“Low value” fixed assets

FAS 5/2019 established the criteria for classifying assets as inventories. One of them is the use of assets in one operating cycle or within 12 months. This means that the new standard prohibits accounting for “low-value” fixed assets in inventories, although this is permitted in clause 5 of PBU 6/01 “Accounting for fixed assets”. A new standard is a later document of the same level and legal force; in case of a conflict of norms, it will take precedence.

In addition, the new FSBU 6/2020 “Fixed Assets” also requires that the cost of low-value assets that can be recognized as fixed assets be expensed. From the beginning of the application of this standard, the conflict is eliminated (no later than 2022).

In this regard, we recommend that the accounting policy establish the procedure for accounting for “low-value” fixed assets - and attribute their cost directly to expenses.

Create an accounting policy based on the parameters of your organization

Analysis

The analytical work is often very extensive. Data such as the average value of all values, their rates of growth or decline, and key points of sharp changes in the value and volume of production are taken as starting points. It reveals how the quality of inventories affects the duration of turnover, which specific positions are currently most important for the company, and where additional purchases need to be made.

All this work is very voluminous, but as already mentioned, products from Cleverence will greatly simplify it. After all, the company’s applications already know all the basic methods of calculations and conducting detailed analysis. You just need to enter the required numbers.

Cancellation of a separate procedure for accounting for special items

FSBU 5/2019 does not identify special items as a separate type of inventory - special tools, fixtures, equipment and clothing. The guidelines for their accounting are also cancelled, so “non-standard” accounting rules can no longer be applied.

The costs of purchasing special items must be taken into account in a general manner.

- If special items are used for more than 12 months (or more than one operating cycle lasting more than 12 months), they are recorded as part of property, plant and equipment.

- If less - as reserves according to FAS 5/2019, that is, with the cost attributed to expenses or to the cost of finished products (works, services) at the time of transfer to operation.

Why is this procedure needed?

Any production organization must timely reflect the receipt, write-off and movement of inventory .

This need is determined by current legislation. If an enterprise does not monitor changes in the number of these assets, then sooner or later it will face the following difficulties:

- it will be impossible to determine the debt to suppliers;

- it is impossible to calculate the price of finished products, since the cost is unknown;

- theft is possible, since the volume of inventories is not controlled, the company does not monitor the safety of raw materials;

- accounting principles are violated, and accordingly, reporting becomes unreliable.

New rules for forming the cost of work in progress

The new standard classifies work in progress (WIP) as inventory. Previously, this was implied, but was not legally enshrined. This means that management costs cannot be included in the cost of work in progress, as well as in the cost of other types of inventories (clause “b”, clause 18 of FSBU 5/2019).

This means that the accounting policy cannot provide for the distribution of management expenses to cost: writing off general business expenses by posting Dt 26 Kt 20 in most cases will be unlawful. The only “standard” way is to write them off to the financial result by posting Dt 90 Kt 26.

An exception is if management costs are directly related to the creation (purchase) of inventories. For example, if the head of an organization personally went on a business trip to purchase materials, travel expenses (including average earnings with accrued insurance premiums) must be included in the cost of these materials.

The procedure for assessing the cost of work in progress is also changing. Now it is impossible to evaluate work in progress at the cost of raw materials, materials and semi-finished products, since this method is not provided for in clause 27 of FSBU 5/2019.

Maintain inventory accounting according to new rules in the web service

Acceptance of inventories onto the balance sheet of the enterprise

PBU 5/01 – inventories are always credited to the enterprise’s balance sheet at actual cost.

The objective cost of inventories purchased for money is the amount of the enterprise's actual expenses for the acquisition , excluding VAT and other taxes.

The actual costs of purchasing materials can be :

- amounts paid under a supply agreement;

- expenses aimed at paying for consulting and necessary information services related to the purchase of materials and equipment;

- customs duties and other payments ;

- non-refundable tax payments paid in connection with the purchase of a unit of inventory;

- intermediary fees;

- costs for timely procurement and reliable delivery of supplies to the place of their use, as well as insurance;

- other costs associated with the purchase of inventories.

Productive reserves.

To find out what the “accounts receivable turnover ratio” is, read the article at the link.

Formation of inventory cost

FSBU 5/2019 introduced new rules for the formation of the cost of inventories.

- The cost of inventories includes an estimated liability recognized in connection with their acquisition or creation (paragraph “d”, paragraph 11 of FSBU 5/2019). For example, an organization creates a construction site to carry out a project. She knows that after completion of the work it is necessary to put the area in order: lay new soil, plant grass, trees or shrubs, etc. In this case, the organization is obliged to create an estimated liability according to PBU 8/2010 and attribute its amount to the increase in work in progress.

- The cost of inventories recognized as investment assets includes interest on borrowed funds (clause “e”, clause 11 of FAS 5/2019). Previously, this rule was enshrined only in PBU 15/2008, so in practice it was not applied to MPZ.

- Inventory may not be valued at the value specified in the purchase agreement. If inventories were purchased with a long deferment or in installments, and interest on a commercial loan was not allocated in the agreement, they are allocated by calculation. The cost of inventories includes the amount that would have to be paid to the supplier without deferment or installments (clause 13 of FSBU 5/2019). The difference, as for borrowing costs, is included in other expenses.

- Products from agriculture, forestry and fisheries, as well as goods traded at organized auctions, can be recognized at fair value (clause 19 of FSBU 5/2019). It is determined according to IFRS 13 “Fair value measurement” (clause 14 FSBU 5/2019).

MPZ: accounting on the enterprise balance sheet accounts

To account for inventories, synthetic accounts are used , such as:

- Materials – 10 and subaccounts;

- Fattening animals – 11;

- Acquisition of assets and their procurement – 15;

- Deviations in asset values – 16;

- Products – 41;

- Finished products – 43.

Accounts on balance:

- Inventory accepted for storage – 002;

- Materials for processing – 003;

- Products on commission – 004 .

When any company enters the market, a trademark is very important. How to register a trademark - read here.

Types of primary reporting

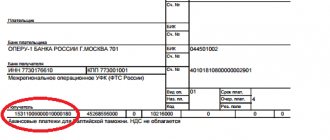

Inventory accounting is carried out on the basis of primary documentation , which includes:

- powers of attorney;

- receipt orders;

- acceptance certificates;

- requirements;

- invoices for intra-enterprise movements and vacations;

- warehouse accounting cards

- accounting statements.

Provision for impairment of inventories

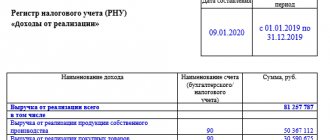

Previously, the amount of the reserve was calculated as the excess of the actual cost over the current market value (PBU 5/01). In the new FSBU, the amount of the reserve is the excess of the actual cost of inventories over their net selling value (clause 30 of FSBU 5/2019). This means that the amount of the reserve may increase. The old and new formulas for calculation are given in the table.

| Provision for impairment of inventories | |

| in PBU 5/01 | in FSBU 5/2019 “Reserves” |

| Actual cost - current market value | Actual cost - current market value - production costs - preparation costs for sale - selling costs |

There was uncertainty in the procedure for calculating the reserve. According to clause 11 of PBU 10/99 “Expenses of the organization”, the amount of contributions to reserves is classified as other expenses. There are no rules in FSBU 5/2019 that would contradict this provision.

But the standard establishes the procedure for restoring the reserve (paragraph 2 of clause 31 of FSBU 5/2019): “The amount of restoration of the reserve for impairment of inventories is attributed to the reduction in the amount of expenses recognized in the same period in accordance with subparagraph “a” of paragraph of this Standard.”

At the same time, in paragraphs. “a” paragraph 43 of FSBU 5/2019 mentions revenue from the sale of these inventories. This means that the amount of restoration of the reserve created in relation to, for example, goods for resale should be attributed not to other income (as required by paragraph 7 of PBU 9/99), but to the reduction in the cost of selling goods.

In this case, a situation that is illogical from an economic point of view arises. When accruing or increasing a reserve, other expenses must be recognized, and when it is restored, the cost must be reduced, that is, expenses for ordinary activities.

In this situation, two options are possible:

- If the amount of reserve recovery is not significant for the organization, it can exercise the right granted by clause 7.4 of PBU 1/2008 “Accounting Policy of the Organization”. Then you can not apply the procedure established by any standard (including FSBU 5/2019). This means that the amount of reserve restoration can be attributed to other expenses, based on the requirement of rationality.

An online conference on accounting changes will be held on December 8.

Participate

- If the amount of reserve recovery is significant for the organization, it must be disclosed separately in the financial statements. This means that violation of economic logic will not affect anything: users of the reports will see the transcripts and make the right decisions.

Gradation according to technical characteristics

It is not customary to separate these elements by quality and cost. The main aspect is purpose. But division is also often allowed based on technical aspects. Flammable substances belong to one category, plastic equipment to another, metal equipment to a third. The dimensions of such a classification depend entirely on how many different items are used in a particular production. Not only auxiliary, but also basic ones are divided according to technical characteristics.

You should also know about a special group. The materials include MBP. Literally, these are low-value or wearable objects. What will belong to the first is a complex question. In fact, the cost is first determined, and in the comparative characteristics the low-value ones are already identified. So, everything depends on the raw materials at the enterprise. But objects that wear out quickly are those with a service life of less than a year. Naturally, the cycle at most enterprises will be much shorter. But still, such wear-out non-consumable parts are usually taken to the MPZ.

Results

Material reserves are the resources of an organization on the basis of which a surplus product is created, or used as a surplus product. All organizations, including budget ones, must keep inventory records. Working with inventories, as a rule, involves determining the business entity’s need for them, as well as analyzing the effectiveness of inventory management.

You can learn more about inventory management in an enterprise in the following articles:

- “Other material reserves - what applies to them?”;

- "Inventory of inventories."

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Business transactions and unified forms for inventories (table)

| No. | Action | Prepared documents for different types of inventory items |

| 1 | Receiving property | Consignment notes forms TORG-12, waybills MX-18 (for finished products), bills and invoices, universal transfer documents, powers of attorney forms M-2 or M-2A. |

| 2 | Acceptance of valuables for accounting | “Prihodnik” M-4, invoice TORG-1 and label TORG-11 (based on materials), Journal for receipt of finished products form MX-5, if there are discrepancies with the invoice - act M-7. The data is also entered into the M-17 warehouse card. |

| 3 | Disposal and relocation of property | Invoices M-11, production order, limit card M-8, invoice for issue on the side M-15, invoice, TTN, invoice TORG-12 |

| 4 | Write-off of resources | Acts on write-off of materials or products, forms TORG-15 and TORG-16, acts of detection of shortages. |

| 5 | Every action | Entries are made in the M-17 card or in the TORG-18 journal |

Grouping supplies in the budget

Analytical accounting of material reserves in a government institution should be detailed by subaccounts. To do this, in the organization’s accounting policy, provide for the grouping of account 105 into subaccounts. It is allowed to include the following subaccounts in the institution’s working chart of accounts:

| 0 105 31 | Medicines and dressings |

| 0 105 32 | Food |

| 0 105 33 | Fuels and lubricants |

| 0 105 34 | Construction Materials |

| 0 105 35 | Soft inventory |

| 0 105 36 | Other inventories |

| 0 105 37 | Finished products |

| 0 105 38 | Goods |

| 0 105 39 | Markup on goods |

But autonomous and budgetary institutions are obliged to allocate particularly valuable property. Grouping by subaccounts follows a similar procedure. Only for particularly valuable property should the account group 105 - 20 be indicated. For example, goods classified as particularly valuable should be recorded in the subaccount 0 105 28. Property of a budgetary and autonomous enterprise that is not particularly valuable should be recorded in the account group 105 - 30.