The movement of material assets in the territories of KFU is carried out according to the invoice for the internal movement of fixed assets f. OS-2, which is used when transferring fixed assets from one materially responsible person to another within an institution or with centralized accounting - from one institution to another, in accordance with the established procedure in accordance with Instruction of the Ministry of Finance of the Russian Federation No. 2 107N dated December 30, 1999.

To export (remove)/import (bring in) material assets you must:

- Fill out the memo (sample).

- Sign the memo in the department of accounting of material assets of the Department of Accounting and Reporting of KFU.

- Submit the memo to the reception of the director of the Department for Internal Regime, Civil Defense and Labor Safety of KFU.

- On the appointed day, receive a memo endorsed by the Director of the Department.

- When removing (exporting) / bringing in (importing) material assets, present a memo to the security officer.

Employees of the maintenance and repair units of the chief engineer's service who carry out maintenance and repair of utility networks have the right to remove (bring in) tools, instruments, and consumables without special permission.

For employees providing support for the information and telecommunications infrastructure of KFU, on the basis of a memo from the head of the relevant structural unit, agreed with the director of the Department, the Service issues passes for the export (removal)/import (input) of material assets for a period of 30 days to 1 calendar year. The pass indicates: structural unit, name of imported (brought in)/exported (taken out) items, (type) brand, serial/inventory numbers, validity period ().

Export (carrying out)/import (bringing in) material assets according to oral orders is not allowed!

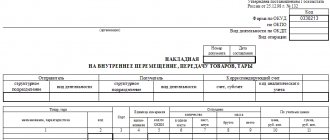

Form OS-2. Invoice for internal movement of fixed assets

The invoice for the internal movement of fixed assets, form OS-2, is intended to document the actual movement of any fixed assets of the organization. This can be interaction between workshops, sections, departments. The main thing is that both sides of the process (receiving and receiving units) belong to the same company.

FILES

The fixed assets of an organization may include buildings, various equipment, machines, instruments, computer equipment, inventory, various tools, livestock, etc. All this may well be transferred from one workshop or site to another.

If the useful life of different parts of one building is different, then it is worth dividing it into two independent objects and describing it separately.

Filling algorithm

The invoice is filled out on both sides. It consists of a header on the title side, a table of seven columns that continues on the reverse side, as well as a place for a brief description of the transferred object and signatures of the responsible persons.

In the upper right corner of the title part of the document there is a link to the Decree of the State Statistics Committee of 2003, which approved this form as mandatory. After 10 years, it became a recommendation, but its use continues.

At the top of the invoice, the OKUD and OKPO forms and the name of the company within which the movement takes place are indicated. The unit from which the object is being withdrawn is indicated first (it is called the “delivery”). The recipient department is indicated below.

Attention! The invoice must be filled out by the delivery department.

After the names of the departments, the name of the document, the date of preparation of the paper and the assigned number are written.

Below is a table with:

- number;

- a description that includes the date of manufacture (or construction), full name, inventory number;

- number of transferred objects in pieces;

- cost;

- results.

After the table, space is left to describe the object, its technical and other characteristics. When filling out, these lines cannot be left blank.

You can mention the condition (good, excellent, satisfactory), existing defects (scuffs, chips, etc.), and describe the packaging. If warranty cards or instructions are included, these are also included.

At the end there should be signatures (deciphered) of the persons who made the delivery and acceptance. The fact that information about the movement was entered into the accounting book is confirmed by the chief accountant (or simply the accountant who carried out the data transfer).

Important! When putting signatures, mentioning the positions of persons is mandatory.

Form and details of the invoice

Each invoice is drawn up in accordance with the requirements of the law, however, there are details that must be present in each document:

- Name of the organization and number of the structural unit transferring the value or full name of the responsible person. Here you will learn how to correctly draw up an act of acceptance and transfer of material assets;

- Company details;

- Date and place of compilation;

- Name and number of the document;

- The basis for its compilation;

- Information about the object - name, quantity, cost of one unit and total cost;

- Signatures of persons are required; without this, the document is not valid.

Nuances of filling

Rows in the table should not be left empty. If a document is generated electronically, then unfilled sections of the document are simply deleted. If the paper is already printed, they are crossed out. Corrections to the invoice are not recommended. But if a mistake was made, it is corrected by a longitudinal strikethrough and the inscription “Believe the corrected one.” Moreover, next to this inscription there must be signatures of all persons who are also signed at the end of the document: the chief accountant, the handing over and receiving persons.

Is it possible to change graphs?

All this data is necessary for maintaining full-fledged accounting and warehouse records in the organization. Since 2013, this form has ceased to be mandatory. It became only advisory, in accordance with the law “On Accounting” dated 06.12.2011 No. 402-FZ.

At its own discretion, the organization has the right to refuse some columns of the primary document or add new ones. However, all these changes must be documented and have good reasons.

In short, the form is widely used today because it is convenient, illustrates the maximum amount of information and does not confuse regulatory authorities when conducting inspections and audits.

How many copies will be required?

The invoice must be filled out in at least 3 identical copies. This is done so that one invoice remains with the accountant (or the employee performing his duties) for the generation of further reporting. The second paper must be kept by the employee responsible for it for a specific facility. And the third option must be provided to the receiving party as confirmation of the verified fact. Ideally, all 3 invoices have 3 signatures of employees who are financially responsible.

In what cases is it issued?

A change in responsible employees can occur for many reasons.

Reasons for changing the MOL:

- departure of a financially responsible person from the enterprise at his own request or his dismissal by management;

- long period of incapacity;

- departure of a specialist on company or personal business;

- neglect of one's duties;

- poor safety of entrusted property.

Control

If during the inspection it is discovered that the object is under the jurisdiction of one division, but is registered with another, then the organization will face administrative liability in the form of a fine.

If a violation is detected for the first time and it does not lead to an understatement of taxes, then the company can get off with a fine of 5 thousand rubles.

If during the audit it is discovered that there is no invoice for the movement of fixed assets, form OS-2, and this fact will underestimate the taxes due from the organization, then less than 15 thousand rubles. There is no penalty for such a violation. Moreover, an amount of 10% of the total tax not paid for this reason may be assigned (but this amount will still not be less than 15 thousand rubles).

simplified tax system

The tax base of simplified organizations that pay a single tax on the difference between income and expenses, the costs of moving are reduced, provided that they are listed in Article 346.16 of the Tax Code of the Russian Federation. For example, when calculating a single tax, you can take into account:

- materials (for example, gasoline) used when moving fixed assets (subclause 5, clause 1, article 346.16 of the Tax Code of the Russian Federation);

- salaries of employees involved in the movement of fixed assets (subclause 6, clause 1, article 346.16 of the Tax Code of the Russian Federation);

- transport services of third-party organizations for the movement of fixed assets (subclause 5, clause 1, article 346.16 of the Tax Code of the Russian Federation).

Reduce the tax base as expenses for moving fixed assets arise and are paid (clause 2 of Article 346.17 of the Tax Code of the Russian Federation).

The tax base of simplified organizations that pay a single tax on income is not reduced by expenses for moving fixed assets (clause 1 of Article 346.14 of the Tax Code of the Russian Federation).

What is the OS-2 form intended for?

An invoice in the OS-2 form is issued at the site from which the internal movement of fixed assets is carried out. The information contained in this invoice is subsequently used to fill out the inventory book (forms OS-6, OS-6a and OS-6b) or a card issued for this transported object.

Read about the design of these forms in the articles:

- “Unified form No. OS-6 - form and sample”;

- “Unified form No. OS-6a - form and sample”;

- “Unified form No. OS-6b - form and sample.”

Why do you need accounting?

Act OS-2 allows you to control the movement of fixed assets within the organization.

If a fixed asset is transferred to another department for permanent use, on the basis of the OS-2 act, the fixed asset is written off from the account of one financially responsible person and assigned to another employee.

Information about the movement of fixed assets is entered into inventory cards for recording fixed assets in the form OS-6, OS-6a or into the inventory book OS-6b (for small enterprises).

taxobzor.info

See also:

The procedure for completing the OS-2 form

The invoice in form OS-2 is issued in 3 copies, one of which is intended for the accounting service, the second remains with the person responsible for the safety of the moved object, and the third is issued for the recipient of the property.

Each copy of the invoice for the movement of assets (OS) within the company must be signed by the deliverer and the recipient, who are financially responsible for the property.

In accordance with the Law “On Accounting” dated 06.122011 No. 402-FZ, since 2013, unified forms, including the OS-2 invoice, are no longer mandatory for use - they are only recommended for use. This means that each company can develop its own form based on the OS-2 form.

Where is OS-2

The invoice form for internal movements of funds was approved by State Statistics Committee Resolution No. 7 dated January 21, 2003. You can download its form on our website.

You can also download a completed sample of this document from us.

Reasons for transferring an object within an organization

The decision on the need for internal movement of fixed assets within one owner can only be made by the management of the enterprise.

Important! Funds can move between structural divisions, workshops, areas, etc.

In turn, the management of the department into which the funds fall has the right to distribute them within the association.

The following circumstances can be considered the main reasons for the internal movement of operating systems:

- the need for repairs, reconstruction or modernization;

- the need to transfer fixed assets to a subsidiary (branch), for which a separate balance sheet is allocated;

- the need to transfer OS objects to another department.

BASIS: VAT

When moving a fixed asset on your own (i.e., without involving a third party), there is no obligation to charge VAT. This is explained by the fact that VAT is charged when performing operations (providing services) to divisions of the organization (subclause 2, clause 1, article 146 of the Tax Code of the Russian Federation, letters of the Ministry of Finance of Russia dated June 16, 2005 No. 03-04-11/132 and the Ministry of Taxes of Russia dated January 21, 2003 No. 03-1-08/204/26-B088). The movement of fixed assets does not apply to such work (services).

Input VAT on materials (work, services) used in the internal movement of fixed assets should be deducted in the usual manner (paragraph 1, clause 5, article 172 of the Tax Code of the Russian Federation). That is, after registration of the specified materials (works, services) and in the presence of an invoice (clause 1 of Article 172 of the Tax Code of the Russian Federation). The exception to this rule is when:

- the organization enjoys VAT exemption;

- the organization uses the fixed asset after the transfer only to perform VAT-free transactions.

In these cases, input VAT is included in the cost of materials (work, services) used when moving the fixed asset. This procedure follows from paragraph 2 of Article 170 of the Tax Code of the Russian Federation. In addition, in the latter case, input VAT on the residual value of the fixed asset must be restored (clause 3 of Article 170 of the Tax Code of the Russian Federation).

If an organization uses a fixed asset to perform both taxable and non-VAT-taxable operations, distribute the input tax on the cost of materials (work, services) used in its movement (clauses 4 and 4.1 of Article 170 of the Tax Code of the Russian Federation).

How to transfer to another financially responsible person within the same owner?

A financially responsible person is considered to be a working citizen whose professional activity involves interaction with company property.

The employee is responsible for its safety, damage and condition, and in case of problems, he compensates the employer for the damage caused.

In order to transfer property under the responsibility of another financially responsible person, it is necessary to carry out several actions.

First of all, you need to take an inventory. The results of the procedure are properly documented.

During the event, the exact quantity of fixed assets and their main characteristics, including condition, are determined.

Both material persons—current and future—as well as members of a specially created commission take part in the inventory.

Next comes the execution of contracts. In this case, there are several of them - about the change of the financially responsible person and about the responsibility assigned to him.

Order to change MOL.

Compiled upon completion of the inventory. The document contains information about employees, as well as fixed assets.

A note is also made on the exact date from which responsibility for the property is transferred to another employee.

Order to transfer OS to another MOL.

Please note that documentation of this nature is quite important. However, there is no standardized form for filling it out.

When issuing an order, the management of the enterprise must comply with certain rules regarding the content of the paper.

If you have a form developed by your company for creating such documents, you can use its sample.

The following information is required to be reflected:

- date of registration;

- serial number;

- full company name;

- the reason why there was a need for internal movement of fixed assets;

- information about the inventory carried out;

- information about financially responsible persons;

- appointment of commission members.

At the end of the order there must be a signature of the chief manager of the enterprise or his deputy.

In addition, when transferring fixed assets to another financially responsible person, the latter draws up a special receipt.

It acts as agreement with the information obtained during the inventory. It also indicates that the new MOL has no claims against the commission members.

There is a corresponding section in the inventory list for registering a note.

A change in the financially responsible person may be due to several factors. Among these, the following should be highlighted:

- dismissal;

- registration of long-term sick leave by the current MOL;

- going on a business trip;

- damage to property, its damage, etc.;

- other unfavorable circumstances.

What documents need to be completed for internal OS movements?

It was previously stated that the movement of OS within an organization must be accompanied by the preparation of special documentation, which must be drawn up properly.

If the established rules are violated, the employer may have problems with inspection authorities.

In this case, several documents must be drawn up - an invoice and an order.

Previously, instead of the first paper, an OS acceptance certificate was used.

At the moment, it is necessary to issue an invoice for internal movement. For this purpose, the unified form of the OS-2 form should be used.

The order can be drawn up in free form, taking into account the generally accepted rules of the company.

Also, marks about the movement of OS within the same owner are placed in the inventory books. Changes are made to section 4 of cards.

Sample order for the transfer of property from one MOL to another

To issue an internal movement order, you do not need to use a unified form. It is enough to adhere to the document management rules used in the company.

The order must contain the following information:

- full name of the paper;

- place and date of issue of the order;

- document's name;

- information about fixed assets transferred within the organization - quantity, cost and other characteristics;

- the name of the divisions in which the fixed assets were previously located and where they are located;

- a note about the persons responsible for the movement;

- a note about the person responsible for executing the order;

- signatures of persons who have read the order.

The chief manager of the enterprise is in charge of processing the order. Without his signature, the document is considered invalid.

order on the internal movement of fixed assets between financially responsible persons - word.

How to issue an invoice to move an asset between financially responsible persons?

An equally important document that must be drawn up when moving fixed assets within the company is the invoice. When filling it out, you should adhere to the unified form of the form - No. OS-2.

The documentation is prepared in 3 copies. The first is intended for the person responsible for the movement, the second for the party receiving fixed assets, and the third for the company’s accounting department.

At the top of the invoice information about the enterprise is displayed:

- name of company;

- information about the OS sender and receiver;

- OKUD form;

- OKPO code.

Next is the paper number and the date of its preparation. The next part of the invoice looks like a table. It consists of 7 columns.

The name of each column should reflect the following meaning:

- serial number of the fixed asset;

- OS name;

- date of acquisition of property;

- inventory serial number;

- number of units;

- the cost of each object;

- the total cost.

If necessary, marks about the state of the OS are placed after the table. There are special lines for this - Notes.

At the end, information about the employee who passed the OS and the employee who accepted them is indicated. A note is made to make changes to the books of fixed assets. The chief accountant also leaves his signature.

invoice for the internal movement of fixed assets from one MOL to another – word.

Equipment acceptance certificate - Sample and form 2021

It does not matter for what reason the equipment is transferred between companies, this procedure must be documented in the appropriate act. It is worth noting that the transfer act is not an independent document. It cannot be issued separately. This is only an annex to any agreement.

There are situations when a third party takes part in the transaction. She additionally confirms that one company gave and the second accepted the equipment.

Also, with his signature, the third party confirms in what quantity the equipment was transferred, whether it meets technical standards, and whether it has the proper quality.

Form of the act

The law does not provide for the mandatory use of a unified form when drawing up this act. That is why many companies use a free style when composing. The document is drawn up as an addition to any agreement. This could be a sale, gift or rental transaction. Some organizations develop special templates for these purposes.

In many ways, the structure of the act depends on the functional characteristics of the organization. For example, complex equipment may be subject to transfer, which must first be checked and test run. In this case, the results of all preliminary tests must be displayed in the document.

What is an act of acceptance and transfer of equipment?

After any transaction is made between organizations related to a change in the location of equipment, this fact must be documented. Naturally, both parties must have copies of the act. By signing the act, the recipient documents that he has received the equipment.

If necessary, a note is made that the device is working and meets all standards. There are situations when, after inspecting the equipment, or during its test run, some minor malfunctions are discovered. Detailed information about them also needs to be included in the act. In this case, the recipient indicates that he agreed to accept the equipment in this condition.

Often this document is used in legal proceedings.

However, it is not always possible to use a free style when drawing up an act. In certain situations, unified documents are used:

- OS-14 is issued when there is a need to keep records of devices transferred to the warehouse. In this case, the device acquires the status of a fixed asset, entering the balance sheet of the enterprise;

- OS-15 is compiled when the device is transferred for installation. The form is intended to record the fact of such transfer;

- OS-16 is issued when defects and malfunctions were identified during configuration, testing or installation of equipment.

Rules for drawing up an equipment transfer acceptance certificate

Despite the fact that the law allows you to fill out this act in a free style, you still need to indicate important data here. This includes details of both companies. It is also noted which employees represent the interests of the company in this transaction.

The same data that is specified in the contract or agreement is noted. All information must match exactly. Even a mistake in one letter can cause trouble. There are cases when the name of the supplier was misspelled in the act.

As a result, it turns out that according to the contract, the equipment was purchased from one company, but the act states that it was received from another company.

When describing equipment, it is necessary to indicate its brand, manufacturers, cost, serial numbers and other information. It is worth paying attention not only to how the device looks externally. The technical condition is also important. After drawing up the document, it must be certified by the managers of the enterprises between which the transaction was made.

https://www.youtube.com/watch?v=xYOfchPFVH8

Usually two copies of the document are made. But there are situations when third parties are involved in the transaction. If they are interested, the number of copies can be increased. Naturally, all copies are signed by the parties to the transaction. When a fairly complex device is to be transferred, technical documentation is often transferred along with it. Of course, this fact should also be included in the document.

The following information is extremely important:

- Details of the parties;

- Full names of managers and their positions;

- List of transferred equipment. The included components, status data, and additional parameters are recorded;

- The number of copies of the document depends on the number of parties participating in the transaction.

When transferring a complex device, its technical condition is determined by a specialized specialist. Quite often you may encounter a situation where a large number of devices and equipment are subject to transfer.

Moreover, they can be indicated not only in the act, but also in a separate document. It will become an annex to the act, which will describe the transferred objects in as much detail as possible.

Naturally, company managers must certify such an application with their signatures.

How to draw up an equipment transfer acceptance certificate in 2021

- The “header” of the act must contain the full title reflecting the essence of the document. It also contains information about the city in which the act was drawn up. The date is noted.

- Below is information about the parties, their representatives and responsible persons.

- Indicates that the device was indeed transferred. The agreement that became the basis for the execution of the act is noted.

- Next, the transmitted device, its characteristics and other information are indicated.

They often write that the recipient is completely satisfied with the quality and condition of the equipment. - Force majeure situations can be prescribed.

- It is noted how many copies this document has.

- The final stage is the affixing of signatures.

The parties thereby confirm that they fully agree with the information provided.

Certificate of acceptance of the transfer of equipment for rent

When the transfer of a device is carried out under a rental agreement, force majeure situations are specified in the act.

For example, if equipment breaks down or is destroyed, the tenant undertakes to restore it at his own expense. It is in the interests of the recipient to describe the technical condition of the device in as much detail as possible in the document.

After all, the lessor will demand the equipment back in exactly the condition in which he handed it over.

Immediately before signing the document, it is recommended to carefully check whether the tenant actually received the equipment referred to in the document. Do not forget that after the act is signed, all responsibility for the serviceability of the equipment falls on the tenant. And he will be obliged to compensate for damage caused to the equipment during operation.

Sample

Certificate of acceptance and transfer of equipment for repair

When equipment is submitted for repair to a supplier or other third party, it is recommended that a corresponding certificate be issued.

This document will always allow you to prove that one company actually transferred the equipment to another company for repair and examination. This act can be drawn up not only between organizations.

The parties here can also be individuals, and the object of the transaction can be equipment used in everyday life.

Sample

Certificate of acceptance and transfer of equipment upon sale

Frequent transactions between companies include the purchase and sale of devices and various equipment. However, such a document only indicates an agreement between the parties. And the corresponding act allows you to confirm the fact of transfer. It is this that will become an annex to the already drawn up agreement. There are usually two participants in a transaction.

However, with mutual consent, a third party can be involved in the transaction. This is usually done when transferring complex and expensive equipment. It is also necessary to remember that if the deed is not signed by one of the parties, it is not considered valid.

If a controversial situation arises between the parties to a transaction, a document without signatures cannot be used as a supporting document.

Sample of equipment acceptance certificate for sale

and the act form in 2021

Source: https://aktinfo.com/akt-priema-peredachi-oborudovaniya-obrazets/

INTERNAL MOVEMENTS IN BUDGET ACCOUNTING

I.V. Artemova, chief accountant, consultant

Internal movements of fixed assets, intangible assets, and inventories are reflected in a number of cases. This may be a transfer for use, transfer of property to another group, or repurchase of leased property. Changes have recently been made to the accounting treatment of such transactions in budget accounting. In addition, when reflecting internal movements from January 1, 2021, it is necessary to take into account the federal accounting standards that have entered into force.

Types of movements

In some cases, the movement of non-financial assets does not lead to their writing off from the account in which they were recorded, but requires the reflection of internal movement. These types of movements include movements:

| — | between employees and departments; |

| — | temporary issuance outside the institution without removal from the balance sheet; |

| — | between property groups; |

| — | when purchasing leased property. |

Fixed assets

In accordance with paragraph 7 of the Instructions for budget accounting, approved by order of the Ministry of Finance of Russia dated December 6, 2010 No. 162n (hereinafter referred to as Instruction No. 162n), the internal movement of fixed assets between financially responsible persons in the institution is reflected as follows: Debit of account 0 101хх 310 “Fixed assets » Account credit 0 101хх 310 “Fixed assets”. In the current edition at the time of submission of the journal Instructions for the Application of the Unified Chart of Accounts, approved by Order of the Ministry of Finance of Russia dated December 1, 2010 No. 157n (hereinafter referred to as Instruction No. 157n), transactions for the transfer and return of a tangible object of non-financial assets for free or paid use are reflected in the corresponding accounting accounts non-financial assets through the internal movement of an object while simultaneously reflecting on an off-balance sheet account the transferred or received object at its book value. The movement is reflected on the basis of the primary accounting document (act) (clause 33 of Instruction No. 157n). Let us recall that last year, changes were made to Instruction No. 162n by Order of the Ministry of Finance of Russia dated October 31, 2017 No. 172n (hereinafter referred to as Order No. 172n<*>). Order No. 172n brought Instruction No. 162n into line with the current edition of the more “general” Instruction No. 157n.

<*> Order No. 172n was registered with the Ministry of Justice of Russia on November 24, 2017 under No. 48998. A similar accounting entry (on the debit and credit of account 0 101хх 310), according to the new edition of paragraph 7 of Instruction No. 162n, reflects the transfer of property for rent, gratuitous use, trust management, storage. At the same time, information about fixed assets that are leased, gratuitously used, in trust management or in storage is reflected in the structure of the corresponding groups (types) of non-financial assets in the corresponding off-balance sheet accounts of the Working Chart of Accounts of the accounting entity. According to paragraphs 381, 383 of Instruction No. 157n, in order to control the movement and safety of transferred property, it is reflected on the balance sheet on account 25 “Property transferred for paid use (rent)” or account 26 “Property transferred for free use.” Let us also recall that by order of the Ministry of Finance of Russia dated December 31, 2016 No. 258n, the federal accounting standard for public sector organizations “Rent” (hereinafter referred to as Standard No. 258n) was approved, which came into force on January 1, 2021. The Ministry of Finance of Russia sent Guidelines on the transitional provisions of Standard No. 258n for the first application (letter dated December 13, 2017 No. 02-07-07/83463) and Guidelines on the application of Standard No. 258n for public sector organizations (letter dated December 13, 2017 No. 02- 07-07/83464).

Accounting: the division is allocated to a separate balance sheet

If the recipient division is allocated to a separate balance sheet, then when moving the fixed asset is written off from the balance sheet of the organization's head office. For settlements with a separate division, use account 79-1 “Settlements for allocated property” (Instructions for the chart of accounts).

In the accounting of the head office of the organization, you need to make the following entries:

Debit 79-1 Credit 01 (03) – reflects the transfer of fixed assets to a unit allocated to a separate balance sheet in the amount of the original (replacement) cost;

Debit 02 Credit 79-1 - reflects the transfer of fixed assets to a division allocated to a separate balance sheet for the amount of accrued depreciation.

In the accounting of a division allocated to a separate balance sheet, the receipt of fixed assets from the head office of the organization is reflected by the following entries:

Debit 01 (03) Credit 79-1 – the initial (replacement) cost of the fixed asset transferred from the head office of the organization is taken into account;

Debit 79-1 Credit 02 – the amount of accrued depreciation on fixed assets transferred from the head office of the organization is taken into account.

Using account 79-1 does not change the balance sheet currency for the organization as a whole. The fact is that separate divisions are not legal entities and do not generate separate financial statements (Clause 3 of Article 55 of the Civil Code of the Russian Federation, Article 2 of Law No. 402-FZ of December 6, 2011). The balance sheet and other forms of reporting are prepared by the head office of the organization, taking into account indicators for all divisions, including those allocated to a separate balance sheet (clause 8 of PBU 4/99). Account 79-1 is an account for intra-company settlements and, in general, according to the organization, the balance on this account should always be zero (Instructions for the chart of accounts).

An example of reflecting in accounting the receipt of property by a separate division of an organization allocated to a separate balance sheet

OJSC "Proizvodstvennaya" is engaged in the production of artificial leather. “Master” has a separate division allocated to a separate balance sheet. To carry out its activities, this division received from the “Master” a machine that the “Master” had previously used in production.

The initial cost of the fixed asset is RUB 2,500,000. Accumulated depreciation – RUB 500,000. The accountant of the separate division continued to calculate depreciation at the rate calculated in the head office - 25,000 rubles.

In the accounting of the head office, the accountant reflected the transfer of property as follows:

Debit 79-1 Credit 01 – 2,500,000 rub. – the transfer of fixed assets to a unit allocated to a separate balance sheet is reflected in the amount of the original cost;

Debit 02 Credit 79-1 – 500,000 rub. – the transfer of fixed assets to a unit allocated to a separate balance sheet is reflected in the amount of accrued depreciation.

When receiving property from the head office, the following entries were made in the accounting of the separate division:

Debit 01 Credit 79-1 – RUB 2,500,000. – the initial (replacement) cost of the machine transferred from the head office of the organization is taken into account;

Debit 79-1 Credit 02 – 500,000 rub. – the amount of accrued depreciation on fixed assets transferred from the head office of the organization is taken into account.

The result was a 79-1 finish for the organization as a whole.

The accountant of a separate division calculates depreciation on a monthly basis until the cost of the fixed asset is completely written off:

Debit 20 Credit 02 – 25,000 rub. – depreciation has been calculated on the received machine.