At the end of the year, companies submit various reports to the Federal Tax Service. The main accounting statements are the balance sheet and income statement. This is the set that a small business entity can limit itself to. Large enterprises, in addition to the forms mentioned, submit several other types of reports. Among them is a cash flow statement. Form 4 is a very familiar and common name for a report among accountants.

As is clear from the name of the form, in the report the organization shows information about the movement of cash and non-cash funds and their balances. All transactions for the receipt and expenditure of money are shown in three areas of activity.

Why is this report needed?

The document is, one might say, generalizing and gives a clear idea of the company’s cash flow. This is important because sometimes, even with full order with fixed assets and other funds, a company may suffer from a lack of money necessary, for example, to pay taxes and social contributions, pay wages, transfers to suppliers, etc. In addition, it is obvious that the lack of a clear picture of cash always affects the economic component of the organization, which is why the report is of great importance for determining further actions and prospects in terms of finance.

- Form and sample

- Free download

- Online viewing

- Expert tested

FILES

The report also plays an important role when the company is interested in attracting investments, since before engaging in any project, a demanding investor always asks for this report and studies it with passion.

In addition, the recipients of the cash flow statement may be:

- tax office,

- Rosstat,

- banking institutions,

- founders of the company, etc.

What is ODDS used for?

The cash flow statement (CFS) is part of the financial statements. It must be submitted at the end of the year. Organizations that present simplified accounting have the right to refuse it:

- small businesses;

- non-profit organizations;

- participants of the Skolkovo project.

Get a free sample accounting policy and do accounting in a web service for small LLCs and individual entrepreneurs

ODDS is, in fact, an explanation of line 1250 “Cash and cash equivalents” of the balance sheet. It discloses information about payments and receipts of cash and cash equivalents (for example, bank demand deposits or bills of exchange with a maturity of up to three months), as well as cash balances at the beginning and end of the period.

ATTENTION. When compiling ODDS, cash flows that change the composition, but not the total amount of cash, are not taken into account. This is receiving cash from a bank account, transferring from one account to another, etc.

Structure and content of the report

For a person without special education, the document may seem quite complicated. It consists of three sections in which monetary transactions are reflected in code values according to three main indicators of the organization’s performance:

- current,

- financial

- and investment.

It should be borne in mind that not all cash movements need to be included in this document. Exceptions include :

- currency exchange transactions,

- receipt and delivery of cash to a bank account,

- exchanging cash equivalents for each other,

- transfer from one organization account to another, etc.

A complete list of actions can be found in clause 6 of PBU 23/2011.

Important feature : the report includes any financial transactions of the company. falling under its qualification requirements, regardless of the monetary units of which country they were produced in, but all data in the document is entered only in Russian rubles, and strictly in the unit of measurement (thousands, millions) that was used in drawing up the balance sheet .

Who submits the form and when?

Form 4-reserves at the end of the month no later than the 2nd day of the next period is submitted by commercial and non-profit organizations of all forms of ownership and their separate divisions, if they are consumers of fuel and petroleum products (Resolution of the State Statistics Committee of the Russian Federation No. 25 of April 12, 2002).

The form must be filled out and submitted by fuel supply organizations that supply fuel to the population and social facilities. Starting in 2021, organizations that ship biofuels must also fill out the form.

Example of preparing a cash flow statement

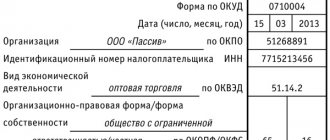

Filling out the header

Since the document is extremely important, you must be very careful when drafting it and fill out all the necessary cells.

- First, the report indicates the year for which it was compiled.

- Next, enter the full name of the organization (with the abbreviation of the organizational and legal status) and the following data:

- Date of preparation,

- OKPO code (All-Russian Classifier of Enterprises and Organizations),

- TIN,

- type of economic activity (required in the form of an OKVED code and decoding).

- Below, again, the organizational and legal form and form of ownership are entered, and next to them are the OKOPF (All-Russian Classifier of Organizational and Legal Forms) and OKFS (All-Russian Classifier of Forms of Ownership) codes.

- The last line of the document header indicates OKEI (All-Russian Classifier of Units of Measurement) codes: i.e. thousands or millions used in the report.

Filling out section 1

The first section of the document contains information about current cash flows .

- First of all, information about “receipt” : data on the total amount of funds received is entered in line 4110, which is then scattered across the underlying thematic lines - from 4111 to 4119 - in accordance with the accounting registers. This takes into account transactions from the sale of services and inventory, rental payments, interest, royalties and other “incoming” finances.

- Line 4120 indicates the total amount for payments made during the reporting period : payment of taxes and contributions to pension funds, wages, transfers to contractors and suppliers, etc. Then this amount is also posted to lines 4121 to 4129.

- the balance from current operations is entered in line 4100 (i.e., the amount of “incoming” finances minus expenses incurred).

This section also contains information about cash transfers and receipts that cannot be unambiguously classified.

An important nuance: expenses in the table must be indicated in parentheses, and excise taxes paid to suppliers and contractors, just like VAT, do not need to be included here.

Filling out section 2

The section entitled “ Cash flows from investment operations ” is completed in a similar manner. First of all, “ total receipts ” are entered in line 4210, including from the sale of shares, returns on loans, dividends, sales of non-current assets, etc., which is then posted in the required values on the corresponding lines (from 4211 to 4219).

Payments ” for investment transactions are also filled in below total is entered into line 4220 , which is then, in full accordance with the accounting registers, signed on the lines below (from 4221 to 4219), including the acquisition and other costly transactions with non-current assets, payment of interest, acquisition of debt securities, etc. .d.

Then enter the value of the balance of cash flows from all investment activities (receipts minus expenses).

Filling out section 3

The last section of the document is devoted to cash flows from various types of financial transactions . Everything is similar here:

- first, line 4310 indicates the value of “total” receipts , which is then distributed along the lower lines (from 4311 to 4319), including income from the issue of shares and bonds, loans, borrowings, etc.

- “total” indicators for financial payments are entered in line 4320, followed by their distribution in lines from 4321 to 4329.

- Then the difference between the “incoming” and “outgoing” cash flows for the reporting period for financial transactions is indicated.

- Finally, the document includes the total balance of all three cash flows for the reporting period (can be either with a plus or a minus sign), financial balances at the beginning and end of the period, as well as the difference in the exchange rate between the currencies of other countries and the Russian ruble, which is calculated using a special formula (filled in only when the organization made settlement transactions in foreign currency).

After drawing up the report, the document is submitted for approval to the head of the organization, who, with his signature, certifies the authenticity of the information included in it.

Example and procedure for filling out the ODDS

As of December 31 of the previous year, Rusalka LLC had balances: on account 50 “Cashier” - 10,000 rubles, on account 51 “Settlement accounts” - 50,000 rubles.

Cash flows from current operations

In the reporting year, the Rusalka account received proceeds from the sale of goods in the amount of 1,200,000 rubles (including VAT 20% - 200,000 rubles). The company transferred RUB 840,000 to suppliers. (including VAT 20% - 140,000 rubles), made payments in connection with wages of employees in the amount of 250,000 rubles. and transferred 98,000 rubles. taxes (including income tax - 50,000 rubles).

The lines of the ODDS reflect:

- 4110 “Receipts - total” 1,060 thousand rubles (1,000 + 60)

including:

- 4111 “From the sale of products, goods, works and services” 1,000 thousand rubles (1,200 - 200)

- 4119 “Other receipts” 60 thousand rubles. (200 - 140)

- 4120 “Payments - total” 1,048 thousand rubles (700 + 250 + 50 + 48)

including:

- 4121 “Suppliers (contractors) for raw materials, materials, work and services” 700 thousand rubles (840 - 140)

- 4122 “In connection with the payment of employees” 250 thousand rubles.

- 4124 “Organizational profit tax” 50 thousand rubles.

- 4125 “Other taxes and fees” 48 thousand rubles (98 - 50)

- 4100 “Balance of cash flows from current operations” 12 thousand rubles (1060 - 1048)

Fill out and submit your balance using the current form Submit for free

Cash flows from investment operations

Rusalka sold shares issued by another organization in the amount of 500,000 rubles. and issued a long-term loan to a third-party company in the amount of RUB 300,000.

The lines of the ODDS reflect:

- 4210 “Receipts - total” 500 thousand rubles.

including:

- 4212 “From the sale of shares of other organizations (participatory interests)” 500 thousand rubles.

- 4220 “Payments - total” 300 thousand rubles.

including:

- 4223 “In connection with the acquisition of debt securities (rights to claim funds against other persons), provision of loans to other persons” 300 thousand rubles.

- 4200 “Balance of cash flows from investment operations” 200 thousand rubles (500 - 300)

Cash flows from financial transactions

“Rusalka” took out a loan from the bank in the amount of 400,000 rubles. and returned his part in the amount of 150,000 rubles.

The lines of the ODDS reflect:

- 4310 “Receipts - total” 400 thousand rubles.

including:

- 4311 “Obtaining credits and loans” 400 thousand rubles.

- 4320 “Payments - total” 150 thousand rubles.

including:

- 4323 “In connection with the repayment (redemption) of bills and other debt securities, repayment of loans and borrowings” 150 thousand rubles.

- 4300 “Balance of cash flows from financial transactions” 250 thousand rubles (400 - 150)

Final indicators

- 4400 “Balance of cash flows for the reporting period” 462 thousand rubles (12+200+250)

- 4450 “Balance of cash and cash equivalents at the beginning of the reporting period” 60 thousand rubles (10 + 50)

- 4500 “Balance of cash and cash equivalents at the end of the reporting period” 522 thousand rubles. (462 + 60)

IMPORTANT. The OKUD code of the cash flow statement form changes. The previous value is 0710004, the new one is 0710005. Changes were made by order of the Ministry of Finance dated 04/19/19 No. 61n, applied from reporting for 2021.

What to pay attention to when filling out the form

Check the provided data for last year. If the form based on the results of November 2021 indicates the amount of fuel remaining in November 2021 (column 5), then this information must match the data submitted last year in November 2021. If there are discrepancies in the data, the reasons for the discrepancy will have to be explained.

Heads of organizations and their separate divisions bear responsibility established by law for violation of the procedure for submitting state statistical reporting.

If an enterprise simultaneously produces and consumes fuel, the report includes only reserves intended for its own energy, technological and household needs.

What is it for - purpose

An annual cash flow report prepared by a legal entity in Form 4 allows a business entity to successfully solve the following tasks:

- Conduct factor analysis of money flows in order to distribute it correctly.

- Control real expenses (payments) made by a business entity in various items/directions.

- Timely identify and eliminate areas of deficit in the cash flow of the enterprise.

- Characterize the organization's net profit without taking into account costs.

- Assess the possibilities and reserves for increasing the company's cash flow.

- Check the sufficiency of available funds to ensure the normal functioning of the organization.

- Justify the economic feasibility of attracting additional investments, obtaining borrowed funds, and issuing securities.

- Compare the amount of profit earned with the flow of money.

Calculation example

The balance of Horns and Hooves LLC at the beginning of the month is 250,000 rubles. Current account transactions for the month (in rubles):

- 500,000 - payment for products by buyers;

- 300,000 - payment for materials by suppliers;

- 100,000 - payment of salaries to employees;

- 200,000 - receipt for a sold car;

- 150,000 - repayment of the loan;

- 50,000 - dividends paid to owners.

Balance of flows:

- current activities: 100,000 rub. (500,000 - 300,000 - 100,000);

- investment activity: 350,000 rub. (200,000 + 150,000);

- financial activities: — 50,000 rub. (0 - 50,000).

The balance of Horns and Hooves LLC at the end of the month is 650,000 rubles. (250,000 + 100,0000).

Where to submit form 4-inventory

The organization must submit the completed form to its territorial body of Rosstat. If an organization has a separate division, it submits the form at its location. If an organization is registered in one territory, but operates in another region or city, it submits the form to the statistical authorities where the activities actually take place.

If an organization has subsidiaries and dependent business entities, they submit reports themselves on a general basis, and the parent organization submits information to the statistical authorities without taking into account the data of these divisions.

If IFRS is applied

In addition to the direct method, IFRS allows the use of the indirect method, but only for financial flows from operating activities. And it's more common. This method is based on adjusting earnings from the income statement for changes in the value of assets and liabilities that do not result in cash flows. For example, depreciation. After all adjustments are reflected, cash flow from operating activities is determined. This makes it easier to compile an ODDS. But there are rumors that the indirect method in IFRS will soon be abolished, so I will not go deeper into it.

Author: Knowledge Director of Internet Accounting “My Business” Alexey Ivanov. Read more in the Zen channel “Accounting Translator”.