← Prev. articleFinishing materials: what are they needed for, classification In addition to building materials, there is a huge category of accessories for finishing, repairing and reconstructing premises. Finishing materials are intended for decoration from the inside and outside, as well as to protect the building from aggressive environmental phenomena: oxidation, which causes rust on the metal, burnout, cracking...

07/30/2020Author: Foreman

Track. article →Plumbing: what is it, what is it made of, how to choose In a broad sense, plumbing is all the means connected to water supply and sewerage, intended for performing hygienic procedures. Available in kitchen and bathroom, depending on the installation location...

- 1. What is it

- 2. Types of household goods

- Random articles

Standard composition

The law does not contain a list of characteristics by which an object is determined. Traditionally, household supplies mean the following objects:

- Office furniture: sofas, tables.

- Communication equipment: telephones.

- Electronic equipment: cameras, tablets, computers.

- Tools for cleaning the internal and adjacent areas of the enterprise: vacuum cleaners, rakes, mops.

- Fire safety tools: fire extinguishers.

- Lighting tools: lamps, lanterns.

- Toilet supplies: towels, hand drying equipment, air fresheners, toilet paper, soap.

- Stationery: pens, pencils, notepads.

- Household appliances for equipping kitchen premises: microwaves, refrigerators, electric kettles.

The list of accessories will depend on the size of the enterprise and the type of its activity. However, the main list is standard.

Types of household goods

- Made of plastic, which can be divided into tableware products, for the bathroom and toilet, for the garden and vegetable garden, interior items for furnishing residential premises, and household furniture. This includes toilet brushes, all kinds of soap dishes and shampoo bottles, garden plastic furniture, dishes, scoops and sponges and much more. Plastic is inexpensive, it is light, impact-resistant and beautiful.

- Made of glass, with a separate classification according to purpose and functionality, composition, color, sizes and styles, production method. For example, there is glassware for daily use: glasses, glasses, plates, jugs, salad bowls, etc. There are household utensils designed for storing food for a long time: these are jars, pans, glass bottles. There are decorative products, similar to glassware, but intended for interior decoration. This includes GOST lamps, as well as lighting fixtures, for example, lampshades.

- Made of ceramics similar in properties to glass. Ceramic household goods cover a significant part of household needs: first of all, these are ceramic dishes, divided into tableware, coffee, tea, etc., single and double (saucer + cup). This includes plates, saucers and mugs, all kinds of sugar bowls and cream containers. In addition to traditional earthenware and porcelain dishes, there are rarer products made from other types of ceramics - for example, pottery, majolica, and semi-porcelain.

- Made of metal - knives, metal dishes and cutlery, kitchen utensils, tools for plumbing and installation work, window and door handles, hinges, latches, locks, latches. The selection of a specific metal depends on the scope of use of household goods. Cast iron, aluminum, and stainless steel are very popular.

- Household chemicals (go to products), which include detergents, paints and varnishes (go to products), adhesives, everything for caring for the home, yard and garden.

- Textiles - rags, towels, carpets, knitwear.

It is worth noting that this division is very arbitrary. No less common is the division of household goods by area of use: for the garden, garden, kitchen and bathroom, etc.

Inventory accounting

Accessories will be included in fixed assets only if their use period exceeds a year. This rule is contained in subparagraph “b” of paragraph 4 of the Accounting Rules (PBU). Inventory may be recorded as part of the materials. However, this is permissible only within a certain limit. This limit may be set by the policy of the enterprise itself. However, it cannot be more than 40 thousand rubles. The maximum volume of the limit is established by paragraph 4 of clause 5 of the PBU.

If the useful life does not exceed a year, records are kept in the list of materials. For this purpose, according to paragraphs 2 and 4 of the PBU, the score is 10-9. The introduction of objects is reflected in accounting in a standard manner.

Question: An enterprise purchased inventory and household supplies for its new division, but due to the fact that the division did not start operations, it was forced to sell them. How to reflect this transaction in accounting? View answer

Features of modern household goods

In conclusion, it should be noted that the range of these products is constantly being updated, and the variety is growing. Engineers are inventing new and sophisticated ways to make life easier and make housekeeping more efficient by developing practical things for the home. In addition, improved grades of polymer materials are being introduced.

Therefore, household goods are a constantly evolving category, evolving along with the modern household. And there is no doubt that if you are looking for some convenient device with which you can do something in the kitchen, when cleaning, while doing laundry, it probably already exists and is on sale.

To the list of articles"

Documentary support

When releasing tools from warehouses, it is necessary to issue a demand invoice. The document is executed according to form No. M-11. The requirement was established by the State Statistics Committee of the Russian Federation in 1997 (resolution No. 71a). The document indicates, in accordance with Order of the Ministry of Finance of the Russian Federation No. 119n, the following information:

- The name of the department that requested the inventory.

- Account number for accounting costs for supporting the activities of the unit.

Accessories can be transferred to an intermediate unit (this concept refers to accounting departments and purchasing departments). In such a situation, it is difficult to determine the exact amount of inventory that will be used by the departments. The way out is to draw up reports as supplies are used up. The acts are drawn up in free form, but they must contain the following information:

- department name;

- number of supplied accessories;

- price;

- the purposes for which the object is requested.

Based on the drawn up acts, objects are written off as expenses. The procedure was approved by MU No. 119n.

How to fill out line 6330 “Acquisition of fixed assets, inventory and other property” in the Report on the intended use of funds?

Accounting in a simplified form

Companies classified as small businesses can conduct accounting in a simplified form. The release of objects involves a connection with the account “Production expenses” or account 44 “Expenses for sales”. The accountant must issue a demand invoice. It is performed according to form No. M-11. At the same time, posting is carried out: DT 25, 26, 44 KT 10-9 (release of objects).

Writing off accessories involves setting a price at which they will be written off. The operation is performed from a count of 10-9. The cost is determined based on the following methods:

- At the cost of one piece.

- FIFO.

- Average cost.

The methods are approved by paragraph 16 of the PBU. The method used must be reflected in the accounting policy. This is needed for accounting purposes. This provision was introduced by paragraph 73 of MU No. 119n.

When reflecting, security control is used. This is due to the fact that when a facility is put into operation, costs are transferred into costs.

Only objects whose service life exceeds a year and are registered in the list of materials are controlled.

The law does not stipulate the procedure for accounting for objects transferred to use. Therefore, it is installed by the enterprise itself. To track the movement of objects across departments, the following documents are used:

- Statement.

- Off-balance sheet accounting.

The chosen option for maintaining papers is fixed in the company policy. Documentation is maintained by an employee with financial responsibility. The Plan does not have an individual off-balance sheet account, and therefore it is created independently. For example, an enterprise opens account 013 “Households. accessories".

When transferring inventory to use, the following transactions are made:

- DT 25, 26, 44 KT 10-9 (release of objects from warehouse).

- DT 013 (accounting of objects).

- KT 013 (inventory write-off).

When objects are disposed of, it is necessary to create a write-off report. Its form is not established by law. Its independent approval is allowed. The procedure for recording related expenses is determined depending on the taxation system adopted by the enterprise.

Business registration

You should start with legalizing your activities. To do this, it is necessary to choose a form of management. The best option would be individual entrepreneurship.

After this, you need to register with the tax office. Next, you can begin obtaining permits. These include:

- permit issued by the sanitary and epidemiological station;

- document from Rospotrebnadzor;

- permission from the fire department;

- agreement for the disposal of mercury lamps;

- an agreement with a company that will remove household waste.

In addition, it is necessary to create a consumer corner in the store, where there will be a book of complaints and suggestions, as well as an extract from the law on the protection of consumer rights and other documents.

How is tax calculated?

Objects with a service life of more than a year and costing more than 100 thousand rubles must be included in fixed assets.

This is depreciable property, which is stipulated by paragraph 1 of Article 256 of the Tax Code of the Russian Federation. Expenses on accessories that are not included in depreciable items are taken into account as part of material expenses. The write-off procedure is determined by the enterprise itself. For example, this operation can occur at once or in parts. If the enterprise uses the cash method, the tax base is reduced after the facilities are put into operation.

All costs must be justified by the economic policy of the enterprise. For example, the advisability of their acquisition may be stipulated by an internal agreement. The document indicates the need to maintain sanitary and hygienic standards. In connection with this rule, the purchase of toilet accessories is carried out. Other expense items may be justified by other internal documentation.

Example

The company purchased the following toilet accessories:

- Toilet paper for 1180 rubles (VAT will be 180 rubles).

- Towels worth 11,800 rubles (tax is 1,800 rubles).

- Soap for 3,540 rubles (VAT – 540 rubles).

- Air freshener for 2,950 rubles (tax – 450 rubles).

The total cost was 19,470 rubles. VAT – 2,970 rubles). Accessories worth 1,650 rubles were released from the warehouse. The following wiring is required:

- DT 10-9 CT 60 (16,500 rubles).

- DT 19 CT 60 (2,970 rubles).

- DT 68 subaccount “Calculations for VAT” KT 19 (tax deductible in the amount of 2,970 rubles).

- DT 60 CT 51 (19,470 rubles).

- DT 26 CT 10-9 (1,650 rubles).

All expenses must be recorded in accordance with the reporting period and month. Before accounting, all relevant calculations are made. In particular, you need to determine the total costs and subtract VAT from the resulting amount. Then the accounting itself is carried out on the basis of primary documentation.

Location and premises

The location of your store should be selected most carefully, because the success of all activities depends on it. The most successful areas may be residential areas. That is, those places where residents can buy everything they need for their home in close proximity to their home.

The private sector or a large shopping center would not be a very suitable option. Agree, hardly anyone will go to the city center to buy soap or detergent. But the presence of numerous residential buildings and complexes around your outlet will just play into your hands. It is unlikely that any housewife will be able to pass by a hardware store that has everything she needs.

As a premises, you need to choose one that will have at least two rooms - a sales area and a warehouse. The area for the sales area should be at least 45-50 square meters. Considering the fact that almost the entire assortment of such a store is quite small in size, you will have absolutely no need for a large hall.

Stationery

These office products are in turn divided into the following groups:

- Paper products. This includes writing and printer paper, notebooks and folders, notepads and diaries.

- Drawing tools. Rulers, compasses, pencils, protractors, patterns, leads individually and in sets.

- Storage of accessories. Desk organizers, paper trays, folders, binders, stands, business card holders.

- Marking. Bookmarks, stickers, colored stickers, dividers, markers, highlighters, paper folders.

- Stapling documents. Hole punchers, awls, stitching staplers and staples for them, stationery knives, scissors, guillotines, laminators.

If there is a large turnover of papers, it is advisable to use products from this category of household goods not on an individual basis, but to organize separate areas in the office where employees can use, for example, equipment for stitching or laminating documents.

Note! Some stationery products have a long shelf life. At the same time, most products belong to the category of consumables and require constant updating.

Consumer characteristics when choosing manufactured goods

When choosing a product for the further purpose of purchasing it, the consumer is guided only by an independent assessment of the qualities inherent in a particular item of trade. Each subtype of non-food products has its own characteristics that are unique to it alone. However, over the years, experts have identified a certain list of features that are characteristic of all categories of goods that do not fall under the “food” type. These include:

- harmlessness (the product must not contain harmful substances, except for the relevant category);

- durability (the buyer expects a certain service life of the purchased product);

- aesthetics (appearance and design for the consumer are far from unimportant factors when choosing a product);

- physical and technical serviceability (the purchased item must be in good working order, free from breakages and defects);

- ergonomics (provides a feeling of comfort and coziness);

- maintainability (the buyer always considers the possibility of carrying out repair work in the event of a breakdown of the purchased item);

- popularity of the manufacturer (most buyers choose a big name or a well-known manufacturer).

When choosing manufactured goods, you should pay attention to all features that can be assessed.

What applies to household equipment and accessories?

What may be included in the list of tools, household equipment and accessories (hereinafter referred to as material assets, MC) has not been determined by anyone. The organization regulates this itself. Typically it includes:

- office furniture and equipment;

- lighting;

- stationery;

- Appliances;

- means related to fire safety;

- hygiene products;

- cleaning equipment and materials;

- tools, etc.

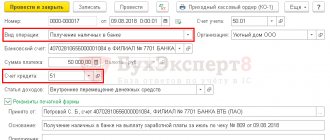

It is possible to purchase such goods both by bank transfer and through accountable persons.

How to account for the purchase of materials through accountable persons, read in Art. “What kind of posting reflects the acquisition of material assets under the report.”

To organize accounting, it is necessary to correctly classify MC.

There are 2 options for inventory accounting:

- as part of fixed assets (fixed assets);

- as part of the MPZ.

In any option, objects are taken into account at their acquisition cost, which is the sum of all costs associated with the purchase. In general, VAT is not included in this amount. It is included in the price only if MCs are used for non-taxable activities (clauses 2, 5, 6 PBU 5/01 “Accounting for inventories”, approved by order of the Ministry of Finance of Russia dated 06/09/2001 No. 44n, clause 8 PBU 6 /01 “Accounting for fixed assets”, approved by order of the Ministry of Finance of Russia dated March 30, 2001 No. 26n).

The procedure for spending funds for business needs

Enterprises (institutions) issue cash on account for business and operating expenses in amounts and for periods determined by the heads of the enterprises. Money issued on account can only be spent for those purposes that are provided for when it is issued.

Expenses for business and operational needs usually mean the expenses of an institution for the purchase of office or household goods, material assets, fuels and lubricants, for minor repairs, and entertainment expenses.

When an organization withdraws money from its current account for business needs, the following procedure must be followed:

1. The withdrawn funds must be credited to the organization’s cash desk on the same day. Capitalization is done as follows: a cash receipt order is drawn up for the amount withdrawn from the account (receipt order form No. 0310001).

2. Then it is necessary to issue cash to the person who will purchase goods (work, services) for business needs for the organization.

The issuance of funds is formalized by the following documents (clause 4.4. Regulations):

- an application from the employee to issue him amounts on account, drawn up in any form, indicating the period for which the funds will be issued and their amount; The head of the company must sign and date this application.

- an expense cash order, which is drawn up according to form 0310002.

3. Entries are made in the Cash Book (form 0310004) about the receipt of funds from the bank under a receipt order and about their issuance under an outgoing cash order.

4. After spending the funds, but no later than 3 days from the end of the period for which the money was issued, the accountable person must draw up an advance report in Form No. AO-1.

The report must be accompanied by documents confirming the expenses incurred (for example, sales and cash receipts, clause 4.4 of the Regulations).

The advance report is presented to the chief accountant or accountant, and in their absence - to the manager. The person to whom the advance report is presented checks the intended use of funds, the availability of supporting documents, the correctness of their execution and the calculation of amounts.

After this, the expense report is approved by the manager. The period during which the verification of this report, its approval and final payment is carried out is established by the head (subclause 6.3, clause 6 of the Directive). After approval of the advance report, the accountable amounts are written off.

Unspent or undocumented amounts of money must be returned to the organization's cash desk.

If the employee spent less money than he received on the report: the chief accountant should draw up and sign a cash receipt order, which, in particular, reflects the amount of money being returned.

If the employee spent more money than he received on the report: after the advance report is approved by the head of the organization, the overexpenditure should be returned to the employee using a cash receipt order, the details of which are entered in the advance report.

If the advance report is not approved or the balance is not returned, then the money can be withheld from the salary (Article 137 of the Labor Code of the Russian Federation). To do this you should:

— obtain the employee’s consent to withhold the appropriate amount (if the employee does not agree to the withholding, the money can be recovered through the court);

- within a month from the date of expiration of the period established for the return of accountable funds, issue an order from the head of the organization to withhold (if you miss the deadline, you will have to recover the money in court);

— familiarize the employee with the order (letter of Rostrud dated 08/09/07 No. 3044-6-0).

The total amount of deductions cannot exceed 20% of the amount of wages due to the employee (Article 138 of the Labor Code of the Russian Federation). If the debt exceeds this limit, then deductions will need to be made from several payments.

Thus, the organization can spend cash only for its own needs. In addition, you need to confirm all out-of-pocket expenses with documents that must be kept.

In addition, if cash was issued to an individual without drawing up documents and an advance report, the tax authorities, during inspections, additionally charge this person personal income tax (NDFL), as well as penalties and fines for non-payment.

Example 1. Issuing money against a report from the cash register

Secretary of Vek LLC E.P. Kovaleva was given 5,000 rubles on March 24, 2021. for five days to buy stationery. The accountant issued E.P. Kovaleva money based on her application signed by the director.

On March 27, the secretary bought stationery worth 4,000 rubles. and brought the expense report and checks to the accounting department. Unused 1000 rub. The secretary handed it back to the cashier.

The accountant made the following entries:

March 24:

Debit 71 Credit 50 – 5000 rub. - money was issued against a report from the cash register.

March 27:

Debit 50 Credit 71 – 1000 rub. – the balance of unspent accountable funds is entered into the cash register;

Debit 10 Credit 71 – 4000 rub. – stationery items are accepted for accounting.

Example 2. Transfer of accountable amounts to an employee’s salary card

On November 6, 2014, Klyuchik LLC transferred 30,000 rubles to the salary card. accountable money for the purchase of stationery for O.R. Klyuchkin.

On November 7, Klyuchkin purchased the necessary inventory and materials in the amount of 27,350 rubles, paying for them with a bank card. On the same date, Klyuchkin provided the accounting department of Klyuchik LLC with an advance report with a cash register receipt, a receipt from PKO and a terminal slip, as well as a delivery note and an invoice in the name of the organization (since Klyuchkin was issued a power of attorney on behalf of the company). Also on November 7, Klyuchkin returned the remaining unspent amount in cash to the company’s cash desk.

The following entries will be made in accounting:

November 6, 2014:

Debit 71 Credit 51 – 30,000 rub. – the amount was issued for reporting,

November 7, 2014:

Debit 10 Credit 60 – 27,350 rub. - purchased stationery,

Debit 60 Credit 71 – 27,350 rub. – the debt to the stationery seller has been repaid,

Debit 50 Credit 71 – 2,650 rub. – the unused accountable amount is returned to the cash desk.

I. Administrative expenses

1. Costs for remuneration of administrative and economic personnel:

management staff (managers, specialists and other employees classified as employees);

line personnel: senior work producers (site managers), work producers, construction site foremen, local mechanics;

workers providing economic services to management staff (telephone operators, telegraph operators, radio operators, telecom operators, electronic computer operators, janitors, cleaners, cloakroom attendants, couriers).

2. Deductions for social needs (mandatory deductions according to the norms established by law: for state social and health insurance, pensions and the state employment fund) from the cost of remuneration of administrative and economic personnel.

3. Postal and telegraph expenses, expenses for the maintenance and operation of telephone exchanges, switches, teletypes, control room installations, radio and other types of communications used for management and listed on the organization’s balance sheet, expenses for renting the specified communication equipment or for paying for relevant services, provided by other organizations.

4. Costs for the maintenance and operation of computer equipment, which is used for management and is listed on the balance sheet of the organization, as well as the costs of paying for relevant work performed under contracts by computer centers, machine counting stations and bureaus that are not on the balance sheet of the construction organization.

5. Expenses for printing works, for the maintenance and operation of typewriting and other office equipment.

6. Costs for the maintenance and operation of buildings, structures, premises occupied and used by administrative and economic personnel (heating, lighting, energy supply, water supply, sewerage and cleanliness), as well as costs associated with payment for land.

7. Expenses for the purchase of office supplies, accounting forms, reporting and other documents, periodicals necessary for the purposes of production and management, for the purchase of technical literature, binding work.

8. Expenses for all types of repairs (contributions to the repair fund or reserve for repairs) of fixed assets used by administrative and economic personnel.

9. Expenses associated with official travel of administrative and economic personnel within the location of the organization.

10. Costs for the maintenance and operation of official passenger vehicles listed on the balance sheet of the construction organization and serving the management staff of this organization, including:

wages (with deductions for social needs) of workers servicing passenger vehicles;

the cost of fuel, lubricants and other materials, wear and repair of automobile tires, vehicle maintenance;

expenses for maintaining garages (energy supply, water supply, sewerage, etc.), rent for garages and parking lots, depreciation (depreciation) and expenses for all types of repairs (contributions to the repair fund or reserve for repairs) of cars and buildings garages.

11. Costs of compensation (within the limits established by law) for employees of administrative and economic personnel of a construction organization, whose production activities are associated with the need for systematic business trips, expenses for using personal passenger transport for these purposes.

12. Expenses for hiring company cars.

13. Expenses associated with the payment of relocation costs for administrative and business personnel, including employees servicing official passenger vehicles, and payment of allowances for them in accordance with the current legislation on compensation and guarantees for transfer, rehiring and sending to work in other areas.

14. Expenses for business trips related to the production activities of administrative and economic personnel, including employees servicing official passenger vehicles, based on the standards established by law.

15. Contributions made by structural units that are not legal entities for the maintenance of the management staff of a construction organization.

16. Depreciation deductions (rent) for fixed assets intended for servicing the management apparatus, depreciation and repair of wear-out equipment and other low-value items for administrative and managerial purposes.

17. Representation expenses related to the commercial activities of the organization, and expenses for holding meetings of the council (board) of the organization and the audit commission of the organization in accordance with the norms established by law.

18. Payment for consulting, information and audit services.

Features characteristics of manufactured goods

The main distinguishing features of non-food products are the following criteria:

- no need for special conditions of maintenance, transportation, storage of goods;

- increased complexity, and sometimes danger, of the object of trade;

- the need for appropriate training or special training for the correct or safe use of the item.

Due to such complex specifics of the group of goods under discussion, manufacturers have developed special sales standards and rules for the process of assessing the quality of such products and items.