When to pay tax

General approach

As a general rule, personal income tax must be paid in 2021 no later than the day following the day the employee (individual) was paid income. So, let’s say the employer paid the salary for January 2021 on February 9, 2021. The date of receipt of income will be January 31, 2021, the date of tax withholding will be February 9, 2021. The date no later than which personal income tax must be paid to the budget, in our example – February 11, 2021.

Benefits and vacation pay

Personal income tax withheld from temporary disability benefits, benefits for caring for a sick child, as well as from vacation pay must be transferred no later than the last day of the month in which the income was paid. For example, an employee goes on vacation from March 6 to March 23, 2017. Vacation pay was paid to him on March 1. In this case, the date of receipt of income and the date of withholding personal income tax is March 1, and the last date when personal income tax must be transferred to the budget is March 31, 2021.

In general, pay the withheld personal income tax in 2021 to the details of the Federal Tax Service with which the organization is registered (paragraph 1, clause 7, article 226 of the Tax Code of the Russian Federation). Individual entrepreneurs, in turn, pay personal income tax to the inspectorate at their place of residence. However, individual entrepreneurs conducting business on UTII or the patent taxation system transfer tax to the inspectorate at the place of registration in connection with the conduct of such activities.

Also see “Personal Income Tax Payment Deadline in 2021: Useful Tables.”

Emerging difficulties - tax period code

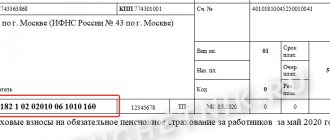

The sample payment order contains field 107, where you need to indicate the tax period code.

The instructions for filling out payment slips do not directly answer the question posed. What exactly should you put in this field?

Based on Federal Tax Service letter No. BS-3-11/ [email protected] dated September 1, 2021, the month code should be entered here.

In most cases, this field is not provided for a specific date of receipt of income.

The exception is those situations where the law establishes several exact deadlines with specific dates for payment.

Let's give a few examples.

- When transferring personal income tax, you need to look at when, according to tax law, this payment will be recognized. Let's say for wages this is the final day of the month in which the funds were received. Then, for personal income tax on wages for March, you need to enter the code for this particular month, even if the funds are issued in person in April.

- As for vacation pay, the tax office recognizes the payment on the day it is transferred. Therefore, in this case, in field 107 you should put the code of the month in which the funds were transferred to the employee.

- The same rule applies to sick leave, the calculation of which has been amended. The payment is recognized by the tax service on the day it is made. This means that you need to put in the payment order the code of the month in which the amount was issued, even if the employee brought the sick leave in another month.

Another question that arises in this regard is how to document payments for taxes transferred on the same day?

It all depends on which month these incomes relate to.

If payments for vacation and sick leave fell within one month, it is enough to fill out one payment order.

However, if on the same day you need to transfer personal income tax on income relating to different months, you should fill out two separate payments.

back to menu ↑

KBK in 2021

In connection with the publication of Order No. 230n of the Ministry of Finance of Russia dated December 7, 2016, some BCCs changed in 2017. So, for example, the BCC for insurance premiums has changed. See “KBK for insurance premiums in 2021: table with explanation.”

However, the BCC for personal income tax for employees in 2021 did not change and remained exactly the same. The BCC on personal income tax for individual entrepreneurs has not undergone any amendments. We present in the table the current main BCCs for 2021 for income tax.

| Type of personal income tax | KBC for 2021 |

| Personal income tax on employee income | 182 1 0100 110 |

| Penalties for personal income tax on employee income | 182 1 0100 110 |

| Personal income tax fines on employee income | 182 1 0100 110 |

| Tax paid by individual entrepreneurs on the general taxation system | 182 1 0100 110 |

| Penalties for personal income tax paid by individual entrepreneurs on the general system | 182 1 0100 110 |

| Penalties for personal income tax paid by individual entrepreneurs on the general system | 182 1 0100 110 |

Sample payment order 2021

The budget classification code (BCC) must be indicated in field 104 of the payment order for the payment of personal income tax.

Accordingly, if a tax agent transfers personal income tax in 2021, the payment order may look like this:

When filling out the payment form (field 104), it makes sense to carefully indicate the BCC for personal income tax in 2021. Inaccuracy in even one figure will lead to incorrect posting of payments in the budget. The payment will have to be “searched” and clarified. The correct BCC for personal income tax for 2021 is a very important “moment”.

Read also

26.12.2016

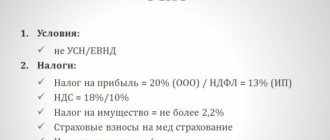

VAT: basic concepts

In Russia, the value added tax appeared in 1992, and its history begins with the German economist Wilhelm von Simenson, who in 1919 proposed a “refined turnover tax.”

In tax practice, the French were the first to levy VAT in 1954, but not on the territory of their country, but in the colony of Cote d'Ivoire. Today, VAT with various modifications exists in tax practice in more than 50 countries around the world. In the legislation of the Russian Federation, Chapter 21 of the Tax Code of the Russian Federation is devoted to VAT. In addition, the Ministry of Finance and the Federal Tax Service constantly issue letters and clarifications for ambiguous situations.

The essence of VAT is the withdrawal from the budget of part of the value added at each stage of production of a product or creation of a service. VAT refers to indirect taxes, in contrast to direct taxes, which are levied directly on the financial results of the taxpayer’s activities or his property; VAT is included in the price of each product. And the actual tax payers are citizens, since they regularly buy goods or use services. Businessmen, in fact, only transfer the tax amount to government agencies.

The advantage of VAT as an indirect tax is that revenues from it to the budget do not dry out: even in a crisis situation, the population needs to make purchases, even the most minimal ones, only what is necessary for life.

According to Art. 143 of the Tax Code of the Russian Federation, organizations, entrepreneurs and persons moving goods across the borders of the Customs Union are required to pay VAT. Taxpayers in special regimes, as well as a number of companies organizing major sporting events in the Russian Federation, are exempt from VAT.

The Tax Code of the Russian Federation provides for tax exemption in several other cases. Read more in the material “How to properly exempt from VAT” .

The object of taxation is the sale of goods or the provision of services, the performance of construction and installation work on one’s own, the importation of goods into the Russian Federation, the transfer of goods or the provision of services for the company’s own needs (Article 146 of the Tax Code of the Russian Federation).

What business processes are not subject to tax, read the article “Transactions not subject to taxation: types and features” .

The taxpayer will calculate the amount of VAT payable to the budget as the difference between the “outgoing” tax (that is, the tax presented to buyers of his goods or (that is, the one allocated by his suppliers in invoices).

The basic VAT rate in 2020-2021 is 20%. For socially significant goods, reduced tax rates are provided: 10 and 0% (Article 164 of the Tax Code of the Russian Federation). In addition, a number of transactions are exempt from taxation: education, banking, ritual, religious services, transportation of passengers.

The tax period for VAT is quarterly. At the end of each quarter, the taxpayer submits a declaration and pays tax to the budget.

NOTE! The VAT return is submitted only electronically.

In 2020-2021, the deadlines for submitting VAT reports (including postponements) are as follows:

- for the third quarter of 2021 - until October 26, 2020;

- for the fourth quarter of 2021 - until January 25, 2021;

- for the first quarter of 2021 - until 04/26/2021;

- for the second quarter of 2021 - until July 26, 2021;

- for the third quarter of 2021 - until October 25, 2021;

- for the fourth quarter of 2021 - until 01/25/2022.

In order for the declaration to pass control at the Federal Tax Service, and for the payment order to be correctly executed by the bank, the accountant must indicate the correct BCC VAT years 2020-2021.

Why is the accounting register filled out?

A tax accounting register is prepared for each employee.

This applies equally to those who work under an employment contract and to those who are registered on the basis of a civil law agreement.

The tax register contains the following information:

- income received during the year by an individual;

- the amount of tax deductions;

- amount of personal income tax contributions.

Although there is no single template for the register, the Tax Code defines a number of requirements for its content. Let's list the main ones:

- Personal data of the taxpayer (this includes full name, tax identification number, passport details).

- Code of income received.

- Tax deductions and their size.

- The total amount of income with the date they were received.

- Status (whether the taxpayer is a resident of the Russian Federation).

- Date of deduction and transfer of personal income tax contribution, payment order number.

Information from the register is used to issue a certificate in form 2-NDFL.

back to menu ↑

More information about the types of personal income tax reporting

Each employer (this applies equally to individual entrepreneurs and organizations) needs to submit reports in a timely manner.

Let's consider 2 forms - 6-NDFL and 2-NDFL.

- Quarterly, the employer must provide a form in Form 6-NDFL. This rule is enshrined in Law No. 113-FZ of May 2, 2015. The completed document is submitted by the last day of the month following the reporting period.

- Every year, a 2-NDFL certificate is compiled for each employee. Since December 8, 2015, its updated form has been in force, established by Order of the Federal Tax Service No. MMV-7-11 / [email protected] dated October 30, 2015. The deadline for submitting a certificate in general cases is April 1. If it is impossible to deduct personal income tax, the form must be submitted before March 1. The certificate should be accompanied by the Register of Information on the Income of Individuals in two copies.

The document in form 2-NDFL can be submitted either in person or by electronic communication.

A printed document can be provided by an employer with fewer than 25 employees (instructions are provided for calculating the average number of employees).

It can be brought directly to the tax office. Sending by registered mail is also possible.

Important: when visiting the tax office in person, you must obtain a protocol from the employee confirming the acceptance of the document. One copy remains with the inspection, the second is given to the applicant.

If the number of employees is 25 or more people, the 2-NDFL certificate is provided in electronic form.

It can be brought to the inspection on removable media or sent via the Internet.

If we take the latter, within 24 hours the tax service must notify the applicant of the acceptance of the document. The protocol is sent within 10 days.

back to menu ↑