Before you begin full-time work in the 1C 8.3 Accounting 3.0 program, you need to set up the accounting policy of the organization whose accounting you will be maintaining. In the case where the program keeps records of several organizations at once, it must be configured for each.

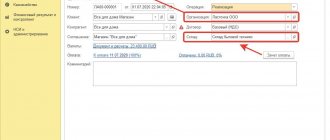

First, let's figure out where to find the accounting policy in 1C 8.3 Accounting. In the “Main” menu, select “Accounting Policy”. It is located in the “Settings” subsection.

Presets

The functionality parameters are set by default, but the user can independently select and configure only what he needs through “Main-Settings”, the “Functionality” item. The same item is available in the “Administration-Program Settings” section.

Fig.1 Administration-Program Settings

Fig.2 Selecting program settings

You can choose options - basic, custom or full functionality.

Fig.3 Program functionality

- when selecting the main functionality, all checkboxes in the settings will be unchecked;

- full functionality checks all settings of accounting sections;

- selective functionality allows the user to independently configure accounting sections by checking the necessary boxes on the tabs of this window - Documents, Cash and bank, Payments, Trade, Production, OS and intangible assets, Employees.

During operation, it is possible to edit these settings or disable them completely.

To set accounting parameters , go to “Administration-Program Settings”.

Fig.4 Accounting parameters

In this section, you can set up a chart of accounts, set up payment terms for customers and suppliers, set up salaries, fill in prices, print articles and checks.

Fig.5 Setting up accounting parameters

It is necessary to carefully read these settings, as they directly affect accounting. For example, an accounting policy for production involves setting up a chart of accounts, which, in turn, determines how inventory and costs are accounted for.

Fig.6 Setting up the chart of accounts

After completing the initial setup, you can move on to our main process. If accounting is needed for several organizations, the process is repeated for each of them separately. If necessary, changes can be made to the settings during operation.

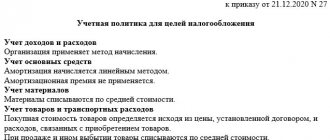

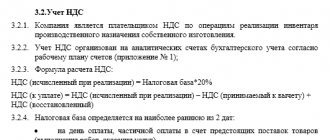

Tab “Income Tax”

The “Income Tax” tab is displayed if the “All taxation systems” flag is selected on the “Taxation systems” tab. Having reached this tab, some accountants remain perplexed for a long time. Why are there different income tax rates?

The “Different income tax rates apply” flag.

The general tax rate for income tax in the amount of 20% is established in paragraph 1 of Art. 284 Tax Code of the Russian Federation. In this case, it is distributed as follows.

- 2 % the tax amount is subject to credit to the federal budget of the Russian Federation.

- 18 % the tax amount is subject to credit to the budgets of the constituent entities of the Russian Federation.

But it also says that constituent entities of the Russian Federation have the right to lower the tax rate, subject to credit to the budget of the corresponding subject, for certain categories of taxpayers. In this case, the tax rate established by the law of a constituent entity of the Russian Federation cannot be lower than 13.5 percent.