Choosing the correct accounting method The updated edition of PBU 1/2008 more specifically establishes the rules for

All individuals and legal entities (institutions, enterprises, organizations) are required to pay for damage caused to the environment

1-TORG - report for trade organizations Form 1-TORG The Federal State Statistics Service expects from

“1C: Salary and Personnel Management” (hereinafter we will use the short name 1C 8.3 ZUP) allows you to prepare

A sick leave certificate is a document that confirms that a citizen is temporarily disabled. Issued

Insurance premiums for individual entrepreneurs without employees: new calculation for 2021 This year, legislators have

The year the tax deduction began to be used is those 365 days for which an individual

How to take into account books and magazines: Many companies subscribe to various newspapers and magazines and buy books

An invoice is a necessary document not only in accounting, but also in general

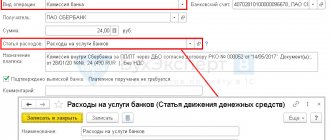

Bank commission - postings in 1C 8.3 In accounting, the bank commission is reflected in the account