1C Accounting 3.0.75.109

In accordance with the requirements of Article 170 of the Tax Code, organizations carrying out both VAT-taxable and tax-exempt transactions are required to keep separate records of incoming VAT amounts.

Briefly

- The accounting policy should indicate that separate VAT accounting is carried out.

- When preparing documents for Receipt of goods and services, the method of further VAT accounting is indicated for each line.

- At the end of the reporting period, a “VAT Distribution” document is created, which calculates the amount of goods/services sold with and without VAT. And then, in the same proportion, we distribute the VAT for each line of the Receipts document, where “Distribute” was indicated. The part of VAT attributable to sales without VAT is included in the cost of the product/service by the same document.

- And the part of the VAT attributable to sales with VAT is accepted for deduction, for which the necessary records are created in the document “Creating purchase ledger entries”.

Details.

The first thing to do is Menu / Administration / Accounting parameters / Setting up a chart of accounts / Accounting for VAT amounts on purchased assets / check the “By accounting methods” flag.

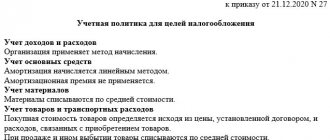

Next, we proceed to changing the accounting policy on the Menu / Home / Taxes and reports tab.

Tip - Create a new accounting policy line for each year. If there are changes in the work with the program with accounting policies that were not possible in previous years, you may not see the changes. And one more thing - after making changes to the accounting policy, it is necessary to re-post all documents included in the period of change.

— on the “VAT” tab, check the “Separate accounting of incoming VAT by accounting methods is maintained.”

ATTENTION . After setting this flag in documents of the type “Invoice received”, the ability to set the flag “Reflect VAT deduction in the purchase books by the date of receipt” disappears. It is possible to reflect a deduction only using the regulatory document “Creating Purchase Ledger Entries.”

When migrating from version 2.0, you may not see this flag if the accounting policy was created for several years. Create a separate line for the last year.

Set the application start date. After this, the program will generate balance entry documents and provide you with the link “Balance Entry Documents” for editing.

This is well described here - “1C: Accounting 8” (rev. 3.0). How to enter balances for VAT accounting purposes (+ video)? I would like to highlight some issues.

To maintain separate accounting, balances by batch are required so that the program knows when registering an expense from which receipt it is doing this, and what to do with VAT.

At the beginning of the quarter there should be no VAT for distribution; all of it should have been distributed at the end of the previous quarter.

In the tabular part of the document, when you click on the “Accounts” column, an additional window appears, where there is a field “VAT accounting method”.

If this material/service is intended to be used for the sale of goods/services with VAT included, “Accepted for deduction” is indicated. If VAT is excluded, “Included in the price” is indicated. If it is intended for both cases, “Distributed” is indicated.

This field can be filled out in one of the following ways:

— select one of the values separately in each line.

— editing all lines. To do this, use the “Change” button.

— in order for the column to be filled in automatically, you must fill out the “Item Accounting Accounts” directory.

— you can fill out all the lines for several documents at once using the “Group change of details” processing.

The document is created once per reporting period (features for OS and intangible assets are discussed below)

On the “Revenue from Sales” tab, the distribution base is automatically filled in. If you are not satisfied with the calculated amounts, you can correct them.

On the “Distribution” tab, the tabular part of the document is automatically filled in with VAT amounts for which the “Distributed” accounting method is specified.

Please note that materials written off for production are distributed in a separate line from the same materials from the same batch, but not yet written off.

This document immediately generates transactions for including distributed VAT in the price.

This document is no different from the usual one. One can only note that if some of the received materials were written off, and some have not yet, in the “VAT Distribution” document these materials were divided into different lines, and in this document they are again collected in one line.

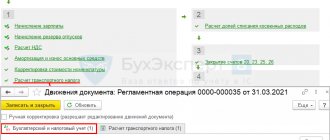

It is recommended to carry out all routine operations from the VAT calculation assistant (Menu / operations / Month closing / VAT calculation or Menu / Reports / VAT reporting), which will ensure the correct sequence of execution.

Example #1

It is necessary to distribute VAT in the amount of 40 rubles from the services received, which were used for the sale of goods with and without VAT. When registering the receipt, VAT was marked for distribution.

During the reporting period, goods were sold for 80 rubles with VAT and for 20 rubles without VAT.

In our example, 4/5 should be taken as a deduction, and 1/5 should be taken into account in the cost. Why in the document “Distribution of VAT” the third subconto 19 of the account will be changed from “Distributed”: for the VAT amount of 32 rubles to “Accepted for deduction”, and for the VAT amount of 8 rubles to “Taking into account in the cost”.

Distribution of VAT for separate accounting

Let's see how the mechanism for posting VAT in the Turnover Balance Sheet/SALT works according to account 19.

Fig.7 SALT according to account 19

SALT according to account 19 is a separate accounting register, which reflects tax amounts with different accounting procedures. Before the start of operations for posting VAT and before entries are generated in the Purchase Book, the balance on account 19 is not closed, with the exception of VAT taken into account in the cost, since it is displayed on this account in transit.

If you generate SALT according to account 19 after posting the tax, then the additional subconto will indicate the unclosed balance at the end of the selected period. Then you can close it using the routine operation “VAT Distribution”. It is carried out on the basis of primary documents, which set all the parameters for correct accounting.

Fig.8 VAT posting

After automatic filling, click the “Fill” button in the table field to display the data of the accumulation register “VAT on indirect expenses” for the period we need. After this, the costs will be reflected in accounting. By clicking the “Calculate” button, the necessary details are automatically filled in.

Example No. 2

Materials were purchased in the amount of 131.11 rubles (VAT 20 rubles). VAT is marked for distribution. 3/4 of them (VAT 15 rubles) were written off. 1/4 (VAT 5 rubles) remained in the warehouse unused.

During the reporting period, goods were sold for 80 rubles with VAT and for 20 rubles without VAT.

Please note that VAT on written-off materials and those remaining in the warehouse is included in the “VAT Distribution” document on different lines. For the remaining materials, the cost account will be the same as the account for the materials themselves (for example, 10.01). Decommissioned ones have 20 or 26, depending on your settings.

In the document “Creating Purchase Ledger Entries” these lines are combined again.

VAT for beginners

VAT - value added tax. This is the main principle of its work. In a very simple example, its base coincides with the profit tax base (after all, profit and added value are synonymous concepts), but the clarifications were written differently and, as a result, there is almost nothing in common in accounting.

Example: We decided to sell 10 apples grown with our own labor for 3 rubles = 30 rubles. On top of the sale, VAT of 10% is charged 30*10%=3 rubles. Total sold for 33 rubles. including VAT. 3 rub. They took 30 rubles for the work. - this is our income. 3 rubles were set aside and VAT was paid.

The amounts of accrued VAT are not our income and are not taken into account when calculating income tax. It turns out that in this example, the amount of income for income tax and VAT is the same.

In general, VAT is a separate wide river flowing into and out of accounting and not shifting with the rest of accounting.

In addition to the fact that VAT is a value added tax, it is a tax that is always paid by the last buyer, and this may also be our organization.

Lawmakers are trying to restore the original meaning of the tax as enterprising people find ways around it. And in my opinion, it was this struggle that gave birth to a monster from a tiny formula, a detailed description of which does not fit into one book. In my opinion, it is easy to check the correct application of this tax for yourself by simply comparing how we use it and its original meaning.

Let's move on to the book tax formula: VAT payable = VAT shipped - VAT accepted.

The primary document for tax accounting is the Invoice (a very strict document). Outgoing (sales) Invoices are registered in the Sales Book, and incoming ones in the Purchase Book. The difference between the Sales Book and the Purchase Book is VAT payable. These documents are the basis for maintaining tax accounting for VAT. And reflection by postings is already accounting.

VAT shipped - BookSales, Kt68.02 (increase in VAT debt)

VAT accepted - Book of Purchases, when purchasing a product, we also acquire tax and reflect Dt19_VAT_accepted Kt60_Supplier.

Accordingly: (VAT shipped - VAT accepted) posting Dt68.02_VAT_shipped (“-“reduction of VAT debt) Kt19_VAT_accepted (“-“decrease in assets for accepted VAT”). And the balance on Kt68.02 is VAT payable to the budget.

This formula precisely reflects the principles that VAT is paid by the last buyer, and that this is Value Added Tax.

Let's add some details.

Tax accrual occurs at the time of sale. Accountants consider the moment of sale to be the issuance of documents (Act, Invoice, Invoice), since accounting is very optimistic and anyone will be paid. In this regard, some tried to transfer money in advance (no invoice, no tax), to which legislators responded by requiring that an invoice be issued upon receipt of an advance. The continuation was the desire to offset VAT as a purchase when transferring an advance payment, which was permitted subject to certain conditions, the main one of which was the inclusion of amounts in the Sales Book by the recipient of the advance payment (VAT is like a relay baton, the main thing is that it does not fall).

In “1C: Accounting 8” there is a separate account 76.AB to account for the advance received. This is the transshipment base account for postings Dt90.03 (VAT in the cost of goods) Kt 68.02 (VAT payable), it turns out 90.03-76.AV-68.02 (this “temporary maintenance” is often found in postings when operations are extended over time). Let’s skip the postings for now and see what happens with the documents (what actual transactions we need to register). When we receive an advance, we issue an invoice to ourselves and reflect it in the Sales Book. After some time, we make the shipment and generate real documents including an Invoice. It turns out to be a double, both an advance and a sale (or a partial double if the advance is partial). To eliminate this, we must remove the Invoice for the advance payment, and according to the rules for maintaining VAT tax accounting, we will add a line to the Purchase Book upon closing the advance payment. For example: we received an advance of 100 rubles and included it in the Sales Book Dt76.AV Kt68.02, a week later we shipped goods worth 150 rubles and included it in the Sales Book Dt90.03 Kt68.02, at the same time we closed the advance by including it in the Purchase Book 100 rubles Dt68.02 Kt76.AV. VAT payable (150) = Sales Book (100+150) - Purchase Book (100).

The same applies to advances issued. And a long time ago, when there were non-payments and VAT was calculated on payment, it was still 76.N and the amounts were temporarily stored on it, waiting for payment, before getting to 68.02.

There are subtleties of accounting, do not forget to check the legislation, especially in the case of crediting (inclusion in the purchase ledger) what you “ate” yourself.

That's all for now.

Features of separate VAT accounting for fixed assets and intangible assets

Separate accounting of VAT on account 19 is carried out for all types of purchased assets, including fixed assets and intangible assets. When purchasing a fixed asset or intangible asset, the method of accounting for VAT is also indicated, and upon acceptance for accounting it can be adjusted. The distribution of VAT on fixed assets and intangible assets is made by the same document as for other assets. However, for fixed assets and intangible assets, the tax code provides for the possibility of distributing VAT based on the results of the month. If the VAT distribution document is entered for the 1st or 2nd month of the quarter, revenue will be calculated for the corresponding month, and VAT distribution will be made only for fixed assets and intangible assets accepted for accounting in the current month.

Regulatory regulation

Cases when it is necessary to keep separate VAT records are prescribed in clause 13 of Art. 167 Tax Code of the Russian Federation, clause 4, clause 2.1 art. 170 Tax Code of the Russian Federation:

- there is taxable and non-taxable VAT revenue;

- OSNO and UTII are combined;

- there is sales at a VAT rate of 0%, with the exception of trade in non-commodity goods and precious metals with state funds and banks;

- goods, works, services (hereinafter referred to as GWS) are purchased at the expense of budget subsidies, the list of which is not known in advance;

- There is a production of GWS with a long production cycle.

If you do not keep separate records, then the “total” input VAT will have to be taken into account at the expense of net profit. The VAT deduction will be lost and the expense will not be recognized in tax accounting (clause 4 of Article 170 of the Tax Code of the Russian Federation).

The exception is tax periods, in which the “5% rule” is triggered. The share of non-taxable expenses is less than 5% - in this case, you can deduct the entire total VAT. The procedure for calculating the share of expenses is established in the Accounting Policy (hereinafter referred to as the UP).

Read more 5 percent rule for maintaining separate accounting of incoming VAT

Compliance with the “5% rule” does not exempt you from maintaining separate records. It only affects the right to deduct the entire amount of input VAT and not distribute it in the current quarter.

Develop a methodology for maintaining separate VAT accounting yourself and record it in the UP.

Read more Compliance with the 5 percent rule

Changing the VAT accounting method

If, upon receipt of materials, one accounting method was indicated (for example, “Distribute”), and upon write-off, the accountant realized that it was necessary to “Accept for deduction,” then in the document “Request-invoice” you can indicate the desired method. It will be used for these materials.

ATTENTION ! You can change the VAT accounting method only before the VAT is distributed. This means that if you make a document “VAT Allocation” at the end of the quarter, the VAT of all materials received in this quarter will be distributed. And those that you wrote off, and those that are still in stock. This means that in the next quarter you will no longer be able to change the way VAT is written off for these materials.

Wiring

Posting VAT generates transactions:

- Dt19 Subconto: deductible, included in the price for transactions at 0%

- Kt19 Subconto: distributed

- Dt20 Kt19 Subconto: included in the price

VAT included in the cost will be written off to cost accounts.

The above material allows us to conclude that the correct reflection of business transactions and the correct settings for the implementation of the process in question in 1C: Accounting 8 helps to avoid mistakes if you need to make the transition to separate VAT accounting.

Adjustment of VAT offset

VAT included in the offset is subject to exclusion from the offset in the following cases:

- upon full or partial return of goods;

- in case of changes in the terms of the transaction;

- when the price changes;

- for goods, works, services used for purposes other than taxable turnover;

- in case of damage to goods;

- for excess losses, etc.

VAT amounts are excluded from the offset in the tax period in which the grounds for adjustment arose.

In the “Accounting 8 for Kazakhstan” configuration, you can reflect data on the return of goods and adjust the VAT offset using the document Return of Inventory to Supplier

.

You can adjust VAT offset in other cases using the document Registration of other transactions on purchased goods (work, services) for VAT purposes

. With this document, you can register a transaction to accept VAT as an offset, and you can adjust the previously offset VAT in various cases.

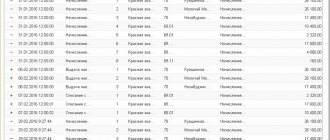

Movement of goods

The operation “Movement of goods” in 1C is carried out in order to give the program the task of keeping records of goods in the context of the following types of activities:

- subject to VAT;

- not subject to VAT (not UTII);

- not subject to VAT (UTII).

Also, the “Movement of Goods” operation helps the accountant avoid the VAT recovery procedure in situations where the dates of purchase and sale of goods fall in different tax quarters.

Let's assume that the company in our example purchased a product in the 1st quarter of 2016. In the 2nd quarter, she sold some of the goods wholesale, and some at retail (UTII). If you do not carry out the “Move goods” operation, then at the end of the 1st quarter the company will pay VAT with a deduction for all goods. And in the 2nd quarter it will have to restore the VAT accepted for deduction on goods sold at retail. If the “Movement of goods” operation is carried out in the 1st quarter, then VAT will not have to be restored in the 2nd quarter.

For more information about restoring previously deducted VAT, read the article “Procedure for restoring VAT previously accepted for deduction.”

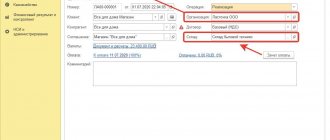

To carry out the operation in question, you need to go to the “Movement of Goods” journal through the “Warehouse” menu, click the “Create” button and fill out the document form that appears. How to correctly formalize the operation of moving goods in 1C is shown in the figure below: