Almost all taxpayers submit statistical forms to the statistics agency. At least, even if the report indicators are zero, there is a random sample when it is necessary to provide figures for a particular area of activity. Therefore, we can say that every businessman has “surrendered to statistics” at least once in his life. Small businesses submit significantly fewer forms to the statistical office than large and medium-sized taxpayers. However, there is a form that applies specifically to small businesses. Let's take a closer look at it.

Who should submit PM-bargaining

Not all enterprises are required to submit the form in question. The number of respondents included only small businesses, namely legal entities that sell goods wholesale.

The following categories of small businesses did not receive an exemption from submitting the form:

- simplified small businesses - reports are submitted according to standard rules;

- organizations that carried out activities only for part of the reporting period - submit on a general basis and indicate since what time they have not worked;

- bankrupt organizations at the stage of bankruptcy proceedings;

- subsidiaries and dependent business companies;

- organizations that carry out trust management of an enterprise as a whole property complex.

The only exceptions from the number of respondents were:

- large and medium-sized businesses - a different reporting form is provided for them;

- micro-enterprises - those with less than 15 employees and 120 million rubles in annual income;

- non-profit organizations;

- liquidated organizations;

- individual entrepreneurs.

Additionally, it is worth considering that the survey of small businesses is selective. That is, Rosstat regularly determines which legal entities must report in this period and sends them a notification about the new obligation. You can check your presence in the list of respondents on the official website of Rosstat. If PM-torg is not among the forms that Rosstat expects from you, you don’t have to submit it.

Who is required to submit a statistical form?

There are different types of reports for different organizations and entrepreneurs. Some information is provided only by large and medium-sized companies, and some types of reports are intended only for small companies.

The report form applies exclusively to representatives of small businesses, and specifically legal entities engaged in wholesale trade.

It happens that a report must be provided as part of a sample conducted by a statistical agency. Usually, for these purposes, information about the activities of the enterprise is analyzed quarterly and then a decision is made on including a particular company in the sample. So statistics are a stubborn thing, you can’t argue with them.

Also, do not forget that even if a bankruptcy procedure is carried out against a company, the form must be submitted before its completion.

Deadlines and procedure for submitting PM-torg

The FSGS expects the PM-Torg form from respondents on a monthly basis. It must be submitted by the 4th day of the month following the reporting month. You can also submit your report on the 4th, you won’t be punished for it. So, for February 2021, the form had to be submitted by March 4th.

Let us remind you that in connection with the decree of the President of the Russian Federation on uniform non-working days, Rosstat exempted all small enterprises from submitting forms in the period from March 30 to May 12. The exception was small businesses that were included in the sample and continued to operate as usual or remotely.

Organizations submit this report to the territorial body of Rosstat at their location, that is, registration. If the location and actual location of the activity do not coincide, then the report must be submitted to the actual address of the activity.

Who does not provide the report form

Everything is clear with those who must submit a report. But there are also those who are not obliged to submit the form to the statistics agency.

- First of all, individual entrepreneurs do not submit reports. The Instructions for filling out the form say that only legal entities are required to submit the form.

- The second obvious point, which is also directly referenced in the Guidelines, is that non-profit organizations do not fill out the report.

- Another exception is that micro-enterprises also do not fill out or submit the form.

- Well, since the report concerns information on wholesale trade, those involved in retail sales also do not provide a reporting form

Responsibility for violation of the delivery procedure

Companies that did not have time or forgot to submit a report bear administrative liability under the Code of Administrative Offenses of the Russian Federation. Similarly, fines are provided for false information in the report.

For the first violation, legal entities face a fine of 20 to 70 thousand rubles, and for repeated cases the fine increases significantly and ranges from 100 to 150 thousand rubles.

During the coronavirus pandemic, Rosstat canceled liability measures. Thus, in May 2021, the measures provided for in Article 13.19 of the Code of the Russian Federation on Administrative Offenses are not applied. This is due to the continued high alert regime in a number of regions of Russia.

Title page

The address part of the form indicates the full name of the reporting organization in accordance with the constituent documents registered in the prescribed manner, and then the short name in brackets.

The line “Postal address” indicates the name of the subject of the Russian Federation, legal address with postal code; if the actual address does not coincide with the legal address, then the actual postal address is also indicated.

In the code part, a legal entity must enter the code of the All-Russian Classifier of Enterprises and Organizations (OKPO) on the basis of the Notification of assignment of the OKPO code sent (issued) to organizations by the territorial bodies of Rosstat.

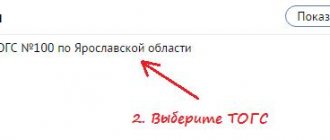

Attention! To select the direction for submitting the report (TOGS), follow this procedure:

Attention! If the list of proposed TOGS does not contain the one you need, you can select it by clicking on the “Show all” button. Next, select the appropriate region and TOGS in this region.

The procedure for filling out the PM-torg form

The most important rule is that information in the form must be submitted for the entire legal entity as a whole. One report will reflect information about its wholesale trade, as well as the trade of its branches and structural divisions. Their location does not matter.

At the same time, subsidiaries and dependent economic entities submit their own forms, and the main economic entity or partnership does not include information on them in its form.

The rules for filling out the report were approved by Rosstat Order No. 321 dated July 16, 2015. The form includes a standard title page and a small tabular form with the main report on wholesale sales.

Title page

Immediately below the name of the form you must indicate the year and month for which you are sending information.

Next, provide information about your legal entity - its full name and short name in brackets. As well as postal or physical address, if they differ. In the code part, indicate the OKPO code.

Main part

The main part of the form consists of one table in which it is necessary to present data on wholesale trade turnover for three periods: the reporting month, the previous month and the corresponding month of the previous year.

For the purposes of filling out this form, wholesale trade turnover represents revenue from the sale of goods that were previously purchased for resale to other organizations or individual entrepreneurs. The main sign that a particular operation falls into the category of wholesale sales is the presence of an invoice for the shipment of goods.

Wholesale trade turnover must be shown on line 01 in thousands of rubles with one decimal place, that is, as a decimal fraction.

Information for filling out this form indicator must be viewed under account 90.1 “Revenue”.

Organizations that sell goods wholesale provide this indicator in the actual sales price, which includes trade margins, VAT, excise taxes, duties, customs duties and other mandatory payments.

Commission agents who are engaged in wholesale trade for other persons under a commission, commission or agency agreement reflect in line 01 only the amount of remuneration received, and the cost of goods is reflected by the principals. The amount of commission agents' remuneration is also reflected at actual cost and includes VAT.

Important

! Line 01 does not need to reflect the sale of goods to the public, since it belongs to the category of retail trade. It also does not include the cost of lottery tickets, telephone cards, communication services, fuel cards, utilities and sold real estate.

The finished document should be checked for accuracy. After verification, it is signed by a company employee who is responsible for providing information to Rosstat. Additionally, he indicates his position, full name, phone number, and email address. In the conclusion, the date of drawing up the document is indicated.

Important points when filling out the report

There are some important points to keep in mind when filling out the form:

- The reporting form is usually submitted to the statistics department where the company is registered, however, if the activity is carried out elsewhere, the form is submitted to the place where such activity is carried out

- The form must be completed for the organization as a whole. This means that if a company has branches or representative offices engaged in wholesale trade, then this information is included in the report of the parent organization

- But “subsidiaries” and dependent companies submit the form independently, regardless of the main organization

- In the case when a company must report on a form, but there are no indicators for filling it out (that is, they are zero), then a letter must be submitted to the statistics body stating the impossibility of filling out the form due to the lack of required data

This is perhaps all that you need to pay additional attention to when drawing up a report.

Application and purpose

In any organization where the movement of goods takes place, it is imperative to register their receipt and decrease. For this purpose, in accounting, documentation of the receipt and release of goods is formed in special registers.

Reconciliation of balances and the reliability of the availability of shipping documentation is carried out on the basis of commodity reports submitted to the accounting department in the TORG 29 form. In it, the reporting employee summarizes all the information on the papers about the arrival and departure of his commodity mass. Thus, the report is, in its own way, a register of invoices, compiled into separate lists according to the documents received. Based on the reflected amounts, final figures are calculated separately on the amount of goods received and lost, as well as their balance at the beginning and end of the reporting period.

This form of report easily allows you to control the turnover of a separate area for which the responsible person is responsible. The main thing in this matter is not to make mistakes and carefully fill out the form, then everything will be in order at the enterprise.

Sample report on retail turnover

Let's look at an example of how to fill out form 3-TORG (PM).

LLC "Molochnaya Dolina" is a small enterprise engaged in the sale of dairy products to the population. In 2021, through a network of retail stores, Molochnaya Dolina LLC sold milk, fermented baked milk, kefir, sour cream, cottage cheese and cheese in the amount of RUB 12,341,000. Inventories of dairy products as of December 31, 2017 amounted to RUB 4,987,670 in value equivalent.

When registering 3-TORG (PM), a company is required to fill out the introductory part, section 1 and 3 explanatory lines from section 2 (17–21), taking into account the following detail:

| Report line | Name of product | Product group details |

| Dairy | Data on retail sales and inventories of dairy products | |

| Of them: Drinking milk | Retail and Inventory Data:

| |

| Dairy drinks | Sales value and inventory data:

| |

| Fat cheeses | Information about retail sales of cheese | |

| Canned milk powder, freeze-dried | Cost of sold powdered and freeze-dried milk and its balance at the end of the quarter |

See below for a sample report filled out using this data.

Completing section 1

In the first line, it is necessary to indicate the turnover of retail sales of goods, which generates cash income from the sale of products to the public for use for business purposes or for personal consumption.

Legislation allows the following to be included in the retail sales of goods:

- cash sales;

- payment by credit cards;

- sales using bank checks,

- purchase from the depositor's account;

- sales without opening an account on behalf of an individual;

- sale via payment card;

- payment under a commission agreement;

- purchase via bank transfer with postal delivery;

- purchase with credit funds;

- sales of durable products according to images;

- purchasing goods in online stores;

- selling products through a vending machine;

- sale of medicines that are provided to certain categories free of charge or at a discount;

- sale of goods (for example, fuel) to certain groups of the population at discounts;

- payment for subscriptions to printed publications;

- sale of packaging that is not included in the price of the product;

- price of empty containers.

Principals, principals and principals who are the owners of the products are not required to fill out line No. 1.

Line No. 3 contains information about the turnover of retail sales of products sold on the Internet.

Line No. 4 is intended for statistics of data on the turnover of products sold by mail.

Columns 3 and 4 in line No. 5 reflect the inventories of products that will be sold to the population. Inventories are valued based on average prices for similar products. The relevance of the price must be checked quarterly, that is, every time the 3rd TORG PM 2017 is filled out. If the price has increased or decreased, you need to re-evaluate and indicate the current average price in the new form.

The fifth line is forced to be filled out only by the owners of goods, and not by companies that trade in the interests of other persons.

How to fill out section No. 2?

The second section is intended to decrypt the information specified in line No. 1 of the first section. In lines 6 to 82 you need to classify products by product groups in price terms:

- lines 6-11 are devoted to the classification of meat products depending on the type of animal, living environment and method of partial or complete preparation for consumption;

- lines 13-15 are for the classification of edible oils;

- line No. 16 contains data on retail sales and inventories of margarine products;

- lines 17-19 are devoted to fermented milk products;

- line No. 23 contains the classification of goods sold and stocks of sugar, as well as sugar substitutes;

- lines No. 24 and 28 indicate stocks of flour and flour product concentrates;

- line No. 25 contains information about stocks of tea, coffee, cocoa, capsules for coffee machines, as well as coffee and tea gift sets;

- in line 29 an entry is made about the supply of cereals and baby food;

- line No. 31 contains the classification of stocks of crackers, bread, croutons and other bakery products;

- line No. 35 contains information about alcoholic beverages;

- line No. 36 is dedicated to stocks of fruit and vegetable juices, water and other non-alcoholic drinks;

- line No. 38 reflects information on sales and stocks of chewing gum, spices, herbs, biological and food additives;

- line No. 40 must include all perfumes and cosmetics, not including soap;

- lines 42-47 are intended to reflect inventories of household appliances;

- line No. 49 indicates data on equipment and footwear intended for sports, not including boots and sportswear;

- lines 50-53 contain information about stocks of computer equipment, accessories for them, mobile phones, as well as cameras and all necessary accessories for them;

- line No. 54 contains data about bicycles;

- line No. 55 is dedicated to books;

- lines 60-64 indicate stocks of clothing, excluding leather and sportswear, as well as special sports shoes;

- line 65 reflects information about stocks of construction materials;

- line 67 contains data on medical equipment and medicines;

- line No. 69 contains information about jewelry made of stones and metals;

- lines 70-74 indicate stocks of motor fuel, which are sold through gas stations;

- line 76 contains information about car parts, not including radios;

- line 77 indicates inventory data for motorcycles, mopeds, scooters, snowmobiles and ATVs;

- in line No. 82 it is necessary to indicate stocks of non-food products.

Reflecting the stocks of alcoholic beverages in all stores and warehouses where they are stored.

Registration procedure

For convenience, this report is used in companies engaged in the sale of goods at retail, and accounting of activities upon their receipt and departure is carried out using the sales price. Convenient for those enterprises that use the cost method of accounting for goods, called the balance method.

The requirements for this document are:

- How many copies are made? It is submitted in two copies, one of which remains in the accounting department with the original documents attached to it, and the second remains with the responsible person.

- Which employees should report? The obligation to draw it up applies to financially responsible persons who receive and release goods. This employee submits the report to the accountant for verification. If everything is in order, then one copy of the two forms is endorsed by the inspector and returned to the responsible person.

- How is data entered into the report? Filling out the parameters from the turnover documentation received during the reporting period is done both electronically and manually using a pen with blue or black ink.

- What should this document confirm? All information reflected in the TORG 29 form is confirmation of the movement of goods: how much arrived and left, as well as what balance is available at the end of the reporting period.

- Grounds and procedure for using the TORG 29 form. The form is filled out by the financially responsible person, based on the availability of documents for the reporting period, approved by the chief manager of the organization. All documents are divided into 2 tables about the receipt and consumption of goods in accordance with the chronological order of their creation.

- The storage location for each copy of completed TORG 29 forms. One of them is stored in the archives of the accounting department of the trade organization, and the other is kept by the financially responsible person.

Now let's move on to filling out the report form itself.

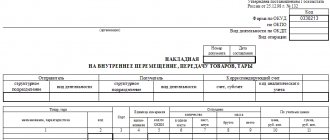

Sample of filling out a product report (TORG 29 form). Page 1

Sample of filling out a product report (TORG 29 form). Page 2