Today, one of the dominant types of non-cash payments in the Russian Federation is the execution of a payment order. But, despite their widespread use, when creating payment slips, questions often arise regarding the correct filling out of the document fields. Especially often, legislators change the requirements for the provision of information positioning the status of the payee and the payment direction factor. This is detail 110 in the payment order. Let's talk about the features of filling it out in 2018.

Field 110 in the payment order

Today, one of the dominant types of non-cash payments in the Russian Federation is the execution of a payment order. But, despite their widespread use, when creating payment slips, questions often arise regarding the correct filling out of the document fields. Especially often, legislators change the requirements for the provision of information positioning the status of the payee and the payment direction factor. This is detail 110 in the payment order. Let's talk about the features of filling it out in 2018.

Payment order fields in 2021: sample filling

It’s not difficult to fill out the document, the main thing is to prevent corrections. To avoid mistakes, fill out the payment order and simply enter your details.

Get a sample for free!

Register in the online document printing service MoySklad, where you can: completely free of charge:

- Download the sample you are interested in

- Fill out and print the document online (this is very convenient)

General provisions about the document

The payment order form, like all other forms of documents used to make payments, was prepared and approved by the Central Bank of the Russian Federation in Regulation No. 383-P dated June 19, 2012. It also presents the methodology by which the document is filled out, and Appendix No. 3 contains its approved form indicating numbered fields for ease of completion.

We will not list all the payment details, since for our publication only field 110 is of particular interest. in the 2018 payment order , or more precisely in the Central Bank’s requirements for filling it out, since the latest adjustments were approved quite recently - in August 2017. Let’s look at the vicissitudes of completing this detail.

Clarifications for field 107

As for field 107, in a letter dated June 11, 2019 No. 21-08-11/42596, the Ministry of Finance explained how it views the correct filling out of tax bills. Using personal income tax as an example, officials clarified that what should be written in the field is not the specific date of transfer of money, but the month (quarter, year) for which the payment is being made. The correct design option is shown by a sample payment for transport tax in 2021, and in the case of personal income tax payment, it must be written in the format “MS.09.2020” if income tax is transferred for September.

Payment order: field 110 in 2021

Filling out detail 110 today is provided only in cases where the payment is addressed to an individual, and he receives funds from the country’s budget. Such payments are considered:

- Salary/salary/remuneration/ of government employees;

- Remuneration of personnel of state institutions, municipal organizations, as well as state extra-budgetary funds;

- State scholarships;

- Pensions, compensation and other social payments from the Pension Fund;

- Lifetime imprisonment for judges.

If the payment falls under any of the categories indicated in the list, then the type of payment in the 2021 payment order in field 110 o. It is quite possible that over time this list will expand, since Law No. 161-FZ does not exclude such a possibility.

When making other payments, the rule still applies - field 110 in the payment order is not filled in. This is true even for:

- Mandatory transfers to the treasury;

- Settlements made by companies, entrepreneurs and individuals.

So, filling out line 110 in a payment order in 2021 has so far become mandatory only for transactions involving the transfer of money to individuals from budget funds.

How to fill out a payment order at the request of the tax office in 2021

Filling out the payment order form at the request of the Federal Tax Service has its own peculiarities. For convenience, we have collected them in a table:

| Field | What to indicate |

| Reason for payment (106) | Enter "TR". This means that the debt is repaid based on the tax claim received. |

| Tax period indicator (107) | Here, indicate the payment deadline, which is noted in the Federal Tax Service's requirement. For example, if you pay tax for the 2nd quarter of 2021, indicate in the payment order form: KV.02.2017 |

| Document number (108) | Tax claim number. |

| Document date (109) | The date of the document requesting the Federal Tax Service is transferred to this field. |

New details have been added to the payment

The Bank of Russia issued Directive No. 4449-U dated July 5, 2021, which amended Bank of Russia Regulation No. 383-P dated June 19, 2012 “On the rules for transferring funds.” Such changes are necessary for bankers in order to monitor compliance with the law’s requirement for non-cash payments from the budget only to Mir cards. Now, when transferring funds in favor of individuals at the expense of budget funds, senders will have to fill out field 110 of the payment order. Until now, this field has remained empty.

Table. Status of payer of contributions and taxes in 2021

Column 101 of the payment order contains information about the status of the payer of funds. The status can be determined based on the information specified in Appendix 5 to the order of the Ministry of Finance, registered under number 107n. We have already talked about the main statuses above, the rest are reflected in the following table:

| 01 | taxpayer (payer of fees) - legal entity |

| 02 | tax agent |

| 03 | federal postal service organization that drew up an order for the transfer of funds for each payment by an individual |

| 04 | tax authority |

| 05 | Federal Bailiff Service and its territorial bodies |

| 06 | participant in foreign economic activity - legal entity |

| 07 | customs Department |

| 08 | payer - a legal entity (individual entrepreneur, lawyer, notary, head of a farm) that transfers funds to pay insurance premiums and other payments to the budget |

| 09 | taxpayer - individual entrepreneur |

| 10 | taxpayer is a notary engaged in private practice |

| 11 | taxpayer is a lawyer who has established a law office |

| 12 | taxpayer - head of a peasant (farm) enterprise |

| 13 | taxpayer - another individual - bank client (account holder) |

| 14 | taxpayer making payments to individuals |

| 15 | a credit organization (a branch of a credit organization), a payment agent, a federal postal service organization that has drawn up a payment order for the total amount with a register for the transfer of funds accepted from payers - individuals |

| 16 | participant in foreign economic activity - individual |

| 17 | participant in foreign economic activity - individual entrepreneur |

| 18 | a payer of customs duties who is not a declarant, who is obligated by the legislation of the Russian Federation to pay customs duties |

| 19 | organizations and their branches transferring funds withheld from the wages (income) of a debtor - an individual to repay debts on payments to the budget on the basis of an executive document |

| 20 | credit organization (branch of a credit organization), payment agent, who drew up an order for the transfer of funds for each payment by an individual |

| 21 | responsible member of a consolidated group of taxpayers |

| 22 | member of a consolidated group of taxpayers |

| 23 | authorities monitoring the payment of insurance premiums |

| 24 | payer - individual person who transfers funds to pay insurance premiums and other payments to the budget |

| 25 | guarantor banks that have drawn up an order for the transfer of funds to the budget system of the Russian Federation upon the return of value added tax excessively received by the taxpayer (credited to him) in a declarative manner, as well as upon payment of excise taxes calculated on transactions of sale of excisable goods outside the territory of the Russian Federation , and excise taxes on alcohol and (or) excisable alcohol-containing products |

| 26 | Founders (participants) of the debtor, owners of the property of the debtor - a unitary enterprise or third parties who have drawn up an order for the transfer of funds to repay claims against the debtor for the payment of mandatory payments included in the register of creditors' claims during the procedures applied in a bankruptcy case |

Filling out field 110 in the payment slip

If you are transferring budget funds, you must enter the number “1” in this field. This code will tell the recipient's bank to check whether the account owner has an issued Mir payment card. For regular transfers at the expense of the organization’s own funds, field 110 still does not need to be filled in.

If during the verification it turns out that the recipient has a Mir card attached to his bank account, or that any issued payment card is missing, the recipient’s bank must credit him with the payment amount. If the recipient does not have a Mir card, the bank reflects the payment amount in the account for accounting for amounts of unknown purpose. After this, the bank must, no later than the next business day, send a notice to the recipient of the funds with an offer to appear within ten working days to receive the payment amount in cash.

In addition, the recipient can submit an order to the bank to credit the payment amount to a bank account that provides for transactions using the Mir card. If within these 10 days the citizen does not receive his money or does not provide an order for transfer to another suitable account, then the bank must return it to the payer.

New details in payments

The Central Bank has introduced new details into the payment order. Field 110, which has not been filled in recently, will indicate the payment code.

It will be filled out when transferring funds to individuals at the expense of budget funds. For regular payments, at the expense of organizations’ own funds, this field will not be filled in.

Directive of the Central Bank of the Russian Federation dated July 5, 2021 No. 4449-U required that non-cash payments from the budget be made only to Mir cards. When transferring budget money, the sender will have to put the number “1” in this field. And this will be a signal to the recipient’s bank to check whether the account owner has an issued Mir payment card.

If the recipient does not have a Mir card, the bank reflects the payment amount in the account for accounting for amounts of unknown purpose. And no later than the next day, sends a notice with a proposal to appear within no later than 10 working days to receive the payment amount in cash or submit an order to credit the amount to another account.

If within ten days an individual does not appear to receive cash or does not provide an order for transfer to another suitable account, the funds will be returned to the payer.

Such rules are established for recipients of pensions, salaries of civil servants and other public sector employees, government scholarships and the monthly lifelong allowance of judges.

Let's sum it up

- Contributions for injuries are transferred not to the Federal Tax Service, like all other insurance contributions (for compulsory medical insurance, compulsory medical insurance and VNiM), but to the Social Insurance Fund.

- The deadline for payment of contributions for accidents and occupational diseases is until the 15th day of the month following the one in which the employee received income.

- When filling out the payment form, code “08” is indicated in field 101, regardless of who pays the injury contributions.

- Fields “106-109” are not filled in when paying “unfortunate” contributions.

- Contributions for injuries are paid to KBC - 393 1 02 02050 07 1000 160.

If you find an error, please select a piece of text and press Ctrl+Enter.

Explanation in field 110

For the beneficiary's bank, column code 110 will indicate the purpose and type of payment. It is used to decipher banking transactions for non-cash transfers of mandatory insurance and tax contributions to the budget. Subject to the new rules, each individual entrepreneur, legal entity or individual entrepreneur must leave field cell 110 in the payment form empty. Based on the regulations of the Central Bank of the Russian Federation - enter “0”. The double explanation does not add to the understanding of how to proceed when paying taxes and filling out a financial order. Read on to find out where to find the required line and how to fill it out.

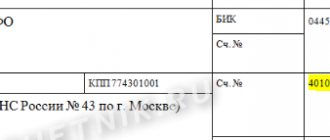

Where to find field 110 on the sample form

Payment of taxes and insurance contributions to the budget system of the Russian Federation through a non-cash transaction obliges tax agents to fill out payment orders. They indicate the required details - type and type of payment. By order of the Bank of Russia, in accordance with the order of the Ministry of Finance of Russia, a separate column is allocated for these purposes.

Attention! Cell 110 is located in field 110 at the bottom of the payment document, where information about the recipient is reflected.

In the example below you can see that field 110 in the payment slip is in the lower right corner.

Filling out field 110 - legal explanation

The generally accepted type of payment order used when transferring tax payments was developed on the basis of the regulation of the Central Bank of the Russian Federation dated June 19, 2012 No. 383-P. The document described in detail the specifics of entering information into its columns, including line 110. The field was filled in only in case of transfer of funds to budgetary areas. The instructions for entering data in the “type of payment” column were as follows:

- “PE” - when transferring late payments and penalties for mandatory payments;

- “PC” - when transferring interest;

- “0” – tax payments coming from the Federal Tax Service.

The instructions for drawing up payment order columns change frequently. Therefore, you need to monitor the release of updated instructions. It often happens that legislation issued by different departments contradicts each other. By Order of the Ministry of Finance of October 30, 2014 No. 126n, the need to fill out line 110 of the payment order was abolished. Based on this document, it should remain empty. It was recommended to move information about the type of payment to field 109.

The response to this was the letter of the Central Bank of the Russian Federation dated December 30, 2014 No. 234-T, which explained that in column 110 the number “0” should be entered. A year later, on November 6, 2015, by decree No. 3844-U of the above-mentioned government agency, this decision was canceled. It feels like everything is back to normal. Disagreements regarding the formation of payment order lines have been eliminated.

In July 2021, a new resolution of the Central Bank of the Russian Federation No. 4449-U was issued, which makes adjustments to the previous provision on making non-cash transfers and the formation of orders. The changes took effect on August 8, 2021. They were justified by the restructuring of the general payment system of the Russian Federation and the country's transition to its own independent settlement system MIR.

Currently, the mandatory fields for filling out the payment order are cells 101 to 109, 110 is empty. State institutions receive information about the purpose of the payment on the basis of the KBK, for which line 104 is reserved. An erroneous code in this section of the payment will not allow the payment to be processed correctly. The funds may simply get stuck in the bank's system. The sample for filling out field 110 in a payment order will not be any different from 2021. The latest innovations regarding filling out line 110 are dated August 2021.

Basis of payment - 2nd feature of the penalty payment

The 2nd difference in the payment for penalties is the basis of the payment (field 106). For current payments we put TP here. Regarding penalties, the following options are possible:

- We calculated the penalties ourselves and pay them voluntarily. In this case, the basis for the payment will most likely have a code ZD, that is, voluntary repayment of debt for expired tax, settlement (reporting) periods in the absence of a requirement from the Federal Tax Service, because we, as a rule, transfer penalties not for the current period, but for past ones.

- Payment of penalties at the request of the Federal Tax Service. In this case, the payment basis will have the form TP.

- Transfer of penalties based on the inspection report. This is the basis of payment to AP.

All three of the above cases are discussed in detail in the Ready-made solution from ConsultantPlus. Samples of filling out payment forms are provided for each of them. You can view them by getting trial access to K+ for free.

Read more about payment details in this article.

When is it necessary to fill out field 110?

Filling out detail 110 in the payment order depends on the type of payments, the transfer of which is formalized by such a financial document. It is necessary to enter information in field 104 together with cell 110 of the payment order when:

- Wages and remuneration are paid to employees of enterprises owned by the state.

- Payments are being made to government employees.

- Beneficiaries receive pensions, benefits or compensation from the Pension Fund.

- Scholarships are provided to young promising specialists.

- Documents are being drawn up to pay the lifelong salaries of judges.

For all other payments, including transfers of legal entities and individual entrepreneurs by bank transfer and payment of mandatory contributions to the budget, the method of entering information in column 110 does not change. The field must remain empty, without dashes or numbers.

Code “1” in field 110 when making non-cash transfers from budgetary structures means that money can only be credited to accounts to which a MIR debit card is attached. If the bank client does not have such a means of payment, his actions should be as follows:

- After the money arrives at the bank, it will be detained in the company’s accounts until the circumstances of the transfer are clarified.

- The next day, the recipient will be sent a notification with a requirement to visit a bank branch within 10 business days to receive the transfer amount in cash using their passport.

- If the client has another account through which it is possible to carry out monetary transactions using the MIR card, information on its details must be provided to the bank employee.

- After the ten-day period, if the recipient specified in the financial order has not visited the bank and provided new account information, the funds will be transferred back to the sender.

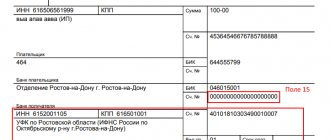

What does the 2021 payment order consist of?

A payment order created to generate and reflect the amount required for the payment of taxes, fees and contributions for the purpose of insuring employees of an enterprise is carried out on form 0401060. Each field has a separate number. It is necessary to fill out the document, guided by the KBK for paying tax deductions and making contributions, which is carried out in 2021.

At the same time, in 2021 the following features should be taken into account:

- It is impossible to apply the BCCs in force in 2021; for example, the BCCs for contributions to the Pension Fund are outdated.

- The data on line 110 in the PDF has also changed.

In 2021, the information to be filled in regarding contributions and tax amounts is the same:

1. Paragraph 1 describes the name of the organization.

2. Next, the numbering of the form is indicated, which corresponds to the All-Russian standard-classifier of management documents, approved back in 1993.

3. In column 3, enter the payment number, which is written not in words, but in numbers.

4. Clause 4 consists of the date the notification was completed. Here you need to follow these rules:

- if the document is submitted on paper, the full date is entered, following the format DD.MM.YYYY;

- The electronic version involves recording the date in the format of the credit institution. The day is indicated by 2 digits, the month by two, and the year by four.

5. In paragraph 5, record one of the values: “urgent”, “by telegraph”, “by mail” or another indicator determined by the bank. You can leave the column empty if the bank allows it.

6. In paragraph 6, write the payment amount. In this case, rubles are written in words, and kopecks are listed in numbers. Rubles and kopecks are not reduced or rounded. If the amount to be paid is a whole amount and does not have small change, then pennies separated by commas may not be recorded. In the “Amount” line, the amount is set, followed by the equal sign “=”.

7. Clause 7 contains the amount to be paid, determined in numbers. Rubles are separated from change using a dash sign “–”. If the number is an integer, then an equal sign “=” is placed after it.

8. Paragraph “8” contains the name of the payer; if it is a legal entity, you need to write the name in full, without abbreviations or abbreviations.

9. In paragraph 9, enter the number of the payer’s account registered with the banking institution.

10. Contents of clause 10: name of the bank and address of its location.

11. Point 11 shows the bank code identifying the institution where the payer of taxes and contributions is served.

12. Paragraph 12 consists of the correspondent account number of the taxpayer’s bank.

13. Clause 13 determines the bank that will receive the transferred funds. Since 2014, the names of Bank of Russia branches have changed, so check this issue on the official website of the financial institution.

14. Point 14 consists of the bank identification code of the institution receiving the money.

15. In column 15 you should write down the number of the corresponding bank account to which contributions are transferred.

16. Line 16 contains the full or abbreviated name of the enterprise receiving the funds. If this is an individual entrepreneur, write down the full last name, first name and patronymic, as well as legal status. If this is not an individual entrepreneur, it is enough to indicate the citizen’s full name.

17. Column 17 records the account number of the financial institution receiving the money.

18. Props 18 always contains the encryption “01”.

19. As for detail 19, nothing is recorded here unless the bank makes a different decision.

20. 20 props also remain empty.

21. Line 21 requires determining the order of the amount to be paid in a figure corresponding to legislative documents.

22. Requisite 22 presupposes a classifier code for the amount to be paid, whether it be contributions or tax deductions. The code can consist of either 20 or 25 digits. The details exist if they are assigned by the recipient of the money and are known to the taxpayer. If an entrepreneur independently calculates how much money he should transfer, there is no need to use a unique identifier. The institution receiving the money determines payments based on the numbering of TIN, KPP, KBK, OKATO. Therefore, we indicate the code “0” in the line. The request of a credit institution is considered illegal if, when recording the TIN, you need to additionally write information about the code.

23. Leave field 23 blank.

24. In field 24, describe the purposes for which the payment is made and its purpose. It is also necessary to indicate the name of goods, works, services, numbering and numbers used in documents according to which payment is assigned. These can be agreements, acts, invoices for goods.

25. Requisite 43 includes affixing the IP seal.

26. Field 44 consists of the signature of an authorized employee of the organization, manager or corresponding authorized representative. To avoid misunderstandings, the authorized representative must be entered on the bank card.

27. Line 45 contains a stamp; if the document is certified by an authorized person, his signature is sufficient.

28. Requisite 60 records the taxpayer’s TIN, if available. Also, those who recorded SNILS in line 108 or the identifier in field 22 can enter information in this line.

29. The recipient’s TIN is determined in detail 61.

30. In line 62, the employee of the banking institution enters the date of submission of the notification to the financial institution related to the payer.

31. Field 71 contains the date when money is debited from the taxpayer’s account.

32. Field 101 records the payer status. If the organization is a legal entity, write down 01. If you are a tax agent, enter 02. Coding 14 applies to payers who settle obligations with individuals. This is just a small list of statuses; a more complete one can be found in Appendix 5 to the order of the Ministry of Finance of Russia, which was issued in November 2013 and registered in the register under number 107n.

33. Field 102 consists of the checkpoint of the payer of contributions and taxes. The combination includes 9 digits, the first of which are zeros.

34. Field 103 – checkpoint of the recipient of funds.

35. Line 104 indicates the BCC indicator, consisting of 20 consecutive digits.

36. Props 105 shows the OKTMO code - 8 or 11 digits, they can be recorded in the tax return.

37. In detail 106, when making customs and tax payments, record the basis of the payment. TP is indicated if the payment concerns the current reporting period (year). ZD means the voluntary contribution of money for obligations occurring in past reporting periods, if there are no requirements from the tax office for payment.

Where can I get a complete list of possible values? In paragraph 7 of Appendix 2 and paragraph 7 of Appendix 3 to the order of the Ministry of Finance of Russia, issued in 2013.

If other deductions are made or it is impossible to record a specific indicator, write “0”.

38. Requisite 107 is filled in in accordance with the purpose of the payment:

- if taxes are paid, the tax period is fixed, for example, MS 02.2014;

- if customs payments are made, the identification code of the customs unit is indicated;

- you need to deposit money in relation to other contributions - write “0”.

39. Payment of tax contributions involves entering a paper number, which serves as the basis for the payment.

40. What data is recorded in field 109?

- if tax revenues and deductions to the customs authorities are to be paid, determine the date of the paper that is the basis for the payment, pay attention to the presence of 10 digits in the encoding (the full list of indicators can be found in paragraph 10 of Appendix 2 and paragraph 10 of Appendix 3 to the order of the Ministry of Finance of Russia, registered in November 2013);

- if other money is transferred to state budget funds, write “0”.

- In field 110 there is no longer a need to fill in the type of deductions.

What payments do banks accept?

Not only are tax agents confused with the method of filling out field 110, but bank employees also do not have clear instructions on which payments to accept. Some employees make payments using documents with “0” in field 110. Others, citing the law, require that the field be left blank or have a space in it. But for some there is no difference.

In order for the execution of a financial order to be carried out in accordance with all the rules, and for the money to reach the recipient on time, you should adapt to the requirements for payment documents and field 110 established by the bank servicing the enterprise.

How to indicate the number and date of the document - grounds for paying penalties

If you pay the fine yourself, enter 0 in fields 108 “Document number” and 109 “Document date”.

In all other cases, in field 108, provide the document number - the basis for the payment (for example, a claim), and do not put the “No” sign.

In field 109, indicate:

- date of requirement of the Federal Tax Service - for the basis of payment TR;

- the date of the decision to bring (refusal to bring) to tax liability - for the basis of an administrative agreement.

A sample payment order for the payment of penalties in 2020-2021 can be viewed and downloaded on our website: