Changes 2021

Anastasia Pimenova

Accountant expert with 10 years of experience

Current as of July 14, 2020

From January 1, 2021, the special tax regime in the form of UTII is cancelled. Tax payers are faced with the question of which taxation system to switch to in 2021. Let's talk about who has the right to replace UTII with a simplified one and how to do it.

What to do immediately after switching to the simplified tax system

There are two important points that need to be done after changing UTII to simplified tax system:

- Notify partners

about the transition to a new tax system. This is done in order to simplify the preparation of documents and the correct conduct of operations. To notify, it is necessary to send notification letters and copies of the information letter or tax return title according to the simplified tax system to counterparties. - Submit a UTII declaration and pay tax

. The deadline for filing a return is 01/20/2021, and the deadline for paying tax for the 4th quarter of the current year is 01/25/2021.

Attention!

There is no need to submit an application to the Federal Tax Service for withdrawal from UTII. The tax office will perform this operation automatically.

Terms of use

It was intended to abolish the UTII starting from 2021, but taxpayers were given a deferment until 2021. Finance Minister Anton Siluanov says that there will be no more delays; from 2021, “imputation” will no longer be applied. The fact is that when using it, most of the income of entrepreneurs is not taxed. In addition, an exception is made for taxpayers of this regime when labeling is introduced, which is now becoming mandatory for more and more groups of goods. Thus, the algorithm of how to switch to UTII will soon lose its relevance. Although entrepreneurs have another 1 year to work on this system. And for those who are thinking about how to replace it in the future, the authorities recommended considering the possibility of using the self-employed regime instead of “imputation”.

Who should not use the simplified tax system?

Not all entrepreneurs have the right to make the transition from UTII to the simplified tax system. A complete list of persons who cannot apply this taxation system is presented in clause 3 of Article 346.12 of the Tax Code of the Russian Federation. Here we note some of them:

Note!

If an individual entrepreneur or LLC meets the requirements of the simplified tax system and has the right to apply this tax regime, but during the year violates the conditions of working under the simplified taxation system, then it is automatically transferred to the OSNO.

Read more about the transition from UTII to OSNO in our article at the link >>>

Who is affected by the abolition of UTII from 2021

From January next year, the concept of “retail trade”, defined for the purposes of applying the single tax, excludes the sale of the following goods:

- medicines labeled in accordance with Part 4 of Article 67 of Law No. 61-FZ (comes into force in January 2021);

- footwear products, mandatory labeling of which has been introduced since July 2019 (Russian Regulations of the Russian Federation No. 792-r);

- fur products, other items of clothing, accessories made from natural fur (Reg. Regulation No. 787-r of 2021).

The list of specific goods is determined in accordance with the codes “OK 034-2014 (CPES 2008)” and the Unified Commodity Nomenclature of the EAEU. Thus, the abolition of UTII from 2021 has become a reality for pharmacies, pharmacy points and stores selling footwear and fur products. The introduced restrictions apply equally to individual entrepreneurs using PSN.

The answer to the question why these particular goods were the first to come out of the special regime is simple. The introduction of labeling and online cash registers makes it possible for tax authorities to calculate the actual income of entrepreneurs, while UTII is calculated from physical indicators that do not directly reflect the scale of the business. According to the Federal Tax Service, this leads to abuses on their part.

Time frame for the transition from UTII to simplified tax system

The deadline for submitting a notice of transition to a simplified taxation system is December 31, 2021. If an entrepreneur does not have time to submit an application in the current year, then he is automatically transferred to the general taxation system (OSNO).

The consequences are not the most pleasant - within a year, neither individual entrepreneurs nor organizations will be able to switch to another SNO and will be forced to pay VAT, property tax, as well as personal income tax or income tax.

Application for transition from UTII to simplified tax system: how to fill out

Sample application for transition from UTII to simplified tax system:

The application must indicate the following parameters:

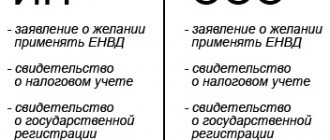

For individual entrepreneurs and LLCs:

- tax object code: 1 - income, 2 - income minus expenses.

Only for LLC:

- the amount of income for 9 months of 2021 (since to work on the simplified tax system, annual profit should not exceed 150 million rubles, then income for 9 months cannot exceed 112.5 million rubles);

- residual value of fixed assets as of 10/01/2020.

Sample of filling out an application for transition from UTII to simplified tax system:

Read more about the application for withdrawal of UTII in the article >>>

How to account for income from sales of goods

Include payment for goods (work, services) in income if both operations (sale and payment) were carried out using a simplified procedure (letters from the Federal Tax Service No. SD-4-3/ [email protected] dated November 20, 2020, No. SD-4-3/ [email protected] dated 10/27/2020).

If the goods were delivered on imputation and payment was received after the transition to the simplified system, the payment is not included in income, as well as the advance received before the transition and worked out after (Clause 1 of Article 346.17 of the Tax Code of the Russian Federation).

Expenses for the purchase of goods incurred during imputation are taken into account after the transition to the simplified regime in accordance with paragraphs. 2 p. 2 art. 346.17 of the Tax Code of the Russian Federation as goods are sold.

The costs associated with the sale of goods paid after the transfer to the simplified system are taken into account in the costs of the simplified tax system.

The cost of raw materials and supplies purchased and paid for during the period of application of the imputation is taken into account when calculating the simplification as they are written off (Part 1, Article 4 of Federal Law No. 373-FZ of November 23, 2020).

ConsultantPlus experts have collected all the explanations from tax authorities on the abolition of the Unified Tax and the transition to other regimes. Use these instructions for free.

Conditions for an organization's transition to the simplified tax system

To switch to a simplified taxation system, organizations must meet the following requirements:

- Number of employees - up to 100 people;

- Annual income is less than or equal to 150,000,000 rubles;

- The residual value of fixed assets according to accounting does not exceed 150,000,000 rubles;

- The share of other organizations in the authorized capital does not exceed 25%;

- The organization has no branches.

Notification of the transition from UTII to simplified tax system

You can send the document to the authority

- through the Personal Account of the Federal Tax Service;

- via TCS (telecommunication channel);

- by mail with a description of the attachment;

- personally.

All fundamentally important points are indicated in Letter No. AB-4-19/ [email protected] You can download it from the link>>

Results

There are many aspects in the transition from UTII to the simplified tax system that tax authorities and courts interpret ambiguously. Legislators are trying to clarify slippery points by finalizing the provisions of the Tax Code, but they have not yet been able to do this completely.

Sources:

- Determination of the Supreme Arbitration Court of the Russian Federation dated August 21, 2009 No. VAS-8660/09

- Resolution of the Federal Antimonopoly Service of the Moscow District dated March 16, 2012 No. A41-36987/10

- Resolution of the Federal Antimonopoly Service of the North Caucasus District dated February 13, 2009 No. A32-22122/2006-51/313-2008-25/8-19/164

- Resolution of the Federal Antimonopoly Service of the North-Western District dated 06/04/2008 in case No. A21-6882/2007

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How is tax calculated under the simplified tax system?

If income is chosen as the object of taxation, its size is the basis for calculation. The average rate under such conditions is 6%. The tax can be reduced by no more than 50% due to insurance premiums, benefits for 3 days of sickness of employees, contributions under voluntary and personal insurance contracts.

If the object of taxation is income minus expenses, then the basis for calculation is the difference between these indicators (income minus expenses). The tax rate in this case is 15%. If the year ends with a loss, then the minimum tax must be paid - 1% of the amount of taxes.

We remind you that today interest rates for those who switch from UTII have been noticeably reduced in many regions. In the near future they plan to unify them for all entrepreneurs in Russia.

Combination with other systems

Partial combination of UTII and other taxation systems is not prohibited by law. A partial transition is also possible when, along with the “imputation”, the taxpayer carries out types of activities for which it does not apply. Accordingly, taxes on these types of activities are paid according to the established and chosen system.

However, in this case, according to paragraph 7 of Art. 346.26 of the Tax Code of the Russian Federation, payers are required to keep separate records of property in the generally established order, liabilities and business transactions for different types of activities: taxable under UST and under OSNO. Calculation of taxes for other types of activities not included in the “imputation” is carried out in accordance with the rules established for them. This is the official position of the Federal Tax Service of the Russian Federation.

Responsibilities of the payer of the simplified tax system

Taxpayers who use the simplified tax system are required to:

- submit a declaration once a year (based on the results),

- pay taxes and advances four times a year,

- keep a book of expenses and income (KUDiR).

The Business.ru program will help automate the maintenance of KUDiR in electronic form >>>

Additionally, all LLCs must maintain accounting records and submit financial statements on time.

How to switch to the simplified tax system from 2021: step-by-step instructions

At the beginning of the article, we already told you how to prepare for a change in the tax regime and what to do immediately after switching to a simplified tax regime. Let us briefly recall the procedure:

- Select the object of taxation: “income” or “income minus expenses”;

- Draw up an application for the transition from UTII to the simplified tax system according to form No. 26.2-1, approved. By order of the Federal Tax Service of Russia dated November 2, 2012 No. ММВ-7-3/ [email protected] :

- Specify the code of the taxable object;

- Indicate the amount of income for 9 months (for LLC);

- Indicate the residual value of fixed assets as of October 1, 2020 (for LLC);

What is the responsibility of the imputator

Responsibility for the UTII payer does not differ from the responsibility provided for taxpayers who have chosen other regimes, and therefore the following types of violations of the law that entail punishment can be distinguished:

- failure to submit a tax return (clause 1 of Article 119 of the Tax Code of the Russian Federation);

- violation of the rules for accounting for income and expenses (Article 120 of the Tax Code of the Russian Federation);

- non-payment of taxes (Article 122 of the Tax Code of the Russian Federation);

- failure to fulfill the duties of a tax agent (Article 123 of the Tax Code of the Russian Federation);

- failure to submit reports to the funds (Article 26.30 of the Law “On Insurance Contributions from NS and PZ...” dated July 24, 1998 No. 125-FZ, Article 17 of the Law “On Personalized Accounting...” dated April 1, 1996 No. 27-FZ);

- failure to provide data for tax control (Article 126 of the Tax Code of the Russian Federation).

This article will help you choose the tax regime between OSN, simplified tax system and UTII.

What happens if you don’t switch to the simplified tax system?

The transition to a simplified taxation system may not be necessary. You don’t even need to submit an application for withdrawal from UTII - the tax office will do everything for you. However, at the same time, the Federal Tax Service will immediately transfer the individual entrepreneur or organization to OSNO.

What are the disadvantages of this:

- it will be possible to switch to another taxation system only after a year;

- you will have to pay VAT;

- you will be required to pay property tax;

- An individual entrepreneur will not bypass personal income tax, and an LLC will not bypass income tax.

We advise you to think today about what will be more profitable for your company. There is little time left until the end of 2021, so we advise you not to delay your decision.

Example of VAT recovery on fixed assets

In February, Shelkopryad LLC bought equipment worth 130 thousand rubles (including VAT 23,400 rubles). Input VAT on the purchased equipment was successfully accepted for deduction in a timely manner, and from July Shelkopryad LLC decided to switch to UTII. Accordingly, it became necessary to calculate the amount of VAT to be restored.

The residual value of the equipment, based on tax accounting data, as of June was equal to 103 thousand rubles. As a result of simple calculations, it turns out that the amount of VAT to be recovered is:

RUB 23,400 x 103 thousand rubles. : (130 thousand rubles – 23,400 rubles) = 22,609 rubles.

Innovations of the simplified tax system from 2021

Changes in the simplified tax system primarily concern new restrictions on the number of employees and the amount of profit for the year.

If previously violators were transferred to another taxation system, now they retain the opportunity to use the simplified tax system, but with increased tax rates: 8% and 20%.

Changes in the area of limits

From 2021, individual entrepreneurs and LLCs will be able to work under the simplified tax system, even if they exceed the limits on income and number of employees.

However, there are nuances here:

- Revenues may exceed 150 million rubles, but not more than 50 million;

- The number of employees can exceed 100 people if there are no more than 30 new employees.

As soon as all declared limits are exceeded, the enterprise is transferred to OSNO.

New tax rates

So, if the limits listed above were increased, but the income remained within 200 million, and the number of employees did not exceed 130 people, then new rates come into force for taxpayers:

- For the “Income” object, the percentage increases from 6% to 8%.

- For the object “Income minus expenses” - from 15% to 20%.

The new rates must be paid from the moment the profit limits and/or the number of employees are exceeded.

Which tax regime to choose

Since January, the tax office has automatically removed entrepreneurs and organizations from UTII. If you do not have time to switch to another mode, you will be transferred to OSNO, so you need to think about the transition in advance.

Thus, both companies and individual entrepreneurs can choose OSNO or simplified tax system, and those who are engaged in agriculture can also choose unified agricultural tax. Entrepreneurs can also switch to PSN and NAP.

To choose the appropriate tax regime, you need to calculate approximate income and expenses and take into account the nuances associated with reporting, the number of employees and restrictions on types of activities. On the Federal Tax Service website there is a service “Selecting an appropriate tax regime”, which will help you decide.

Evgeny is an individual entrepreneur, he has his own car service in Krasnogorsk. He has no employees; he works alone in the garage. Annual income is one million rubles, expenses are within 200 thousand rubles.

On OSNO, Evgeniy will have to pay personal income tax. At the same time, the tax base for personal income tax can be reduced by the amount of confirmed business-related expenses - professional deductions. If there is no confirmation, you can reduce it by the allowable amount of expenses according to the standard - 20% of revenue. You can also reduce the tax base by the amount of insurance premiums (43,238 rubles per year). The result will be: 13% * (1,000,000 = 92,289 rubles.

At the same time, the tax base for personal income tax can be reduced by the amount of confirmed business-related expenses - professional deductions. If there is no confirmation, you can reduce it by the allowable amount of expenses according to the standard - 20% of revenue. You can also reduce the tax base by the amount of insurance premiums (43,238 rubles per year). The result will be: 13% * (1,000,000 = 92,289 rubles.

At the same time, Evgeniy may not pay VAT, because his annual income does not exceed two million rubles.

Thus, the total tax burden on OSNO for Evgeniy will be 92,289 rubles per year.

Answers to popular questions

What is important for a retail store owner to know when replacing UTII with the simplified tax system?

Entrepreneurs working in retail trade do not have the right to sell labeled goods on UTII. In this regard, many imputation officers have already switched to the simplified tax system or are working under a combination of two taxation systems.

Who in retail can switch to simplified?

The answer is simple - everyone who meets the requirements of this aid. Therefore, this can be done by any retail company that:

- revenue up to 200 million rubles per year;

- number of employees up to 130 people;

- residual value of fixed assets up to 150 million rubles.

The area of the retail space does not matter. With such a taxation system, it is possible to sell marked and excisable goods.

What should stores that combine two taxation systems do?

With a complete transition to the simplified tax system, there is no need to submit a notification: the enterprise will be automatically transferred to a simplified taxation system. The application is only necessary if you want to change the object of taxation.

UTII: briefly about the features

A single tax on imputed income implies that the tax here is paid not on any specific income already received, but on future expected profits. Moreover, the tax can be applied only for certain types of activities that are prescribed in OKUN and OKVED. Each region independently selects from the general list those areas of activity for which UTII can be used on its territory. Thus, while engaging in some work or services that fall under UTII in one administrative district, an enterprise or individual entrepreneur may not always be able to engage in them under the same conditions in another.