Bookmarked: 0

What are production costs? Description and definition of the concept.

Production costs are the amount of costs an enterprise incurs in the direct production of services and goods.

Production costs include direct costs that are associated with the production of services and products, indirect costs (for security and management), auxiliary costs and losses from product defects. Production costs are grouped into three blocks.

The first is based on the place of their appearance (workshop, division). Such costs are recorded in reports on economic activities. The second block is costs based on the cost of product types. And the third - by calculation items and cost elements.

Let's take a closer look at what production costs mean.

Manufacturing costs are the direct costs of materials, labor, and various manufacturing overheads.

Non-productive (periodic or reporting time expenses) are commercial and administrative expenses.

Direct and indirect costs

Direct costs are direct material costs and labor costs. They are accounted for by debit and are attributed directly to a specific product.

Description of direct material costs:

Each industrial product consists of certain materials. Basic materials are those materials that become part of the finished product, and their cost can be directly and economically attributed to a specific product without much expense.

In some cases, it is not economically feasible to take into account the material consumption for each type of product produced. For example: nails in furniture or rivets in airplanes. Such materials are classified as auxiliary, and the costs for them are classified as indirect general production costs, which are usually taken into account as a whole for the reporting time period, and then distributed using special methods between certain types of marketable products.

Direct labor costs include all labor costs that can be directly and economically attributed to a particular type of finished product. Labor costs for a job that cannot be directly and economically attributed to a specific type of finished product are called indirect labor costs. These expenses include remuneration of such specialists as mechanics, supervisors and other support personnel. Like the costs of auxiliary materials, indirect labor costs are usually classified as indirect general production costs.

The size of direct costs per unit of production is independent of the volume of production, and it can be reduced by increasing production efficiency, labor productivity, and introducing new resource- and energy-saving technologies.

Indirect costs are a set of costs that are associated with production and which are not usually attributed to specific types of products. These are also called overhead costs.

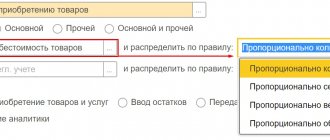

Indirect costs are distributed among individual goods in accordance with the methodology chosen by the enterprise (in proportion to the basic wages of production workers, hours worked, etc.). This methodology is indicated in the production accounting policy.

Types of indirect costs:

production – these are general shop expenses associated with the organization, maintenance and management of production;

non-production costs are used for production management purposes. They are not directly related to the production activities of the organization and are recorded on the balance sheet account.

The peculiarity of general business expenses is that within the scale base they remain unchanged. They change with the help of management decisions, and the degree of their coverage is changed by sales volume.

It should be noted that the main production costs necessary for the production of products are, as a rule, unchanged, and the costs of ensuring the level of manufacturing quality consist of three variable categories: I) costs of monitoring the level of product quality during the production process 2) costs of developing and carrying out activities aimed at preventing the occurrence of defects 3) losses from defects and rework.

[p.20] Sales and management costs 26% 35% of main production costs [p.81] All main production costs are distributed among services (sections I-X), except for the main distributed expenses (section XI), the nomenclature of which is as stated above is common to all services. [p.206]

The main production costs for materials, fuel and other costs for water supply are [p.217]

Classification of production costs - grouping of production costs in planning and accounting according to certain criteria. The economic grouping of production costs is carried out according to costing items and economic elements (see Costing item, Economic elements of production costs). In addition, production costs are divided by purpose - into basic and overhead (costs of management and maintenance of production) depending on the method of inclusion in the cost of production - into direct and indirect in composition - into homogeneous (single-element) and complex (see Main production costs , Production management and maintenance costs, Direct production costs, Indirect production costs, Single-element production costs, Complex production costs). [p.63]

Overhead costs are the costs of managing and maintaining production. According to their purpose, all production costs are divided into basic and overhead (see Basic production expenses, Costs of production management and maintenance). Enterprises may have N. r. on main activities and N. r. for construction (administrative and economic, for servicing workers, for organizing and performing work, non-productive expenses, etc.). These expenses are taken into account according to the range of items provided for in the estimates and limits. Account No. 27 Overhead expenses is intended for accounting, the debit of which includes N.R. on construction. N.r. is written off from the credit of this account. for construction projects. On collective and state farms, account No. 27 does not apply. These expenses are accounted for in separate analytical accounts under account No. 33 Construction and acquisition of fixed assets. [p.75]

Basic production costs are expenses that are directly related to the production of products. These include [p.87]

Production expenses are the expenses of enterprises for the production of products (consumption of raw materials, supplies, fuel, electricity, wages of workers, employees, collective farmers, depreciation of fixed assets, etc.). For the correct calculation of product costs, planning, accounting and analysis of P. r. their classification is applied (see Classification of production costs). As prescribed by P. r. are divided into basic expenses and expenses for management and maintenance of production (overhead expenses). According to the method of attributing costs to the cost of production, they are divided into direct and indirect. In terms of composition, production costs can be single-element or complex. The former cannot be decomposed into their component parts. For example, wages, materials, etc. Complex ones consist of several types of expenses. For example, general shop expenses include wages, fuel, depreciation, etc. (see Basic production costs. Costs of management and maintenance of production, Direct production costs, Indirect production costs). The list of production costs in sectors of the national economy is very large. Therefore, in planning and accounting they are combined into homogeneous groups. This grouping is carried out according to costing items and economic elements. The list of costing items makes it possible to see the purpose of expenses, their connection with production [p.110]

Basic production expenses are expenses that are directly related to the production of products, performance of work, and services. These include costs for technological needs of raw materials, materials, fuel, electricity, wages, etc. According to their purpose, all production costs are divided into basic costs and costs of managing and maintaining production. [p.119]

Expenses for the maintenance and operation of equipment are part of the main production costs (expenses for maintenance, routine repairs, and depreciation of equipment, etc.). Analytical accounting is maintained in statements where expenses are shown by item for each division. [p.148]

The main type of gas consumption for the production and technical needs of gas pipelines is use as fuel gas for gas turbine and gas engine installations of compressor stations. [p.179]

Calculation of costs for materials is based on cost estimates for current repairs of fixed production assets of pipeline transport and costs for maintaining buildings [p.258]

When breaking down the annual plan quarterly, costs under the heading Costs for the maintenance and operation of warehouse buildings and structures should take into account the increase in costs during the winter period of the year and the timing of the commissioning of new fixed assets in accordance with capital construction plans. [p.266]

For approximate calculations, you can plan the amount of expenses under the headings Costs for the maintenance and operation of warehouse buildings and structures and Costs for the maintenance and operation of transport mechanisms and warehouse equipment in the amount of 7% of the cost of fixed production assets. [p.267]

For approximate calculations in general for territorial administration, expenses for current repairs can be planned within the limits of up to 1.2% of the cost of fixed production assets for supply and sales purposes. Exceeding this standard must be justified by appropriate calculations. [p.267]

The main costs are those directly related to the implementation of the technological process. These are the costs of raw materials, reagents, catalysts, initiators, process fuel, energy of all types, wages of production personnel, maintenance of technological installations, including depreciation charges. [p.210]

Elemental costs consist of one cost element - raw materials, wages of key production personnel, etc. Grouping by economic elements allows you to determine the enterprise's total need for material resources in value terms, the total amount of depreciation, labor costs and other cash expenses . [p.210]

Shop, general plant and other production costs are distributed among technological stages in proportion to the amount of direct processing costs, which include (minus the costs of raw materials and supplies) fuel and energy costs for technological purposes, basic and additional wages and social insurance contributions. and operation of in-plant pumping equipment. [p.220]

Pure products do not have these disadvantages. The advantage of this indicator is an objective assessment of the contribution of each workforce to the development of the economy, a fairly accurate determination of the measure of its participation in the creation of national income, since when assessing the net product in the final results of the enterprise, on the one hand, other people’s labor (the cost of raw materials, supplies) is not taken into account , energy, fixed assets), and on the other hand, reflects the actual use of material resources and fixed assets. When assessing labor productivity and forming a wage fund based on net production, this creates additional material incentives to reduce not only the labor intensity of manufactured products, but also the consumption of raw materials, fuel and energy, as well as to improve the use of production capacity. [p.37]

The balance of income and expenses of an enterprise is a calculation of the income and expenses projected in the planning year both for the main production activities of the enterprise and for non-industrial enterprises and capital construction. This calculation is the only document of the technical industrial and financial plan that covers all aspects of the economic activity of the enterprise. At the same time, it reflects the relationship of the enterprise with the state budget and higher organization. [p.337]

During operation, when the operating mode of the main production changes, such a system of standards makes it possible to determine the current values of all the main standards for the consumption and use of resources both for the main production activity and for related units. [p.61]

Thus, networks and structures of water supply, sewerage, heat supply and gasification are united into a single group by pipeline support networks. This group also includes treatment facilities and networks that are not part of the complex for primary production purposes. The need for material resources is determined for the entire complex of a given group of structures. It is used as the basis for calculating individual material consumption standards. [p.112]

Other production costs are accounted for in the Main production account and distributed among installations (processes) in the same way as general plant expenses. [p.192]

Direct costs include 1) costs of materials consumed during construction, installation and drilling operations 2) wages (basic) of production workers 3) costs of operating drilling equipment and tools 4) transportation costs 5) energy costs 6) other auxiliary services production and external expenses and other expenses. The amount of these costs in the estimates is determined for individual objects, types of work and structural elements based on the volume of work and the price list of regional prices for the construction of oil and gas wells. In terms of their economic content, they are the main expenses, and in terms of their connection with accounting objects, they are direct. [p.211]

At the expense of profits, enterprises pay into the budget payments for fixed production assets and working capital, fixed (rent) payments, and also pay interest on a bank loan, form special funds, repay loans for capital investments according to a centralized plan (except for loans repaid from the fund production development), cover losses from the operation of housing and communal services and expenses for the economic maintenance of buildings and structures transferred for free use to trade union organizations, make contributions to Stroybank for centralized capital investments, finance the increase in their own working capital, make contributions to higher organizations and to the reserve to provide temporary financial assistance, as well as for other purposes provided for by law. The free remainder of the profit is sent to the budget. [p.274]

Distributed between gas and condensate a) in proportion to their gross production - costs of auxiliary materials (reagents spent for technological purposes by operational and production services) wages of production workers of the same services costs of preparation and development of production depreciation of wells costs of maintenance and operation of field equipment expenses for artificial impact on the formation b) in proportion to the basic wages of production workers and production maintenance costs - shop and general field (general production) expenses c) in proportion to the field cost of gas and condensate without other production costs - deductions for research and experimental work and centralized technical propaganda, as well as other targeted expenses included in other production expenses (of course, with the exception of deductions for geological exploration). [p.215]

Drilling is the determining process in the creation of fixed production assets in the oil industry and ensures the exploration and development of oil and gas fields. About 1.6 billion rubles are spent annually on drilling exploration and production wells. [p.12]

Expenses for the element “Depreciation of fixed production assets” include depreciation charges for all types of fixed production assets. Depreciation charges for the complete restoration of fixed assets and their overhaul at enterprises of transport, storage and distribution of oil, petroleum products and gas largely determine the level of operating costs. [p.211]

An important place is given to economics as a science to the study of the use of fixed production assets and production capacities, which have reached significant levels in the sub-industry, meaning the achievement of the highest capital productivity in specific production conditions. It is also of great importance to find ways and means of economic use during the operation of main gas pipelines and oil depots of material, primarily fuel and energy resources, as well as reducing the consumption of oil, gas and petroleum products for the sub-industry’s own needs and their losses during transportation and storage. In this regard, the economics course pays attention to the formation of the cost of transportation and storage of products, the correct reflection of operating costs in it and the most important areas for reducing costs and, on this basis, ways to increase the profitability and profitability of the sub-industry. The composition and circulation of working capital in the sub-industry and ways to accelerate their turnover are also considered. [p.8]

The USSR created the country's Unified Gas Supply System (UGS), which includes gas fields, gas transportation systems with underground gas storage facilities and consumers - cities and other populated areas, enterprises from all sectors of the national economy. Gas transportation through main gas pipelines is the largest sub-sector of the gas industry in terms of the cost of fixed production assets, the number of employees, and the consumption of fuel and energy resources for its own needs. [p.18]

As private indicators characterizing the use of certain types of costs and resources, labor intensity is used - the ratio of labor costs to the volume of produced products (work) capital intensity - the ratio of the average annual cost of fixed production assets to the volume of produced products (work) material intensity - the ratio of material costs to the volume of produced products . The use of individual costs and resources can be characterized by a number of more detailed indicators: capital intensity, equipment utilization rates in time and capacity, specific costs of raw materials, materials, fuel, and electricity. [p.92]

Along with the main production assets, items that are important in the production process are raw materials, semi-finished products, fuel, basic and auxiliary materials and fuel and energy resources that create the material substance of the finished product or contribute to the implementation of the process of its production. Objects of labor, unlike fixed production assets, are completely consumed in each production cycle in their natural material form, their consumer value disappears, as a result of which a new consumer value arises in the form of manufactured products, and their value is entirely included in the total cost of these products (work ). [p.180]

Overhead costs are the costs of managing and maintaining production. According to their purpose, all production costs are divided into basic and overhead (see Basic production expenses, Costs of production management and maintenance). Enterprises may have N. r. on main activities and N. r. for construction (administrative and economic, for servicing workers, for organizing and performing work, non-productive expenses, etc.). These expenses are taken into account according to the range of items provided for in the estimates and limits. [p.103]

Materials. Material costs are determined by the places where they arise (for routine repairs of fixed production assets, for the maintenance of buildings and structures, etc.) based on the work plans of production shops and services. The cost of materials (except for odorant and reagents) is distributed across all production processes. The cost of the odorant and reagents relates to underground gas storage (when they are consumed in the process of gas selection and injection) and to cleaning, drying and odorization (when they are consumed in all other production processes). [p.258]

The initial data for drawing up cost estimates are, firstly, the calculation of the costs of raw materials, materials, fuel and energy for the entire main production (in the main workshops); secondly, the calculation of the basic and additional wages of production workers and social insurance contributions in -third, cost estimates for auxiliary workshops (product cost calculations) and, finally, cost estimates for all complex expense items (for the preparation and development of production of new products, workshops, units, for the maintenance and operation of equipment, workshop and general plant expenses, transportation -procurement and other production costs, as well as non-production costs). As can be seen from this list, when drawing up cost estimates, the results of calculations performed in other sections of the plan are used. [p.256]

The change in the total volume of output by product as a result of a decrease or increase in actual labor intensity versus the planned one can be established by using as the initial base the indicator of the expenditure of normalized wages of the main production workers. This indicator most fully and reasonably reflects the labor intensity of each product, and in accordance with this, the amount of wages paid according to the amount of labor expended per volume of products produced. To substantiate the indicator under consideration, it is necessary to determine the composition of products, the rate of wage expenditure per unit of production, including for all useful products of complex processing industries [p.41]

The features of the sub-industry use of chemical materials characterize, to a certain extent, the schematic diagrams of the relationship between the main production processes and material consumption in the gas sub-sectors. Sub-industry schemes are necessary to identify the range of materials used and develop methods for calculating individual consumption rates of chemical reagents, which make it possible to identify standard-forming factors according to technological limits. [p.100]

In various regions, the specific weight of a complex of structures and installations for the main production purpose in cost is 30-70% of the total capital investments per construction unit, therefore it is necessary to develop differentiated standards for material consumption for each standard installation included in a given complex, with their subsequent consolidation into an individual one the norm for the entire complex. For the continuous operation of the main technological process, auxiliary production is necessary. The consumption of material resources for their construction must be determined separately. [p.112]

The fourth feature is the territorial dispersion of the main production facilities - oil and gas wells. Their placement in the field is determined by the development grid, which usually provides significant distances between them. Under these conditions, it is impossible to do without a complex and expensive system for the collection, transportation and storage of oil and gas, the costs of maintenance and operation of which must be taken into account separately. [p.79]

Calculations of costs included in the cost of oil and gas production on the direct basis of the basic and additional wages of workers in the main production of oil and gas production and social insurance contributions from this amount of depreciation deductions from the cost of wells and other fixed assets estimates of other production costs directly related for the cost of oil and gas production, estimates for production preparation. The composition and procedure for calculating these costs will be given below when considering the issue of drawing up planned calculations of the cost of NGDU products. [p.344]

Systems of oil, product and gas pipelines, underground gas storage facilities, transshipment and distribution tank farms are characterized primarily by significant fixed production assets. The predominance in their total amount of underground linear structures with a service life of more than 30 years makes it necessary to carry out a large amount of work on routine and major repairs of these communications. The processes of pumping gas, oil and petroleum products through pipelines are quickly automated, and therefore engineering structures are saturated with automation and telemechanics and information systems with the widespread use of microprocesses and electronic computers. In the process of oil and gas supply, large fuel and energy resources are consumed. [p.5]

Basic and overhead costs

Basic costs include all types of resources (raw materials, basic materials, purchased semi-finished products, depreciation of equipment, etc.), the consumption of which is associated with the production of goods. In every production, basic costs constitute the most important part of costs.

Overhead costs are caused by management functions, which are different in nature, purpose and role from production functions. These expenses, as a rule, are associated with the organization of the enterprise’s activities and its management. Under the carrier cost allocation method, overhead costs are indirect.

What are overhead costs

Production of products involves direct expenses (for raw materials, equipment, wages, etc.), as well as indirect expenses. In addition to the costs directly for the manufacture of products, funds must be spent on the organization of this process itself; it must be continuously managed, regulated, and at all production levels (management of a team, workshop, department, site, line, etc.).

Funds spent on organizing and managing the production process in all structural divisions of the organization are considered general production expenses. Previously, this type of expense was called “shop expenses.”

IMPORTANT INFORMATION! In the current situation, the national accounting system is gradually being brought in line with international market standards. Related to this is the revision of the mechanisms for the formation of ODA in domestic accounting. In this article we consider only current provisions.

Variable, fixed, semi-fixed costs

Variable costs increase or decrease in proportion to the volume of commodity production, in other words, they depend on the business activity of the company. Both production and non-production costs can be variable. Examples of manufacturing variable costs are direct material costs, direct labor costs, auxiliary materials costs, and purchased intermediates.

Variable costs characterize the cost of the product itself, all others (fixed costs) characterize the cost of production itself. The market is not interested in the cost of production, it is interested in the cost of the product itself.

Total variable costs have a linear dependence on the indicator of business activity of production, and variable costs per unit of production are a constant value.

Non-production variable costs include the cost of packaging manufactured products for shipment to the consumer, costs associated with transport that are not reimbursed by the buyer, and commission to the intermediary for the sale of products, which directly depends on the total sales volume.

Production costs, which ultimately remain unchanged during the reporting period, are not dependent on the business activity of production and are called “fixed production costs”. Even if production (sales) volumes change, they do not change. Fixed production costs include expenses associated with the rental of production space and depreciation of fixed production assets.

Total fixed costs are a constant value and do not depend on the volume of business activity, however, they may change under the influence of other reasons. For example, if prices rise, then total fixed costs also rise.

A type of variable costs are proportional costs. They are growing at the same rate as business activity in manufacturing.

Another type of variable costs are digressive costs. Their growth rate is less than the growth rate of the company's business activity.

In reality, it is practically impossible to encounter costs that, in their essence, will be exclusively constant or variable. Economic factors and associated costs are much more complex from a maintenance point of view, and therefore, in most cases, costs are semi-variable or semi-fixed. In this case, fluctuations in the business activity of the enterprise are also accompanied by changes in costs, while, unlike variable costs, the relationship is not direct. Conditionally variable or conditionally fixed costs include both variable and fixed elements. As an example, we can cite payment for using a telephone, which consists of a fixed subscription fee, which is a constant part, and payment for long-distance calls, which in this case will be a variable component.

Composition of overhead costs

Expenses that the Accounting Rules in paragraph 15 classify as general production expenses include expenses that are ultimately included in the cost of production, such as:

- Production management funds:

- salaries, bonuses, financial assistance and other payments to heads of structural units;

- medical insurance for management staff;

- funds allocated for social activities carried out for management;

- travel allowances for production and management personnel;

- payment for trainings, seminars, etc., conducted for employees;

- various expenses, such as purchasing office supplies, writing out teaching literature, paying for postal services, internet, etc.

- Expenses on fixed assets and non-current assets (their use and/or maintenance):

- direct costs of operating assets (cost of auxiliary products such as lubricants, wages of auxiliary workers, costs of fuel, electricity and other types of energy for production, utilities and other expenses for the premises);

- rent if non-current assets are leased;

- costs of security services - guard and fire safety (salaries and insurance of own personnel or expenses for third-party hired specialists);

- costs for the restoration of fixed assets (repair of buildings, equipment, transport, including amounts spent on spare parts and materials and on the services themselves);

- expenses for repairs of leased assets (by agreement with the owner).

- Depreciation of general production fixed assets and intangible assets (for different structural divisions).

- Maintenance costs:

- salaries for personnel servicing the production process;

- social and other payments;

- funds spent on control over the production process and its quality.

- Progressive costs – costs for modernization and improvement of the production process:

- remuneration of relevant personnel (directly involved in development, modernization, efficiency improvement, etc.);

- costs of prototypes, models, samples, tests, etc.;

- payment for consultations, examinations, third-party studies and other similar procedures;

- other expenses aimed at improving production.

- Expenses for labor protection of workers:

- money for alarms;

- means for installing and maintaining protective structures, fences, hatches, etc.;

- maintenance of auxiliary equipment, if provided for in the employment contract - locker rooms, lockers for storing personal belongings and clothing, showers, laundries, dryers, disinfection room, etc.;

- finances for workwear, footwear and personal and group protective equipment;

- purchase of medical nutrition or means for the prevention of diseases (if the profession provides for their issuance);

- costs of medical examinations of personnel;

- other expenses for labor protection.

- Environmental costs:

- wastewater treatment plant costs;

- funds for hazardous waste disposal;

- other environmental expenditures.

- Mandatory government payments:

- taxes (land, transport, utilities);

- fees (for environmental pollution, use of natural resources).

- Other ODA:

- costs of moving goods within production;

- shortages, losses, decreases identified as a result of inventory;

- payment for downtime;

- other expenses that cannot be included in categories other than ODA.

Costs taken into account and not taken into account in estimates

In the process of making a management decision, it is assumed that several alternative options are compared with each other with a specific goal - choosing the best one.

option. The indicators compared in this way can be divided into two categories: the first remain unchanged under all alternative options, the second fluctuate depending on a particular decision. When considering a large number of alternatives that differ from each other in many respects, the decision-making process becomes significantly more difficult. This means that it is advisable to compare not all indicators in full, but only the indicators of the second group, and these are precisely those that vary from option to option. These costs, which distinguish one alternative from another, are usually called relevant costs in management accounting. They are taken into account when making certain decisions. Indicators of the first group, on the contrary, are not taken into account when searching for options.

The accountant-analyst provides management with initial information for choosing the optimal solution, preparing his reports in such a way that they contain only relevant information.

The concept of general expenses

The activities of any enterprise are necessarily connected with the functioning of its various departments. A production workshop cannot operate on its own without management and control employees. The products must then be stored and sold, which requires other personnel and premises. All this leads to the formation of costs that seem to be far from the production process, which are combined into the group of general business expenses.

They may include amounts necessary for:

- covering administrative and management expenses;

- remuneration for employees employed outside production;

- depreciation and repair of general purpose fixed assets;

- payment for rent of non-production premises;

- covering other expenses of a similar nature.

General business expenses are also written off to the cost of manufactured products in accordance with the rules of the enterprise's accounting policy.

Opportunity costs

This category is present only in management accounting. The financial accountant cannot afford to “imagine” any costs, since he strictly follows the principle of their documentary validity.

In management accounting, in order to make a decision, it is sometimes necessary to accrue or attribute costs that may not actually occur in the future. Such costs are called imputed. Essentially, this is lost profit for the enterprise. It is an opportunity that is lost or sacrificed in favor of an alternative management decision.

What determines the division of cost items into elements?

The above groups of cost items will be detailed by cost items, the allocation of which is determined by the need to break them down into specific types. For example, the current needs of the department will require detailing, among which items such as:

- material costs,

- depreciation,

- rent,

- insurance,

- Information Support,

- travel expenses.

Each of the articles, in turn, should be divided into elements, focusing in this process on correlating them with the expenses allocated for tax purposes and with the possibility of fairly easily obtaining from the accounting data the information necessary for drawing up various types of reports. For example, insurance costs may include expenses related to:

- to compulsory property insurance;

- voluntary property insurance;

- compulsory liability insurance for damage;

- voluntary insurance of liability for causing harm;

- voluntary long-term insurance of personnel in case of death or disability;

- voluntary personal insurance for a period of more than 1 year with payment of medical expenses by insurers;

- voluntary personal insurance in case of death or disability;

- voluntary personal insurance of employees in excess of the limits established by clause 16 of Art. 255 Tax Code of the Russian Federation;

- other voluntary personal insurance for personnel.

Incremental and marginal costs

Incremental costs are additional and arise as a result of manufacturing or selling an additional batch of products. Incremental costs may or may not include fixed costs. If fixed costs change as a result of a decision, then their increase is considered as incremental costs. If fixed costs do not change as a result of the decision, then incremental costs will be zero. A similar approach is applied in management accounting to income.

Marginal costs and revenues represent additional costs and revenues per unit of output (good).

Results

Production costs are divided into direct and overhead.

Among the latter, production and general business expenses stand out. Production costs combined with direct ones form the production cost of production. The full value of the cost requires the inclusion of general business expenses. For each type of cost, its own list of cost items is formed, which in this list are combined into groups and divided into elements. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Regulated and non-regulated costs

Regulated expenses depend on the influence of the responsibility center manager. However, it cannot influence non-regulated expenses. A manager's performance is assessed by his ability to manage regulated costs.

For example, a manufacturing department overused material. Are these costs regulated by the shop manager? The answer is unclear. In the case where overexpenditure is associated with a violation of labor or technological discipline in the department, then these costs are controllable. When the reason is the low quality of the purchased materials, then these unproductive expenses are considered as not regulated by the head of the production department, and the head of the supply department will be responsible for this.

We briefly examined what production costs are, their types and their impact on the state of production. Leave your comments or additions to the material.

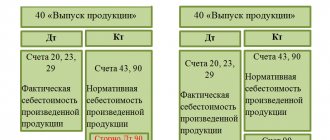

Accounting for direct costs of creating products (works, services)

To account for direct production costs, accounts 20 (main production), 23 (auxiliary production), 29 (service production) are intended. The costs for them are collected in relation to each department of the corresponding purpose, breaking down the expenses in accounting by types of products produced by these departments and by cost items.

Among the direct cost items, the most common expenses are:

- for main and auxiliary production materials,

- production staff salaries,

- wage accruals for production personnel.

The following expenses may also be present (if it is possible to organize appropriate accounting):

- for energy resources,

- production services provided by third parties,

- depreciation of production equipment.

Why are costs allocated?

The distribution of an organization's expenses on this basis is important for internal accounting policies, since it directly affects taxation. They are included in the tax base when calculating income tax.

How are direct and indirect costs taken into account as part of the total cost ?

When calculating this tax, all expenses are important, and all of them will be taken into account sooner or later. But for business, time is often critical, and for direct and indirect taxes, accounting time is different.

How to take into account direct and indirect costs when providing services ?

- Direct expenses must be recognized for tax purposes exactly when they occur. They have to be distributed between goods sold and goods awaiting sale, completed or unfinished work. So, if the cost of expenses is included in the sale of goods or payment for work, then they can be written off only upon completion, perhaps this will take several months or even years.

- indirect expenses in the same accounting period; they are fully taken into account for tax purposes.

IMPORTANT NUANCE! Expenses in the provision of services, even if they are classified as direct, are recognized in the current period and are not distributed, since the service is consumed in the process of its provision, its result is not expressed materially (based on clause 5 of Article 38, Article 313, para. 3 clause 2 article 318 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated June 15, 2011 No. 03-03-06/1/348).

Details

Production costs

...are the costs associated with managing departments (main, service and auxiliary). It is these expenses that are included in the cost price as general production costs. .

General production expenses are included in the cost of manufactured products in accordance with the accounting rules of the enterprise.

General production and general expenses together constitute indirect costs generated by the enterprise during the production process. They are written off by distributing expenses in proportion to a given indicator. These types of expenses are taken into account by highlighting separate expense items and workshops (departments). This helps to identify objects that are expensive to maintain and produce and allocate funds.

The amount of general production and general business expenses

taken into account on 25 and 26 synthetic accounts. At the end of the month, these two accounts do not have a balance because they are intended only to collect the costs of basic production and distribute them. The amounts are written off to account 20 by posting Dt20Kt 25/26. A number of enterprises (for example, those providing intermediary services) reflect all expenses on account 26 without using account 20.

Analytical accounting is maintained for accounts 25 and 26. For each workshop, sub-accounts are formed and, in addition, for individual items of general business expenses. When filling them out, the accountant relies on information from primary documents and other forms of accounting registers used by the enterprise. To account for general business and general production expenses, statements No. 12 and No. 15 are additionally maintained.

Accounting for overhead costs includes collecting information about cost items for maintenance and servicing the needs of production (main and auxiliary). Account 26 is used for the same purpose, only the amounts of administrative and management expenses are taken into account. The necessary information accumulates in the debit of accounts 25 and 26 during the designated period.

Different quotes apply

..., the main thing is that the double entry method and the active account rule are not violated: credits are taken into account in debits, and write-offs are taken into account in credits.

According to the instructions for using the standard chart of accounts, synthetic accounts 25 and 26 at the end of the reporting month must be closed without fail. This means that debit amounts will be assigned to account 20 or 90 (for general business expenses). These wires look like this:

DT “Main production” CT “General production expenses” - the amounts of general production expenses spent on the work of the main production departments are written off;

DT “Service production” CT “General production expenses” - the amount of costs for wages of service production workers is taken into account;

DT “Auxiliary production” CT “General production expenses” - the costs of paying utility bills for auxiliary production facilities are written off;

Dt “Cost of production” Ct “General production expenses” - the amounts of administrative and management expenses are written off to the cost of production.

The cost of production is based on the credit of which account the information about the debit turnover of general business expenses is entered into.

Expenses incurred in connection with the maintenance of production facilities or their maintenance can be taken into account for the final result in proportion to the amount adopted by the enterprise accounting policy. The main purpose of allocating overhead costs is to determine the cost per unit of goods, taking into account the costs of the production cycle at the exit from the workshop.