published: 11/23/2017

Article 209 of the Tax Code of the Russian Federation establishes that for individuals who are not tax residents of the Russian Federation, the object of personal income tax taxation is income received from sources in the Russian Federation.

If a non-resident provides services on the territory of a foreign state, then such income is recognized as received from sources outside the Russian Federation and is not subject to taxation in accordance with Article 209 of the Tax Code of the Russian Federation. A similar rule is enshrined in paragraphs. 6 clause 3 art. 208 Tax Code of the Russian Federation. This position is also confirmed by Letter of the Ministry of Finance of Russia dated December 8, 2011 N 03-04-06/6-341.

Thus, to determine the need to pay personal income tax, you should, first of all, take into account the place of provision of services - on the territory of the Russian Federation or outside the Russian Federation. If services are provided on the territory of the Russian Federation, they are subject to personal income tax.

Within the meaning of paragraph 5 of subparagraph 4 of paragraph 1 of Article 148 of the Tax Code of the Russian Federation, the Russian Federation is recognized as the place of sale of consulting services and training services.

You may be interested in the service: Consultation with a tax lawyer.

Who are non-residents of the Russian Federation

Non-resident status is established based on the criteria given in Article 207 of the Tax Code of the Russian Federation. In particular, this is a stay in the country for less than 183 days within 12 months. In this case, the months must go one after another. If a person is outside the Russian Federation for a number of reasons, these periods will not be included in the calculated period. Consider these reasons:

- Study or treatment abroad for no more than six months.

- Travel to offshore hydrocarbon fields.

- Business trips (this paragraph applies to military personnel and government officials).

The list of reasons under consideration is specified in paragraphs 2.1 and 3 of Article 207 of the Tax Code of the Russian Federation. A person’s stay in Crimea from March 18 to December 31, 2014 will also be considered as being in the Russian Federation. Short-term departures (up to 6 months) from the state are also not taken into account in calculations.

Taxation of non-residents in Russia. What taxes does a non-resident pay in 2021?

Who is a tax non-resident in the Russian Federation?

By law, a non-resident is one who stays in Russia for less than 183 days within 12 months.

A citizen is recognized as a non-resident even if his business is registered with the Russian tax office and operates for a whole year, but he himself is in Russia for less than six months. In 2021, you can become a resident after 90 days of stay in Russia. The Ministry of Finance made this decision due to the coronavirus epidemic, since not all Russian citizens could quickly return to their homeland. Due to the delay abroad, they would lose their resident status and pay a higher tax rate.

What is the difference between a resident and a non-resident?

Tax rate.

A citizen receives income - he sells real estate or a car at a higher price than he bought it for, and he is paid a salary or fee. He is obliged to pay tax. The rate for residents is 13%, for non-residents - 30%.

Previously, non-residents always paid a 30% tax when selling property before a minimum period of 3 or 5 years. From 2021 they don't need to do this. They are subject to the same minimum period of ownership of an apartment, plot or car as for residents.

Non-residents pay 13% tax in exceptional cases:

- highly qualified specialists who are engaged, for example, in scientific or engineering work;

- individual entrepreneur with taxation - “patent”;

- refugee;

- a Russian who came to Russia under the program for the return of compatriots;

- crew member on a Russian vessel;

- citizen of a member state of the Eurasian Union: Kazakhstan, Armenia, Kyrgyzstan or Belarus.

Deductions.

A citizen buys an apartment, a car, pays for education and treatment. He will not receive a deduction if he stayed in Russia for less than six months.

How to obtain resident status and is it possible to lose it?

How to get a.

In 2021, you can obtain the status ahead of schedule - after 90 days. You must inform the tax office that you have lived in Russia for the required period. The Federal Tax Service did not provide the application form and list of documents, but these could be:

- migration card with information about the date of entry and exit,

- certificate from an accountant at work,

- travel order,

- waybill or tickets,

- contracts for paid treatment or training,

- certificates from the management company or HOA.

Documents must be submitted by the end of April 2021, because this is the reporting deadline for 2021.

From 2021, the period for obtaining resident status will again be the same - 183 days per year. It is enough to spend this time on the territory of Russia, but not necessarily consecutively. You can, for example, alternate: a month in Russia, a month abroad.

Why are they deprived?

If the Federal Tax Service can prove that a citizen has not been in Russia for more than six months, he will be deprived of his resident status.

What taxes does a non-resident pay in Russia?

A citizen with this status pays the same taxes as a resident: income, transport, land and property. But the income tax rate is higher - 30%.

How is personal income tax calculated for non-residents and who pays it?

If there is an employer.

It is the employer's responsibility to report to the tax office and pay taxes for an employee, even if the employee is a non-resident. In this case, the employer deducts tax at a rate of 30% from the employee’s salary.

If a non-resident is an individual entrepreneur or founder of an LLC.

There are no allowances for individual entrepreneurs. There are only differences for those who are on the patent system - it does not work with fixed contributions, but with a rate of 13%. All other forms of individual entrepreneurs are taxed according to tax legislation for residents.

If a non-resident receives dividends from the operation of an LLC, he is required to pay 15% of these incomes.

If he sells the property.

Sometimes a citizen receives income not in the form of a salary, but from the sale of property, for example, a plot of land or a car. When selling land or a car, the rate on income is 30%; you cannot get a deduction.

Property tax for tax non-residents in Russia

A non-resident pays property tax like all Russian citizens. There are 3 types of basic interest rates:

- 0.1% - for a house, apartment, room, garage, parking space or barn with an area of no more than 50 square meters. m;

- 0.5% - for non-residential premises, if the area is not more than 150 square meters. m;

- 2% - for non-residential premises, if the area is more than 150 square meters. m.

Rates may vary by region. It’s easier not to calculate the tax yourself, but to use the calculator on the Federal Tax Service website.

Transport tax for tax non-residents in Russia

Everything here is the same as for residents - the amount of tax depends on the region, the power of the car and its price. Let's calculate the tax for a Moscow car with a capacity of 110 hp. With. per year of ownership. The rate for this power in Moscow is 25 rubles per horsepower.

110 × 25 = 2,750 rubles.

For more information about how to pay, who is entitled to benefits and how to save, read our article on transport tax.

Land tax for tax non-residents in Russia

A non-resident will pay land tax at the same rates as a resident:

- 0.3% - if a citizen grows vegetables and fruits not for business.

- 1.5% - if the plot is purchased for business activities.

The tax is calculated according to the formula:

Tax amount = cadastral value × rate × share size / ownership coefficient

The cadastral value can be viewed on the Rosreestr website. The share size is 1 if there is only one owner. The ownership coefficient is taken as 100 if the ownership time is exactly one year. To avoid calculating coefficients and rates, use the tax calculator from the tax authorities.

All taxes must be paid by December 1 of the year following the reporting year.

What happens if a non-resident is late or fails to pay taxes?

The sanctions are the same as for residents - the tax office will begin to calculate penalties according to the formula:

Tax amount × number of days overdue × 1/300 of the Central Bank rate

For example, a citizen sold a plot of land after 2.5 years of ownership for 2,315,000 rubles, and bought it for 2,455,000 rubles. Let's calculate the amount of tax and penalties for 2 months of delay.

First, let's calculate the tax amount:

2,455,000 - 2,315,000 = 140,000 rubles.

140,000 rubles × 30% = 42,000 rubles.

This is the tax amount. Let's calculate the penalty:

42,000 × 60 days × (4.25%/300) = 362 rubles.

Read more about penalties in our separate article.

How to check taxes of non-residents

If a non-resident has an INN or a Russian passport, this can be done at Autotax.

If a non-resident is a foreigner who enters Russia for the first time to earn money, he needs to obtain a TIN from the tax office. To do this, he submits a completed application and copies of documents to the tax office:

- migration card;

- migration registration form with registration at the place of stay;

- notarized translation of the passport.

To obtain a passport of a Russian citizen, you need a temporary residence permit, a residence permit and spend 5 years in Russia.

Enter 12 numbers from the TIN form in the first box, as on the right side of the picture

If you don’t have a Russian passport, it’s easier to first get a TIN and check taxes using it

Remember

- A non-resident is considered to be someone who stayed in Russia for less than 183 days during the year.

- The tax rate on non-resident income is 30%, and no deductions are allowed.

- To obtain resident status, provide the Federal Tax Service with documents indicating that you worked, were on business trips and bought tickets for transport within the Russian Federation.

- Non-residents pay property taxes according to the same scheme as residents.

- If you don’t pay taxes, the Federal Tax Service will charge penalties.

- On Autotaxes, a non-resident can check notifications from the Federal Tax Service if he has an INN or a passport of a Russian citizen.

Tax rates for non-residents

The procedure for taxation of non-residents is established by Article 224 of the Tax Code of the Russian Federation. The rate is 30% of the income. For residents this rate is 13%. However, there are exceptions:

- Highly qualified employees. These are workers with a specific specialty. This category includes persons participating in the Skolkovo project. In this case, the salaries of specialists will be taxed at a rate of 13%. If an employee receives other forms of income from the company, they will be taxed at a rate of 30%.

- Foreign persons working on the basis of a patent. Since 2015, residents of countries with which Russia has a visa-free regime are not required to obtain a work permit. They need to apply for a patent. If applicable, income tax is paid in advance. If a person has a patent, he pays tax at a rate of 13%. The patent is valid for a limited time. The validity period is specified in the certificate from the Federal Tax Service.

- Foreign citizens with refugee status. In this case, the rate will also drop to 13%.

- Persons arriving from the EAEU countries. These citizens also receive benefits: simplified employment and preferential rates.

The list of exceptions also includes these employees:

- Participants in the resettlement program in the Russian Federation who were previously residents.

- People who have been given temporary asylum.

- Members of the crews of ships belonging to the ports of the Russian Federation.

In 2021, individuals do not have to pay personal income tax on funds received from foreign sources.

ATTENTION! The rate on income from shared ownership of a company for non-residents will be 15%.

Land tax

As for property, when we said that foreigners have the right to purchase real estate, we did not mean land plots. For some reason, Russian legislators decided to deprive foreigners of such joy as buying land plots, and this also applies to houses standing on the ground. Foreigners only have the right to rent land and a house on the land. But they still have a chance to become the owner of land or a house on earth. We are talking about inheritance or gift. In this case, the foreigner can become the owner of the above real estate. Land and property taxes are regional taxes, which means that the rates for such taxes are set by local authorities, but within approved limits that are established by the federal government. People themselves do not charge land and property taxes; this is done by the tax authorities, who calculate these taxes and send notifications to the owners. All owners have to do is pay taxes on time.

Payment of personal income tax from non-residents

The employer pays personal income tax for its employees. This refers only to those companies with which the specialist has entered into an employment contract. If an employee works unofficially, the employer does not pay any taxes for him. However, there is an exception: specialists who work on the basis of a patent. When purchasing a patent, part of the taxes is paid in advance.

If the tax is calculated for non-residents working on the basis of a patent, the accountant should send a request to the fiscal authorities. This is necessary to determine the amount of advance payment already paid by the employee. The amount of tax deductions may be reduced by this amount. A response will be received within 10 days after sending the request.

If a specialist serves in several places at once, the advance can be credited to only one company.

As a rule, the company that first submitted the request can take advantage of the discount. The procedure for paying personal income tax for a non-resident is the same as for a resident. Tax calculation and remittance is carried out by the employer. That is, he plays the role of a fiscal agent.

The timing of tax payment is determined by the form of income received:

- Salary – on the date of non-cash payment or the date of cash withdrawal.

- Vacation pay and certificates of incapacity for work - no later than the end of the month of making payments.

- Income in kind – the next day after the transfer.

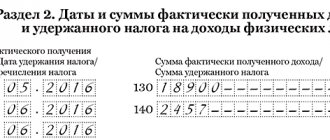

Information about the tax paid is transmitted to the Federal Tax Service. To transfer information, a 2-NDFL certificate is used.

Insurance premiums

In accordance with Russian laws, in addition to personal income tax, insurance contributions to the pension fund, social insurance fund and medical insurance fund are calculated from wages. The employer pays insurance premiums at his own expense. In general, three types of foreigners can be distinguished:

- those who are temporarily staying on the territory of Russia (a foreigner is on the territory of Russia with a visa or in a visa-free regime, while he either does not have a temporary residence permit or does not have a residence permit);

- those who temporarily reside in Russia (have a temporary residence permit);

- those who permanently reside in Russia (have a residence permit)

Insurance contributions to the pension fund and contributions to the social insurance fund are charged to all working foreigners, except for highly qualified specialists with the status of temporary residents. Contributions to the health insurance fund are charged only to foreigners with a temporary residence permit and those who have a residence permit. As for contributions from the income of citizens of Belarus, Armenia, Kazakhstan and Kyrgyzstan. As well as refugees, they pay the same fees as ordinary Russians. And if highly qualified specialists from these countries work in Russia, then they do not pay contributions to the pension fund, only contributions to the health insurance fund and the social insurance fund.

Can a non-resident count on a tax deduction?

If a person has non-resident status, tax deductions in relation to him are not accepted. This limitation is established by Article 210 of the Tax Code of the Russian Federation, paragraph 1 of Article 220 and paragraph 3 of Article 224 of the Tax Code of the Russian Federation. In addition, non-residents cannot use the method of reducing the income received from the sale of property by the purchase price of this property. These persons are not entitled to the benefits established by subparagraph 2 of paragraph 1 of Article 220 of the Tax Code of the Russian Federation. That is, they cannot deduct expenses from income. This restriction was established in a number of letters from the Ministry of Finance. This is explained by the fact that a decrease in income for expenses is, in fact, a tax deduction, and it is not available to non-residents.

Property tax

If a foreigner owns real estate in Russia, he is required to pay property tax. Property tax for foreigners is paid in the same amount as for Russians. The tax base is taken from the cadastral value of the property, which is equal to the market value. Property tax rate:

- if the value of the property is less than 300,000 rubles, then the property tax rate should be more than 0.1% of the tax base;

- if the value of the property is from 300,000 to 500,000 rubles, then the property tax rate should be in the range from 0.1% to 0.3%;

- if the value of the property is more than 500,000 rubles, then the property tax rate should be in the range from 0.3% to 2%

The property tax rate varies in different regions of the country. Local authorities set their own rates, but they must fall within the specified ranges established by federal law.

Is it possible to reduce income?

Is it possible to reduce income in order to reduce taxation? There is no clear judicial practice on this matter. However, some experts argue in favor of the possibility of reducing the volume. In particular, paragraph 4 of Article 210 states that the deductions established by Articles 218-221 of the Tax Code of the Russian Federation are not relevant for non-residents. At the same time, this does not indicate that the base cannot be reduced by the amount of spending. That is, there are no direct prohibitions in the Tax Code of the Russian Federation. The deduction of expenses from income is not called a tax deduction, and therefore there cannot be unambiguous restrictions here.

FOR YOUR INFORMATION! Even if a person is convinced that he can reduce the amount of income, he should not do this without prior approval from the tax office. Consent must be obtained before submitting the declaration.

Tax on the sale of property

Since, as we have already understood, foreigners have the right to own real estate, in this case they have a tax on the sale of property. Property includes real estate, land, vehicles, etc. As we have already discussed above, foreigners will in this case pay personal income tax. If the property has been owned for more than 3 years, then you do not need to pay personal income tax when selling it. But this applies only to residents; non-residents pay the tax in full. In addition, non-residents cannot take advantage of tax deductions and thus reduce personal income tax.

Contribution to the authorized capital of the company from a non-resident in cash - is it possible? It is forbidden!

Contribution of funds to the authorized capital is a foreign exchange transaction. And again, settlements when carrying out foreign exchange transactions are made by resident legal entities through bank accounts in authorized banks, the procedure for opening and maintaining which is established by the Central Bank of the Russian Federation. In this regard, contribution to the authorized capital by depositing cash into a bank account or into the organization's cash desk is prohibited.

And yes, that's right! For this violation, the company faces the same fine - from 3/4 (three-quarters) to 100% (full) of the amount of the illegal currency transaction (Clause 1 of Article 15.25 of the Code of Administrative Offenses of the Russian Federation).

How to make a contribution to the authorized capital of an LLC from a non-resident correctly

By analogy with solving a situation related to a loan agreement, in order to avoid violation, the founder should open his personal account as an individual in a bank of the Russian Federation, deposit funds into it and make a transfer to the organization’s current account. The transfer can also be made from a current account of an individual opened outside the Russian Federation.

Is it possible for a non-resident to receive dividends in cash? It is forbidden!

In the case of dividends, a clear answer can be given: it is impossible to pay dividends to a non-resident founder in cash.

A Russian organization is required to carry out all settlements on permitted foreign exchange transactions using an account with an authorized bank. With the exception of cases when an organization has the right to conduct cash payments without a bank account.

We reviewed a complete list of cases when a Russian organization has the right to pay residents and non-residents in cash in rubles or foreign currency. This list is exhaustive. Payment of dividends does not apply to such operations .

Transport tax

Transport tax is paid by individuals who own a car, motorcycle, boat and other vehicles. The tax authorities calculate the amount of tax for individuals. The amount of tax depends on information about the transport, namely the type of vehicle, the power of its engine, year of manufacture, etc. To calculate this tax, basic tax rates are established, but local authorities can increase them.

Read in more detail: Taxes of a foreign citizen working in Russia (under a patent) in 2021

Rate the quality of the article. We want to be better for you:

Personal income tax of a highly qualified specialist: personal income tax VKS 2021

The personal income tax rate in 2021 on income from the labor of highly qualified specialists is always thirteen percent (tax status is not important).

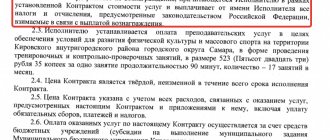

It applies, for example, to wages, allowances for work away from permanent residence, and remuneration to members of the board of directors. A rate of 13 percent is applied to payments accrued during the validity of an employment contract or a civil contract for the implementation of work (provision of services).

Everything that was accrued after completion of the contract is subject to personal income tax at a rate of 30 or 13 percent, based on the tax status. The personal income tax rate in 2021 for income that does not affect work activity for a highly qualified non-resident specialist is 30 percent.

It is applicable in the case of payment of financial assistance, compensation for food costs, and giving gifts.

We draw your attention to the fact that the average salary retained by an employee during vacation (vacation pay) is not included in the category of income from work. Vacation is a period of rest during which a person is relieved from performing his work duties. Consequently, personal income tax should be collected at a rate of 30 percent on vacation funds for a highly qualified non-resident specialist.

Is it possible to get a cash loan from a non-resident? It is forbidden!

Let's return to our situation described at the very beginning. If a non-resident founder (or any other non-resident individual) provides a loan to the company by depositing cash into the company's current account, this action will be a violation of currency legislation. It does not matter how the lender deposited the cash: through an ATM, with the help of a bank teller, or deposited it into the company’s cash register.

Once again, settlements when carrying out currency transactions are made by resident legal entities through bank accounts in authorized banks, the procedure for opening and maintaining which is established by the Central Bank of the Russian Federation (Article 14 of the Federal Law No. 173-FZ).

For a non-resident depositing a loan in cash into the current account of a company organization, he faces a fine - from 3/4 (three-quarters) to 100% (full) of the amount of the illegal currency transaction (Article 15.25 of the Code of Administrative Offenses of the Russian Federation).

How to make a loan by a non-resident for a legal entity correctly

In order to avoid violations, the founder should open his own personal account as an individual in a bank of the Russian Federation, deposit funds into it and make a transfer to the organization’s current account. The transfer can also be made from a current account of an individual opened outside the Russian Federation.

Personal income tax of a foreign citizen working on the basis of a patent in 2021

If a foreign worker has acquired a patent to work in the Russian Federation, he must independently transfer the established advance payment for personal income tax to the budget.

After a foreign citizen is hired, personal income tax on his income is calculated and withheld by the employer - the tax agent. The tax rate is 13 percent regardless of whether the foreign citizen is a resident.

Personal income tax, which is transferred by a foreign employee in the form of an established advance payment, must be counted towards the payment of personal income tax from wages.