If there are no grounds for filing 6-NDFL, it is recommended to notify the Federal Tax Service about this before the deadline for submitting the calculation. There are no legal requirements for providing zero calculations or written notification, but a letter to the tax office about failure to provide 6-NDFL will help avoid imposing a fine on the company. This document notifies tax authority specialists in advance about the reasons for the absence of income tax calculations in the database for an enterprise or individual entrepreneur.

Business entities that act as a tax agent in relations with employees must submit Form 6-NDFL to the Federal Tax Service. If the enterprise does not use the services of hired personnel, then the obligation to provide income tax calculations does not arise (letter of the Federal Tax Service No. BS-4-11/4901 dated March 23, 2016).

The situation is different for those individual entrepreneurs and legal entities that accrued income to employees at the beginning of the year, but in the second and subsequent quarters there were no wage expenses - they must continue to prepare 6-personal income tax until the end of the reporting year. The reason is that the calculation form reflects the data on an accrual basis.

When you don’t have to submit a calculation using Form 6-NDFL:

- the business entity did not have hired personnel during the reporting period;

- since the beginning of the year, employees have not received income from the employer;

- the enterprise did not operate in the designated time range.

The fine for failure to provide 6-NDFL is provided for in Art. 126 of the Tax Code of the Russian Federation. It is the practice of tax authorities to prosecute all taxpayers who are registered in their database but have not filed a report. This can be prevented in two ways:

- generate and send a zero calculation, which is not provided for by regulations, but must be accepted by the Federal Tax Service, which is confirmed by a letter dated 05/04/2016 under No. BS-4-11/ [email protected] ;

- notify the Federal Tax Service in writing that there are no grounds for filling out 6-NDFL.

The fine for failure to provide 6-NDFL is equal to 1000 rubles for each month of delay (clause 1.2 of Article 126 of the Tax Code of the Russian Federation). Every day of delay in filing a document is taken into account. The full fine is also imposed for incomplete monthly intervals (even if there is only 1 day in an incomplete month).

There is no need to submit zero calculation 6-NDFL

All tax agents must submit calculations using Form 6-NDFL (clause 2 of Article 230 of the Tax Code of the Russian Federation). Tax agents are, as a rule, employers or customers under civil contracts under which individuals receive income.

At the same time, if during the reporting period an organization or individual entrepreneur did not accrue or pay any income to individuals, did not withhold tax and did not transfer personal income tax to the budget, then there is no need to submit 6-NDFL calculations. The fact is that in such a situation, an organization or individual entrepreneur is not recognized as a tax agent. The conclusion is confirmed by paragraph 3 of paragraph 2 of Article 230 of the Tax Code and letters of the Federal Tax Service of Russia dated March 23, 2016 No. BS-4-11/4901 and dated May 4, 2016 No. BS-4-11/7928.

An organization or individual entrepreneur has the right to submit a zero calculation of 6-NDFL to the INFS (despite the fact that they are not obliged to do this). The tax office, in turn, must accept a zero calculation.The tax office, in turn, must accept a zero calculation.

Periodicity

In the vast majority of cases, 2-NDFL calculations are submitted once a year. Information is provided for each employee who is registered in the organization separately. The deadline for this is April 1. Moreover, if this date falls on a weekend, then the “border” becomes the weekday preceding this date.

Moreover, it is interesting that simultaneously with hiring an employee, a legal entity or individual entrepreneur automatically agrees to provide appropriate reporting to the tax authorities. All responsibility for this process lies with the head of the company.

Thus, the letter stating that there is no obligation to provide a 2-NDFL calculation is also sent only once a year.

Why do you need a letter about zero 6-personal income tax?

Let us say right away that the Tax Code of the Russian Federation does not provide for the sending or submission of any letters about zero calculations of 6-NDFL. However, the advisability of submitting such a letter is due to the following.

The fact is that without waiting for the calculation of 6-NDFL, the tax office has the right to block the current account of an organization or individual entrepreneur. Blocking is possible if the 6-NDFL calculation is not submitted within 10 working days from the date of the deadline for its submission (See “Penalties for late submission of 6-NDFL in 2021”). After all, the inspectorate simply will not know whether the organization or individual entrepreneur is a tax agent or whether they simply forgot to submit 6-NDFL.

Unfortunately, there is a possibility of such a development of events. And in order to protect the business, it makes sense to submit a free-form letter to the tax office, in which it is reported that the organization or individual entrepreneur has neither employees nor contractors and therefore 6-NDFL is not submitted.

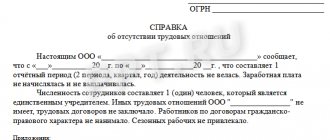

Let's give an example of such a letter.

Features of drawing up different types of statements

Different types of applications can be sent to the tax office. They are divided into types depending on the purpose of the direction and content.

About obtaining a TIN

Any tax payer is registered with the Federal Tax Service. Registration is carried out within 5 days after sending the application. The latter is compiled according to form No. 2-2-Accounting, established by order of the Federal Tax Service No. YAK-7-6 / [email protected] dated August 11, 2011.

About the deduction

A deduction is an amount that reduces the calculation base when determining tax. There are these types of deductions:

- Regular.

- Child deduction.

- For investment.

Tax refunds are made based on the application. Its form is established by order of the Federal Tax Service No. ММВ-7-8 / [email protected] dated February 14, 2021.

On issuing a certificate stating that the payer has no debts

The payer may request information about the presence/absence of tax debts. To do this you need to request a certificate. It may be needed, for example, when obtaining a mortgage.

The application form has not been approved. That is, the document can be drawn up in free form. However, it is recommended to adhere to the standard structure: “header”, title, text with a formulated request, signature and date.

For a refund or offset of tax that was overpaid

A company may mistakenly pay too much in taxes. To get a refund, you need to send an application to the tax office. You need to formulate your request in the “body” of the document. It could be:

- refund;

- offset of funds against future payments.

The application must be submitted within 3 years from the date of overpayment. Funds must be returned within a month from the date of receipt of the tax paper. The application can be submitted in electronic format. To do this, you need to go to your personal account of the Federal Tax Service.

About deferment of payment

Sometimes individuals or legal entities cannot pay taxes on time. In this case, they can request an installment plan. The amounts for which the installment plan is issued cannot exceed the value of the debtor's property on which the tax is paid. To receive the benefit, you must fill out an application in the form specified in Appendix No. 1, approved by Order of the Federal Tax Service No. ММВ-7-8 / [email protected] dated September 28, 2010.

ATTENTION! If an installment plan is issued, interest accrues.

How often to submit a letter

The above letter can be written only once. In this case, the letter should indicate that the organization or individual entrepreneur will submit calculations in form 6-NDFL as soon as such an obligation arises.

However, an even more reliable option is possible - such a letter can be submitted to the inspectorate at the end of each reporting period. Thus, at the end of each reporting campaign, tax authorities will receive a “reminder” that there is no need to wait for 6-NDFL calculations from a company or individual entrepreneur.

Let us remind you that the reporting periods for submitting 6-NDFL are as follows:

- I quarter;

- half year;

- nine month;

- year.

For example, you must submit 6-personal income tax for the 2nd quarter of 2021 no later than August 1, 2021. Accordingly, after August 1, 2021, you can submit such a letter to the Federal Tax Service.

Error when registering registers

Tax registers for personal income tax are necessary for the correct preparation of the 2-NDFL certificate and the calculation of 6-NDFL. Therefore, the document must contain all the data for these reports. An extract from the register plays an important role when applying for a tax refund.

The registers do not include non-taxable income that does not have codes:

- benefits (except for those taxed for temporary disability)

- daily allowance within the limit (700 rubles per day – within Russia and 2,500 rubles per day – for trips abroad).

Partially taxable income has its own codes (gifts, financial assistance, prizes) and they must be fully included in the document.

Deadline for submitting a letter

There is, of course, no specific deadline for submitting the letter. The letter is submitted solely at the discretion of the tax agent. However, if you have already decided to send a letter to the tax authorities, it is better to submit it immediately after the end of each reporting campaign and not wait until 10 days have passed. After all, if the 6-NDFL calculation is not submitted within 10 working days from the date of its submission, the Federal Tax Service will be able to block the bank accounts of the organization (clause 6 of article 6.1, clause 3.2 of article 76 of the Tax Code of the Russian Federation). During this period, tax authorities should be reminded that they may not expect a payment from you.

Read also

21.07.2016

Situations

Organizations are created to bring profit to their owners. When this does not happen, they are not tax agents. But they don’t fulfill their main function either. Sending employees on unpaid leave or other reasons for not providing 2-NDFL calculations most often arise in companies:

- Young, newly formed. It takes them a certain amount of time to “build up”. Therefore, for the first year or two, such an organization may well operate in the red, without attracting close attention from tax authorities.

- In a crisis. Even stable, unfavorable times are in this form. After all, paying wages to employees is one of the main expense items.

The second situation is threatening for the company. Moreover, if it remains in such a “frozen” state for a long time, then this raises questions from the tax authorities. The latter organize various inspections of such companies. After all, it is possible that in this way an organization can evade paying due taxes.

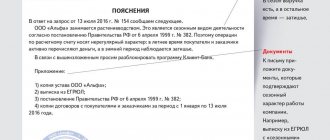

Explanations to the tax office regarding personal income tax (sample).

Rosstandart dated December 8, 2016 No. 2004-st). Simplified, they can be represented as follows:

- details of the sender-taxpayer (name indicating the organizational and legal form, legal address, INN/KPP, telephone). If the support is issued on a “company” letterhead, then the bank details will be indicated: current account number, name of the bank, its BIC, correspondent account;

- details of the recipient - Federal Tax Service (name and number of inspection, legal address);

- date and outgoing number with reference to the received request from the Federal Tax Service (incoming number and date);

- content (may begin with the words: “In connection with the requirement of the Federal Tax Service dated 00.00.2018 No. _ to provide written explanations for ... ____ for 2021, we report the following:”, after which the requested information is listed point by point);

- attachment (if there are attachments, then after the main text a list of attached documents is given in the form of a simple numbered list. If there are many attachments, then in this place an indication is given of the inventory, which is attached to the cover letter separately);

- signatures (usually a manager or individual entrepreneur, but there may also be a signature of an authorized representative);

- information about the contractor (usually in the lower left corner of the cover letter, after all his details the full name of the person who wrote the cover letter, his phone number, e-mail, and other details are indicated).

Since the paper form of a cover letter is not unified, using the details listed above is quite enough to compose such a letter.

How to avoid paying a fine for 3-NDFL

Let us emphasize again. Only those persons who are OBLIGATED to submit a declaration can be held liable for taxation. You have no such obligation. Therefore, holding you accountable and imposing a fine for not filing a declaration is illegal and unjustified.

Let any resource stand behind the tax authorities. It's your job not to pay the fine. Especially considering the fact that it is possible to forcibly collect it from you only in court. So let the tax authorities practice their verbiage in court. The main thing is to come to the court hearing. And say everything that is written above. The court will not decide to hold you accountable and collect a fine.

In addition, by illegally demanding a fine from you, your tax authority is breaking the law.

And for such violations she can be brought not only to disciplinary, but also to administrative liability. We need to tell her about this somehow. Sincerely, administration of the “Your Taxes” portal.

Are you late with your reporting? Explain yourself

Svetlana Posledovskaya, financial legislation expert

Magazine "Actual Accounting"

A company that submitted its RSV-1 calculation to the Pension Fund late should better attach an explanatory note to its reporting. Experts from the journal “Actual Accounting” explained how to compile this document.

Organizations submitting reports may encounter technical glitches, problems with the provider, errors in document format, etc., which can lead to a delay in reporting. For lateness, a fine is provided - 5 percent of the amount of insurance premiums accrued for payment for the last three months of the reporting (calculation) period, for each full or partial month from the date established for its submission, but not more than 30 percent of the specified amount and not less than 1000 rubles (Part 1, Article 46 of Federal Law No. 212-FZ of July 24, 2009 (hereinafter referred to as Law No. 212-FZ)).

To reduce the fine, the company should attach an explanatory note explaining the reasons for the delay (clause 5, part 1, article 28 of Law No. 212-FZ). If the inspectors consider the delay to be justified, then they may recognize such circumstances as excluding or mitigating guilt (clause 4, part 1, part 2, article 43, clause 4, part 1, part 4, article 44 of Law No. 212-FZ) .

Writing a note

The explanatory note is drawn up in any form. You should start with what reporting and for what period was not submitted on time, and also indicate the days of delay. Next, you need to indicate the reasons that prevented the timely submission of reports. This could be a computer breakdown at the company itself, technical failures at the Internet provider or special operator. The reasons may vary, and since the list of excluding and mitigating circumstances is open, the company should provide as many arguments as possible in its defense. Supporting documents must be attached to the explanations: a certificate from a special operator about a technical breakdown or a report from an Internet provider.

It would be useful to indicate a number of other important factors that may influence the fund’s decision: lack of intent to commit an offense, payment of insurance premiums in full and on time. If the offense was committed for the first time, this is also worth mentioning.

A sample explanatory note is given below.

Judges' position

Even if PFR specialists do not pay attention to the explanatory note to the RSV-1 calculation and impose the maximum fine, the company can challenge their actions in court. Arbitrators, like controllers, have the right to reduce the fine if there are mitigating circumstances. As the judges note, the list of such circumstances is not exhaustive (regulatory Federal Antimonopoly Service No. F03-344/2011 dated February 21, 2011). Sanctions may be reduced to such an amount as they deem appropriate in each particular situation.

For example, the Federal Antimonopoly Service of the North-Western District (registered by the Federal Antimonopoly Service of the North-Western District dated January 27, 2012 No. A56-19757/2011) reduced the fine from 30,000 to 1,000 rubles. The company sent the calculation to the Pension Fund of Russia with a delay of one day; Due to a malfunction in the computer program, the calculation was received by the department seven days after the deadline for submitting reports. The company did not agree with the amount of sanctions and went to court, which reduced the fine to the minimum.

The arbitrators pointed to mitigating circumstances: lack of intent to commit an offense, a short period of delay in submitting the calculation, and the commission of an offense for the first time.

Other arbitrators, under similar mitigating circumstances, reduced the fine by four (ruling of the Seventeenth Arbitration Court dated March 30, 2011 No. 17AP-1739/2011) and nineteen times (ruling of the Thirteenth Arbitration Court dated February 2, 2012 No. 13AP-23704/11).

For more information about when a fine is not dangerous when submitting electronic reports, read in “Current Accounting” No. 10-2011 on p. 74.

Expertise of the article: Tatyana Batygina, Legal Consulting Service GARANT, legal consultant

The Federal Tax Service sends for use in the work clarifications on the issues of submitting and filling out the form for calculating the amounts of personal income tax calculated and withheld by the tax agent (Form 6-NDFL).

Please bring this letter to the lower tax authorities.

For the purposes of the promotion, the organization pays cash prizes to lottery participants. Cash prizes do not exceed 4,000 rubles. Are such amounts subject to reflection in the calculation of personal income tax amounts calculated and withheld by the tax agent in Form 6-NDFL?

In accordance with the provisions of paragraph 2 of Article 230 of the Tax Code of the Russian Federation (hereinafter referred to as the Code), tax agents submit to the tax authority at the place of their registration a document containing information on the income of individuals for the expired tax period and the amount of tax calculated, withheld and transferred to the budget system of the Russian Federation (hereinafter referred to as information in Form 2‑NDFL), as well as calculation of the amounts of personal income tax calculated and withheld by the tax agent.

In section 1 of the calculation of the amounts of personal income tax calculated and withheld by the tax agent (hereinafter referred to as the calculation according to form 6-NDFL), approved by order of the Federal Tax Service of Russia dated October 14, 2015 No. MMV-7-11 / [email protected] “On approval of the form calculation of the amounts of personal income tax calculated and withheld by the tax agent (form 6‑NDFL), the procedure for filling out and submitting it, as well as the format for presenting the calculation of the amounts of personal income tax calculated and withheld by the tax agent in electronic form" (hereinafter – order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11/ [email protected] ), the amounts of accrued income, calculated and withheld tax, aggregated for all individuals, are indicated on an accrual basis from the beginning of the tax period at the appropriate tax rate.

According to clause 3.3 of the Procedure for filling out and submitting the calculation in form 6‑NDFL, approved by order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11/ [email protected] , line 020 of section 1 of the calculation in form 6‑NDFL indicates a generalized figure for all physical for individuals, the amount of accrued income on an accrual basis from the beginning of the tax period.

Line 030 “Amount of tax deductions” is filled in according to the values of codes for types of taxpayer deductions approved by Order of the Federal Tax Service of Russia dated September 10, 2015 No. ММВ-7-11/ [email protected] “On approval of codes for types of income and deductions.”

Based on paragraph 28 of Article 217 of the Code, income not exceeding 4,000 rubles received by a taxpayer during the tax period in the form of winnings and prizes in competitions, games and other events for the purpose of advertising goods (works, services) is not subject to personal income tax. .

In this regard, the organization has the right not to reflect in the calculation in Form 6-NDFL the income received by individuals in ongoing advertising campaigns in the form of cash prizes not exceeding 4,000 rubles for the tax period.

If the amount of the indicated income, for example, received by the same individual, exceeds 4,000 rubles in the tax period, then this income must be reflected in the calculation using Form 6-NDFL.

Is income in the form of financial assistance paid to an employee upon the birth of a child in the amount of 50,000 rubles subject to reflection (filling out) in the calculation using Form 6-NDFL?

Based on paragraph 8 of Article 217 of the Code, the amounts of one-time payments (including in the form of financial assistance) made by employers to employees (parents, adoptive parents, guardians) at the birth (adoption) of a child, paid in during the first year after birth (adoption), but not more than 50,000 rubles for each child.

In this regard, the employer has the right not to reflect in the calculation using Form 6-NDFL the employee’s income in the form of one-time financial assistance at the birth of a child during the first year after the birth of the child in an amount not exceeding 50,000 rubles.

When is an income payment transaction considered completed for the purpose of reflecting it (filling it out) in the calculation using Form 6-NDFL?

Section 1 of the calculation in Form 6‑NDFL is compiled on an accrual basis for the first quarter, half a year, nine months and a year (hereinafter referred to as the presentation period).

Section 2 of the calculation in Form 6‑NDFL for the corresponding submission period reflects those transactions that were carried out over the last three months of this period.

If a tax agent performs an operation in one presentation period and completes it in another period, then this operation is reflected in the presentation period in which it is completed. In this case, the operation is considered completed in the submission period, in which the deadline for transferring the tax occurs in accordance with paragraph 6 of Article 226 and paragraph 9 of Article 226.1 of the Code.

For example, a transaction for the payment of wages accrued for June 2021, actually paid on 06/30/2017 (refers to the half-year submission period), with the transfer deadline in accordance with paragraph 7 of Article 61 and paragraph 6 of Article 226 of the Code 07/03/2017 (refers to presentation period for nine months) is reflected in section 2 of the calculation in form 6-NDFL for nine months of 2017.

On 02/05/2017, a civil contract was concluded with an individual to carry out construction work. The acceptance certificate for works (services) under a civil contract was signed in March 2021, and the remuneration to an individual for the provision of services under this contract was paid in April 2017. In what period should this income be reflected in the calculation using Form 6-NDFL?

In accordance with subparagraph 1 of paragraph 1 of Article 223 of the Code, the date of actual receipt of income in the form of remuneration for the provision of services under a civil law agreement is considered the day of payment of income, including the transfer of income to the taxpayer’s bank accounts or, on his behalf, to the accounts of third parties.

According to paragraph 4 of Article 226 of the Code, tax agents are required to withhold the accrued amount of tax directly from the taxpayer’s income upon their actual payment, taking into account the specifics established by this paragraph.

At the same time, tax agents are obliged to transfer the amounts of calculated and withheld tax no later than the day following the day of payment of income to the taxpayer.

If the acceptance certificate of work (services) under a civil law contract was signed in March 2021, and the remuneration to an individual for the provision of services under this contract was paid in April 2021, then this operation is reflected in sections 1 and 2 of the calculation according to form 6‑NDFL for the first half of 2017.

An employee of the organization goes on vacation from 06/01/2017. Vacation pay for June 2021 was paid to the employee on May 25, 2017. How to reflect these amounts of vacation payments in the calculation using Form 6-NDFL?

In accordance with subparagraph 1 of paragraph 1 of Article 223 of the Code, the date of actual receipt of income in the form of vacation pay is defined as the day of payment of income, including the transfer of income to the taxpayer’s bank accounts or, on his behalf, to the accounts of third parties.

According to paragraph 4 of Article 226 of the Code, tax agents are required to withhold the accrued amount of tax directly from the taxpayer’s income upon their actual payment, taking into account the specifics established by this paragraph.

When paying a taxpayer income in the form of temporary disability benefits (including benefits for caring for a sick child) and in the form of vacation pay, tax agents are required to transfer the amounts of calculated and withheld tax no later than the last day of the month in which such payments were made.

If the employee was paid the amount of vacation pay for June 2021 on May 25, 2017, then this operation is reflected in sections 1 and 2 of the calculation in Form 6-NDFL for the six months of 2021. In section 2 of the calculation in Form 6‑NDFL for the first half of 2021, this operation is reflected as follows:

line 100 indicates 05/25/2017; on line 110 – 05.25.2017; on line 120 – 05/31/2017; on lines 130 and 140 - the corresponding total indicators.

During the time an employee of an organization is on a business trip, he is paid the average salary along with his salary. What date in the calculation of 6‑NDFL on line 100 of section 2 should be indicated in relation to the average earnings accrued to the employee while on a business trip?

According to the provisions of Article 139 of the Labor Code of the Russian Federation, for calculating the average salary, all types of payments provided for by the remuneration system that are used by the relevant employer are taken into account, regardless of the sources of these payments.

Since an employee performs job duties on a business trip, and the average earnings for the days on a business trip are part of the salary, the amount of average earnings accrued for the days the employee is on a business trip, in accordance with paragraph 2 of Article 223 of the Code, is recognized as his income on the last day month for which this income was accrued. It is this date that is reflected in line 100 of section 2 of the calculation in Form 6-NDFL.

The organization, after submitting to the tax authorities a calculation in Form 6-NDFL for the first half of 2021, discovered in the first quarter of 2017 an error leading to an understatement of the amount of income, and, consequently, to an understatement of the calculated and withheld amount of personal income tax. Is it necessary to submit an updated calculation in Form 6-NDFL for each submission period (for the first quarter and half of the year)?

Section 1 of the calculation in Form 6‑NDFL is filled out with an accrual total for the first quarter, half a year, nine months and a year. Section 2 of the calculation in Form 6‑NDFL for the corresponding submission period reflects those transactions that were carried out over the last three months of this period.

According to paragraph 6 of Article 81 of the Code, if a tax agent discovers in the calculation submitted by him to the tax authority the fact of non-reflection or incomplete reflection of information, as well as errors leading to an understatement or overstatement of the amount of tax to be transferred, the tax agent is obliged to make the necessary changes and submit to the tax authority updated calculation.

In accordance with Section II of the Procedure for filling out and submitting calculations in Form 6‑NDFL, approved by order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11/ [email protected] , when submitting an updated calculation in Form 6‑NDFL, the number is indicated on the title page adjustments (“001”, “002” and so on).

Thus, if a tax agent discovers, after submitting to the tax authority a calculation in Form 6-NDFL for the first half of 2021, an error in terms of understating the amount of tax in the calculation in Form 6-NDFL for the first quarter of 2021, the tax agent should submit to the tax authority updated calculations for the first quarter and half of 2021 since section 1 of the calculation in Form 6‑NDFL is compiled on an accrual basis.

The tax agent made arithmetic errors when calculating personal income tax on wages for December 2016 paid in January 2021. In February 2021, the tax agent recalculates. How to reflect the recalculation of wages made in February 2021 for December 2021, paid in January 2021, in the calculation according to Form 6-NDFL and information on the income of individuals according to Form 2-NDFL?

In accordance with subparagraph 1 of paragraph 3 of Article 24 of the Code, tax agents are required to correctly and timely calculate, withhold from funds paid to taxpayers, and transfer taxes to the budget system of the Russian Federation to the appropriate accounts of the Federal Treasury.

According to paragraphs 1, 4 of Article 54 of the Code, when errors (distortions) are detected in the calculation of the tax base relating to previous tax (reporting) periods, in the current tax (reporting) period, the tax base and tax amount are recalculated for the period in which they were the specified errors (distortions) have been made.

In the event that a tax agent, in connection with the identification of arithmetic errors, recalculates in February 2021 the amount of personal income tax from wages for December 2016, paid in January 2021, then the total amounts, taking into account the recalculation made, are reflected in section 1 of the calculation according to form 6‑NDFL for 2021 and in section 2 of the calculation according to form 6‑NDFL for the first quarter of 2021.

In addition, the amount of personal income tax on wages for December 2021, taking into account the recalculation made, is subject to reflection in information on the income of individuals in Form 2-NDFL for 2021.

Maintenance requirements

There are many reasons to submit information to the Federal Tax Service at the place of registration (or place of registration of taxable objects), for example:

- response to a message from the Federal Tax Service with a request to provide explanations for conducting a desk tax audit of a tax return (based on clause 3 of Article 88 of the Tax Code of the Russian Federation);

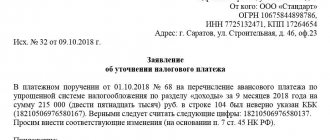

- a taxpayer’s message about submitting an updated tax return to the Federal Tax Service in connection with an incorrectly specified BCC (based on clause 1 of Article 80 of the Tax Code of the Russian Federation);

- a list of documents to be submitted in connection with the request received (based on clause 2 of Article 93 of the Tax Code of the Russian Federation).

When preparing the support, the taxpayer must choose in what form - paper or electronic - he wants to send it. The procedure and form of the cover letter itself depends on this.

However, there is a list of details that must be present in it in any case (GOST R 7.0.97-2016, approved by pr.

Electronic document management

In the process of electronic document management, the parties exchange electronic documents (clause 2.4. Appendix No. 1 to the regulation of the Federal Tax Service of the Russian Federation dated June 13, 2013 No. MMV-7-6 / [email protected] ):

- request;

- appeal;

- information message about the representation;

- acceptance receipt;

- notification of refusal of admission;

- confirmation of dispatch date;

- response to a request;

- letter from the tax authority;

- newsletter.

As well as technological electronic messages:

- notification of receipt;

- error message.

An electronic document is a document presented in digital form, in accordance with the format requirements for this type (Part 1 of the above-mentioned Guidelines). Since there are many of them, each one has a form approved by the relevant order of the Federal Tax Service of the Russian Federation.

In digital communication, documents confirming the date of sending and the date of receipt of documents are very important for the parties. They are generated by the electronic document management operator or the Federal Tax Service and sent to the correspondent after registration of the fact of dispatch or acceptance via TKS.

Document flow terms

The exchange of documents between tax authorities and taxpayers is regulated by two main regulations:

- By Order of the Ministry of Finance of the Russian Federation dated July 2, 2012 No. 99n “On approval of the Administrative Regulations of the Federal Tax Service...”.

- Based on it, “Methodological recommendations for organizing electronic document management ...” (approved by order of the Federal Tax Service of the Russian Federation dated June 13, 2013 No. ММВ-7-6 / [email protected] ).

In them, participants in information interaction mean not only taxpayers (their representatives) and tax authorities, but also EDI operators (in the case of electronic document management).

Taxpayers mean payers of taxes, fees, insurance premiums, as well as tax agents. Taxpayer representatives are individuals or legal entities authorized by the taxpayer to represent his interests regarding taxes and fees.

An application to the Federal Tax Service is generated by the taxpayer (or his representative) and sent to the place of registration.

At the end of the article, you can download a current sample of how to write a cover letter to the tax office - we’ll look at it below.