Each enterprise has property (goods, products), and it must be taken into account. To do this, an audit is carried out, based on the results of which an inventory list is compiled. Why is this necessary? What forms are there? In the article we will tell you about all this in detail. And we will separately dwell on how to correctly fill out the inventory and what its storage period is.

Thanks to the article, you will learn how documents are drawn up during inventory. Do you know that based on its data, not only records are kept, but property taxes are also paid? Yes, when opening your own company, you need to think about issues such as reporting to government agencies and taxes.

What if you don’t have an accountant on staff and you don’t need one on a permanent basis? Then we advise you to use outsourcing. Companies providing accounting services will prepare and submit all reports to the tax authority and government funds for you.

Inventory inventory: types of forms

Inventory inventory forms were approved by the Decree of the State Statistics Committee of the Russian Federation “On approval of unified forms of primary accounting documentation for recording cash transactions, for recording inventory results” dated 08.18.1998 No. 88.

At the same time, for government bodies, local self-government, management bodies of state extra-budgetary funds, State (municipal) institutions developed special forms of inventory lists (matching statements). They were approved by order of the Ministry of Finance of Russia dated March 30, 2015 No. 52n. For example, inventory form 0504087 is used to reflect the results of an inventory of non-financial assets carried out in an institution.

The most commonly used types of inventory records are:

- inventory list of fixed assets (INV-1);

For information on the design features of INV-1, see the material “Unified Form No. INV-1 - Form and Sample” .

- inventory inventory of intangible assets (INV-1a);

- inventory inventory of inventory items (INV-3 form);

- cash inventory act (INV-15);

Features of filling out INV-15 are disclosed in the material “Unified Form No. INV-15 - Form and Sample” .

- act of inventory of receivables and payables (INV-17).

For information on the procedure for filling out INV-17, see the material “Unified Form No. INV-17 - Form and Sample” .

The procedure, nuances and timing of inventory are described in detail in the Tax Guide “Practical Guide to Annual Reporting” from ConsultantPlus. Study the material by getting trial access to the K+ system for free.

In this article, as an example, we will consider the procedure for filling out an inventory list for intangible assets and goods and materials.

Inventory card for accounting of fixed assets

An inventory card is a document that reflects information about all movements of a fixed asset. It is issued in the following situations:

- Any activity is carried out with the OS object (from the beginning of its registration);

- OS is moved within the organization, revalued, repaired, disposed of;

- The first entry in the card is made at the time of acceptance for registration or during introduction into use.

An inventory card for recording fixed assets allows you to solve many important problems, such as:

- Organizing information;

- Simplification of the analysis of OS information – for the company manager and other employees, as well as for inspection bodies;

- You can very quickly compile statistics about OS objects.

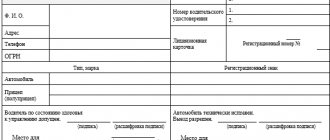

Necessary information to issue a card

An OS accounting card is created on the basis of an OS acceptance and transfer certificate. From the same document, some information about the purchased object is entered into it. Data from accompanying papers is also used.

A complete list of information required to correctly fill out the card is given below:

- Full name of the company;

- The name of a separate division, the OS of which is reflected in a particular case;

- Number and date of document generation;

- The object, as well as its main characteristics (date of construction, manufacturer, number and series);

- Codes for OKUD, OKOF and OKPO;

- Serial number, inventory number, depreciation group number, passport number;

- Date of acceptance for registration and date of deregistration;

- Account and subaccount;

- Analytical accounting code;

- The location where the OS object is located;

- Organization-manufacturer of the object;

- Information about the asset known at the time of its acceptance for accounting;

- Information about revaluation;

- Admission data;

- Information about changes in the original price;

- A short description and characteristics.

Procedure for filling out the card

The inventory card is filled out in the following order:

- Entering the necessary information into the card header - date of issue and card number in order.

- The accountant fills in the required details of the organization.

- The purpose of the structural unit is determined.

- The full name of the fixed asset accepted for accounting in the appropriate manner is indicated.

- Enter the number of the depreciation group to which the object belongs.

- The location of the OS object is determined.

- The first section is filled out - information about the object at the time of transfer is entered: production date, information about putting into use, service life, depreciation amount, residual value (only for objects that have already been in use).

- The second section is filled out - information about private investment and initial cost is recorded (this information is required for calculating depreciation).

- Section four is filled out - it indicates information about the acceptance of the object: details of the acceptance paper, the price of the object, as well as the full name and position of the responsible employee.

- Section seven is filled out - a brief description of the OS is written down.

- The third section is filled in only when a revaluation of an asset has occurred. The date of revaluation, conversion factor and replacement cost are indicated.

- The fifth section is filled out only if the original price of the property changes during modernization, reconstruction or liquidation.

- Section six includes information on the costs of repairing fixed assets.

After the card has been completely filled out, it is signed by the employee responsible for its storage and execution. In most cases, this employee is an accountant.

Card storage period

Inventory cards are primary reporting documentation. In this regard, standard rules apply to them. This means that after disposal of an object, they must be stored in the organization for at least five years. After this, the cards can be recycled.

Inventory of cards

An inventory of inventory cards is a mandatory procedure for organizations that must be carried out every few years. The main purpose of this is to register the IP.

This procedure will help ensure that all documents are safe and sound. Registration must be carried out in full accordance with the accounting budget accounts.

When disposing of an asset, the following information must be reflected:

- Date of operation – year, day and month;

- Serial number according to the transaction registration book.

Features of card design in budgetary organizations

There are nuances that are associated with accounting for property in budgetary institutions. To begin with, it is worth defining a list of situations when disposal of objects occurs:

- The donation occurs free of charge;

- The object became completely unusable;

- A shortage is identified - write-off is carried out at the expense of employees found guilty;

- Write-off of shortages due to natural disasters.

Upon disposal, the following documentation must be completed:

- Act on write-off of fixed assets (not drawn up for transport);

- An act of writing off an entire group of objects at once;

- Act on write-off of motor vehicles;

- The act of writing off soft and household equipment;

- The act of writing off library literature.

Similar articles

- We draw up an inventory list - forms and samples

- Inventory list of intangible assets (sample)

- Inventory card for accounting of fixed assets

- Inventory card for accounting of fixed assets

- Inventory list of intangible assets (sample)

The procedure for filling out an inventory list using the example of the INV-1a form (download)

The inventory inventory form in INV-1 form provides information about the company’s intangible assets.

IMPORTANT! During the inventory, you should make sure that the object is correctly classified as intangible assets.

As a rule, 2 copies of the inventory list are compiled. The header records information about the timing of the inspection, as well as about the documents justifying the start of its implementation. After this, a receipt is provided on the receipt and write-off of intangible assets by the responsible persons.

Information on objects is entered into the tabular part of the inventory list in accordance with accounting data and actual availability. In case of deviations of the fact from the accounting data, this is indicated in the inventory.

You can download an inventory list - an example and a sample of filling out INV-1a on our website:

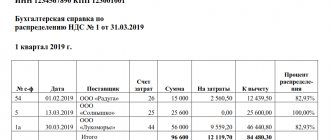

Let's look at an example of filling out an inventory list using the INV-3 form.

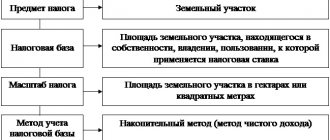

Document structure

Regardless of which inventory form is used at the enterprise (developed by the organization independently or approved by the State Statistics Committee), it must contain:

- Accounting accounts.

- Information about discrepancies identified during the audit. They are indicated in monetary terms.

- Information about the cost of damaged materials and goods.

- Information about misgrading, write-offs, and detected losses due to the fault of financially responsible employees. These data are indicated in rubles.

Sample of filling out an inventory list of inventory items

The inventory inventory of inventory items in the INV-3 form is also drawn up in 2 copies. Filling out the inventory can be done using computer technology or manually. On the 1st sheet in front of the table, financially responsible persons affix their signatures. Data in columns 1–9 of the inventory table is entered based on the information available to the taxpayer.

IMPORTANT! In column 9 “Passport number” the value is entered only if we are talking about precious metals.

Columns 10 and 11 of the inventory list reflect the actual availability of objects, and the values in columns 12 and 13 are entered according to accounting data. When damage to objects is detected, reports are drawn up, and any deviations found are included in the inventory. After filling out the table, the inventory is endorsed by the commission and responsible persons.

You can take an inventory of inventory items on our website:

When is inventory taken?

The methodology and frequency of the procedure are established by the management of the business entity. But in certain cases, the law requires an inventory of property:

- before the start of the formation of the annual balance sheet

if it is planned to transfer the property for rent, its sale or purchase- at the stage of transformation of the form of ownership (state or municipal)

- after theft, damage to property, abuse of property rights

- when changing personnel with financial responsibility

- after natural and man-made disasters

- at the stage of liquidation or reorganization of the company

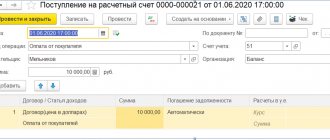

Results

Monitoring the compliance of real information and information reflected in accounting data for current and non-current assets, as well as short-term and long-term liabilities, allows you to avoid errors in accounting and tax accounting.

The correct preparation of inventory records will help to perform this function. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Design nuances

The inventory sheet must contain information about the enterprise itself where the audit is being carried out. If the check is carried out in a separate unit (workshop, department), its name is also indicated.

The statement must contain information not only separately for each account, but also general data on the amounts of identified surpluses or shortages. Based on the final result, the information in the financial statements is adjusted.

The information reflected in the statement must be confirmed by the signatures of responsible employees, the manager, and members of the audit commission.

Features of collection

Shortages in excess of the established attrition standards are registered with the guilty employees and must be compensated by them. Excessive shortages may be included in production costs if the culprits could not be identified or collection was refused.

In any case, the facts must be supported by documents. If, for example, it was refused to satisfy the demands for recovery from those responsible for losses caused to the enterprise, evidence of this is a court decision or a resolution of the investigative body.