Insurance premiums refer to those payments that individual entrepreneurs and legal entities make for their employees, as policyholders, in order to provide them with financial stability in some cases provided for by law. One of these cases is temporary disability, as well as motherhood. If such situations arise, it is necessary to ensure financial stability for the employee, even though he will cease his employment with the company for a certain time. It is in such situations that policyholders have to deal with KBK 39310202090071000160, which has raised quite a few questions before, especially with the onset of the new year.

How does KBK stand for?

KBK - budget classification codes

The organizations' BCCs, which are necessary for the payment to go where it was intended, change almost every year. And the responsibility for their correct indication lies with the payer!

Let's try to figure out what these mysterious codes are, why they are needed, how they are formed and why they change regularly. We will also tell you what to do if you find an error in the specified code, and what you risk in this case, and most importantly, how to prevent this risk and not end up with accrued fines and penalties for paying taxes and fees on time.

Details of the Social Insurance Fund and the Federal Tax Service for paying insurance premiums in 2021

In 2021, the authority to consider applications for the return of VNiM expenses has been retained by the Social Insurance Fund, but the administrator of income for contributions to VNiM has changed. To pay only the difference, you must confirm the expenses with the Social Insurance Fund by filling out a refund application with supporting documents.

Details for transferring contributions in 2021

- Payment details for “injury” in 2021 have not changed.

- Calculations for 2021, if the organization has a debt for the previous period (identified during a desk audit, an error in the payment), we pay using the old details.

- Submission of reports submitted to Social Security.

- Receive reimbursement of insurance costs if your region is not included in the pilot project to directly finance these costs.

- Appeals to the Fund (complaints, clarifications, disagreements, etc.).

Budget classification - what is it and why?

In July 1998, the Budget Code of the Russian Federation in Federal Law No. 145 first introduced the term “KBK”, used as a means of grouping the budget.

There are 4 types of KBK:

- relating to government revenues;

- related to expenses;

- indicating the sources from which the budget deficit is financed;

- reflecting government operations.

What are KBKs used for?

- organize financial reporting;

- provide a unified form of budget financial information;

- help regulate financial flows at the state level;

- with their help, the municipal and federal budget is drawn up and implemented;

- allow you to compare the dynamics of income and expenses in the desired period;

- inform about the current situation in the state treasury.

INFORMATION FOR ENTREPRENEURS! KBK is an internal coding necessary, first of all, for the state treasury, where the distribution of incoming funds takes place. Entrepreneurs need these codes insofar as they are interested in complying with the requirements for processing government payments, especially taxes and contributions to extra-budgetary funds. Therefore, do not forget to indicate the correct and current KBK code in field 104 of the payment receipt.

KBC for enforcement proceedings by bailiffs 2021-2021

Another example of calculations for a writ of execution is offered by Letter of the Ministry of Taxes of the Russian Federation No. BG-6-10/253 dated 03/05/2021 under number 10. The letter provides examples of filling out payment orders for different situations. Number 10 shows an example of a receipt filled out by an organization that reimburses a tax debt.

Payment order to bailiffs

- Fill in the employee’s TIN, indicate 0 in the checkpoint field, and the organization will be the payer.

- The debtor's position is 19. This means that the company calculates the amount accrued for debt repayment from the salary of the individual debtor. All statuses are indicated in Appendix 5 of Order No. 107n of the Ministry of Finance of Russia.

- To confirm your identity, in field 108, indicate a passport coded with the number 01. After entering the number 01, the accountant writes information about the passport from the second page, separated by a semicolon.

- The bailiff service - FSSP - is indicated as the recipient: they write the corresponding OKTMO number, and the UIN - 0.

The powers of Social Insurance as a regulatory body have not changed: employees also conduct desk and on-site inspections, monitoring the reimbursement of funds for insurance coverage and the correct calculation of payments.

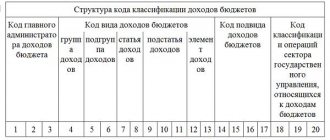

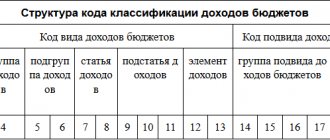

Structure of the KBK

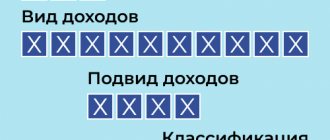

This code consists of 20 characters - numbers, separated by hyphens into groups, it has the following form XX - X XX XX XXX XX - XXXX - XXX.

Each group of characters corresponds to an encrypted meaning determined by the Ministry of Finance. Let's consider the structure of the profitable BCC, since they are the ones that entrepreneurs mainly have to use (expense codes can be found mainly when returning funds under any government program).

- "Administrator" . The first three signs show who will receive the funds and is responsible for replenishing this or that part of the budget with them, and manages the received money. The most common codes for businessmen begin with 182 - tax authority, 392 - Pension Fund, 393 - Social Insurance Fund and others.

- “Type of income” includes characters from 4 to 13. This group of characters helps to quite accurately identify income according to the following indicators:

- group – 4th character (that is, the first in this paragraph);

- subgroup – 5th and 6th characters; a two-digit code indicates a specific tax, duty, contribution, fine, etc.;

- article – category 7 and 8 (the value of the purpose of the received income is encoded in the settlement documents for the budget of the Russian Federation);

- subarticle – 9, 10 and 11 characters (specifies the item of income);

- element - 12 and 13 digits, characterizes the budget level - from federal 01, municipal 05 to specific budgets of the Pension Fund - 06, Social Insurance Fund - 07, etc. Code 10 indicates the settlement budget.

- “Program” - positions from 14 to 17. These numbers are designed to differentiate taxes (their code is 1000) from penalties, interest (2000), penalties (3000) and other payments (4000).

- “Economic classification” – last three digits. They identify revenues in terms of their economic type. For example, 110 speaks of tax revenues, 130 - from the provision of services, 140 - funds forcibly seized, etc.

Application for compensation for sick leave to the Social Insurance Fund

The necessary documents for the Social Insurance Fund for compensation for sick leave are listed in the order of the Ministry of Health and Social Development dated December 4, 2021 No. 951n. According to this regulatory document, in order to reimburse expenses incurred, the policyholder must submit:

List of documents for submitting an application to the Social Insurance Fund for sick leave compensation

IMPORTANT! It must be taken into account that the application form is not fixed in a regulatory document. The FSS letter (which, according to the norms of the Civil Code of the Russian Federation, is not a legal act) offers a sample that is recommended for use. But it makes sense to check information about the current application form with your territorial authority.

The FSS certificate is not an independent report, and has the status of an appendix to the main document - an application for the allocation of funds to pay security to insured persons. It is presented when applying for a refund for periods starting from 01/01/2021 (for earlier periods you can submit Calculation 4-FSS).

We recommend reading: Type of Activity of a Law Firm

The form and principle for filling out the calculation certificate were brought to the attention of policyholders by Letter of the Social Insurance Fund No. 02-09-11/04-03-27029 dated 12/07/2021, according to which, the calculation certificate provided when applying for the allocation of funds must include indicators for the amounts :

Social Insurance Fund: structuring benefits

As part of the package of documents presented by the policyholder to cover the difference that exceeds the accrued OSS contributions, the policyholder must fill out and submit a calculation certificate to the Social Insurance Fund. Let's consider what kind of document this is, what information it carries, and in what form it should be executed in the current reporting period.

- the company's debt for insurance premiums at the beginning and end of the reporting period (or debt to the Social Insurance Fund);

- accrued insurance premiums (including for the last three months);

- additional accrued insurance premiums;

- social insurance expenses not accepted for offset;

- money received to the company’s account from the Social Insurance Fund to reimburse expenses;

- refunded or credited overpaid contributions;

- social insurance expenses (including for the last three months);

- paid contributions (including for the last three months);

- amount of debt written off.

Why are budget classification codes changing?

This is the cry from the heart of the vast majority of entrepreneurs: how much easier it would be if these codes were uniform and established once and for all. But the Ministry of Finance makes certain changes to the BCC almost every year. Entrepreneurs and accountants do not always have the opportunity to timely monitor innovations and correct the specified BACs, this is especially evident during reporting periods. Responsibility for incorrectly specified code lies entirely on the shoulders of businessmen, which often results in unexpected expenses and hassle in correcting the error and proving that they are right.

There are various versions put forward by entrepreneurs and the Ministry of Finance and the Ministry of Justice do not comment in any way.

- The more receipts passed through incorrect BCCs, the more funds will be “suspended” for some time as unknown. Until errors are corrected, they can be used for unseemly purposes, and on a national scale this is a huge amount.

- Additional filling of the budget by charging fines and penalties for “overdue” payments that were made through the already inactive BCC. Proving timely payment is quite troublesome.

- Inconsistency between the actions of the Ministry of Finance, which assigns codes, and the Ministry of Justice, which approves them.

- Since the KBK is directly “tied” to the public sector, any changes within the relevant structures, the receipt of new directives, etc. lead to a change in coding.

When was the BCC for insurance premiums last updated?

Since 2021, the bulk of insurance premiums (except for payments for accident insurance) began to be subject to the provisions of the Tax Code of the Russian Federation and became the object of control by the tax authorities. As a result of these changes, in most aspects, insurance premiums were equated to tax payments and, in particular, received new, budgetary BCCs.

The presence of a situation where, after 2021, contributions accrued according to the old rules can be transferred to the budget, required the introduction of special, additional to the main, transitional BCCs for such payments.

As a result, from 2021, there are 2 BCC options for insurance premiums supervised by the Federal Tax Service: for periods before December 31, 2021 and for periods after January 2021. At the same time, the codes for contributions to accident insurance that remain under the control of the Social Insurance Fund have not changed.

From April 23, 2018, the Ministry of Finance introduced new BCCs for penalties and fines on additional tariffs for insurance premiums paid for employees entitled to early retirement. KBK began to be divided not by periods: before 2017 and after - as before, but according to the results of a special labor assessment.

From January 2021, BCC values were determined in accordance with Order of the Ministry of Finance dated June 8, 2018 No. 132n. These changes also affected codes for penalties and fines on insurance premiums at additional tariffs. If in 2021 the BCC for penalties and fines depended on whether a special assessment was carried out or not, then at the beginning of 2021 there was no such gradation. All payments were made to the BCC, which is established for the list as a whole.

However, from April 14, 2019, the Ministry of Finance returned penalties and fines for contributions under additional tariffs to the 2021 BCC.

In 2021, the list of BCCs is determined by a new order of the Ministry of Finance dated November 29, 2019 No. 207n, but it has not changed the BCC for contributions. Find out which BCCs have changed here.

Thus, the last update of the BCC on insurance premiums took place on April 14, 2019. Nothing else has changed yet, and these same BCCs will be in effect in 2021 (Order of the Ministry of Finance dated 06/08/2020 No. 99n).

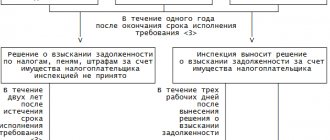

What are the consequences of an error in the KBK?

If the payment purpose code is specified incorrectly, the payment will be transferred to the budget, but it will not be distributed correctly there, which means that the state will not actually receive it. The result may be the same as if the money had not been transferred at all: the tax office will count the arrears under a certain item. At the same time, if the BCC is simply mixed up, there may be an overpayment under another item.

As a result, the tax office will issue a demand for payment of arrears, a fine for late payment of tax or a fee and penalties for late payment. This situation is extremely unpleasant for a conscientious entrepreneur who paid the tax on time, whose entire fault lies in confusion with numerous CBCs.

KBK of insurance premiums administered by the Federal Tax Service of the Russian Federation

Tables with codes are grouped by periods of accrual of contributions and occurrence of debt. We transfer all contributions to the Federal Tax Service (payee in the payment order).

KBC for payment of insurance premiums accrued from January 1, 2017

KBC for the transfer by policyholders of insurance premiums for the payment of pensions

| KBK | Purpose of the code |

| KBC for payment of insurance premiums by employers | |

| 18210202010061010160 | Insurance contributions for compulsory pension insurance in the Russian Federation, credited to the Pension Fund of the Russian Federation for the payment of an insurance pension (payment amount (recalculations, arrears and debt on the corresponding payment, including canceled ones) for billing periods starting from January 1, 2017) |

| 18210202010062110160 | Insurance contributions for compulsory pension insurance in the Russian Federation, credited to the Pension Fund of the Russian Federation for the payment of an insurance pension (penalties on the corresponding payment for billing periods starting from January 1, 2021) |

| 18210202010062210160 | Insurance contributions for compulsory pension insurance in the Russian Federation, credited to the Pension Fund of the Russian Federation for the payment of an insurance pension (interest on the corresponding payment for billing periods starting from January 1, 2021) |

| 18210202010063010160 | Insurance contributions for compulsory pension insurance in the Russian Federation, credited to the Pension Fund of the Russian Federation for the payment of an insurance pension (the amount of monetary penalties (fines) for the corresponding payment in accordance with the legislation of the Russian Federation for billing periods starting from January 1, 2017) |

| 18210202080061000160 | Contributions of organizations employing the labor of flight crew members of civil aviation aircraft, credited to the Pension Fund of the Russian Federation for the payment of additional payments to pensions (payment amount (recalculations, arrears and debt on the corresponding payment, including canceled payments) |

| 18210202080062100160 | Contributions from organizations employing the labor of flight crew members of civil aviation aircraft, credited to the Pension Fund of the Russian Federation for the payment of additional payments to pensions (penalties on the corresponding payment) |

| 18210202080062200160 | Contributions from organizations employing the labor of flight crew members of civil aviation aircraft, credited to the Pension Fund of the Russian Federation for the payment of additional payments to pensions (interest on the corresponding payment) |

| 18210202080063000160 | Contributions from organizations employing the labor of flight crew members of civil aviation aircraft, credited to the Pension Fund of the Russian Federation for the payment of additional payments to pensions (the amount of monetary penalties (fines) for the corresponding payment in accordance with the legislation of the Russian Federation) |

| 18210202120061000160 | Contributions paid by coal industry organizations to the budget of the Pension Fund of the Russian Federation for the payment of additional payments to pensions (payment amount (recalculations, arrears and debt on the corresponding payment, including canceled ones) |

| 18210202120062100160 | Contributions paid by coal industry organizations to the budget of the Pension Fund of the Russian Federation for the payment of additional payments to pensions (penalties on the corresponding payment) |

| 18210202120062200160 | Contributions paid by coal industry organizations to the budget of the Pension Fund of the Russian Federation for the payment of additional payments to pensions (interest on the corresponding payment) |

| 18210202120063000160 | Contributions paid by coal industry organizations to the budget of the Pension Fund of the Russian Federation for the payment of additional payments to pensions (amounts of monetary penalties (fines) for the corresponding payment in accordance with the legislation of the Russian Federation) |

| 18210202131061010160 | Insurance premiums at an additional rate for insured persons employed in the relevant types of work specified in paragraph 1 of part 1 of Article 30 of the Federal Law of December 28, 2013 No. 400-FZ “On Insurance Pensions”, credited to the budget of the Pension Fund of the Russian Federation for the payment of insurance pension (independent of the results of a special assessment of working conditions (class of working conditions) (amount of payment (recalculations, arrears and arrears for the corresponding payment, including canceled ones) |

| 18210202131061020160 | Insurance premiums at an additional rate for insured persons employed in the relevant types of work specified in paragraph 1 of part 1 of Article 30 of the Federal Law of December 28, 2013 No. 400-FZ “On Insurance Pensions”, credited to the budget of the Pension Fund of the Russian Federation for the payment of insurance pensions (depending on the results of a special assessment of working conditions (class of working conditions) (payment amount (recalculations, arrears and arrears for the corresponding payment, including canceled ones) |

| 18210202131062100160 | Insurance premiums at an additional rate for insured persons employed in the relevant types of work specified in paragraph 1 of part 1 of Article 30 of the Federal Law of December 28, 2013 No. 400-FZ “On Insurance Pensions”, credited to the budget of the Pension Fund of the Russian Federation for the payment of insurance pensions (penalties on the corresponding payment) |

| 18210202131062200160 | Insurance premiums at an additional rate for insured persons employed in the relevant types of work specified in paragraph 1 of part 1 of Article 30 of the Federal Law of December 28, 2013 No. 400-FZ “On Insurance Pensions”, credited to the budget of the Pension Fund of the Russian Federation for the payment of insurance pensions (interest on the corresponding payment) |

| 1821020213106300160 | Insurance premiums at an additional rate for insured persons employed in the relevant types of work specified in paragraph 1 of part 1 of Article 30 of the Federal Law of December 28, 2013 No. 400-FZ “On Insurance Pensions”, credited to the budget of the Pension Fund of the Russian Federation for the payment of insurance pensions (amounts of monetary penalties (fines) for the corresponding payment in accordance with the legislation of the Russian Federation) |

| 18210202132061010160 | Insurance premiums at an additional rate for insured persons employed in the relevant types of work specified in paragraphs 2 - 18 of part 1 of Article 30 of the Federal Law of December 28, 2013 No. 400-FZ “On Insurance Pensions”, credited to the budget of the Pension Fund of the Russian Federation for payment of an insurance pension (not dependent on the results of a special assessment of working conditions (class of working conditions) (payment amount (recalculations, arrears and arrears for the corresponding payment, including canceled ones) |

| 18210202132061020160 | Insurance premiums at an additional rate for insured persons employed in the relevant types of work specified in paragraphs 2 - 18 of part 1 of Article 30 of the Federal Law of December 28, 2013 No. 400-FZ “On Insurance Pensions”, credited to the budget of the Pension Fund of the Russian Federation for payment of an insurance pension (depending on the results of a special assessment of working conditions (class of working conditions) (payment amount (recalculations, arrears and arrears for the corresponding payment, including canceled ones) |

| 18210202132062100160 | Insurance premiums at an additional rate for insured persons employed in the relevant types of work specified in paragraphs 2 - 18 of part 1 of Article 30 of the Federal Law of December 28, 2013 No. 400-FZ “On Insurance Pensions”, credited to the budget of the Pension Fund of the Russian Federation for payment of an insurance pension (penalty on the corresponding payment) |

| 18210202132062200160 | Insurance premiums at an additional rate for insured persons employed in the relevant types of work specified in paragraphs 2 - 18 of part 1 of Article 30 of the Federal Law of December 28, 2013 No. 400-FZ “On Insurance Pensions”, credited to the budget of the Pension Fund of the Russian Federation for payment of insurance pension (interest on the corresponding payment) |

| 18210202132063000160 | Insurance premiums at an additional rate for insured persons employed in the relevant types of work specified in paragraphs 2 - 18 of part 1 of Article 30 of the Federal Law of December 28, 2013 No. 400-FZ “On Insurance Pensions”, credited to the budget of the Pension Fund of the Russian Federation for payment of an insurance pension (amount of monetary penalties (fines) for the corresponding payment in accordance with the legislation of the Russian Federation) |

| KBC for paying insurance premiums for individual entrepreneurs for themselves | |

| 18210202140061110160 | Insurance contributions for compulsory pension insurance in a fixed amount, credited to the budget of the Pension Fund of the Russian Federation for the payment of an insurance pension, (payment amount (recalculations, arrears and debt for the corresponding payment, including canceled payments, for billing periods starting from January 1, 2021 of the year) |

| 18210202140062110160 | Insurance contributions for compulsory pension insurance in a fixed amount, credited to the budget of the Pension Fund of the Russian Federation for the payment of insurance pensions (penalties on the corresponding payment for billing periods starting from January 1, 2017) |

| 18210202140062210160 | Insurance contributions for compulsory pension insurance in a fixed amount, credited to the budget of the Pension Fund of the Russian Federation for the payment of insurance pensions (interest on the corresponding payment for billing periods starting from January 1, 2017) |

| 18210202140063010160 | Insurance contributions for compulsory pension insurance in a fixed amount, credited to the budget of the Pension Fund of the Russian Federation for the payment of insurance pensions (the amount of monetary penalties (fines) for the corresponding payment in accordance with the legislation of the Russian Federation for billing periods starting from January 1, 2021) |

KBC for the transfer of health insurance premiums by policyholders

| KBK | Purpose of the code |

| KBK for payment of insurance contributions to the FFOMS by employers | |

| 18210202101081013160 | Insurance premiums for compulsory medical insurance of the working population, credited to the budget of the Federal Compulsory Health Insurance Fund (insurance premiums for compulsory medical insurance of the working population for billing periods starting from January 1, 2021) |

| 18210202101082013160 | Insurance premiums for compulsory medical insurance of the working population, credited to the budget of the Federal Compulsory Medical Insurance Fund (penalties on insurance premiums for compulsory medical insurance of the working population for billing periods starting from January 1, 2021) |

| 18210202101082213160 | Insurance premiums for compulsory medical insurance of the working population, credited to the budget of the Federal Compulsory Medical Insurance Fund (interest on insurance premiums for compulsory medical insurance of the working population for billing periods starting from January 1, 2021) |

| 18210202101083013160 | Insurance premiums for compulsory medical insurance of the working population, credited to the budget of the Federal Compulsory Medical Insurance Fund (amounts of monetary penalties (fines) for insurance premiums for compulsory medical insurance of the working population for billing periods starting from January 1, 2021) |

| KBK for payment of insurance premiums of individual entrepreneurs for themselves to the FFOMS | |

| 18210202103081013160 | Insurance premiums for compulsory medical insurance of the working population in a fixed amount, credited to the budget of the Federal Compulsory Health Insurance Fund (insurance premiums for compulsory medical insurance of the working population for billing periods starting from January 1, 2017) |

| 18210202103082013160 | Insurance premiums for compulsory medical insurance of the working population in a fixed amount, credited to the budget of the Federal Compulsory Health Insurance Fund (penalties on insurance premiums for compulsory medical insurance of the working population for billing periods starting from January 1, 2017) |

| 18210202103083013160 | Insurance premiums for compulsory medical insurance of the working population in a fixed amount, credited to the budget of the Federal Compulsory Medical Insurance Fund (amounts of monetary penalties (fines) for insurance premiums for compulsory medical insurance of the working population for billing periods starting from January 1, 2021) |

KBK for the transfer by policyholders of insurance premiums to the Federal Insurance Fund of the Russian Federation

| KBK | Purpose of the code |

| 18210202090071010160 | Insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity (payment amount (recalculations, arrears and debt for the corresponding payment, including canceled ones) for billing periods starting from January 1, 2021) |

| 18210202090072110160 | Insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity (penalties on the corresponding payment for billing periods starting from January 1, 2021) |

| 18210202090072210160 | Insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity (interest on the corresponding payment for billing periods starting from January 1, 2021) |

| 18210202090073010160 | Insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity (amounts of monetary penalties (fines) for the corresponding payment in accordance with the legislation of the Russian Federation for billing periods starting from January 1, 2021) |

Professional accounting for organizations and individual entrepreneurs in Ivanovo . We will relieve you of the problems and daily worries of maintaining all types of accounting and reporting. LLC NEW tel. 929-553

KBC for payment of insurance premiums for 2021 and earlier periods

KBC for transferring insurance contributions for pension insurance for 2021 and earlier years

| KBK | Purpose of the code |

| KBC for payment of insurance premiums by employers for 2021 - 2010 | |

| 18210202010061000160 | Insurance contributions for compulsory pension insurance in the Russian Federation, credited to the Pension Fund of the Russian Federation for the payment of an insurance pension (payment amount (recalculations, arrears and arrears of the corresponding payment) for billing periods expired before January 1, 2021) |

| 18210202010062100160 | Insurance contributions for compulsory pension insurance in the Russian Federation, credited to the Pension Fund of the Russian Federation for the payment of an insurance pension (penalties on the corresponding payment for billing periods expired before January 1, 2021) |

| 18210202010062200160 | Insurance contributions for compulsory pension insurance in the Russian Federation, credited to the Pension Fund of the Russian Federation for the payment of an insurance pension (interest on the corresponding payment for billing periods expired before January 1, 2021) |

| 18210202010063000160 | Insurance contributions for compulsory pension insurance in the Russian Federation, credited to the Pension Fund of the Russian Federation for the payment of an insurance pension (the amount of monetary penalties (fines) for the corresponding payment in accordance with the legislation of the Russian Federation for billing periods expired before January 1, 2017) |

| 18210202020061000160 | Insurance contributions for compulsory pension insurance in the Russian Federation, credited to the Pension Fund of the Russian Federation for the payment of a funded pension (payment amount (recalculations, arrears and debt on the corresponding payment, including canceled ones) |

| 18210202020062100160 | Insurance contributions for compulsory pension insurance in the Russian Federation, credited to the Pension Fund of the Russian Federation for the payment of a funded pension (penalties on the corresponding payment) |

| 18210202020062200160 | Insurance contributions for compulsory pension insurance in the Russian Federation, credited to the Pension Fund of the Russian Federation for the payment of a funded pension (interest on the corresponding payment) |

| 18210202020063000160 | Insurance contributions for compulsory pension insurance in the Russian Federation, credited to the Pension Fund of the Russian Federation for the payment of a funded pension (the amount of monetary penalties (fines) for the corresponding payment in accordance with the legislation of the Russian Federation) |

| KBC for payment of insurance premiums for individual entrepreneurs for themselves for 2021 - 2013 | |

| 18210202140061100160 | Insurance contributions for compulsory pension insurance in a fixed amount, credited to the budget of the Pension Fund of the Russian Federation for the payment of an insurance pension (calculated from the amount of the payer’s income, not exceeding the income limit established by Article 14 of the Federal Law of July 24, 2009 No. 212-FZ “On insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund" for periods expired before January 1, 2021) |

| 18210202140061200160 | Insurance contributions for compulsory pension insurance in a fixed amount, credited to the budget of the Pension Fund of the Russian Federation for the payment of an insurance pension (calculated from the amount of income of the payer received in excess of the income limit established by Article 14 of the Federal Law of July 24, 2009 No. 212-FZ “On insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund" for periods expired before January 1, 2021) |

| 18210202140062100160 | Insurance contributions for compulsory pension insurance in a fixed amount, credited to the budget of the Pension Fund of the Russian Federation for the payment of insurance pensions (penalties on the corresponding payment for billing periods expired before January 1, 2017) |

| 18210202140062200160 | Insurance contributions for compulsory pension insurance in a fixed amount, credited to the budget of the Pension Fund of the Russian Federation for the payment of insurance pensions (interest on the corresponding payment for billing periods expired before January 1, 2017) |

| 18210202140063000160 | Insurance contributions for compulsory pension insurance in a fixed amount, credited to the budget of the Pension Fund of the Russian Federation for the payment of insurance pensions (the amount of monetary penalties (fines) for the corresponding payment in accordance with the legislation of the Russian Federation for billing periods expired before January 1, 2021) |

| 18210202150061000160 | Insurance contributions for compulsory pension insurance in a fixed amount, credited to the budget of the Pension Fund of the Russian Federation for the payment of a funded pension (payment amount (recalculations, arrears and debt for the corresponding payment, including canceled ones) |

| 18210202150062100160 | Insurance contributions for compulsory pension insurance in a fixed amount, credited to the budget of the Pension Fund of the Russian Federation for the payment of a funded pension (penalties on the corresponding payment) |

| 18210202150062200160 | Insurance contributions for compulsory pension insurance in a fixed amount, credited to the budget of the Pension Fund of the Russian Federation for the payment of a funded pension (interest on the corresponding payment) |

| 18210202150063000160 | Insurance contributions for compulsory pension insurance in a fixed amount, credited to the budget of the Pension Fund of the Russian Federation for the payment of a funded pension (the amount of monetary penalties (fines) for the corresponding payment in accordance with the legislation of the Russian Federation) |

KBC for transferring insurance premiums for health insurance for 2021 and all earlier years (including TFOMS)

| KBK | Purpose of the code |

| KBK for payment of insurance contributions to the FFOMS by employers | |

| 18210202101081011160 | Insurance premiums for compulsory medical insurance of the working population, credited to the budget of the Federal Compulsory Health Insurance Fund (insurance premiums for compulsory medical insurance of the working population for billing periods expired before January 1, 2021) |

| 18210202101082011160 | Insurance premiums for compulsory medical insurance of the working population, credited to the budget of the Federal Compulsory Medical Insurance Fund (penalties on insurance premiums for compulsory medical insurance of the working population for billing periods expired before January 1, 2021) |

| 18210202101083011160 | Insurance premiums for compulsory medical insurance of the working population, credited to the budget of the Federal Compulsory Medical Insurance Fund (amounts of monetary penalties (fines) for insurance premiums for compulsory medical insurance of the working population for billing periods expired before January 1, 2021) |

| KBK for payment of insurance premiums of individual entrepreneurs for themselves to the FFOMS | |

| 18210202103081011160 | Insurance premiums for compulsory medical insurance of the working population in a fixed amount, credited to the budget of the Federal Compulsory Health Insurance Fund (insurance premiums for compulsory medical insurance of the working population for billing periods expired before January 1, 2017) |

| 18210202103082011160 | Insurance premiums for compulsory medical insurance of the working population in a fixed amount, credited to the budget of the Federal Compulsory Health Insurance Fund (penalties on insurance premiums for compulsory medical insurance of the working population for billing periods expired before January 1, 2017) |

| 18210202103083011160 | Insurance premiums for compulsory medical insurance of the working population in a fixed amount, credited to the budget of the Federal Compulsory Medical Insurance Fund (amounts of monetary penalties (fines) for insurance premiums for compulsory medical insurance of the working population for billing periods expired before January 1, 2021) |

KBC for the transfer by policyholders of insurance premiums to the Social Insurance Fund of the Russian Federation for 2021 and for all earlier years

| KBK | Purpose of the code |

| 18210202090071000160 | Insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity (payment amount (recalculations, arrears and debt on the corresponding payment, including canceled ones) for billing periods expired before January 1, 2021) |

| 18210202090072100160 | Insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity (penalties on the corresponding payment for billing periods expired before January 1, 2021) |

| 18210202090072200160 | Insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity (interest on the corresponding payment for billing periods expired before January 1, 2021) |

| 18210202090073000160 | Insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity (amounts of monetary penalties (fines) for the corresponding payment in accordance with the legislation of the Russian Federation for billing periods expired before January 1, 2021) |

KBC for payment of insurance premiums for 2010 - 2012

KBC for transferring insurance contributions for pension insurance from 2010 to 2012

| KBK | Purpose of the code |

| KBC for paying insurance premiums for individual entrepreneurs for themselves | |

| 18210202100061000160 | Insurance contributions for compulsory pension insurance in the amount determined based on the cost of the insurance year, credited to the Pension Fund of the Russian Federation for the payment of insurance pensions (for billing periods expired before January 1, 2013) (payment amount (recalculations, arrears and arrears for the corresponding payment , including canceled ones) |

| 18210202100062100160 | Insurance contributions for compulsory pension insurance in the amount determined based on the cost of the insurance year, credited to the Pension Fund of the Russian Federation for the payment of an insurance pension (for billing periods expired before January 1, 2013) (penalties on the corresponding payment) |

| 18210202100062200160 | Insurance contributions for compulsory pension insurance in the amount determined based on the cost of the insurance year, credited to the Pension Fund of the Russian Federation for the payment of insurance pensions (for billing periods expired before January 1, 2013) (interest on the corresponding payment) |

| 18210202100063000160 | Insurance contributions for compulsory pension insurance in the amount determined based on the cost of the insurance year, credited to the Pension Fund of the Russian Federation for the payment of insurance pensions (for billing periods expired before January 1, 2013) (amounts of monetary penalties (fines) for the corresponding payment in accordance with the law Russian Federation) |

| 18210202110061000160 | Insurance contributions for compulsory pension insurance in the amount determined based on the cost of the insurance year, credited to the Pension Fund of the Russian Federation for the payment of a funded pension (for billing periods expired before January 1, 2013) (payment amount (recalculations, arrears and arrears for the corresponding payment , including canceled ones) |

| 18210202110062100160 | Insurance contributions for compulsory pension insurance in the amount determined based on the cost of the insurance year, credited to the Pension Fund of the Russian Federation for the payment of a funded pension (for billing periods expired before January 1, 2013) (penalties on the corresponding payment) |

| 18210202110062200160 | Insurance contributions for compulsory pension insurance in the amount determined based on the cost of the insurance year, credited to the Pension Fund of the Russian Federation for the payment of a funded pension (for billing periods expired before January 1, 2013) (interest on the corresponding payment) |

| 18210202110063000160 | Insurance contributions for compulsory pension insurance in the amount determined based on the cost of the insurance year, credited to the Pension Fund of the Russian Federation for the payment of a funded pension (for billing periods expired before January 1, 2013) (the amount of monetary penalties (fines) for the corresponding payment in accordance with the law Russian Federation) |

KBC for payment of insurance premiums for 2002 - 2009

KBC for transferring insurance contributions for pension insurance from 2002 to 2009

| KBK | Purpose of the code |

| KBC for payment of insurance premiums by employers for 2002 - 2009 | |

| 18210202031061000160 | Insurance contributions for compulsory pension insurance in the Russian Federation, credited to the Pension Fund of the Russian Federation for the payment of insurance pensions (for billing periods from 2002 to 2009 inclusive) (payment amount (recalculations, arrears and debt on the corresponding payment, including canceled ) |

| 18210202031062100160 | Insurance contributions for compulsory pension insurance in the Russian Federation, credited to the Pension Fund of the Russian Federation for the payment of an insurance pension (for billing periods from 2002 to 2009 inclusive) (penalties on the corresponding payment) |

| 18210202031062200160 | Insurance contributions for compulsory pension insurance in the Russian Federation, credited to the Pension Fund of the Russian Federation for the payment of insurance pensions (for billing periods from 2002 to 2009 inclusive) (interest on the corresponding payment) |

| 18210202031063000160 | Insurance contributions for compulsory pension insurance in the Russian Federation, credited to the Pension Fund of the Russian Federation for the payment of insurance pensions (for billing periods from 2002 to 2009 inclusive) (amounts of monetary penalties (fines) for the corresponding payment in accordance with the legislation of the Russian Federation) |

| 18210202032061000160 | Insurance contributions for compulsory pension insurance in the Russian Federation, credited to the Pension Fund of the Russian Federation for the payment of a funded pension (for billing periods from 2002 to 2009 inclusive) (payment amount (recalculations, arrears and debt on the corresponding payment, including canceled ) |

| 18210202032062100160 | Insurance contributions for compulsory pension insurance in the Russian Federation, credited to the Pension Fund of the Russian Federation for the payment of a funded pension (for billing periods from 2002 to 2009 inclusive) (penalties on the corresponding payment) |

| 18210202032062200160 | Insurance contributions for compulsory pension insurance in the Russian Federation, credited to the Pension Fund of the Russian Federation for the payment of a funded pension (for billing periods from 2002 to 2009 inclusive) (interest on the corresponding payment) |

| 18210202032063000160 | Insurance contributions for compulsory pension insurance in the Russian Federation, credited to the Pension Fund of the Russian Federation for the payment of a funded pension (for billing periods from 2002 to 2009 inclusive) (amounts of monetary penalties (fines) for the corresponding payment in accordance with the legislation of the Russian Federation) |

| KBC for paying insurance premiums for individual entrepreneurs for themselves | |

| 18210910010061000160 | Insurance contributions in the form of a fixed payment credited to the budget of the Pension Fund of the Russian Federation for the payment of insurance pensions (for billing periods expired before January 1, 2010) (payment amount (recalculations, arrears and debt on the corresponding payment, including canceled ones) |

| 18210910010062000160 | Insurance contributions in the form of a fixed payment credited to the budget of the Pension Fund of the Russian Federation for the payment of insurance pensions (for billing periods expired before January 1, 2010) (penalties and interest on the corresponding payment) |

| 18210910020061000160 | Insurance contributions in the form of a fixed payment credited to the budget of the Pension Fund of the Russian Federation for the payment of a funded pension (for billing periods expired before January 1, 2010) (payment amount (recalculations, arrears and debt on the corresponding payment, including canceled ones) |

| 18210910020062000160 | Insurance contributions in the form of a fixed payment credited to the budget of the Pension Fund of the Russian Federation for the payment of a funded pension (for billing periods expired before January 1, 2010) (penalties and interest on the corresponding payment) |

KBC for payment of tax fines for 2021

BCC for 2021 was approved by order of the Ministry of Finance of Russia dated 06/08/2020 No. 99n. These codes must be indicated in payment orders when paying tax fines in 2021.

| Payment Description | KBK |

| Income tax, which is charged to the federal budget (except for consolidated groups of taxpayers) | 182 1 0100 110 |

| Income tax, which is charged to the budgets of constituent entities of the Russian Federation (except for consolidated groups of taxpayers) | 182 1 0100 110 |

| Income tax, which is charged to the federal budget (for consolidated groups of taxpayers) | 182 1 0100 110 |

| Income tax, which is charged to the budgets of the constituent entities of the Russian Federation (for consolidated groups of taxpayers) | 182 1 0100 110 |

| VAT | 182 1 0300 110 |

| Tax on property not included in the Unified Gas Supply System | 182 1 0600 110 |

| Tax on property included in the Unified Gas Supply System | 182 1 0600 110 |

| Simplified tax with the object “income” | 182 1 0500 110 |

| Simplified tax with the object “income minus expenses” | 182 1 0500 110 |

| UTII | 182 1 0500 110 |

| Unified agricultural tax | 182 1 0500 110 |

| Personal income tax for a tax agent | 182 1 0100 110 |

| Transport tax | 182 1 0600 110 |

| Land tax from plots of Moscow, St. Petersburg, Sevastopol | 182 1 0600 110 |

Sources

- https://www.expert.byx.ru/strakhovye_vznosy_na_obyazatelnoe_sotsialnoe_strakhovanie/72/156622/

- https://kbk1.ru/yr/18210202090072110160.php

- https://nalog-nalog.ru/uplata_nalogov/rekvizity_dlya_uplaty_nalogov_vznosov/kbk_po_strahovym_vznosam_tablica/

- https://nalog-nalog.ru/uplata_nalogov/izmeneniya_v_kbk_-_tablica_s_rasshifrovkoj/

- https://www.buhgalteria.ru/article/kbk-na-2021-god

Kbk 39310202090071000160

Insurance premiums refer to those payments that individual entrepreneurs and legal entities make for their employees, as policyholders, in order to provide them with financial stability in some cases provided for by law. One of these cases is temporary disability, as well as motherhood.

If such situations arise, it is necessary to ensure financial stability for the employee, even though he will cease his employment with the company for a certain time.

It is in such situations that policyholders have to deal with Kbk 39310202090071000160, about which quite a few questions have arisen before, especially with the onset of the new year.

New introductions

2017 was truly a transitional year in terms of insurance premiums. Since the state not only transferred them under the jurisdiction of the Tax Code, but also subjected them to some changes. What caused the confusion with these payments.

Thus, many cannot understand how social insurance contributions have changed and where they will now have to be paid. Regarding this category of insurance payments, the following situation is typical.

Contributions for injuries or accidents remained under the control of the Social Insurance Fund.

It is there that not only the contribution itself is credited, but also penalties and fines on it, and reporting is also submitted in a certain form.

Another type of social contributions are contributions for temporary disability and those related to maternity, which came under the jurisdiction and control of the Federal Tax Service. It is this service that will now monitor the payments of this contribution, their timeliness and the correctness of calculations. Also, she will monitor the submission of reports on all types of insurance premiums, including this one.

BCC for individual entrepreneur contributions for 2021

Individual entrepreneurs pay the BCC on their own. If an individual entrepreneur simultaneously works as an employee, he still must pay contributions for himself - as an individual entrepreneur.

Entrepreneurs are required to pay mandatory contributions to their own pension and health insurance until they are “listed” as individual entrepreneurs and have a Unified State Register of Entrepreneurs (USRIP) entry about them. The age of the entrepreneur and occupation does not matter. And most importantly, contributions must be paid even if the individual entrepreneur does not receive any income.

Code 18210202140061110160 KBK and its decoding in 2021 for individual entrepreneurs

Individual entrepreneurs are required to pay fixed contributions to the Pension Fund. Current practice involves the use of KBK codes for these purposes.

Thanks to the digital combination, the entrepreneur navigates the budget classification. Codes are used to group budget items of the Russian Federation.

Everyone, without exception, needs to know the code 18210202140061110160 KBK decoding in 2021 for IP. It was carried out according to the standard scheme used for other identical digital combinations.

What is the KBK code

The concept of the BCC is applicable to the Budget Code and has been used since July 31, 1998.

The government adopted Law No. 145-FZ, classifying codes as a tool for grouping expenses with income and sources used to cover the budget deficit.

It is customary to use the KBK in the formation and subsequent execution of the budget. The codes are used in the preparation of reports that allow assessing the implementation of the adopted budget. Thanks to the KBC, it is possible to assess the comparability of indicators.

Code 18210202140061110160 KBK decoding in 2021 for individual entrepreneurs

BCC codes are mentioned in documents when the state or its executive bodies are one of the parties. It is customary to write them in payment orders when legal entities and individual entrepreneurs pay taxes, fines and other payments to the treasury. The KBK code includes 20 digits, divided into 4 groups:

- The first three characters, in our case 182, are called “Administrator” and determine where payments will be received. The digital value 182 is tied to the Federal Tax Service.

- Numbers 4 to 13 classify the “Type of income”, highlighting the following components:

- “Group The first number informs about which “Group” we are dealing with, in particular 1 is income;

- “Subgroup” - the next two characters allow you to understand the type of payment. If the code contains the value 02, then contributions and taxes are paid for social needs;

- “Article” - articles and sub-items are marked in the calculation documentation and correspond to the values available for the classification of budget revenues of the Russian Federation;

- “Element” - informs about the next budget level and consists of two numbers: 06 Pension Fund budget.

- “Program” - includes signs 14 – 17 and helps to separate taxes, monetary penalties and penalties. Our value of 1100 refers to taxes.

- “Economic classification” - includes the remaining 3 digits of 160, which allow us to determine whether the code belongs to deductions and contributions for social needs.