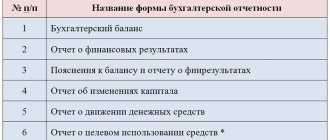

Form KND 0710096 is a simplified accounting statement that certain categories of legal entities have the right to prepare. The form is recommended; the company can develop its own. The article describes who has the right to use simplified reporting, what it consists of and how it is applied. Form KND 0710096 is one of the simplified accounting reporting forms recommended by the Federal Tax Service of the Russian Federation. This type of reporting includes forms of a balance sheet, a statement of financial results and the intended use of funds.

Legal requirements

The main legislative basis for recording all information about the economic sphere of an enterprise is the Law “On Accounting” dated December 65, 2011 No. 402-FZ. It assumes that an entrepreneur is obliged to resort to accounting and draw up appropriate papers for verification by the tax office. The second article also specifies the subjects of this law - individual entrepreneurs, commercial and non-profit organizations, and government bodies.

According to paragraph 8 of Article 13 of Law No. 402-FZ, financial statements can be considered ready only after a paper copy is signed by the manager.

Federal Law No. 402-FZ

Article 18 of the same law states that different organizations can require such documents. As an example, it is mandatory to transfer a copy to the state statistics body. The Tax Inspectorate is the main body for which this reporting is created. Since subclause 5 of clause 1 of Article 23 of the Tax Code of the Russian Federation states only the need to submit documents, the format option can be either paper or electronic.

Article 23. Responsibilities of taxpayers (payers of fees, payers of insurance premiums)

Order of the Federal Tax Service of the Russian Federation “On approval of the format for presenting simplified accounting (financial) statements in electronic form” dated December 31, 2021 No. AS-7-6/710 allowed the submission of financial statements in electronic form. However, this same order does not oblige all entrepreneurs to submit reports in this format. Everyone can choose the one that suits them best.

For those who chose the electronic version, a special format was created - KND 0710096. It is approved at the legislative level and helps to quickly read the necessary information.

Accounting reporting form KND 0710096:

What are the consequences for an organization if it fails to provide zero reporting?

Lack of transactions is not a reason not to submit reports to the Federal Tax Service. For forgetfulness, taxpayers are subject to penalties:

- for organization - 200 rubles. for each form submitted late (Clause 1.Article 126 of the Tax Code of the Russian Federation);

- per manager - 300-500 rubles. (Clause 1, Article 15.6 of the Code of Administrative Offenses of the Russian Federation).

To avoid problems with the tax authorities, it is necessary to report on the results of each reporting period as long as the organization formally exists, regardless of its actual activities. If, due to the absence of responsible employees, there is no one to do this, this function should be taken over by the founders of the organization.

The deadlines for submitting zero reporting are similar to the deadlines for submitting regular reports. You must report for 2021 no later than March 31, 2021. In 2020, accounting reports are submitted only to the Federal Tax Service; you no longer need to submit a copy to Rosstat.

Thus, if for some reason the organization formally exists but does not operate, the founders should ensure that reporting continues to be regularly submitted to the Federal Tax Service. Zero reporting provides for the reflection in it of at least the authorized capital and its placement (in the form of money, fixed assets, etc.). The remaining lines of the balance sheet and income statement are filled with zero indicators.

Simplified balance sheet zero report (filling example for a company that has not operated in the last 3 years):

Who is required to keep financial records?

According to the Federal Law “On Accounting”, starting from January 1, 2013, any organization must maintain financial statements. In this case, neither the taxation system nor the form of ownership matters.

Institutions operating under the simplified tax system, UTII or a combined regime must also keep records and submit the relevant documents to the tax office. A report is produced every year.

Federal law assumes that individual entrepreneurs with a general or simplified system or with imputed tax are exempt from accounting reporting. But at the same time, income must be reflected in accordance with tax legislation.

For those who work under the general tax regime, it is necessary to enter all their income and expenses in a specially designated book for transactions of individual entrepreneurs.

The letter of the Ministry of Finance of the Russian Federation dated July 17, 2012 states that individual entrepreneurs must keep records of how their physical indicators change.

Exceptions to the rules

The procedure for whom simplified accounting is possible is regulated by the Federal Law on Accounting. Its article 20 states that such a right is one of the principles of accounting regulation in Russia. But not all MPs have this right. Thus, paragraph 4 of Article 6 of Law No. 402-FZ contains a closed list of legal entities that are required to keep full records, which means submitting an annual report in full. These include:

- housing and housing construction cooperatives;

- microfinance organizations;

- credit consumer cooperatives;

- notary chambers;

- lawyer consulting;

- bar associations;

- law offices;

- public sector organizations;

- political parties;

- non-profit organizations that are included in the register provided for in paragraph 10 of Article 13.1 of Federal Law No. 7 of January 12, 1996 “On Non-Profit Organizations”, as foreign agents.

If an organization is a small enterprise by all criteria, but at the same time a microfinance organization, a consumer cooperative or a law office, a simplified balance sheet is not for it; all reports will have to be submitted in full.

Who has the right to simplification

The Ministry of Finance of the Russian Federation, in its resolution “On the simplified system of accounting and financial reporting” and the Federal Law “On Accounting”, has provided information on which organizations have access to the simplified system of accounting.

According to the law, these include:

- enterprises related to small business;

- institutions that are related to research activities in the commercial field; for example, the Skolkovo project; Federal Law of September 28, 2010 No. 244-FZ speaks in more detail about this;

- non-profit organizations. However, they should not be included in the list of Part 5 of Article 6 of Federal Law No. 402 of December 6, 2011.

The legislation allows all companies on this list to maintain reporting in any of the convenient forms - simplified or on a general basis. This choice falls on the management of the enterprise. In addition, it is necessary to indicate the type of financial statements in terms of accounting policies.

A new form for the corporate income tax declaration, the procedure for filling it out and the format for submitting it in electronic form have been approved. Statistical form P-4 can be downloaded here.

Who has the right to draw up

Let's present the data in a pivot table.

| Subject | The law that defines this right |

| Small businesses | Federal Law 209 |

| Non-profit organizations | Federal Law 7 |

| Companies participating in the Skolkovo project | Federal Law 244 |

At the same time, in order to obtain the right to simplified accounting, a business entity must meet a number of conditions listed in Federal Law No. 402-FZ. For example, it should not be subject to mandatory audit, not be a political party, etc.

Rules for filling out the KND reporting form 0710096

In order for the Federal Tax Service to be able to read encrypted information, it is necessary to prepare reporting KND 0710096 and take into account the rules for filling it out. They are compiled on the basis of standard plans and recommendations of the Ministry of Finance.

In addition to indicating data for the reporting period, you should provide indicators for the previous year in the report on financial success and for two years in the balance sheet. If this is a zero digit, then dashes must be placed in the lines corresponding to the indicators. This possibility is stated in the accounting regulations 4/99 in paragraph 11.

The title section is filled in first.

It contains the following information:

- INN and KPP of the enterprise;

- correction number (if the documentation is submitted for the first time, indicate the number zero, but if the reporting was subject to clarification, then it is necessary to enter the return number - one, two or three times);

- reporting code - code 34 is assigned for annual financial data;

- the name of the company - in this case, you should also add the form from the point of view of organization and law;

- the date when the documentation was signed by management - this will be considered the time of approval;

- OKVED is an indication of the type of activity of the company in economic terms;

- code, according to OKPO;

- what is the type of ownership of the company in accordance with the OKFS classification;

- organizational and legal scope of activities for OKOPF;

- units of measurement of data that are placed in the balance sheet;

- enterprise registration address.

It is worth noting that all codes can be found in the “Notice on assignment of statistics codes”.

Next, five reports are filled out. In connection with the emergence of a new form, two new lines were added to the company’s liabilities. These are trust funds and funds that include real estate and valuable movable property.

Sample of filling out reporting KND 0710096:

Tax return form according to the simplified tax system for 2021, form according to KND 1152017

KND form 0710099 free download 2021 with barcode in Excel (xls) format or in Word online. It is available on our resource (can be found at the end of the article) or in the same versions on the official legal portal.

You should know:

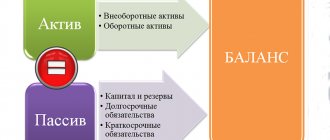

- this type includes all the main components of accounting: balance sheet (accounting); appendices to the balance sheet (accounting) - on the movement and distribution of target resources/monies/capitals, etc.;

- Individual entrepreneurs are exempt from maintaining consolidated reporting and accounting, but they are required to maintain tax records;

- Small businesses are required to fill out only the main forms of the accounting financial report without attachments.

Single simplified form free download

The simplified tax system (simplified taxation system) is convenient in many respects, for example, thanks to it, data can be adjusted (writing off part of the taxes) for VAT, personal income tax, transport tax, property tax, etc.

Land tax reporting

In this option (authority to own/use), enterprises are required to submit annual reports to the Federal Tax Service, however, individual entrepreneurs are exempt from this form until 2015. The new legislative act has been amended (order of the Ministry of Finance), according to which already for 216 years they are required to submit a report as an individual. persons

Download the electronic form

The main advantage of this form of reporting is the ability to download the correct form. In total, the list of required papers includes a title page and five reporting documents. Three of them have a lightweight form and are indicated in order No. 66n. The usual form remains for documents that reflect changes in the company’s capital and movements of financial assets in the company’s accounts.

The main place where you can find a complete package of documents necessary for reporting is the website of JSC “GNIVC”. There is a sample for all types of reports in a unified format.

It is worth understanding that all documents are filled out in accordance with the KND form 0710096. Old samples of KND 0710098 and 0710097 are considered invalid and reports cannot be submitted to the Federal Tax Service using them.

Reporting for small businesses for 2021: are there any changes?

Who has the opportunity to simplify accounting and, accordingly, reporting? The answer to this is given by clause 4 of Art. 6 of Law No. 402-FZ. The list of such entities is given in the table:

| Who can keep simplified records | Law regulating the activities of the subject |

| Small businesses | Law “On the development of small and medium-sized businesses in the Russian Federation” dated July 24, 2007 No. 209-FZ |

| NPO | Law “On Non-Profit Organizations” dated January 12, 1996 No. 7-FZ |

| Companies operating within the Skolkovo project | Law “On the Skolkovo Innovation Center” dated September 28, 2010 No. 244-FZ |

At the same time, the listed entities must meet the conditions specified in paragraph 5 of Art. 6 of Law No. 402-FZ, for example, not be subject to mandatory audit, not be a government organization, political party, not engage in microfinance, etc.

The forms of simplified reports are given in the current version of the order of the Ministry of Finance of the Russian Federation dated July 2, 2010 No. 66n. The table below reveals which reports are required for bookkeepers, as well as the features of special forms:

| Is the report required for bookkeepers? | Is there a special simplified template? (order No. 66n, appendix 5) | Features of the simplified report | |

| Financial statements | |||

| Balance | Yes | Yes | It has enlarged articles that group several elements. If any indicator is significant, it must be highlighted separately |

| Income statement | Yes | Yes | There is no division by type of expenses for core activities, there is no current income tax and other indicators that are most likely to be insignificant for bookkeepers |

| Applications | |||

| Statement of changes in equity | No for insignificant indicators | No, the general one is used, taking into account the materiality of the indicators | |

| Cash flow statement | No for insignificant indicators | No, the general one is used, taking into account the materiality of the indicators | |

| Report on the intended use of funds | Yes - for non-profit organizations and legal entities with targeted revenues; no - for others with insignificant indicators | Yes | There is no breakdown by type of contribution, no detailed breakdown of expenses |

| Explanations for reporting | No for insignificant indicators | No, the general one is used, taking into account the materiality of the indicators | |

The templates from Order No. 66n are advisory; an organization can develop its own form that corresponds to its activities, leaving and grouping the necessary articles of the general reporting forms. There are no templates for applications, since their preparation is mandatory only if the data specified there can have a significant impact on the opinion of users (subparagraph “b”, paragraph 6 of Order No. 66n).

In June 2021, adjustments were made to the full and simplified report forms. Now instead of:

- million rubles use thousand rubles. The unit of measurement in millions has been abolished.

- OKVED use OKVED2.

Read more about the changes here.

Amendments were made to the KND form 0710096 in a machine-readable form (letter of the Federal Tax Service dated November 25, 2019 No. VD-4-1 / [email protected] ).

For a sample of filling out a simplified balance sheet, see ConsultantPlus, using the link below to receive a trial demo access to the K+ system for free:

Read about the nuances of filling out simplified reporting here.

We fill out reports in Form No. 1 “Balance Sheet”

However, in 2021, March 31st falls on a weekend, therefore, the transfer rule applies.

This means that the deadline for submitting the balance sheet for 2021 is

— 04/01/2021. For public sector organizations, other reporting deadlines may be set earlier. This information is communicated to institutions in the prescribed manner. Reporting submitted to the Ministry of Finance, the Ministry of Justice or the founder does not cancel the obligation to report to the Federal Tax Service and Territorial Statistics Bodies within the specified time frame.

Please note that for newly formed, liquidated and reorganized enterprises the deadlines are somewhat different. Let's consider the reporting deadlines for the following companies: Creation. An organization that was formed before 09/30/2018 is required to report according to generally accepted rules, that is, before 04/01/2021.

But those companies that were formed after September 30, 2018 must report in 2021, not 2021.

Download simplified accounting reporting forms for small businesses - forms and samples for filling out balance sheets and financial statements for 2021

The money that is in the bank/cash is taken into account.

Cash equivalents are considered highly liquid financial investments that can be immediately converted into cash without a significant risk of possible loss (for example, demand deposits of a business entity). 1230 Current assets of a financial and other nature This item of the balance sheet takes into account current financial investments, advances issued to someone, receivables of a legal entity, and other current assets that are not significant.

Liabilities 1300 Capital and reserves The capital and reserves line in the balance sheet takes into account the organization's own funds - its retained earnings (optionally, uncovered losses), as well as all formed capital (reserve, additional, authorized).

Non-profit structures reflect here the available target funds, funds of movable and immovable assets, and other target funds.

Sample zero balance sheet

Don't know your rights? Subscribe to the People's Adviser newsletter. Free, minute to read, once a week.

Subscribe If after this a balance sheet is drawn up, then the following lines are filled in:

- 1250 (the debit balance of account 51 is reflected here, that is, an asset in the form of funds that are formed from the authorized capital);

- 1310 (no changes here).

The remaining balance lines will be zero. Let's consider what the balance sheet might look like, taking into account the minimum indicators for assets and liabilities due to the reflection of the amount of the authorized capital in the document.

In a zero balance sheet, first of all, it is necessary to reflect general information - those that are filled in when drawing up a regular balance sheet. Namely:

- Document details:

- reporting period;

- Date of preparation.

- Information about the business entity:

Balance sheet for 2021: sample filling

The auditor's report will need to be submitted along with the financial statements or within 10 business days from the day following the date of the auditor's report, but no later than December 31 of the year following the reporting year.

The latest changes, which came into force on June 1, 2019, were made to the balance sheet and other accounting records by order of the Ministry of Finance dated April 19, 2021 No. 61n. The key changes are:

- The balance sheet must contain information about the audit organization (auditor).

- now reporting can only be prepared in thousand rubles, millions can no longer be used as a unit of measurement;

- OKVED in the header has been replaced by OKVED 2;

The auditor mark should only be given to those companies that are subject to mandatory audit.