Accounting considers assets as tangible and intangible objects with ownership rights, property rights on the balance sheet.

Liabilities are sources of formation (financing) of assets.

Today's article contains a non-classical presentation of issues that sheds light on the property and liability components of bank capital.

The above assessments may differ from generally accepted ones, but they do not obscure the essence of the issues being presented.

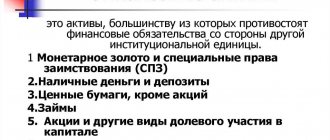

What are bank assets?

Assets are everything where the bank invests its existing funds

. That is, these are loans, securities, and other property in which a credit institution invests borrowed and own funds. The bank's assets can be:

- money;

- loans;

- investments;

- accounts in other banks;

- securities;

- property;

- authorized capitals of different companies.

The bank places its funds in assets to generate income

. It is obtained through depositors' funds, interbank loans, bond issues, and equity.

The bank's assets are growing

, since the organization constantly carries out some operations: issues loans, invests, and conducts other operations related to attracting and placing raised funds.

If there are fewer assets

, this indicates a deterioration in the condition of the credit institution. Anyone looking for a suitable bank to make a deposit must check the liquidity of the credit institution.

Credit institutions constantly report to the Central Bank of the Russian Federation about the status of assets and liabilities. After analyzing this data, the potential client determines the general financial situation in different banks, and can decide which one is worth making a deposit with.

Based on data on the dynamics of assets, capital and liabilities over the course of a year or other long period of time, it is determined how effectively the bank operates in the market

.

Enter the site

RSS Print

Category : Accounting Replies : 22

You can add a topic to your favorites list and subscribe to email notifications.

« First ← Prev. 2 Next → Last (3) »

| Ulya [email hidden] Belarus Wrote 642 messages Write a private message Reputation: | #11[474248] February 15, 2012, 16:47 |

Notification is being sent...

| Ulya [email hidden] Belarus Wrote 642 messages Write a private message Reputation: | #12[474252] February 15, 2012, 16:49 |

Notification is being sent...

| Gogo Morieli [email protected] Wonderland, Field of Fools Wrote 7345 messages Write a private message Reputation: 526 | #13[474255] February 15, 2012, 16:51 |

margo wrote:

3) Settlements with debtors - can be both A and P 5) Settlements with creditors - can be both A and P

the account itself 76, like 60, is active-passive, but the asset or liability needs to be looked at by our debtors or creditors

I want to draw the moderator's attention to this message because:Notification is being sent...

| Catherine [email hidden] Belarus, Minsk Wrote 11 messages Write a private message Reputation: | #14[474259] February 15, 2012, 17:02 |

Notification is being sent...

| Gogo Morieli [email protected] Wonderland, Field of Fools Wrote 7345 messages Write a private message Reputation: 526 | #15[474261] February 15, 2012, 17:04 |

I want to draw the moderator's attention to this message because:Ekaterina wrote:

It seems to me wear and tear OS-passive

Notification is being sent...

| Ulya [email hidden] Belarus Wrote 642 messages Write a private message Reputation: | #16[474263] February 15, 2012, 17:05 |

Gogo Morieli wrote:

margo wrote:

3) Settlements with debtors - can be both A and P 5) Settlements with creditors - can be both A and P

the account itself 76, like 60, is active-passive, but the asset or liability needs to be looked at by our debtors or creditors. You create a balance sheet - that by debit it is an asset, and by credit it is a liability

I want to draw the moderator's attention to this message because:Notification is being sent...

| Gogo Morieli [email protected] Wonderland, Field of Fools Wrote 7345 messages Write a private message Reputation: 526 | #17[474265] February 15, 2012, 17:08 |

margo wrote:

You create a balance sheet - that by debit it is an asset, and by credit it is a liability

that's what I meant

I want to draw the moderator's attention to this message because:Notification is being sent...

| Catherine [email hidden] Belarus, Minsk Wrote 11 messages Write a private message Reputation: | #18[474266] February 15, 2012, 17:08 |

Notification is being sent...

| Gogo Morieli [email protected] Wonderland, Field of Fools Wrote 7345 messages Write a private message Reputation: 526 | #19[474270] February 15, 2012, 5:17 pm |

Notification is being sent...

| Catherine [email hidden] Belarus, Minsk Wrote 11 messages Write a private message Reputation: | #20[474278] February 15, 2012, 17:33 |

Notification is being sent...

« First ← Prev. 2 Next → Last (3) »

In order to reply to this topic, you must log in or register.

What are bank liabilities?

These are the bank's own and borrowed funds, as well as reserves for possible losses. The size of assets and liabilities (including equity capital) must be the same.

Liabilities include:

- customer funds in accounts, deposits;

- loans;

- profit for previous periods;

- issued securities;

- authorized capital;

- emission;

- reserve funds.

Deposits are also included in obligations to depositors

, therefore, is a component of the passive. Due to deposits, new assets of the organization are formed. This happens due to the turnover of depositors' funds. That is, the client places a deposit in the bank, and the bank uses this money at its own discretion (albeit under strict control by the Central Bank).

Assets are property that has a monetary value, and liabilities are the sources of origin of this property.

For a credit institution to successfully operate, develop and increase capital, the ratio of liabilities, capital and assets is important.

Differences between own and borrowed liability objects using an example

It was already indicated above that the structure of the balance sheet gives an idea of the stability of the company. Availability of own funds is a serious advantage of the enterprise. Proper use of liabilities will ensure independence and well-being.

An example of using your own funds. The company bought premises for offices. The property is for rent. Rental funds continuously flow into the company's budget. The organization receives net profit that does not imply liabilities. Funds can be used both for capital formation and for increasing turnover. Profits do not decrease due to inflation, since office rental prices are constantly rising.

An example of the use of borrowed funds. The company took out a million rubles on credit to rent retail space and purchase a batch of products. The loan was short-term. The premises were rented. Products are displayed on the trading platform. The product became popular among consumers. In just a few months, we managed to receive more than 2 million rubles. The million was used to repay the loan.

But another situation is also possible. The company took out a million rubles on credit. The money was also used for rent and purchase of products. However, the product was not successful with the consumer. In a few months we managed to get 200,000 rubles. There was not enough money for the subsequent rent of the retail space, as well as for repaying the loan on time. Creditors went to court to collect the debt. The company had to declare itself bankrupt.

ATTENTION! Based on the examples given, it becomes clear that it is beneficial for an enterprise to have its own reserves. However, most enterprises also have borrowed funds. This is completely normal. The main thing is to monitor the proportions between your own and borrowed funds.

What is the bank's liquidity level?

This is the ability of a credit institution to ensure the fulfillment of obligations on time. Liquidity level is the ratio of available assets to obligations that need to be fulfilled.

Insufficient liquidity

may lead to bank insolvency and significantly affect profitability.

When there is panic in the market and clients run to withdraw their funds from their accounts, the bank has only two types of sources of liquidity:

- Internal – own funds in accounts, at the cash desk.

- External – quickly raise funds if necessary.

With positive liquidity indicators, the parameter means that the bank can fulfill all its financial obligations. If the level of liquidity decreases, the bank has financial problems. When it reaches a critical point of no return, the credit institution may be deprived of its license.

The Central Bank determines the level of liquidity according to three standards:

- Current. Limits the risk of a credit institution losing its solvency in the next 30 days. The minimum value established by the Central Bank is 50%.

- Long term. Limits the risk of insolvency resulting from the placement of funds in long-term assets. The minimum value is 120%.

- Instantaneous. Limits the risk of loss of solvency within one calendar day. The minimum value is 15%.

When one of the regulations is violated, the Central Bank imposes a ban on banking operations, imposes fines on the bank, or even revokes its license.

To prevent it from going to extreme measures, you should not allow there to be more liabilities than assets

.

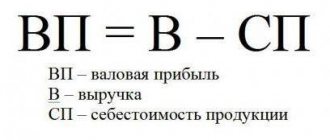

Calculation of the coefficient and its meaning

Described debt is expressed using a ratio that shows the proportion of liabilities in relation to total debt. To calculate this coefficient, use the following formula:

Kkz = Ko: (Ko + Do)

Where

- Kkz is the coefficient that needs to be calculated,

- Ko – short-term,

- Until – long-term.

obligations used:

The indicator that will be obtained after the operations performed shows how dependent the business entity is on borrowed financial injections over a 12-month period. If the short-term liabilities ratio is high, this indicates that the company is solvent, respectable and reliable.

Assets of Russian and foreign banks – who leads the market?

To clearly see the difference, we will display the real situation in the TOP-5 banks of the Russian Federation by the number of assets

during the period from July 1 to August 1, 2021.

| Banks | Assets 07/01/2020 in thousand rubles. | Assets 08/01/2020 in thousand rubles. | Change in thousand rubles | Change in % | |

| 1 | Sberbank | 31 179 957 970 | 31 705 048 988 | +525 091 018 | +1,68% |

| 2 | VTB | 15 322 987 010 | 15 892 668 291 | +569 681 281 | +3,72% |

| 3 | Gazprombank | 6 789 066 670 | 7 216 582 674 | +427 516 004 | +6,30% |

| 4 | Alfa Bank | 3 836 699 423 | 3 940 394 266 | +103 694 843 | +2,70% |

| 5 | Rosselkhozbank | 3 624 377 260 | 3 674 494 265 | +50 117 005 | +1,38% |

Based on the data in the table, it is obvious that the leading position in terms of the number of assets is occupied by Sberbank

. In July, this amount was 31,179,957,970 thousand rubles, in August 31,705,048,988 thousand rubles, which is as much as +525,091,018 thousand rubles. And although in percentage terms this is only +1.68%, when compared with other banks, the amount is significantly higher.

For example, let's take Rosselkhozbank

, which occupies 5th position in the ranking. At the beginning of July 2020, the structure contained 3,624,377,260 thousand rubles of assets, in August 3,674,494,265 thousand rubles. The difference in amounts amounted to 50,117,005 thousand rubles or +1.38%. In percentage terms, this is slightly lower than in Sberbank, but in terms of amounts, it is obvious that Rosselkhozbank is not as in demand as Sberbank.

What about assets in other countries?

To compare the situation in the Russian Federation with global indicators, we present a table of the top 5 largest banks in the world by consolidated assets. These are the resources of a group of interconnected organizations that are considered as a single economic entity.

| Position in the world ranking | Bank | Assets in billions of US dollars |

| 1 | Royal Bank of Scotland | 3 268 |

| 2 | Bank of Germany – Deutsche Bank | 2 954 |

| 3 | French financial conglomerate – BNP Paribas | 2 675 |

| 4 | One of the largest financial conglomerates in the UK - Barclays | 2 443 |

| 5 | French financial conglomerate – Crédit Agricole | 2 068 |

Based on the table data, it is obvious that the most popular in terms of deposits and reliability are French and English groups of companies

. These are huge financial groups represented in different countries of the world, and to whom the richest people in the world trust their money.

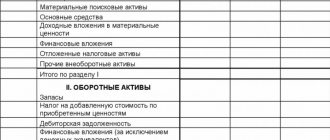

Financial balance sheet liability

Section "Equity". As mentioned above, the basic course of financial management examines the management of funds of a joint-stock enterprise. At the stage of creating a joint-stock enterprise, equity capital is equal to share capital.

The equity capital of an operating enterprise includes: 1) invested capital, including: - share capital; - Extra capital; — funds and reserves; 2) retained earnings. Article "Share Capital".

Typically, the balance sheet shows the authorized share capital and the number of shares actually issued at the balance sheet date (shares issued are treasury shares in the portfolio). Shares are reflected in the balance sheet according to their type in the items: “common shares” and “preferred shares”.

Common shares give their owners the right to vote at shareholders' meetings. Unfixed dividends are accrued on common shares, the amount and payment of which depend on the financial results of the enterprise.

What do you need to know when choosing a bank to make a deposit?

You need to focus not only on the current state of the organization’s assets. It is important to trace the dynamics of the bank in terms of the state of its property throughout the year and different periods of time. The more stable the dynamics and indicators, the more reliable the financial institution

. This means that he is not afraid to entrust his savings and he will be able to increase them over time.

Minor changes up or down are normal.

If there was a one-time reduction in assets in the dynamics, this does not indicate financial problems, this is allowed. But when did this situation become a pattern?

– it’s better to look and choose another bank.

Answers to frequently asked questions

Question No. 1. What does “total capital” mean? What does it include?

The total capital of an enterprise is its own capital + borrowed capital (i.e., the total amount of all capital that exists and is used in the enterprise). This is the name for the entire liability (balance sheet currency).

Question No. 2: Is the presence of long-term liabilities of an enterprise a positive or negative factor? What should you use to correctly characterize this situation?

They are definitely not a negative factor. Quite the contrary, their presence is actually beneficial for the enterprise, especially in light of inflationary processes. Naturally, provided that they are attracted and used rationally, in moderation and competently.