Account 73 in accounting

In addition to remuneration or accountable amounts, other situations may arise in an organization regarding the accounting of settlements with personnel, for example, accounting for shortages or the use of personal property. For these purposes, account 73 “Settlements with personnel for other operations” is used.

Let's look at other situations:

- Providing loans;

- Compensation for material damage;

- Payment for the use of personal property (for example, a car);

- Reimbursement for telephone calls;

- Other calculations.

For each situation, you can select a separate subaccount:

Characteristics of account 73 Settlements with personnel for other transactions:

- It is an active-passive account. The debit balance characterizes the debt of the employee, and the credit balance - of the organization;

- Analytical accounting is carried out in the context of enterprise employees.

Salary issued (reflected on the employee’s personal account): postings

The fact of salary payment is reflected in accounting by posting Dt 70 Kt 51 (or 50).

A similar posting is used when paying an advance.

The date of formation of the above posting for salary or advance payment is determined based on the date of each payment.

In this case, the actual amount of the “basic” labor payment is calculated minus the advance and personal income tax. It turns out that the tax is “withdrawn” from the corresponding amount, although it is charged on the total salary (the summed amount of the “basic” payment and advance payment). This circumstance reflects the specifics of tax accounting.

In accounting, therefore, in any case, the following should be distinguished:

- advance amount;

- the amount of the “basic” payment.

Postings of payment of wages in terms of the advance and its second half are recorded in the accounting registers on the day the funds are issued to employees.

After all the transfers, the employees’ personal payroll accounts are filled out (on Form T-54). Information is entered into them monthly.

Correspondence of account 73 with other accounts

Table 1. By debit of account 73:

| Dt | CT | Wiring Description |

| 73.02 | 20, 29,23 | Damage caused to the main, servicing or auxiliary production is written off to the perpetrators |

| 73.02 | 28 | The marriage is blamed on the guilty parties |

| 73.01 | 50, 51, 52, 57, 62 | A loan was issued from the cash desk, from a current or foreign currency account, by transferring transfers or by endorsing buyer bills |

| 73.03 | 50, 52 | Payment of rental of personal property or reimbursement of amounts for the use of personal property through a cash register or bank account |

| 73.03 | 68 | Withholding personal income tax from other transactions |

| 73.03 | 69 | Debt on insurance premiums for other operations |

| 73.03 | 76 | Insurance payments for personal insurance are reflected |

| 73 | 79 | Transfer of debt upon transfer from a separate division |

| 73.03 | 81 | Issue of own shares |

| 73.01 | 91.01 | Interest on loans issued |

| 73.02 | 94 | The amounts of shortages and damages within the book value were written off |

| 73.02 | 98.4 | Difference between recoverable and book value, shortfalls for previous years |

| 73.02 | 99 | Amounts of damage from emergency events (fire, accident) are written off to the perpetrators |

Table 2. For the credit of account 73:

| Dt | CT | Wiring Description |

| 20 | 73.03 | Accrual of rental of personal property or reimbursable amounts for the use of personal property through a cash register or checking account |

| 41 | 73 | Receipt of goods through payment of debt |

| 50, 51, 52 | 73 | Receipt of payment from employees (loan payment, compensation for shortages, losses from defects) |

| 70 | 73 | Deduction of employee debt from wages |

| 76 | 73 | Amounts of compensation under the employee's insurance contract |

| 91.02 | 73 | Write-off of unreceivable debt |

| 94 | 73 | The claim for shortages is not justified, write-off of debt for shortages |

| 99 | 73 | Write-off of debt in connection with emergency situations in which an employee died |

Postings debit 70 credit 70, 73, 76, 50 (nuances) - all about taxes

Accounting account 73 is an active-passive account “Settlements with personnel for other operations.” Let's consider what transactions account 73 is used to account for, what accounts account 73 corresponds with, as well as typical entries in account 73 using the example of transactions of issuing a loan to an employee, compensation for the use of personal vehicles for business purposes and writing off shortages.

Accounting 70 account. Postings, credit and balance | Accounting on IDdeiforbiz.ru

Account 70 is intended to summarize all data on employee remuneration. It takes into account various bonuses, benefits, reflects transactions for the issuance of pensions, as well as for the payment of profit from the company’s securities. In this publication, the reader will learn a lot of interesting information about the “Settlements with employees for wages” account, its correspondence, balance, and examples will help to master the material.

Credit 70 of the “Settlements with employees for wages” account records the following transactions:

- calculating wages to employees;

- funds accrued due to the formed reserve for vacation pay (D96/K70);

- accrual of contributions through transfers to the social protection fund of citizens and other similar amounts (D69/K70);

- profit arising from participation in the capital of the company (D84/K70).

Account debit 70

70 debit account reflects funds paid, which may include benefits, bonuses, wages, as well as profit from investments in the capital of the enterprise.

This takes into account taxes, payments under enforcement documentation and other deductions. Amounts of money accrued but not paid within a certain period of time due to the recipient’s failure to appear are recorded (D70/K76.3).

Analytical accounting for the account in question is maintained for each employee of the organization.

Debit correspondence

Account 70 “Settlements with employees for wages” interacts by debit with the following accounts:

- "Cash desk" (50);

- “Current accounts” (51);

- “Currency accounts” (52);

- “Special bank accounts” (55);

- “Calculations for taxes and fees” (68);

- “Calculations for social insurance and security” (69);

- “Settlements with accountable persons” (71);

- “Settlements with personnel for other operations” (73);

- “Settlements with various debtors and creditors” (76);

- “Intra-economic calculations” (79);

- “Shortages and losses from damage to valuables” (94).

Example of business transactions

To better understand what transactions can be made using account 70, you should familiarize yourself with several examples.

| D70/K50 | Issuance of wages (in cash) to personnel in accordance with relevant documentation |

| D70/K52 | Salaries have been credited to employees' bank accounts (based on statements) |

| D70/K55 | Transferring salaries from special bank accounts |

| D70/K73 | Repayment of the cost of workwear by the employee according to the application |

| D70/K10.9 | Issuance of branded clothing to staff |

| D70/K68 Personal income tax | Operation of income tax withholding from organization personnel |

| D70/K91.1 | Free transfer of workwear to the company’s courier |

| D70/K72.2 | Reflection of deductions from the salaries of guilty citizens |

| D70/K70 | No arrears in wages and account closure |

Loan correspondence

Account 70 interacts on the loan with the following accounts:

- “Investments in non-current assets” (08);

- “Main production” (20);

- “General production expenses” (25);

- “General business expenses” (26);

- “Service industries and farms” (29);

- “Sales expenses” (44);

- “Calculations for social insurance and security” (69);

- “Settlements with various debtors and creditors” (76);

- “Intra-economic calculations” (79);

- “Defects in production” (28);

- “Retained earnings (uncovered loss)” (84);

- “Other income and expenses” (91);

- “Reserves for future expenses” (96);

- “Future expenses” (97);

- "Profits and losses" (99).

Examples of business transactions on a loan

In accounting practice, the 70 account is used in different cases. The table describes some of them.

| D23/K70 | The operation of calculating salaries for employees performing routine repair work |

| D08.3/K70 | Write-off of costs for investments in non-current assets |

| D08.4/K70 | Accounting for the enterprise's own expenses associated with the purchase of fixed assets |

| D29/K70 | Cash accrued to employees involved in servicing production and various types of farms |

| D97/K70 | Recognition of costs for restoration of fixed assets as future expenses |

| D44/K70 | Funds were transferred to employees who ensure the sale of products |

| D91/K70 | Funds have been accrued for the salaries of people involved in equipment dismantling |

| D08.1/K70 | Implementation of labor costs |

Account balance

In most cases, the account balance is 70 in credit and means the enterprise's debt to its staff. By structure, in the general case, the account is passive and is reflected in the corresponding section of the balance sheet.

However, in practice, there are situations when the advance payment turns out to be more than the accrued salary for the month.

This may be the result of a combination of special circumstances or arithmetic errors (incorrect calculation and transfer of salaries), then the employee will have to return the money, and the balance of funds is recorded in debit.

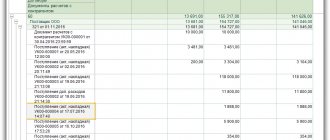

Calculation of wages for personnel in the 1C system

You can correctly calculate your salary in the 1C: Salary and Personnel program if you follow a certain sequence of arrangement of all the required data in the information base. The calculation results are entered into the payroll sheet.

Some organizations issue wages using cash receipts issued for each worker.

To avoid mistakes, users of the 1C system are recommended to calculate all the numbers in the payslip and issue money according to the required documents.

To draw up a payslip in the 1C program, you need to open the “Reports” menu and select the appropriate item. The document can be compiled for the enterprise as a whole or for a specific division, as well as for a group of employees. The procedure for reflecting data in the pay slip:

- The serial number of the entry is entered in column No. 1.

- Columns No. 2-5 contain information about the employee. It can be viewed from the “Directories” section (personnel number, last name and initials, position or profession, tariff rate or salary).

- Based on the working time sheet, data on the number of days actually worked in the period is entered in column No. 6, and data on the number of days worked on holidays and weekends is entered in Column No. 7.

- Information about accruals for the current month by type of payment is displayed (section No. 8-12), as well as the calculation of deductions from the amount.

- Column No. 13 indicates the amount of tax payable this month.

- Data is entered on other deductions from the worker’s salary (column No. 14): loan repayment, alimony, union membership dues, etc.

- Column 15 sums it up.

- Column No. 16 shows the company’s debt (employee’s debt) based on the results of previous calculations.

- If there is a difference between the totals of columns No. 12 and No. 15, it is shown in column No. 18 “Amount to be paid.”

The article examined in detail account 70 “Settlements with employees for wages”. Knowing its features, young specialists will be able to correctly perform the required financial transactions.

Source

Source: https://nalogmak.ru/zadolzhennost/provodki-debet-70-kredit-70-73-76-50-nyuansy-vse-o-nalogah.html

Examples of using account 73 in accounting

Example 1. Accounting for a loan to an employee in account 73

On December 1, employee Petrova A.S. A loan in the amount of 70,000 rubles was issued. for a period of 1 year at 6%. The loan is repaid with salary deductions in the amount of RUB 6,000. monthly. The Central Bank refinancing rate was 10%.

Let's make the calculation:

- Interest - 70,000 rubles. * 6% / 366 days a year * 31 calendar days = RUB 355.74;

- Material benefit – 70,000 rubles. * (2/3 * 10% - 6%) / 366 days a year * 31 calendar days = 39.53 rubles;

- Personal income tax – 39.53 * 35% = 13.84 rubles.

The solution to the example with postings to account 73 in the table:

| date | Account Dt | Kt account | Amount, rub. | Wiring Description |

| December 01 | 73.01 | 51 | 70 000 | The loan amount was issued to the current account |

| December 03 | 73.01 | 91.01 | 355,74 | Interest accrued |

| December 10 | 51 | 73.01 | 355,74 | The employee paid the interest |

| 31th of December | 70 | 68 | 13,84 | Personal income tax accrued on material benefits |

Example 2. Accounting for compensation for the use of a personal car in account 73

Employee Petrov E.P. by agreement with the employer, uses his personal car for business trips. The amount of monthly compensation is set at 2,000 rubles. (within the normal range - 1,200 rubles and 800 rubles in excess of the norm).

Solution to the example with postings to account 73:

| date | Account Dt | Kt account | Amount, rub. | Wiring Description |

| Accounting | ||||

| December 01 | 44 | 73.03 | 2 000 | Compensation awarded for the use of a personal car |

| 31th of December | 73.03 | 50 | 2 000 | Compensation paid |

| If PBU 18/02 is applied | ||||

| WELL | 44 | 73.03 | 1 200 | Compensation within normal limits |

| ETC | 44 | 73.03 | 800 | Compensation above the norm |

Important! Personal income tax is not charged on amounts of compensation for the use of personal property, and these amounts are also not subject to insurance contributions (clause 3 of Article 217 of the Tax Code of the Russian Federation).

Example 3. Shortages were identified during inventory

The trading company Tele Systems Fon LLC carried out an inventory of goods in warehouses as of December 1. As a result of the inventory, a shortage totaling 5,000 rubles was identified. The amount within the limits of natural loss norms was written off as business expenses - 4,000 rubles, the rest - to the guilty parties.

Solution to the example with postings to account 73:

| date | Account Dt | Kt account | Amount, rub. | Wiring Description | A document base |

| Write-off of losses | |||||

| December 01 | 94 | 41 | 5 000 | Shortage identified | Certificate of write-off of goods TORG-6 |

| December 01 | 44 | 94 | 4 000 | The shortfall was written off as business expenses within the normal limits. | |

| December 01 | 73.02 | 94 | 1 000 | The shortage is written off to the responsible person | |

Payroll

Settlements with company personnel for wages are accumulated in account 70. This account is passive, since all calculated amounts of employee earnings are taken into account on a loan. This is done on the last date of the month. And on the 1st day of each next month, the credit balance is reported to employees.

Account analytics is carried out for each employee using personal accounts (cards) in the T-54(a) form.

The amount of accrued salary is posted to the appropriate expense accounts depending on the department in which the employee is registered. Postings in each specific case can be as follows: Dt 20 (23, 26, 44) Kt 70.

If an employee was engaged in the construction or repair of fixed assets, then his earnings should be reflected in the entry: Dt 08 (07) Kt 70.

When calculating sick leave, the calculated amount should be included in debit 69, since it is not an expense of the enterprise and is reimbursed from the budget using the social insurance fund: Dt 69 Kt 70.

Important! The employer pays for the first 3 days of illness of the employee.

Salary in accounting: basic operations

Payroll accounting is carried out within the framework of the following main operations:

- payroll;

- personal income tax withholding and salary contributions;

- making other deductions (for example, alimony under writs of execution);

- salary payments (advance, main part);

- payment of taxes and wage contributions to the budget.

These business operations may be supplemented by others, which are determined by the peculiarities of the production process at the enterprise. For example, by depositing salaries.

Each of the noted transactions must be reflected in the accounting registers. They are carried out at different times, which can be determined based on the specifics of tax accounting at the enterprise and the requirements of labor legislation.

Let's study how the timing of the noted transactions for accounting is established, as well as what entries are used when calculating and paying wages.

Postings for deductions from wages: Dt 70 Kt 76 (73, 68)

- The responsibility of the employer, who is an intermediary (tax agent) between the Federal Tax Service and the recipient of income (employee), is to calculate and withhold personal income tax. In this case, the entry is made: Dt 70 Kt 68.

- If a loan agreement has been entered into between the employee and the company, monthly interest and principal amounts may be deducted from his paycheck. The basis is a written statement from the employee. The accounting entry in this case will be as follows: Debit 70 Credit 73.

- Deductions for compensation for shortages of goods and materials or damage caused are reflected similarly: Dt 70 Kt 73.

- In addition, the employer is obliged to make deductions from the salary accrued to the employee according to executive documents. These may be court orders or bailiff orders, notarized agreements on the withholding of alimony, etc. Such transactions are reflected by the posting: Dt 70 Kt 76 .

Postings for salary payments Dt 70 Kt 50 (51)

According to the instructions of the Central Bank of the Russian Federation “On the procedure for conducting cash transactions...” dated March 11, 2014 No. 3210-U, the cashier must pay wages according to payrolls. In this case, an entry is made: Dt 70 Kt 50.

3 days are given for payment according to the statement. If for some reason the employee does not show up within the specified period, the cashier makes an entry in the “Signature” column indicating the following entry: Dt 70 Kt 76 . The employee can receive the deposited salary within 3 years.

Payments can also be made to employee salary cards. The wiring in this case will be as follows: Dt 70 Kt 51.

Labor compensation accrued: postings

Salaries must be paid at least every half month. For example, until the end of the current month for the first half and until the middle of the next month for the second half. Thus, the generally accepted approach is that the components of salary are:

- An advance paid before the end of the billing month.

Accounting records only reflect the fact of payment of the advance (later in the article we will look at the entries used for such purposes).

- The main part of the salary paid at the end of the payroll month.

If wages are accrued, the posting is as follows: Dt 20 Kt 70 - for the amount of wages for the entire month (regardless of the amount of the advance payment transferred).

In this case, the posting can also be generated by debit of accounts:

- 23 - if the salary is intended for employees of auxiliary production;

- 25 - if salaries are transferred to employees of industrial workshops;

- 26 - if the salary is accrued to management;

- 29 - when calculating wages to employees of service industries;

- 44 - if salaries are paid to employees of trade departments;

- 91 - if the employee is engaged in an activity that is not related to the main one;

- 96 - if the salary is calculated from reserves for future costs;

- 99 - if payments are calculated from net profit.

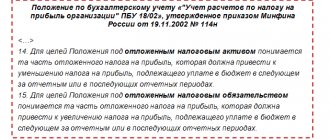

The salary accrual date is determined based on tax accounting standards, according to which salaries are recognized as income only at the end of the billing month (clause 2 of Article 223 of the Tax Code of the Russian Federation).