The Social Insurance Fund of the Russian Federation organizes the execution of the state social insurance budget, approved annually by federal law, and controls the use of social insurance funds. When necessary, the Fund redistributes social insurance funds between regions and industries, maintaining the financial stability of the system. In addition, the Foundation develops and implements state programs to improve social insurance and employee health protection. The Federal Social Insurance Fund of the Russian Federation is a specialized structure that ensures the functioning of the entire multi-level system of state social insurance. The Fund finances the payment of benefits for temporary disability, pregnancy and childbirth, at the birth of a child and a monthly benefit until the child reaches the age of one and a half years, as well as benefits for the burial of the dead. In addition, the Fund finances sanatorium and resort services for workers and members of their families, children's summer health campaign.

If you know about changed addresses and telephone numbers, please let us know by email, and many will be grateful to you.

Address: 107139, Moscow, Orlikov lane, 3a Multi-channel telephone Fax

Name of the territorial body of the FSS by registration number

Perovo111141, Moscow, Zeleny Prospekt, 13 For policyholders Tel.: 742-05-50 For beneficiaries (san/kur) Tel.: No For beneficiaries (TSR) Tel.: 742-88-65 For victims of accidents in production and occupational diseases Tel.: 742-88-64 20 Branch 40 124498, Moscow, Zelenograd, proezd 4806, 6 Zelenograd, bldg. 1003, N.P. Addresses and telephone numbers of branches of the Social Insurance Fund (SFS) in Moscow It’s easy to find out your IRS, PFR and FSS For policyholders Tel.: 912-27-66 For beneficiaries (san/kur) Tel.: 911-68-13 For beneficiaries (TSR) Tel. .: 632-78-44 For victims of industrial accidents and occupational diseases Tel.: 911-69-82 9 Branch 11 Paveletskaya metro station 115114, Moscow, Shlyuzovaya embankment, 6, building 3 Old address: 105062, Moscow, Lyalin per. 7/2, bldg.

- 2623 - territorial department.

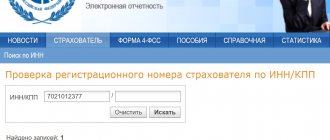

Attention: To find out your FSS branch by TIN, you must follow the link: https://fz122.fss.ru/index.php?section=t&service=28. The service allows you to determine the FSS registration number using the organization’s TIN. STEP 2. Enter your TIN and click the “Search” button. The code of the FSS branch in which we are registered will appear. The first two digits are the region code, the second two digits are the FSS Branch number.

(For example, code 7707, means Moscow region, Branch No. 7). If you have saved the letter received upon registration with the Social Insurance Fund, then there is a subordination code in the Social Insurance Fund, the first two digits of which also indicate the region of registration, the second two - the branch number, which also allows you to proceed to the next step. STEP 3.

FSS in the Moscow region

MOSCOW REGIONAL DEPARTMENT OF THE SOCIAL INSURANCE FUND Hotline telephone: (495)647-25-23 (ext. 44-66) Address: 123298, Moscow, 3rd Khoroshevskaya street, 12 Correspondence address: 121205, Moscow Moscow, st. Novy Arbat, 36/9 Phone: (ext. 44-02; 44-00) Fax: Email: Website: www.morofss.ru

Branch 3 Director Liliya Valentinovna Beresneva Address: 143300, Naro-Fominsk, st. Lenina, 11 Phone: (496) 343-0197; fax - (496) 343-8580 Email: Branch 4 i. O. Director Gusarova Nadezhda Viktorovna Address: 140300, Yegoryevsk, st. Sovetskaya, 126 t. (496) 404-6936 f. (496) 404-6935 140700 Shatura, Vokzalny proezd, 4 t. ((496) 453-0495 f. (496) 453-0495 Email: Branch 7 Director Petrova Olga Nikolaevna Address: 142300, Chekhov, Naberezhnaya St., 3 Phone: (496) 722-2677, fax (496) 726-8611 Email: Branch 9 Director Elena Viktorovna Shtyrikova Address: 143912 Balashikha, Polevaya St., 5 Email: Branch 10 Director — Dubrovskaya Elena Viktorovna Address: 141070, Korolev, Oktyabrskaya St., 5 Phone: 512-2199, 512-1106, 516-6008, 511-0717, 516-0601, 516-6601 Email: Branch 11 Director Naumova Irina Viktorovna Address: 141002, Mytishchi, Novomytishchisky prospect, 30/1, room 411, 412 t. (495) 583-1500; 583-2367; 583-4512; 141200, Pushkino, Pervomayskaya street , house 11/8 t . _ _ _ _ Pantyukhina Tatyana Savelyevna Address: 140500, Lukhovitsy, Zhukovsky St., 46 t. (496) 636-3177, (496) 636-3179 140600, Zaraysk, 1st microdistrict, 11 t. 496) 662-4952 Phone: (496)636-3178 Email: Branch 18 Director Mikhail Vasilievich Udalov Address: 142117, Podolsk, Pilotny lane, 4 Phone: (496)752-8575 (496)752-8578 (496)752-8574 (496)752-8571 (496)752-8579(76) Email: Branch 19 Director Efimova Lyudmila Ivanovna Address: 144005, Elektrostal, Lenin Ave., 25 Telephone: (496) 571-8103, t/f (496)571-8298 Email: Branch 22 Director Krasikova Irina Anatolyevna Address: 142280, Protvino, st. Pobeda, 2, room. 110 t. (496)774-3823 142290, Pushchino, microdistrict. V, no. 2, room 212 t. (496)773-3922 142203, Serpukhov, st. Sovetskaya, 80/8 (496)737-8519, (496)737-8480 Email: Branch 23 Director Vasilyeva Lyubov Nikolaevna Address: 143502, Istra, st. Zavodskaya, 43a t. (496)314-6344; (496)314-6653 143400, Krasnogorsk, st. Pionerskaya, 17 t. (498)568-1440 Phone: Email: Branch 25 Director Stepanenko Lyudmila Konstantinovna Address: 140411, Kolomna, st. Dobrolyubova, 4 (496)612-5670 140560, Ozery, pl. Sovetskaya, 38 (496)702-3176, (496)702-2714 Email: Branch 26 Director Valentina Aleksandrovna Galushkina Address: 141700, Dolgoprudny, Likhachevskoe highway, 22 408-7131, f. 408-4932 141730, Lobnya, st. Lenina, 57, apt. 2 577-1404 141800, Dmitrov, st. Professionalnaya, 3 (496)224-0211 Email: Branch 27 Director Trofimova Irina Ivanovna Address: 140200, Voskresensk, st. Sovetskaya, 4a Phone: (496)441-1236 f. (496)441-1234 Email: Branch 30 Director Oksana Konstantinovna Kuzmishcheva Address: 141900, Taldom, st. Krasnoarmeyskaya, 3 (496)206-1704, (496)206-0079 141980, Dubna, st. Sovetskaya, 14 (496)212-2414 Email: Branch 31 Director Andrey Vladimirovich Starkov Address: 142403, Noginsk, Aptechny lane, 3 Telephone: t/f (496)517-3223 (496)517- 3413 Email: Branch 32 Director Kustova Tatyana Fedorovna Address: 143005, Odintsovo, Severnaya St., 35 Phone: Email: Branch 34 Director Kozlov Alexander Vadimovich Address: 141303, Sergiev Posad, Red Army Avenue, 218 Phone: (496)540-87-14,. Email: Branch 35 Director Stepanov Vyacheslav Vasilievich Address: 142500, Pavlovsky Posad, st. B. Pokrovskaya, 35, office. 2 Telephone: t/f (496)432-2263 t. (496)432-0532 Email: Website: https://www.fil35morofss.narod.ru Branch 37 Director Fonov Vladimir Ivanovich Address: 141600, Klin, st. . Mira, 7 Phone: (496)242-2109 Email: Branch 38 Director Barkhatova Nadezhda Aleksandrovna Address: 140181, Zhukovsky, st. Gagarina, no. 3 140083, Lytkarino, 5th microdistrict, block 2, no. 13 t. 552-5456, 555-4448, 555-4060, 552-5436 140108, Ramenskoye, st. Mikhalevich, 3 tel. (496)467-2768, Email: Branch 39 Director Konina Nina Prokofyevna Address: 142900, Kashira, st. Lenina, 2, room. 428 t. (496)692-8396,695-2949 142970, Serebryanye Prudy village, st. Pervomaiskaya, 3 t. (496)673-2795 142800, Stupino, st. Pushkina, 21 t. (469)644-0745, (496)644-0860 Email: Branch 40 Director Yulia Sergeevna Erasova Address: 141100, Shchelkovo, sq. Lenina, 3, office. 16-19 Telephone: t/f Email: Branch 42 Director Nabatchikova Galina Sergeevna Address: 142700, Vidnoye, st. Stroitelnaya, 1 (t/f 541-3011 142000, Domodedovo, Kashirskoye sh., 51 (496)794-4000 Email: Branch 43 Director Novikova Olga Ivanovna Address: 141401, Khimki, Pobedy St. , 3 Telephone: t. 572-4489 t/f 572-1095 Email: Branch 44 Director Natalya Nikolaevna Sheveleva Address: 142600, Orekhovo-Zuevo, Lenin St., 105 Telephone: (496)415-0049 Email: Branch 45 Director Tatyana Vsevolodovna Gilyazova Address: 105064, Moscow, Zemlyanoy Val St., 36, building 2 Phone: 917-8686, 917-8089, f.917-8725 Email: Branch 46 Director Olga Ambrochi Anatolyevna Address: 141500, Solnechnogorsk, Lesnaya St., 1/17 Telephone: t/f (496)264-1970 Email: Branch 47 Director Denisova Natalya Ivanovna Address: 143700, Shakhovskaya village, Sovetskaya St., No. 25, office 47 t. (496)373-4432 143800, Lotoshino village, Tsentralnaya St., 11 t. (496)362-4866, (496)362-1104 Email: [email protected]

Name of the territorial body of the social insurance fund of the Russian Federation

Share April 15 is the last day this year when entrepreneurs can confirm their OKVED data with the FSS. The most difficult thing in this process is to find the right branch and find out the registration number in the FSS.

However, it is necessary to know the FSS address in other cases. In particular:

- Opening of a separate division.

In accordance with current regulations, it must be registered with the funds at its location; - Submitting reports if done in person;

- If there are pregnant women in the organization, whose benefits are generated from the Social Insurance Fund;

- In the event of a work-related injury to an employee, to provide the necessary materials;

- When interacting on issues related to registration of sick leave.

Our expert Pavel Timokhin has prepared instructions on how to find out the FSS address by registration number in Moscow in 4 steps. STEP 1. What does the subordination code provide? The subordination code assigned to the FSS makes it possible to find out very important information about the enterprise or individual entrepreneur itself:

- Location of the enterprise, territorial affiliation.

- Simplifies the classification of enterprises in the database.

In order to use the services of communication networks when sending reporting documents, you must indicate the subordination code and have your own electronic key. It is important to remember that entrepreneurs who avoid registering with the Social Insurance Fund may be fined. Another point that a businessman and his accountant must know. Registration numbers and subordination codes are two different things.

The subordination code consists of five digits. The registration number contains ten digits. The organization indicates the subordination code when sending reporting documents to various government agencies.

In cities of federal significance and regional centers, the functions of the registrar may be assigned to one specific inspection.

- Information from the site can be printed. If there is no “Print” button on the page, then use the right-click menu.

How to find out the subordination code in the FSS Address, metro Telephones Email. mail, website of the Federal Tax Service Moscow regional branch of the Federal Tax Service of the Russian Federation Head Sidorova Natalya Sergeevna 127006, Moscow, Strastnoy Boulevard, 7, building 1, 650-25-45,650-04-51,650-23-46, https://mrofss. ru — Branch 1 m.

Mayakovskaya metro station Rechnoy Vokzal 125047, Moscow, Triumfalnaya Square, 1, building 1, entrance from 1st Brestskaya Street 13/14125565, Moscow, Leningradskoye Shosse, 84, building 1 8(495 ) 694-62-75 For policyholders Tel.: 452-04-06 For beneficiaries (san/kur) Tel.: 708-08-39 For beneficiaries (TSR) Tel.: 452-04-06 ext.

How to get a?

The number is determined automatically when a person is registered as an individual entrepreneur or legal entity. In the latter case, the tax service transmits the data independently to the FSS. Fund employees assign the appropriate code.

After the number is assigned, the data is sent by mail to the address that the individual entrepreneur indicated during registration. But sometimes the notification does not arrive on time. Therefore, it can be determined on the basis of an economic entity.

An individual entrepreneur receives a code if he or she has employees. If the activity is carried out independently, then it is not necessary to obtain a number. But this can be done at the request of the individual entrepreneur himself.

When starting a business on your own and subsequently hiring employees, an application must be submitted. This must be done even if only one employee is hired.

There is a ten-day period for filing after the employment contract is signed. If this requirement is violated, penalties will apply. The amount of the fine is determined in accordance with the number of days overdue and the type of agreement that was concluded with the employee.

If a woman carries out entrepreneurial activity, she must register. In this case, she can count on payment for maternity leave, as well as child care for up to 1.5 years.

The code is assigned one time. Subsequently, it will not change, even if any indicators in the company are adjusted. When an individual entrepreneur ceases to operate, he is deregistered.

This must be done three days after cancellation of registration by submitting documents:

- papers on the dismissal of employees (orders, copies of work books with relevant records);

- a certificate issued by the Federal Tax Service confirming the absence of tax debts;

- copies of documents on deregistration from tax registration.

The procedure will take about 14 days.

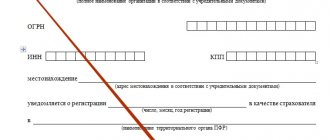

Sample notice of registration as an insurer

Name of the territorial body of the FSS by subordination code. FSS division code

The legislator has made changes to the regulations for interaction with taxpayers: now firms and entrepreneurs can report through the State Services portal. In this article we will take a closer look at how to find out the FSS subordination code by registration number or TIN, and why it is so necessary.

Electronic signature and encryption procedure are mandatory conditions for electronic interaction between taxpayers and regulatory authorities. It turns out that if you need to send a package of forms to the FSS, you need to know all the codes exactly. An error in one number will mean that the reporting was not submitted or was submitted with errors. Basic data is the own registration number of the reporting organization or individual entrepreneur and their identification code of subordination in the social insurance authorities.

Algorithm for searching codes by TIN or FSS registration number

A special interactive service of the fund will allow the code of subordination to the FSS by TIN. To do this, just indicate your identification number in a separate field and then call the search function.

The service looks like this:

In the final certificate, the system will provide comprehensive data taking into account the entered TIN. Several values can be specified here if you have not only a head office, but also branches.

PLEASE NOTE: the first 4 digits of the coding of the company's division in the fund are the subordination code.

In addition it is indicated:

- unit - if we are talking about a taxpayer-organization

- two - when a separate division is coded

- troika – for all private entrepreneurs

Systematization of accounting

- According to the regulatory document, the first four characters in the code indicate affiliation with a specific branch of the social insurance fund that registered the policyholder.

- The last, fifth digit corresponds to the type of company or legal entity.

Another point that a businessman and his accountant must know. Registration numbers and subordination codes are two different things. The subordination code consists of five digits. The registration number contains ten digits.

FSS division code and subordination

The fund needs 3 working days to assign a unique code to a new organization or entrepreneur. It is important to know that it is the tax office that notifies funds about the opening of a new legal entity and taxpayer-entrepreneur. Only after this can you expect an official letter with the FSS code to arrive at your legal address. The code itself carries information about which regional center the newly created legal entity belongs to. Anyone who knows how to read the information hidden in the code will immediately understand what company we are talking about, or rather, what territorial entity it belongs to and to whom it is accountable.

For example, codes 26233 and 26231, these taxpayers belong to the same city. The difference in the last digit means that 3 is an individual entrepreneur, and 1 is a legal entity. If there were a two at the end of the code, we would be talking about a company that has branches. It turns out that if you make a mistake even in one last digit, the specialist will immediately understand that the reporting was filled out incorrectly. Moreover, without knowing exactly the code, the company’s accountant will not be able to send it using electronic data transmission channels. Some people believe that evading registration is the right decision; in fact, this is a direct way to receive a large fine for lack of mandatory registration with the Social Insurance Fund.

We determine the Pension Fund and Social Insurance Fund by the address of the legal entity

Have questions?

Consult a lawyer (free of charge, 24 hours a day, seven days a week): - Federal number - Moscow and Moscow region. — St. Petersburg and Len. region. Any legal entity must register with social funds - the Pension Fund and the Social Insurance Fund. Despite the fact that this operation is automatically performed by the tax office when registering a company and most of the reports are sent there, knowledge of their location will be required when submitting a number of special forms.

Not all entrepreneurs know how to find the Pension Fund at the address of a legal entity. Each locality has its own system for distributing responsibility between various divisions of the Pension Fund and the Social Insurance Fund. For example, in Moscow, each branch of a pension institution serves companies located in two or three adjacent municipal districts. Therefore, the street name will not be directly linked to a specific department in the information databases; it is necessary to find out in which municipality these persons are located.

After establishing the name of the district - Strogino or Lyublino, you can begin searching for the required branch. You can find the area in any search engine or using official directories. It is necessary to understand which territorial division the company belongs to, since part of the mandatory reporting is sent there.

The company is registered with these organizations not independently, but by employees of the Federal Tax Service within 5 days after registration. They are determined on a territorial basis.

Letters

What is the FSS subordination code?

When an organization or individual entrepreneur is registered with the Social Insurance Fund, they, as policyholders, are assigned a subordination code within the following time frame:

- 3 business days from the date of receipt of notification from the Federal Tax Service (through interdepartmental interaction channels) about the appearance of a new taxpayer-legal entity in the register;

- on the same day when a separate division of the organization is registered with the Social Insurance Fund as an insurer;

- on the same day when an individual entrepreneur is registered with the Social Insurance Fund as an insurer who has drawn up an employment agreement with hired personnel (at least one employee).

During the registration procedure at the fund’s branch, the policyholder receives a number and code of subordination to the Social Insurance Fund. This information is prepared in printed form and transmitted to the individual entrepreneur or organization in a way convenient for them (in person, through a representative or by mail).

The subordination code indicates that the policyholder is attached to a specific branch of the Social Insurance Fund. It is not difficult to decode the given indicator, consisting of 5 digits: the first 4 digits on the left correspond to the code of the territorial branch of the Social Insurance Fund to which the policyholder is attached. The 5th digit means the following:

- 1 - legal entity;

- 2 - a separate division of a legal entity;

- 3 - individual entrepreneurs and other individuals.

Example

For the Leninsky district of Voronezh, the first 4 digits of this code will have the value 3601. Accordingly, for an individual entrepreneur the full code will look like 36013, and for a legal entity registered in the same area - 36011.

This code should be given in the 4-FSS report on the 1st sheet. If this indicator is omitted, the electronic program will simply not accept the report for sending.

Purpose

With the help of an identification number issued to each client, the fulfillment of obligations by the employer is verified. Control is carried out over the preparation and submission of reports to the tax service, the Pension Fund of Russia and the Social Insurance Fund. Also, the competent services use such data to monitor the payment of contributions to the funds.

The identification number is indicated when preparing reports. The data is entered manually on paper, as well as electronically in the appropriate column of the 1C program.

It is mandatory to mark the number of the insurance premium payer on the temporary disability certificates. Sick leave is transferred to the Social Insurance Fund for payments.

Also, identification of the policyholder is required when women go on maternity leave. On its basis, payments are calculated and child care benefits are calculated.

Legal entities must register with the FSS independently. Individual entrepreneurs should not apply to the Social Insurance Fund. After all, they may not make contributions, since they are independently responsible for their own lives.

Registration is required if an individual entrepreneur hires workers. After concluding an agreement with the first of them, an individual visit to the district office will be necessary. An application for registration of a person is submitted to it.

Registration is also required when concluding a civil contract with an employee when providing services and performing seasonal work.

Based on the FSS registration number, the employer deducts insurance premiums. They are necessary to protect the life and health of a working person. This eliminates financial losses in the event of accidents during production tasks.

Decoding the code and its significance

The subordination code is indicated in the registration form as an insurer of a legal entity at the location of the unit in the territorial body of the FSS of the Russian Federation. The combination of numbers is assigned during the registration of a legal entity or individual entrepreneur.

Reading the code characters, from left to right, means the following:

- 4 digits – code of the branch or the branch of the regional Social Insurance Fund with which the policyholder interacting with him was registered;

- The 5th character is the reason for registration.

The fifth character, in turn, has several meanings:

- Legal entity (LE) as the policyholder.

- Legal entity as a private division.

- An individual (individual) as an insured.

Having the above data, it is easy to find out the meaning implied by the FSS subordination code. The same applies to the name of the FSS by code.

Detailed advice on how to find out the subordination code can be obtained from the FSS employees themselves. But those sending documentation must know the code for individual entrepreneurs and enterprises in advance - before sending the reports. Without knowledge of the code, the files sent will be compiled incorrectly, and this is punishable by significant penalties from the law. The fine amount ranges from 5 to 10%. Therefore, the amount of payment varies depending on the staff of the enterprise that made the mistake.

How to determine which FSS an organization belongs to

Contents Changes in legislation have allowed organizations and entrepreneurs to send reporting documents through the public services portal.

All files are necessarily encrypted and signed with a personal electronic signature. The entire procedure is carried out using specialized software. But before sending documents to government agencies, a businessman must know his registration number and subordination code to the FSS. You can find out the policyholder’s registration number and FSS subordination code in a special service on the fund’s website.

In a single window, you need to enter the company’s TIN and click on the “Search” button: After this, the system will provide the necessary data: The system can display several values: for each branch and parent organization. The subordination code is the first 4 characters of the “FSS Subdivision Code” plus 1 character:

- 3 - if it is an individual entrepreneur.

- 2 - if this is a separate division;

- 1 - if it is an organization;

For example, in our case, for the first line the subordination code will be “2623” + “1” = “26231”.

For the second line (assuming this is a branch) - “5009” + “2” = “50092”.

An entrepreneur or organization receives a number that is registered with the Federal Insurance Chamber once in a letter after registration. But it so happened that the data was lost and now for reporting you need to restore your code.

We recommend reading: State duty for judges, how to calculate utility bills

As already written, this number is given once, and it does not change, like a pension number.

If the organization moves to another city, then the subordination code changes, since it indicates the territorial connection to the Social Insurance Fund. This number is also sent in notifications about current FSS tariffs.

Information for individual entrepreneurs

Upon receiving a subordination code, the individual entrepreneur also acquires an individual registration number. The IRN does not change in any case until the activity of the individual entrepreneur to which it is attached is liquidated.

IRN consists of 10 characters:

- the first 4 characters are the code of the branch or regional division of the Social Insurance Fund that carried out the registration;

- the remaining 6 characters are the number of the individual entrepreneur under which it is assigned to the fund database.

The subordination number assigned to an individual entrepreneur always has the last digit 3. If there is a discrepancy, the error must be immediately corrected by the Social Insurance Fund. A code is not a simple set of numbers, but they all have significance, on the basis of which it is worth treating it with complete seriousness and attention. An incorrect set of characters loses its validity and makes reporting impossible, which entails adverse consequences. The accounted file of the submitter of documentation is compiled from all those received in the database from sent reports.

All organizations and entrepreneurs hiring employees must be registered with the Social Insurance Fund as insurers. Thanks to the innovations of 2021, the powers of this body have been significantly reduced, due to the fact that most insurance benefits have been transferred to the administration of the tax inspectorate, with the exception of benefits for accidents and injuries at work.

Document 4-FSS has also undergone changes, which due to innovations has been reduced as much as possible. However, the need to disclose information about the subordination code in the report remains the same. For this reason, many questions arise about how to find out the FSS subordination code.

When going through the stages of registration with the insurance authorities, each company and businessman must be assigned a registration number and subordination code. Despite this, when compiling insurance reports, questions often arise about how you can obtain information about the subordination code of your organization.

The subordination code includes five characters, each of which is an element of the coding system and reveals specific information. The first four characters of this code are intended to indicate the territorial body of the Social Insurance Fund that registered the company, and the last indicates the role of the insurer company.

The last element of the subordination code must take the following values:

1 – for organizations, i.e. for legal entities;

2 – for companies with separate divisions;

3 – for individual entrepreneurs.

Information about the code and registration number is transmitted to the companies in a letter. When for some reason the necessary information is not available in the organization (the letter is not received or is subsequently lost in the organization), then filling out the 4-FSS reporting form becomes impossible, due to the fact that this code must be indicated at the top of each calculation sheet.

Registration and deregistration in extra-budgetary funds

Payers of insurance premiums are persons (organizations, individual entrepreneurs, heads of peasant farms, lawyers, notaries, etc.) who are required to pay contributions for compulsory social insurance. They are also called policyholders

.

Registration of policyholders is carried out by control bodies - territorial branches of the Pension Fund of Russia

and

FSS

.

- At the same time, PFR units keep records of payers of insurance premiums for pension insurance, as well as for compulsory medical insurance ( CHI

). - The bodies of the Federal Social Insurance Fund of the Russian Federation keep records of payers of contributions for disability and maternity.

Payers of insurance premiums must be registered

as policyholders in extra-budgetary funds.

As a general rule, registration of contribution payers is carried out without an application.

When registering a legal entity (LE) or individual entrepreneur (IP), the tax authority (or other registration authority), using the “one window” principle, independently transmits information about new taxpayers to all extra-budgetary funds.

Divisions of the Pension Fund of the Russian Federation and the Federal Insurance Fund of the Russian Federation, in turn, are required to register new policyholders within three days and assign them registration numbers

.

Thus, when registering a new taxpayer, registration with the territorial bodies of extra-budgetary funds is carried out without an application.

, i.e. without personal appeal from legal entities and individual entrepreneurs.

The table reflects information about which fund the registering authority transfers information about the payer to and within what time frame the Pension Fund of the Russian Federation and the Federal Social Insurance Fund of the Russian Federation carry out registration of policyholders.

| Policyholder | Registration period | |

| In the Pension Fund of Russia | In the bodies of the FSS of the Russian Federation | |

| Legal entities | No more than three working days from the date of receipt of information from the tax authority | No more than three working days from the date of receipt of information from the tax authority |

| Individual entrepreneurs, heads of peasant farms | — | |

| Lawyers, notaries engaged in private practice | No more than three working days from the date of receipt of information from the territorial body of the Ministry of Justice of Russia | — |

From a document sent to the policyholder electronically.

A document confirming the fact of registration with the Pension Fund of the Russian Federation (and for organizations - with the Federal Social Insurance Fund of the Russian Federation) is sent to the policyholder in electronic form

with an enhanced qualified electronic signature via TCS, including via the Internet, and to an email address.

Notice of registration with registration number on paper

the payer has the right to receive voluntarily by application. This document is issued upon request within three working days.

Attention!

To find out the registration number, we advise you to request an extract from the Unified State Register (USRLE/USRIP).

The following policyholders are additionally required to register.

- Separate divisions of organizations

- Individual entrepreneurs (heads of peasant farms, lawyers, private notaries) - in case of concluding employment contracts with employees or making payments under civil law contracts

- Separate units

- Individual entrepreneurs

When creating a separate subdivision (SU), the organization must register as an insurer with the Pension Fund of the Russian Federation and the Federal Insurance Fund of the Russian Federation at the location of this subdivision, if the following conditions are simultaneously met:

- the division has a separate balance sheet and current account;

- The division independently calculates payments in favor of employees.

If any of the listed conditions are not met, the policyholder is not registered at the location of the separate unit, and all responsibilities of the separate unit related to the calculation and payment of insurance premiums, submission of calculations of contributions, are performed by the parent organization at its location.

You must submit an application and a package of documents yourself.

To register at the location of a separate unit, the organization must submit the appropriate applications

to the branches of each extra-budgetary fund in the prescribed form:

- application form to the Pension Fund;

- application form to the FSS of the Russian Federation.

To the application, policyholders must attach copies of documents confirming the existence of a separate balance, current account and the accrual of payments and other remuneration to individuals.

Within 30 days from the date of creation of a separate unit.

Applications and documents must be submitted to the territorial body of the FSS of the Russian Federation within 30 days

from the date of creation of a separate division.

The deadline for registering an organization in the territorial branch of the Pension Fund of the Russian Federation at the location of the separate unit has not been established

. However, it is advisable to register the OP before insurance premiums from payments to individuals are transferred for the first time. This will allow you to identify payments from this department.

No later than five days

from the moment of receipt of the application and documents, the bodies of the Pension Fund of the Russian Federation and the Federal Insurance Fund of the Russian Federation must register a separate division as an insurer.

At the same time, in each fund the unit will be assigned an individual registration number (when registering with the Federal Social Insurance Fund of the Russian Federation, it will also be assigned a subordination code). It will be indicated in the registration notice, which is sent to the policyholder by the territorial branches of the Pension Fund of the Russian Federation and the Social Insurance Fund of the Russian Federation.

Attention!

The Pension Fund of the Russian Federation sends two copies of the notice of registration of the OP, one of which must be submitted to the Pension Fund of Russia branch at the location of the parent organization within 10 days from the date of its receipt.

An individual entrepreneur must independently

register with the Pension Fund of the Russian Federation and the Federal Social Insurance Fund of the Russian Federation only in the following cases:

- an employment

or

civil law

with an individual , as well as

an author’s

contract; - in the territorial branch of the Federal Social Insurance Fund of the Russian Federation - upon concluding an employment

contract with the employee.

The procedure for registering lawyers and private notaries is the same as for individual entrepreneurs.

Attention!

Individual entrepreneurs are no different from other employers. They must also enter into employment contracts with employees and maintain their work records.

You must submit an application and a package of documents.

To register as an insurer-employer, an individual entrepreneur must, within the prescribed period, submit to the Pension Fund of the Russian Federation and/or the Federal Social Insurance Fund of the Russian Federation at his place of residence.

a corresponding application with the necessary documents attached.

To register at the Pension Fund

An application and copies of the following documents are submitted at the place of residence:

- an identity document confirming registration at the place of residence;

- certificate of registration as an individual entrepreneur;

- licenses to carry out certain types of activities (if available);

- certificates of registration with the tax authority;

- labor (civil law, copyright) contract with an individual.

For registration at the FSS branch of the Russian Federation

An application is submitted at the place of residence, a passport and copies of the following documents are presented:

- certificate of registration as an individual entrepreneur;

- certificates of registration with the tax authority;

- the employee’s work book with a record of employment with this individual entrepreneur.

Attention!

If an individual entrepreneur who has employees working under employment contracts has already been registered with the funds as an insured employer, then in the future there is

no need

.

The following deadlines for registration in extra-budgetary funds have been established for individual entrepreneurs.

- In the Pension Fund of Russia - within 30 days

from the date of concluding an employment (civil law, copyright) contract with the first employee. - In the Federal Social Insurance Fund of the Russian Federation - no later than 10 days

from the date of concluding an employment contract with the first employee.

No later than five days

from the moment of receipt of the application and documents, the bodies of the Pension Fund of the Russian Federation and the Federal Insurance Fund of the Russian Federation will register the entrepreneur as an insured employer, which will be reported by notifications of registration. The notifications will indicate the registration number in the relevant fund (if registered with the Federal Social Insurance Fund of the Russian Federation, the subordination code will also be indicated).

Attention!

Now an entrepreneur will have two registration numbers in the Pension Fund:

- number assigned upon registration as an individual entrepreneur,

- number assigned to both the employer.

Having hired employees, an individual entrepreneur must pay insurance premiums both for himself and for his employees. In this case, the payment documents will need to indicate the corresponding registration numbers and BCC.

Penalties are applied to policyholders for late registration.

For violation of the established registration period, the following fines are applied to policyholders:

- up to 90 days - in the amount of 5,000

rubles, - for more than 90 days - in the amount of 10,000

rubles.

For carrying out activities by an individual entrepreneur who has entered into an employment contract, without registering as an insured-employer with the Social Insurance Fund, a fine of 10% of the taxable base for calculating contributions for the entire period of activity is levied, but not less than 20 000

rubles

In addition, for violating the registration deadlines, an entrepreneur or an official of an organization may be brought to administrative liability in the form of a fine from 500

up to

1,000

rubles. Administrative liability does not apply to lawyers and notaries.

Attention!

Both the Pension Fund and the Social Insurance Fund can fine the policyholder, or both funds can fine them.

Basically, the Pension Fund of the Russian Federation and the Federal Insurance Fund of the Russian Federation independently deregister policyholders.

The territorial bodies of extra-budgetary funds themselves deregister policyholders based on what they receive from the tax authorities.

data.

This happens in the following cases:

- upon liquidation

or reorganization of an organization; - when an individual entrepreneur ceases his activities;

- when the location

of the organization (place of residence of the entrepreneur) changes, if at the new address it is subordinate to another territorial division of the Pension Fund of the Russian Federation or the Federal Social Insurance Fund of the Russian Federation.

First, the tax authorities enter the relevant information (about termination of activity or change of address) into the Unified State Register of Legal Entities/Unified State Register of Individual Entrepreneurs and send information about this to the branches of the Pension Fund of the Russian Federation and the Federal Social Insurance Fund of the Russian Federation in which the organization or entrepreneur is registered.

After this, these off-budget funds independently withdraw

organization or entrepreneur registered as policyholders.

Information on the time frame for non-budgetary funds to deregister policyholders is given in the table.

| Policyholder | Deadline for deregistration | |

| In the Pension Fund of Russia | In the bodies of the FSS of the Russian Federation | |

| Legal entities | No more than three working days from the date of receipt of information from the tax authority | Within five days from the date of receipt of information from the tax authority |

| Individual entrepreneurs, heads of peasant farms | — | |

| Lawyers, notaries engaged in private practice | No more than three working days from the date of receipt of information from the territorial body of the Ministry of Justice of Russia | — |

When policyholders independently apply for registration.

In some cases, in order to be deregistered, an organization, an entrepreneur, as well as a lawyer and a private notary must themselves apply to extra-budgetary funds to do so. The following policyholders must submit such an application:

- organization upon closure of a separate division

that is registered in extra-budgetary funds; - an individual entrepreneur upon termination of an employment contract

with the last employee.

The Pension Fund of the Russian Federation and the Social Insurance Fund of the Russian Federation deregister such policyholders within the time limits specified in the table.

| Policyholder | Deadline for deregistration | |

| In the Pension Fund of Russia | In the bodies of the FSS of the Russian Federation | |

| Individual entrepreneurs (lawyers, notaries) – employers | No more than three working days from the date of receipt of information from the tax authority | Within 14 days from the date of filing the application for deregistration |

| Legal entities at the location of the separate division | — | |

A document confirming deregistration with the Pension Fund of Russia is sent to the policyholder in electronic form

. To confirm deregistration, receipt by the policyholder of a paper document is not mandatory. This document is issued upon request within three working days.

The procedure for deregistration is not as clearly prescribed by the legislator as the procedure for registration. There is no provision for liability for violating the deregistration procedure. However, you should not delay submitting an application for deregistration, since control authorities will require you to submit reports on the payment of insurance premiums.

To submit an application for deregistration of an organization with the Pension Fund of the Russian Federation and the Federal Social Insurance Fund of the Russian Federation, you need to:

- When closing a division, which has a separate balance sheet, its own current account and itself calculates and pays insurance premiums from payments to individuals.

- If the division has lost the authority to maintain a separate balance sheet, current account or accrue remuneration in favor of individuals.

To deregister an OP, you must submit a corresponding application

to the Pension Fund of the Russian Federation and the Federal Social Insurance Fund of the Russian Federation at the location of the separate unit:

- application form to the Pension Fund;

- application form to the FSS of the Russian Federation.

- Deregistration from the Social Insurance Fund

- Deregistration with the Pension Fund of Russia

- application in the prescribed form;

- notification of registration in the fund;

- copies of documents that confirm the termination of the employment contract with the last employee (copies of the order to dismiss the employee, employment contract, extract from the order register or employee accounting register, etc.).

The application must be accompanied by copies of the decision (order, instruction) on the termination of the activities of a separate division or on the transition to centralized payment of insurance premiums through the parent organization.

The application to the division of the FSS of the Russian Federation must also be accompanied by a notice of registration of the organization as an insurer at the location of the separate division.

In case of termination of employment relations with the last of its employees.

If an individual entrepreneur had hired employees and he terminated his employment relationship with them, he will need to take measures to deregister with the Pension Fund of the Russian Federation and the Social Insurance Fund as an employer.

At the same time, the procedure for deregistration is not as clearly defined as the procedure for registration. For example, there are no deadlines for filing an application for deregistration. There is also no provision for liability for violating the deregistration procedure.

Attention!

While an individual entrepreneur is registered with extra-budgetary funds as an employer-insurant, he, in the opinion of regulatory authorities, retains the obligation to submit reporting documents on the calculation and payment of insurance premiums.

After termination of employment relations with the last of his employees, an individual entrepreneur must submit an application for deregistration to the territorial branch of the Federal Social Insurance Fund of the Russian Federation.

Attention!

If, in addition to employment contracts, an entrepreneur has entered into civil contracts with individuals that continue to be valid and under which the obligation to pay accident insurance premiums remains, then there is no need to deregister.

To deregister from the Social Insurance Fund, you must submit the following documents:

There is no deadline for filing an application for deregistration. It is stipulated that the FSS must deregister an individual entrepreneur within 14 days after submitting documents.

The procedure regulating the registration and deregistration of insurance premium payers with the Pension Fund does not oblige

Individual entrepreneurs contact the Pension Fund when dismissing employees.

But it would be logical for an entrepreneur to de-register with the Pension Fund of Russia branch. After all, when concluding an employment or civil law contract with an individual, the individual entrepreneur submits to the Pension Fund of Russia an application for registration as an insurer.

In any case, we recommend that individual entrepreneurs submit an application to the Pension Fund for deregistration as an employer. Otherwise, according to Pension Fund employees, the individual entrepreneur is obliged to submit zero reports within the established time frame.

Subordination code in the FSS: how to find out

The policyholder can obtain information about the subordination code in several ways. Let's take a closer look at each of them:

- The first and easiest is to refer to the registration documents. However, a situation may arise when a letter from the FSS with registration data is missing.

- Policyholders have the opportunity to find out the FSS subordination code using the TIN. To do this, it is enough to contact the territorial body of the FSS in person. In this case, employees of the insurance authority will inform you about the reliable code of subordination and the company will not have problems with reporting. To do this, inspectors must provide an INN, a passport and a document confirming that the person has the right to receive information (power of attorney, order, etc.). You can get the FSS code by TIN by using the social insurance fund portal and requesting data on the subordination code from this electronic resource. To do this, just go through a simple registration process and fill out a form to receive information about the code. Then the program will provide information relevant to the policyholder.

- It is possible to find out the FSS subordination code by the registration number of the policyholder. These two codes partially overlap in their meanings. In order to determine the code of subordination, it is necessary to answer the question of how to find out the code of the FSS department. The registration number consists of ten characters: the first four show the FSS unit code, that is, the territorial body of the FSS, and the remaining six serve to reflect information about the serial number of the insured. Accordingly, in order to find out the FSS subordination code by registration number, you need to take the first four characters of the registration number and add to them the indicator characterizing the policyholder, discussed above (1 - for organizations, 3 - for individual entrepreneurs).

- There is another way to obtain information about the FSS subordination code. If during the period the insurance authorities sent notification letters to the organization about insurance rates, then information can be obtained from this letter. This distribution must be carried out by FSS employees every year, and the 4-FSS report must be submitted at the end of each quarter, so this option will not be convenient for every company.

Thus, without information about the subordination code, the policyholder will not be able to fill out reports for the Social Insurance Fund. If the report is transmitted via electronic communication channels, the system will not allow you to submit a report with blank fields. If 4-FSS is transferred during a personal visit, the inspectors may have a lot of questions and the policyholder will be refused to accept the report. As a result, there may be a violation of the deadlines for submitting insurance reports and the imposition of penalties on the company.

On the title page of form 4-FSS there are several cells to fill out, which often raise questions for beginners. There are usually no questions about the policyholder's registration number. But the next line - the subordination code, consisting of 5 characters, often causes confusion.

How to obtain and how to find out the FSS registration number

Things are different with entrepreneurs. If an entrepreneur does not have employees, then registration of an individual entrepreneur as an insurer is not carried out. The obligation of an individual entrepreneur to register as an insurer arises after hiring the first employee. An entrepreneur must submit an application for registration to the Fund within 30 days from the date of concluding an agreement (labor or civil law). In this case, a package of documents is submitted to the Fund, including:

The need to register a company may arise when opening a separate division located in another area. In this case, the company will need to register with the Fund’s branch and at the location of the corresponding separate division. The order of the Ministry of Labor dated April 29, 2016 No. 202n regulates the registration procedure. To do this, the company submits an application to the Fund’s branch within 30 days from the date of creation of a separate division.

We recommend reading: Million Rural Doctors Law

How to find out the FSS department code

The division code is also a subordination code; it is a code that consists of 5 digits, in which each digit indicates which particular department or branch of the Social Insurance Fund your company or individual entrepreneur belongs to.

The first 2 characters of the code are the code of the region in which you are registered. Accordingly, for Moscow it is 77, for St. Petersburg - 78, etc. The TIN begins in exactly the same way - with the region code.

The next two digits are the code of your FSS branch where you are registered. For example, if you belong to FSS branch No. 10 in Moscow, then the first four digits of your FSS unit code will be 7710. If there are no branches in your region, these two cells will contain the number of the FSS branch itself.

© photobank Lori

The fifth digit of the code indicates the reason for registering the company or individual entrepreneur. Most often, the fifth digit is 1. It indicates registration as an insured - a legal entity.

If the policyholder is a separate division of a legal entity, the fifth digit will be number 2. If the policyholder is an individual (including an individual entrepreneur), number 3.

In the example given above, a legal entity registered with branch No. 10 in Moscow enters the FSS division code - 77101 - when filling out form 4-FSS.

The easiest way to find out the subordination code is from the notice of registration of your company as an insured - it contains this code, as well as the registration number of the insured. However, you can recognize it by looking at the first 4 digits of your registration number. They are identical to the subordination code. And knowing what the last digit of the code means, it’s not difficult to substitute the fifth character yourself.

If for some reason you do not have a notification in your hands, you can check the code on ]]> the FSS website ]]> .

There is one more code that is important for the policyholder to know - the code of the executive body (body code) of the Social Insurance Fund. This is the same code as above, just without the fifth digit.

That is, the authority code for a legal entity registered in branch No. 10 in Moscow is 7710.

Instructions on how to find out the number in the Pension Fund of Russia by TIN online through the Federal Tax Service website

- Go to a special section of the tax service website - https://egrul.nalog.ru/.

- Enter the INN or OGRN (OGRNIP) or the name of the legal entity, full name of the individual entrepreneur and click “Find”. If necessary, select regions and check the box whether you need to search only by exact match of the name of the legal entity or last name, first name and patronymic. No additional registration is required when using the service on the website.

- The search results will contain a list of legal entities and individual entrepreneurs that meet the conditions. When you click on the “Get Statement” button, a PDF file will be downloaded, in one of the sections of which the required number in the Pension Fund will be displayed.

Screenshots for easy understanding:

Registration number of the policyholder in the Social Insurance Fund

→ → Update: March 3, 2021

Individual entrepreneurs and organizations receive their FSS registration number in different ways.

Companies receive it without contacting social insurance authorities, and individual entrepreneurs in some cases must take the initiative. Why do you need a FSS registration number? What do you need to do to get this number, and how do you find it?

We'll talk about this in this article. When registering a company, information about it is transferred through interdepartmental cooperation to the bodies of extra-budgetary funds, including the Social Insurance Fund.

There, this information is taken into account for further control of the company in terms of fulfilling obligations to pay insurance contributions for compulsory social insurance, provide reports and others. For all this, the company is assigned a unique registration number of the policyholder in the Social Insurance Fund. This is a 10 digit number containing:

- code of the FSS territorial agency that registered the company (the first four digits of the number);

- unique number of the policyholder (digits from 5 to 10).

In addition, the company is assigned a subordination code, consisting of 5 digits and including the code of the FSS territorial agency in which the company is registered.

Thus, the company does not need to apply to the Social Insurance Fund on its own initiative to register. Such registration will occur in any case.

Notification of this will be sent by the FSS authorities to the address specified by the company when registering with the Federal Tax Service.

The need to contact the Social Insurance Fund and register with the company may arise if a separate division is created.

Find funds by tax number

We can choose exactly the tax office you need or for an existing company. No. Federal Tax Service No. FSS, address and telephone number of the Pension Fund of Russia No. of the Pension Fund of the Russian Federation Service area. PFR Address and telephone number of the Pension Fund of the Central Administrative District Federal Tax Service No. 1 Branch of the Social Insurance Fund No. 6 Address: 105120,

Moscow, 3rd Syromyatnichesky lane, 3/9, building 2 Phone: (495) 917-49-31; 916-81-98; 917-20-40; 917-96-14 E-mail: Pension Fund No. 10 Department 1 Tverskoy Krasnoselsky Meshchansky Address: 115114,

Moscow, Shlyuzovaya embankment, 8, bldg.

2 Tel.: 8-499-235-10-39 Federal Tax Service No. 2 Branch of the Federal Tax Service No. 7 Address: 105120, Moscow, 3rd Syromyatnichesky Lane, 3/9, building 2 Telephone: (495) 917- 49-31; 916-81-98; 917-20-40; 917-96-14 E-mail: Federal Tax Service Inspectorate No. 3 FSS Branch No. 36 Address: 115054, Moscow, Ozerkovskaya embankment, 50, building 1 Telephone E-mail: Federal Tax Service Inspectorate No. 4 FSS Branch No. 11 Address: 109147 , G.

Moscow, st. Marksistskaya, 34, bldg. 7 Telephone E-mail: Pension Fund No. 10 Office 2 Tagansky Basmanny Yakimanka Address: 115114, Moscow, Shlyuzovaya embankment, no. 8, bldg.

1 Tel.: 8-499-678-30-36 Federal Tax Service Inspectorate No. 5 FSS Branch No. 31 Address: 125047, Moscow, 1st Brestskaya, 13/14 Telephone E-mail: Federal Tax Service Inspectorate No. 6 FSS Branch No. 31 Address: 125047, Moscow, 1st Brestskaya, 13/14 Telephone E-mail: Federal Tax Service Inspectorate No. 7 Branch of the Federal Tax Service No. 7 Address: 115419, Moscow

Moscow, 2nd Verkhniy Mikhailovsky proezd, 9.str.2, office 108 Telephone, E-mail: Federal Tax Service Inspectorate No. 8 Branch of the Federal Tax Service No. 36 Address: 115054, Moscow, Ozerkovskaya