Concept of payment order

A payment order is a document that has a prescribed form, with the help of which the owner of a bank account authorizes the bank to carry out a debit transaction from his current account using the specified details. The payment order is drawn up by the sender himself or asked to be drawn up by an employee of the bank where the client is served. It can be compiled in two forms:

- On paper in A4 format – filled out on a computer in a special program, in a Word document or pdf format;

- In electronic form (only in a special program, not printed on paper).

Tax reporting period in line 107 of the payment document

The tax period is recorded in payment slips in 3 cases:

- if payments are made in the current reporting period;

- if the reporting person independently discovers erroneously indicated data on the tax return;

- upon voluntary payment of additional tax amounts for the past reporting period, if a requirement has not yet been received from the tax authority regarding the need to pay fees;

The value of the tax period for which additional funds are deposited or paid is recorded.

If any type of debt that has arisen is being repaid, be it an installment debt, deferred or restructured, and a bankruptcy case is being considered for an enterprise with debts or an outstanding loan, it is necessary to record a specific number indicating the day on which the amount of money was deposited. The payment deadline is indicated as follows:

- TR – fixes the payment period, which is determined in the notification received from the tax authority to pay the required amount;

- RS – the number when part of the installment debt in relation to tax contributions is paid, taking into account the installment schedule;

- OT – focuses on the end date of the deferment period.

- RT is the number when a certain share of the restructured debt is paid, which corresponds to the schedule.

- PB is the number when the procedure comes to an end, which occurs when the organization goes bankrupt.

- PR – the number when the suspension of debt collection ends.

- In – fixes the date of payment of the share of the investment loan for taxes.

If the payment intends to repay the debt and is carried out in accordance with the audit report or according to the writ of execution, “0” is recorded in the value of the tax reporting period. If the tax amount is transferred before the due date, then the head of the enterprise fixes the future tax period in which the payment of fees and tax deductions is planned.

Procedure for filling out a payment order

The payment order is filled out by the sender independently. The payment order has a form approved by law that must be observed and the form is considered a strict reporting form. Adding or removing any lines is strictly prohibited.

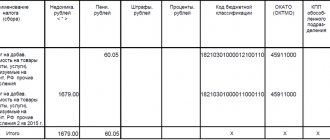

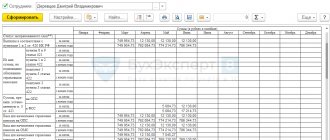

Consider each field of the payment order in detail in the form of a table:

| Field name | What information is reflected in the field |

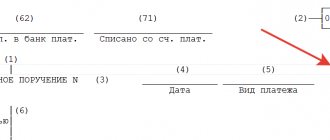

| Field 62 and 71 | The originator of the payment order does not enter anything in these fields, since they are filled in by the bank independently |

| Field 1 | The name of the document, namely “Payment order” |

| Field 2 | The code 0401060 is always entered - this code is unchanged. It means the number of the unified form of payment order, which is established by the Central Bank of Russia. |

| Field 3 | Number of the document compiled |

| Field 4 | Date of document preparation in format dd.mm.yyyy |

| Field 5 | Type of payment, if the client sends a payment through the “Client-Bank” system, then the type of payment is entered electronically, if the document is sent to the bank for execution, then this field remains empty |

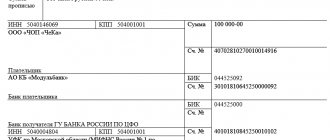

| Field 6 | The amount is indicated in words, and the words ruble and kopecks are not abbreviated |

| Field 7 | The amount is indicated in numbers. Rubles are separated from kopecks by a dash sign |

| Field 60 | the taxpayer's TIN is indicated (For an LLC this is 10 digits, for an individual entrepreneur this is 12 digits) |

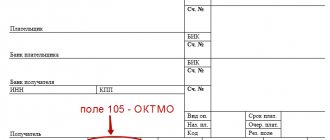

| Field 102 | The checkpoint is indicated - this item can only be filled out by legal entities |

| Field 8 | Taxpayer's name; Legal entity – full name; Individual entrepreneur - full last name, first name and patronymic must be indicated in brackets (individual entrepreneur or notary, or lawyer, or peasant farm) |

| Field 9 | Taxpayer bank account number from which payment will be made |

| Field 10 | Full name of the bank indicating the city from which the payment will be made |

| Field 11 | BIC of the bank from which the transfer is sent |

| Field 12 | correspondent account number of the payer's bank |

| Field 13 | Full name of the recipient's bank |

| Field 14 | BIC of the recipient's bank |

| Field 15 | correspondent account number of the recipient's bank |

| Field 61 and 103 | The TIN and KPP of the recipient of the funds are indicated |

| Field 16 | Full name of the transfer recipient |

| Field 17 | Recipient's current account number |

| Field 18 | The type of operation is indicated, it is always 01 - this is the bank code for payment of the payment order |

| Field 19 | Payment due date - not filled in |

| Field 20 | The name of the payment is not filled in until the Bank of Russia is indicated |

| Field 21 | Payment order - fill in the order in which the payment must be sent |

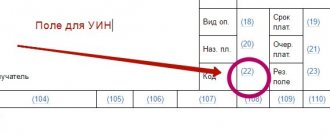

| Field 22 | UIN code is a unique accrual identifier. This field is filled in only when paying fines or other violations |

| Field 23 | This is a reserve field |

| Field 24 | Purpose of payment - all additional information on the payment being made is indicated |

| Field 43 | Place for stamping. The stamp must be placed strictly in the designated place |

| Field 44 | Signatures. In this place, only the person who has the right to dispose of the account has the right to sign and it is indicated on the signature sample card. |

conclusions

Filling out field 109 directly depends on the value of field 106 and helps tax authorities determine on what basis the tax transfer to the budget was made, and also facilitates the task of distributing taxes. Failure to fill in the field is not critical; the obligation will be considered extinguished in any case. This error is classified as safe and will not lead to underpayment. Be that as it may, in order to fully correctly process payment orders, an accounting employee needs to know the filling rules provided for by law.

Similar articles

- Basis of payment

- Field 107 in the payment order

- How to fill out a payment order to pay a fine?

- Filling out a payment order in 2021ː sample

- Reason for payment 106 explanation

How to correctly fill out field 109 of a payment order

Field 109 consists of 10 characters, where 8 characters are numbers and 2 punctuation marks. The first two digits are the calendar date, the second two digits are the calendar month, and the third two are the calendar year.

Which date must be entered in field 109 depends on the type of budget payment, and for what period the funds are transferred, and this field is directly related to field 106.

Filling in the date in field 109 is carried out according to the following rules:

- If there is “TP” in field 106, then “0” is entered in field 109;

- If “ZD” is indicated in field 106, then “0” is entered in field 109;

- If “TR” is indicated in field 106, then the date of the request issued by the tax authorities is entered in field 109;

- If “RS” is indicated in field 106, then field 109 contains the date when the tax authorities made a decision on the installment plan to be provided;

- If “PB” is indicated in field 106, then the date of the arbitration decision to begin the bankruptcy process is entered in field 109;

- Etc.

Results

Field 109 “Document date” does not contain key information about the payment being made and does not lead to non-transfer of tax to the budget, as well as the accrual of penalties. However, the rules for filling out this field are enshrined in law, so every accountant needs to familiarize themselves with them before starting to generate payment orders.

Sources: Order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How to pay insurance premiums in 2021

Who pays the fees

Starting from 2021, the procedure for calculating and paying insurance premiums for compulsory pension, medical and social insurance is regulated by the new Chapter 34 of Part II of the Tax Code of the Russian Federation “Insurance Contributions”. Starting this year, Federal Law No. 212-FZ dated July 24, 2009 (hereinafter referred to as Law No. 212-FZ) has lost its force. The main part of its provisions “migrated” to Chapter 34 of the Tax Code of the Russian Federation. The composition of insurance premium payers also remained unchanged. They continue to be all those who (clause 1 of Article 419 of the Tax Code of the Russian Federation):

1) makes payments and other remuneration to individuals, and this is:

- organizations;

- IP;

- an individual without individual entrepreneur status;

2) does not make payments and other remuneration to individuals, and this is:

- IP;

- lawyers;

- notaries;

- arbitration managers;

- appraisers;

- other private practitioners.

Note! Payers belonging to the 2nd category (individual entrepreneurs, lawyers, notaries, etc.) transfer insurance premiums in case of illness or maternity for themselves on a voluntary basis (Part 3, Article 2, Article 4.5 of the Federal Law of December 29. 2006 No. 255-FZ (hereinafter referred to as Law No. 255-FZ)).

As for separate divisions (SU), in 2021 they themselves pay insurance premiums and report on them if they make accruals in favor of individuals (clause 7 and clause 11 of Article 431 of the Tax Code of the Russian Federation). Let us recall that the previously in force Law No. 212-FZ (Part 11, Article 15) provided for compliance with three conditions for the independent payment of contributions by “separate individuals”, namely:

- OP is allocated to a separate balance sheet;

- OP has its own current account;

- The OP himself calculates payments in favor of employees.

Although the Ministry of Labor believes that for companies with separate divisions, nothing has changed in 2021. The first two conditions were not included in the Tax Code as they were unnecessary. After all, if the “isolation” pays salaries to employees, then it must have a separate balance sheet. And in any case, a bank account is opened for the organization, and not for the division.

The organization must report to the inspectorate about all OPs that will independently accrue payments and remunerations in favor of individuals in 2021 within a month from the moment the department is vested with the appropriate powers. And for “isolations” that are already paying insurance premiums, there is no need to transmit any information to the tax authorities (letter of the Federal Tax Service of Russia dated September 14, 2016 No. BS-4-11/17201).

Payers of contributions “for injuries” are all employers, as well as customers under GPC agreements for the performance of work (provision of services) and author’s order agreements with individuals, but only if these agreements provide for the obligation to pay contributions to the insurer (clause 1, article 5, clause 1 Article 20.1 of the Federal Law of July 24, 1998 No. 125-FZ (hereinafter referred to as Law No. 125-FZ)). But entrepreneurs do not pay these contributions for themselves, either compulsorily or voluntarily.

Where are contributions paid?

Organizations and individual entrepreneurs for employees:

To the Federal Tax Service at the place of registration (from 01/01/2017):

- contributions to compulsory pension insurance;

- contributions for compulsory health insurance;

- contributions to compulsory social insurance in case of illness and maternity;

to FSS:

- contributions “for injuries”.

Individual entrepreneurs (lawyers, notaries, etc.) for “themselves”:

To the Federal Tax Service at the place of registration (from 01/01/2017):

- contributions to compulsory pension insurance;

- contributions for compulsory health insurance;

to FSS:

- (voluntary!) contributions for compulsory social insurance in case of illness and maternity (clause 5, article 4.5 of Law No. 255-FZ).

Let us remind you again! Entrepreneurs (lawyers, notaries, etc.) do not make contributions for personal injury, even voluntarily.

When are dues paid?

Organizations and individual entrepreneurs for employees

In accordance with clause 3 of Article 431 of the Tax Code of the Russian Federation, insurance premiums for compulsory pension, medical and social insurance for the current month are paid until the 15th day of the next month . Moreover, if the 15th falls on a weekend or holiday, then the deadline for payment of contributions is postponed to the next working day (Clause 7, Article 6.1 of the Tax Code of the Russian Federation).

In 2021 there will be only 4 such transfers:

- when paying contributions for December 2021 – as of 01/16/2017;

- when paying contributions for March 2021 – as of 04/17/2017;

- when paying contributions for June 2021 – as of July 17, 2017;

- when paying contributions for September 2021 – as of 10/16/2017.

The procedure for paying contributions “for injuries” to the Social Insurance Fund is exactly the same as described above, although it is regulated by a different law (Clause 4, Article 22 of Law No. 125-FZ)).

Individual entrepreneurs (lawyers, notaries, etc.) “for themselves”

Insurance premiums in a fixed amount (based on the minimum wage) for compulsory pension and health insurance are paid for the billing period, which, in accordance with clause 1 of Article 423 of the Tax Code of the Russian Federation, is recognized as a calendar year.

The deadline for payment is set by clause 2 of Article 432 of the Tax Code of the Russian Federation at the end of the year - December 31 . Moreover, if this date falls on a weekend or non-working holiday, then contributions must be transferred on the next working day following the weekend or holiday (Clause 7, Article 6.1 of the Tax Code of the Russian Federation).

For example, contributions for 2021 must be paid by December 31, 2017. But since the deadline for payment in 2021 falls on a day off - Sunday, it means that contributions must be transferred on the first working day of 2021.

By the way, tax legislation does not specify whether the annual contribution amount can be paid in installments throughout the year, or whether it must be sent at a time.

Pension contributions for income exceeding 300,000 rubles are paid until April 1 of the year following the expired billing period (clause 2 of Article 432 of the Tax Code of the Russian Federation).

Payment of voluntary contributions in case of temporary disability and in connection with maternity is made annually until December 31 (Part 4, Article 4.5 of Law No. 255-FZ).

Late payment of fees

Starting from 2021, payments for insurance premiums for compulsory pension, medical and social insurance are recognized as tax payments, therefore they are subject to legislation on taxes and fees (Clause 1 of Article 2 of the Tax Code of the Russian Federation as amended by Federal Law dated 07/03/2016 No. 243-FZ).

For late payment of insurance premiums, tax authorities can block the accounts of payers, which funds could not do (Article 76 of the Tax Code of the Russian Federation). In addition, for late payment, penalties will be charged based on 1/300 of the refinancing rate of the Central Bank of the Russian Federation for each calendar day of delay (clause 4 of Article 75 of the Tax Code of the Russian Federation). And from October 1, 2017, new rules for calculating penalties will come into effect (Federal Law No. 401-FZ dated November 30, 2016):

1) for legal entities:

- based on 1/300 of the refinancing rate of the Central Bank of the Russian Federation - for a period of delay of up to 30 calendar days (inclusive);

- based on 1/150 of the refinancing rate of the Central Bank of the Russian Federation - starting from the 31st calendar day of the period of delay;

2) for individuals, including individual entrepreneurs:

- based on 1/300 of the refinancing rate of the Central Bank of the Russian Federation - for the entire period of delay.

Responsibility for non-payment of voluntary contributions by individual entrepreneurs in case of illness and in connection with maternity “for oneself” is not provided for by Law No. 255-FZ. If the entrepreneur does not transfer the funds by December 31 of the current year, then the legal relationship for compulsory social insurance between him and the Social Insurance Fund is terminated from the beginning of the next year (Clause 7, Article 4.5 of Law No. 255-FZ).

For late payments of “injury” premiums, the policyholder pays penalties. In accordance with clause 6 of Article 26.11 of Law No. 125-FZ, they are calculated based on 1/300 of the refinancing rate of the Central Bank of the Russian Federation in effect during the period of delay.