transferring contributions from a current account;

- Account 52 - when transferring contributions from a foreign currency account. Despite the fact that such correspondence is directly indicated in the chart of accounts adopted by Order 94-N, it is unlikely in real life, since payments to the budget must be made in rubles.

- Account 55 - when transferring contributions to social funds from open special accounts;

- Account 70 - when calculating benefits to employees at the expense of social funds.

According to the credit of the account, it corresponds with the debit of the following accounts:

- Account 08 - when calculating contributions to employees involved in preparing capital investment objects for operation;

- Account 20 - when calculating contributions to employees engaged in the main production;

- Account 23 - when calculating contributions to employees engaged in auxiliary production;

- Account 25 - when calculating contributions to general production employees;

- Account 26 – when calculating contributions to administrative employees;

- Account 28 - when calculating contributions to employees involved in correcting a previously committed defect;

- Account 29 – when calculating contributions to employees employed in service industries and farms;

- Account 44 - when calculating contributions to employees involved in the sale of finished products or services;

- Account 51 - when crediting excess funds transferred to funds, compensation, etc. to the current account.

- Account 52 - When crediting money, compensations, etc., excessively transferred to funds to a foreign currency account. Despite the fact that such correspondence is directly indicated in the chart of accounts adopted by Order 94-N, it is unlikely in life, since budget payments must be made in rubles.

- Account 70 - When deducting from the employee part of the cost of sanatorium treatment allocated by the social insurance fund;

- Account 73 - when withholding penalties and fines issued by social funds from the guilty person;

- Account 91 - when calculating contributions to employees not directly involved in the production of products or provision of services;

- Account 96 - when accruing contributions for the amount of vacations, employees undergoing warranty repairs, at the expense of previously formed reserves;

- Account 97 - when accruing to amounts of wages that are paid in one period, but are recognized in accounting in the subsequent period.

- Account 99 - when reflecting contributions for wages paid in connection with the liquidation of the consequences of natural disasters. The same entry is drawn up when reflecting accrued fines and penalties for payments to social funds.

You might be interested in:

Authorized capital of LLC: why is it needed, size, timing and procedure for its payment

Compensation of insurance payments

The amount transferred to the Social Insurance Fund of the Russian Federation may be reduced if the employer paid the costs of social insurance for employees at the expense of the enterprise. This includes benefits:

- on sick leave;

- maternity payments;

- lump sum payment at the birth of a child;

- child care up to 1 year 6 months;

- upon adoption;

- caring for a disabled child;

- social funeral payment.

In addition, the legislation establishes the purchase of vouchers for sanatorium and preventive treatment at the expense of the Social Insurance Fund (the fund reimburses the company’s costs). It is worth considering that the list does not include all categories of citizens.

What is Deposited Salary?

There are situations when the salary was accrued, but the employee was not given it on time due to his absence.

Now this is rare, since most people receive their salary on a bank card, but such situations do happen. The reasons why an employee was unable to collect his salary from the cash register on time are different, for example, he was admitted to the hospital and he was unable to appear at the organization’s cash desk. In this case, his salary is deposited, that is, it is reflected as not received in the primary documents. To do this, do the wiring:

Dt 70 Kt 76. Settlements on deposited amounts

When the employee receives the deposited salary, the following posting is made:

Dt 76 Kt 50

Salaries are deposited for up to 3 years. If during this time the employee does not show up for it, then it is subject to inclusion in the company’s income.

Keep records of exports and imports in the Kontur.Accounting web service. Simple accounting, payroll and reporting in one service

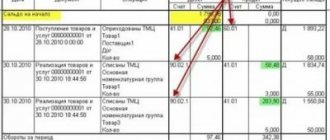

Legislative requirements for SALT

Requirements for SALT according to the bill. 69 are described in paragraphs 4 and 5 of Art. 10 of Law No. 402-FZ. They are common to all accounting registers:

- the register form must be approved by the head of the company;

- The register must contain the following details:

These details cannot be changed or ignored. If necessary, you can expand/supplement the composition of the balance sheet details.

Let's sum it up

Balance sheet for account 69:

- compiled according to a form developed by the enterprise itself, taking into account the requirements of Law No. 402-FZ (availability of mandatory details and approval of the form by the manager);

- shows whether the company has debt or overpayment for each of the extra-budgetary funds: Social Insurance Fund, Pension Fund, Compulsory Medical Insurance Fund;

- forms the final balance for the account. 69, which at the end of the reporting period is transferred to the balance sheet;

- is an accounting register that controllers may request when conducting an audit.

If you find an error, please select a piece of text and press Ctrl+Enter.