In this article I will give step-by-step instructions “for dummies” on the process of accounting for simple production in 1C Accounting 8.3.

Typically, all production accounting comes down to several stages:

- posting of materials;

- transferring them to production;

- return from production of a finished product;

- calculation of product costs.

Stages of production in 1C 8

The production process of creating any product is divided into several conditional cycles:

- purchasing materials;

- their transfer to production;

- release of finished products;

- calculation of the cost of manufactured goods.

Let's take a closer look at how 1C takes into account production as a process and how its stages are reflected. We will use the most popular and widespread program as a tool. allowing you to automate production accounting - “1C: Enterprise Accounting 3.0”. An example would be the production of leather goods.

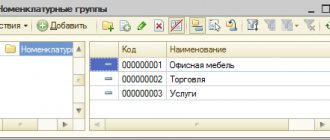

Creating a product range in 1C

In order to begin accounting for production, it is necessary to determine the range of products produced. To perform these actions in the 1C system, you will need to go to the “Directories” menu, then to the “Goods and Services” section, where you need to click on the “Nomenclature” indicator. Clicking the "Create" button will bring up a pop-up window that says "Nomenclature (creation)." Here you fill out the fields in which you enter data about the name of the product (short and full name), units of measurement and article number. In further calculations, these records will significantly simplify the product accounting procedure. In the example used, the product will be a bag made of black genuine leather.

After the nomenclatures are entered into the system for at least a single type of materials used, the system automatically includes the “Specification” tab.

A specification in the generally accepted sense is a document according to which production requirements are established. The specification of a manufactured product is a technology-approved list of materials and accessories required for sewing a unit of product. For this example with a bag, the specification includes the following materials:

- 40 cm genuine black leather;

- 20 m of black thread;

- 1 PC. 30 cm zipper;

- 1 PC. 15 cm zipper.

Purchase and posting of materials in 1C

To start accounting for production in 1C, you will need to determine cost estimates. The purchasing department concludes contracts for the purchase of materials for production. In 1C you can register all concluded contracts, enter data on invoices and invoices linked to specific contracts with suppliers. This is done in the “Purchases” section, where you select the “Invoices received” or “Invoice from supplier” tab.

After the invoice is paid, in 1C the materials are accepted into the warehouse and do not require re-entering the data with the list of purchased materials into the system. Account 10 “Materials” is automatically posted as a debit from account 60 “Suppliers and contractors” of the loan.

Receipt of materials from the counterparty

Material can arrive at the warehouse when purchased from a supplier, and in this case it is accounted for through the “Receipt of goods”, which is opened through “Purchases-Receipts (acts, invoices)”. In the list of documents, click on the “Receipt” button and select “Goods (invoice)”.

Fig.4 Goods (invoice)

Here everything is entered in the same way as receipt, only according to the materials account: the quantity of received material, its purchase price; in the header of the document is the warehouse where it will be listed.

Fig.5 Receipt of materials from the counterparty

When conducting, transactions are generated for the receipt of materials, at the same time the debt to the supplier increases, and movements are also created in the accumulation register “VAT presented” to create a purchase book.

Transfer of material for production in 1C

After the goods necessary for production have appeared in the warehouse, in 1C it becomes possible to generate electronic documents in the “Requirement-invoice” format. The need to create this document is explained by the fact that it allows you to write off materials in the warehouse for production. To create, click the “Create” button in the “Production” menu, after which information on the material and its quantity and write-off account are entered.

Posting the document “Requirement-invoice” in 1C generates a posting from the credit of account 10 (writing off materials) to the debit of account 20 (production). The invoice requirement is generated either for one type of materials, or for all, necessary for production.

It should be noted that accounting in 1C makes it possible to write off only that material for production. which was previously recorded in the warehouse. This acts as an additional means of monitoring the state of warehouse accounting of materials and its actual write-off into production.

In addition, the correct choice of the range of necessary materials allows you to avoid writing off materials that are not related to the type of product being manufactured. In cases where an enterprise produces several different types of products, entering materials into the system and control carried out in the nomenclature mode eliminates the occurrence of inaccuracies in accounting.

Sewing a bag requires writing off the following list of materials for production:

- thread;

- genuine leather;

- accessories;

- material needed to make the lining.

From the listed expenses, variable costs for making the bag are formed.

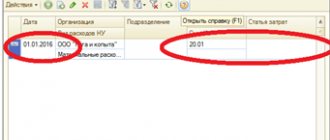

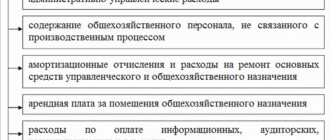

To reflect fixed production costs, you will need to uncheck the “Cost Accounts” item in the “Request Invoice” document that is being generated. This operation allows you to create a bookmark for creating a bookmark for cost accounts. Since in the example under consideration, the enterprise produces only handbags and is not engaged in other commercial activities, expenses associated with remuneration of the management staff are written off as production.

At what cost should materials be accepted for accounting?

To accept materials for accounting, evaluate them at actual cost (clause FSBU 5/2019).

Its calculation depends on the method of obtaining materials. The following options are possible:

- Purchase for a fee . Form the actual cost in the standard manner - take into account all the costs of acquisition, delivery and preparation for operation. Don’t forget to exclude VAT from the price, which you will then deduct.

- Free receipt, full or partial payment in kind . Measure materials at fair value. The rules for its calculation are approved in IFRS No. 13 dated December 28, 2015. Do not forget to increase it by the amount of additional costs for acquisition, delivery and preparation for use.

- Capital contribution . Accept for accounting at actual cost, taking into account additional costs.

- Disposal, repair, modernization or reconstruction of non-current assets. Estimate the cost of materials using the lower of two values:

- cost of similar materials;

the sum of the book value of the asset and the costs of obtaining materials and preparing them for use.

Important! Do not include in inventory cost:

- disaster-related costs;

- management expenses, if they are not related to the acquisition;

- storage costs, unless this is part of production or a condition of purchase;

- refundable indirect taxes.

Accounting for the release of finished products in 1C

In accordance with the results of the shift, a corresponding document is created in the “Production” menu. It should reflect the results expressed in the number of units of products (bags) sewn in one shift.

To enter data, you will need to click the “Create” button, after which a specific product is selected in the “Nomenclature” directory - black leather bags, the number of units produced per shift and the planned estimated cost of the products are established (actual cost results are calculated at the end of the month after all regulatory operations have been completed).

You should pay attention to that. that a production report for each shift can also be generated based on the data entered in the “Requirements-invoice”.

Important! In the specified document, you will need to select “Finished products” - account 43, and link the specification related to specific bags, because other products, despite the same costs for their production, may be of a different color.

Clicking the “Fill” button in the “Materials” tab allows 1C to automatically transfer all necessary materials from the specification to the production of one unit of product. At the same time, quantitative characteristics can be edited. At the same time, the materials necessary for production are written off: threads, leather, fittings, lining material.

When carrying out the operation, a posting occurs: Debit “Main production” 20 account / Credit “Materials” 10 account.

This operation is simultaneously accompanied by a posting for the release of finished products from production: Debit “Finished Products” of account 43/Credit “Main Production” of account 20.

Calculation of the cost of finished products in 1C

Documents on the production report for each shift and the “Requirement-invoice” form similar entries for the write-off of materials for production (Dt-20 inc. Kt-10 inc.). To avoid double write-offs of the same materials, it is necessary to conduct a release for exchange report - this document, in addition to writing off materials for production, also generates postings for their release from production.

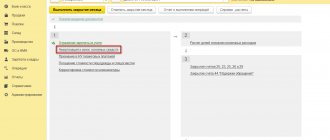

Calculation of the actual cost for finished products in the 1C system is carried out upon closing the month by conducting a routine operation. To perform this action, you must click the “Create” button in the “Routine Operations” section. After this, a list of available operations will be generated: “tax calculation”, “depreciation of fixed assets”, etc. You should select the item that suggests closing accounts 20, 23, 25, 26. The debit of the “Main production” account 20 reflects the costs allocated to production, and for a loan - finished products that came out of production. The difference obtained between the credit of account 20 and the debit is the actual cost of the final product manufactured.

How to reflect transactions with materials in accounting

Three main accounts are involved in the accounting of materials: 10 “Materials”, 15 “Procurement and acquisition of materials”, 16 “Cost variance”.

The main account for accounting for materials is 10. Its debit reflects receipts, and its credit reflects write-offs to production and disposal for other reasons.

You can open subaccounts for account 10 to make accounting simpler and clearer. For example, separately highlight raw materials, fuel, spare parts, containers, workwear, etc.

Keep records of exports and imports in the Kontur.Accounting web service. Simple accounting, payroll and reporting in one service

We receive materials to the warehouse

Each receipt of materials must be confirmed by primary documents. Some of them you will receive from the supplier, and some you will need to arrange yourself. The complete list of documents depends on how you received the materials, for example, under a supply agreement or by producing them yourself.

The receipt of materials at the warehouse is registered by the storekeeper or other employee with financial responsibility. To do this, on the day of acceptance, a receipt order is drawn up in a form approved by the manager. It could be:

- unified form No. M-4 (Decree of the State Statistics Committee of October 30, 1997 No. 71a);

- a form with all the details that you developed yourself (Part 2 of Article 9 of the Law of December 6, 2011 No. 402-FZ).

Important! To reduce paperwork, the receipt order can be replaced with a stamp with all the necessary details. It is placed on the supplier’s document, for example, on the invoice. This decision must be reflected in the accounting policies.

The accounting entries to record the receipt of materials depend on how they were received and what accounts the organization uses.

Purchasing materials

You should have invoices, invoices, invoices and accompanying documents on hand. Capitalize materials at actual cost. If you create the cost specifically on account 10 (this should be specified in the accounting policy), the postings are as follows:

| Debit | Credit | Operation |

| 10 | 60 | Materials purchased |

| 19 | 60 | The seller submitted VAT |

| 10 | 60 (76, etc.) | Additional costs for purchasing materials |

| 19 | 60 (76, etc.) | VAT on additional costs |

| 68 | 19 | VAT on the cost of materials and additional costs is deductible |

| 60 (76) | 51, 50 | Paid for materials and services of other contractors |

Free receipt

The person who gave you the materials must provide the same documents as the seller. Determine actual cost using fair value. In accounting, create the following entries:

| Debit | Credit | Operation |

| 10 | 98-2 | Materials received as a gift |

| 10 | 60 (76, etc.) | Additional costs for purchasing materials |

| 19 | 60 (76, etc.) | VAT on additional costs |

| 68 | 19 | VAT on additional costs is deductible |

| 60 (76) | 51, 50 | Additional costs paid |

Capital contribution

The contribution of materials to the authorized or share capital is formalized by an act of acceptance and transfer; it can be drawn up in any form, but with mandatory details (clause 2 of article 9 of the Law of December 6, 2011 No. 402-FZ).

| Debit | Credit | Operation |

| 10 | 75-1 | The materials were contributed towards payment of the authorized capital |

| 75-1 | 83 | Share premium is recognized if the cost of materials received is greater than the nominal value of the shares (nominal size of the share) |

| 19 | 83 (75-1) | VAT is reflected on the cost of materials, recovered by the transferring party |

| 10 | 60 (76, etc.) | Additional costs for obtaining materials |

| 19 | 60 (76, etc.) | VAT on additional costs |

| 68 | 19 | VAT on the cost of materials and additional costs is deductible |

| 60 (76) | 51, 50 | Additional costs paid |

Keep records of exports and imports in the Kontur.Accounting web service. Simple accounting, payroll and reporting in one service

Receipt upon liquidation of fixed assets

Complete the receipt with a demand invoice. If you liquidate real estate, draw up an act on the capitalization of the MC. Forms No. M-11 or No. M-35 are suitable for this, respectively. Create the following entries:

| Debit | Credit | Operation |

| 10 | 01-v (91-1) | Materials from the liquidation of fixed assets were capitalized |

| 10 | 60 (76, etc.) | Additional costs for obtaining and preparing materials |

| 19 | 60 (76, etc.) | VAT on additional costs |

| 68 | 19 | VAT on additional costs is deductible |

| 60 (76) | 51, 50 | Additional costs paid |

If you use account 15, first account for the receipt of materials and additional costs on account 15, and then capitalize at the accounting price by posting Dt 10 Kt 15.

For those who use both 15 and 16 accounts, deviations between the accounting price and the actual cost are reflected in the following entries:

- Dt 16 Kt 15 when the actual cost exceeds the book price;

- Dt 15 Kt 16 when the book price exceeds the actual price.

How to write off materials when used

The materials that you write off from account 10 can be assessed in three ways (clause 36 of FSBU 5/2019):

- at the cost of each unit;

- at average cost;

- according to the FIFO method or at cost first in time.

FSBU 5/2019 establishes that for materials that have similar properties and nature of use, the same cost calculation method must be used each time. Fix the chosen method in your accounting policy.

To account for the consumption of materials, choose one of two methods:

- write off materials from account 10 when you transfer them to units for use;

- write off from account 10 only those materials that are actually consumed, and reflect the transfer to the unit as an internal movement - by making an entry in analytical accounting.

Write-off of materials

The write-off of materials must always be confirmed by primary documents. When you transfer materials within the organization for further use, create requirements-invoices or limit-fence cards. When selling or transferring materials to another organization, you need an invoice; if there is a shortage, you will need an inventory list.

Postings for writing off materials can be as follows:

| Debit | Credit | Operation |

| 26 (44) | 10 | The cost of materials transferred or used for economic, managerial or commercial needs has been written off |

| 20 (25, 29, 23) | 10 | The cost of materials transferred or used in production has been written off |

| 08 | 10 | The cost of materials transferred to create non-current assets was written off |

| 91-2 | 10 | The cost of materials is written off as other expenses (upon sale) |

If you sell materials, write them off at the same time you recognize the proceeds from the sale; in all other cases, at the time of disposal.

Write-off of deviations from actual costs

Those who use accounting prices and account 16 must also write off deviations when writing off materials.

Write off the difference accumulated on account 16 to the cost accounting accounts:

- Dt 20 (23, 25, 26, 29, 44, 97) Kt 16 - the accumulated positive difference is written off;

- REVERSE Dt 20 (23, 25, 26, 29, 44, 97) Kt 16 - the accumulated negative difference is written off.

Return of unused materials

If you wrote off materials, but never used them for production or other needs, reflect the return in the same way as you reflect the transfer of materials to departments.

If during transfer you reflected the release to production and wrote off materials from account 10, reflect the return of materials by posting: Dt 10 Kt 20 (23, 25, 26, 29, 44, 97, etc.).

If you reflected the transfer of materials as an internal movement (only in analytical accounting for account 10), reflect the return only in analytical accounting.

Kontur.Accounting will help organize accounting of materials in the company. Create a list of materials, create documents for receipt and sale, write off inventory items for costs, shortages and losses. Track inventory balances at the enterprise and analyze the 10th account. All tasks are automated. Try accounting for materials in Accounting. New users receive 14 days of work as a gift.

Work in progress accounting

You can account for work in progress in 1C: Accounting by using the document “WIP Inventory”, which is designed to display the results obtained after an inventory check of production areas for the presence of work in progress. It is required to be created in the following cases:

if the production of products (or the implementation of work or the provision of services) occurred throughout the entire month, but was allowed to be transferred to the next month;

The work cycle lasts more than a month and as a result, at its end there are no finished products or completed works/performed services. Expenses for the past month are included in the work in progress and are automatically transferred to the next reporting period.

There is no need to create an accounting of work in progress when the provision of services, performance of work, production of products within a month has been completed, but there are no balances of work in progress (accounts 23 and 20 are closed monthly).

To generate the document, you will need to fill in the following details:

- cost accounts, which reflect the balance in the work in progress, auxiliary or main production can be selected: accounts 23 or 20.01;

- if the program settings are set in such a way that the possibility of maintaining cost accounting by divisions is noted, the balance in the refinery is reflected in the Cost Division,

- nomenclature group - displays the balance in the refinery in the types of services provided, work performed, products produced;

- balance amount – the total estimate of work in progress balances obtained from accounting data

- balance amount – the total estimate of work in progress balances obtained from tax accounting.

There may be cases in which the reflection of inventory facts and the total estimate will be present in accounting, but it will not be in tax accounting. Or the opposite situation: the presence of an assessment in tax accounting and its absence in accounting.

The formation of product costs may include data on the cost of work in progress for the past month. It is important to take into account that work in progress is considered to be those products that have not gone through all stages (stages) of production operations as of a specific date. When accounting for work in progress, “Semi-finished products of own production” can also be used - account 21.

3.3. Registration of product release, write-off of production costs.

To formalize the release of products, use the document “Product release and performance of work” (menu “Production”). At the same time, if in the resource specification an item with the type “Product” was selected as an output product, then the release document will also contain “Product”, otherwise the item with the type “Work” must be indicated in the release document.

You can create a release document manually from scratch, but it is much faster to create one from the original sales order. In this case, the document will be filled out automatically.

On the first tab, information about the organization, division, warehouse is indicated, and the type of price is selected (to form a preliminary cost in the accounting entry). “Direction of release” is also selected: if the fact of this release needs to be recorded in accounting. accounting, you must select “To warehouse”. If this document registers the release of a semi-finished product/work, which will subsequently participate in the production process of other products (or will be transferred to another division), then you must select “To division” (in this case, the accounting entry will not be generated).

On the “Products and Works” tab, a nomenclature list of manufactured products/works is indicated, indicating the quantity, the specification used and the option for determining the cost of the output product.

Now you need to write off materials and work to the cost of production. To do this, you need to fill out the document “Write-off of production costs”

The form that opens shows all the specifications according to which the product was produced (in our case, one specification). In the command panel, select “Write off production costs.”

The form of the new document “Write-off of production costs” opened, the fields of the document were filled in automatically.

On the “Output Products” tab, data on products and output quantities is filled in. The “Materials and Works” tab lists all material assets and works specified in the resource specification. If there is an actual overrun (compared to the resource specification), it is possible to manually adjust the quantity data in the document.

The “Labor Costs” tab lists all types of work that will be taken into account in the cost price as labor costs. Let's review the document and close it.

Accounting for semi-finished products of own production in 1C

The use of the mentioned account 21 is necessary for organizations in which the production of semi-finished products is one of the production cycles. For all other enterprises, accounting for semi-finished products is carried out as part of WIP accounting. In correspondence on the debit “Main production” of account 20, it is necessary to reflect the amounts of actual costs incurred in the manufacture of semi-finished products. According to the loan, the cost of used semi-finished products is written off to the same production accounts.

As with the release of finished products, the production of semi-finished products is noted in the report produced per shift in the “Product Release” menu. To do this, fill in the following fields one by one:

- write-off account (“Main production” 20/1);

- the production unit that produced the semi-finished product;

- planned cost;

- “Semi-finished products of own production” accounting account 21.

Carrying out this document is necessary to account for the semi-finished products available in the warehouse.

At average cost

The “average cost” method is the simplest and therefore the most common.

First, let's determine the average cost of materials supplied.

To do this, we determine the cost of all materials of our type in the warehouse:

2000 rub. + 4400 rub. + 3150 rub. +9500 rub. = 18,750 rub.

Next, we determine the total amount of our material in the warehouse:

100 units + 200 units + 150 units + 400 units = 850 units

And now, let's divide the total amount by the total quantity, so we get the average cost of the material in the warehouse.

18,750 rub./850 units. = 22,059 rub.

That is, the average cost of the material is 22 rubles. 06 kop.

Accordingly, when we write off material for production using this method, we will get the following result:

22.06 x 600 units. = 13,236 rub.

Closing Cost Accounts

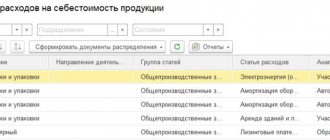

Accounts 20/21/25/26/29 are closed by performing the operation from the regulations - “Closing the month”. At the same time, there are no difficulties with direct costs (they are obvious - these are materials and wages of workers performing work related to the production activities of the enterprise), but with indirect overhead costs the situation is more complicated.

In order to correctly distribute the organization’s indirect costs, the accountant must reflect the cost distribution method in the “Accounting Policies” column. This distribution is usually proportional to either wages paid or the output of finished products.

If the cost accounting method is incomplete or incorrectly reflected, the 1C system will issue information that will indicate the specific error made in the accounting policy, and will issue proposals for actions that can eliminate the inaccuracy.

Indirect costs are written off to account 20 or immediately attributed to sales - account 90. Such expenses are closed before account 20 is closed.

If the accounting setup is correct, the amounts on 25/26/29 accounts are distributed between groups of manufactured goods in accordance with the selected method. In the example given, when the product is the only item produced by the company, indirect costs are written off to production. The 20 account closes with the 40 score.

As a conclusion, it should be noted the accounting capabilities provided by 1C: Accounting. They cover all existing production stages and provide the ability to control, track the origin of costs and analyze them. At the same time, these possibilities are universal and therefore somewhat superficial. If you need to fully automate accounting, for manufacturing enterprises we offer 1C: Complex Automation, 1C: UNF, or automation based on 1C: ERP for the largest industries.

Results

In both accounting and tax accounting, capitalized VOs reduce the amount of material expenses. The organization must choose a method for determining the price at which VOs will be capitalized in accounting, and consolidate this in the accounting policy.

For many industries, the presence of returnable packaging is also relevant, about accounting for which read in the article “Accounting for returnable packaging: price, postings, taxes.”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.