Accounting for income taxes on loans and credits is relevant for almost every organization. In accordance with the law, income tax should be reduced by interest paid under loan agreements. But if the company, on the contrary, issued a loan and thereby received a profit in the form of interest, the tax increases.

Features of calculating interest on a loan

Until 2015, an important rule was in force. There was a specially established amount of the “borrowed” interest received, which was to be included in expenses. Now everything has changed a little, and the following rules have come into force:

- There is no fixed amount of accrued interest when determining income tax. The exception is controlled transactions.

- Rationing is used in relation to those loans that, in accordance with the Tax Code of the Russian Federation, were recognized as controlled transactions.

Today, there are several principles for calculating and accounting for interest:

- Accounting, which requires that all interest rates be accounted for separately from the principal amount due.

- Summova. In this case, when calculating income tax, interest is reflected in the amount specified in the agreement. This will be the case unless the loan is recognized as a controlled transaction.

- Settlement. According to this principle, for all loans and credits there is a formula, which should be used to determine the amount of interest that can be included in expenses.

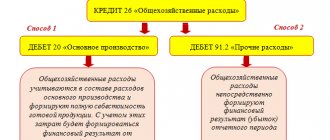

Cost categories

All types of expenses for obtaining and servicing borrowed capital can be divided into two categories: basic and additional.

| Basic | Additional |

|

|

Controlled interest

The features of tax regulation by percentage include:

- Two-way action. It must be remembered that both the borrower's interest expenses and the lender's interest income are subject to rationing.

- Safe betting intervals. Any interest earned at such intervals must be fully tax included. Such intervals are indicated in clause 1.2 of Art. 269 of the Tax Code of the Russian Federation. Starting from 2021, all interest on ruble loans from controlled transactions is calculated the same way - at 75-125% of the Central Bank rate.

The interval rule has a number of features:

- If the rate is greater than the minimum of the interval, then interest income is calculated at the actual rate.

- If the rate is less than the maximum, then the expense is calculated at the actual rate.

- If the rate is outside the interval, pricing methods are applied.

Since 2021, there have been more cases where debt is considered manageable. The following have been added to all previously existing cases:

- If the company's share of participation is more than 25%.

- If the participation of a foreign company in the taxpayer goes through some other organizations, but provided that the share of participation in those organizations is more than 50%.

In order for interest on a loan to be recognized as uncontrollable, you must:

- Compare the loan amount with the organization’s own capital.

- Calculate maximum interest rates using the capitalization ratio.

- If there is no excess, then apply the actual rate.

Transactions are considered controlled in the following cases:

- If an interdependent person participated in the transaction and if the annual income from such transactions exceeded 1 billion rubles.

- If the transaction involved an interdependent person working under the simplified tax system and if the income exceeded 60 million rubles per year.

- If the interdependent person participating in the transaction works under the unified agricultural tax or under the UTII and the annual income was more than 100 million.

- Any transactions with offshore companies with an annual income of 60 million.

A transaction cannot be uncontrolled in the following cases:

- If both parties to the transaction are Russian companies (and not banks), guarantees were provided.

- If both parties to the transaction are registered or reside in the Russian Federation.

If, according to some parameters, it turns out that the transaction is controlled, the taxpayer is obliged to check the compliance of the applied market rate.

New PBU for loan accounting. Brevity for clarity

New PBU 15/2008 “Accounting for expenses on loans and credits”

, approved by order of the Ministry of Finance of the Russian Federation dated October 6, 2008 No. 107n, will need to be applied starting with reporting

for 2009

.

That is, until the end of 2008, accounting is carried out according to the old rules (according to PBU 15/01 “Accounting for loans and credits and the costs of servicing them,” approved by order of the Ministry of Finance of the Russian Federation dated August 2, 2001 No. 60n), and already for

the first quarter of 2009

financial statements must be prepared taking into account the norms of PBU 15/2008.

In general, the new PBU 15/2008 is shorter than its predecessor, but this does not add clarity, rather the opposite.

Interest-free loans and government loans

The previous PBU 15/01 was not applied to interest-free loan agreements and government loan agreements.

At the same time, a special procedure for accounting for expenses on interest-free loans

was absent.

In this regard, these expenses were still taken into account by analogy

with the procedure provided for by PBU 15/01.

There are no such restrictions in the new PBU 15/2008, which means that the provisions of PBU 15/2008 will be legally applied to interest-free loan agreements.

Regarding government loan

, then the Russian Federation, and not the organization, is the borrower.

The organization under government loan agreements is the lender

, that is, does not receive a loan, but issues it.

A government loan agreement is concluded through the acquisition by the lender (that is, the organization) of issued government bonds or other government securities certifying the lender’s right to receive from the borrower the funds lent to him or, depending on the terms of the loan, other property, established interest or other property rights within the terms stipulated by the conditions for issuing a loan into circulation ( Article 817 of the Civil Code of the Russian Federation

).

cannot reflect government loans as part of borrowed funds.

.

Therefore, despite the absence of a direct ban on the application of the provisions of PBU 15/2008 to government loans, it is impossible to take into account government loans according to the norms of this PBU.

Amount of debt – actual or contractual

In accordance with PBU 15/01, the principal amount of debt on a loan and (or) an organization’s loan received from the lender should have been taken into account in accordance with the terms of the loan agreement or credit agreement in the amount of funds actually received

or in the valuation of other things provided for in the contract.

Moreover, the specified debt should have been taken into account at the time of actual transfer

money or other things.

With regard to accounting for debt under loan agreements, the provisions of PBU 15/01 are applicable.

The loan agreement is real

, which means that it is considered concluded from the moment

of transfer of money

or other things, that is, when the parties carry out real actions to execute the contract.

But a credit agreement, unlike a loan agreement, is consensual, that is, the rights and obligations of the parties to such an agreement arise at the time of its conclusion, and not at the time of actual execution (transfer of money).

That is, the borrower’s actual debt under the loan agreement arises on the date of conclusion of the agreement, so it should be reflected in accounting without waiting for the actual transfer of funds and in the amount specified in the agreement, which is what the new PBU 15/2008 prescribes.

Since January 1, 2009

The principal amount of the obligation for the loan (credit) received will be reflected in the accounting records of the borrowing organization as accounts payable in accordance

with the terms of the loan agreement

(credit agreement)

in the amount specified in the agreement

.

That is, firstly, the amount of debt on monetary loans (credits) will be determined by the terms of the agreement, and not by the amount of funds actually received, and secondly, the moment of reflection in the accounting of debt will also depend on the terms of the agreement, and not on the moment of actual transfer of money.

Moreover, under loan agreements, the debt should still be reflected at the time of the actual transfer of money or other things, because this agreement, as already said, is real and begins to take effect only when the money is transferred.

This means in accordance with the terms of the contract

(as stated in PBU 15/2008), debt under a loan agreement arises with the borrower precisely at the moment of actual transfer of money.

Is it long or short?

PBU 15/01

prescribes dividing the debt on received loans and borrowings in accounting into short-term and long-term.

Short-term debt

is considered to be debt on received loans and credits, the repayment period of which, according to the terms of the agreement, does not exceed 12 months.

Long-term debt

is considered to be debt on received loans and credits, the repayment period of which, according to the terms of the agreement, exceeds 12 months.

translation is allowed

long-term debt into short-term debt, which allows you to improve some of the financial performance indicators of the organization.

does not contain similar provisions

.

However, this is not a reason to believe that the division of debt into long-term and short-term is abolished.

Such a division will need to be made, at least until the instruction is taken into account separately

short-term and long-term debt are contained in the Instructions for the use of the Chart of Accounts, approved by order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n.

Let us remind you that the Chart of Accounts provides for the maintenance of two synthetic accounts for accounting for debt on loans and borrowings: depending on the period for which the borrowed funds were received (up to 12 months inclusive or more than 12 months).

Settlements for them are carried out, respectively, either on account 66

“Settlements for short-term loans and borrowings”, or

on account 67

“Settlements for long-term loans and borrowings”.

In addition, Form No. 1

The “balance sheet” also provides for the reflection in the liabilities side of the balance sheet of information about loans and credits, both as part of long-term liabilities (Section IV of the balance sheet) and as part of short-term liabilities (Section V of the balance sheet) - depending on the period for which the borrowed funds were received.

But about the transfer of long-term debt to short-term debt from January 1, 2009

. you will have to forget: such a translation is mentioned only in PBU 15/01 and no other regulatory document mentions this possibility.

Also in PBU 15/2008 (unlike PBU 15/01) there is no division of debt into urgent and overdue.

Although the Instructions for using the Chart of Accounts still require that they be taken into account separately

loans and borrowings not paid on time.

So essentially nothing has changed in this part either.

Interest on bills and exchange rate differences

PBU 15/01

provides for the inclusion in the costs associated with the receipt and use of loans and borrowings, expenses in the form of

interest (discount)

on bills and bonds due for payment and

exchange rate differences

related to interest payable on loans and credits received and denominated in foreign currency or conventional monetary units formed from the moment interest is accrued under the terms of the agreement until their actual repayment (transfer).

PBU 15/2008 does not directly name such expenses.

PBU 15/2008 only talks about expenses in the form of interest

payments due to the lender (creditor), and

additional

borrowing costs.

However, bills and bonds according to Art. 815

and

816 of the Civil Code of the Russian Federation

are just ways to draw up a loan agreement.

So interest (discount)

for bills and bonds - this is essentially the same interest under the loan agreement payable to the lender, which is mentioned in PBU 15/2008.

As for exchange rate differences, their accounting is spelled out in detail in PBU 3/2006 “Accounting for assets and liabilities, the value of which is expressed in foreign currency.”

In particular, PBU 3/2006 obliges the recalculation of funds in settlements, including for borrowed obligations expressed in foreign currency, into rubles on the date of the transaction in foreign currency, as well as on the reporting date, and to reflect the exchange rate differences arising in connection with this in composition of other income and expenses.

In this regard, the Ministry of Finance considered it inappropriate to prescribe the procedure for accounting for exchange rate differences additionally in PBU 15/2008.

Additional expenses

List of additional costs

, contained in PBU 15/01, is broader than the similar list from the new PBU 15/2008.

In particular, PBU 15/01 lists as additional costs the costs associated with:

– carrying out copying and duplicating work;

– payment of taxes and fees (in cases provided for by current legislation);

– consumption of communication services.

In PBU 15/2008 these costs are not listed as additional expenses.

However, in both PBU 15/01 and PBU 15/2008 the list of additional costs is open

.

This means that in 2009 and subsequent years, as now, it will be possible to take into account both the costs of copying and duplicating work, paying taxes and communication services, as well as other costs directly related to obtaining loans (credits).

As now, additional expenses according to PBU 15/2008 can be recognized as other expenses

in the reporting period to which they relate, or be included

evenly

in other expenses during the term of the loan (credit agreement).

Interest: together or separately

PBU 15/01 prescribes showing debt on loans and credits received, taking into account

interest due at the end of the reporting period.

In PBU 15/2008, there was an indication that borrowing costs are reflected in accounting separately from the principal amount of the obligation for the loan (credit) received.

However, the requirement for separate accounting of interest is contained in the Instructions for using the Chart of Accounts.

That is, in essence, interest accounting, as now, will be carried out separately.

Only others, no MPZ

PBU 15/01 states that the costs of loans and credits received may be included in other expenses or in the cost of investment assets.

In addition, with regard to MPZ, PBU 15/01 provides another option for accounting for costs of borrowings and credits.

If an organization uses funds from received loans and credits to make advance payments for inventories

, other valuables, works, services or the issuance of advances and deposits towards their payment, then the costs of servicing these loans and credits are attributed by the borrower organization

to the increase in receivables

generated in connection with the prepayment and (or) issuance of advances and deposits for the specified above the target.

Then, when the borrower’s organization receives inventories and other valuables, performs work and provides services, further accrual of interest and other expenses associated with servicing received loans and credits are reflected in accounting in the general manner

– with the attribution of these costs to other expenses of the borrowing organization.

PBU 15/2008 does not provide for the inclusion of costs for loans and borrowings in the cost of inventories: according to PBU 15/2008, borrowing costs are recognized as other expenses

, with the exception of that part of them that is subject to inclusion in the value of the investment asset.

However, PBU 5/01 “Accounting for inventories”, approved by order of the Ministry of Finance of the Russian Federation dated 06/09/2001 No. 44n, stipulates that interest on borrowed funds accrued before the acceptance of inventories for accounting, if they are raised for the acquisition of these inventories are the actual costs of purchasing inventories and are included in the actual cost

inventories purchased for a fee.

A legal conflict arises: two norms of different PBUs contradict each other.

In this case, you should be guided by the norms of the document later

by date of adoption, in the case under consideration - this is PBU 15/2008.

Note!

Thus, borrowing costs since 2009

must be recognized

as other expenses

and cannot be included in the cost of inventories.

The only exception to this rule is those borrowing costs that are included in the cost of investment assets.

Let's consider this point in more detail.

Investment assets

For the purposes of PBU 15/2008,

an investment asset

is understood as an object

of property

, the preparation of which for its intended use requires a long time and significant costs for acquisition, construction and (or) production.

Investment assets include objects of work in progress and construction in progress, which will subsequently be accepted for accounting by the borrower and (or) customer (investor, buyer) as fixed assets (including land), intangible assets or other non-current assets.

The definition of investment assets is also contained in PBU 15/01, and in the new PBU 15/2008

it is presented in a clearer and more complete form.

But if currently the specified objects are purchased directly for resale

, are accounted for as goods and

do not belong

, then PBU 15/2008 directly states that objects of unfinished production or construction that will be accepted for accounting

by the customer

(investor,

buyer

) are also considered investment assets.

Interest, not costs

PBU 15/01 provides for the inclusion of costs

for loans and credits directly related to the acquisition and (or) construction of investment assets.

costs include

may include both

interest

due to the lender and other additional costs.

New PBU 15/2008

prescribes that the value of investment assets should include only

interest

due to the lender (creditor).

That is, additional costs

cannot

be included in the value of investment assets , and are taken into account in the manner prescribed on page 20.

PBU 15/2008

clearly formulates the conditions for including interest in the value of an investment asset:

A)

expenses for the acquisition, construction and (or) production of an investment asset are subject to recognition in accounting;

b)

borrowing costs associated with the acquisition, construction and (or) production of an investment asset are subject to recognition in accounting;

V)

work has begun on the acquisition, construction and (or) production of an investment asset.

Like PBU 15/01, PBU 15/2008 establishes that when the acquisition, construction and (or) production of an investment asset is suspended for a long period (more than three months), interest payable to the lender (creditor) ceases to be included in the cost of the investment asset .

PBU 15/2008

clarifies that the inclusion of interest in the cost of an investment asset should be stopped

from the first day

of the month following the month of suspension of the acquisition, construction and (or) production of such an asset.

During the specified period, interest payable to the lender (creditor) is included in other expenses of the organization.

But PBU 15/01 does not explain how to take into account the costs of credits and borrowings if the process of acquiring, constructing or manufacturing an investment asset is resumed

.

PBU 15/2008

fills this gap.

Upon resumption

acquisition, construction and (or) production of an investment asset, interest payable to the lender (creditor) is included in the cost of the investment asset from the first day of the month following the month of resumption of acquisition, construction and (or) production of such an asset.

If the goal has changed

It happens that funds from loans and borrowings received for purposes unrelated

with such an acquisition (for example, loan funds received to replenish working capital).

PBU 15/01 prescribes including in the cost of investment assets the costs of such “non-targeted” borrowed funds. This should be done at a weighted average cost rate

.

PBU 15/2008

also prescribes interest payable to the lender (creditor) to be included in the cost of the investment asset in proportion to the share of

such

“non-targeted” borrowed funds in the total amount of loans (credits) payable to the lender (creditor), received for purposes not related to the acquisition, construction and (or) production of such an asset.

The procedure for calculating the share of interest payable to the lender (creditor), subject to inclusion in the cost of an investment asset, is explained in PBU 15/2008 in the form of an example

.

| Index | Amount of loans (credits), rub. | ||

| Total | including | ||

| for the acquisition, construction and (or) production of an investment asset | for common purposes | ||

| Balance of unused loans (credits) at the beginning of the reporting period | 10 000 | 6 000 | 4 000 |

| Loans (credits) received during the reporting period | 40 000 | 30 000 | 10 000 |

| Total loans (credits) in the reporting period | 50 000 | 36 000 | 14 000 |

| Interest to be accrued in the reporting period | 10 800 | 9 100 | 1700 |

| Loans (credits) spent in the reporting period | 48 000 | 44 000 | 4 000 |

Loans (credits) spent in the reporting period on the acquisition, construction and (or) production of an investment asset from loans (credits) received for general purposes: 8,000 = (44,000 – 36,000).

The amount of interest payable to the lender (creditor) for loans (credits) received for general purposes, to be included in the value of the investment asset: 971 = (1,700 x 8,000) / 14,000.

Total amount of interest payable to the lender (creditor), subject to inclusion in the value of the investment asset: 10,071 = (9,100 + 971).

Note for example:

1.

The amount of interest payable to the lender (creditor), subject to inclusion in the cost of the investment asset, must not exceed the total amount of interest payable to the lender (creditor), organization in the reporting period.

2.

When calculating the share of interest payable to the lender (creditor) to be included in the cost of the investment asset, the amount of loans (credits) received for the acquisition, construction and (or) production of the investment asset is excluded from the total amount of loans (credits).

3.

The amount of interest payable to the lender (creditor), subject to inclusion in the cost of several investment assets, is distributed among investment assets in proportion to the amount of loans (credits) included in the cost of each investment asset.

4.

The calculation of the share of interest on loans to be included in the cost of the investment asset given in this example is based on the following assumptions:

A)

rates on all loans (credits) are the same and do not change during the reporting period;

b)

work on the acquisition, construction and (or) production of an investment asset continues after the end of the reporting period.

Calculations made by organizations may be based on different assumptions.

Interest accounting procedure

PBU 15/01 establishes that the inclusion of borrowing and credit costs in current expenses is carried out in the amount of payments due in accordance with loan agreements and credit agreements concluded by the organization

regardless of in what form and when the specified payments are actually made.

The procedure for including the costs of loans and borrowings in the cost of investment assets PBU 15/01 is not specified at all.

But from clause 16 of this PBU (according to which the organization accrues interest on loans and credits received in accordance with the procedure established in the agreement

loan and (or) credit agreement), we can conclude that interest is included in the cost of investment assets in accordance with

the terms of the agreement

.

New PBU 15/2008

provides that interest payable to the lender (creditor) is included in the cost of the investment asset or other expenses

evenly

, as a rule,

regardless

of the terms of the loan (credit) (that is, regardless of the terms of the agreement).

Interest payable to the lender (creditor) may be included in the cost of the investment asset or as part of other expenses based on the conditions

provision of a loan (credit) (that is, based on the terms of the agreement) in the case where such inclusion

does not differ significantly

from uniform inclusion.

Bills and bonds

The procedure for accounting for interest on bills and bonds remains essentially the same: interest accrued on the bill amount, accrued interest and (or) discount on the bond are reflected by the drawer (issuer) as part of other expenses in those reporting periods to which these accruals relate, or

evenly throughout the period for repayment of borrowed funds stipulated by the bill of exchange (during the term of the loan agreement).

PBU 15/2008 clarifies that interest and (or) discount should be reflected separately

from the bill amount and the face value of the bond as accounts payable.

Disclosure of information in accounting policies

PBU 15/2008

, unlike PBU 15/01,

does not provide

a list of information that must be disclosed in the accounting policy.

However, this does not mean that the accounting policy will no longer have to write anything about how the costs of credit and borrowings are taken into account.

After all, PBU 15/2008 provides for variability, for example, in the order of writing off additional expenses on loans, in accounting for interest on bills and bonds, etc.

These points will still need to be recorded in the accounting policies based on the requirements of PBU 1/2008.

Disclosure of information in financial statements

In addition to the information required to be disclosed in the financial statements by PBU 15/01, PBU 15/2008

obliges to report also about:

– about the amounts of income

from the temporary use of funds from a received loan (credit) as long-term and (or) short-term financial investments, including those taken into account when reducing borrowing costs associated with the acquisition, construction and (or) production of an investment asset;

interest included in the cost of the investment asset

, due for payment to the lender (creditor), for loans taken for purposes not related to the acquisition, construction and (or) production of an investment asset.

Rationing of interest

If a company received a loan from its employee or any other individual, then the interest rates must be specified in the agreement. They are payment for the use of the borrowed amount. In such cases, companies can include all interest in tax amounts, there are no restrictions on this for uncontrolled transactions.

At the same time, the borrower is required to charge and withhold income tax. The borrower must transfer all interest to the lender minus personal income tax. The borrower makes payments to the budget within the time limits specified in the Tax Code. The borrower must indicate all interest income and taxes paid on it in reports and in the tax register.

If it is agreed that an individual will receive interest not in money, then personal income tax will be charged on all income paid by the borrowing company. If the borrower has no way to withhold personal income tax, then he must notify the tax authority and his lender about this.

If a loan was taken out to purchase an investment asset, then all interest on the loan is included in the item non-operating expenses. There is no difference whether it is a regular asset or an investment one. The price of an investment asset tends to increase by the amount of interest (but provided that borrowed funds were used to create the asset).

Important! If borrowed funds were used to pay dividends, interest may also be included as an expense.

Income tax when paying interest under a cash loan agreement

Expenses in the form of interest under a loan agreement (including if borrowed funds are used for the acquisition (creation) of depreciable property, for the acquisition of a share in the authorized capital) are taken into account by the borrower as part of non-operating expenses, provided that they are aimed at generating income (clause 2 Clause 1 of Article 265, Clause 1 of Article 252 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance of Russia dated March 10, 2015 N 03-03-10/12339 (sent to the Federal Tax Service of Russia for information and use in the work of lower tax authorities by Letter dated March 23, 2015 N ГД-4-3/), dated 04/26/2013 N 03-03-06/1/14650, dated 02/27/2013 N 03-08-05/5690, Federal Tax Service of Russia dated 09/29/2014 N ГД-4-3/19855 ).

In general, for profit tax purposes, interest calculated on the basis of the actual rate established by the agreement is recognized as an expense (clause 1 of Article 269 of the Tax Code of the Russian Federation).

Special rules should be applied in relation to interest on debt obligations that arose as a result of transactions recognized as controlled in accordance with the Tax Code of the Russian Federation (clause 1, clauses 1.1 - 1.3 of Article 269 of the Tax Code of the Russian Federation), as well as in relation to controlled debt according to paragraphs 2 – 6 of Art. 269 of the Tax Code of the Russian Federation (taking into account the norms of paragraphs 7 - 13 of Article 269 of the Tax Code of the Russian Federation). In this material we do not consider interest on these transactions and on controlled debt.

Thus, to include interest under a loan agreement in expenses, as a general rule, the borrower does not calculate the maximum interest amount. Interest in this case is taken into account in full.

It is possible that borrowed funds are used to pay dividends. The Presidium of the Supreme Arbitration Court of the Russian Federation, in Resolution No. 3690/13 dated July 23, 2013 in case No. A40-41244/12-99-222, formed a legal position on the issue of accounting for expenses in the form of interest on such a loan when taxing profits. It lies in the fact that the payment of dividends is associated with activities aimed at generating income, and therefore interest on the loan that was raised to pay dividends reduces the tax base for income tax. These interests are recognized as non-operating expenses based on paragraphs. 2 p. 1 art. 265 Tax Code of the Russian Federation. This position is reflected in the Review of the practice of considering tax disputes by the Presidium of the Supreme Arbitration Court of the Russian Federation, the Supreme Court of the Russian Federation and the interpretation of the norms of legislation on taxes and fees contained in the decisions of the Constitutional Court of the Russian Federation for 2013. This Review was sent to the tax authorities for use in their work by Letter of the Federal Tax Service of Russia dated December 24, 2013 N SA-4-7/23263.

A similar approach to resolving the issue under consideration is expressed in Letters of the Ministry of Finance of Russia dated November 3, 2015 N 03-03-06/1/63388, dated July 24, 2015 N 03-03-06/1/42780. The financial department clarified that for income tax purposes, interest on a loan used to pay dividends is recognized as non-operating expenses based on paragraphs. 2 p. 1 art. 265 Tax Code of the Russian Federation. This position is supported by reference to the Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated July 23, 2013 N 3690/13.

Thus, interest on debt obligations (including loans and borrowings) in the case of using the corresponding raised funds to pay dividends is taken into account when taxing profits.

Previously, the Russian Ministry of Finance adhered to a different point of view (see Letters dated 05/06/2013 N 03-03-06/1/15774, dated 03/18/2013 N 03-03-06/1/8152). It was that expenses in the form of interest on a debt obligation raised to pay dividends are not recognized when determining the tax base for income tax, since such expenses were not made for the purpose of generating income.

In tax accounting, interest on a loan agreement is taken into account by the borrower on the date of recognition of the expense in accordance with Chapter. 25 of the Tax Code of the Russian Federation (clause 3 of Article 328 of the Tax Code of the Russian Federation). Thus, if the borrower uses the accrual method, then under a loan agreement, the validity of which falls on more than one reporting (tax) period, the amount of interest is expensed at the end of each month of the corresponding reporting (tax) period, regardless of the date (terms) of such payments provided for by the contract (clause 8 of article 272, clause 4 of article 328 of the Tax Code of the Russian Federation). Thus, interest is taken into account as part of non-operating expenses evenly throughout the entire term of the loan agreement, regardless of the date of their actual payment - at the end of each month of use of funds (Letter of the Federal Tax Service of Russia dated February 16, 2015 N GD-4-3/2289, Ministry of Finance of Russia dated January 21, 2015 N 03-03-06/1/1521, dated April 10, 2014 N 03-03-06/1/16339).

In the event that the loan agreement expires (the loan is repaid) within a calendar month, the amount of interest is included in expenses on the date of termination of such an agreement (loan repayment) (clause 8 of Article 272 of the Tax Code of the Russian Federation).

Note: if the loan agreement stipulates that the fulfillment of the obligation under it depends on the value (or other value) of the underlying asset with the accrual of a fixed interest rate during the validity period of the agreement, then on the last day of each month of the corresponding reporting (tax) period the borrower recognizes expenses in the form of interest at a fixed rate. In this case, expenses actually incurred based on the current value (or other value) of the underlying asset are taken into account as of the date of fulfillment of the obligation under this agreement (clause 8 of Article 272 of the Tax Code of the Russian Federation).

Income tax when paying interest under a loan agreement, the amount of which is expressed in foreign currency (cu), but was actually received in rubles

The borrower, according to the general rule, takes into account as expenses interest under the loan agreement, calculated on the basis of the actual rate established by the agreement (paragraph 2, paragraph 1, article 269 of the Tax Code of the Russian Federation).

When applying the accrual method in tax accounting, interest obligations expressed in foreign currency (conventional monetary units) are recalculated into rubles on the date the obligation arose, on the date of termination (fulfillment) of obligations and (or) on the last day of the current month, depending on what happened before. Recalculation of obligations (accounts payable) to the lender is carried out on the specified dates at the rate of the Bank of Russia or at another rate established by law or agreement of the parties (paragraph 2, 3, paragraph 8, article 271, paragraph 2, 3, paragraph 10, article 272 Tax Code of the Russian Federation). Due to changes in the exchange rate of foreign currency (conventional monetary units) to the ruble, exchange rate differences arise in settlements with the lender. A positive exchange rate difference occurs when liabilities are devalued, and a negative difference occurs when they are revalued. Such differences are included in non-operating income or non-operating expenses, respectively (clause 11 of article 250, subclause 5 of clause 1 of article 265 of the Tax Code of the Russian Federation).

Exchange differences are recognized as part of non-operating income or non-operating expenses on the date of termination (fulfillment) of obligations and (or) on the last day of the current month, depending on what happened earlier (clause 7, clause 4, paragraph 2, clause 8, art. 271, paragraph 6, paragraph 7, paragraph 2, paragraph 10, article 272 of the Tax Code of the Russian Federation).

Income tax when paying interest under a loan agreement, the amount of which is expressed and actually received in foreign currency

The borrower, according to the general rule, takes into account as expenses interest under the loan agreement, calculated on the basis of the actual rate established by the agreement (paragraph 2, paragraph 1, article 269 of the Tax Code of the Russian Federation).

Expenses in the form of interest payable in foreign currency must be recalculated into rubles (paragraph 1, paragraph 3, paragraph 5, article 252 of the Tax Code of the Russian Federation). For profit tax purposes, this recalculation is made at the official rate established by the Bank of Russia on the date of recognition of the corresponding expense (paragraph 1, clause 10, article 272 of the Tax Code of the Russian Federation).

When applying the accrual method, interest payment obligations expressed in foreign currency are recalculated into rubles on the date the obligation arose, on the date of termination (fulfillment) of obligations and (or) on the last day of the current month, whichever occurred first. Recalculation of obligations (accounts payable) to the lender is carried out on the specified dates at the Bank of Russia exchange rate (paragraph 2, paragraph 8, article 271, paragraph 2, paragraph 10, article 272 of the Tax Code of the Russian Federation). Due to changes in the exchange rate of foreign currency to the ruble, exchange rate differences arise in settlements with the lender. A positive exchange rate difference occurs when liabilities are devalued, and a negative difference occurs when they are revalued. Such differences are included in non-operating income or non-operating expenses, respectively (clause 11 of article 250, subclause 5 of clause 1 of article 265 of the Tax Code of the Russian Federation).

Exchange differences are recognized as part of non-operating income or non-operating expenses on the date of termination (fulfillment) of obligations and (or) on the last day of the current month, depending on what happened earlier (clause 7, clause 4, paragraph 2, clause 8, art. 271, paragraph 6, paragraph 7, paragraph 2, paragraph 10, article 272 of the Tax Code of the Russian Federation).

"Natural" interest

Interest can be paid not only in monetary terms. The loan can be issued in kind and any material assets can be used for payments - goods, products, etc. Even if such a loan has been issued, the agreement must still indicate the method of payment of interest. The terms for paying interest rates for a loan in kind are the same as for conventional loans.

How does a loan differ from a loan?

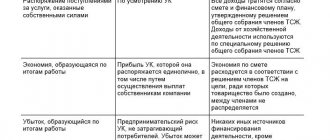

The activities of a non-profit organization are not always financed from their own and budgetary funds.

Borrowed capital is one of the sources of financing. A common form of borrowing among economic entities is loans and borrowings. When receiving or providing borrowed capital, the accountant should be guided by the provisions of PBU 15/2008. It is important to distinguish between these two concepts.

Credit is a category of borrowed capital that is provided exclusively in cash. There is an additional condition: only a specialized company - a company with a special license - is engaged in lending. For example, a bank. Another requirement for lending is charging a fee. Loan capital is issued for a certain percentage.

The loan is provided in any form, both in kind and in cash. An unlicensed organization can also issue borrowed funds. Borrowed funds can be obtained from both an individual and an entrepreneur. There may be no charge for using borrowed assets.

Calculation of interest to the lender using the simplified tax system

If an individual who is a founder wants to take out an interest-bearing loan from a company operating under the simplified tax system, then the following rules apply:

- The agreement specifies the rules for paying interest. If there are no interest conditions, then the borrower undertakes to pay them every month until the debt is paid in full.

- It is very convenient for everyone working under the simplified tax system to pay the entire amount of interest. This is because all interest income must be recorded for the tax authority. This is done on the date when they actually arrive at the company’s cash desk or into its current account. For accounting, this does not play an important role, since in accounting the accrual of interest along with income should be displayed every month.

- Personal income tax is also paid on the material benefit from savings on interest. This only applies to cases where the contract rate is less than 2/3 of the Central Bank refinancing rate. Such calculations must be performed on the last day of the month throughout the entire period of use of borrowed funds.

Accounting records

Reflect in accounting transactions on received and issued loans in accordance with PBU 15/2008. Typical entries for loans and borrowings:

| Operations | Dt | CT |

| Credit received, posting | 50 - cash to the cashier 51 — by bank transfer to a current account 10 - materials were shipped for the loan 41 - goods received 08 - investments in fixed assets | 66-1 - short-term loan 67-1 - long-term borrowed capital |

| Accrued interest amounts are included in operating costs | 91-2 | 66-1 67-1 |

| Additional costs for obtaining and servicing borrowed capital are included in costs | 91-2 | 60, 76 |

| Payment of additional debt costs has been made | 60, 76 | 50, 51 |

| Long-term loan converted to short-term | 67-1 | 66-1 |

| Loan repaid, posting | 66-1 67-1 | 50 51 10 41 08 |

| Interest on borrowed capital transferred | 66-2 67-2 | 51 |

Loan funds can be issued only by a licensed organization (bank, financial institution). Therefore, an NPO can only issue a loan. Lending is not carried out without the appropriate license. But a loan can be issued and received in kind, as well as in cash.

Tax obligations when providing a loan

Any loan agreement is an agreement between the parties that the borrower is provided with money or any valuable property, and he undertakes to repay the debt on time. When concluding such agreements without interest charges, the following tax obligations arise:

- VAT. Here, the form in which the loan was issued is of great importance. There is no need to pay VAT if the loan was issued in cash. This is due to the fact that in this case there is no transfer of ownership. You don't even need to create an invoice here. If the loan was provided in the form of an item, then VAT exemption is not provided. The lender must send the client an invoice with allocated VAT within 5 days from the moment of transfer of things. Thus, it turns out that when issuing a loan not in cash, VAT is calculated already at the time of transfer of property.

- Income tax. Any property transferred under a loan agreement cannot be included as an expense when taxing profits.

- Insurance premiums. There are no insurance premiums for loans. This equally applies to pension, medical and social insurance contributions, as well as those that are listed as contributions for injuries.

Interest-bearing loans have the following differences:

- They are not subject to VAT.

- Interest on the loan goes to the item “non-operating income”.

- Personal income tax is paid if an individual receives benefits by saving on interest.

- Insurance premiums are not paid in this case either.

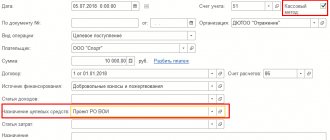

Postings for obtaining a loan

The period for issuing short-term loans does not exceed 1 year. When an organization receives funds from a credit institution, founder, etc. they are accounted for in account 66. The loan can be received in cash, by transfer to an account, or in foreign currency. The following entries will be made accordingly:

- Debit 50 (51, 52) Credit 66 - entries for receiving a loan.

When repaying the debt, the posting is reversed:

- Debit 66 Credit 50 (51.52).

The payment amount and frequency are specified in the terms of the contract.

When a company incurs additional costs when obtaining a loan, they are recorded in 91 accounts:

- Debit 91.2 Credit 66.

Long-term loans are provided for a period of more than a year. Accounting account – 67. The loan can be accounted for in this account, or after the repayment period becomes less than 12 months, transfer it to account 66:

- Debit 67 Credit 66.

Examples

1. The company provided two loans in the amount of 100,000 rubles for a period of 6 months. The operations performed should be displayed.

| D | TO | Description | Sum |

| 76 | 51 | Providing a loan | 100,000 rubles |

| 51 | 76 | Repayment of a short-term loan after 6 months | 100,000 rubles |

2. The company issued a loan in the amount of 100,000 rubles with an interest rate of 10.95% per annum for a period of 3 months from 02/01/2017 to 04/30/2017. Interest is paid along with the calculated part of the loan. It is known that the company does not issue loans as a credit institution.

| date | D | TO | Description | Sum |

| 01.02.2017 | 58 | 51 | Providing credit resources | 100000 |

| 28.02.2017 | 76 | 91 subaccounts "PD" | Accrual of % for February | 840 |

| 31.03.2017 | 76 | 91 subaccounts "PD" | Interest accrual for March | 930 |

| 30.04.2017 | 76 | 91 subaccounts "PD" | Accrual of % for April | 900 |

| 30.04.2017 | 51 | 58 | Repayment of the loan amount | 100000 |

| 30.04.2017 | 51 | 76 | Receipt of % of funds to the account | 2670 |

3. The organization provided the employee with cash in the amount of 300,000 rubles on August 1, 2017. The issuance involves the payment of interest on the funds - 8% per annum. Duration: 3 months. An agreement was concluded, which stipulates that accrued interest is paid every month.

| date | D | TO | Description | Sum |

| 01.08.2017 | 73 | 50 | Providing credit funds | 300000 |

| 31.08.2017 | 73 | 91 subaccounts "PD" | Accrual of % for August | 2033 |

| 31.08.2017 | 50 | 73 | Interest repayment for August | 2033 |

| 30.09.2017 | 73 | 91 | Interest accrual for September | 1967 |

| 30.09.2017 | 50 | 73 | Interest repayment for September | 1967 |

| 31.10.2017 | 73 | 91 | Interest accrual for October | 2033 |

| 31.10.2017 | 50 | 73 | Interest repayment for October | 2033 |

| 31.10.2017 | 50 | 73 | Repayment of the principal amount of the loan | 300000 |

Interest-free issuance principle

An interest-free loan should not be classified as a financial investment, as it must bring benefits. The issuance of a simple loan will then return only a fixed amount, so the posting is carried out in the settlement account.

To carry out operations that decipher the return on finances without dividends, account 76 “Settlements with various debtors and creditors” is required.

Postings when providing borrowed money without calculating interest look like:

- issue: Debt 76, Credit 50 (51);

- return: Debt 51 (50), Credit 76.

The loan agreement may be interest-bearing or interest-free.

The contract is always interest-bearing, unless otherwise specified in the contract itself. The opposite rule applies in cases where an agreement is concluded between citizens for an amount not exceeding 5,000 rubles and is not related to the entrepreneurial activity of at least one of the parties, and also when under the agreement the borrower is not given money, but other things determined by generic characteristics - in these cases, the loan agreement is considered interest-free, unless otherwise provided in the agreement itself. Please note that if the agreement does not contain conditions on the amount of interest, their amount is determined by the existing bank interest rate at the lender’s place of residence, and if the lender is a legal entity, at its location the bank interest rate (as of February 10, 2014, the refinancing rate is 8. 25 percent per annum Directive of the Bank of Russia dated September 13, 2012 N 2873-y) on the day the borrower pays the debt amount or its corresponding part (clause 1 of Article 809 of the Civil Code of the Russian Federation).

Funds under a loan agreement can be transferred both in cash and using non-cash payments. When making cash payments, it is necessary to take into account that in accordance with paragraph 1 of the Central Bank of Russia instructions dated June 20, 2007 N 1843-U, cash settlements in the Russian Federation between legal entities, as well as between a legal entity and a citizen carrying out business activities without forming a legal entity , between individual entrepreneurs related to their business activities, within the framework of one agreement concluded between these persons, can be made in an amount not exceeding 100,000 rubles.

RECEIPT FOR RECEIPT OF LOAN AMOUNT: SAMPLE

Important! There are no restrictions on cash payments involving citizens not related to their business activities. Legal entities and individuals who are not individual entrepreneurs can make such payments among themselves in Russian currency without restrictions.

When issuing and repaying loans and borrowings, cash register equipment is not used and cash receipts are not required (Letter of the Ministry of Finance of Russia dated February 21, 2008 N 03-11-05/40).

It should also be noted that neither legal entities nor individual entrepreneurs have the right to spend cash received in their cash registers for goods sold, work performed or services provided (CBR Letter No. 190-T dated December 4, 2007). Therefore, if an organization decides to provide a cash loan, then it must first deposit the cash proceeds to the bank, and then withdraw the required amount from the account and issue the money under the loan agreement (letter of the Central Bank of the Russian Federation dated August 3, 2009 N 14-27/292).