Question

The company must reflect the amount of accrued benefits in the calculation of insurance premiums in accordance with the Procedure for filling out the calculation, approved by order of the Federal Tax Service of Russia dated October 10, 2016 No. ММВ-7-11/[email protected] After receiving your report, the inspectors will transfer the data to the Fund. After the FSS confirms the expenses, the tax authorities themselves will carry out the offset.

Unified calculation of insurance premiums 2020

From 01/01/2020, the correctness of calculation and payment of these mandatory payments is supervised by tax officials. Law No. 250-FZ establishes that reporting on contributions for previous years, including corrective forms, are submitted to the Pension Fund of the Russian Federation and the Social Insurance Fund of the Russian Federation in accordance with the previous rules.

- The overpayment can be offset against future payments only for the same contributions that turned out to be overpaid (clause 1.1 of Article 78 of the Tax Code of the Russian Federation);

- it is impossible to return the overpayment that was reflected in the reporting submitted to the Pension Fund and has already been taken into account for specific insured persons (clause 6.1 of Article 78, clause 1.1 of Article 79 of the Tax Code of the Russian Federation);

- If there are debts on penalties and fines for the same contributions that turned out to be overpaid, the refund will be made minus the amount of the existing debt (clause 1.1 of Article 79 of the Tax Code of the Russian Federation).

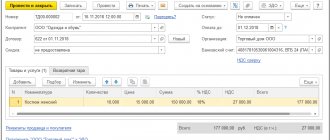

Reimbursement of FSS expenses: posting

Organizations must reflect the accrual and reimbursement of social benefits in their accounting records. The following wiring is used for this:

Dt 20 (25, 26, 44, etc.) / Kt 69.01 – insurance premiums are charged;

Dt 69.01 / Kt 70 – the employee received benefits at the expense of the Social Insurance Fund;

Dt 51 / Kt 69.01 - money was received from the Social Insurance Fund to reimburse the missing funds.

Funds received from the Social Insurance Fund are also reflected in the “Calculation of Insurance Premiums” - on page 080 of Appendix No. 2 to Section 1 (clause 10.14 of the Procedure for filling out the DAM, approved by Order of the Federal Tax Service dated September 18, 2019 No. ММВ-7-11/ [email protected ] ).

Offset (return) of contributions according to the rules of the Tax Code of the Russian Federation and the Social Insurance Fund

Since 2021, almost all types of insurance premiums (except for payments for accident insurance) have become subject to the provisions of the Tax Code of the Russian Federation, which has not only a separate chapter devoted to these charges, but also references to contributions in all general rules for working with tax payments (h 1 Tax Code of the Russian Federation). As a result of these changes, the return (offset) of insurance premiums from 2021 began to be made according to the algorithms used in similar procedures for taxes and fees (Articles 78, 79 of the Tax Code of the Russian Federation).

Why are there 2 types of rules for the return (offset) of contributions?

- contributions paid after 2021 continue to be paid separately by fund;

- contributions received by the Pension Fund are taken into account individually;

- During the 2020-2020 period (transition period), the question may arise about the return of contributions transferred there according to the rules in force until 2021.

We reflect reimbursement of social insurance expenses for the last year in the RSV

You can also check the balance of social insurance settlements using a calculation certificate (Appendix 1 to the letter of the Federal Social Insurance Fund of Russia dated December 7, 2016 No. 02-09-11/04-03-27029). Such a certificate, along with other documents, is submitted to the Fund by those policyholders who want to receive compensation.

We recommend reading: Testing for the position of payroll accountant with answers

Procedure for payment of benefits

- In the DAM for 2021, line 090 of Appendix 2 to Section 1 indicates the amount of 25 thousand rubles with attribute 2.

- In accounting, in the debit of account 69, the subaccount “Social Insurance Settlements” at the end of the year there remains a balance of 25 thousand rubles.

The fund will return funds for periods up to 2021, and from 2021 - the tax office. The Ministry of Labor of Russia issued an order in October 2021, which presented a package of documents according to which the Social Insurance Fund of the Russian Federation will allocate funds to employers for the payment of maternity and other benefits when applying for periods after January 1, 2021. The Foundation has developed forms for these documents; they came into effect in December 2021.

Reimbursement of benefits from the Social Insurance Fund in 2021

- Name of the organization;

- legal address of the policyholder;

- last name, first name, patronymic (if the submission is made by an individual entrepreneur);

- passport data (for individual entrepreneurs);

- address of residence (for individual entrepreneurs);

- policyholder registration number;

- the amount of funds that must be reimbursed.

- When reimbursement of benefits paid to an employee as compensation for a period of incapacity for work, as well as funds spent on pregnant employees, sick leave certificates must be attached.

Reimbursement from the Social Insurance Fund in 2021

78 of the Tax Code of the Russian Federation indicates that it is impossible to offset the overpayment of one contribution (that is, one BCC) against the payment of other contributions or taxes (that is, other BCCs). One of the previous sections already contains an application form for the return of overpayments on disability insurance premiums as of 01/01/2020. There is no need to attach any documents to the application.

Thus, the application standardly contains information about the policyholder (name, legal address, insurance registration number), bank details for receiving compensation and the amount of funds required. The text of the sample application itself states that it is provided simultaneously with two applications:

Enterprise IP Novikov M.M. has a staff of hired workers, pays remuneration for labor, and pays insurance premiums. In the second quarter of 2021, the individual entrepreneur accrued the amount of wages to employees in the amount of 1,390,000 rubles, the amount of deductions for which to OSS amounted to 40,310 rubles. IP Novikov M.M. in the 2nd quarter, he made payments for social insurance expenses in the amount of 55,000 to pay for leave under the BiR, disability benefits in the amount of 79,000 rubles (including the amount of payment at the expense of the enterprise in the amount of 3,000 rubles).

Reimbursement for sick leave from the Social Insurance Fund in 2021

That is, if the amount of benefits paid for any month exceeded the contributions to the Social Insurance Fund accrued for the same month, the policyholder has the right to apply to the fund’s branch for a refund of funds for the payment of insurance coverage.

A positive or negative decision is submitted to the tax service, which must, no later than three days, transfer compensation for expenses to the bank account of the policyholder, which was indicated in the application.

Although the tax service has been refunding expenses since 2021, the Social Insurance Fund still must control where insurance premiums go. If an employer wants to return compensation for expenses from the social insurance fund, he must:

Grounds for reimbursement of expenses from the Social Insurance Fund

- Fill out and submit the uniform calculation form to your local tax office.

- Provide the Social Insurance Fund and the tax inspector with a basic and additional package of documents for reimbursement of funds.

- Wait for the test results.

- If the decision is positive, receive a refund to your bank account. An alternative option is to offset against a future contribution and. reduce future costs for mandatory insurance payments.

As you know, starting from 2021, contributions that were previously paid to the Social Insurance Fund have been transferred to the tax department. Only contributions for injuries were not affected by the changes; they are paid as before by the Social Insurance Fund. However, despite the fact that contributions are controlled by the Federal Tax Service, benefits are also checked by the Social Insurance Fund.

If the FSS owes the policyholder

The policyholder must first file an application. The application must contain:

- name and address of the insured - a legal entity or surname, first name, patronymic, passport details, address of permanent residence of the insured - an individual;

- policyholder registration number;

- the amount of funds required to pay the insurance coverage (best detailed by type of benefit, so that specific expenses are visible to both the policyholder and the fund).

The unified application form for reimbursement of expenses is not approved by the fund.

Some regional branches of the FSS of the Russian Federation have developed their own model. As a rule, it is posted on the department’s website. And anyone who has not found a sample application on the website of their fund branch can draw it up in any form, for example, as shown in sample 1 below.

You can receive reimbursement of expenses in the online support service “My Business” by receiving free access via the link. The service presents more than 5 thousand forms compiled in accordance with the requirements of the legislation of the Russian Federation.

Form-4 FSS

The policyholder must attach to the application a calculation in accordance with FSS Form-4 confirming the costs of paying out the insurance coverage.

The calculation can be made not only at the end of the reporting period, but also at the end of the month in which expenses were incurred, that is, an interim calculation from the beginning of the year and for any month.

Additional documents that the fund may require

The list of additional documents that the fund may request from the policyholder when considering an application depends on the type of benefit.

Deadline for reimbursement of funds by the fund department

As a general rule, the branch of the Federal Social Insurance Fund of the Russian Federation must transfer to the policyholder the money spent on the payment of benefits within 10 calendar days from the date the latter submitted the necessary documents (Part 3 of Article 4.6 of Law No. 255-FZ).

But if the fund has doubts, the FSS of the Russian Federation will conduct an inspection, which may take three months (Part 2 of Article 34 and Part 11 of Article 35 of Law No. 212-FZ). The legislation does not provide for sanctions for late compensation. If your fund branch is delaying in returning the money, then complain to the Federal Social Insurance Fund of the Russian Federation or go to court. Sample 1.

Application for reimbursement of funds from the Federal Social Insurance Fund of the Russian Federation

Table 2. Documents that may be required by the FSS of the Russian Federation

| Type of benefit | Document* |

| For temporary disability | Certificate of incapacity for work |

| For pregnancy and childbirth | Certificate of incapacity for work, application for maternity leave, order |

| One-time benefit for women registered in medical institutions in the early stages of pregnancy | A certificate from the antenatal clinic or other medical institution that registered the woman in the early stages of pregnancy (up to 12 weeks) |

| One-time benefit for the birth of a child | Certificate of birth of the child issued by the civil registry office**, certificate from the other parent’s place of work confirming non-receipt of benefits |

| Monthly child care allowance | Documents provided for by parts 6 and 7 of Article 13 of Law No. 255-FZ |

| Social benefit for funeral | Death certificate issued by the civil registry office |

* In addition to those presented in the table. 2 documents, the fund may also request copies of employment contracts, employee passports on which the insured organization receives compensation (part 4 of article 4.6 and article 4.7 of Law No. 255-FZ).

** In the event of a birth of a child outside the Russian Federation - a document legalized in the established manner confirming the birth of the child, with a duly certified translation into Russian.

Reimbursement amount is not income

Amounts received from the Social Insurance Fund of the Russian Federation to reimburse expenses for the payment of social insurance benefits are not income for profit tax purposes (Article 41 of the Tax Code of the Russian Federation).

Situation two - the FSS debt arose due to overpayment of insurance premiums

Let's consider another case. When paying insurance premiums, the accountant made a mistake in the details and unintentionally mixed up the numbers. Having discovered an error, I made another payment of insurance premiums and penalties for this period. I wrote a letter to the bank to correct the details for the first payment. Both payments eventually reached the addressee. As a result, the policyholder incurred an overpayment of premiums, and the Social Insurance Fund of the Russian Federation incurred a debt to the policyholder.

Penalties are paid if an error is discovered after the deadline for paying insurance premiums

In such a situation, the fund is obliged to inform the payer of insurance premiums about the detected fact of overpaid contributions within 10 days from the moment of its discovery (part 6 of article 4, part 3 of article 26 and part 8 of article 27 of Law No. 212-FZ).

But in practice, it is better not to wait for the fund’s message, but to initiate the reconciliation yourself and receive a document confirming the presence of an overpayment (Part 4, Article 26 of Law No. 212FZ). The results of such reconciliation of calculations are documented in an act according to Form 21-FSS of the Russian Federation. Based on the act, the policyholder can decide what to do with it:

- offset against future payments of insurance premiums;

- issue a refund to your bank account.

Offset of overpayment

We described the rules for offsetting insurance premiums above. They also apply to cases of overpayment of insurance premiums - they can only be offset within the billing period (Part 2.1 of Article 15 of Law No. 212-FZ).

If in the current year, 2013, an overpayment from the previous year, 2012, is revealed, it will not be possible to offset it. In this situation, only a refund of overpaid amounts is possible.

Refund of overpayment

O mandatory condition for return.

Refund of overpaid or collected amounts of insurance premiums can be made by the fund only after the debt on penalties and fines, if any, has been repaid (Part 12 of Article 26 and Part 2 of Article 27 of Law No. 212-FZ).

Deadline for returning money from the Federal Social Insurance Fund of the Russian Federation.

The funds necessary for the policyholder to pay the insurance coverage are allocated by the territorial body of the Federal Insurance Service of the Russian Federation within 10 calendar days from the date the policyholder submits all the necessary documents (Article 4.6 of Law No. 255-FZ).

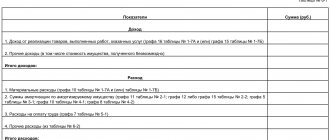

The procedure for reflecting received funds in reporting.

The amounts received from the FSS of the Russian Federation by the organization must be reflected in line 7 of column 3 of Table 1 of Section I of FSS Form-4 during the period of receiving money to the current account (clause 6.8 of the Procedure for filling out FSS Form-4, approved by order of the Ministry of Health and Social Development of Russia dated March 12, 2012 No. 216n) .

We prepare documents for offset or refund of overpayment amounts

To return or offset the amount of overpayment, the policyholder must send a corresponding application to the fund. We'll show you how to fill it out with an example.

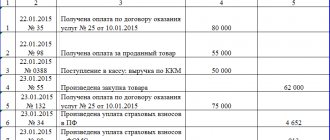

Example

The policyholder (Romashka LLC), when transferring contributions to the Social Insurance Fund of the Russian Federation for January 2013, made a mistake in the details of the payment order, indicating the checkpoint of his separate division. Due to an error discovered, the accountant re-paid contributions for this period in the amount of 500 rubles. and corresponding penalties.

Based on the results of the report for the first quarter of 2013, the overpayment of tax is indicated in the calculation submitted to the fund (FSS Form-4). The overpayment is recorded in the settlement reconciliation report (Form 21-FSS of the Russian Federation). The policyholder may ask the fund to return the overpayment or offset it against future payments. How should I fill out the application in the first and second cases?

Solution

Situation one - offset of overpayment amounts

If the policyholder decides to offset the amounts of insurance premiums overpaid to the Federal Social Insurance Fund of the Russian Federation for compulsory social insurance in case of temporary disability and in connection with maternity against the upcoming payments of contributions, he needs to submit an application to the Federal Social Insurance Fund of the Russian Federation in the form 22FSS of the Russian Federation.

You can pre-register using the link. All forms presented on the service are regularly updated and comply with the requirements of the legislation of the Russian Federation.

Situation two - refund of overpayment amounts

If the policyholder decides to return the amounts of insurance premiums overpaid to the FSS of the Russian Federation, he needs to submit an application to the FSS of the Russian Federation office in the form 23-FSS of the Russian Federation (a sample is given on p. 49). The amount of overpaid insurance premiums is subject to refund upon a written application from the payer of insurance premiums within one month from the date the body monitoring the payment of insurance premiums received such an application (Part 11, Article 26 of Law No. 212-FZ).

Sample 2.

Sample of filling out an application for credit according to Form 22-FSS of the Russian Federation

Sample 3.

Sample of filling out a return application according to Form 23-FSS of the Russian Federation

I.A. Tusheva

— senior scientific editor of the magazine “Salary”

Refund of contributions from the Social Insurance Fund in 2021 in case of overpayment

In just six months, benefits exceeded contributions by 170,000 rubles. (300,000 - 470,000 = -170,000). If we add the funds transferred to the FSS in May 2020 in the amount of 100,000 rubles, it turns out that the FSS still owes the organization 70,000 rubles. We indicate this value in line 090 with the sign “2”.

Reimbursement period

- the inscription “Copy is correct” or a record of similar meaning;

- the signature of the head of the organization or the signature of the entrepreneur;

- seal, if one is used (otherwise a letter stating that the seal is not used is required).

Important! You can submit documents to the Social Insurance Fund for reimbursement of expenses for both sick leaves at once, or separately. Documents for continuation of sick leave confirming reimbursement of expenses will be the same as for the main sick leave.

Reimbursement for sick leave from the Social Insurance Fund 2021

If the employee was issued a continuation of sick leave (for example, in the case of complicated childbirth), then payment for it occurs after the birth. That is, this payment may fall into a period other than the sick leave itself.

Deadline for applying for compensation from the Social Insurance Fund

The Federal Tax Service does not require proof of social insurance expenses from the policyholder when submitting reports on insurance premiums for the quarter and year. Supporting documents can only be requested by the FSS during a desk or field inspection. The basis for the audit will be data from the Federal Tax Service on the incurrence of expenses for the payment of social benefits, due to which the amount of contributions payable is reduced.

We will focus on the general requirements for filling out this calculation: when filling out the calculation, you need to use black/violet/blue ink; text fields are filled in printed capital letters. If the calculation is prepared on a computer and then printed, then when filling out the calculation you must use Courier New font 16-18 points; Calculation pages must be numbered consecutively, starting from the title page.

How to confirm expenses under the Social Insurance Fund under the offset system

As for reimbursement of expenses for paid child benefits, you will also need to prepare an application, a calculation certificate and attachments. In this case, the supporting documents will be:

Documents for reimbursement of child benefits

Sometimes it happens that the document is not lost, but there is simply no possibility of processing it. For example, it is not possible to obtain a certificate from the husband’s place of work stating that he has not received child benefits. In this case, the benefit is still paid. But you need to get an explanatory note from the employee and attach it to the documents submitted to the Social Insurance Fund.

The employer has the right to reduce the amount of contributions to the budget by the amount of accrued benefits. When expenses exceed deductions, a budget debt arises to the enterprise. The employer applies to the Social Insurance Fund for compensation of funds paid for insured events if an overpayment occurs.

The employer fills out that part of the document where there is a note indicating that information has been entered by the employer (“To be completed by the employer”). Thus, he must indicate information about the organization (name, registration number, etc.), personal data of the employee (full name, INN, SNILS, average earnings per day and for the billing period, insurance experience, etc.), period for which a subsidy and its size are assigned. The completed form is signed by the manager, chief accountant. Insurance premiums in 2021 are considered paid on the day when an LLC or individual entrepreneur receives a payment order to pay insurance premiums. Such an order for the payment of insurance premiums can be submitted either by the payer of insurance premiums or by any other person: an organization, an individual entrepreneur or a person who is not engaged in business (clause 1 of Article 45 of the Tax Code of the Russian Federation). Of course, there must be enough money in the current account of the organization or other person for the payment, and the order itself must be filled out correctly. In 2021, transfer insurance premiums to the budget without rounding: in rubles and kopecks (clause 5 of Article 431 of the Tax Code of the Russian Federation).

Reimbursement of expenses from the Social Insurance Fund in 2021

Timely submission of reports on insurance premiums to the relevant authorities allows entrepreneurs to avoid penalties and other problems that complicate doing business. It just seems that filling out strict reporting forms is not particularly difficult.

Individual entrepreneurs, heads of peasant farms, also, according to the new legislation, deduct a fixed amount of 26,545 rubles. “pension” contribution, 5,840 rub. – “medical” for all participants of the peasant farm, including individual entrepreneurs.

Refund from the Social Security Fund due to excess expenses in 2021

- conduct a special assessment of working conditions;

- bring the levels of exposure to harmful or dangerous production factors in the workplace in accordance with state regulatory requirements for labor protection;

- train employees in labor safety;

- purchase special clothing, safety shoes and other personal protective equipment for employees, as well as flushing and neutralizing agents;

- send an employee to sanatorium-resort treatment if he is engaged in work with harmful or hazardous production factors;

- conduct mandatory periodic medical examinations of employees;

- provide workers with therapeutic and preventive nutrition;

- purchase breathalyzers and breathalyzers for mandatory pre-trip medical examinations;

- purchase devices for monitoring the work and rest regime of drivers who carry out passenger and cargo transportation;

- purchase first aid kits.

Reimbursement of expenses to the Social Insurance Fund in 2021

Try online Depending on when the overpayment of social insurance contributions occurred (including due to excess social expenses), the refund is made by the tax authorities or the social insurance fund itself. There are nuances that will be discussed further.

If more contributions are accrued than benefits paid, the difference is transferred to the Social Insurance Fund. If on the contrary, that is, the difference between contributions and benefits turns out to be a minus sign, then it is counted against future payments or returned from the Fund to the policyholder.

Online magazine for accountants

Reimbursement of expenses is made upon the application of the employer accompanied by documents confirming payments. Information on insurance premiums and their movement, necessary for the FSS to reimburse the amounts to the employer, is obtained from the calculation certificate.

Reimbursement for sick leave from the Social Insurance Fund in 2021

The FSS will be able to request information about contributions from the inspectorate (clause 2.2, part 1, article 4.2, part 1.1, article 4.7 of the Federal Law of December 29, 2006 No. 255-FZ, as amended on January 1, 2021). Reimbursement to the Social Insurance Fund in 2021: the Social Insurance Fund scheme has the right to check information about benefits and make a decision on reimbursement or refusal of credit.

- Write an application for a refund and submit this application to the Social Insurance Fund.

- Prepare a statement of calculation, as well as the necessary supporting documents and attach them to the application.

- Wait for the FSS check.

- After the FSS checks and approves the reimbursement, it will transfer the funds to the organization’s account.

To keep records of benefits, use our Simplified 24/7 . It prepares documents and HR reports in one click. Take a trial access to the program for 30 days. Consultation on all accounting issues is available to users 24 hours a day, 7 days a week.

Reimbursement of funds for labor protection

In addition to amounts paid for social benefits, you can receive reimbursement from the Social Insurance Fund for labor protection costs.

Funds for preventive measures to reduce injuries and occupational diseases are allocated by the Fund based on the difference between the accrued contributions for “injuries” for the previous calendar year and the amounts used to pay sick leave for accidents and occupational diseases for the same period, but not more than 20% of the total amount contributions for the previous year (in some cases - up to 30%).

Insurance premiums can be used to reimburse expenses for special assessment of working conditions (special assessment of working conditions), training in labor protection, purchasing personal protective equipment for working in hazardous conditions, sanatorium and resort treatment for workers employed in hazardous industries, etc. (the full list is given in paragraph 3 of Order of the Ministry of Labor of Russia dated December 10, 2012 No. 580n).

The policyholder must fill out an application in the form approved. By Order of the Social Insurance Fund dated 05/07/2019 No. 237, and draw up a Financial Support Plan (from the appendix to Order No. 580n). To receive security for 2020, documents must be sent to the Social Insurance Fund before August 1, 2020.

How to reimburse expenses for payment of benefits from the Social Insurance Fund from 2021 - what has changed?

In 2021, the federal minimum wage should be raised by another 87 rubles. up to 11280 rubles. The bonus is tiny, so you shouldn’t expect significant changes in the amount of Social Security benefits in 2021, although some increase in the amount of payments will still occur.

Refund from the Social Security Fund due to excess expenses in 2021

- workers will have the right to receive compensation for lost labor income due to short-term disability from the moment they return to work, and not after a certain period;

- Payment for temporary disability will be provided for the duration of sanatorium-resort treatment/prosthetics in a hospital, IVF/abortion, as well as in case of illness of the employee’s children/disabled dependents.

Costs for employers participating in the pilot project will not be reimbursed by employers due to their absence. Benefit amounts are paid by the FSS without the participation of the policyholder, with the exception of the provision of documents (

Reduced insurance premiums

To do this, insurance contributions to the Federal Social Insurance Fund of Russia are reduced by the amount of benefits (except for benefits related to industrial accidents and occupational diseases) (Part 2 of Article 15 of the Law of July 24, 2009 No. 212-FZ and Parts 1–2 of Art. 4.6 of the Law of December 29, 2006 No. 255-FZ).

There is an exception to this rule.

Participants of the Skolkovo project, in respect of which the tax inspectorate has confirmed compliance with the criteria given in Article 145.1 of the Tax Code of the Russian Federation, do not reduce the amount of insurance contributions to the Social Insurance Fund of Russia by the amount of hospital benefits. This is due to the fact that for such organizations the zero rate of insurance contributions to the Federal Social Insurance Fund of Russia is maintained for 10 years from the date of receipt of the status of a participant in the Skolkovo project. This is stated in paragraph 2 of part 2 of Article 57 of the Law of July 24, 2009 No. 212-FZ and part 7 of Article 4.6 of the Law of December 29, 2006 No. 255-FZ. Therefore, in order to pay benefits to employees employed in these organizations, the FSS of Russia will transfer funds to the current (personal) account of the organization (Part 2, Article 4.6 of the Law of December 29, 2006 No. 255-FZ).

If an organization applies a general taxation system and pays UTII and pays benefits to employees simultaneously engaged in both types of activities, then the entire amount of benefits to be reimbursed should be included in the payment of insurance premiums accrued to the Federal Social Insurance Fund of Russia within the framework of the general taxation system. There is no need to distribute this part of the benefit between the general taxation system and UTII. This is due to the fact that for organizations that apply different taxation regimes, a general procedure for calculating and reimbursing hospital benefits is provided.

An example of settlements with the Federal Social Insurance Fund of Russia when paying sick leave benefits to an employee. The organization applies a general taxation system and pays UTII

The organization is engaged in manufacturing and retail trade. In the city where it operates, retail trade has been transferred to UTII. The production activities of the organization fall under the general taxation system.

In February 2021, the chief accountant of the organization A.S. Glebova was ill for 5 calendar days.

The amount of benefits due to Glebova amounted to 5,685 rubles. Of which: – 3411 rub. (5685 rubles: 5 days × 3 days) – paid at the expense of the organization; – 2274 rub. (5685 rubles – 3411 rubles) – reimbursed by the Federal Social Insurance Fund of Russia.

The allowance for the chief accountant simultaneously applies to both types of activities. Therefore, the accountant distributed the part of the benefit, which is paid from the organization’s funds (for the first 3 days of illness), in proportion to income. When calculating the proportion, he took into account the indicators for the month in which temporary disability occurred.

For February 2021, the total amount of income from all types of activities amounted to 1,000,000 rubles. (without VAT). Income from the activities of the organization under the general taxation system – 250,000 rubles. The organization had no other income.

The share of income from the activities of the organization under the general tax system in the total amount of revenue is equal to: 250,000 rubles. : 1,000,000 rub. = 0.25.

The benefit, which is paid at the expense of the organization and relates to activities on the general taxation system, is: 3411 rubles. × 0.25 = 852.75 rub.

The benefit, which is paid at the expense of the organization’s funds and relates to activities subject to UTII, is equal to: 3411 rubles. – 852.75 rub. = 2558.25 rub.

By the amount of sick leave benefits reimbursed by the Russian Federal Social Insurance Fund (RUB 2,274), the accountant reduced contributions to compulsory social insurance.

The amount of benefits does not exceed the amount of contributions

If the amount of accrued sick leave benefits does not exceed contributions to the Social Insurance Fund of Russia, then an application to the fund will not be required. In this case, reduce the next payment by the amount of hospital benefits.

An example of settlements with the Russian Social Insurance Fund if the amount of hospital benefits does not exceed contributions to the Russian Social Insurance Fund

In March 2021, the base for contributions to the Social Insurance Fund of Russia in the organization amounted to 200,000 rubles. The amount of the contribution accrued in March to the Russian Social Insurance Fund is 5,800 rubles. (RUB 200,000 × 2.9%).

In March, the organization accrued sick leave benefits to its employee in the amount of 2,000 rubles. The accountant reduced contributions to the Russian Social Insurance Fund for March 2021 by this amount.

Thus, the amount of the monthly payment to the Social Insurance Fund of Russia for March 2016 was 3,800 rubles. (5800 rub. – 2000 rub.).

List of documents confirming the right to compensation

The validity of the employer's expenses for paying for insurance claims is confirmed by the documents submitted as an appendix to the application. The list of documents depends on the type of insured event and is adjusted by the territorial office. Submit copies:

- A document confirming the legal relationship between the employer and the employee - a work book with a record of employment.

- A ballot issued in connection with incapacity for work, leave under the BiR.

- Birth certificates of a child, if there is more than one child, in case of reimbursement of monthly benefits - certificates of all children.

- Applications from an employee for leave for employment and labor, for child care and for the provision of benefits.

- Certificate from the second parent’s place of employment confirming non-provision of leave, benefits or additional days off. If there is no work, a copy of the spouse’s work record book is provided.

- Certificates from a medical institution confirming that the employee is registered.

- Calculation of the benefit amount based on the income previously received by the employee.

- Certificates confirming a child’s disability, applications for additional days off.

- Payment documents for payments made.

The list contains copies of orders of the head of the relevant appointment. The order must be signed by the manager and the employee. An order is not required when paying for a period of incapacity for work on a general basis or a one-time benefit. The documents are listed in the application as an attachment. Copies are certified in the prescribed manner. The document is marked with the entry “Copy is correct”, the name of the enterprise, the signature of the manager or individual entrepreneur with a transcript. The record is certified by a seal provided that it is used by the enterprise in office work.