A bonus payment is an additional remuneration for achieved production or other indicators; in accounting, bonuses are included in wages.

The payment procedure is regulated by the regulations on remuneration, regulations on bonuses or other local regulations of the organization. The bonus accrual is:

- permanent (paid monthly) or one-time;

- established as a percentage of the salary or in a fixed amount;

- related to the employee’s performance or paid in connection with a holiday.

Employee bonuses are awarded as follows: types and sources

The reason for paying an employee an incentive such as a bonus may be:

- achievements of a labor nature, accomplished both by the work collective as a whole and by a specific employee personally;

- events that are not directly related to work activity, but caused by the intention to further reward the employee (for example, in connection with an anniversary or holiday).

For the reasons of the first group, the employer has the unconditional right to include bonuses in the salary structure (Article 129 of the Labor Code of the Russian Federation), and therefore take them into account as part of the payment for labor, i.e., attributing the accrued amounts of bonuses to the corresponding analytical expenses, which will reduce profit base.

It is quite difficult to include bonuses accrued on the grounds of the second group in your salary. The Ministry of Finance of Russia (letters dated 07/09/2014 No. 03-03-06/1/33167, dated 04/24/2013 No. 03-03-06/1/14283) insists on accounting for expenses on them at the expense of net profit.

Depending on the nature of the payments, bonuses can be:

- systematic (regular), the accrual and payment of which is carried out in compliance with the established frequency (once a month, quarter, year or other period of time);

- one-time (irregular), accrued and paid from time to time when an appropriate reason for payment arises.

Bonuses included in the salary structure may have both frequency patterns. But among them, as a rule, systematically paid incentives predominate. Bonuses not related to work achievements are usually one-time.

ConsultantPlus experts have prepared step-by-step instructions for assigning and processing bonuses to employees:

If you do not have access to the K+ system, get a trial online access for free.

Despite the presence of different sources for paying bonuses, bonuses will in any case constitute the employee’s income. And this income will need to be subject to personal income tax in the usual manner (clause 1 of article 210 of the Tax Code of the Russian Federation) and insurance contributions (clause 1 of article 420 of the Tax Code of the Russian Federation, clause 1 of article 20.1 of the law “On compulsory social insurance against accidents...” dated July 24, 1998 No. 125-FZ). Moreover, expenses for the purpose of calculating income tax can include not only those contributions that are accrued for bonuses included in the salary structure, but also those related to bonuses not related to work activities (subclause 49, clause 1, article 264 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated April 2, 2010 No. 03-03-06/1/220).

Read more about the taxation of bonuses in the material “What taxes and contributions are employee bonuses subject to?”

Definition

The procedure for financial incentives for employees at a company is determined by Article 129 of the Labor Code of Russia, which provides that the salary of a working person consists of an official salary, as well as mandatory allowances related to the performance of work activities. At the same time, as mentioned above, local legal acts may establish a fair and equal opportunity for employees to receive additional monetary remuneration.

In general, the law does not have a uniform definition of what a quarterly bonus is. Its action is not provided for by law, but is an incentive measure invented by employers to additionally stimulate employees at the enterprise.

A quarterly bonus can be called an additional money transfer in favor of employees that meets the following criteria:

- paid to all employees at once or only selectively;

- translated once every three months (once per quarter);

- Strict reasons for paying money have been established, which are related to encouraging and stimulating greater work efficiency.

There are no uniform requirements for the formula by which bonus remuneration will be calculated. But this formula should be the same for all employees, regardless of their position.

Reason for payment

Considering that the law does not establish a single definition of a quarterly bonus, it is unlikely to find a fixed list of grounds for its payment. Thus, bonuses are additional incentives that are provided to achieve the following goals:

- stimulating future performance;

- rewarding individuals who have shown good work performance in the past.

Cash support can only be paid at the end of the quarter, that is, every three months of work.

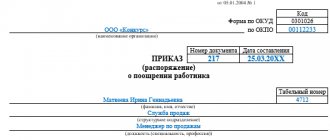

Order form for rewarding an employee

According to which document is the bonus procedure determined?

The employer must develop all aspects of the bonus system used by him himself, establishing them in an internal regulatory act (Article 135 of the Labor Code of the Russian Federation). This act can be created in the form of a separate document devoted only to bonus issues (provisions on bonuses, incentives, incentive payments). But it is also permissible to include the rules for calculating bonuses as an integral part in the texts of other internal documents devoted to issues of labor law:

- wage regulations;

- collective agreement;

- labor agreement.

A specially developed separate document (or part of a document devoted to issues of labor law) is convenient for reflecting the bonus payment procedure applied to the majority of members of the workforce. Its presence makes it possible not to specify in detail the rules for calculating bonuses in the employment agreement with each of the employees, but to provide in this agreement only a reference to the details of the corresponding document on the bonus procedure. Thus, the development of a normative act on bonuses makes it possible to include detailed rules for calculating this incentive in employment contracts only with those persons whose bonuses are paid on an individual basis.

The presence of an internal document on bonuses is mandatory:

- to include bonuses in the salary structure (Article 135 of the Labor Code of the Russian Federation);

- taking into account bonuses when calculating average earnings (Article 139 of the Labor Code of the Russian Federation).

The inclusion of bonuses in the salary structure makes them mandatory for payment when the conditions under which the remuneration should be accrued are met. At the same time, it is allowed to reflect in the bonus document the rules for paying bonuses that are not related to labor achievements.

The regulations on bonuses should cover issues related to:

- all types of remuneration applied by the employer;

- the conditions under which each type of bonus is accrued;

- frequency of accrual of incentive payments;

- the circle of persons entitled to each type of bonus;

- indicators by which the right of a particular employee to the corresponding type of remuneration is assessed;

- grounds that make it impossible to receive a bonus;

- systems for assessing indicators reflecting the right to receive an incentive payment, which makes it possible to convert the assessment of these indicators into ruble equivalent;

- the process of reviewing the results of assessing the labor contribution made by each employee;

- a procedure that allows you to challenge the results of the distribution of the bonus.

Starting from 2021, it is allowed not to develop internal acts devoted to issues of labor law and micro-enterprises (Article 309.2 of the Labor Code of the Russian Federation). However, in such a situation, the employer will have to spell out in detail all the bonus rules in each of the employment agreements, and the employment agreements themselves will have to be drawn up in a certain form. The form that must be used for these purposes is approved by Decree of the Government of the Russian Federation dated August 27, 2016 No. 858.

To learn how information about the accrued bonus can be included in an employment agreement, read the article “How to write a bonus in an employment contract - an example.”

Consequences of drafting the regulations

A one-time production bonus in 6-NDFL is reflected only when it is officially registered. Otherwise, the payment acts as a gift if its size does not exceed 4 thousand rubles.

If the manager draws up a bonus clause, then he has an obligation to pay these funds to the company’s employees. Employees, if necessary, can demand that the manager transfer this money. Therefore, information is usually included in the document that allows, if necessary, to deny funds to hired specialists.

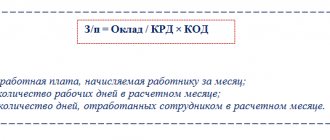

What can be used to calculate bonuses for employees when calculating salaries?

The process of calculating the bonus amount depends on:

- from the base taken as the basis of calculation;

- from the algorithm that determines the sequence of calculation of the base itself or its constituent parts;

- from the restrictions set for taking into account.

The calculation can be based on:

- fixed amount of remuneration;

- salary;

- actual accrued earnings;

- the sum of bonus indicators expressed in ruble equivalent, used to assess the employee’s contribution to the labor process.

All conditions affecting the calculation must be stipulated in the regulatory act on bonuses.

The accrual of a bonus in a fixed amount can occur in different ways depending on the conditions for recording the time of actual work in the bonus period, fixed in the procedure for calculating the bonus from the accrual base:

- The amount of bonuses does not depend in any way on the actual time worked, i.e., remuneration will always be accrued, even if the employee did not work at all in the period under review.

- When calculating the payment amount, the time of actual work in any of the ways established by the regulatory document is taken into account. For example, this amount is calculated:

- in proportion to the number of days (calendar or working) actually worked in the period;

- without accruing it for that month of the period that turned out to be not fully worked (for a quarterly bonus, for example, in such a situation you will need to apply one of the following coefficients: 1/3 or 2/3).

By setting salary or actual earnings as the calculation base, they immediately determine, expressed as a percentage, the amount of the share that will be the bonus accrued from the corresponding base.

A salary-based remuneration is essentially similar to a fixed-amount bonus and may or may not be dependent in the same way on the amount of time actually worked during the bonus period. It differs from a premium accrued in a fixed amount:

- mandatory application of the regional coefficient to the accrued amount if it occurs in the region of work;

- the need to choose a method for calculating bonuses for periods of salary changes, which could be, for example, establishing the obligation to take into account when calculating bonuses the updated salary amount: from the beginning of the period for which the calculation is made;

- from the period following the salary change;

- in the period of change, taking into account the proportion of the number of days (calendar or working) attributable to each salary.

For more information about the features of a bonus calculated from salary, read the material “How to calculate an employee’s bonus based on salary?”

For a bonus determined as a share of actual earnings, the issue of accounting or not accounting for time actually worked in the period is unimportant, since this time is already taken into account at the time of salary calculation. But the bonus rules will have to reflect the choice of the algorithm used for calculating actual earnings. You can calculate it, for example:

- summing up all actual wages accrued for the period, regardless of which component of the payment for labor it relates to;

- by determining (for a bonus period exceeding a month) the average monthly actual salary, including in its calculation all payments accrued for the period, regardless of their relationship to one or another component of payment for labor, and dividing the amount of these payments by the number of months in bonus period.

For the bonus base, established as the sum of bonus indicators expressed in ruble equivalent, which serve to assess the employee’s contribution to the labor process, the algorithm for calculating this base is itself simple and is determined as the sum of the ruble values of the corresponding indicators. But the calculation of the value corresponding to each of the indicators will depend on the evaluation system for this particular indicator and on the specific formula used to calculate its ruble value. Since both evaluation systems and formulas may turn out to be different, including those involving the use of a system of increasing (or decreasing) coefficients, the calculation of such a base will ultimately turn out to be difficult, although it will most realistically reflect the employee’s contribution to the results of the work of the entire team for the period.

How to write a memo?

The basis for the order may be an official (or memo) note. It should be written on behalf of a subordinate and addressed to a superior in position. The text of the note must contain an offer or request for monetary incentives for a distinguished specialist.

There are no strict requirements for the form of the document; it subsequently becomes the basis for an order to accrue money. The memorandum must begin with the information of the person to whom it is addressed and state the reasons that are the basis for the bonus.

The text should justify the need to reward the employee. In addition, it may reflect additional facts relevant to the issue:

- volumes of work performed;

- analysis of the work situation;

- indications of the employee’s special labor merits.

At the end of the memo, the position, full name and signature of the originator are required.

An example of a document is shown in the picture:

How to calculate bonuses for additional pay and overtime

Additional payments and overtime are payments designed to compensate for the employee’s performance of labor functions under special working conditions. Their payment in all aspects is regulated by the provisions of the Labor Code of the Russian Federation. They are included in full in the salary, forming its compensation part (Article 129 of the Labor Code of the Russian Federation).

The question of calculating bonuses for additional payments and overtime can only arise if the basis for calculating the amount of bonuses is the actual earnings accrued for the period. Despite the fact that this earnings can, as already indicated above, be determined in different ways, it is calculated by taking into account all amounts accrued during the bonus period that form the salary, including additional payments and overtime.

If the bonus is set to be calculated from the salary, then additional payments and overtime will not be taken into account when calculating bonuses, since the calculation base here, by definition, forms only part of the accrued salary. When a bonus is awarded in a fixed amount or based on the sum of bonus indicators estimated in ruble equivalent, then it is not tied to salary at all and, accordingly, does not depend on it in any way.

To find out whether there are any restrictions on the amount of bonus paid, read the article “What can be the size of an employee’s bonus?”

Rules for issuing an order

Accounting for one-time bonuses requires the need for their correct registration. If the employer decides to transfer these funds to one or more employees, then he must correctly formalize it by issuing an appropriate order. When preparing this document, the following points are taken into account:

- the order contains information about when and in what amount the bonus is transferred to a specific employee or several employees of the enterprise;

- if there are hired specialists of the company who are not entitled to payments, then they are simply not included in this order;

- if an employee who does not receive a bonus tries to challenge management’s decision by filing a complaint with the labor inspectorate, then the manager must refer to the content of the bonus regulations;

- the order is issued in Form No. T-11, if funds are paid to only one employee who has in any way distinguished himself before the company’s management;

- if payments are assigned to several employees of the enterprise, then form No. T-11a is selected.

Directly in the order, the head of the company indicates the reason for these one-time payments. The one-time bonus income code is given, and it is also indicated when exactly the funds will be paid to employees. The employer independently decides in what form the money will be allocated. They can be issued in cash through the company's cash desk. If a company's employees receive their salaries into a bank account, bonuses are usually transferred to this account.

How to calculate a bonus taking into account the regional coefficient and northern bonuses

The regional coefficient and the northern bonus are additional payments of a compensatory nature, taking into account the fact of working in special climatic conditions. They also represent part of the salary that must be paid. The difference between them is that the regional coefficient is paid from the first day of work, and the right to receive the northern bonus and its increase depends on the length of work experience in the relevant area. The size of the coefficient and premium for each region is established by the Government of the Russian Federation, but at the regional level it is possible to increase these values (Articles 316, 317 of the Labor Code of the Russian Federation, Articles 10, 11 of the Law of the Russian Federation “On State Guarantees and Compensations...” dated 02/19/1993 No. 4520- 1).

It is necessary to increase the amount of the accrued bonus at the expense of the regional coefficient when bonuses are calculated from the salary and the corresponding coefficient is in force in the region. In all other cases, the issue of applying the coefficient remains unregulated by law. On the one hand, there is no need to charge a premium taking it into account, because:

- it is already taken into account in the earnings actually accrued for the period;

- the accrual of a bonus in a fixed amount or from the sum of bonus indicators estimated in ruble equivalent is not tied to the salary, which requires an increase by the corresponding coefficient.

On the other hand, the current legislation does not establish the procedure for applying the regional coefficient to bonuses. Therefore, the rules for bonuses can provide for their accrual using this coefficient in all situations for calculating incentive payments included in wages. The justification here is that the bonus is included in the salary.

The procedure for calculating northern bonuses is regulated by an instruction approved by Order of the Ministry of Labor of the RSFSR dated November 22, 1990 No. 2. It contains a ban on calculating bonuses for the following bonus payments (clause 19 of the instructions):

- one-time remuneration for length of service;

- remuneration based on the results of work for the year;

- incentives of a one-time nature and not provided for by the remuneration system.

At the same time, the instructions imply the possibility of calculating bonuses based on the results of work for a quarter, season or year, but with the condition that in order to calculate the monthly amount of the bonus, bonuses will be distributed over the months of the corresponding period in proportion to the time worked.

By the decision of the Supreme Court of the Russian Federation dated December 1, 2015 No. AKPI15-1253, the provisions of clause 19 of the instructions prohibiting the accrual of bonuses on remunerations paid for length of service and based on the results of work for the year were declared invalid as contrary to the current Labor Code of the Russian Federation. Thus, the northern bonus should be calculated on all bonus payments provided for in the remuneration system.

The procedure for paying bonuses to employees according to current salary rules

After the changes made to the Labor Code of the Russian Federation, from October 3, 2016, the terms of payment of not only vacation pay (Article 136 of the Labor Code of the Russian Federation) and payment upon dismissal (Article 140 of the Labor Code of the Russian Federation), but also wages were legally limited.

The calculation of wages for the past month must now be carried out within 15 calendar days following this month (Article 136 of the Labor Code of the Russian Federation). Accordingly, taking into account the preservation of the wording in the Labor Code of the Russian Federation requiring payment of wages every half month, the timing of advance payments has also become more specific. Now it must be issued in the second half of the month for which it was accrued, maintaining a 2-week interval between the advance and salary.

However, questions remain regarding the payment of bonuses. Although the bonus provided by the wage system is a salary, it is not always calculated at the same frequency as wages. Therefore, the Ministry of Labor of Russia (information dated September 21, 2016, posted on the ministry’s website) recommended that the regulatory act on bonuses reflect an indication of both the month of bonus accrual and the month (or specific date) of bonus payment.

Specifying a payment month means that the premium must be paid no later than the 15th day of the corresponding month. If only the month of accrual is indicated, then the deadline for payment of bonuses will be the 15th day of the month following the month of their accrual (letter of the Ministry of Labor of Russia dated August 23, 2016 No. 14-1/B-800).

For more information about the procedure for paying bonuses under the Labor Code of the Russian Federation, read this article.

Are taxes collected on payments?

One-time bonus payments are regulated differently than regular incentive transfers. But personal income tax must be paid from them if they are properly prepared. Additionally, insurance premiums are transferred from them.

To correctly calculate and pay personal income tax, the following requirements are taken into account:

- the possibility of transferring one-time payments is provided for by the content of the company’s internal regulations;

- only payments that are assigned for any services to the company, and are not tied to weekends or other events, are applied to accounting;

- all costs associated with paying taxes are certainly recorded in the company’s accounting records.

Personal income tax on a one-time bonus is paid by the direct employer, acting as a tax agent for its employees.

Results

The bonus calculation procedure is determined by many factors. First of all, these are bonus rules developed by the employer independently. Among these rules, the description of the features of the applied remuneration and the establishment of algorithms for calculating the base for calculating the amount of bonuses of each type are of primary importance. When calculating bonuses, regional coefficients established in the region and northern bonuses, if the employee is entitled to them, must be taken into account.

Sources: Labor Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.