Modernization of a fixed asset 1C BGU 8.2 Modernization is a change in the value of a fixed asset through reconstruction or major repairs. In this example, we will consider the modernization of a fixed asset in 1C BGU 8.2. Our example will be to install an air conditioner in a minibus. First of all, let's reflect on the purchase of an air conditioner.

Let’s add a new element “Air conditioner for vehicles” to the “Nomenclature” directory.

We will select the item type as “Equipment”, the unit of measurement is pieces, the accounting account is 105.36.

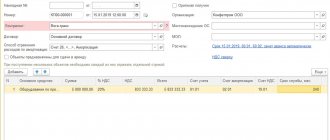

Save using the “OK” button. Next, we will reflect the purchase of the air conditioner with the document “Purchase of Materials”.

In this example, we will not dwell in detail on filling out purchase documents, reflecting services, and writing off.

Let’s fill in all the top details, the “General” and “Materials” tabs.

Let’s run the document by clicking the “OK” button.

OS accounting in 1C 8.3 - step-by-step instructions

10.30.2018 Fixed assets are those assets that are used as means of labor for more than 12 months and cost more than 100,000 rubles.

Next, we will reflect the installation of the air conditioner in the document “Third Party Services”. Let's fill in the top details and the tabular part of the document.

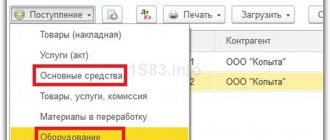

Accounting for fixed assets in 1C 8.3 is 100% automated. First, in 1C Accounting for the operating system, it is drawn up. Next, they are accepted for accounting and assigned an inventory number. The developers of 1C:Accounting 3.0 have reduced this operation to the execution of one document - “Receipts (acts, invoices)” with the type of operation “Fixed Assets”.

In this case, there is no need to create . All transactions, both on receipt and on acceptance for accounting, are created by one document - receipt. Let's look at step-by-step instructions for accounting for OS in 1C 8.3.

In the “Fixed assets and intangible assets” menu, select “Receipt of fixed assets” and create a new document. In the header you must indicate the organization, counterparty and agreement. Set up the way to reflect depreciation and VAT expenses.

What documents are drawn up when transferring for repairs in 1c

The act must indicate the date and number of the concluded contract, as well as the start and completion dates of work under the contract.

If repairs are carried out by a structural unit of the organization, then a work order is issued, which must have a number and date, and also set a deadline for the repair work.

The number and date of the contract (order), the repair period indicating its beginning and end under the contract (order) are entered in the specially designated columns and lines of form N OS-3.

Upon completion of the repair, the act indicates the actual period of work under the contract (order), which may not coincide with the previously planned period. Each primary accounting document must have a number and date. As a rule, each type of document is numbered in chronological order from the beginning of the year.

In turn, the seller in this case has the right to address these demands to the manufacturer. And the manufacturer can either compensate all the seller’s expenses for warranty repairs (including the cost of spare parts purchased by him), or carry out the repairs himself or provide the seller with spare parts free of charge for further transfer to the consumer.

This follows from Article 469, paragraph 2 of Article 470, Article 475, paragraph 3 of Article 477 of the Civil Code of the Russian Federation and Article 6 of Law No. 2300-1 of February 7, 1992. In the situation under consideration, the organization receives spare parts for warranty repairs of sold products free of charge for free transfer to the consumer.

Spare parts received for warranty repairs are the property of the manufacturer (Article 713 of the Civil Code of the Russian Federation).

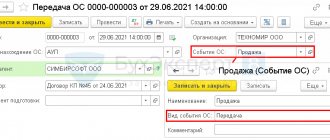

Transfer of OS to 1C 8.3 accounting department - registration of sale of OS

At the time of transfer of materials, the following entry is made: Debit 010536340 Credit 010536340 – materials transferred for processing. In the 1C:Enterprise 8.2 system. Accounting of a government agency" the document "Internal movement of materials" is intended for this operation.

The document has a tab “Transfer of raw materials supplied by customer”, which indicates the counterparty to whom the raw materials/materials and the contract are transferred. Based on this operation, an M-15 invoice is printed. The use of internal movement is justified in 1C by Chapter 37 of the Civil Code of the Russian Federation (see.

below Recommendation No. 1) The cost of materials used by the contractor during repairs is written off upon receipt of a report on the consumption of materials: Debit 010900271 Credit 010536440 - materials written off for repairs. In the 1C:Enterprise 8.2 system.

Accounting of a government institution" the document "Write-off of materials" is intended for this operation.

How to reflect warranty repairs (warranty service) in accounting

Important

Transfer of equipment for installation The certificate of acceptance and transfer of equipment for installation, form OS-15, is a primary document, the execution of which confirms the fact that the received equipment and equipment has been transferred for installation in order to bring the facility into working condition.

A report is drawn up only in cases where installation is carried out by a third-party company that is not related to this delivery. If the object will be installed by the equipment supplier, then upon completion of the delivery and installation work, an act f.

Requirements for the form The act is drawn up in 2 copies: one remains with the party transferring the equipment, the second – with the receiving party.

Refinement of goods before sale in “1c: accounting 8” (rev. 3.0)

Therefore, in accounting, reflect them on off-balance sheet account 003 “Materials accepted for processing”: Debit 003 – spare parts provided by the manufacturer for further transfer to the consumer were accepted for accounting.

Please accept spare parts for accounting at the price indicated in the accompanying documents (invoice, delivery note) received from the manufacturer.

The basis for accepting spare parts for accounting are primary accounting documents confirming the receipt of spare parts (act of acceptance and transfer of spare parts, agreement with the manufacturer, receipt order) (Part 1 of Article 9 of the Law of December 6, 2011 No. 402-FZ).

When transferring spare parts to the consumer, make the following entry: Credit 003 – the cost of the spare parts transferred to the buyer for replacement has been written off. Write off spare parts based on the spare parts acceptance certificate and the spare parts consumption report. This procedure follows from the Instructions for the chart of accounts, as well as the provisions of Article 713 of the Civil Code of the Russian Federation.

Certificate of acceptance and transfer of equipment: correct execution of the document

You should also indicate the organization code according to OKPO, which was assigned to the organization upon registration by the territorial body of state statistics.

The following lines of the form include the name of the organization performing the work, indicating the code according to OKPO, if repair, reconstruction, and modernization work is carried out with the involvement of third-party organizations. If the repair is carried out by a structural unit of the organization itself, then the name of this unit is indicated.

As a rule, to carry out repairs by a third-party organization, an agreement is concluded with it, one of the essential conditions of which is the period for carrying out the repairs.

Attention

N 129-FZ “On Accounting”, the primary accounting document must be drawn up at the time of the transaction, and if this is not possible, then immediately after its completion.

Thus, an act in Form N OS-3 must be drawn up immediately at the time of acceptance and delivery of completed work. The persons who compiled and signed the document must ensure its timely and high-quality execution, as well as the reliability of the data contained in it.

The act is approved by the head of the organization or a person authorized to do so, indicating the date of approval of the document. On the front side of form N OS-3 there are two sections. Section 1 “Information on the condition of fixed assets at the time of transfer for repair, reconstruction, modernization.”

The table contains the name of the fixed asset item, its inventory number, passport number, as well as the serial number, if any.

The main thing is that your own form contains all the mandatory details listed in Part 2 of Article 9 of the Law of December 6, 2011 No. 402-FZ.

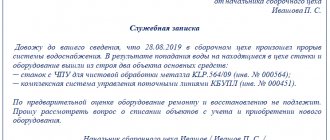

The report must indicate the faults of the fixed asset and proposals for their elimination.

The number of copies of the report on identified faults (defects) of the fixed asset (defect sheet) will depend on who owns the property and who will do the repairs.

If an organization decides to repair fixed assets on its own, one copy is sufficient. If the work will be performed by a third-party organization, it is better to fill out the report (defect sheet) in several copies according to the number of companies involved in the repair. In this case, the documents must be signed by representatives of all parties involved.

Source: https://advokat-na-donu.ru/kakie-dokumenty-oformlyayutsya-pri-peredachi-na-remont-v-1s/

Accounting for fixed assets in 1C:Accounting 8: answers to frequently asked questions

Accounting, taxation, reporting, IFRS, analysis of accounting information, 1C: Accounting

11/28/2017 subscribe to our channel

1C experts answer frequently asked questions about OS accounting in the 1C: Accounting 8 program (ed.

If you are going to rent out the property in the future, check the appropriate box. In the tabular part of the document, list the required fixed assets.

3.0). Restoration of a fixed asset object can be carried out through repair, modernization and reconstruction (clause.

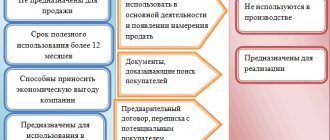

23 PBU 6/01). For profit tax purposes, fixed assets located by management decision

Modernization of a fixed asset in 1C 8.3 using an example

» » The modernization of fixed assets in 1C 8.3 means a change in their original properties.

26 PBU 6/01 “Accounting for fixed assets”, approved. by order of the Ministry of Finance of Russia dated March 30, 2001 No. 26n, hereinafter referred to as PBU 6/01). During the period of restoration of an asset, the duration of which exceeds 12 months, the accrual of depreciation charges is suspended (clause

As a rule, it makes sense to modernize for the better. For example, add additional functionality or processing accuracy. Accordingly, for this it is necessary to purchase the necessary additional equipment and carry out installation work. The work can be done in-house, or done by third parties.

In this article, we will consider the option when the work is performed by another organization, as this will cover the topic more fully. For example, let’s modernize a woodworking machine from the 1C Accounting 8.3 demo database.

Namely, we will replace its engine. First you need to complete the purchase of this engine. The receipt is processed as usual, only the type of operation needs to be selected “Construction object”: Fill in the necessary details: Organization; Counterparty; Agreement; In the tabular part of 1C we select the construction object.

How to reflect the modernization of a fully depreciated operating system in accounting and tax accounting?

Property with an expired useful life (SPI) and zero residual value may well be used in income-generating activities. The organization may modernize or reconstruct such property to restore its useful properties.

The costs of modernizing a fixed asset increase its initial cost both in accounting (clause 27 of PBU 6/01) and for profit tax purposes (clause 2 of Article 257 of the Tax Code of the Russian Federation), and then are written off through depreciation. However, the procedure for depreciation of modernized fixed assets in accounting and tax accounting differs.

In accounting, the annual amount of depreciation for a modernized fixed asset is determined based on its residual value and remaining useful life, which can be revised upward by the organization (clause 60 of the Guidelines for fixed assets accounting).

As a result of modernization of a fully depreciated asset, its residual value will correspond to the costs of modernization. But the useful life of such an object has already expired. Therefore, in order to pay off the costs of modernization, the organization is forced to increase the SPI, otherwise depreciation is impossible.

In tax accounting, part of the costs for modernizing the OS can be taken into account as expenses at a time, in the month of completion of the modernization work, by applying a depreciation premium (clause 9 of Article 258 of the Tax Code of the Russian Federation). After modernization, the useful life may increase or remain unchanged (Clause 1, Article 258 of the Tax Code of the Russian Federation).

As for calculating the amount of monthly depreciation of a modernized fixed asset when applying the linear method, this issue is not regulated by law.

According to the position of the Ministry of Finance of Russia (see, for example, letter dated November 16, 2016 No. 03-03-06/1/67358), starting from the month following the month of putting the modernized fixed asset into operation, depreciation on it is calculated based on the following indicators :

- the initial cost of the OS, increased by the amount of modernization;

- the depreciation rate that was initially applied to the asset when it was put into operation. If, after upgrading the asset's operating system, the useful life of the asset has increased, then the organization has the right to charge depreciation at the new rate, calculated on the basis of the new SPI. But the period can be increased only within the limits established for the depreciation group of a given asset.

A similar approach is applied if the organization has modernized an operating system that is fully depreciated and whose residual value is zero (letter of the Ministry of Finance of Russia dated October 25, 2016 No. 03-03-06/1/62131).

There is another point of view (see, for example, the resolution of the Arbitration Court of the East Siberian District dated June 4, 2015 No. F02-1262/2015, F02-1612/2015 in case No. A19-9978/2014), according to which the amount of depreciation charges is fully depreciated OS should be calculated based on:

- amounts of modernization (reconstruction);

- new depreciation rate, which must be determined based on the revised useful life, since the useful life before the modernization has expired.

In “1C: Accounting 8” edition 3.0, the position of a “cautious” taxpayer is supported, therefore the modernization of a fixed asset in tax accounting is calculated in accordance with the recommendations of the Ministry of Finance.

Example 1

| The organization Comfort-Service LLC applies the general taxation system (OSNO) and accounting provisions “Accounting for calculations of corporate income tax” PBU 18/02 (approved by order of the Ministry of Finance of Russia dated November 19, 2002 No. 114n). In April 2021, Comfort-Service LLC decides to modernize a woodworking machine assigned to the second depreciation group, which is fully depreciated in accounting and tax accounting. The initial cost of the machine is RUB 180,000.00. When accounting for fixed assets, the useful life was set at 36 months. The amount of modernization costs excluding VAT amounted to RUB 90,000.00. Bonus depreciation does not apply. According to the accounting policy, Comfort-Service LLC uses the linear method of calculating depreciation in accounting and tax accounting. |

Let's register the fact of OS modernization with a document of the same name. On the Construction object tab, you need to indicate the amount of modernization costs accumulated for this object (90,000.00 rubles). They can be filled in automatically using the Calculate amounts button.

On the Fixed Assets tab, you need to fill in the list of OS objects to be upgraded (Add button). According to the conditions of Example 1, this is one object (woodworking machine).

In the Expiration date field The useful life established when the asset was accepted for accounting for accounting and tax purposes is automatically entered. Since the object is fully depreciated, for accounting purposes it is necessary to indicate a new SPI, for example, 51 months. For tax accounting purposes, the maximum period for this depreciation group is indicated, so it cannot be changed. When you click the Distribute button, the amounts of modernization costs are distributed in equal shares across all fixed assets indicated in the table.

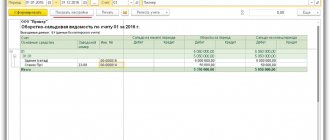

After posting the OS Modernization document, the following accounting entry is generated:

Debit 01.01 Credit 08.03 - to increase the initial cost of the fixed asset (90,000.00 rubles).

For tax accounting purposes, the specified amount is also recorded in special resources of the accounting register:

Amount of NU Dt 01.01 and Amount of NU Kt 08.03

In addition to accounting and tax accounting movements, entries are also generated in periodic information registers that reflect information about the fixed asset.

For upgraded fixed assets for which the useful life has expired, the depreciation parameters must be clarified using the document Changing the fixed assets depreciation parameters (section fixed assets and intangible assets - fixed assets depreciation parameters). If this is not done, then next month when performing the routine operation Depreciation and depreciation of fixed assets, the program will interrupt processing and display an error message.

When entering the document Changing fixed asset depreciation parameters, the following details should be indicated in the header (see Fig. 3):

- the name of the event in the “life” of the fixed asset, which is reflected in this document;

- set the Reflect in accounting and Reflect in tax accounting flags.

Rice. 3. Changing depreciation parameters

The table field indicates:

- a fixed asset whose depreciation parameters are changed;

- in the Expiration date field. (BU) - new SPI of the fixed asset in accounting in months (51 months);

- in the Depreciation period field. (BU) - useful life for calculating depreciation in accounting, that is, the difference between the new and previous useful life in months (15 months);

- in the Cost field to calculate depreciation. (BU) - the cost of modernizing a fixed asset for calculating depreciation in accounting (RUB 90,000.00);

- in the Expiration date field. (NU) - new useful life in months for calculating depreciation in tax accounting. If the useful life does not change, the previous useful life (36 months) is indicated in this column.

Next month, when performing the routine operation Depreciation and depreciation of fixed assets, the program will calculate depreciation according to the specified parameters and in accordance with the recommendations of the Ministry of Finance.

The amount of depreciation of the modernized machine will be:

- in accounting - 6,000.00 rubles. (RUB 90,000.00 / 15 months);

- in tax accounting - RUB 7,500.00. ((RUB 180,000.00 + RUB 90,000.00) / 36 months).

How to assemble a basic tool from components in 1C 8.3

» » In the 1C 8.3 Accounting program, a situation often arises when a fixed asset must be assembled from several components. For example, when buying a monitor, system unit, mouse and keyboard, we must reflect this purchase in accounting as a single OS called “Computer”. Let's look at how to perform a similar operation in the 1C: Accounting 8.3 program (release 3.0).

Contents In the program, such an operation is reflected as with the “Equipment” operation type. Let's fill out the document according to our requirements: Please note that the component accounting account is 07 (equipment for installation), and the VAT account is 19.01 (VAT on operating systems).

To set up accounting accounts, use the mechanism. The 1C program will generate the following transactions: The components of the future fixed asset have arrived at the warehouse.

For an example of preparing a receipt document in 1C 8.3 using the example of a product, see our video: The next stage is installation or assembly of equipment.

Assistant accountant at 1C

Today we will look at the assembly and commissioning of a fixed asset that requires installation and consists of several components (equipment).

Situation. The director finally decided to install a video surveillance system.

You, as the chief accountant, must carry out all this in the 1C: Accounting 8.3 (revision 3.0) program.

The surveillance system is quite complex and consists of 10 video cameras and a server for storing and processing information. In addition, you need to use the services of a contractor who will install and configure all this.

After installation, all purchased equipment (video cameras and server) must be taken into account as a fixed asset “Video surveillance system”.

The general scheme of accounting entries will be as follows:

| Dt 07 Kt 60 equipment received Dt 08 Kt 07 equipment transferred for installation Dt 08 Kt 60 installation services were provided to us Dt 01 Kt 08 OS put into operation |

Let me remind you that this is a lesson and you can safely repeat my steps in your database (preferably in a copy or a training one).

So, let's go!

We create equipment

Go to the “Directory” section, “Nomenclature” item:

Go to the “Equipment to be installed” group and create a video camera and recording server:

Here is the video camera card:

And here is the video recording server card:

We buy equipment

We receive the cameras (10 pieces) and the server (1 piece) from the supplier. To do this, go to the “Purchases” section, “Receipts (acts, invoices)”:

Create a new equipment receipt document:

On the “Equipment” tab, indicate the video camera and server created in the previous step in quantity and price as in the figure below, and indicate account 07 as the accounting account:

We carry out the document:

We collected the following equipment for installation on account 07: 10 video cameras and 1 recording server.

We hand over the equipment for installation

We will hand over this equipment for installation.

We go to the section “OS and intangible materials”, item “Transfer of equipment for installation”:

Let's create a new document. We indicate the new element “Video surveillance system” as the construction object.

Cost account for installation 08.3:

In the tabular section we indicate the equipment assembled on account 07 for installation:

We check the document and see that the equipment has been transferred for installation:

We offer installation services

Let us reflect on the installation services provided to us by the contractor. They also need to be reflected in the 08th account.

To do this, go to the “Purchases” section, “Receipts (acts, invoices)”:

We create a new receipt “Services (act)”:

We select the contractor who did the installation and add a new element to the tabular part:

We add the service “Installation of a video surveillance system” to the reference book (group “Services”):

Here's her card:

And we substitute it into the tabular part:

By default, the cost account was set to 26, but we need 08.3. Let's open the accounting account settings:

And let’s change the invoices as in the figure below (we attributed the installation service to the construction of a video surveillance system, invoice 08.3):

It turned out like this:

Let's check the document:

Excellent costs allocated correctly.

We accept OS for accounting

All that remains is to accept the OS object for accounting. To do this, go to the section “Fixed assets and intangible assets”, item “Acceptance for accounting of fixed assets”:

Let's create a new document. As the type of operation on the first tab, select “Construction objects”:

The receipt method is “Construction (creation)”, the construction object is our system, the construction account is 08.3.

Finally, click the “Calculate amounts” button:

1C automatically analyzed the balances of account 08.3, subaccount “Video surveillance system” and calculated the cost of the fixed asset of 70,000 rubles:

Go to the “Fixed Assets” tab and add a new element:

In the fixed assets directory, create a new one and fill it out as shown below:

There is no point in filling out the remaining bookmarks, since the document “Acceptance for accounting of fixed assets” will do this for us.

We substitute the created fixed asset into the tabular part of the document for accepting fixed assets for accounting:

Our asset will be depreciated in both accounting and tax accounting on a straight-line basis. The period of use in both types of accounting is 5 years.

In accordance with this, we fill out the bookmarks...

… Accounting:

... and tax accounting:

We carry out the document:

And we see that according to the debit of account 01.01 we have a fixed asset. From this moment on, the OS is considered to be put into operation.

We can safely print the acceptance certificate (OS-1):

We're great, that's all

By the way, subscribe to new lessons...

Sincerely, Vladimir Milkin (teacher at the 1C school of programmers and updater developer). How to help the site: tell (share buttons below) about it to your friends and colleagues. Do this once and you will make a significant contribution to the development of the site. There are no advertisements on the site

, but the more people use it, the more energy I have to support it.

Click one of the buttons to share:

Source: https://helpme1c.ru/uchimsya-delat-montazh-os-iz-komplektuyushhix-1sbuxgalteriya-8-3-redakciya-3-0

How to reflect OS repairs on your own in 1C 8 3

/ / 04/20/2018 1,268 Views If modernization of fixed assets is carried out infrequently, you can do it easier.

In the tabular part of the newly created construction object receipt document, click the “Add” button.

A new document line will be added. In the “Construction object” column, select “Show all”: The “Construction objects” directory will open, enter a new object there and select it in the document.

- Now let’s add an engine installation service to the “Services” tab. There are no tricks here, the service is selected from the “Nomenclature” directory, the quantity and cost are indicated. The only issue is the cost account. By default it is 26. I want the service to be included in the cost of the upgrade. So I manually changed the cost account to 03/08.

We carry out the document.

The following transactions should be generated: The cost of the engine and services for its installation is collected on account 08.03. The modernization of fixed assets in 1C 8.3 means a change in their original properties.

Modernization of fixed assets in "1C: Accounting 8"

Accounting, taxation, reporting, IFRS, analysis of accounting information, 1C: Accounting

06/11/2008 subscribe to our channel This article describes the method of reflecting an increase in the initial cost of fixed assets in 1C: Accounting 8.

All operations related to modernization are considered, as well as its consequences (in particular, changes in the useful life of fixed assets, the procedure for calculating depreciation in tax and accounting). The second part of the article is devoted to reflecting the costs of modernization, completion and additional equipment of fixed assets when applying a simplified taxation system with the object of taxation “income reduced by the amount of expenses.”

When reflecting transactions related to an increase in the initial cost of fixed assets and a change in their useful life in accounting, one should be guided by PBU 6/01 (approved.

by order of the Ministry of Finance of Russia dated March 30, 2001 No. 26n)

How to reflect business operations for major repairs that are carried out by contract?

Repair is the elimination of an OS malfunction to maintain it in working condition (see paragraph 16 of the letter of the State Statistics Committee of Russia dated 04/09/2001 No. MS-1-23/1480). Major repairs differ from current repairs in the cost and duration of the activities. During a major overhaul, faulty, damaged or worn structures and parts of the facility are replaced, including replacing them with more durable and economical ones (regulations on carrying out scheduled preventive maintenance of industrial buildings and structures MD 13-14.2000, approved by the resolution of the USSR State Construction Committee dated December 29. 1973 No. 279, clause 14.2 of article 1 of the Town Planning Code of the Russian Federation).

Costs for repairs of fixed assets are recognized as expenses for ordinary activities of the reporting period (clause 27 PBU 6/01, clause 7 PBU 10/99 “Organization expenses”, approved by order of the Ministry of Finance of Russia dated 05/06/1999 No. 33n, hereinafter referred to as PBU 10 /99) and are reflected by posting (clause 67 of the Guidelines for fixed assets accounting, approved by order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n, hereinafter referred to as the Guidelines for fixed assets accounting; Chart of accounts for the accounting of financial and economic activities of organizations, approved by order of the Ministry of Finance Russia dated October 31, 2000 No. 94n, hereinafter referred to as the Chart of Accounts):

Debit 20 (44, 26) Credit 60 (10, 70, 69, 23)

- the amount of expenses incurred.

Expenses for the repair of fixed assets are considered as other expenses and are recognized for tax purposes in the reporting (tax) period in which they were incurred in the amount of actual costs (clause 1 of Article 260 of the Tax Code of the Russian Federation). In “1C: Accounting 8” edition 3.0, expenses for OS repairs carried out by contract are reflected in the standard accounting system document Receipt (act, invoice) with the transaction type Services (Fig. 2).

Rice. 2. Reflection of OS repair work performed by the contractor

To avoid disputes with regulatory authorities, the taxpayer must clearly understand the difference between the concepts of “repair” and “modernization (reconstruction)”.

If during the process of major repairs there is an improvement (increase) in the initially accepted standard indicators of the functioning of fixed assets, for example, useful life, power, quality of use (see paragraph 27 of PBU 6/01), then such repairs will most likely be reclassified as modernization or reconstruction.

The definition of completion, additional equipment, modernization, reconstruction and technical re-equipment is given in Article 257 of the Tax Code of the Russian Federation. The concept of modernization and reconstruction of a capital construction facility can also be found in Article 1 of the Civil Code of the Russian Federation.

Updates to the 1C: Accounting 8 program, edition 3.0, not only support legislative changes, but also expand service capabilities and increase the level of automation. Read about changes in working with directories and reports in the article “Changes in directories and standard reports in 1C: Accounting 8”.

Costs for modernization and reconstruction (as well as for completion, additional equipment and technical re-equipment) of fixed assets increase the initial cost of the object (clause 27 of PBU 6/01, clause 2 of Article 257 of the Tax Code of the Russian Federation), and then are written off through depreciation.

These costs are accounted for in accounting as follows:

Debit 08.3 Credit 60 (10, 70, 69, 23) Debit 01.01 Credit 08.03

- for the amount of expenses incurred (clause 70 of the Guidelines for fixed assets accounting, Chart of Accounts).

To reflect the costs of modernization and reconstruction carried out by contract, “1C: Accounting 8” edition 3.0 also uses the document Receipt (act, invoice) with the transaction type Services. But, unlike repair expenses, in the Accounts field you need to indicate not a cost account (26, 20 or 44), but account 08.03 “Construction of fixed assets” and the corresponding analytics (Construction object; Cost item; Method of construction). An increase in the initial cost of an object by the cost of the modernization performed is registered in the program using the document Modernization of OS (section OS and intangible assets).

Reconstruction or repair: we take into account the costs of updating fixed assets

Author of the article Olga Lazareva 2 minutes to read 428 views Contents Reconstruction or repair? This question is asked sooner or later by every accountant who is faced with a situation, since incorrect classification of these business transactions can lead to a significant distortion of reporting indicators, which entails incorrect calculation of income tax. Therefore, it is so important to distinguish between the concepts of “repair of fixed assets” and “reconstruction of fixed assets” of an organization, because repair costs are recognized in the current tax period in full of actual expenses, and costs for the reconstruction and modernization of fixed assets increase the cost of the object and are included in expenses through depreciation OS. In the article we will understand how accounting for the repair of fixed assets and their reconstruction occurs, and also provide the entries that need to be reflected when carrying out these operations. (Understand how to keep accounting records in 72 hours)

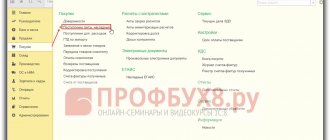

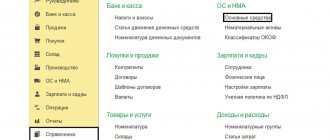

Other reference books and documents from the section “Fixed Assets”

They may be hidden by default. If the directory is not displayed in the navigation panel, use the “Navigation settings” command in the right corner. In the left window we present available reference books. On the right are directories that are displayed in the navigation panel. Let's find the "OS and Intangible Materials" group and move all the directories to the right window. Now in the navigation panel in the “OS and intangible assets” group I have significantly more reference books presented. Let's get to know them.

Construction objects - the directory is intended to store a list of fixed assets under construction (modernized, reconstructed, installed).

Information register “OKOF depreciation groups” - the register sets the applied depreciation groups for the OKOF classifier element.

The directory “Annual fixed asset depreciation schedules” is intended for storing depreciation schedules for fixed assets in organizations with a seasonal nature of production.

The use of a depreciation schedule is indicated when accounting for a fixed asset.

The use of a depreciation schedule after accepting a fixed asset for accounting or a change in the depreciation schedule is registered in the document Change of fixed asset depreciation schedules.

When entering a schedule, you need to specify the distribution coefficients of the annual depreciation amount by month. The distribution coefficient will be taken into account when performing a routine depreciation operation.

The ENAOF directory contains a classifier of fixed assets for which standard codes and annual depreciation rates are established.

This directory classifies fixed assets for which depreciation is calculated according to ENAOF.

For motor vehicles, depreciation rates are used as a percentage of the cost of the car per 1000 km.

Code for ENAOF is indicated for fixed assets in the Code for ENAOF .

The OKOF directory contains an all-Russian classifier of fixed assets.

The directory is used to classify fixed assets when accepted for accounting to determine the depreciation group.

The OKOF code is indicated for the fixed asset in the OKOF .

The directory “Parameters for the production of fixed assets” is intended for storing a list of natural indicators, in proportion to the volume of which depreciation of fixed assets can be calculated.

The directory “Reasons for writing off fixed assets” is intended to store a list of reasons for writing off fixed assets.

Directory “Events with fixed assets” - is intended for storing a list of events with fixed assets of the organization, for example, acceptance for accounting, relocation, modernization, etc.

For each event, you must select Event Type .

When registering fixed asset accounting documents, a value from the reference book is selected in the Event .

The document “Receipt (act, invoice)” is intended to reflect various operations for the receipt of goods and services.

Document “Receipt of additional expenses" - is intended to reflect the services of third-party organizations, the costs of which are included in the cost of goods.

The document “Transfer of equipment for installation” is intended to include the cost of equipment and components requiring installation in the costs that form the initial cost of fixed assets.

The document “Receipt (act, invoice)” is intended to reflect various operations for the receipt of goods and services.

The document “Acceptance for accounting of fixed assets” is intended to reflect the acceptance for accounting of fixed assets.

The document “Movement of fixed assets” is intended to reflect the movement of fixed assets to another division and (or) to another financially responsible person.

The document “OS Modernization” is intended to reflect the modernization (reconstruction) of fixed assets.

The document “Inventory of fixed assets” is intended to reflect the results of the inventory of fixed assets.

The document “Write-off of fixed assets” is intended to reflect the write-off of fixed assets.

The document “Preparation for the transfer of fixed assets” is intended to reflect preparation for the transfer of ownership of fixed assets if the sale transaction is subject to state registration.

The document “Transfer of fixed assets” is intended to reflect the sale of fixed assets.

The document “Production of fixed assets” is intended to register the volume of produced products (work performed) for calculating depreciation of fixed assets.

The document “Changing depreciation schedules of fixed assets” is intended for changing depreciation schedules of fixed assets in organizations with a seasonal nature of production.

The document “Changing the special coefficient for calculating depreciation of fixed assets (tax accounting)” is intended for changing the special coefficient for calculating depreciation of fixed assets in tax accounting.

The document “Changing the methods of reflecting expenses for depreciation of fixed assets” is intended to change the method of reflecting expenses for depreciation of fixed assets - cost accounts and analytics, which include expenses for depreciation of fixed assets.

The document “Changing the parameters for calculating depreciation of fixed assets” is intended for changing the parameters for depreciation of fixed assets.

The document “Change in the state of fixed assets” is intended to suspend or resume the calculation of depreciation on fixed assets.

The document “Registration of payment for fixed assets and intangible assets for the simplified tax system” is intended for registration in the tax accounting of the simplified tax system of information on payment to the supplier of fixed assets, intangible assets and modernization costs.

The document “Registration of payment for fixed assets and intangible assets (IP)” is intended for registration in the accounting of individual entrepreneurs of information on payment to the supplier of fixed assets and intangible assets.

The report “Fixed assets depreciation sheet” is intended for analyzing data on fixed assets. In the report, you can analyze accounting and tax accounting data, set a selection by materially responsible person, display the date of acceptance for accounting, etc.

The report “Inventory book of fixed assets” - an inventory book of accounting for fixed assets in the OS-6b form (approved by Decree of the State Statistics Committee of Russia dated January 21, 2003 No. 7) is used by small enterprises to record the availability of fixed assets, as well as their movement within the organization. The inventory book is kept in the accounting department of the organization in one copy.

OS repair costs

Since fixed assets serve the enterprise for a long period of time, during their operation they can break down, and in connection with this, the organization incurs costs for repairing the operating system.

Repairs can be current, medium or major. Repairs can also be carried out in-house or by a third party. Let's look at how the costs of OS repairs are reflected if the repairs are carried out by a third party and are ongoing.

Expenses for current repairs of fixed assets will be charged to the same cost accounts as depreciation on these fixed assets.

These could be accounts: 20, 23, 25, 26, 44. For example, if a fixed asset that is in the administration is broken, the cost of repairs for it will be charged to account 26 “General business expenses”. If the operating system of a trading enterprise breaks down, all costs will be written off to account 44 “Sales expenses”.

The loan will indicate account 60 “Settlements with suppliers and customers”

Classification of repairs of fixed assets

Depending on what is taken as the basis for dividing into groups (scope of work, their cost, duration, degree of interference in the functioning of the fixed asset and the order of organization), repairs can be divided into several categories.

- If planning is possible:

- scheduled preventive maintenance – carried out regularly, without waiting for problems in the functioning of the fixed asset, in order to prevent a decrease in efficiency;

- emergency repair - emergency elimination of problems or disruptions in the operation of an object to restore its functionality;

- restorative repair is a type of emergency repair, when work is forced to be carried out after the impact on fixed assets of any emergency situations beyond human control, for example, natural disasters.

- According to the volume and characteristics of the work performed:

- current repair – the smallest in scale and cost of repair actions performed, designed to ensure effective operation until the next repair, without affecting the main functional characteristics of the facility (can be carried out several times during the year);

- medium repair is a more labor-intensive process, involving large costs, requiring partial intervention in the operation of the fixed asset being repaired; most often associated with the replacement of parts and important components (not performed more than once a year);

- major repairs are the most expensive and time-consuming of all types of restoration repair work; they completely cover the facility, providing for high-level interventions, as a result of which it falls out of service during the repair (carried out occasionally).

- economic method of repair - maintenance and/or restoration of an object is carried out by attracting internal resources of the organization itself;

- contract repair method - hiring external contractors to carry out the work.

Current and major repairs: how to distinguish

The division of repairs into current and capital is important, since these types of work are reflected differently in the enterprise’s accounting and other reporting. Meanwhile, the regulations of tax and accounting legislation do not provide a clear distinction and definition of these types of repair work.

The letter of the Ministry of Finance of the Russian Federation dated January 14, 2004 No. 16-00-14/10 “On the grounds for determining types of repairs” explains that the organization itself must develop provisions on the basis of which repair work will be classified as current or capital. In this case, it is permissible to use the provisions of documentation that has remained relevant since the times of the USSR, such as the cited Resolution of the State Construction Committee No. 279.

Let's consider the main differences between current and major repairs, which are accepted in business practice.

| № | Base | Maintenance | Major renovation |

| 1 | Periodicity | No more than once a year | More than one year |

| 2 | Nature of work | Elimination of damage, malfunctions, replacement of individual parts | Complete disassembly, replacement of all damaged or worn elements |

| 3 | Duration | Not very long lasting | Long lasting |

| 4 | Basic execution method | More often economic | More often a contractor |

| 5 | Regularity | Must be carried out according to special schedules | Depends on the degree of wear and tear of the fixed asset, is assigned specifically |

| 6 | Additional work | Not provided | May be accompanied by reconstruction, modernization |

OS modernization in 1C: Enterprise Accounting 8

Published 08/07/2015 09:41 Work processes and time lead to the fact that sooner or later we may face such an issue as the modernization of fixed assets. That is, we will deal with the costs of a fixed asset item, as a result of which the quality of use of the fixed asset item will improve and its initial cost will increase. How to modernize fixed assets in the 1C: Enterprise Accounting 8 program, we will look in this article.

So, in order to modernize a fixed asset in the program, it is necessary to collect the expenses that were incurred in the current period on the fixed asset in account 08.03 “Construction of fixed assets”.

Let’s say there is a fixed asset “Woodworking machine”, which was put into operation at the beginning of the year.

Depreciation is charged on it every month at the end of the month.

How to repair a fixed asset in 1C 8.3?

Send this article to my email Sooner or later, any organization whose property uses fixed assets, be it equipment, real estate or any other object, is faced with the need to repair them. Here it is important to understand the difference between repair and modernization and reconstruction, because .

the reflection of these operations in accounting have significant differences. Repair refers to work performed to eliminate faults that interfere with the operation of a fixed asset, and restore its functionality, without entailing a change in the properties of the object. Let's consider the documents that need to be drawn up to reflect the repair of a fixed asset in 1C: Enterprise Accounting 8.3. Repair work can be performed either on your own or by a contractor. When OS repairs are carried out on a self-employed basis, i.e. employees of the organization, without involving third-party companies, record the costs of purchased materials for repairs in the database.

Equipment acceptance certificate

Correct execution of the equipment acceptance and transfer certificate is the key to proper reflection of the asset in accounting and for tax purposes.

Therefore, you should take this document very seriously!

Equipment transfer procedure

In general, regardless of the nature of the operation, the transfer of equipment is as follows:

- mandatory participation of authorized representatives of the parties to the transaction who have the right to complete the transaction and sign documents. This right is usually confirmed by a power of attorney from the receiving party if the equipment is transferred on the territory of the transferring party;

- if the transfer is carried out on the territory of the receiving party, then the act is drawn up by the receiving party. Along with the equipment, she is given a package of accompanying documents - invoice, registration certificate, and other documents;

- When accepting equipment, the receiving party must carefully inspect the asset and check its technical condition. To do this, the receiving party can even use the services of a third-party specialist;

- The acceptance certificate is drawn up with a mandatory indication of the presence or absence of faults.

As soon as the act is signed, it is considered that the equipment is accepted on the previously agreed conditions and in the condition in which it arrived at the receiving party. In addition, the signed act serves as the basis for the transferring party to reflect the disposal of the asset in its accounting.

By the way, when accepting equipment, special attention is paid to the correct execution of all accompanying documents: after all, if the documents indicate an incorrect serial number, it means that the wrong asset is being accepted!

Therefore, it is very important that all documents are drawn up correctly.

and structure of the act

Any equipment is an asset, the presence of which on the company’s balance sheet is confirmed by a large package of documents, among which an important role is played by the act drawn up when the object was initially delivered to the enterprise.

Sample certificate of acceptance and transfer of equipment for installation

This act provides information valuable for the accounting process:

- technical condition of the asset;

- basis for receipt (transfer) – purchase and sale, donation, inventory, and other cases;

- details of the parties to the transaction;

- whether the object is depreciable property or not;

- the number of received objects and their assessment;

- list of accompanying documents.

The presence of an acceptance certificate allows you to correctly reflect the receipt of equipment at the enterprise and at the same time record all deviations in cost, completeness, technical condition and quantity.

And, if all these deviations are not identified immediately, then the signed acceptance and transfer certificate will indicate the consent of the receiving party with the receipt of an object with the characteristics specified in the act.

And then it will be difficult to prove the error of the reception.

Before the amendments to the law “On Accounting” came into force, the acceptance and transfer certificate was drawn up in a unified form OS-14 and OS-16 (for equipment with defects).

These forms are still in effect, but they are no longer mandatory.

Therefore, any company can offer the receiving or transferring party to the transaction its own version of the act or use the specified forms OS-14 and OS-16.

But regardless of the choice of form, the act must contain the following details :

- title and date of preparation of the document;

- name of the parties involved in the transaction;

- Contents of operation;

- cost and (or) quantitative assessment of the operation, i.e. price, quantity and value of the transaction as a whole;

- FULL NAME. and the positions of those responsible for completing and processing the transaction;

- signatures of the indicated persons.

These details are required for the preparation of any primary documents. But for the act documenting the acceptance and transfer of property, these details must be supplemented by another mandatory list that reflects the nuances of the process.

If you have not yet registered an organization, then the easiest way is

This can be done using online services that will help you generate all the necessary documents for free:

- for individual entrepreneur registration

- LLC registration

If you already have an organization and you are thinking about how to simplify and automate accounting and reporting, then the following online services will come to the rescue, which will completely replace an accountant in your company and save a lot of money and time. All reporting is generated automatically, signed electronically and sent automatically online.

- Accounting for individual entrepreneurs

- Bookkeeping for LLC

It is ideal for individual entrepreneurs or LLCs on the simplified tax system, UTII, PSN, TS, OSNO. Everything happens in a few clicks, without queues and stress. Try it and you will be surprised

how easy it has become!

Mandatory points and nuances of drafting

When drawing up an act for the movement of equipment, it is necessary to supplement it with the following details:

- a detailed description of each asset - its serial number and technical condition, model, name, manufacturer, year of manufacture, period of operation, residual value. Without such a description, it is impossible to determine which equipment is being accepted.

- basis for transfer - donation, contribution to the authorized capital, etc. This information forms the basis for the correct recognition of the asset for accounting. In particular, if an asset is donated, then the recipient company will have to pay tax on its value as income;

- transfer place . This is very important, because if the transfer took place on the territory of the transferring party, and then the equipment was transported, then its technical condition should be recorded before its transportation. This will protect the transferring party from claims from the receiving company. And the recipient will be allowed to recognize transportation costs.

Therefore, you need to be very careful when drawing up the act.

Rules and procedure for registration

First of all, the act is drawn up :

- in the presence of all persons authorized by the parties to the transaction;

- in 2 copies - for each party. The number of copies may vary depending on the situation;

- on the day of transfer of equipment;

- without blots or errors;

- indicating the description of the object given in its technical passport.

In addition to the act, accompanying documents are attached - technical documentation for the equipment, invoice, contract and other documents required by the nature of the operation. Moreover, if we are talking about the transfer of structurally complex equipment, then this process can occur in several stages. And for each such stage of acceptance and transfer, its own act must be drawn up.

The signatures of all parties on the deed are placed when the transfer process is completed and there are no claims to the asset.

Purpose and existing types of this document

As a rule, despite the legal opportunity to formulate the form of the act independently, enterprises use old, but valid, forms :

- form 14 . Prepared for the receipt of any equipment;

- form 15 . To be completed upon acceptance and transfer of an asset for installation. When installation is performed by a third-party contractor, the commission transferring the asset must include his representative;

- form 16 . Compiled regardless of the reason for the receipt of the object, but if defects are detected in it;

- form 1 (OS 1b) . It registers the inclusion of equipment (a group of objects) in fixed assets and its transfer into operation. Based on these acts, the inventory card OS 6 (OS 6a - for a group of objects). This card reflects all internal movements of the object: receipt, repair, modernization, transfer to another workshop, etc. Therefore, when transferring equipment, for example, for repair or maintenance within the company, information about this is reflected in this card. For small businesses, instead of cards, you can use an inventory book (OS-6b) ;

- When transferring equipment for rent, the act is drawn up in any form , but indicating those mandatory details that are provided for by the law “On Accounting”. At the same time, these details must include: a detailed description of the equipment, the place of transfer, the technical condition of the asset, a list of accompanying documents and the period for testing the equipment;

- As for the transfer of an asset for maintenance or repair , then, as a rule, the acceptance certificate is drawn up by the company with which the contract has been concluded to perform the specified work. But at the same time, the method of returning the asset back must be indicated.

How to correctly accept equipment into 1C:Enterprise software is discussed in the following video:

Source: https://www.DelaSuper.ru/view_post.php?id=5370

Accounting for fixed assets in 1C 8.3: receipt, acceptance for accounting, installation, depreciation, write-off

» » Fixed assets are inventory assets worth more than a certain amount (constantly increasing) and whose useful life is more than a year.

Fixed assets include buildings, structures and other real estate, construction projects, equipment, power lines, pipelines, and so on.

In the 1C 8.3 system, several separate sections are allocated for accounting for fixed assets, which contain all the necessary operations for full-fledged work on this topic: Section “Receipt of fixed assets“. In this section, documents are created that are included in the cost of fixed assets.

Also in this section 1C is drawn up. In the “Accounting for Fixed Assets” section, you can create documents reflecting the movement and inventory of fixed assets.