First, add to the Counterparties directory the bank with which the agreement for the purchase of currency was concluded. If you already have this bank in the directory of Counterparties, then you do not need to add it again.

In the Full interface menu Directories - Counterparties

Create a new counterparty:

Purchasing currency - creating a counterparty - a bank

To complete currency purchase transactions, it is important to fill out the fields highlighted below:

1C counterparty card - correct filling of the bank card

Please note that you do not need to check the Buyer or Supplier flags, since we only need an agreement with the Other type. If you are using an existing counterparty and it has any of these flags, then it’s okay.

We save the counterparty using the Write button and go to the Accounts and agreements tab:

1C counterparty card - account bookmark and agreements

For currency purchase transactions, you must immediately indicate the bank account of the authorized bank to which we will transfer funds for the purchase. If this is the only bank account in the bank card, then it will be inserted into payment documents automatically.

But, most likely, you will have other accounts in your bank card. Then you will need to indicate the name of the account in such a way that it is convenient to find it in the list. Fill out the account card:

Buying currency - bank account card

The View field at the bottom is editable. I indicated (currency purchase) in this field. When you select an account for a payment document, these words will be visible in the account name.

Let's move on to the contract. If you created a new counterparty, then the 1C program created an agreement with the type Other automatically. An agreement needs to be created for an existing counterparty.

It is important to fill out the contract correctly:

- Fill in the name,

- Type of agreement - Other,

- The contract currency is rubles, since we will buy currency for rubles.

Purchasing currency - Filling out an agreement with a bank in 1C

When can you use currency?

Transactions in foreign currency between Russian organizations are prohibited and are carried out only in Russian rubles (Article 9 of the Federal Law of December 10, 2003 No. 173-FZ).

But there are special cases when payments in foreign currency between residents are allowed. And there are quite a lot of such situations:

- When transferring funds in rubles from an account opened by one resident outside Russia to the account of another resident in one of the domestic banks.

- When resident legal entities carry out a number of transactions in currency credited to their foreign accounts. This includes wages to employees of representative offices located abroad, payment and reimbursement of travel expenses to employees of such branches.

- When paying various budget fees and taxes in foreign currency to the federal or municipal budget of the relevant state.

- When transferring foreign currency from foreign accounts of an individual resident of the Russian Federation to Russia to the accounts of other individual residents opened in Russian banks.

- If a currency transfer is made from Russian accounts to foreign ones between resident individuals who have close family ties, for example, they are spouses.

- For settlements related to obtaining bank/commercial loans from an authorized bank.

- When transferring foreign currency wages to diplomatic missions to the accounts of resident individuals who work there.

We will consider another situation when in contracts with the organization’s counterparties it can be stated that payment is made in ruble amounts, and prices are determined in foreign currency (ye) (clause 2 of Article 317 of the Civil Code of the Russian Federation).

Usually, payment under contracts is carried out at the agreed rate, most often it is equal to the rate of the Central Bank of the Russian Federation, but there are situations when deviations are specified in contracts and a different rate is established. This deviation can be by any percentage from the rate of the Central Bank of the Russian Federation or by an arbitrarily specified part.

But it is worth remembering that all assets expressed in conventional units are in this case subject to mandatory conversion into rubles.

The use of conventional units when making transactions is a way of setting a price that is determined at the time of payment.

Stage three of purchasing currency in 1C

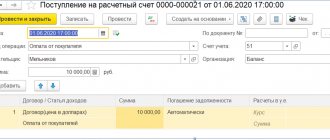

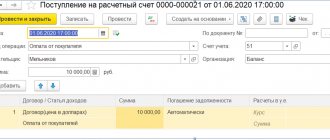

The bank purchases foreign currency. Here the amount is converted into ruble equivalent, and for correct calculation it is necessary to maintain up-to-date exchange rate data in the database. The purchase of currency in 1C Accounting is registered with the document Receipt to the current account (the same list of bank statements, but the button in this case is Receipt, not Write-off).

Filling features:

Type of transaction – Purchase of foreign currency;

The organization, counterparty, agreement are the same as those indicated when performing the write-off, but the bank account is no longer in rubles, but in foreign currency.

Settlement account 57.02

Watch video instructions on channel 1C PROGRAMMER EXPERT

EVERYONE MUST DO THEIR JOB! TRUST THE 1C SETUP TO A PROFESSIONAL. MORE →

Discuss the article on the 1C forum?

How to set up currency accounting in 1C: Accounting 8

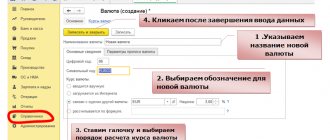

Initially, you should fill out the list of currencies. To do this, you should go to the “Directories” - “Currencies” section, where you can create an arbitrary currency or select from the classifier.

The currency rate is determined in several ways: it is entered manually, downloaded from the Internet, calculated using a formula, or depends on the rate of another currency, i.e. it decreases or increases by some percentage of the reference currency (Fig. 1).

Fig.1

In order for settlements to be made in conventional units for a specific transaction with a counterparty, you should create an agreement in which you must indicate that: “Price” is set in the currency we need, which can be selected from a previously downloaded directory, and “Payment” is made in rubles (Fig. .2).

Rice. 2

After this, the program is ready for foreign exchange transactions.

When choosing a contract for settlements in cu. Accounting accounts will be automatically added to all documents:

- 60.31 “Settlements with suppliers and contractors (in monetary units)”;

- 60.32 “Settlements for advances issued (in cu).”

- 62.31 “Settlements with buyers and customers (in monetary units).”

- 62.32 “Calculations for advances received (in cu).”

It should be noted that when accepting goods for accounting in the document “Receipts (acts, invoices)” in the tabular part, the cost of goods is indicated in monetary units, the same applies to the “Sales” documents.