Many have heard that recently the government decided to transfer business to online cash registers. Of course, not all owners of their own enterprises were happy with this innovation, because every businessman again had to spend money to buy the necessary equipment.

With all this, citizens soon realized how useful and convenient the invention is online cash registers. Now it’s time to talk about what the main goal of this innovation is.

Also in this article we will mention each of the types of reports that will be generated when a cash register of this type is connected.

Is it necessary to lead?

Form KM-6 is an important reporting document for the cashier, which indicates the amount of daily revenue. These report certificates are of great importance when carrying out inspections by supervisory authorities.

Based on them, a complete picture of the completeness of the reflection of the enterprise’s revenue is compiled. Certificates are also required when drawing up a summary report.

The question of whether to fill out a report is ambiguous.

The absence of this form does not entail the application of penalties; in many organizations it is simply not needed; private entrepreneurs, as a rule, do without it.

If the supervisory authorities, when carrying out control activities, discover the absence of a certificate-report, then this fact will be considered an aggravating circumstance.

The director of the company will be in trouble, and he, in turn, will transfer all the blame to the cashier.

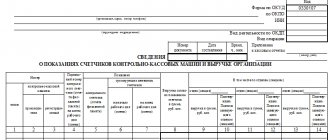

In addition to the KM-6 report, the KM-7 form can be drawn up - information about cash register counter readings and revenue must be filled out if the enterprise has two or more cash registers.

Difference between Z and X

Despite the fact that these two reports are similar, they have significant differences. The difference between these two documents is that the first is designed to close the shift and reset the sales registers, increasing the shift counter by one point. After all these steps, the cash register is ready for the next cashier to work. The second document opens the shift and shows the amount of cash and revenue from the moment of its opening, recording this in the fiscal registrar. It can be printed as many times as you like to verify the amount of money in the cash register. Another difference is in the list of details contained in each of them, but more on that in the next section.

The X-report helps to determine the correctness of entering information into CCP, as well as to analyze trade turnover, both in general and specifically for a specific product.

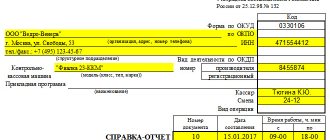

KKM PORT DPG 55 ФKZ

Rules of conduct

One of the norms for maintaining a report is its daily (at the end of the shift) execution.

The cashier signs his autograph on it and hands over the form, along with all proceeds, to the senior (chief) cashier or directly to the head of the company.

If the organization is small (one or two cash desks), then all the money is handed over to the collector of the credit institution.

How to fill?

To prevent errors when filling out the certificate form, you must follow the general rules. The help report is presented in the form of 3 blocks: line, table and summary.

The first line of the document indicates the name of the company, its address (must be identical in all documentation), and telephone number. The name of the individual unit is also indicated.

For individual entrepreneurs, similar rules apply as for legal entities. In a number of situations, individual entrepreneurs mistakenly assume the use of a similar form, but this report is drawn up only on the approved form.

Below is the TIN of the enterprise, structural unit (if any). In the field intended for entering information about cash register equipment, enter its brand (type, model) and serial number in accordance with the available cash register documentation.

The “Application program” line is not filled in if it is not used in the work. Next, the surname and initials of the cashier are entered in the appropriate line; if there are several cashiers, then the field remains blank.

The “shift” cell records the report number, which, as a rule, begins with the letter “Z”.

The next field contains the document details: number, date, start and completion time of work. Don't forget to fill out this information.

The tabular part of the help report is divided into 10 columns:

- 1 — serial number of the control counter;

- 2, 3 — department and section number, respectively;

- 4 - remains empty when using modern cash registers;

- 5 - readings of the cash counter at the beginning of the shift, day (the amount from column 9 of the cashier’s journal of the last shift, a similar amount is written in the morning X-report, in the GROSS TOTAL line;

- 6 - meter readings at the end of the working day, GROSS TOTAL line of the Z-report;

- 7 - enter the revenue for the shift, the sum of all punched checks, the difference between columns 5 and 6;

- 8 - the amount of all refunds and erroneously issued checks, information is displayed in the KM-3 act, to which all checks confirming the return are attached, the information must match the amount from column 15 of the KM-4 journal;

- 9 - cashier's surname;

- 10 – cashier’s signature.

The total expressions of columns 7 and 8 are recorded in the resulting field.

The cashier generates a Z-report from cash register equipment at the end of the working day (shift). It displays information about all cash transactions. Based on the balance recorded in the Z-report, the cashier reconciles the available cash and then transfers it to the responsible persons, the bank.

The cashier removes the X-report from the cash register to determine the cash in the cash register during the work shift (day). An unlimited number of it can be generated, information about such actions is not displayed, and revenue is not reset.

You can put dashes in the empty lines of the KM-6 certificate so that supervisory authorities do not have questions about the document being unfilled.

In the final block, the amount of revenue is written down in words. The “accepted” line contains the details of the receipt order.

If the report is handed over to the collector, then information about the transfer of proceeds to the bank is entered; when transferring it to the chief cashier, this line is not filled in.

Next, the cashier, senior cashier and head of the company put their signatures; if these positions are combined by one employee, then the signature is affixed three times.

and a sample of filling out the unified form KM-6

certificate-report KM-6 – word, excel.

filling out the KM-6 form - example.

Other forms of cash documents:

- KO-4 - cash book;

- KO-5 - certificate-report of the cashier-operator.

Cash transactions for individual entrepreneurs

Entrepreneurs are also required to observe cash discipline. But a simplified procedure is provided for them. Here's what not to do if you're an entrepreneur:

- do not draw up cash documents (PKO, RKO) (clause 4.1, clause 4 of the Bank of the Russian Federation Directive N 3210-U);

- do not keep a cash book (clause 4.6, clause 4 of Directive No. 3210-U);

- do not set a cash balance limit (clause 2 of Directive No. 3210-U).

Individual entrepreneurs can spend the cash proceeds received at the cash desk for personal needs (clause 1 of Bank of the Russian Federation Directive No. 5348-U).

How do I make corrections?

Cashiers with little work experience allow, when filling out the cashier-operator's certificate-report form, sometimes they write their own number instead of the company's TIN.

This is, of course, not true. The identification number is always recorded by the company.

Columns 5 and 6 should be carefully filled out; information from the GROSS TOTAL X-report cannot be entered into column 6.

This error occurs due to negligence and inattention.

There are also errors in the numerical value of writing revenue amounts.

The cashier or cashier-operator must carefully check each digit in KM-6.

If typos occur on the form, penalties can be avoided; a fine is issued for errors in the numbers personally recorded by the operator.

Innovations from 2017-2020

According to the explanations of the tax inspectorate (letter of the Federal Tax Service of the Russian Federation dated September 26, 2016 No. ED-4-20 / [email protected] and the Ministry of Finance of the Russian Federation No. 03-01-15/19821 dated April 4, 2017), the transition to online cash registers is made by filling out a cashier’s certificate report -operator optional (all information about ongoing cash register transactions is stored in your personal account on the Federal Tax Service Inspectorate website).

What documents are not needed at online checkout?

According to the letter of the Federal Tax Service of Russia dated September 26, 2016 No. ED-4-20 / [email protected] , 9 unified documents are optional for registration:

- Form No. KM-1 - act on the translation of cash register meter readings.

- Form No. KM-2 - an act on taking readings from KKM control meters when handing over the cash register for repairs and when returning it to the company.

- Form No. KM-3 - act of returning money to the client.

- Form No. KM-4 - journal of the cashier-operator.

- Form No. KM-5 - register of cash registers operating without a cashier-operator.

- Form No. KM-6 - certificate-report.

- Form No. KM-7 - information about cash register meters and the company’s revenue volume.

- Form No. KM-8 - call log for technical specialists.

- Form No. KM-9 - act on checking cash at the cash register.

The following documents are required for online checkout:

- cash book (individual entrepreneurs are kept at will);

- PKO and RKO.

The cash book reflects data on cash inflows and outflows. It records the details of the PKO and RKO, the recipient, and the one who deposits the funds.

Is it necessary for online checkouts?

Explanations of the tax authority dated September 26, 2021 No. ED-4-20/ [email protected] in connection with the use of online cash registers allows legal entities to refuse to maintain a certificate report; all information about transactions performed on cash registers is stored in the taxpayer’s personal account.

If no cash transactions were carried out throughout the working day (shift), then a certificate report is not issued.

Payment is displayed in the KM-6 form:

- In cash;

- bank cards.

Non-cash transfers to the company's current account are not recorded in the report.

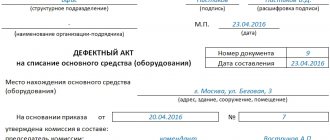

Cash book: sample manual filling and filling requirements

Maintaining a cash book in 2021 begins with numbering and stitching its sheets. The ends of the lacing at the back of the journal must be sealed with a paper strip on which you must indicate the number of sheets, the start date of maintaining the cash book and the end date. To certify the record, the chief accountant and the head of the organization must sign, and a seal, if available, must be affixed. It should look like this:

On the title page of the cash book you must indicate the name of the organization and the period for which the document was opened. All entries must be made only with blue or black ballpoint pen or ink.

Each sheet is divided into two parts:

- one remains in the book;

- the second is detachable and is stored together with the RKO and PKO registers.

To fill out the sheet, the cashier places carbon paper so that the entry in pen is on the sheet that remains in the document. The entries must be completely identical, but you cannot sign a carbon copy. Therefore, at the end of the day, the cashier must sign on each copy of the cash book. All records about cash settlements and cash settlements are entered line by line in the appropriate columns, indicating the details of the person who deposited or received the money. Income and expense are entered in different columns. If one sheet is not enough to reflect all transactions for one day, the cashier must fill out the “transfer” line, which records the total amount of money received and spent at that moment. The next sheet of the cash book begins with the same amounts.

At the end of the day, you should sum up the results and indicate the total turnover at the cash register for the day and withdraw the remaining cash at the end of the day. If the cash register included amounts intended for the payment of wages or benefits according to the payroll or payroll, the cashier must allocate them in the line “including wages, social payments and scholarships.” After all the entries have been made, they are checked against the primary documents and certified by the chief accountant.

A correctly completed cash book sheet for the day looks like this:

Important points

If the cash register operator's journal is lost, a specialist from the cash register technical service center is called, he takes down a fiscal report (or a report from the EKLZ unit, if the company has a modern cash register with the letter “K”) from the cash register for the entire period from which the journal was lost.

But it would be better to check the dates with the tax inspector; the procedure for restoring the cashier-operator’s journal is not recorded anywhere, each department may present its own requirements.

Then a free form application is written to the tax office about the loss of the cashier-operator’s journal, a power of attorney is issued with a seal for the registration of the cashier-operator’s journal (for the organization), a new journal is purchased and with the fiscal report removed (or with a report from the EKLZ unit).

Then you should contact the Federal Tax Service again (the date the fiscal report was taken), where, based on the documents submitted, they will issue a new cashier-operator journal.

How, according to the rules of cash discipline, money is issued to accountable persons

Accountable money is cash given to an employee to pay for business expenses, travel expenses and other needs of the enterprise.

To issue such money, an application from the employee receiving the money is required, in which it is necessary to indicate the full amount, period and purpose of receiving it. The application must have the signature of the manager.

If business or other expenses of the enterprise are paid with the employee’s own funds, they are also subject to reimbursement on the basis of an application, which must indicate that “the employee has no debt on previously issued advances.” This is a legal requirement that an employee must fully account for previously received advances before receiving accountable money.

To provide a report on spent funds, the employee is given 3 working days from the expiration of the period for which the funds were issued, or from the date of return to work. Expenses are confirmed by appropriate receipts, which are attached to the expense report. This is necessary to accept them as expenses and to correctly calculate the tax base. In addition, for funds spent without supporting documents, it is necessary to pay insurance premiums and withhold personal income tax.

Restriction on the issuance of money according to the rules

You should also pay close attention to cash payments between business entities. This does not apply to settlements with individuals. Legal entities and individual entrepreneurs can make cash payments among themselves, but not more than 100 thousand rubles within the limits of one agreement.

This restriction also does not apply when issuing from the payroll office to employees accountable funds to an individual employee, if this money is not planned to be used to pay for goods and services on behalf of the organization on the basis of a power of attorney.

Who and when can take money from the cash register for personal needs?

Any income of the organization belongs directly to the organization. Therefore, payment for the personal needs of the founders, even if there is only one, cannot be made from the cash desk of the enterprise.

This does not apply to individual entrepreneurs, who can use money both from the cash register and from the current account in any quantity, provided there are no arrears in paying insurance and tax contributions.

If an individual entrepreneur does not have an order to cancel the maintenance of cash documents, in order to receive cash from the cash register, an expense order must be drawn up containing the following wording: “Issuing funds to the entrepreneur for his own needs” or “Transferring income from current activities to the entrepreneur.”

What to do with the KM-6 form after filling it out

The completed document must be given to the chief cashier, if the company has one. The chief cashier passes the certificate report to the general director or accountant. If there is no such cashier, then the cashier-operator gives the document directly to the accountant or director. The certificate must be kept for 5 years.

Important! Individual entrepreneurs, as a rule, are triune. An individual entrepreneur is his own cashier-operator, accountant and manager. Therefore, he gives the document directly to the bank.

Features of using a certificate in the KM-6 form

| Filling conditions | Decoding |

| Who fills out the certificate | Since the preparation of this report is related to the material side of the company’s activities, its preparation should be carried out by the financially responsible person. The cashier is just such a person |

| How information is filled out | All data is entered into the certificate form using a pen with blue or black ink. |

| Are blots allowed when filling out the form? | Since this document is very important and concerns the financial sector, it must be filled out in legible handwriting, preferably without errors or blots. If regulatory authorities find corrections, a fine may be imposed |

| Certificate preparation period | Such certificates are prepared every day |

| Who is the report sent to? | The completed certificate along with the cash is handed over to the senior cashier, accountant or director of the enterprise. It is also given to the bank |

| Certificate storage period | Certificate – the report must be kept by the company for 5 years |

What is a certificate in the KM-6 form?

The job of a cashier is difficult and responsible. In their work, these specialists are guided by Law No. 54-FZ and Directives of the Central Bank of the Russian Federation No. 3210-U dated March 11, 2014. Cashiers are faced with numerous reports that show cash register movements. Every cashier is faced or has encountered the preparation of the KM-6 form. This is an important document for the cashier, his report on the amounts posted at the cash register.

Initially, the report was compiled only on cash revenue, but with the development of technology and the advent of payments using bank cards, such information also began to be displayed in the certificate report.

The form of the certificate - report was approved by Resolution of the State Statistics Committee No. 132 of December 25, 1998. At the same time, the company can use in its work both a unified form and a report form developed at the enterprise. This possibility is enshrined in the Letter of the Federal Tax Service of the Russian Federation No. ED-4-20 / [email protected] dated September 26, 2016. However, it is worth considering that the report form developed at the enterprise must necessarily contain the key details of the unified document.

Features of the help report

The cashier-operator's certificate-report has several characteristic features:

- the KM-6 form, approved by the State Statistics Committee of the Russian Federation in 1998, is unified;

- errors when filling out, as well as deviations from the generally accepted format, may result in a fine during the work of inspection bodies;

- KM-6 must be filled out daily (or at the end of each shift), and simultaneous filling out of certificates for 2 or more days/shifts is not allowed;

- The document must be submitted simultaneously with the proceeds - either to the chief cashier of the company or to the bank;

- The certificate must be kept for exactly 5 years, after which it loses its value.

Important! Column 4 is filled in only when using outdated cash register equipment. If modern devices have been installed in the organization over the past 12 years, then this section should be left blank.

Is it possible not to fill out the KM-6 form?

This question is ambiguous. On the one hand, no one is fined for the absence of a certificate-report. Many enterprises simply do not require it, and individual entrepreneurs most often do without it. But if the check reveals the absence of such certificates, then this will be considered an “aggravating circumstance.” The manager will have problems, and naturally he will blame the cashier-operator who did not fill out the KM-6 form.

No cash transactions

If no cash transactions were carried out during the working day (shift), then a certificate-report of the cashier-operator is not drawn up.