The act in form KM-3 is used to document the fact of the return of funds to the buyer. In practice, KM-3 is associated with an incorrectly entered amount, return of goods or unsold invoices.

The completed document must be accompanied by a receipt (cash or sales receipt), as well as other materials, including statements and explanatory notes from the employee. All erroneously issued checks must be marked “Canceled” and signed by either the head of the enterprise or the senior cashier. Refund checks and settlement checks are not generated for such cases.

A prerequisite for filling out KM-3 is return on the day of surgery. If the Z-report for the shift has already been withdrawn, then instead of the indicated act, an expense and cash order is filled out.

When is a certificate of return of funds to the buyer drawn up?

Situations when a buyer wants to return a purchased product arise quite often.

The possibility of such a return is provided for by the Law “On the Protection of Consumer Rights” dated 02/07/92 No. 2300-1. Before the transition to online cash registers, the procedure for the cashier and company management depended on whether the buyer paid at the cash register in cash or by card, as well as on the moment of return (on the day of purchase or later).

For more information about what requirements must be observed when working with cash, see the material “Cash discipline and responsibility for its violation .

If the buyer paid in cash and returned the goods on the day of purchase, the fact of the buyer’s return of money to the seller was formalized using the unified form KM-3, called “Act on the return of money to buyers (clients) for unused cash register receipts (including erroneously punched cash register receipts). checks)". On the check, a representative of the store administration had to put his authorization signature as the basis for issuing cash from the cash register. The check was pasted on a separate sheet and, together with the KM-3 act, was transferred to the accounting department.

ConsultantPlus experts explained in detail how to correctly process the return of goods from the buyer and return the money from the cash register. Get free demo access to K+ and go to the Ready Solution to find out all the details of this procedure.

Let's take a closer look at filling out the KM-3 form.

When to compose

The act is executed in all cases when cash receipts (for purchase) were not used, i.e. actually failed to sell the product or service. This happens in 2 cases:

- The buyer, for some reason, wished to return the product or did not use the service that he had already purchased. If the law allows for the return of goods, and if the buyer meets the return deadline, he has the right to full monetary compensation (cash or refund to a bank card, depending on the payment method).

- The cashier punched the check by mistake, and it is no longer possible to cancel the action (i.e. the check has already been printed).

We fill out the act form KM-3

Act KM-3 was drawn up in 1 copy by a commission consisting of the head of the department, senior cashier and cashier and approved by the head. It was necessary to fill out information for all canceled checks, as well as for checks returned by customers in cases where they returned goods. Cash proceeds for that day were reduced by the amount returned to customers, and an entry was made about this in the journal of the cashier-operator KM-4.

It was not necessary to draw up a KM-3 act in all cases of returning goods. If the buyer paid with a bank card, it was impossible to give him money from the cash register when returning the goods, since this direction of spending cash proceeds was not provided for by regulatory documents (clause 2 of Bank of Russia Directive No. 3073-U dated October 7, 2013 on spending cash from the cash register) . An act was not drawn up in the KM-3 form even if the goods were returned not on the day of purchase. In this case, at the request of the buyer, the return of the goods, paid for in cash, was carried out on the basis of his application from the main cash register using a cash receipt order.

Appendices to the act

As an annex to the act, it is necessary to attach an incorrectly executed check, signed by the head of the enterprise, the head of the department (section), and stamped “cancelled”. The absence of a receipt may be interpreted by a tax representative as non-receipt of the proceeds, which could result in a significant fine. In this case, certain circumstances should be taken into account in which there was a return of funds or a discrepancy between the amount of the check and the actual amount of cash in the cash register.

Example 1

The buyer did not provide a receipt to the store when returning the product or item. This situation is stipulated by the Consumer Rights Protection Law. In this case, the buyer’s statement for the return of the funds paid must be attached to the act, with a mandatory note stating that the check was lost. Upon application, the head of the enterprise issues a visa and makes a note that he agrees with the requirements and is ready to return the funds. A significant addition to the application from the buyer can be printed cash register information about the purchase, if such a technical possibility exists.

Example 2

A check with an incorrect (larger) amount was posted incorrectly:

- The cashier does not have it in stock, since it was left with the buyer who paid the correct amount;

- the unsold receipt was lost by the cashier.

A shortage at the cash register in such a situation will become an irrefutable fact, for which all responsibility falls on the cashier. However, it can be documented that money was received in full for goods sold during the day. In this case, the manager will consider it possible not to shift responsibility to the cashier-operator, taking an explanatory note from him. The KM-3 act may be accompanied by a product report and an explanatory note from the employee.

Filling out KM-3 when using an online cash register

From July 2017-2019, all sellers, with rare exceptions, are required to use online cash registers.

Read about the use of online cash registers by UTII payers in the article “Use of online cash registers for UTII (nuances).”

When using an online cash register, it is not necessary to use KM-3 when returning money to the buyer. Fiscal data that comes to the tax office from online cash desks completely replaces information from forms KM-1, KM-2, KM-3, KM-4, KM-5, KM-6, KM-7, KM-8, KM-9 (see letter of the Ministry of Finance dated September 16, 2016 No. 03-01-15/54413 (notified to the tax inspectorates by letter of the Federal Tax Service dated September 26, 2016 No. ED-4-20/18059).

When the buyer returns the goods, the seller using the online cash register, based on the buyer’s application, must issue a check with the “return of receipt” sign (see letter of the Ministry of Finance of the Russian Federation dated July 4, 2017 No. 03-01-15/42312, 03-01-15/42315 ). In addition to the check with the sign “return of receipt”, it is also necessary to issue a cash receipt order for the amount of the refund (Article 1.1, Clause 1, Article 1.2, Clause 1, Article 4.7 of the Law of May 22, 2003 No. 54-FZ, Clause 6.2 of the Bank’s instructions Russia dated March 11, 2014 No. 3210-U).

If you trade retail and use OSNO, when returning goods from a buyer, it is important to correctly reflect the transaction for calculating VAT.

The Ministry of Finance explained in detail how to do this. To do everything right, get trial access to the ConsultantPlus system and find out the opinion of officials. It's free.

For more information on issuing refund checks, read the following materials:

- “How to make a refund check in KKM online?”;

- “How to make a refund for a purchase at an online checkout?”;

What to do if there is not enough money in the online cash register is discussed in the material “[LIFE HACK] If there is not enough money in the cash register for a refund, make a “cash deposit””.

And you can learn about processing a refund for non-cash payments from the material “[LIFEHACK] We issue a refund if the buyer pays by bank transfer.”

The need for KM-3 at present

Legislation of the Russian Federation by 2021 obliges almost all businesses to switch to online cash registers, which means that the work will become more transparent, all checks through the fiscal data operator will go to the tax office, which will completely control the process of trade and services. Last year's experience showed that this innovation is quite convenient and interesting, and also reduces the number of documents to complete.

With the transition to online cash registers, a number of documents were abolished, including KM-3 and KM-4. Since it has now become much easier to obtain a refund, there is no need to draw up these acts. However, those organizations that still operate without online cash registers can use them. And those enterprises that have switched to online cash registers have the opportunity to track all transactions through an electronic platform where each check is visible, with the number, date, amount, and all complete information. You can print it out at any time. The transition to a new stage of life has become much more convenient for both cashiers and clients; anyone can visit the tax office website and track the authenticity of their check, if necessary. And you can receive a refund on any convenient day by filling out an application; the act is now optional.

Important! If there is no QR code or other details in the receipt, the receipt becomes invalid and the fact of the purchase is not taken into account, which can lead to a number of problems, such as a fine or administrative liability.

The main function of this code is that the buyer has the opportunity to check his receipt on the tax website and report to the inspectorate if violations are detected. To carry out this check, there is a special mobile application that was developed by the tax service, it is completely free and allows you to check every cash receipt. A QR check allows you to scan it using a mobile phone. Responsibility for violations in the issuance of checks

The legislation does not provide for separate fines for failure to issue a check with an error, however, for failure to issue a check in principle, either paper or electronic, a fine will follow. In this case :

1. for officials and individual entrepreneurs 2000 rubles, and the company can be fined 10,000

The term for prosecution in this case is one year.

2. When choosing a cash register, you must be guided by the requirements of the law and ensure that the cash register is included in the list of certified ones.

Results

If the seller has not yet switched to the online checkout and the buyer purchased the goods for cash, and then changed his mind and decided to return it, then the seller needs to fill out the KM-3 act.

In the case of using an online cash register, when returning money, a form in the KM-3 form may not be issued, but issuing a check with the sign “return of receipt” and cash settlement is required. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Features when drawing up a return certificate

Form KM-3 is drawn up in a single copy at the end of the work shift and before the receipt of revenue for the current day.

The return act is approved by the director of the organization or another person vested with appropriate authority, and signed by a commission, which includes:

- head of the enterprise (or entrepreneur);

- Department head>;

- senior cashier>;

- cash register operator issuing a refund.

If there were several cases of returned or erroneously issued checks within one business day, all of them must be indicated in one report. A separate KM-3 form is not compiled for each case.

Entering data into the columns of the KM-3 form

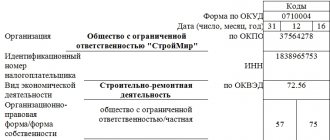

The form header indicates:

- name and details of the organization (or its structural unit);

- information about the cash register (manufacturer, model, registration number);

- surname and initials of the cashier who issues the return.

The table of the act includes the numbers and amounts of each individual check for which the goods were returned, as well as the position and full name of the authorized employee of the enterprise who issues permission to the cashier, accepting responsibility for the fact of the return of the amount of money.

Form KM-3 can be filled out either by hand or using a computer type.

Answers to common questions

Why is the KM-3 form necessary?

This act is used if the client wishes to return the money for the purchased goods or the cashier made a mistake and knocked out an erroneous receipt. However, there are a number of nuances that must be kept in mind; in every case, this document is required. If the cashier finds a discrepancy with the receipt or the date is inappropriate, and also if the boss’s approval for the return has not been received.

What documents need to be attached to the deed?

When registering KM-3, you must take from the buyer a receipt for the purchase, an application for a refund, and if the receipt is lost, an explanation of how it was lost. Then from the program you need to print this receipt from the seller.

Form of act when returning money from the cash register

Tax risks

Please note that the presence of a statement or claim from the buyer may become the basis of evidence in a dispute with tax authorities.

In practice, controllers may consider procedures for issuing monetary compensation in favor of buyers to be unreasonable. In this situation, tax authorities increase the amount of revenue per shift by the amount of the refund and adjust the tax base accordingly.

It is especially important for business entities using the simplified tax system to insure themselves with a statement from the buyer, so that as a result of a dispute with tax authorities, a situation with a double offense does not arise:

1. Artificially lowering the tax base.

2. Exceeding the income limit under the special regime as a result of changes in the calculation base by inspectors.

The legislative framework

A certificate of return of money to the buyer is drawn up as confirmation of the transfer of these funds. The document can be drawn up in free form, but subject to a number of necessary requirements.

If the company independently develops the form of this document, then its form must be approved in the accounting policy. The procedure for drawing up the act is contained in the following regulatory documents:

- Instructions for the use of primary accounting documentation through cash register (Goskomstat Resolution 132);

- Operating rules for cash register machines (approved by the Ministry of Finance No. 104);

- Instructions of the Bank of Russia “On making cash payments.”

In what cases can the seller refuse to return

The retailer may refuse to return the consumer if the following conditions are not met:

- Return deadlines have been violated.

- If the item has been used and does not have a presentation, labels, labels (in case of returning a quality product).

- The product is included in the list of non-returnable goods.

- If the food product is of good quality. Products can only be returned if they are of poor quality or expired.

Attention! Due to recent changes in legislation, the legal information in this article may be out of date!

Our lawyer can advise you free of charge - write your question in the form below:

Return deadlines

Products of proper quality must be returned within two weeks . Refunds are made within three days.

Defective products can be returned within the warranty period or expiration date. Funds are transferred within 10 days.

Expert opinion

Yulia Volkova

Lawyer, ready to answer your questions

Ask me a question

Products included in the list of non-returnable goods are accepted only during the warranty period if defects are detected. It cannot be returned if the product is of high quality.