Contents of the reporting form liability

The asset reflects data on the enterprise's property assets, monetary resources and material reserves. This block of information shows what the company actually has.

In turn, the liability side of the balance sheet reflects information about the sources of formation of the enterprise’s property base. All liability sections systematize data on sources of financing, short-term and long-term obligations.

The balance sheet form has been approved by the Ministry of Finance. Its current template is given in the order dated 07/02/2010 under No. 66n. Structurally, the passive consists of three sections:

- Capital and reserves.

- Long-term liabilities.

- Short-term liabilities.

All sections are detailed by lines. Each indicator is assigned an individual code.

Such important “other” indicators

In the introduction to his remarkable work “Comprehensive Analysis of Economic Activities” ([1]) A.D. Sheremet, quoting the French professor Jacques Richard, well known to our readers, writes: “For a long time in the West, and even now, the analysis of the economic activity of an enterprise was often limited to an analysis of the financial condition, that is, it was mainly reduced to the study of the profitability and solvency of the enterprise. A Russian reader, - Anatoly Danilovich continues to quote Jacques Richard, - who wants to buy books on economic analysis of enterprise activities in the USA or France, will not find them: but he will find there an abundance of publications on the analysis of financial activities, which, using similar schemes, enthusiastically interpret profitability and solvency, devoting a very modest place to the study of other indicators for assessing the results of an enterprise’s economic activities” ([1], p. 7).

One of the most important groups of this kind of “other” indicators for assessing the state of affairs of organizations, the information basis for which is their financial statements, are indicators for assessing the structure of funding sources. Thus filling the gap noted by J. Richard, the German author of the work “Enterprise Economics”, which has survived 15 editions, Professor H. Schierenbeck, classifies “vertical indicators of the capital structure” as the most important when analyzing the balance sheet for the purposes of company management.

Author about ([2], p. 741).

Getting acquainted with the methods of analyzing accounting data on company liabilities should begin with becoming familiar with the purposes for which such analysis is carried out. In other words, we need to understand what information the accounting data about the company's liabilities may contain.

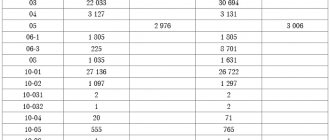

Strings

The information block dedicated to capital and reserve funds formed by the enterprise contains the following lines:

- code 1310 designates a group of articles for accounting of authorized capital;

- code 1320 is represented by the size of the company’s own shares, which were purchased from shareholders during the reporting period;

- 1340 – this line indicates information based on the results of the revaluation of assets with a long period of operation (non-current assets);

- 1350 – column to reflect the amount of additional capital without taking into account revaluation;

- in line 1360 enter data on the amount of reserve capital;

- in cell 1370 the amount of retained profit is entered, and in its absence - uncovered losses.

The company can provide explanations for different types of capital. The list of indicators that need clarification and the degree of detail of the enterprise are determined independently.

For long-term liabilities of business entities, the following categories of indicators are grouped in the liabilities side of the balance sheet:

- borrowed resources that were registered by the enterprise (line 1410) - it is necessary to decipher their composition in the explanations to the balance sheet form;

- the amount of deferred tax liabilities corresponds to the credit balance in account 77 and is given as one number in column 1420;

- 1430 – line in which all estimated liabilities must be reflected;

- 1450 - this line summarizes other types of obligations that have signs of long-term duration, but are not included in other articles of the section.

For all types of long-term liabilities, a total is summed up and the result is entered in line 1400.

Current liabilities in the balance sheet are divided into 5 groups of indicators:

- a separate line is allocated for borrowed funds - the amount is taken from the credit balance of account 66, the data is indicated in balance sheet line 1510;

- accounts payable with a maturity of less than 1 year should be shown as one amount in line 1520 (in addition, a detailed explanation of the structure of this indicator must be provided in the notes to the report);

- on line 1530 indicate income related to future periods;

- cell code 1540 is for estimated liabilities;

- The last element of the section is line 1550, which combines all types of short-term liabilities that are not reflected in other categories.

The total amount of short-term debt is given in line 1500.

Liabilities are divided into short-term and long-term according to the duration of their full repayment: if the debt must be closed in a period of less than 12 months, then it is short-term. Provided that the loan can be repaid over a period of 1 year or longer, it is classified as long-term.

Read also

30.06.2018

An example of constructing a balance sheet

LLC "Horns and Hooves" as of January 1, 2021, has the following assets and liabilities:

- intangible assets - 100 thousand rubles;

- fixed assets - 200 thousand rubles;

- stocks of materials and goods - 300 thousand rubles;

- accounts receivable from customers - 250 thousand rubles;

- money in current accounts and at the cash desk - 150 thousand rubles;

- authorized capital - 400 thousand rubles;

- retained earnings - 50 thousand rubles;

- long-term loan debt - 200 thousand rubles;

- accounts payable - 350 thousand rubles.

The balance sheet of Horns and Hooves LLC looks like this.

By the way, in the online accounting “My Business” the balance sheet is generated automatically based on the balances of the accounting accounts. At the same time, the system checks control ratios and compliance of data for previous years with submitted reports. If something doesn’t add up, she will alert the accountant about it. Try it - it's convenient and saves a lot of time!

About assets in simple words

Assets are the totality of all property, property rights that are the property of the enterprise, which have undergone appropriate assessment and are put on the balance sheet. This includes means of production and fixed assets (fixed assets), accounts receivable and everything that may constitute the overall property picture of the organization.

An asset cannot be negative, since these are real available funds for conducting business activities. They can be counted, measured or weighed because they have a quantitative basis.

Question: Is the value of assets that are not subject to VAT included in the VAT tax base when selling an enterprise (clause 1 of Article 158 of the Tax Code of the Russian Federation)? View answer

The most reliable assets are those that can easily be converted into cash without a serious loss of value. Therefore, these assets are called liquid :

- cash,

- finished product inventories,

- short-term investments and more.

How to calculate net assets ?

Accordingly, illiquid assets can be called those property that acquires a monetary form with a very significant loss of current value or can be repaid only after a long time:

- means of production,

- fixed assets,

- overdue debts of debtors, etc.

Using assets, the management of an enterprise can receive benefits, control them, and direct them in the right direction in order to increase the level of financial flows.

The company needs financial stability

V.V. sees the task of assessing the structure of liabilities and the possibility of analyzing it more broadly. Kovalev and Vit.V. Kovalev. Defining this area of accounting data in general as an analysis of financial stability ([12], p. 279), they write that “the indicators of this section of the analysis allow us to obtain some answers to questions related to the system of financing the company’s activities, in particular: 1) what is the structure of funding sources; 2) whether the company is able to maintain such a structure; 3) what changes in the financing system took place during the reporting period; 4) whether the existing and target structure of sources correspond to each other” ([12], p. 279).

“Financial stability,” the authors note, “understands the ability of an enterprise to maintain the target structure of funding sources. ...Attracting borrowed funds is profitable,” they continue, “but up to certain limits. There are no strict recommendations in this direction, and therefore, over the years, each company develops its own idea of the optimal structure of funding sources, which is called the target structure. ...The above reasoning,” they emphasize, “allows us to draw the following conclusion: from a long-term perspective, both the enterprise itself and any persons interested in its activities must monitor, firstly, the state of the structure of funding sources and the changes occurring in it and, secondly , the ability of the enterprise to maintain this structure” ([12], pp. 279–280).

Asset valuation

During this procedure, the value of the organization’s funds – tangible/intangible assets – is determined. It is used when developing strategies for the development of a company, its purchase and sale or reorganization, determining creditworthiness and other operations.

The procedure is preceded by the collection of information about the enterprise and the prospects for its further development, the study of financial reports, and a qualitative market analysis. Three methods are used for assessment:

- costly – considers the cost of assets as the costs incurred by the enterprise to maintain normal operations.

- comparative – allows you to determine the value of fixed assets by comparing similar ones on the market.

- profitable – determining the value of profitable assets and prospects for their development.

Valuation must be carried out as accurately and efficiently as possible, which requires experienced specialists who can foresee every factor that can affect the value of assets.

long term duties

Long-term liabilities are the organization's debts to other participants in economic turnover, the repayment of which occurs more than 12 months from the date on which the statements were prepared. They include a number of articles:

| Line | Long-term liability item |

| 1410 | Borrowed funds |

| 1420 | Deferred tax liabilities |

| 1430 | Estimated liabilities |

| 1450 | Other obligations |

Amortization of intangible assets

Depreciation is understood as the gradual transfer of parts of the cost of intangible assets to the finished product during the use of intangible assets in the production processes of the enterprise. There are three ways to calculate depreciation:

- linear – repayment in equal parts based on the original cost of the intangible asset and the indexation coefficient.

- reducing balance method - determining the annual write-off amount based on the remaining value of assets at the end of the reporting period, as well as depreciation rates;

- write-off of value is proportional to the volume of production - accrual is made based on the ratio of the initial cost of assets to the volume of the final product during their use, taking into account the quantitative indicator of finished products for the reporting period.

REFERENCE. Depreciation is not charged on intangible assets received free of charge or the value of which becomes higher over time or does not change.