Any business activity involves expenses. You have to spend money on diverse processes and purchases: those needed for the production of products, equipment maintenance, the purchase of raw materials, packaging, and transportation. And also on management processes, not to mention wages. This multifactorial nature of costs indicates the need for their classification and separate accounting.

Let’s understand the concept of “overhead costs”, clarify which costs can be attributed to them and how to recognize them in financial accounting.

How are overhead expenses different from core expenses?

What is overhead

Not all costs in production go directly into the product and can be directly planned and taken into account in its cost. Nevertheless, the funds spent turn out to be absolutely necessary for the manufacture of products, their sale, promotion on the market, as well as the management of the organization itself.

The most accurate definition of overhead would be “everything else.” This type of costs is not highlighted in a separate article in the Tax Code of the Russian Federation; naturally, their structure is not spelled out there either. In accounting, it is also impossible to clearly differentiate them.

NOTE! The law establishes a list of overhead costs only in the construction and medical industries. All other enterprises must determine overhead costs themselves, fixing this in their accounting policies.

overhead costs, accepted in business, implies expenses that cannot be attributed directly to technological production processes, accompanying the production process, but not included in the cost of work and raw materials. Another name for overhead costs is indirect costs . They are indicated when planning and drawing up estimates for both the company as a whole and individual structural divisions.

How to calculate the cost of production taking into account overhead costs ?

Fixed and variable costs

The two main types of costs that exist in an enterprise are fixed

and

variable

costs.

Fixed costs do not depend on output, while variable costs do. Fixed costs are sometimes called overhead. They are produced regardless of whether the firm produces 100 units or 1,000 units. When budgeting, fixed cost items may include rent, depreciation, and executive salaries. Manufacturing overhead can include cost items such as property taxes and insurance. These fixed costs remain the same despite changes in production volume.

On the other hand, variable costs fluctuate in direct proportion to changes in production volume. In the budget classification of manufacturing costs, labor and materials costs are typically variable costs that increase as production volume increases. More labor and material are required to produce more output, so the cost of labor and materials varies directly with the volume of output.

For many service companies, the traditional division of costs into fixed and variable costs does not work. Typically, variable costs are defined primarily as “labor and materials.” However, in service industries, labor is usually paid by contract or management policy and is thus independent of production. Therefore, for these companies it is a fixed cost rather than a variable cost. There is no hard and fast rule about which category (fixed or variable) is appropriate for a particular expense. For example, the cost of office paper in one company may be an overhead or fixed cost because the paper is used in administrative offices to perform administrative tasks. For another company, that same office paper may be a variable cost because the business produces printing as a service for other businesses. Each company must determine based on its own needs whether an expense is a fixed or variable cost to the business.

In addition to variable and fixed costs, some of the costs are considered mixed

. That is, they contain elements of fixed and variable costs. In some cases, the costs of supervision and inspection are considered to be mixed.

Why consider overhead costs?

The most obvious goal is planning future profits, which are affected by all the costs incurred by the entrepreneur. But in terms of overhead costs, this poses certain difficulties. If potential direct costs can be fairly accurately calculated for specific types of products, then it is quite difficult to determine how many indirect costs will result and how they will be distributed when, for example, expanding production or signing a certain contract.

IMPORTANT! To adequately determine the cost of a product, it is necessary to take into account and distribute overhead costs in proportion to direct expenses - calculate production costs .

Calculation of the percentage of overhead costs from direct costs

For questions of forecasting and decision-making on prices, such an indicator as the ratio of direct costs and overhead costs is important, more precisely, the value by which, by multiplying the existing direct costs (or the amount of one of their types), you can get the amount of overhead costs related to these direct costs. The calculation of this ratio itself is quite simple: divide the amount of overhead costs by the amount of direct costs or by the amount of one of the types of direct costs. To express the ratio as a percentage, the quotient of the division is multiplied by 100%.

The first such calculation is made according to the planned calculation (estimate). In the future, its results will be refined as evidence accumulates. To determine a stable value for the ratio of direct costs and overhead costs, ensuring a high level of reliability of forecast calculations, it is necessary to process actual data for a sufficiently long period.

Read about the organization of cost accounting in the material “Production cost accounting system and their classification.”

What is included in overhead costs

Indirect costs can be roughly divided into 4 main groups:

- Management costs:

- his salary;

- money spent on training, certification and advanced training of management.

- Contents: purchase of computers, office supplies, expenses for office needs, including communication services.

- Expenses associated with the process of organizing production:

- maintenance repairs of structures, buildings, premises, equipment belonging to the organization;

- costs of transport owned by the company;

- payment of rent for warehouse premises and/or office;

- waste of money due to downtime, defects, etc.;

- money that needs to be spent on maintaining fixed assets.

- Personnel costs:

- social tax contributions;

- payments to social security and other funds;

- equipment of household premises, canteens, showers, etc.

- Non-production costs:

- advertising expenses;

- payment for consultations and examinations;

- payment of utility bills, etc.

Controllable and uncontrollable costs

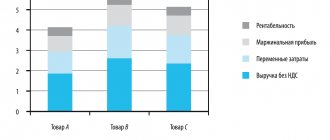

When using budgets to calculate performance indicators, it is important to distinguish between controllable and uncontrollable costs. Managers should not be held responsible for uncontrollable costs. Therefore, a typical budget will show forecast sales revenue and the variable costs associated with that sales level. The difference between sales revenue and variable costs is the margin or contribution margin. Fixed costs are then subtracted from contribution margin to arrive at operating income. As a result, managers and financial responsibility centers (CRCs) are evaluated based on the costs they are expected to control.

Overhead distribution options

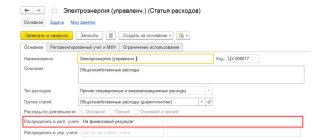

IMPORTANT! Recommendations for the distribution of overhead costs from ConsultantPlus are available here

Despite the difficulties of planning indirect costs, this is a necessary procedure that can be carried out in several ways:

- The "working wage" method. If the main production employs a large number of workers, especially if manual labor predominates, overhead costs can be calculated in proportion to the wage fund for their labor.

- The “sales volume” method is advisable to use if automated processes predominate in the company. You can distribute income in proportion to machine hours.

- The unit of production method is applicable when direct costs significantly exceed indirect costs. Then we can take as a basis the ratio of direct costs per unit of goods to the total amount of direct costs.

- Direct counting method. Indirect expenses are summed up separately for each expense item.

- Combined methods are applicable in large companies with a complex structure, where several types of products are produced. For example, you can account for manufacturing overhead on the payroll basis, and general business overhead on the basis of unit cost.

EXAMPLE OF CALCULATION. Avtokoleso LLC is engaged in the transportation of goods. The staff wage fund is 8 million rubles per year. The overhead expense ratio in 2021 was 80%, that is, 6 million 400 thousand rubles. The company decided to reduce overhead costs, for which it fired several people. At the same time, the wage fund decreased by 20%, which means that the overhead costs of Avtokoleso LLC for 2021 can be planned in the amount of 5 million 120 thousand rubles.

Is there any provision for rationing of overhead costs ?

Is it always necessary to post indirect expenses?

The very logic of classifying costs into direct and overhead (in relation to a specific object) seems to be understandable.

The purpose of this classification is to calculate the economic efficiency of the analyzed objects. By highlighting direct costs, you can, for example, calculate how much profit each product, division (if more than one department is involved in sales), sales channel, client, branch, store (if it is a retail chain) gives the company.

Obviously, it is quite easy to calculate the profit of any object based on direct expenses, but then the company asks itself another question: how to determine, so to speak, the full efficiency of the object.

This automatically leads to another question - how to correctly allocate overhead costs to objects. It seems to me that there is no correct answer to this question. Yes, there are methods for allocating indirect costs, but before you apply them you need to understand why you need to do this at all.

Everyone seems to understand that drawing up any management report is not an end in itself. Each management report should help make decisions, the implementation of which will increase the efficiency of the company and ultimately improve its financial and economic condition.

If the allocation of indirect costs allows you to make a decision, the implementation of which will reduce the company's expenses (without causing any harm) and increase its efficiency, then in this case it makes sense to allocate indirect costs. But if nothing improves, then why bother doing it at all.

Like any other functions, the allocation of indirect costs to any objects in each specific company should have a very clear practical meaning. Before choosing a diversity technique and developing a specific scheme for each specific case, you need to decide why this needs to be done at all.

Let's assume that the company managed to come up with the most correct methodology for allocating indirect costs, after applying which a certain management report was obtained containing information about the financial and economic efficiency of the corresponding accounting objects. So, what is next?

Logically, a company should probably get rid of ineffective objects if a detailed analysis shows that the situation cannot be improved. Now comes the most important part. If, after reducing inefficient objects, the total indirect costs remained the same, then a completely logical question arises: why was it necessary to carry out such an allocation at all?

After all, the situation with overhead costs has not improved at all, but at the same time, the final financial and economic condition of the company could worsen due to the fact that the company could lose the profit that the reduced facilities provided.

For example, after allocating overhead costs to products, it may turn out that some of them are unprofitable. Although without taking into account the allocation of overhead costs, they made a certain contribution to covering overhead costs.

If the overhead costs distributed among accounting objects are not relevant, then there is no point in allocating them, since such manipulations and subsequent making wrong decisions can only lead to a deterioration in the final financial and economic condition of the company.

Relevant costs are those costs that depend on the decisions made. For example, if, as a result of allocating indirect costs to products, a decision was made to discontinue unprofitable products, but no overhead item was reduced, this means that all of them were not relevant, that is, they did not depend on the decision made.

In fact, the decision to reduce the same assortment line can be made without taking into account the allocation of overhead costs. The presence of a positive margin should not at all be considered a necessary and sufficient condition to ensure the “immortality” of a product (as well as any other object).

To control the effectiveness of the assortment, the company may apply specialized restrictions (limits) on marginal profit and product profitability (examples of such special restrictions are discussed in Book 1 “Budgeting as a management tool”

from

the series “100% practical budgeting”

).

There may be situations where the allocation of overhead costs to objects is not regular, but one-time. That is, such a procedure can be performed before making strategic decisions.

Examples of such strategic decisions could be opening a new business line or downsizing a division and then outsourcing its functions, or opening a new business line based on an existing division (for example, creating a subsidiary).

In this case, of course, it is better to use the ABC method (which will be discussed below). On the one hand, it is more complex than distribution by base, but in this case the work is one-time, not permanent, and the consequences of strategic decisions can very significantly affect the future financial and economic state of the company.

By the way, when making such strategic decisions, it is necessary to take into account not only the financial and economic component, but also marketing prospects. For example, when one fairly large company seriously thought about separating several divisions into subsidiaries in order to increase the efficiency of their work, they encountered the following problem.

One of the candidate divisions for allocation was a service performing construction, installation and repair work. On the one hand, if this division were separated into a subsidiary company, it would be easier to calculate the financial and economic result (there would be no need to allocate indirect costs of the entire enterprise) and, most importantly, it would be possible to increase the powers and responsibilities of the manager, which would contribute to would work more efficiently.

But when they began to evaluate the marketing perspective, they came to the conclusion that practically the only customer would be the parent company. This means that no market mechanism will work, and the expected increase in efficiency will not occur.

In fact, when spinning off subsidiaries, another problem may arise related to the calculation of the financial and economic condition. Before dividing a single company into business units, the problem of allocating indirect costs in order to more accurately calculate the financial result of each business unit may be quite relevant. But after the division, another problem will arise - the construction of consolidated reporting for the group.

After all, it will be important to calculate the financial and economic result not only of each individual company, but also of the holding as a whole. And the task of consolidation may turn out to be no simpler than the task of distributing overhead costs.

In general, in practice there may be many different situations in which a decision must be made about the advisability of allocating overhead costs and choosing a particular method. Unfortunately, there is no scheme that is common to everyone, but the principles that need to be relied on are almost universal for any company.

Once, the head of the PEO of a regional retail chain involved in the sale of household appliances took part in my workshop on management accounting. During the first break, he came up to me and asked how to correctly allocate some indirect advertising costs to stores, in particular, we were talking about the cost item “Radio Advertising”. On the radio they advertised the entire chain, not just one particular store.

He wanted to calculate, so to speak, the operating efficiency of each store, taking into account all costs, including overhead.

There was no answer to my question why to do this. Then I suggested imagining that we had found a way to allocate overhead costs absolutely correctly across stores. Now we begin to talk about what this will give us.

Suppose that after such posting it turns out that a certain store is unprofitable or its profit is less than the limit (restriction) established in the company. What decision will be made in this case?

The head of the PEO said that in such a situation a decision may be made to close the store. Now the next logical question arises: will advertising costs change after this? Naturally not, but at the same time the company will lose profit, since the store was profitable in terms of direct expenses.

Quite often, the issue of allocating overhead costs becomes relevant when the financial structure of the company is being developed.

This raises the question of the distribution of indirect costs among financial responsibility centers (FRC). Although in fact the need to distribute overhead costs across the central financial district can also be questioned.

Again, there seems to be logic in this. If a company wants to introduce real responsibility for the results of the activities of the central financial district, then all central financial districts must also be responsible for the costs that they influence.

But in this case, everything is more or less clear with direct costs, which the central financial institutions directly influence, and therefore must bear responsibility for. Are differences and indirect costs necessary in this case?

If we are talking about, say, a profit center motivation scheme, then quite often the material incentive fund (MIF) of such a central federal district is tied to the profit of the central federal district. Therefore, they believe that when calculating the profit of the Central Federal District, it is necessary to take into account all expenses: both direct and overhead. After all, if you do not take into account invoices, then the FMP of the Central Federal District may be overestimated.

In fact, you don’t have to do this, but it’s easier to do. Calculate the profit of the Central Federal District only based on direct expenses, but at the same time reduce the coefficient in the incentive scheme.

Thus, before thinking about how to correctly distribute overhead costs among objects, you first need to understand why this is needed at all. Only after the company has come to the feasibility of such a decision should it look for a way to allocate indirect costs.

So, in practice, in each specific company, the decision on the allocation of overhead costs must be made taking into account various factors that significantly affect the company’s business and its financial and economic condition.

If the company still finds it advisable to regularly allocate overhead costs to certain objects, then when choosing an allocation methodology, it will have to take into account the ratio of utility and costs of carrying out this work.

Procedure for calculating overhead costs

Planning and accounting of all expenses, including overheads, is carried out in a certain order:

- The total amount of costs for general business activities of the company is calculated.

- The amount of overhead costs that will need to be included in the estimate per unit of each type from the product range is determined.

ATTENTION! It is necessary to take into account the legal limits for overhead costs for specific items and the standards defined by the company's internal regulations.

Collection of direct production costs

For the accumulation of direct expenses in accounting, accounts 20, 23, 29 are intended, selected depending on the purpose of the production corresponding to these accounts:

- basic,

- auxiliary

- serving.

On the same accounts, the final cost of the created products will be formed by adding the required share of overhead costs to the direct costs.

Analytics on accounts 20, 23, 29 is organized by:

- by department;

- types of products created;

- cost items, among which, in addition to those directly related to direct ones, there will also be corresponding types of overhead costs included in the cost.

The list of items of direct production costs is, as a rule, very limited and most often involves a breakdown:

- for materials,

- workers' salaries,

- salary accruals.

Legal limits regarding overhead costs

The law determines the composition and limits of overhead costs in the construction and medical industries.

Construction overhead

In this industry, overhead planning is especially important. An estimate is drawn up, which indicates the average costs for the industry, which are included in the cost of construction products or services.

Cost rationing in the construction industry is regulated by the Methodological Guidelines for determining the amount of overhead costs in construction, approved by the Resolution of the State Construction Committee of Russia (separately for regions of the Far North and equivalent regions). These documents define the coefficient that must be applied to determine overhead costs for a particular construction activity, and also clarify the scope of its application. The wage fund for construction workers is taken as the base. The distribution of coefficients is carried out according to the following main types of construction:

- industrial;

- agricultural;

- transport;

- housing;

- energy;

- related to water management;

- in the field of nuclear energy;

- restoration work;

- major repairs;

- other types.

FOR YOUR INFORMATION! Overhead costs according to construction standards must be applied at the stage of drawing up estimates, as well as when paying for work performed.

Medical overhead

The standards and composition of overhead costs in the medical industry are regulated by Order of the Ministry of Health and Medical Industry of Russia No. 60 dated March 14, 1995. According to the provisions of this order, the cost of medical care must include all annual costs of a medical institution:

- salaries of all types of personnel, except medical personnel, with all accruals;

- expenses for the purchase of furniture, stationery, household goods (everything, except medicines and dressings);

- means for repairs.

The basis is the wage fund of medical personnel providing specific medical services, based on a coefficient of 1.5.

IMPORTANT! Typically, overhead costs are significantly higher in medicine than in construction.

Structure of direct and overhead costs by item

Direct costs most often consist of the following costs:

- for materials necessary to create specific products;

- salaries of personnel directly involved in the creation of these products;

- insurance premiums accrued on the salaries of personnel creating products.

The composition of overhead costs, usually divided into 2 main types, is much wider and is characterized by significant similarity in the lists that occur for general production and general business costs. These lists typically include expenses:

- for remuneration of management and other personnel of a production or general business unit;

- insurance premiums accrued to pay for the labor of these personnel;

- material support for the current work of departments (low-value equipment, office and household supplies, consumables for low-value equipment);

- depreciation of used fixed assets;

- maintenance and operation of fixed assets, including their routine maintenance, provision of necessary resources (fuel and lubricants, replacement parts, electricity, water, heat, gas), current and major repairs;

- property rental;

- property and personnel insurance;

- obtaining permits;

- ensuring the quality of products;

- labor protection;

- information, consulting and legal support;

- business trips;

- entertainment events;

- personnel selection.

A sample order for approval of overhead costs can be found in K+. Get trial access to the system and proceed to the example of this document.

Read more about the composition of general business expenses in the article “Account 26 in accounting (nuances).”

Due to the impossibility of direct correlation with specific types of products created (objects), overhead costs are allocated. The organization chooses the basis for this distribution independently. This may be one type of direct costs (materials or labor) or their total amount.

General overhead expenses

Account 26 is intended for collecting general business expenses. Analytics on it is organized according to the same principles as on account 25: by department and by type of expense. The list of general business expenses is basically similar to that created for account 25, but can be expanded by adding to it, for example, expenses:

- to ensure communication with counterparties (telephone, Internet, mail);

- legal and consulting services;

- entertainment events;

- conducting medical examinations of employees;

- selection and training of personnel;

- protection of the enterprise territory;

- taxes attributed to expenses.

Just like account 25, account 26 is subject to monthly closure. However, depending on the level at which it is decided to form the cost, the costs collected at it will be taken into account as follows:

- for partial cost - written off to the account for recording the financial result from sales without inclusion in the cost formed on accounts 20, 23, 29;

- for the full cost - distributed among all types of created products in proportion either to the same base in relation to which account 25 was distributed, or to another selected base.

As part of the total cost of a specific product, the share of overhead general expenses included there will also be included without breaking down into components under a single analytics “general expenses.”

General business expenses can be written off using the direct costing method.

An example of cost formation using the direct costing method from ConsultantPlus: Workshop No. 1 produces tables and chairs. The balance of work in progress and finished products at the beginning of the month is 0 rubles. Within a month, materials were transferred from the warehouse for the production of tables for 325,000 rubles, for the production of chairs - 100,000 rubles. 50 tables and 45 chairs were produced in a month. The balance of work in progress at the end of the month... Study the material by getting trial access to the K+ system for free.

other expenses

There are other costs that are reflected in a separate group of expenses. The main share in them is occupied by compensation for damage. These are the costs of payments to residents for compensation for repairs for leaks, damage to cars from icicles, snow or damaged trees. Civil Housing Property fines also take up a significant share of costs.

It is important for any operating organization to control and take into account the costs of its core activities as much as possible. An important role in the performance of this function is assigned to the economist in the housing and communal services sector.

We recommend that you read the article on taxes and profitability of management companies