Changes for 2021 IMPORTANT! In 2021, taxpayers will no longer have to submit advance reports.

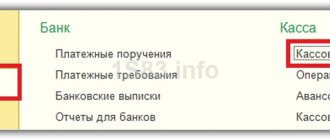

An individual entrepreneur in need of funds for personal needs can take money from the cash register or

Bonus is the second most popular type of accrual after salary in our country and one

In "1C: Accounting 8" (rev. 3.0), starting from version 3.0.41, accounting for transactions with loans is supported

Sending an enterprise employee on a business trip begins with an order from the director. The employee is informed about this

When pension grounds arise, a person independently arranges pension payments. Information about insurance experience

According to the requirements of Art. Law No. 402-FZ of December 6, 2011 “On Accounting” all assets and liabilities of companies

What is advertising? Advertising is information that is addressed to an indefinite circle of people and is directed

In Russia, the transport tax may be abolished or reduced for owners of environmentally friendly transport, in particular,

Where to pay insurance premiums in 2017 The most important thing is that next year the order