Employers often provide comfortable working conditions for employees by creating food establishments, such as canteens, or organizing meals by concluding an agreement to deliver lunches to the office. In this regard, it is necessary to clearly define the procedure for providing food, its types and legal features: In what cases is the employer obliged to provide food? How to document employee meals? What taxes will be associated with the provision of free food to employees? How to reflect employee meals in accounting entries?

Meals for employees of an organization can be provided both in accordance with legal requirements and at the initiative of the employer. In the latter case, free food is one of the components of the social package offered to the company's employees. Therefore, before talking about the process of organizing the provision of food, it is necessary to understand what type of food this is.

Employee meals: organization and tax consequences

Employers often, taking care of their employees, organize meals at the workplace.

And for some businessmen this is a legal obligation. For employees, food from the employer is an important part of motivation. This allows you to save not only money, but also time on preparing lunch or traveling to your home or cafe. But for a businessman, feeding employees at their workplace can lead to additional tax payments.

Let's look at how to make workplace lunches not only convenient for employees, but also beneficial for the business as a whole.

Power card as a tool for monitoring all business processes

Any of the above schemes can be implemented using a card. It is issued separately to each employee, which means that the card base will become a single client base. It is used as an electronic pass when paying for lunch, to control working hours from those eating to the service desk. The card can be magnetic, proximity, or not be plastic at all - virtual for a personal account, a bracelet with a barcode, an electronic key, a fingerprint, etc.

The balance is replenished by the enterprise, for example, by deduction from the salary. either as subsidies, or by the employee himself in payment terminals. Using such a terminal you can place a pre-order . An employee inserts a card into the kiosk and selects dishes for today, tomorrow, a week or a month - whatever your heart desires. The order is stored in the system on his card and is available to both the cardholder and the cashier. Knowing the final number of dishes, the kitchen will be able to calculate the required amount of ingredients for a specific day and purchase as efficiently as possible. What does it mean? No surplus on salads and cereals, no shortage of your favorite stew or hodgepodge. So, with the license “RestArt: Payment Kiosk”, the employee will be able to independently manage the account and his lunch at any time and anywhere, and the enterprise will receive a well-fed = satisfied employee and the most efficient operation of the kitchen.

The card also serves as a carrier of information about employees. Not only for identification, but also about data with turnover, balance, credit, restrictions. The receipt can print the contents of the order, the amount of subsidies and the amount of payment, the amount of deduction and the period. Separately, it is possible to print a report on the card by the cashier. By the way, even if the card is lost, it will not be possible to pay. In “RestArt: DDS Administrator” you can set a password for the card, upon payment of which it will be requested.

Employee meal plan options

For two categories of employees, according to Article 222 of the Labor Code of the Russian Federation, the employer is obliged to organize free meals at the workplace.

- Workers in hazardous conditions are supposed to be given milk or other substitute products.

- For workers in particularly hazardous conditions, the employer is obliged to organize therapeutic and preventive nutrition for them.

In this case, the cost of food for employees within the established norms reduces the base for income tax or the simplified tax system “Income minus expenses” and is not subject to personal income tax and insurance contributions. There is also no need to charge VAT on the cost of such food.

The organization of meals for other categories of employees remains at the discretion of the company management. But many HR specialists believe that this motivation option is very effective. Therefore, the employer, if he has the opportunity, should make additional expenses that will be paid off by the loyalty of employees.

The procedure for providing meals to all “ordinary” employees who do not work in harmful or dangerous conditions is not established by law. Therefore, employers themselves have the right to choose the most convenient option for them:

- Open your own canteen.

- Issue products.

- Order lunch delivery or full catering service.

- Prepare the room for eating.

- Pay employees for food expenses.

However, the employer’s desire to make the work process more comfortable for its employees often runs into legal requirements. From the point of view of regulatory authorities, a businessman, by providing meals to employees, increases their income. In this case, an additional object for taxation arises. Therefore, you need to carefully study each method and choose the most suitable one.

Methods of accounting for food expenses

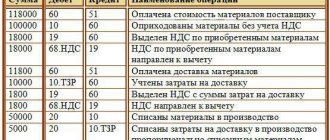

The appearance in accounting of information about the cost of food costs will depend on the chosen method of organizing food.

Having your own canteen will require allocating it to a service production, where the costs for this production will be generated: Dt 29 Kt 02 (10, 25, 60, 69, 70).

If food services are provided by a third-party contractor or the employer purchases products that are subsequently transferred to employees, then an entry will arise to record the cost of meals (products) received from the supplier: Dt 10 (41) Kt 60.

The posting for the recording of expenses already incurred by the employee for his food (if they are part of wages) will be similar: Dt 10 (41) Kt 70.

The issuance of food, regardless of what category it belongs to (special food or other preferential or free food), will be carried out through the account for accounting of settlements with personnel. In this case, you will have to personally make an entry for the amount of the cost of the food received for each employee when calculating wages: Dt 70 Kt 10 (29, 41).

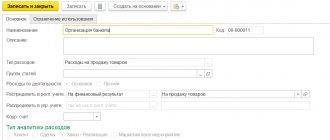

Expenses for which personal accounting is not organized, even if these expenses are present in the wage system, cannot be attributed to settlements with personnel, so the posting for them will be as follows: Dt 91 Kt 10 (29, 41).

Meals issued as remuneration will be taken into account in the employer's expenses by assigning the following amounts:

- to cost accounts if these expenses:

- obligatory for the employer under the provisions of the current legislation (special food) and carried out within the established standards;

- provided for by the internal regulatory document on the remuneration system;

- exceeding the norms for issuing special food;

- not provided for by the current wage system.

Read more about special food and its accounting in the material “Art. 222 of the Labor Code of the Russian Federation: questions and answers" .

Costs for food, mandatory for the employer by law or due to their inclusion in the wage system, when distributing data on food personally among employees, will be included in wage costs: Dt 20 (23, 25, 26, 29, 44) Kt 70 .

Meals that do not meet the criteria for labor costs or mandatory delivery will be reflected in the posting: Dt 91 Kt 70.

Meals for employees in their own canteen

There is nothing better and tastier than freshly prepared food. But to organize a full-fledged dining room, you need to take into account many points:

- The premises must be in a non-residential building.

- The dining room must be equipped with a sewerage system, an exhaust hood and a place for collecting food waste.

- There are special requirements for the finishing of the premises.

- It is necessary to hire qualified personnel.

- Organizing your own canteen will significantly complicate your accounting.

- You need to take into account many Sanitary Pins and prepare for regular inspections, since public catering establishments are strictly controlled.

The main disadvantage is that opening your own canteen is very expensive. Therefore, this option is suitable mainly for medium and large organizations.

However, with the right approach, the company will be able to generate additional income by providing the opportunity to use the canteen services not only to employees, but also to third-party clients. As a result, catering may even become a separate type of business.

Having your own dining room also has significant advantages:

- You can control the quality of employee diets.

- The number of sick leaves due to gastrointestinal diseases is decreasing.

- Possibility of additional income for the company.

If an employee pays for lunch himself, then he does not have any additional taxable income. The employer can take into account the costs of maintaining the canteen for tax purposes on a general basis.

If the canteen meets the parameters for the use of UTII in terms of the area of the hall (up to 150 sq. m), then until the end of 2021 it can operate on an “imputed” basis. But for this, the organization itself must have no more than 100 people. But in practice, such companies rarely open their own canteens.

Total control

The subsidized food automation system should control not only the company’s employees, but also the work of the service personnel. Integration of the video surveillance system and “RestArt: Integration Interface” will help compare each event in the program with the actions of cashiers, waiters, and managers. Any cancellation, transfer, printing of a receipt, guest bill, or order stamp will be reflected as a comment on the broadcast video.

Providing power in large network companies requires prompt collection of information from all remote offices. And not only for data analysis, but also for storing it, setting up a spare or only storage server. The mechanism is as simple as possible and does not require high-tech equipment: the connection between the node and the server appears - the information has arrived, if it does not appear - waiting for communication. “RestArt: Consolidation Server” is precisely used to receive data from all points. Moreover, any change in the information already received will not go unnoticed: you won’t be able to simply delete the check or change it.

Delivering lunches or issuing groceries to employees

An organization can enter into an agreement for on-site catering or lunch delivery.

Advantages of this method:

- No need to buy groceries or prepare lunches yourself.

- Possibility of pre-ordering with a choice of menu.

- Corporate volume discounts and free shipping.

- Quality guarantee from a supplier who specializes in catering.

Providing food is a compromise option when the employer does not want to spend large sums on food, but strives to provide employees with everything they need for tea breaks.

The company’s obligation to organize meals for employees in one way or another must be reflected in internal regulations: regulations on remuneration, collective agreement, etc. The documents must detail exactly who is provided with food and in what form.

In this case, the employer has the right to take into account the costs of food for employees for income tax (clause 25 of Article 255 of the Tax Code of the Russian Federation, letter of the Ministry of Finance dated July 23, 2018 No. 03-03-07/51494).

For the simplified tax system “Income minus expenses” the approach will be similar, because Labor costs and equivalents are taken into account under this regime in the same way as income tax (clause 6, clause 1 and clause 2, article 346.16 of the Tax Code of the Russian Federation).

VAT may not be charged on the cost of issued lunches or products (letter of the Ministry of Finance dated 03/06/2015 N 03-07-11/12142). But in this case it will not be possible to deduct input tax. VAT amounts invoiced by the catering company or food supplier can be included as expenses for income tax purposes.

When a company purchases ready-made meals or products for the purpose of providing meals to employees, the question arises about the taxation of payments in kind. Indeed, in the general case, these costs are employee income in kind. Therefore, personal income tax must be withheld from the cost of free food, and insurance premiums must be charged on them.

However, these payments are “personalized”, i.e. when calculating, they must be tied to a specific employee - the recipient of the income. Therefore, if it is impossible to accurately determine which employees received free meals, then these expenses may not be subject to personal income tax and insurance premiums (letter of the Ministry of Finance of the Russian Federation dated August 3, 2018 No. 03-04-06/55047).

When purchasing ready-made lunches, to make it impossible to identify the income of each employee, it is enough to place a general order, which will not be detailed. If an organization purchases products, then it is also impossible to find out how much and which employee received, for example, sugar and tea. Therefore, in such situations, there is a reason not to accrue mandatory payments - it is simply impossible to specify the income for each employee.

But it is impossible to give a full guarantee that with such a scheme it will be possible to do without paying personal income tax and contributions. Inspectors can calculate these payments by calculation, for example, based on the total costs and the number of employees receiving meals (letter of the Ministry of Finance dated May 17, 2018 No. 03-04-06/33350).

In addition, if the employer does not charge insurance premiums for the cost of food for employees, then, according to tax authorities, he cannot take these costs into account for income tax (letter of the Ministry of Finance dated March 4, 2008 No. 03-03-06/1/133). There is also an opposite position, but you will most likely have to defend it in court (Resolution of the Federal Antimonopoly Service of the Moscow District dated April 6, 2012 No. A40-65744/11-90-285).

Meals without VAT

An enterprise can do without VAT at all if the meals are organized within the framework of the norms of the Labor Code of the Russian Federation. This includes the provision of milk to employees employed in hazardous industries, or special meals provided for particularly hazardous work.

The Ministry of Finance agrees with the opinion that in such cases there is no need to impose VAT on food . The Ministry even issued a letter on this matter dated October 23, 2021 No. 03-15-06/69405. Should food costs not be subject to VAT? If:

- this provision is specified in the employment or collective agreement

- there are special working conditions

The opinion of the judges, however, is that in this matter one cannot proceed only from the concept of harmful labor.

Organizing a place to eat

There is an option for those employers who, for some reason, are not suitable for all the previous ones. You can increase employee loyalty by organizing a place to eat. To do this, you will need an empty room, household appliances and furniture. Appliances may include a refrigerator, microwave, kettle, coffee machine. Some employers go even further and provide not just a kitchen where you can heat up food, but also a full-fledged recreation area - with chairs, board games and more.

Firstly, this measure will allow employees not to waste time going to third-party cafes and to comply with safety precautions in the workplace.

Secondly, organizing a place for food requires only one-time investments, since the company only equips the place without further spending money on food for employees. Consequently, the problem with “salary taxes” discussed in the previous section will not arise.

In order for these costs to be taken into account for tax purposes, it is necessary to reflect the employer’s obligation to create conditions for eating in local regulations.

Popular mistakes

- The first mistake: the employer feeds employees buffet style and then transfers compensation to the employees for meals. If during an audit the tax inspectorate suspects that the company’s management is simply selling its products in this way, then VAT will be additionally charged on compensation payments.

- The second mistake: the employee requires his employer to pay a salary supplement in the amount of compensation for his food. If a compensation payment in an organization is provided in the form of an increase to the official salary, then these funds are considered as a person’s income and are subject to taxes.

Employee benefits

The simplest method, which does not require the employer to take special measures to organize meals for employees. However, it is also the most “expensive” from a tax point of view. These payments are personalized and therefore are subject to all contributions and personal income tax.

That is, at least 30% of insurance premiums must be added to the amount of costs for lunches and 13% of personal income tax must be withheld from payments.

In order to take into account additional payments for employee meals when calculating income tax and the simplified tax system, they, like other types of similar expenses, must be reflected in internal personnel documents.

But this option may be convenient for many employees, because... they choose how and where to dine.

Reporting system

Each RestArt module has its own reporting system. If, for example, the catering of canteens is automated with a minimum set of licenses, you can use standard reports on dishes, orders, forms of payment, etc.

A more in-depth analysis of work at a remote point, separately for each node or all in a complex is carried out in “RestArt: Business Analysis” . The innovative reporting system is a constructor for generating standard and non-standard reports. Business analysis brings information about the sales of each outlet into a format acceptable to the manager.

Advantages:

- operational data on provided compensations, subsidies, discounts by company, division, category of employees, each employee, etc.;

- accounting of work time, bonuses and fines;

- launch through a browser anywhere in the world;

- low price of the software product;

- There are no restrictions on the number of connections to the configuration.

Conclusion

The employer is obliged to provide meals only to certain categories of employees. In all other cases, this is his voluntary decision. Therefore, if a businessman wants to increase the loyalty and motivation of employees, then he can choose a method that is convenient for himself.

With any option for voluntary organization of free meals for employees, this obligation of the employer must be reflected in internal documents. Otherwise, the costs cannot be taken into account to reduce the tax base.

For a large business, the best option is your own canteen. In this case, not only there are no “extra” taxes, but the organization can also receive additional income.

If an employer provides employees with free lunches or groceries, then, according to tax authorities, they should be subject to personal income tax and contributions, even if personalized accounting is not possible. The opposite position will most likely lead to the need to resolve the issue in court.

If you simply add the additional payment for employee meals to the salary, then taxes will have to be paid in any case. But with this option, there is no need to equip the premises, purchase and deliver products, etc.

As a result, the choice depends on the financial capabilities of the employer and his readiness for additional difficulties both in organizing meals for employees and in the event of an inspection.

Personalization

A key feature of corporate canteens is the identification of each client. The system simply must associate revenues and expenses with each employee.

This approach also requires personalization of sales, for example:

- organization of a unique menu for different categories of eaters;

- control of the amounts of subsidies, benefits, charges to the current account of each employee;

- use of individual forms of payment.

Complex nutrition

The company provides business lunches to several organizations strictly on schedule. The composition of the menu is specific for each day of the week, but if desired, the client will be able to purchase something from the main menu at a reduced price.

Using AS RestArt, you can automatically assign a menu depending on the day of the week, time, and control the uniqueness of its composition. But the most important thing is to customize the availability of specific dishes for each employee or group of employees. Moreover, their cost may differ from the price at which sales are made to non-residents of the company or, for example, on weekends.

Particular attention is paid to business lunches. The main requirement is to prohibit the sale of dishes of the same category. For example, a set lunch includes salad, first and main course. You can only take one of each and replacement is not possible. For such cases, control of the minimum and maximum number of dishes in a set is provided.

There are several options for determining the retail price of a set lunch:

- fixed price for business lunch;

- the total cost of all components.

Flexibility of settings allows you to limit access to certain types of payments. For example, Ivanov should pay with coupons, and Sidorov with the balance from the current account for business travelers. If necessary, you can enter restrictions even on the amount or % of payment for the established payment type.

*The minimum set of modules is Administrator workstation + Fast food workstation.

Transaction control

The company plans to compensate the cost of lunch daily by 100 rubles. If this amount is not used, it “burns out”. The management eats without restrictions, but at the end of each month the amount of food is deducted from the salary.

Along with the division of employees into categories, belonging to certain departments or organizations, there is also a need for individual assignment of benefits. If you have a current account (aka deposit card), you can use transaction limits:

- by time: day, week, month, year;

- according to the check amount.

In order for the system to automatically reset the account turnover to zero, for example, every month, you must indicate the beginning of the reporting period. This is one of the tools for tracking money spent. By the way, some enterprises use coupons. Moreover, it is possible to both use the balance of the coupon and block the coupon immediately after payment, even if not the entire amount was spent.

*The set of modules depends on the accounting solution used.

Dinner time

To reduce the load during rush hour, many enterprises introduce shift meals. This eliminates endless queues and has a better effect on the quality of service. The meal schedule both for groups of people (first shift, second, etc.) and individually (privileges for management) is easily customized for each type of menu.

Catering

This work scheme, which involves the delivery of ready-made meals, has become increasingly popular in recent years. True, it is worth noting that this form of providing meals to employees is most popular for office-type companies, but is poorly suited for any production organizations.

The scheme of interaction between the parties, as well as the procedure for accounting and control, is prescribed in the agreement between the customer and the provisions supplier. If it is indicated in the documents that the customer pays only for the provision of catering services, then such expenses can be carried out in the same form as payment for set meals. If the customer organization regularly pre-purchases ready-made meals for subsequent resale to its own staff, then financial actions for such transactions should be reflected in the column “Other income and expenses” or “Sales”. If lunches are given to staff free of charge, then records are kept in the “Materials” column.

Agreement with the contractor

This format of interaction, when the task of providing comprehensive benefits to employees of an enterprise falls on the shoulders of an organization specializing in activities related to catering - a cafe, restaurant, canteen - implies the need to conclude a bilateral agreement between the companies. This contract should reflect exactly how the procedure for ensuring benefits for representatives of the customer company will be established:

- delivery of prepared food to the enterprise;

- organization of distribution according to the type of field kitchen;

- a visit by employees to a public catering facility with the presentation of relevant documents, issued in the form of passes, coupons, or in registration format by signing in a statement or a special journal.

Accounting schemes, reporting forms, formats of invoices, invoices, acts and other documentation in this type of interaction are chosen by the parties independently, based on the idea of simplicity and comfort of mutual work, and mutual settlements are made in the general manner according to the standard account “Settlements with suppliers and contractors” "