Citizens of the country, according to the law, are required to pay taxes on all types of income received, including

Application for state registration of an individual as an individual entrepreneur. Create an application using the form

Income of an individual in the form of material benefits is taken into account when determining the tax base for personal income tax

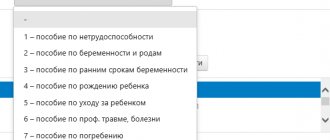

Policyholders regularly submit reports to the Social Insurance Fund. If the company employs 25 or more people,

VAT restoration is an operation that reflects the restoration of the accrued tax amount that was previously declared

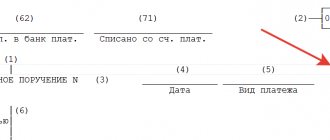

The status in the payment order in 2021 is information about the payer to the budget

All entrepreneurs and organizations paying income to individuals are recognized as tax agents. Upon completion of the calendar

An expense transaction in cash for an enterprise is the issuance of wages from the cash register, posting in this

What is the code for the type of currency transaction KVVO - this is a value of five numbers,

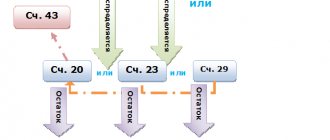

The balance sheet is a reporting form in which all information about